Another Gold Coast Beauty Heading Towards Foreclosure: 1520 N. State Parkway

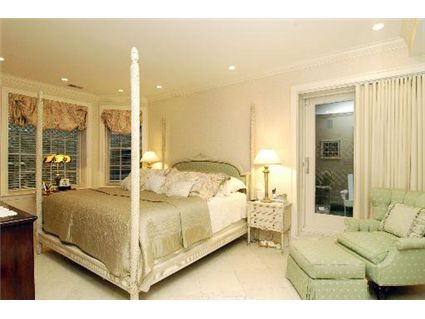

Right on the heels of a pending foreclosure on a mansion at 1515 N. State Parkway comes this 4,000 square foot coach house at 1520 N. State Parkway in Gold Coast. (This is a picture of the building in front. There are no pictures of the actual coach house.)

It’s not, obviously, your “average” coach house.

Originally listed in 2005 and then re-listed in 2007, it has had several price reductions. A lis pendens was filed by National City at the end of June against the property.

Here’s the listing:

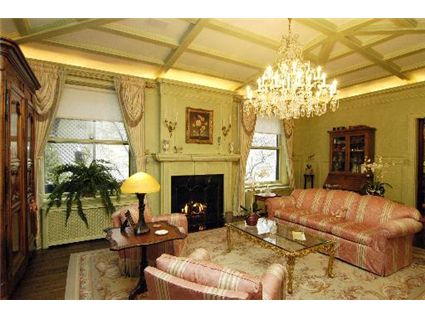

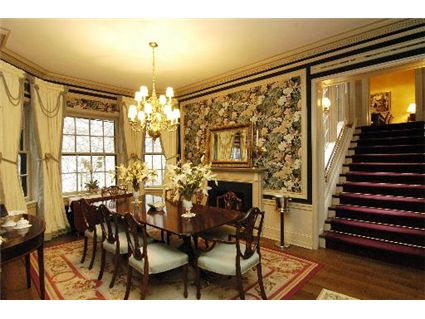

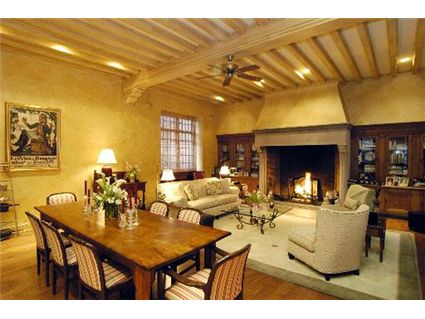

A Living Masterpiece Featured In Chicago’s Home & Garden Magazine! This Tuscan-inspired Gold Coast Mansion Is For Those Lifestyles That Suggest A Love Of Grandeur.

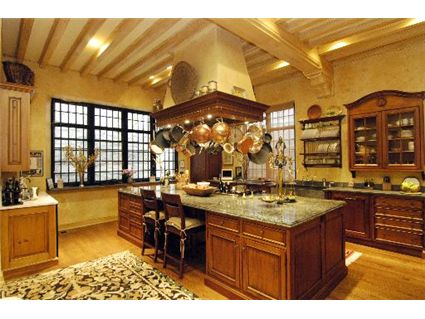

41×22 Gourmet Granite Kit/Immense Great Room W/De Guilio Custom Cabs, Boasts A Dramatic 1899 Limestone Fireplace, Formal Living/Dining Rooms Perfect For Entertaining. Beautiful Master Suite W/Radiant Heated Flrs & Lovely Walkout English Garden Await You!

1520 N. State Parkway Coach House: 3 bedrooms, 3.5 baths, 4000 square feet, 2 car parking

- I couldn’t find a prior sales price- sometime in the 1990s

- Originally listed for $2,499,900 in 2005

- Withdrawn

- Re-listed in April 2007 for $2,499,900

- Reduced (several times)

- Recently reduced again

- Currently listed at $1,999,880

- Lis pendens filed in June 2008 for $1.75 million

- Assessments of $1503 a month

- Taxes of $15,216

- Sudler Sotheby’s has the listing

What do those assessments cover? It’s almost $3k/month(!!!) just to hold title to the place. Wow.

A place this decadent deserves something classier than granite countertops.

