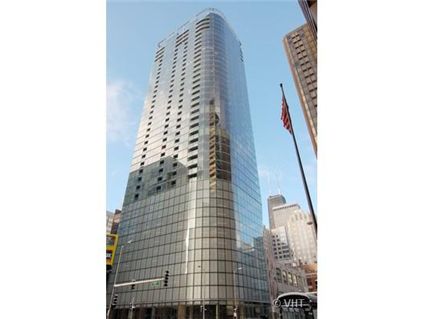

Flipper Alert: Unit #1301 Still Fascinates: 600 N. Fairbanks

We have chattered extensively about Unit #1301 in 600 N. Fairbanks in Streeterville.

The 3-bedroom unit was on the market for months, had numerous price reductions, went under contract and finally sold.

It has set a new comp for the 01-tier units in the building.

Or has it?

Mysteriously, it is back on the market again. Priced over $90,000 more than it just sold for.

A refresher on its history:

Unit #1301: 3 bedrooms, 2.5 baths, 1746 square feet

- Sold in November 2007 for $805,000

- Originally listed in January 2008 for $929,000 (plus $60k for parking)

- Reduced

- Was listed in March 2008 at $895,000 plus $60k for parking

- Reduced again

- Listed in early April 2008 for $839,000 plus $60k for the parking

- Reduced again

- Listed in early May 2008 at $799,000 plus $60k for parking

- Reduced again

- Was listed in June 2008 for $789,000 plus $60k for parking

- Closed in August 2008 for $805,000 (included the parking- I believe)

- Assessments of $585 a month

- Taxes “new”

Now it’s listed again:

Unit #1301:

- Sold in November 2007 for $805,000

- Sold in August 2008 for $805,000

- Currently listed for $899,000 (I believe the parking is extra)

- David Panozzo at Coldwell Banker has the listing

Other 01-tier units have been lowering prices in recent months as well.

Robin Brooks at Prudential Preferred has the listing.

Unit #1901: 3 bedrooms, 2.5 baths, 1746 square feet

- Sold in November 2007 for $838,000

- Originally listed for $1,140,000

- Reduced

- Was listed in April 2008 for $975,000

- Listing says parking on the 2nd floor so probably $70,000

- Reduced

- Currently listed at $950,000 (parking extra)

- Assessments of $605 a month

- Taxes “new”

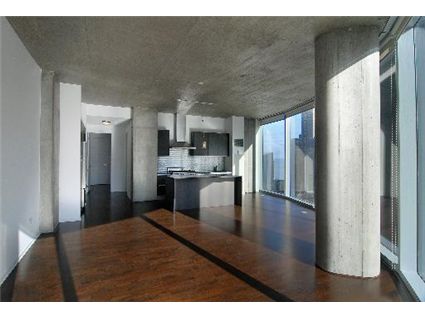

Sort of OT, but count me as a charter member of any design group that feels exposed concrete ceilings should only be done in parking garages. I was “fascinated” with this building when it was underconstruction, but now the newness has already worn off and it does not seem as uniq

(cat paw caused “submit comment”) add “ue” to uniq.

Why would anyone expect to be able to buy something and turn around and resell it for a profit a few months later? It’s like that commercial with the guy who buys the painting at an auction and then immediately puts it up for auction. And why would someone pay more for something than they could have bought it for a few months earlier? I guess if you can find a greater fool…

1301 is also listed for rent for 4,000/month

Any chance the buyer is associated with the developer? Seems a rather extreme coincidence that it sold for exactly the original purchase price.

It is called an investor buying something he thinks is undervalued. I doubt it is the huge conspiracy that you are dreaming up 🙂

Gary – It is done all the time. There is what is called “market value” and then something called “under market value”. You see, if you can buy something “Under Market Value”, you can then turn around and sell it for “market value” and make yourself a nice little profit.

I would recommend this book that has all the answers to making money. It is called “Subtraction, Addition’s Tricky Pal!”. It works wonders to be able to calculate your profits 🙂

This transaction has stupidity written all over it.

