Reductions on New Construction Luxury Lofts in the Loop: 223 W. Lake

These 8 new construction luxury lofts at 223 W. Lake in the Loop came on the market in June 2017.

We last chattered about them in July.

You can read our chatter here.

If you recall, this building was constructed in 1895.

These units have all the features that loft lovers look for including tall reclaimed wood ceilings, exposed brick walls and iron and glass double paned window as the El line runs right in front of the building.

These lofts are all 3 bedroom, 3.5 baths. There are 2 units per floor, one facing north (towards the El) and one facing south (towards office buildings).

The 2 penthouse units each have private rooftop terraces.

They have chef kitchens with white modern cabinets and stainless steel appliances.

The bathrooms are also in the modern style.

There are light wood floors throughout.

From pictures and the 3D tours, it appears that each of the bedrooms have windows, although it looks like they are all frosted for privacy.

Each loft has a private elevator entry. The building has a heated garage but no doorman.

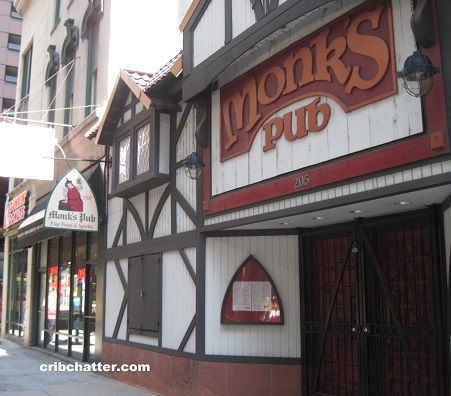

This block of Lake contains several historic brick buildings, including one with a Chipotle on the first floor, as well as Monk’s Pub, one of the oldest restaurants in the loop.

It appears none of these lofts have sold.

But recently 5 of the 8 lofts saw price reductions including the following:

- Unit #4S: Originally $1.86 million but now reduced 10% to $1.674 million

- Unit #3S: Originally 1.86 million but now reduced 10% to $1.674 million

- Unit #3N: Originally $1,472,500 but now reduced 5% to $1.55 million

- Unit #2S: Originally $1.7 million but now reduced 10% to $1.53 million

- Unit #2N: Originally $1.48 million but now reduced 5% to $1,406,000

Neither of the penthouses nor #4N have been reduced.

- Unit #PHN: Still $2.34 million

- Unit #PHS: Still $2.34 million

- Unit #4N: Still $1.82 million

By Thanksgiving, the market will be in holiday/winter mode where sales slow.

Will these price reductions get the job done before 2018?

Helaine Cohen at Berkshire Hathaway KoenigRubloff is still handling all the listings. You can see pictures of the penthouse here.

Or you can see the 3D tour with floor plan here.

PH-N: 3 bedrooms, 3.5 baths, 2718 square feet

- New construction

- Originally listed in June 2017 for $2.34 million

- Currently still listed at $2.34 million

- Assessments of $679 a month (includes heat, A/C, scavenger, exterior maintenance and snow removal)

- Taxes are “new”

- 1 car heated garage included

- Bedroom #1: 36×14

- Bedroom #2: 26×14

- Bedroom #3: 26×10

- Rooftop Deck: 35×19

Somewhere a developers pucker factor went to 11

Next to Monks? A steal at any price. That was the place to get shithoused at lunch.

Throw in a liver transplant and it’s a deal

More cuts to come. Talk about reaching, even still.

Nice nighttime views, look at how the garage glows across the street in pic #22….

Yeah no, last time I was here (friend lives in the linea buidling) there was a homeless dude sleeping in the cubby for the doorway

the EL is fucking loud here and there aren’t a ton of amenities in this part of the loop

The places are nice, but the prices are crack pipe level

Stories like this are what fascinate me on CribChatter. What in the world were the developers thinking? I have to assume they’re hoping for a) Someone who wants to be closeby to work, (Mart, Rush, NWM Hospital, Trade). I can’t see anyone wanting this as a part time place – as it’s close to nothing “fun” nor does it have a view of anything “fun.” I guess it’s reasonably close to the train. It’s all work and no play. That said, I have no idea what price might make sense here. As cool as the space is, given other options in the 1.5-2.3mm range, this would be damn far down on my personal list, so I’m guessing it needs to drop quite a bit more.

