Rehabbed 4-Bedroom Co-Op Reduces $350K Since 2009: 3500 N. Lake Shore Drive in Lakeview

We last chattered about this 4-bedroom vintage co-op at 3500 N. Lake Shore Drive in Lakeview in May 2009.

See our prior chatter here.

It sold for just $293,000 in 2008. In May 2009, the unit had just come back on the market after a major rehab and was listed for $849,900. You can see the “before” and “after” pictures in the prior post.

Most of you thought the rehab was nice but that the unit might have been priced too high despite the sale of Unit #8C, which had also been renovated, in February 2008 for $915,000.

2 1/2 years later, the unit is still on the market and has now been reduced about $350,000 to just $499,000.

Yes, the assessment is now $2733 a month. That includes heat, gas, doorman, and cable. The listing states that is only $0.78/ft per month.

Parking is available next door for $250 to $275 per month.

If you recall, the unit has been completely restored. It now has a new kitchen with limestone countertops, custom cabinets, SubZero, Wolf and Kitchen Aid appliances. The butler’s pantry was renovated with mahogany countertops.

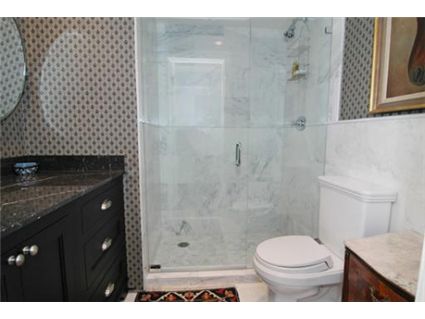

The third bathroom is new but the other two were left intact with new lighting and reglazed tubs and tiles.

The entire apartment was re-wired with 150 amp electrical. A washer/dryer was installed along with the space pac cooling system.

The millwork was replaced and all the walls skim coated.

Additionally, the common foyer outside the door got new millwork and marble flooring.

Is this now a deal?

Steve Acoba at Keller Williams still has the listing. See the property website with floorplan here.

Unit #2C: 4 bedrooms, 3 baths, 3500 square feet

- I couldn’t find an original price

- Was listed in May 2008 for $315,000

- Sold in August 2008 for $293,000 (per Redfin)

- Originally listed in May 2009 at $849,900

- Withdrawn

- Re-listed in April 2010 for $660,000

- Reduced

- Currently listed at $499,000

- Assessments of $2733 a month (was $2309 a month in May 2009)- includes heat, gas, doorman, cable

- Taxes of $5718 (was $7896 in May 2009)

- Co-op

- Now has space pac

- Now has in-unit washer/dryer

- Rental parking for $250 to $275 a month

- Bedroom #1: 23×13

- Bedroom #2: 19×12

- Bedroom #3: 19×13

- Bedroom #4: 16×9

I’m sorry, but I am really confused. Why in the world would anyone buy a place where the assessments are higher than the mortgage payment? That just seems ridiculous to me. Under what circumstances does that make sense? The mortgage for this place would be around $2,000/month, and the assessments are $2,700/month? Why in the world wouldn’t someone buy a much nicer place with a $3,500/month mortgage, $3-600/month in assessments and still be $300-600/month to the good after utilities, AND more of your monthly payment goes to your interest deduction?

There are a large number of units for sale in this building at rates seemingly below market compared to comparable co-ops in the area. Any idea what is wrong with this building?

“•Assessments of $2733 a month (was $2309 a month in May 2009)- includes heat, gas, doorman, cable

•Taxes of $5718 (was $7896 in May 2009)

•Co-op”

Are the taxes in or out of that assessment amount?

I swear the day is coming when the value of these places, given the assessments, will be damn near zero. As long as the total cost is comparable to other places it doesn’t matter that the assessments are more than the mortgage payment – eventually the mortgage payment may approach zero.

BTW, the listing does not indicate that taxes are included in the assessments but they nevertheless might be. Wouldn’t be the first time that a listing is not accurate.

Agreed. This reminds me of the condo on State pkwy that is practically unsellable because of killer assessments.

