No Cookie Cutter 1-Bedroom Here: 546 W. Brompton in Lakeview

This vintage 1-bedroom at 546 W. Brompton in Lakeview recently came on the market.

It has some unique features including a 2-story living room with a beamed ceiling and lofted extra room which could be used as an office, guest room, or den.

The unit also has a separate dining room.

Like a lot of vintage buildings, however, it is lacking central air and an in-unit washer/dryer and it has no deeded parking.

But it does have a fireplace mantel usually found in mansions (the fireplace is decorative only.)

There are no pictures of the kitchen but you can see a white refrigerator and wood cabinets in the kitchen in one of the dining room pictures.

What’s the market for this 1-bedroom?

Bill Mozckierz at Estate Realty has the listing. See more pictures here.

Unit #3S: 1 bedroom, 1 bath, no square footage listed

- Sold in July 1990 for $105,500

- Sold in June 1993 for $114,500

- Sold in June 1998 for $108,000

- Sold in May 1999 for $140,000

- Originally listed in March 2011 for $229,000

- Currently still listed at $229,000

- Assessments of $331 a month (includes heat, cable)

- Taxes of $2797

- No parking

- No central air

- No in-unit washer/dryer

- Bedroom #1: 14×10

- Loft: 11×11

- Living room: 20×12

- Dining room: 14×12

- Kitchen: 12×7

There are pics of kitchen on listing link. Needs updating, but a lot of space though for a 1br and very unique.

I like it…if you’re in the market to stay in a 1br long term.

cute

not sure about the price but cute.

$140,000.

This is really neat. What a joy to see something so unique. I don’t know the prices for the area, but this should demand a premium given the space. HD, it is true that you always want the 1999 price : )

Abomination but not a bad price so could be “repaired”

perfect for trapezoid enthusiasts!

Great apt,looks huge for a one-bed.

$190K.

Definitely beyond my tastes, I would be inclined to de-convert back to attic space. But someone will like it for $175-190k.

i like it. could picture the “ladies man” leon phelps buying this place

I’d like it at $170k, assuming there is W/D in the building somewhere since it’s not in unit.

That loft space seems cool but is impractical and a little ridiculous. I would probably lose the loft, take out the stairs and open up the ceiling to the bedroom (make the bedroom 2 stories).

yeah or the “man’s man” since its basically in boystown

It’d be perfect for me, because it has a main floor bed in addition to the loft, so I could get my painting off the main floor. The main floor is beautiful, while the loft is rough enough that I wouldn’t cringe at the thought of supplies all over the place, and it’s out of the “public” way.

Really great apt. in a prime area.

a man’s man and this place would shut down steamworks

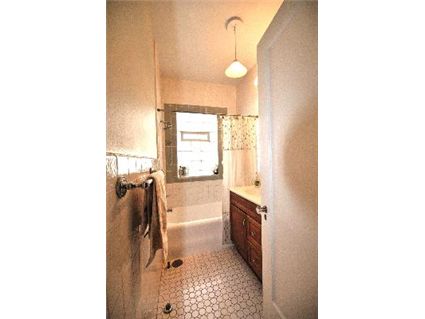

Love the separate dining area. The idea of the loft is cool, although the staircase might be intrusive in the flow of the space? There were A LOT of photos of the fireplace and I’m not sure if that’s the main selling feature of this place. Not sure I love it, but if I was looking right now in this price range for a 1/1 – this would probably make the short list because it has enough to qualify: pleasantly different, location, good condition, reasonable assessments and taxes. I’m not usually terribly picky about the kitchen, but it definitely takes away from the rest of the unit. And, what’s with the pic of the tiles in the bathroom? I think I’ve gotten spoiled on my Edgar Miller tile work – not terribly impressed with that, either.

HD, would you go back to 1999 salaries to go along with your 1999 housing price?

As it happens, salaries have dropped 1% since 1999 on average. So maybe prices SHOULD go back to 1999 levels.

“As it happens, salaries have dropped 1% since 1999 on average. So maybe prices SHOULD go back to 1999 levels.”

In constant dollars, not nominal dollars. In constant dollars, that $140k 1999 price is $187,790 in 2011.

Laura:

I guess it depends on what you do for a living. I assure you that the salaries typical of DINK professional couples have not dropped to 1999 salary levels.

Most BigLaw, consulting firm, i-bank, middle management f500 (MBA type jobs), etc pays quite a bit more now than they did in 1999. These are the people typically buying properties in the GZ.