Perhaps they should have built some micro-offices in this location instead. I can’t imagine buying and living here.

These are really nicely done, but agree the location leaves a lot to be desired. I recently had a meeting in a building on the 200 block of W Wacker and you could hear the trains screeching and rumbling down Lake St from the 7th floor.

It’s a fairly easy walk to West Loop / Randolph / Fulton Mkt and to River North, though, and I think the riverwalk will eventually become more of a year-round destination. The price doesn’t reflect the ‘eventually’ aspect of that!

What surprises me more than anyone who would buy a luxury loft next to a noisy train line, is anyone who would build luxury lofts next to a noisy train line. Was the developer so starved for a rehab project that this location was acceptable?

If this were rental property, the units would rent for far below the average for the area. Even for office space, this is a class C location.

The developer needs to Google “silk purse” and “sows ear”.

wow this is perfect. I work just 1 block away. I am going to buy the penthouse suite and I’ll be able to keep an eye on my condo from work. money is not a barrier for me with all the money i’ll save not having to commute to work.

That entry “nook” looks like a great place for a homeless person to use as a urinal…

They need to keep on cutting the price…or at least hold out until Amazon announces where H2 will be (if that is even going to be reasonably soon), then chop chop chop chop.

“or at least hold out until Amazon announces where H2 will be (if that is even going to be reasonably soon), then chop chop chop chop.”

I believe they announced San Diego as their H2 site. Which makes this a bit of a commute.

No, San Diego was not announced as HQ2.

In short, no.

These cuts are not enough. Bring that penthouse down to 1.5 and maybe they will get some bites.

Wait, the train is directly outside the penthouse windows? Jk. see you at 999.

“They need to keep on cutting the price…or at least hold out until Amazon announces where H2 will be (if that is even going to be reasonably soon), then chop chop chop chop.”

Aren’t they supposed to announce this in early 2018? Don’t have long to wait.

This builder must have watched Field of Dreams before building. I go to Atlas all the time, they can’t believe it either.

“Aren’t they supposed to announce this in early 2018? Don’t have long to wait.”

Floating a $7MM+ (Back of the envelope) note for another 6mo +/- might change your perception of time

@JohnnyU C’mon. That’s only about $30K in interest per month. NBD.

“Floating a $7MM+ (Back of the envelope) note”

$4.5m, which is refi of the $5m acquisition note, and not a construction loan. Seems to be funded with investor equity.

“$4.5m, which is refi of the $5m acquisition note, and not a construction loan.

Seems to be funded with investor equity.”

I disagree.

I believe 2014 building purchase @ $2 mil was all equity but there’ve been two subsequent construction loans. Fwiw principal of owning entity appears very experienced at buying low/selling high & also appears to have jv’d in past with other very qualified local investor/developers. The 2014 seller purchased bldg for $3.5 mil in 2005.

In May, 2015 a lender made a $2.5 mil construction loan, due in 2017, extendable under specified conditions. (Ime Cook Cty recorder often sees mortgage doc. language which claims a right to secure double the note amount to protect bank & then records loan accordingly.) Owner instead paid loan off by refinancing loan when due, with a $4.5 mil construction loan in May, 2017. That loan came imo from a ‘bridge loan direct portfolio lender’ aka ime a ‘hard money lender’. That’s a lender who charges 7%-12% annual interest for short term commercial mortages (typically one year max.).

Hey it’s been a week since political thoughts were posted here – in my opinion US politics & policies have a huge impact of real estate markets & values and hence are fair game for discussion no matter who’s in office.

“two subsequent construction loans.”

That’s a BS construction mortgage, then. Drafter (and borrower, frankly) should be embarrassed, even for Illinois docs, where anything goes.

Maximum principal amount is ‘typically’ shown as 2x actual loan, whether or not there is any future advance component, nevermind construction loan.

That said, you may well be right–didn’t look at the prior mortgage.

