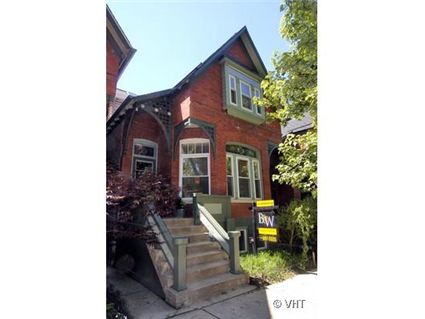

What Would You Pay for a Bucktown Cottage? 2243 W. Homer

This cute 2-bedroom 1888 Bucktown cottage at 2243 W. Homer has been on the market since June.

Here’s the listing:

Vintage detail with modern convenience! Don’t miss this beautiful Bucktown Shepard’s cottage. Custom spiral staircase, hardwood floors, updated kitchen & baths, high ceilings, great yard.

Antique stove and SS subzero and a perfect back yard and deck for entertaining. Easy possibility for 3rd bedroom on LL. All backing up to Ehrler Park.

Is it the lack of 2 full bathrooms or the spiral staircase the connects each floor that is hurting this sale?

It has been reduced several times.

Anastacia Mason at Baird & Warner has the listing. See more pictures here (especially of the spiral staircase).

2243 W. Homer: 2 bedrooms, 1.5 baths, 2 car garage, no square footage listed

- Sold in February 1996 for $142,050

- Originally listed in June 2008 for $665,000

- Reduced several times

- Currently listed at $615,000

- Taxes of $6,628

- Central Air

What a burn! I have never understood why Bucktown is so trendy, and why folks are paying such stupefying prices for 120-year-old worker’s cottages in this unattractive neighborhood.

For the life of me, I can’t see why anyone wants to live around there, or why anyone would pay more that $250K for something like this.

I have not been in this house but my wife has. She said that you bump into the staircase as soon as you enter the front door. The rooms are small and filled with small furniture. 1.5 bathrooms does not help either. Kind of an eclectic home for one or two people.

Is that a kitchen island or a podium?

Cute little house. Slash the ask by 40% and it sells.

I don’t understand why people think a rehabbed SFH in a nice location is only worth between $250k and $369k. Even if you had bought this place before the rehab for the price of the lot I’d still expect you’d pay $200k to $250k. And I’m sure a complete rehab done properly would be at least $200k.

So that would put costs at at least $450k-ish. And while Laura doesn’t care for the neighborhood, many folks do enjoy living in bucktown and ARE willing to pay somewhat of a premium for it. Not to mention that I believe it’s in walking distance to the blue line.

With all those things considered, I don’t think a price between $550k and $600k is all that unreasonable.

And no I’m not an agent. I just think a SFH is worth considerably more than some condo where you have an association to deal with and neighbors on the other side of a shared wall.

I hate having to repeat myself over and over again but this property is extremely overpriced. Yes it’s nice looking but small. But it’s an average house for an average person with an average income. The $649k price tag is just plain ridiculous (they can’t just give it away!). Anyways, we’re (slowly) heading back to ’99 prices….give or take a few thousand. Adjust the $142k accordingly, give a little credit for gentrification, a slightly smaller credit for upgrades, take some money off for the 1.5 bath….and the true price value (i.e. non-bubble and post RE depression) probably around $250-$300k. I agree with Bob that it would probably sell for 40% off its list but that’s like catching a falling knife.

Mike S,

I see your points. However you should also consider the competition in other parts/neighborhoods in the city and how much you can really get for 550-600k, a heck of a lot more than this.

You can get a 4br/4 or 5ba 4,500-5,400 sf house in non-hipster neighborhoods like Bridgeport for this price range, with a two or three car garage. Which are easily walkable to the Orange line.

Sorry but the hipster premium is not 4x the real estate value of non-hipster areas. And most hipsters don’t have money. Now with easy credit gone they can’t afford to overpay for real estate using the bank’s money.

Sorry but if I was in the market to buy theres no way I’d pay anywhere near ask on this place for the ability to walk to Cans bar, you can get so much more for this price range in so many other areas.

I love this little house except for….those staircases! What a tragic addition to a vintage cute little house. I agree with Michael S. that a sfh should be worth substantially more than a condo and or townhouse but this price is still very high for the size/location of this home.

I actually like Bucktown/Wicker Park. It’s convenient to the Kennedy and Blue Line, thus good for getting into the Loop and out to O’Hare. Really not too bad for getting anywhere in the city except Lincoln Park/Lakeview when traffic is bad (which is always on the weekend). There’s a lot of excessive trendiness in the area but there is also decent retail and restaurants.

That said, this house is just too small. It’s too small for a family, too expensive for the young professional. It may be a townhome alternative, with pluses for the garage and having your own lot. The lack of a second full bath (not sure if the partial bath has a shower) is a big problem. Who wants to have overnight guests share a bathroom?

