It’s Back and Reduced Again: 6030 N. Sheridan

Our favorite penthouse at 6030 N. Sheridan is still on the market after it fell out of contract during the summer.

And it’s been reduced another $100k.

Remember the listing:

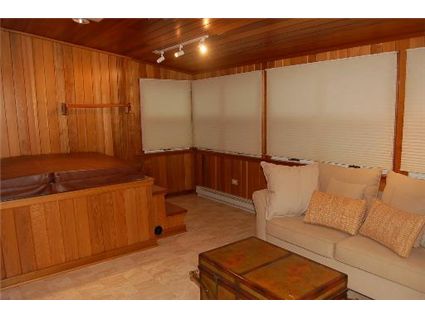

Stunning 3 bed 3.5 bath PH unit with a private 1000 sq ft deck over looking the lake! Over 2600 sq ft floor plan with luxurious finishes throughout, including 2 master suites.

The unit is completely upgraded with new Marvin windows and doors, year round lined cedar sunroom with Jacuzzi tub, stunning lake & city views. 2 car garage parking included. An incredible space, must see!

Arsiak Raffaelli at Century 21 Sussex & Reilly has the listing (there’s also a virtual tour on the site).

Unit #PH01: 3 bedrooms, 3.5 baths, 2600 square feet, 1000 sq ft terrace, two car parking

- Sold in April 2003 for $700,000

- Was listed in May 2008 for $1.16 million (2 car parking included)

- Reduced

- Was listed in July 2008 for $999,000 (2 car parking included)

- Was under contract in the summer

- Reduced

- Currently listed for $899,000

- Assessments of $755 a month

- Taxes are “new”

- The listing says central air, but in the bedroom pictures you can clearly see window units- but maybe they just can’t get rid of the units even though they have installed the central air

This place will never sell. I wouldnt even buy it for 200k.

This building is a scary monster. It must give the children that live nearby nightmares. Someone would have to pay me to live there.

I guess you don’t need to worry about getting kicked out of your condo, just stop paying the mortgage, taxes, HOA fees, and live for FREE!!! Great, let’s throw condo flippers and the irresponsible another bone.

—————-

Cook County sheriff to suspend foreclosure evictions

October 8, 2008 at 10:12 AM | Comments (0)

The Cook County sheriff’s office announced this morning it will suspend its mortgage foreclosure evictions in light of the national foreclosure crisis. Details to come.

Further details about the suspension will be released during an 11 a.m. news conference at the Daley Center, 50 W. Washington St.

CLTV, Chicago Tribune

JOHN – That is a really stupid move on the government’s part. It makes me sick when politicials do stuff like that. These people are not victims. Now what are banks supposed to do?

REEEEDICULOUS. As a lawyer I would fight this, the sheriff’s office cannot disobey a court order. If the court orders the sheriff to do something, they have to. (I have to do some research on this, but that is my hunch, the sheriff could be held in Indirect Civil Contempt.)

Or there is always the south – side way, go in there with a baseball bat and start knocking heads until people get out on thier own. 99.9% of the time, they have a place to go. I speak from 10 years of housing litigation experience.

(Seems like you agree, and I am not advocating that property owners bash tenants/mortgagors heads in, (that is not right) but still, I hate this. Do you realize how many deadbeats are just going to stop paying thier mortgage now if they think nothing will happen to them? More than you think.

(Sorry about the rant but this pisses me off.)

Jason – I’m with you here. These deadbeats aren’t victims…WE ARE with having to bail these people out and other asset value declines. No more mercy.

If sheriffs are going to start ignoring the rule of law and not evict people from foreclosed properties than the banking system has a lot more to worry about than the credit markets.

If legally people are no longer allowed to stay in a residence isn’t that trespassing? Can a third party do evictions like a security firm or something?

If the sheriffs office is the only entity able to force a foreclosure eviction this stinks to high heavens of derelection of fiduciary duty.

This story is all over the wires. My e-mail inbox has been crazy because of the announcement.

Great news – Homedelete gets to stay in his home. Don’t you live in this Sheridan building HD?

I think this matter deserves its own topic…..file under really really dumb things not to do. I would imagine the sheriff and the county could be hit with hundreds of lawsuits, that will be really nice on the county budget!

———

Cook County sheriff to suspend foreclosure evictions

October 8, 2008 at 1:10 PM | Comments (6)

Cook County Sheriff Tom Dart said today his office plans to stop serving eviction notices on people who have fallen behind on mortgage payments as well as renters unaware their buildings have fallen in arrears.

He said his action was necessary in light of the national foreclosure crisis that is driving down the American economy.

Dart acknowledged he could be found in contempt of court for ignoring court orders, but said he was willing to risk that to carry out “justice.”

He noted that hundreds of Cook County residents each month who are evicted after sheriff’s deputies show up at their doors, not knowing that their landlords haven’t made their mortgage payments.

