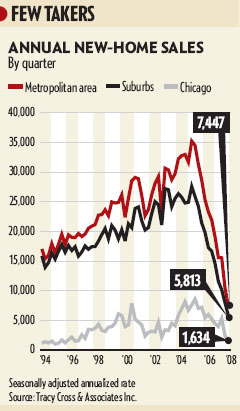

Market Conditions: New Home Sales Plunge 64% in the First Qtr

First quarter 2008 numbers are out for new home sales and they’re not pretty. Is anyone surprised?

According to Crain’s:

- 5,813 sold in the suburbs

- 1,634 sold in the city

Suburban new home sales were down 60% year-over-year.

In the city, sales were down 64% from the first-quarter 2007.

“It remains to be seen when this market will hit bottom,” says Brian Brunhofer, president of the Illinois division of Pulte Homes Inc., the area’s largest suburban homebuilder. “But it’s not surprising. We were prepared for ’08 to be a bit tougher than ’07.”

At their current pace, new-home sales are on track to total 7,447 for the year, down 52% from 2007, at a seasonally adjusted, annualized rate.

Bad winter weather may have played a role in the year’s slow start. But the broader economy also had a chilling effect of its own, as economists debated whether a recession had begun or merely was imminent, consumer confidence plummeted and banks tightened lending standards, making it more difficult for home buyers to get a mortgage.

“The best way to describe the market is it continues to remain frozen,” says Mr. Cross, president of the consulting firm. “We were at a low point in the fourth quarter last year. Now we’re at a lower low.”

We’re in the middle of the spring selling season, but the homebuilders aren’t seeing a big uptick yet.

This chart from Crain’s tells the tale:

I think the same can be seen in the numbers we’re seeing in the re-sales as well. Some things are selling, but it’s far off the pace of even 2007.

Housing Slide Picks Up Speed [Crain’s]

Ok, so the question is when do prices really start to fall?

How long does it take for a lack of sales to actually move prices down as much as they should be? It seems that right now nothing is selling but sellers still think they can get their absurd valuations (unless they are foreclosures).

Prices will fall when the banks truly dump the REO’s on the market, not trickle them.

The interesting point is that you cannot get a Zero Down anymore. Has anyone else noticed this? If you got a guy that can give a Zero Down still pls post here. Everyone that I have talked to requires 5%, and Freddie Mac wants 3%. This is BIG news that no one is talking about. This will cause sales to continue to plumet and eventually prices of home that HAVE to sell will come down just meet the d.p.

Stuckinthe city: I have also heard that you cannot get a zero down loan anymore. I think it was either Chase or Citibank that was the last to offer it, but they cut their program.

This is a disaster. I think much of the blame goes to the government for implicitly backing higher homeownership as better for society and part of the “American Dream”. Just because homeowners don’t committ as much crime and tend to be better educated than non-homeowners correlation does not imply causation.

Mortgage interest deductions should be eliminated from taxes and Fannie and Freddie should not be able to obtain debt at a government subsidized rate. Cut them free and let them operate like any other private company. Oh yes and ARMs and liars loans should be eliminated as well.

Can’t get zero down no more? Oh man! I wanted to be a mini donald trump, buy 15 condos on liar loans and flip them like they show me on “flip that house”. After all house is not a place to live and raise families but a place to trade like pork bellies. Not Fair!

On a more serious note, I am hearing that the banks are moving very slowly on putting reo’s on the market for 2 reasons

1. They are inundated

2. They don’t want to take the loss on the books and until they sell at a steep loss they don’t have to.

Right 9:58, I think the short answer to all this is that we are seeing prices stagnating right now but supply demand will have to cause a substantial decrease in housing values some time “soon”.

The question is how long “soon” will be and if that will be a real bottom in the market. I’m not worried that buying now will not cause appreciation (the gov’t tax incentives insure that it is a good investment) I just don’t want to buy when prices are still on the steep decline.

The summer season will be interesting, if things don’t really start moving come late fall / next winter we should start to see serious price depreciation.

Sweet.

Kevin,

watch the ARM reset calendar which is about to spike again later this year well into 2009. In addition additional inventory will put downward pressure on rents which will weed out flippers hoping to rent their way out of this. Finally, the downtown chicago market is about to see huge supply come online– aprox 6000 units. At the current pace of sales, this is about 4 years of inventory.

However like any asset price deflation, there will be several false bumps at different resistance levels. Expect the real estate establishment to call the bottom at each of these levels.

My guess is that summer will make no difference. In fact, I wouldn’t be surprised if 10% down becomes the norm in the near future. Then back to 20%….that will really burst the sellers bubbles!

