Trump: The Chicago Market is “dead as a doornail”

At least The Donald tells it like it is:

“The market in Chicago is dead as a doornail right now, as is the rest of the country, other than Manhattan or Palm Beach, Fla.,” Trump said, blaming the nationwide credit crunch. “But that will change. A lot of good things could happen in Chicago’s case. It has a great chance of getting the [2016] Olympics … and if credit becomes available again, that will help.”

The quote comes from yesterday’s Chicago Tribune story on the brewing troubles at Trump Tower and the other condo-hotel buildings in Chicago.

The condo-hotel is a strange real estate phenomena. It’s a hotel room that you own. You pay a management company (in the case of Trump Tower, it’s, well, Trump International) to rent out your room as a hotel room whenever you’re not wanting to use it. Trump claims that the condo-hotels in Trump Tower will start at $300 a night. Prices on the condo-hotel units range from $500,000 to $9 million.

Everyone in the real estate industry concedes that condo-hotels make poor investments. You can’t cover your costs from renting it out as a hotel room (because assessments are high and you still have that big, pesky mortgage) but you are banking solely on appreciation. From the Tribune article:

A Jones Lang LaSalle study found that generally these are not income-producing investments, Johnson said, adding that the potential payoff is all tied to appreciation.

“So if we’re entering a period where values are going to be flat, or God forbid, declining … it’s a whole ‘nother story,” she said.

“You need to approach it with second-home economics in mind, that ‘I’ll write a lot of checks, I’ll hold it until I’m empty-nesting, and then I’ll sell it,'” she said. “It’s not something you’ll get in and out of in a year or two or three.”

Some investors got in and out quickly before the condo market cooled, noted Steilen, of Warnick. “The idea of buying and flipping your contract for more money … is just not present,” he said.

The article gives the numbers on various developments:

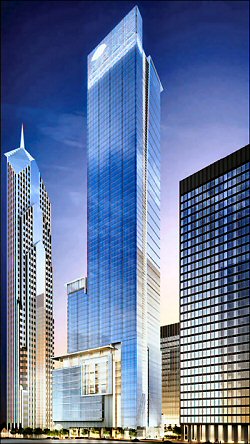

Trump Tower:

- 65% of condo-hotel units sold with about 60% of those sold to corporate buyers

- 77% of the traditional condo units sold

- Slated to close in the next few weeks on the condo-hotels and in 2009 on the condos

Mandarin Oriental at 215 N. Michigan:

- Won’t say how many have sold

- “We’re comfortable with the path we’re on but in the current environment, like everyone else, we’re looking at various options,” said Peter Connolly, president for hotels of Palladian.

- Has not yet started construction

Elysian at 11 E. Walton (in the gold coast where the new Charlie Trotter restaurant is slated to open):

- 70% of 188 condo-hotel units have sold

- Slated to begin closings next November

Waterview Tower on Wacker Drive:

- Shangri-La will anchor the building

- 50% of condo-hotel units sold

- Already under construction

The question is: who will close on these condo-hotel units if there is no chance of appreciation for many, many years?

That is the question everyone is wondering. Will significant number of Trump buyers walk away from their deposits?

“Frankly, there are developers who are concerned about buyers coming to the closing table,” said Scott Steilen, a principal at Warnick & Co., a lodging advisory firm.

The Trump team acknowledged the potential for no-shows, but said there have been no signs of hesitancy so far. “We’re in constant contact with purchasers,” said Ivanka Trump, Donald’s daughter and vice president of development for the Trump Organization.

Stay tuned. It could get interesting.

Hey Sabrina,

Great article but don’t forget about some of the successful conversion hotel/condo projects, such as Hotel Raffaello and Amalfi Hotel. I doubt these owners are covering costs; however, the projects did sell out. Yes, I realize these were conversions and not new contruction.

http://www.raffaello-condo-hotel-chicago.com/

http://www.amalfihotelchicago.com/

Yes, the Hotel Raffaello did sell out. But isn’t it really about the price points as well? Those sold for around $150,000 to $200,000- didn’t they? That was much more “affordable” for the average investor.