So, 5%/year since 96 (somewhat reasonable to account for B’town gentrification) makes it $255k. Add in 50% of the $200k (estimated by Michael S.) spent on renovation and $45k for being two blocks from the map room, you get $400k. Call it $429,897, so you can use a 97% conforming mortgage to finance it.

That $665 ask was driven by (a) 2006 pricing for teardowns and (b) $500k 2 br condos in 3-unit buildings. Both of those are fantasies now, so is $600k+ for this condo substitute (tho nice enough for a couple w/ no kids or plans to have them).

Serious question—Would anyone here *really* rather have a middle-unit 2 br condo in a three unit building than have this–assuming the prices were the same?

“Serious question—Would anyone here *really* rather have a middle-unit 2 br condo in a three unit building than have this–assuming the prices were the same?”

As long as this house didn’t become a money pit then yes, I would rather have the house then the middle unit of a three-flat.

then= than

i like this location. you have the mexican supermarket close by on western, and Margies. Cans might suck, but the Charleston is a great bar and walking distance. I’m pretty sure the elem school is crap but i might be wrong.

This neighboorhood isnt that bad, however I think that Michael S value of the land is too high still, the next great oh crap moment is when people realize they over paid hundreds of thousands of dollars for land that now makes the unit on it not rentable, and a home built on it unaffordable

In some ways, this place is too small for its lot. I’m assuming it’s the standard 25×100 bucktown lot. There is some significant value to the lot, whatever that value might be, but it is not being used effectively as compared to larger places on same sized lots.

Even other cottages I’ve seen manage to eke out 3 bd 2.5 ba (albeit with small room sizes) with dormers and such. Granted they list for more than this place, but they are at least plausible as starter homes. This place the moment you had a kid, you’d have to move out.

Well… not severely overpriced. Worth around 500K because of the premium of being a SFH. I do agree with many on here who think that condo prices will fall a lot more than SFHs. I expect that with this real estate crash, the premium of owning a SFH over a condo will widen.

DZ said, “Even other cottages I’ve seen manage to eke out 3 bd 2.5 ba (albeit with small room sizes) with dormers and such. Granted they list for more than this place, but they are at least plausible as starter homes.”

I agree with you that the more expensive homes are plausible “starter homes” but just take a step back and think how the bubble has warped our sense of thinking – where a $615k cottage is now a starter home in Bucktown. The original starter homes, crappy run down bungalows, are finally selling in the upper $300’s.

One postive result from this bursting bubble is the forthcoming change in attitude towards the starter home. How in the world a family in their 30’s with two young kids is supposed to afford a $615 starter home is beyond me, but the market has been priced like since at least 2001+. I welcome the return of home prices to reality, the reality where real families have to pay daycare, car payments, burdensome student loans, high taxes and gas, and a $615k starter home is a thing of the past.

Perhaps you’re forgetting that younger couples and families realize they’re paying a premium to live in desirable city neighborhoods. People seeking affordable starter homes usually head for the suburbs or much less expensive areas of the city (i.e. Bridgeport). Bubble or not, location still determines pricing.

Anybody who earned their money themselves and wasn’t playing with the banks money probably wouldn’t have bought property in Chicago since around 2003, perhaps as far back as 2001.

People who accumulate equity know how hard it is, and how long and hard and treacherous the path is to accumulate a significant amount of equity. The banks money is entirely different. Losing your FICO score to a bankruptcy is not nearly the same as losing 30k+ of your own money due to poor decision making. The equity loss hurts a lot worse than a FICO hit, trust me.

And now we bail out the banks who don’t want to sleep in the bed with fleas that they made.

Nice place, but I assume it’s being hurt by the fact that it’s just a very small place for a pretty hefty price. This house is priced, located, and sized such that it will only be purchased by a DINK household, and if they’re DINKs then there is -likely- also a bit less of a premium in having an SFH vs. a condo.

Seems to be a very nice place all in all, but as others have suggested, something in the high 400s is probably more plausible unless the seller gets lucky and finds the perfect gay couple or empty nesters who fall absolutely in love with all aspects of the house.

I can see not having a 3rd bedroom being a problem. Joe, you said your wife had been in the bedroom. Has the basement been rehabbed?? What it be plausible to add a guest bedroom and a bath in the basement?

“Serious question—Would anyone here *really* rather have a middle-unit 2 br condo in a three unit building than have this–assuming the prices were the same?”

Yes. I hate multi-level living, and that awful staircase isn’t helping.

Of course, with middle-unit condo, it all depends on the quality of the construction, and the neighbors. If both are OK, I wouldn’t have a problem living in it.

I do not value SFH at all. I infinitely prefer living in a multifamily dwelling, and would unambiguously prefer the middle unit described. Yes, I hate yardwork and snowshovelling THAT MUCH. (And that includes hiring/monitoring people to do it for me.)

Michael S,

According to my wife, the basement is finished with an office on the south side and a sitting area on the north side. The ceilings are low but she thinks a bedroom and bathroom are possible.

As stated earlier, the place is small and the kitchen has no dishwasher.