Someone (i.e., the realtors) needs to clue their clients into reality. No, you cannot ask $400,000 for your never been updated house. Besides, who has the 5% ($20,000) just laying around. That doesn’t even include closing costs, moving expenses, etc. Should be interesting….

Prices will come down when sellers can’t afford to hold on any longer. When the stubborn ones finally realize it isn’t 2005 anymore.

As a side note, if someone thinks they can buy a house but then cannot come up with a mere 3% downpayment, what better evidence is there that the person can’t afford the house? What will they do when the water heater breaks?

First subprime, then alt-a, and finally prime. There is no way to get the cat back into the bag.

sartre on April 21st, 2008 at 9:58 am

Can’t get zero down no more? Oh man! I wanted to be a mini donald trump, buy 15 condos on liar

—

S, there is more to Zero Downs than big pimpin. Many new buyers will need their hard saved dollars to improve a newly bought house, or build an extra bathroom, or build a garage, or demo a rotted pool. Dumping downpayment dollars into a sink hole before you can do upgrades or repairs will have a major impact on the market.

But the majority of people put zero down because they either could not afford the downpayment or they wanted to use their money to invest in other properties.

Sure some people wanted to do improvements, but that begs the question. Why are you buying a house that needs so much in upgrade costs if you can’t afford to still put at least 10% down.

Thanks for all the helpful posts. When I was bidding on a one bedroom at 240 E. Illinois, the seller seemed a bit insulted over the initial offer, refused to budge on list price. Their explanation was that the location and quality of the building mean that prices there (and surrounding developments – 600 N Fairbanks) were insulated to the sales trends in the rest of Chicago. I know that obviously it helps to have that amazing location, but how realistic or unrealistic is it to think that prices there won’t dip? Guy made me feel like I was mad for starting bidding around 18 percent below list. Now I feel like I was mad for trying to buy at all this early in the market.

Moving to Chicago: I think some areas of the city feel that they are insulated or that prices will hardly drop (such as Streeterville, parts of River North, and Lincoln Park.)

Those sellers are holding onto their prices- unless they get into financial difficulty. It’s why we haven’t seen much sell as re-sales in 600 NF, 240 E. Illinois, 160 E. Illinois and, soon, ParkView.

The sellers are pricing way too high.

I would be patient in this market. The best neighborhoods are always the last to fall.

Sure some people wanted to do improvements, but that begs the question. Why are you buying a house that needs so much in upgrade costs if you can’t afford to still put at least 10% down.

—

I will cannot claim to know what “most people want”, but I am sure that there are plenty of people that do not want a small condo with no parking in the heart of this conjested city. There are many people that do want a SFR with their own land and no one above or below them. Those people face the immense prive v. condition problem that buyers have in this current market. Yes, yes, you get what you pay for. But Sab’s (and mine) thought that the re-sales numbers will parallel new homes, is a reflection of the buyers mindset. That they are not going to (or cannot bec of higher d.p. reqs) pay for a high priced un-updated home like buyers of the past were.

Moving to chicago: The only person insulted was you who was being asked to pay for an overpriced and deflating asset. This is probably the single biggest purchase you will make. If someone is insulted by your offer, thats too bad.

Stuckinthecity: whatever happened to saving money and doing upgrades as cash came in. I guess thats old school. I agree with Jeremy–if people can’t afford to upgrade, they can either wait to buy or live in the house they bought and upgrade as they go. This zero down nonsense has put the whole financial system at risk. When the buyer has no skin in the game, it is very easy to walk away and that is exactly what is happening.

Here is what I am talking about:

http://www.azcentral.com/realestate/articles/0421walkaway0421.html

I understand this is not chicago but remember that west and florida bubbles preceded ours by a couple of years. Expect “jingle mail” to become part of popular lexicon.

After all the debates we have on this website, wouldn’t it be nice to own a home ay about 65 and not have to worry about rent? Get a loan and PAY it OFF!! 😉

Jeremy on April 21st, 2008 at 3:28 pm

“But the majority of people put zero down because they either could not afford the downpayment or they wanted to use their money to invest in other properties.

Sure some people wanted to do improvements, but that begs the question. Why are you buying a house that needs so much in upgrade costs if you can’t afford to still put at least 10% down.”

Wow, not sounding condescending…but are you actually in the market to buy or are you looking in from the sidelines???

My spouse and I have been looking at single family homes on the NW side of Chicago for the last few years. Why would we put any money down on a $300,000 + house that needs thousands of dollars worth of improvements?! That’s not the exception, that’s the norm. Unless you can afford to put down the 20%, you’re throwing your money away.

