Is that an elevator shaft in the middle of your loft?

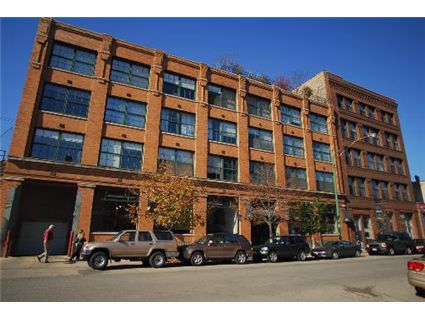

The old loft conversions have interesting layouts. Take 110 N. Peoria for instance. This building was converted in 1993. It’s in a “prime” area of the West Loop, near the Randolph Street restaurants and Oprah.

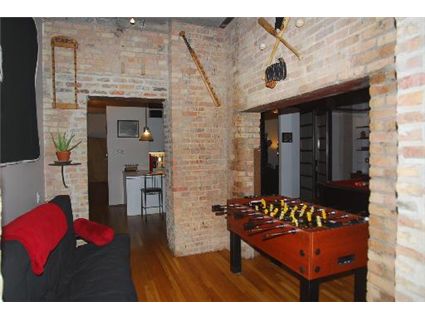

There are some really large one bedrooms in the building, including this one that has an old elevator shaft in the middle of the living room (see the brick walls in the photo above).

Unit #206: 1 bedroom, 1 bath, 1450 square feet

- Sold in May 2000 for $252,500

- Currently listed for $323,000 (plus $25,000 for parking)

- Assessments of $319 a month

- Keller Williams West Loop Realty has the listing

The all white kitchen was common in the 1990s loft conversions. Some people have upgraded the kitchens, some have not.

Question is- what do you do with the elevator shaft? This owner put a couch in there. I’ve seen some people put a dining room table in the space. But there is also space in another part of the loft for that (there is a 17 x 17 “family room.”)

Is it possible to sometimes just have too much free space?

I’d put a yoga room in there!

Topic suggestion.

This is off-topic….how about a “too good to be true” recurring column that highlights firesale properties?

The website already has highlighted many interesting properties/pre-foreclosures, but it would be nice to have all those postings grouped by the same keyword.

As mentioned before in some of the posts and quick browses through MLS, 7+ year-old, nicely located, 2BR/2BA that are starting to be at “even with the downturn and weather, why wasn’t bought already prices.”

Cheers.

Topic suggestion.

This is off-topic….how about a “too good to be true” recurring column that highlights firesale properties?

The website already has highlighted many interesting properties/pre-foreclosures, but it would be nice to have all those postings grouped by the same keyword.

As mentioned before in some of the posts and quick browses through MLS, 7+ year-old, nicely located, 2BR/2BA that are starting to be at “even with the downturn and weather, why hasn’t this been bought already prices.”

Cheers.

I would close off the openings and make it into a little cozy home theater

Me: I don’t have a problem with doing some posts on things that appear to be on “sale”. I’ve seen a few properties like that (either pre-foreclosure or already foreclosed.)

My question is: what is a “firesale” anyway? In this kind of market, where not much is selling and prices are declining anyway- how do we determine when something is truly a firesale?

There are some that seem obvious (the River City duplexes that are now 55% off their sale price in 2005) but even those aren’t selling – so is it really a “firesale” then?

But I understand your point of putting these properties into a category where everyone can find them.

as for a firesale, I’d say $250-$275 a square foot (move-in condition, doesn’t have to be lux) in 60610, 11, 14, 57 would be a good start.

or perhaps current price is at least 20% less than initial listing price (seeing more and more of those).

dunno….one of those, you know it when you see it.

thanks.

If you are looking for a nice place to live, $250-275 per sf in a building and location you really like isn’t too much to ask, but it’s not a fire-sale either.

Right now, foreclosures coming to market are not worth the outstanding mortgages for the most part (otherwise they would be selling before getting foreclosed). As a result, no one is bidding on these properties and they are being taken up on the lenders balance sheets as REO.

So far, the banks are still drinking Pat’s Kool-Aid and are just re-listing the properties at fantasy asking prices and waiting. But REO inventory is accumulating at the fastest pace in decades and eventually banks will be forced to bite the bullet and start dumping.

When “eventually” comes is anyone’s guess. You won’t have a hard time finding someone in the real estate industry who will be happy to tell you that the market will stablize before we reach that point and the banks will simply sell all there REO at or near asking prices over time.

I have a different theory. Basically everyone is waiting for Countrywide to blink. They have not been the least bit aggresive in reducing their REO (which is becoming absolutely massive). But if they do shift gears, as I expect they will when their stock price gets low enough, it will set off a chain reaction. No one will be comfusing $275 per sf with a fire-sale then.

Just one man’s opinion, YMMV.

John