I did not say if it was a good idea or bad. I simply said people are making money all the time buying and selling properties.

Steve,

I wasn’t responding to your comment. It’s true that people buy and resell immediately and profit (even now). But personally I’d reserve such attempts in a market like this for distressed properties and foreclosures.

You also can’t assume that this aspiring flipper bought the property for “what is called ‘market value'” and has superior arithmetic skills.

I’m not giving the current owner of #1301 the benefit of the doubt.

“People are making money all the time buying and selling properties”

After 9 months of carrying costs, 1301 sold for the original purchase prices, factoring in 6% in commissions thats ~50k hit. But somehow the next guy thinks he can do better. There’s a sucker born every minute.

Beautiful building, but add me to the list of doubters that this was an arm’s length transaction.

Still yet there are still flippers with money out there still taking risks. I can’t wait to follow this property over the coming months and years.

what other transactions have taken place in the building in the last 3-4 months? does anyone have that info?

Sorry, off subject… Sabrina, can you review 29 W Chestnut, a townhouse listed at $850,000? A friend expected this listing to be priced at $450,000, and was surprised to see it listed so high even if the unit itself is impressive. I’m interested, but can’t find comps because it’s so unusual.

29 W Chestnut isn’t priced out of line for that particular area (as in, that block), not that anything seems to be selling there…

839 N Dearborn is the neighboring building, and there are similarly large condos there for about $1.2M and $1.5M. There was one listed most of the spring for just under $1M, but I believe it finally sold.

820 N Dearborn is a bit further away, asking $790K for a 3BR. It also has an attached garage.

There is a SFH at 851 N Dearborn for about $2M.

The even-numbered side of Chestnut appears to be mostly small buildings like this (from State to Dearborn), but I don’t know if any have been on the market lately. Similarly, 800s N Dearborn is mostly small buildings. This building is wedged between 839 N Dearborn (3-4 floor SFH converted to condos) and 21 W Chestnut — a mid-rise condo tower.

Hi MMk,

Looks like they bought it for only 440 k in 11/01. No outdoor space, apparently. They are apparently looking for huge appreciation.

The 820 N Dearborn is a newer townhome, with a deck, listed for a looong time (I think they just relisted),mostly bigger bedrooms, and last seems to have sold for 750 in 07 (last I checked, it is a lis pendens). Also, a 3 BR townhouse in the Oak Club sold for 850 a few months ago, seemed bigger, also attached 1 car, much more recent construction, of course, and that one had a lovely huge roof top deck. (Please check these details at your own risk – much of this I looked up a while ago).

Sooo… not sure what to make of it. Overpriced? Opinions?

All I can say is that I’d like to see the stats on flippers’ returns. Unless the market is really screwed up, as a group, they should break even on average – unless they are buying pre-construction and selling post construction or fixing a place.

I posted this in response to a request on another thread (“First Lis Pendens in Fairbanks at City Front Plaza: 240 E. Illinois.”) Here’s the 600 N Fairbanks closed/rented in past 60 days:

#1301 Closed 8/4/2008 for $805,000

#2606 Closed 7/28/2008 for $386,000

#3402 Closed 7/21/2008 for $752,500

#3305 Closed 7/15/2008 for $725,000

#3705 Closed 7/8/2008 for $1,255,500

#3701 Closed 6/27/2008 for $2,153,132

#3803 Closed 6/18/2008 for $1,702,000

Only #1301 is a confirmed flip (as highlighted by Sabrina.) The others cannot be determined with certainty yet, but have no prior mls sale and appear to have been sold by the developer.

#3206 Rented 8/1/2008 for $2,100 no parking

#3001 Rented 7/25/2008 for $4,900 with parking

#2908 Rented 7/13/2008 for $2,400 with parking

#3306 Rented 7/9/2008 for $2,350 with parking

#2907 Rented 6/25/2008 for $3,150 with parking

#1506 Rented 6/25/2008 for $2,000 with parking

#1508 Rented 6/20/2008 for $2,150 with parking

#3407 Rented 6/12/2008 for $3,200 with parking

G:

Thank you for posting this latest info on 600 NF.

