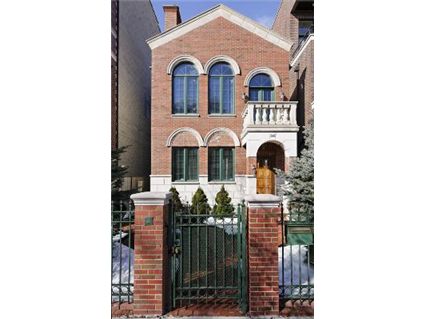

3-Bedroom East Village Single Family Home Reduces Further: 1040 N. Wolcott

We’ve chattered about this 3-bedroom single family home at 1040 N. Wolcott in the East Village neighborhood of West Town several times over the last year.

See our December 2010 chatter here.

Since it was first listed in April 2010, the house has been reduced $105,000.

Back in December 2010, when it was listed at $719,900, the old Homedelete predicted it would sell in the mid-$600,000s and chastized those who bought in 2007 as not being as “patient” as he was.

The discussion in the prior chatter is worth checking out.

The house is now listed at $674,900.

If you recall, the house was built in 2000 so it’s newer construction.

The listing says it has hardwood floors throughout.

The kitchen is described as “gourmet” and has granite counter tops.

The master bathroom has been renovated.

The family room is located on the second level and there are 2 wood burning fireplaces.

The 3 bedrooms are split, with the master bedroom on the second floor and the other two bedrooms on the third.

It has central air and a 2-car garage on a standard 25×125 lot.

It also has a great location if you are a fan of Division Street, which is just a block away.

Condos have been fairly strong sellers in this neighborhood (given the market).

Could it be that the East Village is seen more as a condo destination than one where you buy a single family home?

Jason Vondrachek at Quest Realty still has the listing. See more pictures here.

1040 N. Wolcott: 3 bedrooms, 2.5 baths, 2 car garage, no square footage listed

- Sold in November 2001 for $525,000

- Sold in May 2007 for $765,000

- Originally listed in April 2010 for $779,900

- Reduced

- Was listed in June 2010 for $749,900

- Reduced

- Was listed in December 2010 for $719,900

- Reduced

- Currently listed at $674,900

- Taxes of $11,741

- Central Air

- Bedroom #1: 18×12 (second floor)

- Bedroom #2: 14×14 (third floor)

- Bedroom #3: 13×10 (third floor)

“homedelete on December 2nd, 2010 at 4:22 pm

Secondly, this will not sell at ask. This will be a mid-$600’s.”

Credit where credit is due…

For folks who rank location as a distant second or third among their housing criteria (many if not most of the CC regulars), this place seems like a great opportunity at $625k, give or take $10k.

It’s still got to sell, chuk.

This was a laugher from the prior chatter:

“JMM on December 3rd, 2010 at 9:20 am

“It doesn’t seem much worse to me.”

According to HD, Bob and the other fear mongers, it’s down at least 20%, at least in their heads. Stick around and read a few of their posts, they will educate you.

On a serious note, use a SA CS as a proxy. That has you down 10%.

6/2009 135.7170243

9/2010 122.7539441

(9.6%)”

The latest Chicago condo CS SA index:

6/2009 135.22 (revised)

4/2011 107.66 (-20.4%)

LOL

“For folks who rank location as a distant second or third among their housing criteria”

What would be first (or second)? Can’t be aesthetics.

And, contrary to your repetition, there *are* sane people who have different location preferences than yours.

I went through this place last year. Odd layout but at this price it’s becoming a steal. The place was in pretty good shape iirc.

This listing was cancelled some time today.

I would never question one’s sanity based on location preferences. And I can’t help the fact that this property would fetch an extra $300k (and would have sold by now) were it located within my optimal zone.

“And I can’t help the fact that this property would fetch an extra $300k … were it located within my optimal zone.”