Yeah but there are fewer of those jobs, russ. And one F500 recently moved their HQ out of downtown and another I know is constantly downsizing or relocating employees to lower cost cities.

I think its pretty awesome and wish i’d seen this 6 years ago before i bought my current place!

The number of upper-middle and middle-class jobs has surely shrunk in the past 10 years, and new jobs being created tend to be low end “wage” jobs.

Additionally, our younger people are much likelier to be burdened with excessive student loan debt, thanks to the Sallie Mae college debt scam machine and its enablers in Congress, who have not only made it impossible to discharge any student debt, whether Federal or “private”, but have given college loan lenders rights that no other lender has, and deprived borrowers of the protections granted to every other kind of borrower. It is difficult to see how people burdened with $80,000 to $300,000 worth of debt, before figuring interest, penalties, “collection” fees, and other consumer debt as well, are going to be in any position to buy a home, even if they are well-paid professionals with 6 or more years of education from top schools. A person who makes $200K a year but is paying off $250K or even more worth of school loans is arguably in no better position to save for a down payment and buy a house of the type usually appropriate for his income, than is someone with an income of $50K to $80K.

Despite official spin, our economy is not growing, and the tower of government and household debt has a lot of unwinding to go before we see incomes rise and housing start to “recover”.

Debt is the problem on all levels still (personal and government.)

It’s really hard to save for a property if you’re starting out at 22 with student loans hanging over your heads (even for those graduating from professional school.) That’s why the real estate bubble was so perfect. It allowed even those with big car loans, student loans and credit card debt to still buy a house/condo because you needed no money down.

You mean it allowed people to BELIEVE that they were “buying” a house or condo, and to believe that debt equals wealth. Well, these buyers have now found out that you don’t build wealth by leveraging yourself to the eyeballs. Not only did the insane debt run the prices up to unsustainable levels, but the delusional thinking that has made us equate the ability to borrow for everything somehow equals prosperity has impoverished 80% of us. Most of us will not recover from the debt binge of past decade.

What a scam we’ve fallen for in the past 40 years. The mountain of personal debt in this country is what will make the next 20 years of asset deflation and economic stagnation (or even contraction) so much worse than it has been in Japan. While Japan has stagnated under a mountain of government debt and has experienced steep asset deflation, it at least has a population that is very resilient because of high personal savings rates. This will also help this country recover from last month’s mega-disaster much more quickly than would otherwise be the case. We, on the other hand, are net debtors, with almost no personal savings.

Whats interesting is student loan debt isn’t a ton compared to all outstanding debt at only $1T. But given the prevalence of college degrees in GZ hoods it will likely hit them particularly hard. Groove you can sleep well at night–the student loan debt burden seems almost targeted to the GZ. 😀

Student loan debt is certainly the next big issue, both from a securities/default standpoint (though smaller in amount that mortgage-backed securities, at least with mortgages, there is “something” there to sell) and its overall impact on the economy. I’d say it’s playing a role in slowing the current economic recovery, and may well be at the heart of the next downturn.

Personally, my monthly student loan payments are about the same as my mortgage payments. That obviously (i) limited my ability to build a downpayment, (ii) limited the price of the home I could comfortably purchase (despite getting “approved” for something much higher) and (iii) limits the amount of disposable funds with which I would otherwise stimulate the economy.

And, because of income caps, I receive no tax relief whatsoever. One way to ameliorate the student loan crisis is with respect to taxes. Whereas certain “good things” are fostered in this country by way of tax relief (e.g., pre-tax purchase of health insurance and public transit passes and tax deductions for mortgage interest), hardly anything is done in the student loan area. The law should be changed to provide (i) a tax credit on all student loan interest paid and (ii) a tax deduction on all student loan principal paid – with no income caps. Such a radical change would encourage education, which liberals should like, and reduce taxes, which conservatives should like. The lenders would get paid more reliably, which they and those who purchased student loan-backed securities would like, as would taxpayers, who are on the hook for most of the loans. Who would oppose such a change?

Sorry, annony, but the fact you could buy with that student debt load tells me your plan is unnecessary. The student loan bubble has done the most to promote exploding costs already. No more gas is needed for that inferno. Heck, people are finally waking up to the distortions created by the mortgage interest deduction and how it mostly benefits the wealthy. Now we should offer tax relief for top tier law school grads?

“Who would oppose such a change?”

Ummm. The government. It would result in lower tax receipts.

I would oppose such a change, too, and I’d much rather take another approach to helping people with insurmountable student loan debt, one that does not also help the for-profit diploma mills that have proliferated like weeds.