“The people we’re interacting with are, many times, oblivious to the financial straits their landlord might be in,” Dart said. “They are the innocent victims here, and they are the ones all of us must step up and find some way to protect.”

He asked banks to send representatives to rental properties being foreclosed on to notify them of foreclosure proceedings and tell they have 120 days to vacate. Banks now only give such notification to the actual mortgage holders, he said.

According to Dart, foreclosures have risen astronomically over the past year. In 2006, 18,916 mortgage foreclosures were filed in the county, and last year, that number rose to 32,269. This year, Dart is projecting more than 43,000 to be filed.

Dart did say, however, that evictions not related to inability to pay mortgages on time will continue. Such evictions would include renters in apartment building who don’t pay their rent or violate lease agreements.

So far this year, roughly 2,000 people a month have been evicted from their homes, and of that, as many as 500 are evicted because of mortgage foreclosures. Dart said about one-third of those people fall under the category of rent-paying individuals who are unaware that their landlord has fallen into mortgage-related foreclosure.

–Azam Ahmed, Chicago Tribune

So if I am a renter and I don’t pay on time they will still come to evict me. But if I am a mortgage holder and don’t pay on time they won’t?

How is inability to pay rent not different from inability to pay a mortgage?

Way to contribute to the discussion Steve …. classy, as usual.

The suspension of tossing people on the street is well intentioned. Unfortunately, it will only end up hurting the responsible owners within these buildings. The irresponsible don’t need protection from what’s coming.

Also, this unit has pretty sweet views despite being wayyyyy overpriced. This seller will likely be riding the market to the bottom.

Heitman, is isn’t our fault that you can no longer rake in money hand over fist selling homes to buyers who could never afford them with sensible lending standards in place. You’ll just have to get a real job that’s more in line with your skillset. I hear Taco Bell is still hiring. But lose the attitude before you get fired for snapping at a customer.

Suspending foreclosure evictions? SWEET!!!!!

I mean, why didn’t I just buy that $400K condo I really craved, on a Pay Option ARM with the 1% teaser rate, and then refinance it to buy myself a BMW and an assortment of other toys, or, better yet, HELOC the place and just stick the cash out someplace safe…

… so I could sit in the place now and live rent-free, while the govn’t raids the treasury and threatens to trash our currency to Weimer Germany levels in order to help me “stay in my home” and crams down my mortgage.

I mean, I feel like such a chump now. Here I sit paying rent, my job in the financial industry at extreme risk, my pay stagnating, and my costs for absolutely everything up 40% over the past 6 years, thanks mostly to the creation of the massive credit bubble that is now unspooling, and will take my job and ability to pay my rent down with it. Unlike the poor foreclosure “victims”, I won’t be able to sit here rent-free. My landlord will, if I come up empty, just swiftly move to evict.

The whole thing fills me with hate.

Appropos 6030 N. Sheridan. I would have to be paid to live in this dump, too. It’s the ugliest building on Sheridan Road. The only help for it is a headache ball.

***“The people we’re interacting with are, many times, oblivious to the financial straits their landlord might be in,” Dart said. “They are the innocent victims here, and they are the ones all of us must step up and find some way to protect.****

The above statement is a lie. These people are playing stupid. They probably haven’t paid rent in months, another reason the building is going into foreclosure.

****I mean, I feel like such a chump now. Here I sit paying rent, my job in the financial industry at extreme risk, my pay stagnating, and my costs for absolutely everything up 40% over the past 6 years, thanks mostly to the creation of the massive credit bubble that is now unspooling, and will take my job and ability to pay my rent down with it. Unlike the poor foreclosure “victims”, I won’t be able to sit here rent-free. My landlord will, if I come up empty, just swiftly move to evict. ****

Well put Laura, it sucks to be educated and responsible! (Not that I am perfect!

Home Delete, what kind of emails are you getting?

Yep, the lesson to be learned from all this is to figure out the angles and game the system. Playing by the rules is for suckers. There’s no reward for it anymore.

Laura: I mean, why didn’t I just buy that $400K condo I really craved, on a Pay Option ARM with the 1% teaser rate, and then refinance it to buy myself a BMW and an assortment of other toys, or, better yet, HELOC the place and just stick the cash out someplace safe… … The whole thing fills me with hate.

Latest news flash, kids.

AIG is getting another $37 Billion loan ON TOP of the $85 Billion they’re already flushing down the porcelain appliance.

And Nancy Pelosi is proposing ANOTHER $150 B “stimulus package”.

These little aids bring the total tote for all interventions of the past few months together up to $2 Trillion.

What’s next?

What just floors me is that both McCain and Obama couldn’t talk about anything else last night but “putting a floor on housing prices”, “helping homeowners stay in their homes”, or “boosting housing prices”. BOTH CANDIDATES ARE ECONOMIC AND FINANCIAL ILLITERATES.

