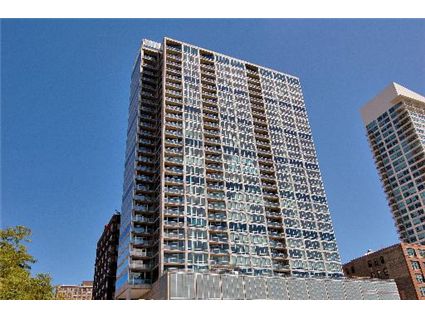

Is “Special Pricing” Permanent at The Vetro? 611 S. Wells

Last June we chattered about “Special Pricing” on floors 7-18 at The Vetro, the new construction high-rise at 611 S. Wells, in the Printers Row area of the South Loop.

It appears that those “special prices” that were for a “limited time” are still in effect on Units #1603 and #1607 (the units we chattered about last June).

Current stats on the building (out of 232 units):

- 12 for sale

- 2 for rent

Some units may be both for sale AND for rent.

The current stats for this building aren’t very accurate. The developer is not listing all of the available units on the MLS.

From what I can gather from public information, only about 50% of the building has sold.

Unit #1603 has also had a further reduction and now also includes a parking space.

Unit #1603’s current listing:

CORNER UNIT 1667SQFT 2BR+DEN 2.5BA WITH N+E+W EXPOSURES TONS OF NATURAL LIGHT. GREAT VIEWS SEARS TOWER AND CITY.9FT CONCRETE CEILINGS,PRIVATE BALCONY.

1.25 GRANITE KIT W/MOSAIC TILE BACKSPLSH, S/S APPL,GROHE FXTRS,DBLE BWL UNDERMNT SINK,DISPOSAL,HRDWD FLRS IN LIVING AREA. MBA INCL:MARBLE,SEP SHWR W/FRMLSS,DBLE BWL VANITY W/LIMSTNE C-TOP.MBR HAS W-I-C,W/D INCL.GARAGE PKG INCLUDED

Rebecca Farrell and Nathan Skillicorn at Baird and Warner have the listing. See more pictures here.

Unit #1603: 2 bedrooms, 2.5 baths, den, 1667 square feet

- Originally listed for $518,900

- Was listed in June 2008 as “special pricing” for $468,900 (parking extra)

- Reduced

- Currently listed for $460,900 (parking included)

- Assessments of $699 a month

- Taxes are “new”

Unit #1607 has had a price increase since last June.

Here’s the listing:

**BEST VALUE IN AREA***END UNIT WITH S+E+W EXP TONS OF NAT LIGHT. OVER 1500SQFT 2BR+DEN 2.5BA OPEN LAYOUT. 9FT CONCRETE CEILINGS, PRIVATE BALCONY,1.25 GRANITE KIT W/MOSIAC TILE BACKSPLASH, S/S APPL,GROHE FXTRS,DBLE BWL UNDERMNT SINK,DISPOSAL,HARDWD FLRS IN LIVING AREA.

MBA INCLDES:LIMESTONE TILE,SEP SHWR AND TUB,DBLE BWL VANITY W/LIMESTNE C-TOP.W/D INCL.GARAGE PKG AVAI

Brian Morand and Gabriel Datcu at Baird and Warner have the listing. See more pictures here.

Unit #1607: 2 bedrooms, 2.5 baths, den, 1525 square feet

- Was listed in June 2008 at “special pricing” for $434,900 (parking extra)

- Currently listed at $437,900 (parking extra)

- Assessments now only $499 a month (were $533 a month in June)

- Taxes are “new”

They seem to have realistic square footage for a 2br unlike that “2 br” I saw here yesterday. Do they have any 1 bedrooms?

Don’t buy here.

a,

There are many 1brs available. I really like the building and have my eye on one in particular, but even I realize its doubtful it won’t sell by the time I’m ready to buy.

The only tiers for the true 1brs are the -02s and the -09s. Right now they’re asking 230s for the 02s and 240s for the 09s. The 1brs are slightly less nice than these units though: no separate shower, for instance.

Little Boi: Can you elaborate? I’m curious about this building.

the places themself look nice, but i’m concerned about the south loop in general. my brother bought a unit from this developers project in Evanston and has had a good experience with it, and the developer.

“Special pricing” in a downmarket is just a sales gimmick. If something isn’t selling at the “special” price, you can’t somehow expect to sell it at a higher price. So all of those “buy now or the price goes up” listings are bunk in a declining market.