But that’s so evidently counter factual that it doesn’t bear discussion. Nothing this small *and* tweener-ish in finishing would have been built on one of the 4 full blocks and 9.5 half blocks of your “optimal zone” in 2001. That $525k price was basically the teardown price for a buildable lot in “LP-OZ” in late 2001.

ps:

The “what’s the first priority, then” was a serious question.

“the old Homedelete”

Today’s kids would say that this phrase is full of win.

““the old Homedelete”

Today’s kids would say that this phrase is full of win.”

Funny thing is, someone else undercut his prediction by 20%. Unless the withdrawal today is related to a sale, I have trouble seeing it holding the “mid” 600s, and going for “low” 600s.

Be that as it may. Again, I wasn’t setting prices in 2001, nor am I today. My point is that there was (as you argue), is (as I argue) and will likely continue to be (as it stands to reason) not just a small premium, but in fact at rather significant pricing premium based on where a property is located. That premium would be, say, $150k in certain desirable northside hoods, and $300k within others. As for the size and finishes of this particular property, were it located within my zone, I’d happily pay $950k for it (if I could), and gradually enhance the finishes (plant a big tree or two in the back yard to block the neighboring stairs/building and errect taller fences, put some vines or whatever on the garage, build a nicer deck, perhaps wall-off the kitchen, though if the upstairs family room is adequate for the t.v. room, I’d just keep the main level one big, t.v.less living/dining area, etc.).

“what’s the first priority, then”

Why, the first priority, of course, is the end-all-be-all midwestern dream – the SFH.

The second priority seems to vary, and is held by minority subsets of CC regulars. For some, it’s close proximity to the expressway. For others, it’s close (but not too close) proximity to the el. Still others appear place at least a modest premium on close proximity to Dominicks or Pot-Belly.

“were it located within my zone, I’d happily pay $950k for it”

And I think you’d be paying a premium above current replacement cost, at that, but I have a low opinion of the pix-apparent finish quality of this place.

“Why, the first priority, of course, is the end-all-be-all midwestern dream – the SFH.”

Dude, you have a real issue with the SFH but I bet, if condos and SFHs of equal size and condition were the same price in Lincoln Park, that you would probably snatch up a SFH yourself. If just offers a level of privacy and autonomy and decisions relating to the building that you don’t get with a condo.

When it comes to narrow, only the Alta Vista place has it beat (and not by much).

I’m not familiar with this neighborhood, but I’m not sure if I would like to live in a SFH squished between two multi-family buildings. Otherwise, it seems like it’s getting to be a good deal.

“I bet, if condos and SFHs of equal size and condition were the same price in Lincoln Park, that you would probably snatch up a SFH yourself.”

Sucker bet, as he said he’d pay $950k for it, were it in LP-OZ. And, since one *can* find large, 3/2.5 condos in (or near, as I’m not quite sure of the exact half blocks included) LP-OZ for under $950k*, that implies at least equal footing for SFH, if it’s “properly” located.

*eg, this one: http://www.redfin.com/IL/Chicago/331-W-Belden-Ave-60614/unit-3/home/13347900

“I bet, if condos and SFHs of equal size and condition were the same price in Lincoln Park, that you would probably snatch up a SFH yourself.”

Not true of elderly, disabled or single women who often want the security of a doorman condominium. Also, not true of people who want great views and/or exceptional entertaining space. The same sq foot on one level often allows for grander entertaining space than the same sq foot crammed on to four floors. Foreigners also don’t get the appeal of a single family home (with owner doing his own upkeep) over the services of a building. The rich often prefer the amenities.

Not everyone gets the “Midwestern Dream.”

“Not true of elderly, disabled or single women who often want the security of a doorman condominium.”

Well, I was referring to anonny here. I get the sense that he would gladly take a SFH, ceteris paribus, but scorns them because SFHs in Lincoln Park are not in his budget

“you have a real issue with the SFH but I bet, if condos and SFHs of equal size and condition were the same price in Lincoln Park, that you would probably snatch up a SFH yourself. If just offers a level of privacy and autonomy and decisions relating to the building that you don’t get with a condo.”