And so are all politicians, categorically speaking, and letting Paulson & Co do a 5-minute sales close – “You gotta buy this stock NOW!!!” proves it.

Their whole support program consists of trying to get the EZ money and fraudulent loan game going again and start piling up more debt- the very thing that got us into this fix to begin with. They still have their tiny heads wrapped around the idea that the only thing that will drive the economy is asset inflation. Forget about real productivity- we haven’t had THAT in 25 years.

I guess our currency is going to have to collapse completely and our country become the world’s major IMF Client State before we can begin the work of building a reality-based economy, one based on making real things and performing real services, in relevant, competitive industries.

Oh YEAH, I think I know what’s next.

Citicorp is next, I do believe.

How we’re gonna deal with THAT hairball, I have no idea.

I am pretty sure a few months ago they said they were going to do the same thing in Philly and it got overturned. Not sure about my facts on how it turned out though.

Citicorp could be a Trillion on its own. Yes, one very big hairball. I hope this gets so bad they charge everyone who lied on their mortgage ap for fraud. borrowing from someone by lying about ability to pay back is fraud. Then march the realtors to the guillotine. Set it up by the Mich Ave bridge so it’s close to their headquarters.

IB, you forgot to include the heads of banks and investment banks on your Kill List. Plus their head traders, plus the chiefs of the rating agencies.

Plus Paulson, Bernanke, Greedscam, and Phil Gramm, the author of the whole mess; or Bush, or Pelosi, or Dick “deficits don’t matter” Cheney. These are the people who enabled and encouraged the fraudsters at the top of the criminal financial concerns, with either implicit or explicit government guarantees, constant rate cuts, and the administrations stated, deliberate economic policy, which was frankly to drive the economy by debt creation, for they had no other way to get it going, as they also had a policy of doing everything possible, by privileged tax treatment and whatever other government inducement would avail, of driving our manufacturing (or what remained of it) offshore.

Our country has committed suicide.

So far, we have not seen ONE perp walk. How come? The FBI is now investigating the banks and insurance companies and investment companies, but they have explicit orders not to look any higher that the broker level! Why not? Anybody who has ever worked for these concerns can tell you that orders came FROM THE TOP at IndyMac, Countrywide, whoever, to encourage “stated income” loans, and that loans were to be approved no matter how the application had to be massaged to do that. Nobody was to be turned down. If you looked at all the loan apps, you’d think 50% of the population made $100K a year or more.

This country has a massive “accountability” problem- we have developed a ruling class that is positioned to profit from its malfeasance while the underlings take the blame and pay the costs. I know a former mortgage broker who just got nailed and fined $20,000 for- get this- paying his “loan finder” on commission instead of by salary.

Has Fuld been fined one dime? Greenberg? Mozillo, or any of the other people who took home hundreds of millions of dollars a year during this rampage of greed and malfeasance?

Now Fuld deserves to go to jail for same reason as Skilling did. He violated his fiduciary responsibility to shareholders by misleading them as to the financial health of the company. Mozillo for the same, selling into the market while manipulating the price.

Otherwise I see nothing sinister. Just one big giant mistake after another, everyone was playing a game that got too big and out of control, being wrong is not a crime, remember they all drank their own Kool Aid, i think the whole country did for that matter. As for the incompetence of gov’t I expect it and unfortunately incompetence is not a crime. Players were not smart enough. An idiot like barney Frank is just an idiot blinded by noble ideals that Americans will pay a very heavy price for. The end result in all this will be a definite diversification away from the US. Players like China were so impressed with themselves to be playing with the dominate force in capitalism, now they are figuring out how to get un-handcuffed with as little pain as possible. They will waste money dragging it out for a while and then realize they are throwing good after bad and walk away but never again forget rule # 1… diversify!!!

Laura, you forgot to include Barny Frank and Chris Dodd, they were the ones who fought against increased regulation of Frannie when the Republicans asked for it in 2004. I’m not sure why everyone is blaming Phil Gramm, he had nothing to do with this. Gramm lead the way to overturn the Glass-Steagal Act, which make it illegal to combine an investment bank and a commercial bank ( a relic of the ’30s). Even Robert Rubin, Clinton’s Treasury Secretary, has said that overturning Glass-Steagal had nothing to do with this. In fact, if it hadn’t been overturned then BoA couldn’t have bought Merrill and JP couldn’t have bought Bear and this all would have been even worse! Here is a good article about what’s happend http://www.realclearmarkets.com/articles/2008/10/myth_busting_on_the_way_to_an.html

As a followup- here is a link and an exerpt from Rubin on Gramm:

http://cdobs.com/archive/our-columns/its-the-stupid-economy%2C1745/

“Barack Obama is even more incoherent than McCain, blaming the Gramm-Leach-Bliley deregulation act of a decade ago, which allowed banks to diversify their holdings and services. At the time, the Clinton Administration rightly proclaimed that act to be one of its economic accomplishments. In fact, the banks which have been least affected by this crisis are those who best took advantage of the provisions of the act to diversify. Without it, Bank of America could not have taken over Merrill Lynch – and we’d be on the hook for that, too. No less a luminary than former Clinton Treasury Secretary Robert Rubin heard Obama blame the Gramm Act and responded with the equivalent of, “Say what?” (Rubin drily said the act had no influence on the present crisis).”