As we’ve chattered about before- there have only been about 4 units that have actually successfully flipped in the building.

Lots of rentals though.

Has the building instituted a rental restriction yet? The new board might not have gotten around to it yet.

I’m 90% sure that the units on 33 and 34 are flips. 3402, for example, was priced pre-construction at $620k and that tier sold out in a week back in 2005. Even if they bought the most expensive parking spot at $65k and added $35k (about the max) in upgrades this person has done surprisingly well considering the market. 3305 was pre-con at $600k, so they’ve done great as well.

D

So my friend did close the north facing 1 BR this weekend! He did not want to tell me the specific price, but he said in the low 400k and parking included! High floor. He said there is only 1 BR left there, the highest floor under contract now for $485k. If my friend closed at a low $400k, don’t you think the guy closing or having the contract pending at $485k for the 36th floor, will get a heart attack once his number is on the deed record?

There is a big difference in the North view once you get above the 32nd floor. 32 and above have forever water views, the floors below just look at buildings! View is everything.

Why 32nd floor? Not 30th floor or 31st floor?

I would imagine there’s no difference in the view between 31st floor and 32nd floor, or even 30th floor!

32nd floor clears the buildings! That’s why! 31st floor doesn’t clear the buildings. Check it out for yourself!

Does anyone know who has the pre-construction price list? I know it probably changed several times. The lataest one would be great.

Deaconblue was wrong again on August 14th, 2008 at 7:54 am:

“I’m 90% sure that the units on 33 and 34 are flips. 3402, for example, was priced pre-construction at $620k and that tier sold out in a week back in 2005. Even if they bought the most expensive parking spot at $65k and added $35k (about the max) in upgrades this person has done surprisingly well considering the market. 3305 was pre-con at $600k, so they’ve done great as well.”

#3402 (deed #820633007) and #3305 (deed #819933181) were both sold by the developer, “600 FAIRBANKS COURT DEV CO LLC.” The only question that remains is whether or not there were concessions which would lower the real purchase price.

You know what must have happened, I bet whoever bought those units originally walked away from their deposit, because I know for a fact the whole 02 tier sold out within a week back in 2005. However, I know that 3402 went originally for either $615k or $620k.

They paid $752k now. Since it just came back on the market, the only parking spots left were no more than $50k and the most you could put in for upgrades was about $35k. That means the base price for the unit could have been no less than $667k, significantly higher than the preconstruction price. Once the first 40% of the building was sold, they increased prices about 7% to what the market truly was at the time. This means that this unit would have sold in 2006 for about $663k after the pre-con prices were over. I know this since I saw what a number of units when for before and after pre-con prices.

Bottom line- a few of these units went for exactly the same prices as they went for two years ago at the peak of the bubble. Not returns to write home about, but exactly what I was hoping for in this building. Anyone who put down 10% back in 2005 has essentially doubled their value on it in 3 years, based on current sales prices (not to mention we got 5% interest on our deposit for 2.5 years, which is about what the stock market has returned).

D

Little Boi,

I have a general idea of what the 3 two bedroom tiers went for, but I’m not sure about the 1BDs and the 3BDs.

D

DB said “Anyone who put down 10% back in 2005 has essentially doubled their value on it in 3 years, based on current sales prices.” LMAO. Counting phantom “value” again, eh DB? What current sale prices are you refering to? The recent developer sales could be old contracts. The only confirmed recent flip (1301) lost quite a bit of money. The lack of sales are due mostly to changing lending standards. More weak hands will be folding here and the lack of resales indicate it will not be easy to get out.

That and I can’t tell you how many times I see a developer sell something for much more than what it gets on the MLS. Some buyers still think the best value is to be had by going to the developers themselves amazingly.

3402 & 3305 were both units the developer took back and resold this summer. #3402 was $695,000 for the unit and $57,500 for the parking. #3305 was $665,000 for the unit and $60,000 for the parking.

“What current sale prices are you refering to?”