If condos/coops could come up with enough lobbying power and make assessments tax deductible, you would see the biggest condo/townhouse boom in history!!!! (at the same time, they should make maint.costs for houses – up to a certain amount- tax deductible as well). That’s all the housing market would need to reverse itself. Believe me, the money is out there.

Gary is correct. In fact the day is coming when some of these buildings will have negative value due to cost of demolishing them and disposing of them. No different than a beat up old car.

I honestly just don’t understand how the assessments get this high. The thing that doesn’t make sense in my mind, is the fact that if you used these assessments as a guide – the expense of operating a building like this would make any vintage high rise virtually worthless. Yet somehow – the apartment buildings (i.e. those owned by the Wirtzs on LSD) seem to be doing great, and when they do sell – they fetch a pretty penny. Why is it that apartment buildings can keep their expenses in check but co-ops cant?

I’m not sure a tax deduction would make that much difference. Tax deductible does not equal free. And many owners of high end condos and co-ops would not be able to take the deduction anyway due to AMT. A monthly assessment of nearly $3000 is HUGE, with or without a tax deduction. Besides, there’s no political will to even consider making assessments deductible (talk about tax breaks for the rich…).

One reason I think that the “old money” buildings have monster assessments is because the old people long ago paid for their units so they have no mortgage, and may have never had one. The assessment and taxes are their only housing expense, so paying thousands of dollars a month isn’t a big deal to them. Especially since it allows the association enough money to hire lots of staff to take care of every want and need. Old money types often value service and convenience over low assessments.

Andy, coops include taxes in their assessments. Also, they usually offer more services that are included in assessments. Furthermore, what people don’t understand is that coops offer some degree of asset protection in that you only own “shares” of a building and therefore it is looked at as an investment (liabilty protected asset and protected from future lawsuits – your home/house isn’t). You can put this into an investment accout/trust more easily than a house and, if you get divorced, it is harder for your wife to get it…..

“I honestly just don’t understand how the assessments get this high”

Redfin sez 64 units.

Full-time (24/7–meaning a minimum of 4.5 FTE, union employees) doorstaff, on-site engineer. That’s probably close to $800/mo/unit, if shares are equal.

Back out the taxes (assumption), you’re left with less than $1500/month including heat, electric, cable–which, when one considers the (likely) age of the mechanicals, and the (certain) profligate use that such billing encourages plus water and garbage and insurance, gets you down to well under $1000/month for exterior/interior maintenace and reserves, etc, etc.

If condos/coops could come up with enough lobbying power and make assessments tax deductible, you would see the biggest condo/townhouse boom in history!!!!

As many coops are historically significant, it would benefit them to get some kind of tax break for the higher than average maintence costs of a vintage buildings. I for one would prefer that these pretty old buildings line the park than the new (although more efficient) condos that have gone up in the last few decades. Think of all the old ugly, white brick buildings that line LSD…they are eysores. On the other hand, if Congress does away with the mortgage deduction goes away for all Americans, then this will level the playing field for coops. Doesn’t matter whether you are spending in assessments or mortgage as neither will be deductible.

Gorgeous place though… I would would have redone the tile and everything in the master bath (more luxurious) but kept the vintage style. The view could be better too. The second floor is too close to the drive.

The placement of the antlers is creepy, not to mention the antlers themselves. Let’s sit on the couch and position ourselves directly below the antlers so we look like deer.

“Why in the world wouldn’t someone buy a much nicer place with a $3,500/month mortgage, $3-600/month in assessments…”

Do you have an example property in mind, i.e., a much nicer 3,500 sq ft, 4/3 in a doorman building, where the assessments are $3-600/month?

This unit will appeal to the Park Avenue wanna-bee, transplanted from NYC and who thinks $3000/month assessment (in 2011) is still “a steal”. A Chicagoan able to drop this amount of $$$/month for housing costs will blanche, and invariably go for a much higher priced house or condo with a much lower monthly cost/maintenance commitment.