Expanding on that… if people invest in companies without due diligence (usually the case) they deserve the losses. The sought the reward and the commensurate risk needs to be accepted by them. Equity holders should get wiped out with bondholders next. Why Washington deserves a Bastille Day party was for taking those losses from the private sector and making them public. All they did was create a vehicle for transferring the losses to where they have no right being transferred.

SH, I thought I lived in a studio in uptown!

Jason, my e-mails were people letting me know what was going on, my boss wants to file a class action against the sheriff, the reo lawyer’s closing pipeline was just extended 120 days on a number of properties…..it’s never good news when the sheriff wants to basically halt evictions.

Who priced this place? Someone has a sense of humor.

Fuld, AIG, Bear Stearns, Wachovia, Lehman Brothers, Merrill, WAMU….. The list goes on and on and on. But lets get real folks the big hitters on Wall Street where not the snake oil salesmen selling these mortgages. Were they part of the problem? Yes. Did they escalate the problem? Yes. Are they solely to blame? Absolutely not. Everyone in America needs to take a good hard look in he mirror these days. Their are allot of people going around and talking about how people should not spend over their means but come on, how can everybody be on that side, if everyone lived within their means we would not be in this mess. Lots of people losing their houses should never have had houses in the first place. People going into foreclosure on $700K plus houses should probably have been in $350K plus houses. This is just as much main streets fault as Wall Streets fault, people need to take personal responsibility, I have not heard this from either Candidate. America is in a sad pathetic state and I don’t see it being corrected anytime soon.

What is really comical is that people keep blaming Wall Street. I find this somewhat amusing as I don’t consider the snake oil salesman throughout the country in their independent mortgage brokerages to resemble anything close to Wall Street.

Oh and any Democrat that has one cent of credit card debt, a HELOC, and drives and SUV is a complete hypocrite.

If you guys would take a moment and actually LOOK at the suspension and what it means. It means that if your LANDLORD defaults on the property and you’re RENTING from him, it means the renter isnt going to get a “surprise, get out!” eviction. Renters have rights. They do this in plenty of other states.

In theory it sounds great to help out the innocent tenant – but in reality – the tenant is never really innocent. The tenants almost always know the landlord is in foreclosure. The banks tell the sheriff to serve “unknown owners and occupants” at the property address. So the sheriff goes out there and hand delivers the documents to someone in the household age 13 years or older. The mailbox at the property also gets flooded with mail from scammers and investors wanting to ‘help’ the foreclosure owner. Often the landlord themselves out of some sense of right and wrong tell the tenant that the building is going into foreclosure. Additionally, copies of court pleadings are sent to the resident addressed as “unkonwn occupants and tenants.” Including the final order approving sale which says “enforcement of this order is stayed for 30 days”. The entire foreclosure filing process can take anywhere from a minimum of 3 to 4 months (if there is a default) to 7 to 10 months, or longer, if the tenant or landlord makes even one court appearance.

Finally, in cook county, the bank has to file a separate eviction action against the former mortgage holder, the known tenants and the “unknown tenants and occupants” and the sheriff again serves these documents to someone over the age of 13 at the property address. if they cannot serve the documents the sheriff will often leave copies of the documents at the home, and then record service as NS (not served). The bank can’t just take the deed to the sheriff after the foreclosure, they have to spend more money and more time with a separate eviction case.

Finally, after the eviction order is entered, the sheriff sends a postcard to the property address saying that within the next few weeks we are coming to evict the tenants at this address. If nothing else grabs the tenants attention up until this point the postcard usually does. Finally, when the sheriff shows up to the property address, if there is a person over the age of 18 in the home whose name is not listed on the eviction order, the sheriff refuses to do the eviction (i.e. due process to the tenant) and the court gives the bank time to amend the court, the tenant another few weeks to move out, and then it has to be reissued with the sheriff. Furthermore, the sheriff stopped doing its own evictions a few months ago. Now the banks have to hire outside movers to actually haul the stuff out of the home; the sheriff shows up only to facilitate the process. And of course, the sheriff looks at the weather every morning and if the temperature is 45 degrees or below at 8am, he calls off all evictions for the entire day. This means that there no evictions in cook county between november and march.

Anyone who says they first learned of the eviction when the sheriff started throwing their shit on the front lawn is either a liar, and illegal non-english speaking or reading immigrant, or a complete and utter bumbling idiot.