G, do you know how to read? The current sales prices are the ones YOU POSTED. I CLEARLY explained that those prices are DEFINITELY above the original pre-con prices, even using worst-case scenarios. Are you just stupid or is your brain not able to understand that you are wrong?

D

Thanks Nicole, that’s exactly what I suspected. 3402 went for about $620k pre-con and 3305 for about $595k, so the people who dumped their contracts should have held on to them. Do you have any idea if there were significant upgrades put into the units?

Sorry G, but the high floor units with great views in this building have both gone for $30k more than 2006 NON pre-con prices. Even if you assume that’s because of $30k in upgrades, worst case the good units in this building have not dropped a dime since the bubble peak. Thanks again for the data, you made my day.

D

Neither unit had significant upgrades. The developer standards for this building are nice so not a lot of upgrades were needed. These units both have fantastic views and yes the people who bought preconstruction have seen appreciation. The 01 tier (although popular preconstruction) does not have good views and they are building a new high rise in the lot across the street making this a difficult tier to resell. Quite the opposite for the 02,03, 04 & 05 tiers (floors 32 & above). 1301 is on the first floor of residential units (down the hall from the management office) and looks directly at other buildings (I think it will always be a discounted unit).

Thanks Nicole, that makes a lot of sense. Do you think that if someoe puts in $30k of upgrades it’s going to be captured in resale or typically not? I put a bunch in but I’m not sure it’s likely that I could recoup it immediately.

D

Typically it is difficult to get a good return on upgrades. It does make a difference if you are competing with another unit in your tier for a sale. If a unit has a complete designer look that can capture the emotion of a buyer you may see a return. You shouldn’t worry! This is a great building and the resales will shake out. A lot of the condos in this building are 2nd and 3rd homes. These people are not financially distressed and plan on using the condo for themselves for years. Once the initial investors are gone you will not see a lot of resales. Also, there are only 212 condos in the building so once the building matures there will only be 5-10 units for sale on average. Is the amenity deck open yet? That is going to be awesome and help the resales!

I wish it was open! I guess they laid down the wood flooring and fire Marshall said it didn’t meet code, so they had to rip it all up and reinstall new wood. They are saying late August but I’ll believe it when I see it. Does anyone know how many units in the building are still on the market?

There are currently 28 listings and two of them are in attorney review. 8 of those listings are developer units and 14 of them are priced over $900,000.

These balconies are so small they’re little more than a place to stand and smoke.

You can get two chairs and a table on the smaller balconies and they can easily hold 6 standing adults. They aren’t huge but they are very functional. I just watched the Blue Angels fly a couple hundred yards over my head with 5 friends and it was great.

D

It’s always nice to have outdoor space. The Trump building has no balconies.

Yes, and when your five friends are imaginary, they take up much less room.

Are there any 05 or 02 lines available on the MLS on higher floors?

I don’t even compare this building to Trump’s–I guess its a similar market for some but I love outdoor spaces and wouldn’t consider owning a unit without any. In fact I seem to be drawn to terrace levels.

Agreed that some outdoor space is far better than none.

Bored today Keny-poo?

Bob, ditto. I think I would have already made offers in 512 N. McClurg–a mid-priced Streeterville highrise located on top of my gym and steps from my work–but for that very thing.

Re: terraces, though. Several people on this Board have mentioned the horrors of living on terrace level in a mostly-renter building. Apparently, be prepared to be showered with cigarette butts, spilled beer, and trash.

The longer I look, the less attracted I am to highrises, and the more I’d like the top floor of a vintage three flat, with a biiiiiiig roof deck on top!

Terraces are great, but I think a lot of people don’t want to be outside on super high floors. Notice that the Spire doesn’t have them either. Waterview is the tallest one I can think of with terraces (if it ever gets built).

D

I love how G disappears whenever evidence show’s how wrong he is. What a wimp!

D

Nicole,

Do you happen to know if there were any significant differences between 3305 and 3402 in the interior? I’m surprised that 3402 went for a $30k premium over 3305. The one floor difference explains about $10k of it, but the 02 went for a premium over 05 pre-construction because people expected better views. It turns out that 05 has much better views than 02, so I find it surprising that it still went for such a premium. Did they both keep their exposed concrete walls?

