Heartbreak Lofts Continues to Live Up to Its Name: 17 N. Loomis

We’ve chattered about heartbreak in the Heartbreak Lofts at 17 N. Loomis in the West Loop before.

Some sellers continue to have difficulty making money in the building, despite the size of these lofts.

This 2050-square foot unit is listed at only $9,000 more than it sold for in 2006.

Here’s the listing:

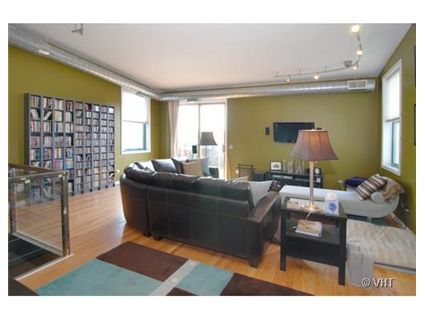

Rarely available penthouse duplex-up with 2beds/2.5ba in the Heartbreak Lofts. This 2000 sq/ft concrete loft feats. rehabbed kitchen w/ SS appliances, granite countertops, open living/dining room, tons of in unit storage, 12ft ceilings, and HDWD floors throughout.

Private roof deck w/skyline view. Deeded garage parking for $25K.

@Properties has the listing. See more pictures here.

Unit #4J: 2 bedrooms, 2.5 baths, 2050 square feet, duplex

- Sold in November 2000 for $342,000

- Sold in March 2004 for $351,000

- Sold in June 2006 for $460,000

- Currently listed for $469,000 (plus $25k for parking)

- Assessments of $503 a month

- Taxes of $4,957

- Central Air

2006 was the absolute peak price. NOTHING is going to sell as high as it did then.

Since when is “making money” on your property at resale, a God-given entitlement? Before the 80s, you bought for home, not appreciation, and there was very little inflation in house prices between 1950 and 1975.

They should discount the price to 2002 levels for comparables if they want to generate interest.

Laura, a discount to 2002 pricing is know as a foreclosure.

I have heard from the realtor that there is a special assessment coming to the building after the current exterior work being done is finished. They said that the developer installed the windows incorrectly.

Yeah, I know that. But that’s where things are, because the stone cold truth of the matter is that prices would not have gone past 2001 levels were it not for government policies that drove debt creation in conjunction with lenders that took insane risk and dropped all lending standards, feeling safe in the knowledge that our authorities would step in to bail them out when things began their inevitable unwinding, which everyone knew would happen by 2004. By 2005, the debacle now taking place was pretty well set in stone.

The brutality of the unravelling is proportionate to the utter insanity and heedlessness of the buildup to it over the past 10 years. And it wasn’t because of lending to “poor” home borrowers- it was the deliberate decision to base economic growth on debt creation, asset inflation, and monetary manipulation, due to the fact that we ceased to be a manufacturing and commericial economy twenty years ago, and completely financialized our economy over the past 20 years. Notice that EVERYBODY, not just the “poor”, borrowed way beyond their means for houses, and the housing market is the least of it. The commercial credit is absolutely insane, and the credit card debt is unbelievable, and will be the next frontier of default. Truly poor people don’t buy houses, and didn’t in this wave of speculation, either. But everybody who did buy was “poor” relative to the loans they were assuming, and never in the history of the world was there ever built so much redundant retail.

There are going to be a lot more foreclosures on the way back to housing normalcy.

[/rant]

You forgot to close your tag, Laura.

Sorry, I can’t help ranting on this. Sick up listening to our candidates talk about how they will “prop up home prices”.

Back to this development…. did or did not the developer hex this place by calling it the Heartbreak Lofts?

That is like naming your used car lot Lemon Bargains.

haha… don’t know why it is called “Heartbreak” because it used to be home to a fire escape making company. Although… Fire Escape Lofts probably would have been worse!

I believe this was an American Invsco project. It was doomed regardless of the name of the building.

not asking for only $9000 premium since 2006, but a $34000 premium (note game with parking). In other words, the seller wants something like a 4%/year appreciation rate (I’m doing in the math in my head so that’s only approximate), in a declining market. As others have said before, “Does this seller not read the papers?”

The sellers read the papers but their property is different and special. And they can’t just give it away you know. The can wait it out until the market returns after the superbowl.

Yes, megc629, I believe this was one of the conversions of the loft apartment portfolio that American Invsco bought from Annie Properties. Annie Properties was the main landlord of west loop rental lofts before the boom.

“something like a 4%/year”

3.6%/year to June 08. Drops to 2.4%/year if they keep that asking price ’til next June.

No homedelete,

They’re waiting for the market to return after the Cubs win the World Series.

“…a discount to 2002 pricing is know as a foreclosure.”

Nah, that would be a short sale. A foreclosure price would revert it to before the ’00 price level.