First, thanks for the blog. It’s nice to see all the great info on my local market. I appreciate all the work you put in to it.

…

The Raffaello and Amalfi got in under the wire time-wise and had a large advantage in entry price (well at every price-point actually). Also, as you mentioned, conversions are much different than new construction. The time between contract and closing for conversions is a fraction of the time compared to new construction. This is a huge advantage in a market that has inarguably turned south from its previous rate of price appreciation.

Trump might be okay with all the HR middle managers closing on their other-people’s-money corporate contracts, but they will be sucking wind with the rest of the market on the rest, IMO. The Chicago Trib is generous in its analysis in the article. They have sold virtually zero units in the last year and they haven’t even asked to see any checkbooks yet! What’s going to happen at closing time? I see very little chance that this ends well for any of the high-end new construction builders. My guess is there will be a few accidental landlords in the high-end Chicago market for years to come (maybe even Duetsche Bank although others are more likely).

“The Trump team acknowledged the potential for no-shows, but said there have been no signs of hesitancy so far. “We’re in constant contact with purchasers,” said Ivanka Trump, Donald’s daughter and vice president of development for the Trump Organization.”

Sorry, I don’t believe this for a second. I’m sure the Trump name and reputation for quality will leave them better off than most, but no hesitancy at all? Constant contact? Give me a break, are their customers all in comas or something? You haven’t sold a condo in a year (for all intents and purposes) and you want us to believe that all the current contract holders are just fine and dandy with that? The only thing that matters is what happens when it’s time to show up with your checkbook. Everything else is just PR.

John

PS when did Trump add units? The Trib article above quotes a higher number of condo-hotel units, 339 vs. the 286 I see quoted in earlier articles. They also quote 486 normal condo units vs. 472 previously. Did they take out some retail or something??

John:

The reason the number of units is going up could be that Trump is reconfiguring some of the larger units into smaller one bedrooms or two bedrooms that might be more marketable (and hence sell) in this slowing market.

That’s just a hunch. I’ve seen developers reconfigure in new construction buildings based on demand and hopes for selling a certain sized unit.

How many people are buying $10 million huge units right now? Not many. His odds of selling a $700,000 one bedroom are better (at least to a foreign investor or someone like that.)

But I totally agree with your comments about how everything Trump is saying is just simply PR (and he’s great at that!). We won’t know until people have to show up to actually close on these units where they are certain to lose money. In Florida, investors have been abandoning their downpayments in these types of units. Do they think that buyers will be dumber up here?

I’d rather take a loss of $100,000 right now than hold onto a unit that sucks me of money for years and years.

We’ll see. The corporate holders will close. Will the others?

It also brings up an interesting question about other investors in normal condos that are hoping to flip. We’ve been seeing quite a few flips come on the market in many of the new buildings in Streeterville and the Loop. Hardly any are re-selling (right now.) Makes you wonder if investors in future buildings set to close later this year or next year will just walk away from those deposits too.

“It also brings up an interesting question about other investors in normal condos that are hoping to flip.”

There are too many accidental landlords there to count. Not to mention all the buyers who could have rented at a much lower price point who are slowly awakening to the fact that real estate doesn’t always go up. These people were sold a bag of goods and they’ll be sitting on the offer for years to come. Not that there isn’t enough blame to go around, plenty or greed on the buyers part. But in many cases it was just people going with the flow of what had become conventional wisdom. What’s with college grads making $30k a year with student loans going out and buying instead of renting? This was unheard of 6+ years ago but became commonplace during the bubble. Ownership society or debt-slave for life, you be the judge.

I hear and read about buyers on the sidelines and ‘pent-up demand’ all the time. The way I see it, there are many times more sellers on the sidelines not listing due to the hopelessness of their situation. This shadow-inventory doesn’t show up in any MLS stats.

John