D

Deaconblue mumbled “I love how G disappears whenever evidence show’s how wrong he is. What a wimp!”

Kind of like when I took you up on your bet and haven’t heard from you? Not that I’d expect your wife to let you lose her money anyhow.

By the way, where have I been wrong? I have been consistent. First comes the sales volume collapse (as predicted,) next will be price drops.

Kind of hard to be wrong about the future yet, don’t you think? I’ll keep giving you rope, so don’t worry.

What bet?

So even though you are seeing disconfirming evidence right before your eyes, you still believe that the future will get worse, even though you have no evidence? You predicted sales volume wouldn’t stay at generational highs forever and you pat yourself on the back? Are you kidding me? A monkey could have told you that! We’ve gone through 2 years since the bubble peaked and during that period we’ve seen volume drop and the worst home financing crises ever, yet the good neighborhoods haven’t budged. As what point will you admit you are wrong?

D

DB once again “You predicted sales volume wouldn’t stay at generational highs forever and you pat yourself on the back? Are you kidding me? A monkey could have told you that!” Then how did all the banks and wall streeters miss it? Not enough monkeys in their employ?

If you are so certain about the future are you investing in real estate? My bets against it the past couple of years have worked out great, with more joy to come.

I honestly believe many Wall Streeters missed it because they care about one thing and only thing only: their annual bonus check. If you have the opportunity to earn several hundred thousand dollars in a bonus check you’re going to play whatever musical chairs game is popular at the time in the world of high finance. The incentives are so misaligned on Wall Street against long-term shareholder value its perverse.

Some people did predict this, the problem is timing. Even if you’re right eventually if you mistime it it can be disastrous too. The highest earner in the US last year was a hedge fund manager who shorted at the right time.

You can’t compare what a resale can get from what the developer’s marketing team can get. I know this sounds wrong, but it’s dead on (international buyers and buyers not from the area who want precon usually go straight to the developers with the thought this is the best pricing available). Developers (I should say of large projects) can do better than resellers on the MLS in most cases. Flippers often undercut developer pricing significantly because they have to – their marketing doesn’t compare. ANYONE who has actually flipped at a major development since the downturn knows this.

I would be curious to see if 3402 and 3305 could resell at those prices right now – I’d bet they couldn’t.

What was the range of BASE pre-construction pricing (no-upgrades, bare-bone unit) for a 1BR in this building? These upgrades are hard to control and you don’t know exactly (price-wise- how much each and indvidual upgrade item really cost.

How I look at it (if it’s a successful flip or not) is from the BASE price first, and then the upgrades and parking spot COME LATER.

So, for example, if the base STARTING price of 3402 few years back (when the contract was signed by the guy who walked away) WAS $620K (per Deaconblue), and then the base price that it was sold at few months back was $695K (per Nicole), then right there it’s already a succesful flip! And, what’s even better is they have $57.5K on top of it as parking! I consider this a succesful flip from the developer. No non-developers have made money on this 🙂

I really would like to know what was paid by the original buyer to the developer to unit 3303, a north-facing 1 BR. THIS IS THE UNIT MY FRIEND JUST MOVED INTO THIS WEEKEND. I am sure you guys can find out what he really paid very shortly, because I sense a few people here are real-estate experts (realtors, etc.), who have access to the deed records, etc., and he closed this weekend, and I am sure the deed record will show up very soon in the next few weeks. I did ask him several times and he just wouldn’t tell me!!!

Nicole – I did check out the view from my friend’s unit this weekend, and you’re right the view from the 33rd floor is unbelievable. If this will forever be protected (my friend also told me the developer bought the air right for the building just north of 600 NF, which is now called The Schatz Building I believe (go check one of their building walls and the developer’s name is on the wall)), then the view is maintained (for the next few years at least), because if the developer chooses to sell this building, it will kill the view of a lot of the people owning north-facing units.