He said he might like the big house in Lakewood Balmoral (although he would almost surely prefer it in ELP). He just places a much higher weight on location (and his somewhat dogmatic view of what is the one true right location) than others. But he has a formed PoV, which is generally more interesting than not.

Many (but certainly not all) would, if they had a higher budget, choose to live somewhere else that they cannot currently afford (given other priorities). anonny might stay where he is (maybe he prefers gold coast?), just live in a nicer place, even SFH.

“Sucker bet”

Good thing I didn’t wager anything.

The place at 331 W Belden would be the stuff of daydreams, if it had a garage. I walk past there several times a week – I can’t believe that’s how it looks inside.

“The place at 331 W Belden would be the stuff of daydreams, if it had a garage.”

Enh, I’m a garage-havin’-snob and I would deal with the outdoor space.

“I get the sense that he would gladly take a SFH, ceteris paribus, but scorns them because SFHs in Lincoln Park are not in his budget.”

No, no. The $2 – $3 million SFHs in Lincoln Park aren’t even on my radar. Rather, my scorn (though that might be a bit harsh) is reserved for those who’d pay $1 million for a house with a bit more space and top end finishes up on the northwest side (as I read the map) of the city, whereas I’d be content with a smaller, less lavish place within The Zone.

But you’re correct that I’d take a SFH under the right circumstances. In a few years (assuming prices remain unchanged, which would be both bad and good for me), I hope I’m in a position to pay $950k for a SFH (or rowhouse) or $750k for a condo (factoring in as much as $1k/mo assessments), if it can get me a 3 bed with approx. 2 – 2,500ish sq ft (while meeting all the current Unicorn Criteria, plus some sort of family room/seperate t.v. space would be nice). I’m not picky.

for those of you who thought that what your eyes were telling you in the field conflicted with the data espoused by the realtors—–

http://www.chicagotribune.com/business/chi-realty-trade-group-overreported-chicago-home-prices-20110711,0,7597129.story

The Illinois Association of Realtors dramatically overreported the median price of condominiums sold within the city of Chicago in May, with the price tumbling 23 percent year-over-year, not rising 10.3 percent as the trade group said.

The state Realtors’ group acknowledged the error after the Tribune, acting on a tip, questioned the accuracy of the data. The group now believes median prices for both condos and single-family homes sold within the city are inaccurate going back to at least January and possibly more than three years.

http://www.chicagotribune.com/business/chi-realty-trade-group-overreported-chicago-home-prices-20110711,0,7597129.story

Ok, due respect to G. Very solid, I gotta say.

“Realty trade group overreported Chicago home prices”

I’m shocked, shocked…

I really wonder when the data was ever correct. Of course local realtors say they don’t look at this data, but it’s just another factor that buyer look to. People aren’t that smart and when they read articles about prices going up, they are more likely to be influenced into buying.

Just saw this on the Trib site and came over here.

My first thought: Which one of you tipped off the Tribune.

G, of course.

BTW, just went back and reviewed the thread where we discussed this and reran the numbers for myself. I’m still getting what I got that day but what’s interesting is that for condos in the city of Chicago May was down 7.4% so it sounds like the numbers the media has are still wrong.

they have people reading blogs for news articles

“Just saw this on the Trib site and came over here.

My first thought: Which one of you tipped off the Tribune.”

Stop the presses. The group of “professionals” who will tell any seller “now’s a great time to sell” while telling any buyer “now’s a great time to buy” were less than honest with data?

Mistakes CAN happen – and why is everyone making such a big deal about it – people should buy houses/condos because they WANT to or NEED to – not becaue “it’s a good time to buy” or “because everyone else is doing it”. Cut the realtors a little slack.

Now that we’ve cleared that up, have I mentioned that it’s a great time to buy?