It is inarguable that we have too much debt, both government and personal, and any government program or incentive that encourages debt creation, be it tax deductions for loan principal or interest, government guarantees for loans, or any other incentive or program that enables someone to assume a debt far in excess of what he’s likely to make per year, is pernicious and needs to be revamped or discontinued altogether.

It would be better, IMO, to discontinue the student loan program, or at least cap lifetime student debt at a low amount, say $20,000, while granting buried college borrowers the same rights and protections that any other debtor has. This would result, I believe, in demise of the hundreds of for-profit diploma-mill scam sinks that have sprouted in response to the flood of money generated by student loans, and would render the inflated tuition at most legitimate schools unaffordable, forcing their adjustment to reality. I’m betting that tuition would readjust rapidly in response.

Then let borrowers who are really, truly buried bankrupt, which we can only do if we discontinue the program or at least revise it to steeply reduce the risk of default. As it stands at the moment, there is no cap on what a student can borrow, and no lending standards that recognize that a degree in, say, Art History from a mediocre school does not confer the same kind of earning power as a law degree from Northwestern, and vet the loan requests accordingly.

This would be better than using tax revenues to fund higher education of whatever quality while starving elementary and secondary education. The way we do things now is not resulting in a better-educated population in general, or producing people qualified in the fields where they are most needed. All it is doing is exposing the taxpayers to more risk while destroying our younger generations, burying them for life in debt that will prevent them from enjoying even a minimally decent life.

Laura, I’ve often said that student loans should be underwritten in a free market based on the value of the degree and/or employment opportunities from said schools. It makes plenty of sense to borrow a ton of money to get an Ivy League or peer school degree, however, that cannot be said for many schools.

The bigger problem we have is the lack of good vocational schooling. On one hand, we encourage college level education, but the reality is that all colleges are not created equal, nor are all students really cut out for college – particularly if they are going to go to schools that offer no real opportunities for its graduates and any usable skill sets to go along with that degree. Universities are some of the worst bait & switchers around.

Many students would be much better off learning a real trade – plumbing, electrical, chefs, mechanics, etc. Our society has all but down played that route of training. In fact, much of the employment problems in low income areas could be solved with adequate vocational training at the high school level. Way too many of our young folks are graduating with no usable skill sets whatsoever and that is a huge problem.

Cute unit and well furnished. Loft is great for TV usage, dark and separate. I would worry about temperature control, esp in summer.

Russ, I agree with you on the need for vocational training at the high school level. How sad it is that many programs have been tried in the past but have failed, possibly because they are very poorly designed and do not train in skills that are currently needed. In the past, there were “work-study” programs that helped students get part time jobs with local employers, while completing essential coursework in English and math, and receiving mentoring in how to succeed in their jobs. I don’t know if these programs still exists.

Unfortunately, many low-income people have gotten themselves into a great deal of financial trouble that they are never going to get out of, by borrowing to go to trade schools to train in just the vocations you’re talking about. The typical tuition is about $20,000 for one of these programs, but it can be as high as $40,000 for a two year program, for jobs that often top at $30,000 a year, such as nursing assistants and other low-grade occupations.

These are student loans, too, that are written on the same terms as any other student loan, for low-quality schools that typically promise assistance in job placement, but when the student graduates, s/he typically can’t even get a job interview.

As for borrowing heavily to go to a top-tier school, consider just how much money you must earn to pay back a debt of $250K while paying for housing and transportation. Young people need to know just how much an impact a debt equal to or exceeding their probable yearly earnings will have on their daily lives, and just how difficult it is to repay a debt that size, especially on the terms most people are borrowing at this time, which means interest rates that can be raised at any time. A $200K loan, for example, with interest of 5.5% and a payback period of 20 years, means a payment of $1,375. At 7%, the payment is $1,550… before you pay your mortgage or rent, buy a car, or even clothe yourself and pay for medical insurance. Even if the borrower is fortunate enough to earn a starting salary of $100,000, he will have a difficult time handling this, and he will be carrying it for 20 years at least.

One thing is certain, and that student loans are very predatory and it is urgent that meaningful regulation be applied if we are going to continue to make these loans.

Maybe an “in-town” for a Cubbie and family?

Russ – in the “blue-collar suburban” high school system I went to (as a student in the college-prep program), there were vocational programs that were pretty close to union apprenticeships. Juniors and seniors took academics in the morning then went to work-study jobs in the afternoon at local construction companies, electrical contractors, etc. By graduation they presumably had enough work credits to qualify for a union job at a local factory/contractor.