I see this as nothing more than political grandstanding by the sheriff’s office. They’re evicting thousands of potential voters and it looks bad. Furthermore, they want to stick it to the banks, like they’ve been doing time and time again, and Dart’s actions are despicable. It’s stuff like this that makes banks redline neighborhoods and cities. Shenanigans like this benefit the few scammers living rent free but drive up the cost of borrowing and lending for everyone. Dart well knows damn well what he’s doing.

______________________________________________________

“If you guys would take a moment and actually LOOK at the suspension and what it means. It means that if your LANDLORD defaults on the property and you’re RENTING from him, it means the renter isnt going to get a “surprise, get out!” eviction. Renters have rights. They do this in plenty of other states.”

The above was a little rambling and hastily written, but to clarify, the banks have the sheriff serve the foreclosure summons and complaint to the property address. Of course it’s in the tenants best self-interest to lie and say “I didn’t know” because then they get plenty more time to live in the unit rent free, like they’ve been doing for months.

P.s. tenants ALWAYS stop paying the moment they find out the building is in foreclosure. The landlord doesn’t want to throw good money after bad so they rarely, if ever, file their own eviction proceedings against the tenant. The landlord just walks away and lets the banks deal with the problem tenant. I’ve seen it time and time again. Tenant lives rent free for months and months and then says “i didn’t know the building was in foreclosure. This is news to me! I have no proof I’ve been paying my rent because I always pay in cash.” Its the same lie over and over again, just like “the police planted the drugs on me.” or “Officer i had only one beer, I swear.”

If people here are noticing the anger level rising just a bit, I just rode through Florida. Lot of frightened/angry people. I bet anyone who walks away thinking this will be wiped clean from their credit records in a few years is in for a heck of a surprise down the road.

HD,

Sounds like the banks are taking it on the chin and the deadbeats are in a privileged position. Despite the collapse of our stock market I can’t be but somewhat gleeful that the banks are stuck holding the turd again. Stupid bankers should’ve figured out what they were sewing, now they reap it.

I hope the common and preferred equity of any bank that got significantly involved in Alt-A and subprime goes to 0. Their entire top management and most of middle management need to be out on the streets. They knew what they were doing, they just never envisioned a worst case scenario. In life worst case scenarios sometimes happen, have a plan or tough sh_t. Now watch as financial services contracts violently from ~20% of our economy to around 7% is my guess. That whole industry is toast for the next decade.

IB – I am in Florida now. The people that banked on home appreciation is just incredible. It is like an entitlement even though they knew it was too good to be true. Banks gave them any loan so the noncreditworthy borrows took the money and made stupid purchases. The fraud is worse than anything in Chicago, except maybe the special “deals” Obama got on his downtown pad.

Homedelete – You make it sound as if a renter should pay the landlord when the landlord is in fact not paying their own mortgage. If I lived in a rental (you will have to remind me as I can’t remember what that feels like) where my landlord was not paying his obligation, I would not pay either.

would you????

People need to look at what they own, whether it is a home or stocks. The spot price for these assets doesn’t mean much right now unless you need to sell soon. The stock in GE represents the same ownership as it did last month regardless of the price that it was last month or today.

If I discovered my landlord was in default, I’d move. Usually, if your landlord is in trouble, you know it, for services like heat and day-to-day maintenance start to disappear and the building becomes a sump no one would want to live int.

John-

Funny how no one ever assumes your accounting method on the way up. Anything other than mark to-market is the same as sticking your head into the sand. Your net worth in GE is clearly calculated as lower by any third party.

And I am a huge believer of ethical behavior but no… You should not have to pay the landlord. I do not think that is the point HD is making though.

Small time landlords generally require the tenant to pay rent so they can use that money to pay the mortgage. If the tenant doesn’t pay rent then the landlord doesn’t can’t the mortgage. That’s what’s happening on the south and west sides right now. A tremendous number of loans were given wannabe land barons with poor credit and no landlord experience. I saw a Chap 13 come across my desk the other day. The landlord is an upside down land baron with three or four investment properties but doesn’t make any money off the rentals. One of the properties has some equity in it but the rest are upside down. The landlord’s day job is like a mechanic or something making $35k a year. My client’s landlord filed bk to try and save the property with equity from foreclosure but he’s giving back he other three to the bank.

SH: If I found out my landlord was not paying the mortgage I would probably live for a month or two rent free – as sort of a way to recoup my lost security deposit, and then I would leave. Fortunately I don’t live in the ghetto or even a borderline area so I’m not worried about my landlord going into foreclosure. Things would have to be pretty bad, great depression redux bad, in order for me to be evicted because my landlord went into foreclosure.