I’ll have a post on the IAR data tomorrow. It’s a BIG deal. The IAR’s press release seems to imply it might not just be the sales prices that were wrong but also the volumes.

Yikes!

I kind of wish anonny would move north of North Ave, south of Fullerton Ave, and east of North Ave Beach.

Yeah, this is a huge deal. Any data they release will always be seen as unreliable in my mind. I heard numerous people talking about this today, who I didn’t think cared at all about the residential real estate market. This negative chatter will be good to prove what fools they were.

“Any data they release will always be seen as unreliable in my mind.”

Thank goodness we have some people with access to the data here who can double check it for us.

“The IAR’s press release seems to imply it might not just be the sales prices that were wrong but also the volumes. ”

My numbers and G’s numbers tied out to their sales numbers. Just not to their median price numbers. But like I always say you can ignore those median numbers anyway. I don’t even report on them at all.

I don’t understand how they could get something so simple wrong. It’s a simple query that every realtor can do. I have found errors in their market time data before but that was a really arcane and understandable mistake.

While we’re at it…you folks might be interested in how June came out: http://www.chicagonow.com/getting-real/2011/07/the-summer-real-estate-market-is-in-the-doldrums/

I’m less concerned about the closings at this point than I am about the contract activity. Contract activity is really sucking but at least inventories are down – which is good for sellers but not buyers.

Thanks for the update Gary- I always like your monthly reports (love the graphs!)

But I wonder how “juiced” June of last year really was?

The first credit, if you recall, had the provision that not only did you have to be under contract- but you had to CLOSE by the end of November that year. So everyone rushed to close by the deadline.

This second credit had the provision that you only had to be under contract by April – and then they gave you two extra months in which to close (by the end of June.)

How many people under contract by the April deadline actually closed in May? I wonder.

But either way- we DO know the June number was juiced by the credit.

What the data is telling us, then, is that sales were pulled forward by several months.

But, interestingly, prices continue to fall. Heck, in some areas, say in 2/2 condos in Lakeview- prices are down 10% from May of last year. Why aren’t buyers rushing out to get these “deals?” On a $300k condo, saving 10% is significantly more money than any $8000 credit you would have gotten last year.

Even much lower year over year prices (and still record low mortgage rates) aren’t putting the fire under many people to buy.

If not these things- what will? Even LOWER prices?

By the way- Gary- I agree with you on the inventories. They are SUPER low. It feels more like November/December inventory levels to me than the middle of the summer. Sellers are definitely keeping properties off the market now- unless they HAVE to sell.

“But either way- we DO know the June number was juiced by the credit.”

Without a doubt. June had a huge spike last year. Last June was up over 27% from the previous year. Then July was in the toilet so it will be an easy comparison.

“Why aren’t buyers rushing out to get these “deals?” …Even much lower year over year prices (and still record low mortgage rates) aren’t putting the fire under many people to buy.”

Because few properties are priced properly. Only short sales and serious sellers move their properties. When you are buying it’s really hard to find something decent. I’m looking for myself and several buyers and it’s always the same story.

Regarding inventory…people are really hunkering down. The pain is excruciating for sellers and they can’t take it. They will simply stay put or rent the place out. When push comes to shove people can get by with a lot less than they thought they needed.

I don’t think volume is going to increase. Many people on this site don’t remember what the 70s and 80s were like. Volume was relatively low – the only times real estate volume and prices were so high were in the late 90s through 2008. Prior to that, people really stayed put (just think of people you know who are older – many of them have been in the same house for decades) – I think that is what you are going to start seeing (at least until the next bubble – which I still think is going to occur in about 10 years).

I thought the Homepath closing cost assist promotion that just ran would bump up June numbers this year but apparently they’ve already got another deal going until October.

How long can most of these people realistically hold out? 5 years? 6 years? I don’t think this is going to end well unless these people have significant financial wherewithal to be able to hold out. If not, these are just properties coming on the market in 2012 or 2013.