Little Boi, why not? I’ve been inside, and thought it was quite nice, if you have a taste for modern.

The assessments for this building are bizarrely high, esp. given that it is supposed to be an energy-efficient building (though maybe I’m confusing it with another).

Kenworthey, I honestly don’t think the assessments are high. I have a two bedroom in another building, with less square footage, and mine is more than double.

Maybe I’m weird…I find the separated shower / tub to be a complete waste of space. The last time I took a bath was approximately 3 years ago when my ankle was bandaged and stitched up after surgery. I’d much rather have a shower and large closet where a bathtub would go, or just make do with the shower / tub combo like most people.

I put this in there with exposed concrete ceilings – a new hallmark of “luxury” that I’d rather do without.

Can I get a witness?

^^ agreee. put the shower head in the tub and save the space.

Meh. I would severely question this: “over 1500 sq ft”. They have to be counting the balcony, storage, and maybe a couple other imaginary rooms to get to that. I wish Chicago would fine realtors/sellers for perpetrating this fraud. Yes, this is fraud in my opinion. There have been numerous times where I was attracted to a unit because of its square footage only to find out that realtor/seller either completely lied or counted stuff like outdoor space, storage space, double counting certain spaces that were open to below, etc. I’m not sure whether these are legal practices but I sure don’t count those as living spaces.

Dave, your assessments are $1400 a month? I’m assuming you live in vintage. If not, that is crazy–and not the norm. For new construction, $700 a month in assessments for a 1600 square foot place really *is* high. Compare it to other new construction buildings posted on this site, and you’ll see what I mean.

Realistically how much less do you all think they would accept for these units, and how much less for the parking spaces?

No tub. It isn’t even a jacuzzi (which never gets used anyway) Make the shower a steamroom!!!!

Steve, if this building really is only 50% sold from the developer… add the unsold developer units to the flippers’ units, and you’ve got a whole hell of a lot of excess inventory. This is a great location in the South Loop, but the South Loop really is doomed. At this point I honestly expect prices there to go under $200 a square foot, even for new, nice buildings like this. (More, obviously, for older units further south.)

Nice windows… White framed. Like those. Bldg I bought in had model with white frames. Apartment frames were black when finished. Pissed me off.

“More under $200,” is what I meant, which is a dumb way to phrase “appreciably less than $200 a square foot for older units further south.”

I don’t compare this building nor Wells Street Tower or Harrison St Lofts with the rest of the south loop. That is because even in the winter from this location you can still walk to work, a huge amenity people like me would be willing to pay for. In fact on some MLS sites its listed as Loop.

Not say this place isn’t having issues, but it looks like units are selling at between 2-4 units/month. Snails progress but forward progress nonetheless.

One concern is that seeming lack of inhabitants in this building, sugesting a lot of investors/flippers. On any given weeknight its not often I see more than a few lights on in the entire building, far less than 100 or even 50.

“I don’t compare this building nor Wells Street Tower or Harrison St Lofts with the rest of the south loop.”

Yeah, north of Polk is a reasonable walk to anywhere in the loop; south of Roosevelt is an entirely different story.

while looking at 2 other condos within a block of here, I saw the sign for this place. I walked in and asked the doorman about the model. He told me to have a seat and fill out a form, and pretty much gave the impression I was infringing on his time. I spoke with a lady also waiting in the lobby and asked her if she’d been waiting long. She said “Yes, and I’m about to give up.” She took her form and left. About 3 minutes later and after noticing that 2 other groups of people were waiting as well, I decided to leave too. Suddenly as I was about to leave the doorman took an interest and said “You can leave that form here with your information”. I said “I don’t think I want to. Thanks.”

You would think in a market like this, this place would actually want people to see the model.

Building looks very nice with very livable spaces. Assessments seem a bit high for new construction, but they are plausible especially if they include most/all utilities. There’s a possibility it’s merely a developer trying to be fully honest about how much it costs to operate and maintain a building like this going forward, in contrast to most developers who price the starting assessment at around 50-75% where they should be to maintain adequate reserves and have a pool of money for necessary capital projects down the road.

“One concern is that seeming lack of inhabitants in this building, sugesting a lot of investors/flippers. On any given weeknight its not often I see more than a few lights on in the entire building, far less than 100 or even 50.”