Something tells me that these programs are not quite what they used to be.

http://www.chooseyourfuture.org/college-and-career-academies

Fashionista, the work-study programs at your old high school are very similar to those offered by to non-academic-track students at my old high school, long ago. I don’t believe they are the same anymore.

These days, the schools are colluding with the financial industry to turn our kids into lifelong debt serfs before the kids can develop the judgment they need to sort through the array of instant-debt-slavery financing options. From what my sister tells me, you cannot enroll in a private college, university, or vocational school now without taking out a line of credit, even if you have paid your tuition in full at the time of your enrollment. My nephew’s tuition at Webster University in St. Louis was paid in full when he enrolled, but the college still insisted he open a line of credit, which is a massive temptation for a 19-year-old kid. My sister was able to dissuade him from using it, thankfully, and the following year he transferred to U. of MO- Columbia, where he also had to open a line of credit, even though his relatively low tuition was paid in full.

Something has gone extremely wrong in this country when we make a policy of inducing the entire population into assuming dangerous debt loads.

True, on university campuses the first couple of weeks of classes, we were flooded with credit card offers luring the kids with some useless freebies.

“Something has gone extremely wrong in this country when we make a policy of inducing the entire population into assuming dangerous debt loads.”

“Something has gone extremely wrong in this country when we make a policy of inducing the entire population into assuming dangerous debt loads.”

Average credit card debt for college students:

2002: $552

2004: $2900

2008: $4100

I couldn’t find more current stats (I’m sure someone can). I’m assuming it has gone up even higher than $4100 now.

Some graduate with $10k- $15k on credit cards (in addition to student loans.)

We as a country will eventually our pennance for the student loan debt debacle.

But HD- when will people stop taking them on? When will it really get to be too much? (and I’m talking even for a “prestige” degree not just the University of Phoenix.)

When will it be just too much to pay for Boston College, Williams, MIT etc.?

Graduates from those schools are still making $40k or $50k upon graduation just like the U of I grads.

I saw an episode of Suze Orman a few months ago where she had an 18 year old call her. She had gotten into her “dream” school which was Boston University. It was $55k a year but they were only giving her aid of $25k a year. So she was taking out $25k (or more) in loans a year.

She also got into a school that was $33k (can’t remember what it was) which was a less prestigious school. They were giving her $24k in aid. So she only had to take out loans of $9k a year.

She wanted to major in journalism.

Suze told her something like, “I know it’s your dream school- but don’t do it. You won’t make enough money to pay off the debt possibly for the rest of your life.”

So at least the people with some influence (and yes, I believe Suze has influence on mainstream America and their money decisions) is telling the young people that this is “bad” debt and not to do it.

By the way HD, did you see the article in the NYT about how law schools are luring students in with “grant money” for their first year of law school (where it pays the entire tuition) but you have to maintain a 3.0 to get it for your 2nd and 3rd year?

And, of course, because law school is graded on a curve, the majority of those students lose the aid and then take on massive debt?

At one of the schools in the article, 70% of the first year class got those scholarships. Most of them would have them taken away for their 2nd and 3rd years (I think it was Golden Gate U in SF.) But some Chicago schools were also mentioned (Kent and others.)

They do it to lure the “best” students to the school (over going to a more prestigious school that doesn’t give out the aid) so that it boosts them up in the ranks of the US News and World Report because those students usually have higher LSAT scores etc.

Good times we live in.

Here’s the article for all you lawyers or wannabe lawyers out there (or parents of prospective law students):

http://www.nytimes.com/2011/05/01/business/law-school-grants.html?_r=1

“I believe Suze has influence on mainstream America and their money decisions) is telling the young people that this is “bad” debt and not to do it.”

Ask 100 18 year olds what they think of Suze Orman: maybe her opinions will impact 1%.

18year olds worldviews are formed by their peers, K12 education and the media. Not a single one of those influences suggests that going to a more affordable school is a good idea.

“Something has gone extremely wrong in this country when we make a policy of inducing the entire population into assuming dangerous debt loads.”

The puppet masters pulling the strings on the policy makers are the financial sector lobbyists.

The financial sector actually doesn’t create anything of value, yet somehow it grew to 22% of GDP during the credit bubble.

During the financial crisis we had a golden opportunity to let capitalism follow its nature course and rapidly shrink the financial sector. That wasn’t done due to their connections to those in power.

And now they’re using their heft to speculate on oil futures driving our current high gas prices.