My point was that its so irritating to hear tenants saying “we didn’t know our buidling was in foreclosure” but they’re basically a bunch of liars. I doubt they’ve paid rent in months if not a year. The people I feel bad for the people that are scammed. A few months back a friend of a friend gave a $1,000 security deposit to a guy on craigslist….her mistake was not signing a lease…she got a little suspicious and asked me to look up the building. The building was in foreclosure and was weeks away from being sold at auction. I told her this and she was pretty upset. She tried to get her money back from the scammer but he refused to return her phone calls. I told her to go to the police for fraud because I wasn’t going to file a lawsuit for $1,000. I don’t know what happened after to the guy after that but I hope he was arrested and charged.

Just read the article. Reading between the lines I get the impression that many times the bank doesn’t realize that the home has been rented out. The sheriff’s office seems to be on the leading edge of discovering this. It certainly doesn’t make sense for a bank to evict a rent paying tenant so ignorance is the only explanation.

Yeah it’s called checking the “owner occupied” box on the uniform mortgage application. Some banks send people out to the homes pre-foreclosure to find out who lives there. If the home is vacant in a default case then the bank files an affidavit with the court stating that the home is vacant and they pray for an expedited foreclosure schedule shortening the redeption period by a couple of months. The fact of the matter is that it’s unfair and biased that a renter in an apartment building can be evicted upon a 5 days notice but a renter in a foreclosed home gets a mimimum of 120 days from the sheriff. The renter thing is merely pretextual; the Sheriff is grandstanding and doesn’t want to evict tens of thousand of his constituients.

“I’m not sure why everyone is blaming Phil Gramm, he had nothing to do with this.”

This is so dumb, I’m not sure where to start.

You **really** believe that the actual problem is the puny $5T backed by Fran?

What about the $54T (Yes, Fifty-four. An order of magnitude more than the Frannie total–which actually has *some* collateral to support it, unlike CDS) of CDS that made it easy for folks to believe that they were laying off risk? Why did Bear & Lehman fail? You think it was their Frannie holdings? Get serious! And who was the head of CFTC when they decided to completely un- (or de-) regulate CDS? Who is her husband? And who was her husband a paid lobbyist for at the time?

If the sheriff knocks on the door to evict you then send your nephew to the door. Since your nephew’s name isn’t on the mortgage that’s at least 120 days more of living for free off the backs of the banks and the american tax payer.

The banks don’t want to collect rent nor do they have the resources to collect rent. Do you know how difficult it is to collect rent in some of the sketchier neighborhoods? “Yeah you come to my door and you try and get it from me A$$hole”. No way do the banks want to enter into that mess.

“It certainly doesn’t make sense for a bank to evict a rent paying tenant”

To put hd’s point another way: Who do you think the tenant is writing checks to? The bank?

hahahahahahahahahahahahahahahahahaha!!

That’s the funniest thing I’ve read here in weeks. Thanks for the AM laffer, Gary! Remember, in “owner-occupied” properties, there isn’t typically a mechanism set-up to take assignment of rents (altho, generally, the m’ee is entitled).

I suggest any renters here follow Gary’s implicit suggestion and start sending their rent checks to the mortgagee of their apartment/house and see how long that works–why would your landlord want to evict a rent-paying tenant?

If I was renting and the building was going into foreclosure, there is absolutely no way I would pay the rent. I’d live there until I was kicked out. Ethically wrong, but no way I’m paying $ to someone who is about to be foreclosed on.

In this whole asset bubble and subsequent unwind I think ethics are quite relative. If you play by the traditional ‘ethics’ rules you do finish in last place, as no one else in the entire property bubble ecosystem acted with any ethics.

I would quit paying rent too if I was in that situation. Luckily for me my landlord is a professional and they never heeded the siren call of RE gains.

I think several of you are missing my points. First, a lot of buyers checked the owner occupied box and proceeded to rent it out anyway. Or maybe they lived there for a while but now they rent it out. So the bank is clueless. And of course, the renter is not paying the bank but if the bank knew there was a tenant then a chance at collecting rent is better than a vacant building.

“if the bank knew there was a tenant then a chance at collecting rent is better than a vacant building”

What’s the likelihood of that “chance” and how would it be enforced? I haven’t looked a residential mortgage in a while, but what’s the provision for taking assignment of rents and the lease? Does it require judicial process? Will the tenant attorn to the Lender as the new landlord, if they are required to assume the lease?

Even if they could easily step into the shoes of the landlord w/o a foreclosure, does the lender have the infrastructure to manage the lease payments, maintain the unit in compliance with the lease and seek eviction if necessary? Sounds like a whole lot of trouble that most banks (and ALL MBS servicers–they don’t get paid enough to make that much effort, even if their agreement would allow it, which is doubtful) would want to avoid.

I fail to see the moral/ethical hazard of not paying rent to someone who is in default to the bank. Essentially you are with knowledge that he will not be able to carry the terms of his contract he made with you forward and if not technically having breeched contract you have knowledge that his actions will shortly force the breech. Not to mention you will shortly be put through the expense of moving and even worse (since i just did it) packing up all your crap.