This place is a complete ghost town. I have unobstructed views from my office across Congress and it’s like Willy Wonka’s factory before the golden tickets, “nobody ever goes in, and noboday ever comes out!”

Seriously, I can see the entire North side of the building, all the blinds are open, and I have NEVER seen a living sole in any of the units. I can see all but the bottem few floors of the east side of the buiding and I have seen a grand total of 2 people out on a balcony in the last 9 months (since I have had this view).

I was shocked when I read here that it is 50% sold. Is it possible that it is 50% sold but but only a fraction of those people have closed?

John

I see approx 111 deeds recorded for developer sales through 10/24/08. A small number might be parking only. The deed transfers for the most recent months are as follows:

10/08 = 5

9/08 = 7

8/08 = 8

7/08 = 5

6/08 = 3

Thanks. I do like the look of this building. This would be a weekend place we’d keep for five years or so. Walking, or busing, to restaurants, theater, and shopping is important.

Below are the two I’m focused on. 1606 and 1605 in case the links don’t work.

http://www.redfin.com/IL/CHICAGO/611-S-WELLS-St-60607/unit-1606/home/13130148

http://www.urbanrealestate.com/property/611-S-Wells-St-Unit-1605-CHICAGO-IL-60607-FFS3N76FZGSZY.html

trader “Meh. I would severely question this: “over 1500 sq ft”.”

trader – go to vetro’s website. they have all room dimensions available on the floor plans. some things are excluded like closets and hallways but you could probably estimate the square footage. doesnt seem like they’re hiding anything. the agent is only quoting what is on the floor plans.

“I was shocked when I read here that it is 50% sold. Is it possible that it is 50% sold but but only a fraction of those people have closed?”

Flippers, John, you’re forgetting about flippers, who never intended to occupy the units.

So how long before the flippers stop paying assessments and association defaults. Everyone looking at condo prices in new developments needs to take association balance sheet into account.

sartre,

This is the #1 reason why I’ve pushed back my entry into the market until 2010 at least. I’m worried about 1) who pays HOA for unsold units, 2) will HOA pricing and tax estimates be stable once its turned over from the developer and 3) what happens to flipper & other defaults in terms of HOA.

These three uncertainties would need to be worked out before I’d consider owning any place. I don’t like contingent liabilities that can’t be quantified, so I’ve been effectively been scared away from the market until it settles a bit. Its just not worth the risk right now.

Bob, I am worried about the same thing. Foreclosures in a neighborhood of single family homes are one thing. It’s quite another when the building’s water get turned off because the association can’t afford the bill, or passes a huge assessment to force remaining residents to pay the share of expenses that are unpaid by all the foreclosees.

Why not buy here

1) Location is dead; There’s nothing around. You walk in the evening and it’s dead, not as vibrant as Streeterville. Everything is not right there. 600 NF or 340 On the Park, everything is right there (movies, shopping, night-life, etc.), and literally you walk everywhere if you were on 600 NF or 340 On The Park, and that’s not the case here with Vetro. Maybe because it’s still developing, but really though given the market is now I am not optimistic south loop will ever be as vibrant and as ‘glamorous’ as the north side in 3 years!

2) Close to highway. I personally just don’t like watching cars passing by and living close to a major highway.

3) There’s an open lot across the street. Who knows what would get built there, so your view would get blocked eventually.

4) Take a look at the finishes once you’re inside. Pay attention to the hallway, choice of furniture, appliances, etc., and you’ll see that everything is basic.

I don’t think the price is cheap. I was at one time looking at a higher floor north facing 2 BR and 3 BR and I am glad I backed off. My biggest turn off is LOCATION.

I spent the weekend at my friend’s place at 600 NF and really the location of that building is, in my opinion, the best location. You really walk everywhere to get to the common places we go, e.g. groceries, shopping, movies, restaurants, park, lake, hospital (northwestern hospital is right there), museums (moma is 1.5 blocks south), etc etc.

My personal view of urban living is ‘everythin within my reach’ and ‘convenience’, it’s like if you want to move to nyc and you don’t live in manhattan but living in queens or harlem, then it kinda defeats the purpose of moving to nyc … living in queens or harlem or brooklyn is no different than living in, say, lakeview or rogers park, or whatever … it’s just my personal view, that’s why I don’t fancy the location where Vetro is, plus the cheap finishes.