2+2 is 4 both at Harvard and at a third tier school. The primary distinguishing factor is the student body and the faculty. The connections, etc.

There are overwhelming amount of people who outperform first tier school grads both on salary, and rank.

So, it’s great, if a student can make to a top 10 school, but it’s important for them not to feel like a loser, if they don’t.

“So, it’s great, if a student can make to a top 10 school, but it’s important for them not to feel like a loser, if they don’t.”

Spinoza- did you read the article? These law students who thought they wouldn’t have much debt now have enormous amounts of debt and a law degree that isn’t worth much in this market (in fact, one woman in the article who had the bait and switch done to her graduated in 2009 and still doesn’t have a paying job.)

So what’s the point of taking on all that debt again?

That was my question. At some point- both for undergraduate and graduate school- there will come a point when people simply say “no.”

“Ask 100 18 year olds what they think of Suze Orman: maybe her opinions will impact 1%.”

I’m thinking about the parents, Bob. The parents might be listening to someone like Suze. Sure- the kids listen to their friends. But if the parents are helping to pay for college AT ALL- it will be the parents who have the most influence.

Sabrina, don’t even get me started on the law schools.

I lose sleep over this. I grind my teeth at night for fear for a beloved young relative, very near and dear to me, who has wracked up $200K in debt for law school, in a climate where the ABA has accredited something like 200 law schools in the past 20 years or so and the market is FLOODED with new grads. It makes me choke to dwell on this.

Please, someone out there, tell me there’s a chance for someone who did not go to one of the top 14 schools. I badly want my relative to succeed and somehow pay those bills, as there is no way I can assist with them.

I don’t know much about law schools, but there are certain jobs, such as positions at management consulting firms, investment banks, academia that are unfortunately very brand name oriented. Often times top firms or prestigious universities do not even consider graduates of non top notch schools. Say one has a much better change of getting an interview with McKinsey if she/he graduated from MIT than Boston Univ. So there is an incentive to go to top schools if one has the prospects of getting very high paying or highly selective jobs otherwise I agree that it is a complete waste of money.

“So there is an incentive to go to top schools if one has the prospects of getting very high paying or highly selective jobs otherwise I agree that it is a complete waste of money.”

Of all of the thousands that go to top-tier schools each year what percentage do you think wind up working at “management consulting firms, investment banks” or onto further academia that requires a top-tier degree?

Is the Goldman & McK analyst class of…maybe 500 combined going to come to the rescue of these 22year olds buried in 200k of debt? Nope.

“So there is an incentive to go to top schools”

For networking I could see this, as well as that the differential between top-tier tuition and lower tiers is not much. But it seems these days top-tier pedigrees have become more something for parents to brag about than actually useful for students.

If you think they’re actually teaching mostly useful life or professional skills at these top tier liberal arts schools I have a bridge to sell you.

learned absolutely nothing useful in college but the name of a nice school always gets you an interview. Simple, 1 opening, 5,000 resumes, 8 meetings to go to today.

‘cut that 5,000 down to only people that have proven something *already*, i don’t have time to do it any other way.

Yep, i know the diamond in the rough is probably some kid out of U of F or Tulane but….. Just not enough time….

And why when i was 5 i knew not to borrow money i couldn’t pay back? I’ll say it again, Americans feel entitled to what most of the world does not. I like what Russ says, most people graduate with no usable skills. I can get that elsewhere for half price. Wage inflation, ROFLMAO!!!

seriously, wages here have doubled and I can still pull a CIT level graduate for US35K a year. Thats nuts! Why when you read a headline saying an American company is building a new multi billion dolar plant you always know the next sentance will be something like ‘in Sao Jose, Costa Rica’ -with something like 95 percent literacy-

College tuition and the related financial aid are the next bubble to burst. When prices increase at 7% per year for 25 years, pretty soon people can’t pay anymore, especially when aid provided by state and local governments goes down (it will due to budget issues). Real estate, health care, education – they all had government induced bubbles. Where was the incentive to keep costs down? The government’s involvement ruined it.

Exactly Ze. I have been on hiring committees and with so many applicants, the first cutting criterion is where they graduated from.

Also I agree that some of these kids have much higher expectation than their peers in other parts of the world. I lived with my parents while I was an undergrad and drove my mother’s car whenever she was willing to give it to me otherwise took the public transport and my parents could have easily afforded to buy me a new car. I also interned over the summer and worked hard. I was always top of my class and still never was sent to fancy vacations abroad as I see kids my colleagues do these days.