So how long is it ok to live in a foreclosure house without paying rent? As long as possible? As long as possible plus another 120 days because when the sheriff came to do the eviction your nephew answered the door as you hid in the bedroom? How long?

I think there might be a business opportunity in creating a market to allow tenants to remain in place and sending the payments directly to the bank.

Unfortunately the legal structure of CDOs probably precludes this! Lol the lawyers and wall street geniuses likely were too smart for their own good this time around. Massive market dislocations await.

If the tenant doesn’t pay the rent to the bank then they get evicted. The whole premise of this debate is that you have a rent paying tenant who is facing eviction through no fault of their own. If they are paying rent to the landlord then they should have no problem paying rent to the bank. Besides, it’s better to sell an investment property with rent paying tenants in it.

As for the ethics of not paying rent to a defaulting landlord…as a renter you have no way of knowing what your landlord may or may not do. You can’t assume they are going to be in breach of your contract. However, if you don’t pay the rent then there is no way they can avoid default.

“If they are paying rent to the landlord then they should have no problem paying rent to the bank.”

The tenant shouldn’t have a problem, but the banks might, especially with a typical gross rental rate that doesn’t cover mortgage + taxes + insurance + water bill + etc.

“the legal structure of CDOs probably precludes this”

First, it’s not the CDOs, it’s the RMBS–where the mortgages are actually held. CDOs package the interests in the RMBS (and sometimes CMBS and ABS). The CDO servicer has, at best, attenuated rights to enforce anything under a particular residential mortgage.

The problem with retaining renters is really about there not being enough money–if the rent were actually enough to cover all the expenses, it might work. It’s also about the compensation of the servicer, who would be taking on a LOT of additional responsibilities (and probably some risks as well) without receiving a single additional dollar for the trouble.

As with not having read an Illinois residential mortgage lately, I also am not up on the typical special servicer provisions for RMBS, so maybe there’s something that could make this work, if the holders of the MBS exercise their rights.

WOW. That was a lot of reading. I just want everyone to know that I do not know Homedelete, but just about everything he has said is true, including the outline of the legal process. These tenants that the Sheriff is refusing to evict are simply scamming the system.

(But I have a secret way of getting thier asses our of there quick, and it doesn’t involve baseball bats!

Jason, thanks for verifiying my description of the legal process. How do you get them out? Offer them cash?

“WOW. That was a lot of reading. ”

But it doesn’t compare to the amount of reading we did as 1L’s!

HD:

Yea, but at least the 1L reading made sense and was well thought out sometimes! LOL. One way to get them out is to allege dangerous and hazardous conditions at the property. That’s all I can say here. (This is not legal advice.) Offering them cash can also do the trick, it might be cheaper. Finding them another apartment, paying thier moving expenses and giving them a GREAT recommendation….

Just so you can stick someone lese with the problem! Hey if they play the system, then what the hell…you have to be craetive without breaking ethical rules.

To all:

I am not trying to sound like a jerk, but I want to let everyone know that “the poor, innocent tenants” are not at all innocent, and very often culpable. 99.9% of the time. I swear, and I am not some psycho right winger.

Ah, I get what you’re saying. that’s smart. No judge will allow someone to live in the property if the unit is structually unsound, uninhabitable or dangerous. No one wants to put emergency officials at risk to save people living in uninhabitable structure.

Until you can make arrangements to leave. There are 2 sides of the argument once intent is removed, why should the person renting the property take your money when they are just pocketing it. If you are paying “near” carrying costs for them they should be able to make payments.

I made my comment assuming you “knew for certain” they were not making payments.

IB,

I think generally when tenants pay the rent, the mortgage is getting paid, therefore there is no foreclosure. If the owner is commiting fraud then I agree.

HD:

Also, judges are not going to want it on thier shoulders if somebody dies in a D and H structure. (See the E2 disaster, and the porch collapse.)

I recently had 2 apts in Chi Town. One the rent would have covered almost all carry, the other, had i rented it, would have left me about 15-20 k a year short so not so sure about renter paying and wouldn’t default.

Now it’s that damn tom petty song.. “free falling oh we’re free falling”

any predictions on 30yr jumbo fixed rates soon? 12-14% ??? Libor resets? Ouch!!

How about DOW at 1000? Why not?

The gov’t is gonna do all they can to stem this crisis to little avail.

They really have no ammo to defuse the ticking time-b_mb that this asset bubble has become. They can use poor securities as collateral for loans, they can allow securities firms to borrow money against questionable collateral, they can flood the market with liquidity, they can buy toxic crap MBS, they can cut the fed funds rate, they can pay interest on reserves, they can buy CP outright, they can even buy banks outright. They can roll out a dancing bear and a juggling monkey for all I care.