The performance of Vetro speaks itself, how many units really are owner occupied in that building, compare the stats with other buildings in the North Side.

I guess you could buy anything in the South Loop for investment, but don’t expect to make a profit in the next 5 years. In 10 years yeah maybe you’d get something back, so it really depends on what your ambition is.

They should discount their prices more, because with that price I don’t think they can compete with the new condos in the North side.

Little Boi:

The Vetro is much cheaper than 600 NF so the location is reflected in the prices.

Also- if you think nothing is there, you haven’t been to Printers Row lately.

Additionally, new movie theaters and shops are going into the Roosevelt Collection (hopefully) only a few blocks away from the Vetro. You’ll be able to walk to that area easily. (It is currently under construction.)

The South Loop, especially the Printers Row area, is much more vibrant than it was even 5 years ago. And, as someone pointed out, you can walk easily to work.

“Additionally, new movie theaters and shops are going into the Roosevelt Collection (hopefully) only a few blocks away from the Vetro. You’ll be able to walk to that area easily. (It is currently under construction.)”

Is that the low-rise development just to the southeast and right on the train tracks (I’ve beend watching and wondering what the heck they were building)?

If so, it is no longer under construction, those cranes haven’t budged in a month.

John

Looking to buy one bedroom at 1720 s. Michigan

they are asking $219,000.00

How much shuld I offer based on the current market conditions ?

Thanks

Z

I’m looking at the Vetro also. Well, I’m looking to live near the Sears tower. It seems like there is a ton of excess supply in the south loop with these new constructions finishing soon.

I’m thinking about renting for 1 year first. That way I can also wait for 235 W Van Buren to finish too. I like that property a lot since it’s very close to the Sears Tower.

I’m worried that if I purchase a place the developer might default or the place will be 50% occupied and the assessments would be huge for each individual.

I’m young and inexperienced. Does anyone have any comments and suggestions for the market in the south loop right now?

Phil: Just rent then!

Frankly, you could get stuck in a building that is only 50% sold with the developer renting out the other 50% of the units (good times) or with the developer going under on the other 50% of the units.

Try out as many buildings as you can.

You also might want to check out 565 Quincy (lofts and new construction) that is going up on Quincy by Union Station (not far from the Sears Tower.)

235 W. Van Buren only recently started up construction again (it had been halted for about 3 or 4 months.) I’m assuming this is going to push back completion.

I’m an investor-owner in Vetro, and been investing in the South Loop for over 10 years. I love the location and love the building. The assessments are actually going DOWN in 2009… I’ve never seen that before in my 10-yr history of buying condos in the South Loop. I own a junior 1-BR and assessments are going from $165 down to $149. Very reasonable, I think, for such a high-amenity building.

Scott:

A few questions: What is the developer’s motivation for lowering assessments? (As the condo board could not have taken over the building as it’s not even 50% sold.)

What is the developer doing with the unsold units in the building? Renting them out?

And I wonder if they even COULD rent them out. I was in the Target on Clark Street yesterday and was stuck in traffic to get out at the light and couldn’t help but notice that about 85% of the brand new apartment high rise directly to the south of the Target was unoccupied (rents around $1700 and up in that building.)

Doesn’t appear to be any demand for these high priced rentals at the moment.

Theres noone living in Vetro. I get a glimpse of the building around 7pm from my El car and typically theres 0-2 lights on in the whole building. That being said you can rent a jr-1bdrm here for $1500 with parking, so I think a lot of these investor-owners are going to undercut other rentals.

I am a big fan of Vetro but not in a position to buy just yet. Sadly the unit I was eying sold but its not surprising: it was listed at a great price for the area.

Bob: Do you consider $1500 to be a good price for a rental in the south loop?

Those junior 1-bedrooms are barely 600 square feet.

They should be renting for $1200 a month (WITH the parking). Not $1500 a month.

Heck, I can rent nearly anywhere downtown for about $1700 (for over 800 square feet.)

Maybe that’s why there are only 1 to 2 lights on in the building.

Bob:

I like the looks of the Vetro also, What do you think a good price for a 2 bedroom/2 bath unit should be? Do you think that they’ll throw in parking?

Srteve A,

For a 2/2, I think a broad price range would be 350-500k. Depending on the view, the floor, the floorplan, the square footage, etc. I think they probably would throw in parking as an incentive, but only 1 space / unit as far as I know.