They shouldn’t worry. National City is about to go belly-up, and when the FDIC takes over they’ll do like they did IndyMac–halt all foreclosures. Party on, coach house “owners”!

P.S. Rumors for the last week that Wachovia was shutting down its wholesale residential mortgage biz. Word is a press release to be issued, well, now, so we’ll know if it’s true soon enough.

Kenworthey,

NCC is still worth 3.5B. Not a foregone conclusion that they are going belly up or that they will be the next one.

IndyMac was an obvious one given their specific exposure to the Alt-A segment, the coming bank failures are likely going to have some unknowns as well as some household names. I’d be hesitant to write them off so soon.

I was basing it on my “CD Rate” metric. They are offering 2-yrs at 5.05. Which is a very bad sign, in my book.

What do you think of the Wachovia rumors? Crap? So hard to tell. On a Friday, we had Paulson and Bernanke outraged, outraged!, that anyone could say that the discount window would be open to Freddie; by Sunday, it was revealed to be true. I honestly no longer believe a word out of anyone’s mouth about solvency, capitalization, etc. anymore.

per wiki:

A carriage house, also called remise or coach house, is an outbuilding which was originally built to house horse-drawn carriages and the related tack.[1]

Now valued at $2.5M

My, times have changed!

It’s beyond disgusting for someone wealthy enough to pay even HALF this much money, to end up in foreclosure.

This owner could have dropped down many levels in housing, and still have been able to afford a choice dwelling with no financial stress.

It’s even more disgusting that this loser will be able to squat in this great place completely rent free for quite a few months until whoever’s servicing the mortgage then gets around to serving him or her. Meanwhile, I continue paying rent, and most homeowners are paying for their homes even though they might be buried in them financially.

Time to restore Moral Hazard, and roll back laws that make first mortgages non-recourse. Creditors have recourse on your credit card debt and car loan and HOSPITAL BILLS- what’s so sacred about homeowners?

Kenworthey,

I don’t believe anything anymore either. I wouldn’t be surprised either way about the Wachovia rumors. You had the inside scoop on Indy hours before that was announced so your grapevine might be better than mine. The government has zero credibility left after the past month of selective leaks and immediate reversals.

It’s sad that I believe rumors and innuendo more than the Secretary of the Treasury and the Chairman of the FED. All the dollar has to back it is trust–what do they do when that goes? Anyway, we’ll see what’s true in another… ten minutes or so, after market closes. Tick, tick, tick…

I’ve been reading the National City rumors for a few weeks now, and somehow the financial bloggers seem to know this stuff way ahead of the mainstream media or anyone else.

Corrus and National City are considered to be very fragile right now.

re: Wachovia–I’m actually surprised that they haven’t dumped the wholesale lending operation yet. Give the scale of problems they have had with wholesale loans, they must just be filling up the existing pools with sufficient replacements.

Good point, anon, which might be why this Wachovia change is not big news. After all, most big lenders, it seems, have gotten out of the wholesale business. WaMu did it a few weeks (even months?) ago, and it didn’t spell the end. On the other hand, when Indy did this, within a couple of days, FDIC was closing up shop.

So, by “FDIC Friday” we’ll see whether this move by Wachovia makes them more like WaMu, or more like Indy. I n the meantime, I revert to my “CD metric.” Wachovia is offering a 4.25% rate on a 1 yr CD.

Uh oh…

“CD metric.”

The sure sign of the end is if they stop accepting brokered deposits, as Indy did 3 or 4 days before the end.

As to Nat City, I think the advertising they are doing (esp. the “rebate” for ATM fees charged by other banks) is a worse sign than their CD rate. Honestly, 5.05 is a non-crazy estimate for inflation (or USD devaluation, if you prefer) over the next 24 months.

So the wachovia news was true, but given the state of the housing market, it probably meant very little. As far as the owners of this building going into foreclosure, it is likely as much their fault as it is the creditors (Nat City in this case) and frankly the creditor shouldn’t be bailed out for the bad loans that they engaged in, hopefully they get to squat much longer on the banks dime. It’s the least these banks/mortgage brokers owe people.

On another note, NCC looks like it is headed straight for zero (trading around 4 today) so as was stated earlier they probably wont get foreclosed in the near future. If we let the free market work and quit bailing out those on either side of this housing mess we will find a bottom much quicker.