As my wife toured this place, the realtor told her the current price (665 K) was low and was set with the intent that the new owner would rehab the place into a larger home. A similarly styled home on the same block that had been rehabbed sold for 785 K in June 08.

Joe,

That’s interesting. How was the other home that sold for 785k rehabbed? Was there an addition out the back? Was the basement excavated? Or an addition on top????

Every house on the south side of that street literally looks the same except for the paint jobs.

Michael S,

I think the home was at 2333 Homer. It had three bedrooms, 2.1 baths. The addition appeared to be dormers and an extension of the home on the back.

“The addition appeared to be dormers and an extension of the home on the back”

Can that be readily done for $100k? Is that realistic?

Anon,

I don’t think it’s realistic. Also, Nov 08 is not the same market as June 08….

“Nov 08 is not the same market as June 08”

Yeah, obviously. But I was wondering if there was even any basis for their pricing when they first listed. So, what is a reasonable estiamte for the reno? $150k? $200k? When you add 20% for the buyer for dealing with the headache–say $200k all-in (minimum) off of the comp–which is *now* maybe 10% off the June closing. So, really, this place is max $500k, assuming one could get a construction loan for the work.

I’ll stick with the conforming max w/ 3% down as a realistic price in the current market.

How does everyone (except the seller) feel about $430k for this place?

I don’t see why this place is priced at over 600k. Is the land’s value the reason?

“Dave on October 29th, 2008 at 4:19 pm

I don’t see why this place is priced at over 600k. Is the land’s value the reason?”

Greed. Entitlement. Naivety. George Bush!! I don’t think there really is a reason why it’s priced so high. My personal favorite is “but amount less would be like giving it away!” At the sellers have reduced the price a little since June. Unfortunately, they’re chasing the market down. Like IB says, in a declining market, you don’t wait for buyers, you find buyers, and price accordingly.

49% of homeowners still believe their home has held steady or increased in value over the past year.

http://www.bloomberg.com/apps/news?pid=20601213&sid=aE04JJV9jIWA&refer=home

Its tough telling someone that they aren’t quite worth what they think they are because their largest asset is illiquid and has lost value lately. In fact I wouldn’t suggest doing so, as its unnecessarily mean on the ego, unless that person needs to sell.

Bob:

Thanks for the link. Yet another sign that we are far from the bottom of this housing bust. People still “believe” in real estate. You’re not seeing fear and capitulation yet.

IMHO, homeowners are starting to get it if the value misperception index dropped from 32 to 16 over 1 quarter. This represents a 50% change in value perception over one quarter, which is huge. If the index went from 32 to 0 over 1 quarter, we would be in a great depression. While the stock market now swings at lightning speed, home prices cannot move a quickly because we do not have the same level of transparency.

That said, the media has done a great job of helping to expedite the residential market freeze with a continuous pounding of negative stories.

I welcome the return of home prices to reality, the reality where real families have to pay daycare, car payments, burdensome student loans, high taxes and gas, and a $615k starter home is a thing of the past.

Truer words have never been spoken.

“And I’m sure a complete rehab done properly would be at least $200k.”

What?! Did they gold plate the floors?!

My parents bought a 3/2 ranch five years ago that hadn’t been updated since the 70’s and spent only $80,000 and they did everything you could imagine to the place. Gutted the kitchen and both bathrooms. Tore the old deck off and replaced it with a new deck and a three seasons room. Replaced all the flooring and carpeting. Finished the basement. Put in a new mantle over the fire place. Replaced the furnace and hot water heater. And the only thing they did themselves was paint.

I seriously doubt this place got $200,000 worth of a rehab unless it was structurally unsound.

I should add that my parents replace all the windows and doors and had an extensive amount of landscaping done too.

ken – a 1970’s ranch is a totally different remodel proposition than an 1900 victorian cottage.

And i also think the $200,000 being bandied about included some cost for dormers and/or small addition. In which case, it might be difficult to do that, plus renovation of the existing interior, for $200K.

How much a renovation would cost is pretty much academic at this point. No bank will give you a HELOC for 125% of the value of any home nowadays. The $200k anybody ponies up will be their own cold hard cash. Who has that kind of cash laying around to spend on a renov and who would spend $200k to do that on a $615 house anyway???

homedelete,

Spot on. Where the 200k figure came from I have no idea, but I know you can get almost complete homes in Chicago (developer went bust) in okay neighborhoods for 600k that need about 100k worth of work. Oh and these homes are 5,400 square feet.

Lets face it: the yahoos that bid up prices in trendy hoods were dong so with bank money, not with their own money. Yahoos are incapable of gathering a significant amount of savings, like anywhere even close to 200k. At the end of the day these days banks want to be repaid after learning their lesson. No more ridiculous credit extended to yahoos.

And this ask price is indeed laughable. I could see it making sense if this was in Aspen abutting the ski-slopes, but for Bucktown the ask price is hilarious, a total disconnect from reality.

You call them yahoos I call them bozos but they’re all the same. It’s the howmuchamonth mentality. “I make $3,000 a month. You say I can borrow $500,000 for only $2,000 a month? Sign me up!”