As far as price range these are very rough guesses: I am much more familiar with the entry level (1/1 units) and pricing for those.

Bob:

Thanks.

My wife and I will be in town at the end of the month to look at condos. As much as I like the looks of this building we are going to pass it by. Much too chancy, They have now lowered prices and are giving free parking. The developer has gotten an extension on his bank loan. Comments here indicate that although 57% are sold there are not many occupants. All signs of trouble.

I don’t want to take a risk on this building.

Steve A,

I think you are smart to be weary but if those are things that make you want to avoid a building you are going to be avoiding pretty much everything built in the last 3 years.

Can anybody name any large building in the last 3 years that is more than 80% owner occupied?

Sabrina, I think the developer’s motive for lowering assessments is so they can more effectively market the unsold units as having low assessments. There was a Crain’s article this week reporting the percentage sold units in Vetro and a few other highrises… I don’t remember the percentage, but there seem to be more sold units than posters to this blog speculate. Article also said developer negotiated an extension of his construction loan another year, through April 2010. I rent my junior 1-BR for $1,250 without parking… seems fair to me, what do you think? It rented quickly. I don’t know if the developer is renting unsold units, I suspect not. I still say if I had cash I would buy another unit at Vetro. The amenities are really amazing, as is the location. (just wait til Roosevelt Collection retail and entertainment district down the street is completed and then see what these units are selling for)

Scott,

The trick is to specify what you mean by “sold.” Virtually no one on a site like this cares if the developer has sold all its units to flippers/landlords. They care about how many units have been sold to people who plan to actually live in the building. Even if the developer has sold all the units, the building could still be either a) empty or b) filled with renters (such as your tenants), neither of which is an attractive scenario for someone who wants to own there to live.

Scott:

I also don’t understand why you would care, as an investor, about the “amenities” in the building. Most of the downtown new construction high rises have similar amenities (give or take a pool.) Do renters really care? I think they care more about price.

Also- what’s a “fair” rent on a JR 1-bedroom? As an investor- all that matters is that you can cover your cost and hopefully make some money. You’re just trying to wait it out at this point as there will be little to no appreciation on that asset for years. If you can’t cover your costs, what’s the point? It’s a losing investment.

What happens when that renter leaves and it takes you a few months to find a replacement? Or if that renter ruins the floors/carpets/appliances and they must be replaced? Are you covering your costs then?

I really don’t understand the desire to own any of these downtown condos as “investments” when there are literally THOUSANDS of units coming on the market all competing for renters. It means prices will go down.

Maybe someone can help me understand the allure of being a downtown condo landland in this type of environment.

Also:

Here’s the excerpt from the Crain’s article about condo loans coming due. These obviously aren’t the only two that haven’t sold enough units and will have their banks calling them:

“Miami-based Lennar Corp. has sold only 80, or 43%, of the condos in Library Tower, a 184-unit project it’s building at 520 S. State St., and faces a Jan. 11 due date on $43.5 million owed to LaSalle Bank N.A.

Spokespeople for Lennar and Bank of America N.A., which owns LaSalle, decline to comment.

Evanston-based developer Thomas Roszak has sold about 57% of the condos in the 232-unit project he’s building at 611 S. Wells St., below the 70% to 80% a developer typically needs to pay off lenders.

With an April 30 due date on a construction loan from Corus Bank N.A. looming, Mr. Roszak says he worked out an extension of more than a year with the Chicago-based lender.”

High rise headache [Crain’s Chicago Business, Dec 14, 2008]

“Maybe someone can help me understand the allure of being a downtown condo landlord in this type of environment.”

It’s not so much allure as stupidity, greed and blissful ignorance. It’s much easier to lose money than to make it. The real estate mania is still alive and kicking. We’re nowhere near the bottom. This is just the beginning of price reductions.

I really like Vetro but only on the penthouse floors and 7. Those are the only floors with the 11ft ceilings that don’t make it feel like a concrete box but rather more loftlike.

If anyone here owns a unit on 7 and is looking to get out of being a mini landlord in a couple years we’ll talk. 🙂

Agree re: floor 7, Bob. It’s the terrace floor. But you have to get on the right side of the building to avoid the shorter building next door. But at least buyers no longer have to worry about the possibility of the areas around it being developed!

I agree Homedelete. But it’s amazing to me how many e-mails I am still getting from people who believe the path to riches is from buying condos as investment units.

Still.