As soon as the greedy sellers realize that qualified buyers WILL NOT throw their money away on their neglected garbage, the better off we’ll all be. I invite you to find us a fully updated home on the NW in a good neighborhood for $300,000 or less. It doesn’t exist in today’s market.

“fully updated”

What does this mean to you? Are you expecting the “standard” kitchen with granite and matching SS appliances? And all current code electric and plumbing? With bathrooms bedecked in stone with separate showers and commode rooms? And a roof and windows and HVAC that are less than 3 years old? And a new-ish garage?

I don’t think that a return of sub-$300k “fully updated” single-family homes in “good” neighborhoods in the city will happen short of near economic depression. And then it won’t do anyone any goodm as even $250k will be too much for all but a few anyway.

I think that Busted Bubble has the mindset that put us in this mess in the first place.

Whatever happened to the idea of actually building up equity in your house,or in this case having some equity in your house JUST IN CASE SOMETHING BAD HAPPENS.

Why is it throwing away money to actually put money in your house? I’m guessing you’re arguing that you can deduct mortage interest from taxes and invest your money elsewhere?? – Which was my original argument (that people put zero down to invest elsewhere, during this frenzy real estate).

You ask me: “Why would we put any money down on a $300,000 + house that needs thousands of dollars worth of improvements?! ”

I answered this in my original post: “Why are you buying a house that needs so much in upgrade costs if you can’t afford to still put at least 10% down?”

Again, this comes down, I think, to what value you attach to having some equity in your house from the start.

And this: “That’s not the exception, that’s the norm.” actually was my point.

TO: anon on April 22nd, 2008 at 1:04 pm

“fully updated”

‘What does this mean to you? Are you expecting the “standard” kitchen with granite and matching SS appliances? And all current code electric and plumbing? With bathrooms bedecked in stone with separate showers and commode rooms? And a roof and windows and HVAC that are less than 3 years old? And a new-ish garage?’

For $300,000, I shouldn’t be inconvenienced by looking at your crappy avocado green kitchen appliances, fake wood counters, stained shag carpeting, and subway tiled bathrooms from the 1950’s.

If you were even slightly familar with homes in that price range in decent neighborhoods, you’d already know that natural stone bathrooms/kitchens, ss appliances, etc. are NOT standard. Instead, the features I mentioned are.

TO: Jeremy on April 22nd, 2008 at 4:34 pm

“I think that Busted Bubble has the mindset that put us in this mess in the first place.”

You are WRONG. In fact, if more people thought like my spouse and I, they wouldn’t be standing in the government empathy line with palms up waiting for a mortgage bail out. Instead, they are pointing fingers at ‘predatory lenders’ that took advantage of their dimwitted nature. If you can’t afford a house with a traditional mortgage, you shouldn’t be buying one in the first place. I suspect this thought will occur to these people as they hand their keys over to the bank.

As we are only a lowly city workers, maybe you can supplement our incomes so that we can buy a house that doesn’t need all of the usual updates. While your at it, why don’t you make it in a neighborhood where there is no Section 8, no gangbangers hanging out on the corners, a low-ish crime rate, and a useable public school.

Oh yeah, and it has to be within the Chicago city limits because King Daley has violated our civil right to choose where we want to reside. Good luck. If you do find this utopian house, we’ll gladly put down the 10 or even 20%!

BustedBubble,

I’m not even really sure where our point of disagreement is. I have been arguing for this point: “If you can’t afford a house with a traditional mortgage, you shouldn’t be buying one in the first place.”

And the rest of your post I pretty much agree with.

“For $300,000, I shouldn’t be inconvenienced by looking at your crappy avocado green kitchen appliances, fake wood counters, stained shag carpeting, and subway tiled bathrooms from the 1950’s.

If you were even slightly familar with homes in that price range in decent neighborhoods, you’d already know that natural stone bathrooms/kitchens, ss appliances, etc. are NOT standard. Instead, the features I mentioned are.”

Right, I understand that. But I’ll ask again–What are you defining “fully updated” to be? You’ve explained what is NOT “fully updated”, but does an early 80s remodel (laminate counters, white cabinets and appliances, no shag carpet) count as “fully updated”? It doesn’t to me, but then I recognize that $300k is basically still the teardown price for a lot in “a neighborhood where there is . . . a useable public school”.

Oh, and btw, we don’t need to supplement your income–we’re paying your income. How ’bout you give some back so my taxes don’t go up?