Dave, people can hold out for longer than you think. The economy is slowly improving and those that lost their jobs and overextended themselves are probably already in foreclosure – for those that were able to hold on, there is a light at the end of the tunnel. For those people that WANT to move, many will reassess their motivations for moving. Most will do with less space and stay put. People are getting used to the “new market” and re-evaluating everything. People no longer are expecting or wanting to live in large expensive houses. I see more practical thinking/living out there. That is a HUGE change from the 2000s excess…. but then again, everything will change back in about 10 years.

“these are just properties coming on the market in 2012 or 2013.”

In a lot of cases people are becoming or will become landlords. I would say that 3 out of 4 potential sellers that I talk to are moving in that direction. If you’re equity has been wiped out and you can get cash flow neutral then why not? It’s like having a futures contract – no capital and a leveraged bet on the direction of housing prices. Of course, at any sign of a turnaround these homes will come on the market.

As for people getting by…we are about to find out what that really means over the next few decades as the rest of the world starts to consume their share of the world’s resources. Our standard of living WILL decline from a surge in commodity prices.

“I don’t think volume is going to increase. Many people on this site don’t remember what the 70s and 80s were like.”

In the 1980s, no 20-something was buying a 2/2 condo in Lakeview either.

Look at all the buildings, just on the north side alone, that were converted into condos during this boom.

So what happens to all those people now? As Gary said- they’re choosing to become landlords. How long will that last once they realize they have to DO things to the unit when the renters trash it (like painting, repairing clogged sinks and toilets, putting in new appliances, fixing the furnace that the renters forgot to change the filters on for years etc. etc. )

I have no doubt that people are choosing to simply rent out the small condo in the hopes that they can sell again in 2 or 3 years. They all believe that the housing market will come “back”. But when?

And at any sign of “life”- won’t they all simply be listing their units at the same time?

Gary- how many of these potential sellers you talk to will actually get approved by the bank for a second mortgage?

If they’ve been wiped out on the first purchase and are underwater- how often are they getting another loan for another $300k (or more) on the next purchase? Don’t they have to have a significant downpayment on the second property?

I’m just wondering how many have it given the 100% financing we saw in 2005-2007.

By the way- I’ve been seeing a lot more SFHs come on the market as rentals- because they’re either not selling or the seller is unwilling to take the huge loss.

This is fairly new. It’s been mostly condos.

For example: 1305 W. Waveland in Lakeview.

You can buy it for $1.85 million or you can rent it for $7900. They’re not having much luck with either strategy (so far).

http://www.coldwellbankeronline.com/ID/2116841

“but then again, everything will change back in about 10 years.’

Why?

You keep saying this Clio.

But under your argument- the Generation Ys are stuck in their condos (underwater) and making do. Suddenly, within 10 years, while still paying off college loans, they’re going to be moving into huge homes in the suburbs?

With what money? Wages have been stagnant for years.

“Gary- how many of these potential sellers you talk to will actually get approved by the bank for a second mortgage?

If they’ve been wiped out on the first purchase and are underwater- how often are they getting another loan for another $300k (or more) on the next purchase? Don’t they have to have a significant downpayment on the second property?”

My sample is biased so many of the ones I talk to tend to have the down payment. Those that don’t will rent the next place they move into.

“I’m just wondering how many have it given the 100% financing we saw in 2005-2007.”

Even the ones that put 20% down are wiped out. The saddest cases are the ones that have their current down payment wiped out and will have to eat into their next down payment to bring cash to closing. They can’t buy either.

“By the way- I’ve been seeing a lot more SFHs come on the market as rentals- because they’re either not selling or the seller is unwilling to take the huge loss.”

Yep, I’m seeing this too. One that I had a personal interest in was 1939 W Erie. Very nice place next to what looked like a grow house that was falling apart. Had it listed for 3 1/2 months at $899K. $11,300 in taxes. Paid $912,500 in December 2005 with a large down payment.