I did check out the SOUTH exposure units, and yeah you can’t really beat the view of the NORTH facing units.. I am sorry no offense to the SOUTH facing owners, but I do really think regardless of where you are facing North (02, 03, 04, or 05 tiers), each of them has an excellent view. From the 04 or 05 tiers, you can still get the water view (if you turn your head to the right of course!), but of course 04 and 05 do NOT have A LOT OF water exposure, unlike 02 and 03, which some people may not care much, as it is dark at night anyway 🙂

“$620K (per Deaconblue), and then the base price that it was sold at few months back was $695K (per Nicole), then right there it’s already a succesful flip!”

That’s exactly what the original prices was, except they didn’t flip it, they bailed on the contract and the developer re-sold it a few weeks ago. I don’t remember what the 1BD’s went for, I’m sorry. The 02 and 03 only have marginally more lake view than the 04 and 05, McClurg Court blocks most of the additional lake view. If you walk into and 04 unit, your view is the Hancock tower to the left and you are looking right at the lake on the right. The problem with the 02 and 03 is that the east view is awful, looking right at the Doubletree and the hideous McClurg Ct. Buildings. The 05, 06 and 07 units look west and south right at the Tribune, Trump and Sears towers. It’s amazing at night!

D

You guys don’t seem to understand what the “Wall Streeter’s” were doing. They were packaging mortgages and selling them. That has nothing to with housing sales volume. They packaged loans and got a commission for trading them. They didn’t care about sales volume, just moving the mortgage backed securities. I don’t think that anyone is surprised that volume has dropped, that’s inevitable. The good neighborhoods simply aren’t dropping even with the reduced volume. Sorry!

D

“I would be curious to see if 3402 and 3305 could resell at those prices right now – I’d bet they couldn’t.”

We have no idea what would happen. What we do know is that 3402 was just sold by the developer for 12% more than the pre-con prices and 4.7% more than the 2006 post-precon prices. Even if an individual can’t get quite the same resale price as the developer, it can’t be too much less and they have clearly still done well since the bubble peaked.

D

Don’t underestimate how much more the developer can get vs resellers.

But that point aside, Deacon I really don’t understand your argument here entirely. You want to pick out two unit types and say that since these have appreciated 12% that the whole building will see a similar increase, and therefore that the building has not dropped at all? 1301 is flat, as a counterexample.

One thing you need to keep in mind is that developers often misprice, or misestimate demand, for certain unit lines. Even if we pretend that these two units appreciated 10% (based on what they could resell for now), your argument still doesn’t hold. I know of buildings where the view units increased 50% in value, while the rest remained flat over a 2 year period.

That, and keep in mind developers often price their units 10% below market precon. So if something went into contract 3 years ago and today sells for 10% more, that implies the market for the neighborhood is flat. And if it sells for the same as it did 3 years ago, that implies the nieghborhood dropped 10%. You average out all these things to arrive at a market value.

As a case in point, look at 505 N McClurg, same neighborhood (SV). There are people in that building who are unable to get the precon prices they paid 3 years ago. This suggests to me that your claim that the “good neighborhoods haven’t budged” is patently false.

Has anyone closed on a unit at 505 that went for less than pre-con?

In any neighborhood or building, some units will do well and some won’t. But the average for the best neighborhoods has yet to drop. I agree that it will be harder to sell units in a market like this, but I bet most of those seller will just wait.

D

No, no one has closed for a unit in 505 that went for less than precon because there have been no resales. However, people are dropping their contracts after marketing their condos for the same price they bought them and not being able to find a buyer. Additionally, a few unlucky people closed and cannot get the price they paid and are now renting them.

And yes, in any neighborhood there are winners and losers. But I still don’t see where you arrive at the conclusion that Streeterville hasn’t dropped. Even your building, if you consider that builders price things 10% below market precon, seems to AT BEST be flat (and more likely seems to have dropped 5%-10% on most units – again, factoring in a 10% discount on precon purchase).

I agree it’s at best flat, but considering we are two years away from the peak in 2006, isn’t flat pretty darn good? That’s all I’ve been saying, that the best neighborhoods will likely just go sideways for a long time.