Eventually- it’ll hit bottom and fortunes will be made. But right now, in most cases, you can’t even cover your costs with the rent.

I continue to see some incredible rental deals (on properties that owners can’t sell so they’re willing to rent instead.)

Hi everyone,

I’ve been in this building and was looking at the studios/jr 1 bedrooms. Units are nice for the price, I didn’t like the train station and the noise you can hear from idling trains. The nice thing is that the form of the balcony allows a lot of light.

I’m a first time buyer and young professional. I’m planing to live in the unit, but want to return family money in about 5 years.

I’m trying to compare studio here and at 1255 Sandburg. Here, they have 174,900 for a 523 sq. ft. on 22d floor and will though in parking if you go with there price + 170 assessments. At Sandburg, same 520 sq ft – 175,000 and has a balcony + 350 assessments 17th floor. The price can be negotiated to 165,000, I think. But unit needs to be remodeled. My agent is recommending me Sandburg, because it is very well managed building with established reputation and high owner occupancy. My problem is that I need to put money and time in remodeling. Also the building was built at 1963. But there is no other options in this price range in near north side. What do you think is better? Or maybe I should be looking for a one bedroom not in the near downtown area?

And more general question new constructions in the south loop with low owner occupancy VS old building at near north/gold coast?

Bogdan:

Lots of different questions here.

Your agent is right that the Sandburg buildings are more “stable” than the new construction high rises. You know what you’re buying into (and whether there is a good condo association in place- as well as any problems with the building.)

Additionally, no one knows what is going to happen with many new construction buildings that have not sold their units. What if the developer cannot refinance the loans? In the Vetro’s case- they got an extension from the bank until spring 2010. What happens then?

This is a big purchase- why add on more risk? (that’s just my opinion.)

Also- in the spring/summer, there will be a lot more units coming on the market. You might be able to get something in short sale or foreclosure.

Otherwise- yes- the market is tight at that price range downtown. You may have more luck looking outside of the downtown (or to simply rent for awhile.)

Does it have in unit laundry? Can you live without it? I had to move because I could NOT STAND going to the laundry room.

Bogdan,

This choice should be influenced by which neighborhood you like, where you work or you can’t live without certain amenities as SR mentioned.

On vetro I consider this building more of a Loop location than South Loop which can include places as far S as the Stevenson. Where it would be tough to walk to work, especially in winter. Its location is under 1,000ft from a loop El stop so thats the loop to me.

I actually like Vetro enough I’m considering renting there from a flipper.

Bogdan,

There is a studio and jr 1 bedroom (with terrace) both for rent in the Vetro for under 1300/month. Perhaps, you should try the building out for a year?

Thanks SR, but I decided to make an offer for Sandburg. I don’t think that waiting for a year is right in my case. Because I’ll need to invest money in something else to protect from inflation. If I need to take loan, than I would wait.

I hate the Vetro. I live in the building that looks similar to it 2 doors down (Wells Street Tower) and that building shouldn’t have ever been built. By the way, it doesn’t have a 24 hour doorman, but a “part time security” person who is a rent a cop and probably why it took him 5 minutes to find a pen when you called. The building is probably never going to get filled therefore bringing down my value even more with it’s crappy concrete ceilings among other things. It is a ghost town in the building. To the person who said there’s nothing in this neighborhood, you’re way off. There are so many restaurants, several gyms, South Gate Market, a Target, a Best Buy, Home Depot, 3 grocery stores, and a new Mall at Wells and Roosevelt that is slated to be open 10/2009 with a movie theatre. This is by far one of the best neighborhoods in Chicago with it’s proximity to the loop and highway, surrounding colleges like Columbia, Roosevelt, etc., and a lot of families with pets and children. If you don’t/haven’t lived here then you really can’t comment on the neighborhood.

So they now include parking in their price. Any idea what they value it at? Any thoughts to what a parking space is actually worth (either rent by month or deeded)? Thanks

“Additionally, new movie theaters and shops are going into the Roosevelt Collection (hopefully)”

No go on the movie theater and shops at Roosevelt Collection.

http://yochicago.com/construction-checkup-roosevelt-collection-2/11092

Anyone who bought here expecting those amenities bought on a hope that will not be realized (in the near term, at least).

“No go on the movie theater and shops at Roosevelt Collection.”

Link sez movies in about four weeks. Or do you just *have* to see Saw VI this weekend?