“a ‘hard money lender’. That’s a lender who charges 7%-12% annual interest for short term commercial mortages”

Not always by any means, as far as the rates.

Here’s the Lender’s description of the loan:

‘In May 2017, Emerald Creek Capital provided a $4,500,000 refinance in “the Loop” neighborhood of Chicago, Illinois. The loan is secured by a five-story, mixed-use property with a gross building area of 32,000 SF and net rentable area of 28,930 SF. The borrower plans to renovate the building to encompass seven three-bedroom units with ground floor retail. Bordered by the Chicago river, the neighborhood is a central business district known for cultural attractions and restaurants, shopping centers, and modern skyscrapers.’

SB – was the bldg purchase price 2 or 3.5MM?

With no pre-sales, I don’t think they’d be getting cheap money (though it would depend a bit on the quality of the development team).

That’s a long gestation for a project. Would think that there’s a little nervousness

Fwiw the recorded 2017 mortgage is styled “construction loan” and balance is due in one year.

Fwiw from lenders website:

“About: Emerald Creek Capital is a direct portfolio lender originating commercial bridge loans. We provide short-term financing secured by a 1st mortgage on commercial real estate. Our open-door lending platform allows us to deliver fast and flexible loans tailored to the specific needs of each client. Capital is available for acquisitions, refinances, repositioning and other market driven opportunities.

The present economic environment highlights the need for non-traditional lenders. With many banks inhibited by governmental oversight, borrowers are finding it more and more challenging to find credit. In contrast, Emerald Creek’s loan product is fast, flexible and provides certainty of execution. It has proven to be a more attractive path for many qualified sponsors.”

“Interest Rates – Starting at 7%”

For investors: “Emerald Creek Capital is a private investment firm focusing on short-term debt secured by income producing real estate… Our funds focus on providing bridge financing, typically one year notes, for commercial real estate transactions.”

That sounds like a hard money lender ime

SB – was the bldg purchase price 2 or 3.5MM?

With no pre-sales, I don’t think they’d be getting cheap money (though it would depend a bit on the quality of the development team).

That’s a long gestation for a project. Would think that there’s a little nervousness”

The 2014 purchase price was $2,000,000.

In my opinion the failure to secure pre-sales doomed extending existing 2015 construction loan when initial two year period expired. The recorded mortgage specified loan was extendable for additional two years subject to certain conditions. Either lender, borrower or both decided against extending. In my opinion the current/replacement financing isn’t cheap & who here believes ownership will close the sales of enough units to pay off $4,500,000 loan in 7 months?

Finally I believe anon(tfo)s post of lender’s description of loan is directed at their investors. It sure sounds like a well reasoned business decision. But who believes this building is worth $6,750,000?

But who believes this building is worth $6,750,000?

Might be.

A 30% haircut across the board would leave enough meat on the bones provided that you could sell the units in a year. Don’t know if that’s enough tho

Don’t think the initial developer can drop prices that low

“who believes this building is worth $6,750,000?”

All about how much of the construction is completed, right? If only the one unit is finished, and the rest are not even to whitebox stage, then clearly no.

If they are all finished, then perhaps. You could probably get over $2 psf as rentals, no?

“Fwiw the recorded 2017 mortgage is styled “construction loan””

Uh, no, it’s not.

http://www.ccrecorder.org/recordings/show_recording_from_parcel/570580290/1644878/

No future advance provision, nothing.

The 2015 mortgage is for a construction loan–I just assumed, and should have looked at it.

Anyone know what’s going on with these lofts? I did get a chance to tour them several months ago and was actually very impressed. I was considering a unit for my primary residence, but thought they were a bit overpriced at the time. It appears they are now off the market with no units sold. What could that mean?

“It appears they are now off the market with no units sold. What could that mean?”

You could contact the prior listing agent as she was representing the building. She would know what’s going on.

Could be that they’ll re-list them again this spring OR possibly they’ll rent them out.

I agree with everyone else that this location is one of the worst. Not sure why anyone would pay big bucks to live here. Noisy and no nearby amenities.

PH-N appears to be for rent for $13,000 per month.