It’s more likely the tax deduction for mortgage interest will end, or be incremently reduced based on filers’ income. Making co-op assessments tax-deductible is unlikely.

Co-ops’ high monthly assessments are often due to two specific issues: low unit count per elevator bank for doorman-served buildings (often only 2 or 3 units/landing), and ancient mechanical systems requiring constant maintenance/repair/replacement, and instance of old boiler plants, very high fuel charges. In addition, some co-op buildings have refinanced their building debt to recapitalize for major capital projects (roof replacement, tuckpointing, elevator replacement, etc).

Personally, I like the small vintage co-op buildings in the 1200 LSD area far more than this cluster at 3500 – 3800 LSD filled with more units. These co-op associations up here are likely embattled due to the steep assessments.

“if Congress does away with the mortgage deduction goes away for all Americans, then this will level the playing field for coops.”

Coop owners can deduct the interest on their unit mortgage plus their share of any interest paid on any mortgage paid by the coop corp, so the field is already level.

O.k., to recap:

Buy a co-op = have a lower mortgage payment (but you’ll need a larger downpayment and there’s less of an interest deduction), with much higher assessments (partly on account of taxes, and partly due to issues relating to the land lease, etc.)

Buy a condo = have a higher mortgage payment (and attempt to put as little down as possible while still getting a decent rate, and enjoy a greater interest deduction (assuming you’ve not reached the max)), while paying assessments that are lower (than a co-op).

The monthly carrying costs are roughly same, with the main differences between the two being that, during the course of ownership, the condo unit owner (for now) enjoys a larger tax deduction and, at least in theory, stands to walk away from a future resale with a much larger check than the co-op unit owner. But I could see how the co-op option might be fairly attractive to certain buyers, or at least be a nonmaterial factor in deciding between a condo and a co-op with similar monthly costs.

And reiterate my question: Seriously, I’d like to see some listings for condos in the 3,000 sq ft + range, in nicely kept doorman buildings, where the assessments $300 or $600. Or for that matter, a mere $1,200/mo.

I wish more of these listings had floorplans. And I really like how the arrows in the floorplan let you see which angle the corresponding photo is viewing.

I used to live at 3520 LSD (condo not coop), and moved out partly because the assessments felt too high for amenities received. But I do miss the vintage bathroom I had there, which was similar to the ones shown.

anonny, not only would I like to see that nicer 4 bed/3 ba 3000+ sq/ft comp with only $300-600 assessments, but I’d also like to see a listing price that doesn’t make the price between that condo and this co-op be equal to the difference in month payments on the assessments. Any nicer 4 bed/3 bath 3000+ sq ft condo is going to be priced WELL north of $500k.

“Coop owners can deduct the interest on their unit mortgage plus their share of any interest paid on any mortgage paid by the coop corp, so the field is already level.”

good point

“And reiterate my question: Seriously, I’d like to see some listings for condos in the 3,000 sq ft + range, in nicely kept doorman buildings, where the assessments $300 or $600. Or for that matter, a mere $1,200/mo.”

It does not exist anonny. A 3000 square foot condo with a doorman is going to have nearly similar assessments to these vintage buildings (even in a newer building.) People are simply used to their 1250 square foot 2/2 condo with $750 a month assessments. They don’t get it that this unit is nearly triple the size.

It really is a gorgeous unit, and I can definitely see someone from NYC being a buyer.

This is unit 12D. They’re asking $175,000. It’s also 3 BR, on a higher floor, and with lake views. Lower assessments as well. So why would anyone pay more than twice as much for unit 2C?

http://www.movoto.com/il/3500-n-lake-shore-dr-chicago/461_07866882.htm

OK – I goofed. I guess 2C is a bigger unit. Still, I’d imagine whoever is moving to this building can deal with having 3 BR, instead of 4. And the square footage is still nice at 2,500 SF, about the size of a typical single family home. I’d sacrifice the extra bedroom and SF for the lake views and the much, much lower price of 12D.

Serious question, how many people here understand the difference between a co-op and a condo and the resulting implications with respect to sales price and maintenance costs?