Any thoughts on Superior 110 (110 W. Superior)?

Brett: Superior 110 hasn’t started closing yet. It’s due to in the next 6 to 8 months, I believe. (maybe sooner?)

Once some units have pictures and come on the market- I’ll be covering it.

With those blue windows, it appears to be a very interesting new construction building.

All you 600 N Fairbanks lovers see that drill in the parking lot across the street today? Looks like their may be NO south facing view very shortly!

How about the NORTH facing view? Are they expanding Northwestern Hospital? How high is that hospital going to be? I notice they are already tearing down the building at the North East corner, wondering what they are building – Another hospital, college campus building, or a new condo ?? —

Northwestern owns the land that the veterans hospital is on right now. They are tearing it down but I do not think any plans are finalized… all the research I have done only says that it will be part of the medical campus… so no condo building as far as I can tell… who knows though. Conventional wisdom would suggest the building they put on that land will not be much higher than the other new buildings they have put up recently. Which is around floor 30 in 600NF. Also, I agree with Nicole about the North views above 30 being much better than the lower floors, but also think the 32 claim is arbitrary. I live facing north on 31 and I see a ton of lake. Those 10 feet between me and 32 obviously makes a difference, but it is not substantial. The North view from 41 isn’t that much clearer than mine. Speaking of which, 41 is now open and is beautiful. Really small gym and in my opinion, a useless pool… but it really is unlike any outdoor space I have seen in the city. It definitely adds a wow factor. The south view will be ruined soon unfortunately, but I haven’t seen any final plans for that space and find it hard to believe anything will be started in this market… who knows though.

Thanks C .. Yeah I heard it’s going to be another hospital or campus. Yup the 41st floor is awesome. I had a high-tea brunch this morning with my friend up there outside, it was super nice!

C – I haven’t paid attention to the lot just South recently but my understanding is that the Hot Dog stand has shut down and soil testing has begun on site. The proposal for that site is a hotel plus condos so we will see how the smaller number of presales needed to get it started effects the status of the project.

http://www.emporis.com/en/wm/bu/?id=565northfairbanks-chicago-il-usa

SSDD

Little Bois,

Your friend closed on his unit, 3303, for $415,000, on 8/20/08.

The original owner purchased the unit on 2/29/08 for $412,500.

Jeff: That hotel/condo was the original idea. But word is that they are simply repaving the parking lot now (it’s awful) and that they are looking for another buyer for it.

Who is getting loans to build ANY building right now? No one (see Waterview Tower, which is under construction and 60% sold and is having difficulty securing further financing.)

SR,

Did both of those transactions include parking on 3303?

I don’t know for certain but I would assume so. Typically, parking is not broken out into a separate transaction in this building

Sabrina — I would believe that, I haven’t been following new developments as much as I use to.

SSDD

At our recent board meeting we were told that they are repaving the lot and that it will continue as parking. However, word has it that the lot is for sale, so it looks as though the proposed project is a no-go.

I sit on a plan review commitee in streeterville, and we have not reviewed a single project for probably 4 months. Anything in planning or close to construction phase appears to dead. The only new project that has broken ground is the residental tower arcoss the street from the AMC theater.

sorry for the typos, hit return before review

Valasko,

Is that condo or apartments across from AMC? I would assume rentals otherwise they would have started marketing….

Streeterville Realtor,

Thanks for the info! That’s cheap what my friend paid!!! I want to say he got a bargain on it, because he paid what the original owner pretty much paid to the developer, and the original owner made $2500 from the sale … Yes I know for sure he has a parking a spot, so that price of $415K must have included a parking spot!

Wow.. think about it, parking is usually $50K – $65K, so if he paid $415K total with parking included, that means the ACTUAL unit on 3303 really only cost him ranging from $350000 to $365000… THAT is insane how much these people out there are trying to make money!

If you think 33rd floor’s 1 bed room REAL price is in $350K range (which is an AWESOME unit by the way because I have been in there), then what are these people out there with the lower floor units are thinking..

Wow 😉