It was not until I got into the grad school that my parents started helping me buy a condo and all. I never paid any tuition and had always full support from my school. I think some kids feel it is their parent’s job to pay their college off rather than do their best and make it in the world on their own.

I agree Bob, but what I am saying is that it is one thing to pay for tuition to study engineering in MIT or do an MBA at Kellogg. It is another thing to pay to study history of art in some fancy liberal arts school and have to work in a coffee shop for 30 years to pay it off. The truth is there are some degrees that are for the rich elite who don’t need real jobs not for the lower middle class. But in this country everyone is deluded into thinking they are middle class or upper when they are not.

“Is the Goldman & McK analyst class of…maybe 500 combined going to come to the rescue of these 22year olds buried in 200k of debt? Nope.”

“If you think they’re actually teaching mostly useful life or professional skills at these top tier liberal arts schools I have a bridge to sell you.”

What “professional skills” should people pick up in college? Other than engineers or architects (the latter of whom need to go to grad school anyways), who’s developing professional skills in college? Certainly not business majors.

Twenty springs from now, when my kid is (hopefully) graduating from college, I sincerely hope that it will be from a small, top tier liberal arts college – the smaller and more liberal the better. I am not raising a cog.

“Certainly not business majors. ”

Accounting majors learn very applicable professional skills. I wasn’t one of them but there’s a reason the CPA requires five years and 150 credit hours to obtain, with many of them in accounting.

Finance majors can learn pretty good analytical skills–for those that actually pay attention and study the material (unlike accounting it is a lot easier to skirt by in finance from my observations).

You’re right though the rest of the majors are largely fluff.

“Twenty springs from now, when my kid is (hopefully) graduating from college, I sincerely hope that it will be from a small, top tier liberal arts college – the smaller and more liberal the better. I am not raising a cog.”

You’re kid will be unemployable but definitely good at discussing Leibniz and Kant at the dinner table. Teach them how to work an espresso machine while on their college breaks.

Your kid will be like one of my cousins, anonny. Recently graduated an Ivy League school with a liberal arts degree (I think history).

Going to continue her studies in grad school, already likely deeply in debt (money is rarely talked about, but her pa IS working two jobs–that never used to eb the case). Wants to get her PhD.

If she’s lucky she’ll come out of it as a post-doc earning 35k/year for…what 10 years? Sad thing is she is smart as heck, too. But either her or uncle are financially f$*@d with her career path.

I’m telling one of her brothers who never went to college to be a plumber or welder. He’ll have a more comfortable lifestyle and a far easier go of things than her.

I don’t know maybe it is a cultural difference, but I would have felt terrible for my father to work two jobs for me to do a degree that most likely I wouldn’t find a job with. One of my assistants has a daughter that did some type of theatre (drama?) program and this poor women is paying off her college loans and helps the daughter with rent of her NYC apartment. Also she got a loan a few years back to pay for the daughter to go see Italy and Greece!

“Going to continue her studies in grad school, already likely deeply in debt (money is rarely talked about, but her pa IS working two jobs–that never used to eb the case). Wants to get her PhD.”

If she has to pay tuition after the first year of the PhD program, she’s doing it wrong.

Paying? First year?

In just about every case, if you’re getting an arts/sciences PhD and not receiving tuition remission plus a stipend/fellowship (~$25k/yr), it’s an excellent sign that your path is not the correct one (it’s likely not the correct one, anyway, but that’s another story).

Unless of course, you’ve got Royal Family money or something and you’re doing it just for kicks.

The percentage of people who are making a good decision by taking on any debt at all for an academic advanced degree is not above 0 unless you’re looking at a whole mess o’ decimal places.

#

anon (tfo) on May 8th, 2011 at 10:06 pm

“Going to continue her studies in grad school, already likely deeply in debt (money is rarely talked about, but her pa IS working two jobs–that never used to eb the case). Wants to get her PhD.”

If she has to pay tuition after the first year of the PhD program, she’s doing it wrong.

“Paying? First year?

In just about every case, if you’re getting an arts/sciences PhD and not receiving tuition remission plus a stipend/fellowship (~$25k/yr), it’s an excellent sign that your path is not the correct one”

Know/of many people in hard science phd programs (and some number in arts programs) who did not get funding first year, b/c that’s the year you can get a masters and can just up and quit thereafter and have something to show for it, and received funding for phd program. Yeah, the “stars” all get funding first year, too, but there are a hell of a lot more students than stars.

Loft space is cool, but I bet it must be pretty hot up there during the summer. Two window units isn’t enough to adequately cool this space, especially that lofted area.