He rented it out at $4200/month. Assume he could have cleared $750k on a sale. Do the math and it looks like renting was a pretty good deal for him.

I just don’t think that 100% of these people can hold out another 5-10 years. Life situations and other issues could force them to sell, especially if they are not cash flow positive, which I doubt many of these places are at this point, which will only get worse with increasing property taxes, maintenance costs, and assessments (if its a condo). It’s kind of like saying that 100% of 65 year old people will live to 75. It’s not going to happen.

Gary- that makes sense that there is a bias as to who you see even thinking about renting out the first property and buying the second. If they don’t have any other cash on hand- they’re not even talking to you.

Kind of like the kinds of buyers Russ sees. It’s not really representative of the broader market.

1939 W. Erie is interesting Gary. But I wonder- as I think people underestimate what happens when renters live in a property. It is beautifully painted right now with the nice carpet and hardwood floors and kitchen.

What happens when the renters move out in a year or two?

In my opinion – you can really tell the wear and tear on a property once renters have been in it. They frankly don’t care (even at $4200 a month.) What do you do about outside maintenance with a SFH? Do you hire a gardener to maintain the exterior or are you going over to the house to mow the lawn and water the flowers yourself?

Interestingly- in the San Francisco bay area SFH rentals are pretty common. In Silicon Valley- they almost always provide a gardening service included in the rent.

But I can also understand how the owner doesn’t want to take the $200k or $300k loss (or whatever it is.) You can pay for a lot of gardeners and interior maintenance for that amount of money- I suppose.

Hello all. Owner of the home. We are not distressed sellers, but did want to test the market to see where we were at. Has definitely been a tough market to sell. Had many showings, one good offer at $675k which fell through due to financing. Seems like well priced condos can move relatively quickly, but volume for SFHs can be quite a bit more limited.

Decided to finally pull the listing off market and test the rental market which has been much stronger than I expected (relative to the sales market at least). So gonna go that route until the housing market comes back. When is that? May be 1 year, may be 10 years. But with a 3% 5/1 ARM, we can bide our time.

Happy hunting!

Thanks for checking in Andrew. We’re just talking about this (sellers who are now going to rent out the house instead.)

So I’ll ask you- what will you do about exterior maintenance?

Hire a gardener to maintain the outside of the property? I’m just curious.

Sure, no problem.

We actually just secured a renter and we will have the tenants maintain the exterior, as per the lease. Maintenance hasn’t been too bad. Just some watering, a little weeding and a backyard mow once in a while. In general we have a lot of evergreens and low maintenance foliage, which is crucial, since we do not have green thumbs by any means.

“But I can also understand how the owner doesn’t want to take the $200k or $300k loss (or whatever it is.) You can pay for a lot of gardeners and interior maintenance for that amount of money- I suppose.”

A lot of people look at it this way and it’s seriously flawed thinking. The money is already lost. The real question is how much money can you get out of it today and what is the alternative cash flow relative to the liquidation value.

Behavioral finance tells us a lot about this decision making. I wrote up an entire post on this a while ago:

http://www.chicagonow.com/getting-real/2011/06/should-you-wait-for-home-prices-to-recover-before-selling-your-home/

best way to say it correctly, i find, is realized loss or unrealized loss. Regardless, as Gary says, they are the same loss. Equity took wings and flew bye bye… Funny though how many people who argue the banks need to eat their losses, still mark their house near peak. People are funny.

Andrew – What happened with the financing on the last offer?

“People are funny.”

Indeed. It’s ridiculous to me to believe that the accidental landlords are any better at timing their market exit than they were their entry. They just inflate the shadow inventory and further guarantee the correction will go on for years.

Guy was pre-approved and put down the escrow, and was supposedly counting on a commission check to come in, which was supposed to be the down payment, which never came in apparently.