Their remedies can’t solve the fact that most of our economimc growth over the past decade or so was credit driven. To an extent that an overcorrection on the conservative side of credit and lending will have devastating affects on the economy. My favorite W moment maybe of all time was when a journalist asked him about one of the bailouts and he used the analogy that our financial system was like a house of cards, remove one and they could all come crumbling down. Incredibly honest I’m just not sure he even realized that analogy might not help inspire confidence in the system.

“most of our economimc growth over the past decade or so was credit driven”

Right. So the economy shrinks to the size it was in ’98. Not exactly the great depression. And for all of the (all-too-likely-accurate) comparisons to Japan in the 90s, it’s not like the Japanese standard of living took a nosedive–they just weren’t able to buy whatever they wanted, wherever and whenever.

The difference between the Japanese and the US is that the Japanese lend trillions of dollars to borrower nations while the US borrows trillions of dollars from creditor nations. So maybe there’s some sort of middle ground between Japan and the great depression. I suggest we all prepare for a third, new and totally unexpected model. Hold on tight because we’re in for a ride.

Even without this credit crisis we were doomed to a lower standard of living. We can’t continue to consume 25% of the world’s resources with only 5% of the population. It’s not sustainable. This credit crisis probably accelerates this because other countries are going to cut our credit off and the dollar is going to decline.

Gary Lucido – the 25% 5% stat is misleading. It depends on how you define resources. If you base it on purely economic activity than the stats are not that far off of using resources versus economic activity…. moreover, I rarely see stats about 3rd world countries were the top 5% consume 90% of those resources. The simple fact is, there is a ton of economic activity concentrated in the US and that is why the resources flow here.

True. But we consume those resources. Up until now we have been able to because of higher GDP per capita. However, as GDP rises in other countries (India, China) they will be consuming more. We saw this briefly over the summer as commodity prices rose – before the world economy really dove.

The Nikkei is down 1,000 points, I’ve never seen anything like this. I really hope it recovers or they suspend trading tomorrow.

They really need to add circuit breakers to our markets. What happened to the short sale uptick rule? What about stopping trading at certain % declines?

Head in the sand again. Stopping it just creates more nervousness. Tell someone they can’t get out and even if they didnt want to before they will now want to for fear of never being able to. Russia keeps trying to stop it. Go look into how that is working out for them. let it go where it has to and get it over with already.

Interestingly, as bad as the housing market has been, the stock market has been much worse. Of course, at this point I’d rather have the money in the stock market. More upside.

RE is as bad as the stock market.

It’s just illiquid.

Oh Gary.. give it time… RE is in MASSIVE deep sh*t right now. This will be much worse than I ever expected, and I expected crazy bad. We are moments away from NO lending. NONE!!!!

I think I read somewhere that while the RE market has lower gains than the stock market, because of the lower volatility it does have a higher Sharpe ratio than the stock market.

I used to think that that was true until the bubble. Given what we’re seeing today with the stock market that statement I’d bet holds true even in this bubble. Maybe FL & CA real estate come close in terms of % decline in real estate vs the market, but certainly not Chicago as of now.

My friends in NYC and Paris keep trying to tell me the same thing. I have seen too many times the last to fall, fall fastest. 30 yr Jumbos should be over 10% very soon. Enough said.

and after 10 days of cabin fever it finally stopped raining so soon no one has to hear from me 🙂

NYC immune to RE downturns? I love that one. Is ’87-94 really forgotten? Or ’65-80, for that matter?

Probably the last of summer, IB. Enjoy.

Oh the blackout in ’77 is a real memory one should forget. G I had a bad dream last November which led to a panic attack and me liquidating everything in the US. I am afraid to be in a country where people feel entitled and will not deal well with hard times. I am no longer in the U.S. so my summer is just starting. Chicago, awesome city though.

All the best to you to…

On the lam, IB?

The stock market declines 50% in one year. Not uncommon. I don’t think any US real estate market has ever done that. Well, none that I have lived in. The problem with the real estate market is the leverage. 10% can easily become 50% or more of your equity through leverage.

“I don’t think any US real estate market has ever done that”

Sure it has. Indeed, Riverside, CA has seen a 43.1% decline in the past 12 months (see, housingtracker dot net for one data source). I’m sure there are markets in Florida and others in CA with similar losses, but don’t want to bother.

Back to this building. Please explain. Someone said this is a scary building. Why? Other than landlord’s not paying the mortgage, is it full of bad/dangerous types? Is this part of town bad? I’m not familiar with it, but noticed a decent condo for sale, for the price. I was considering a purchase for a family member. Someone said the building is going into foreclosure. How does that work? I understand if each condo has it’s own mortgage. What happens if someone owns their own and it’s paid off? Can the building itself go into foreclosure? Sorry, I don’t get this. I have only owned a home, not a condo.