Foreclosure Alert: Stresses Continue in The Sterling at 345 N. LaSalle

Is it possible that even investors have tired of buying up foreclosed and short sale units in The Sterling, at 345 N. LaSalle, in River North?

There are two in the building that have been sitting on the market for awhile with no takers but this high-floor 2-bedroom looks particularly intriguing.

Here’s the listing:

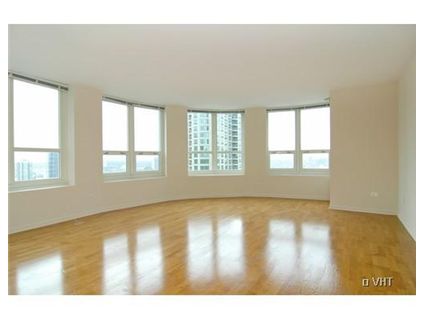

PRE-FORECLOSURE PROPERTY! HIGHLY UPGRADED 2 BDRM/2 BTH IN THE PRESTIGIOUS STERLING BUILDING. FLOOR TO CEILING WINDOWS SHOW BREATHTAKING NORTH CITY & LAKE VIEWS.

ITALIAN MARBLE FLR THRU-OUT, GRANITE C-TOPS IN KITCH AND BTHRMS, STNLESS STEELE APPLCS, CUSTOM ITALIAN LIGHTING, IN UNIT WASHER/DRYER, TENNIS, POOL, FITNESS CNTR. INCREDIBLE LOCATION ON THE RIVER. SUBJECT TO THIRD PARTY APPROVAL! NO SAT OR SUN SHOW 24HRS

ParkVue Realty Corporation has the listing. See more pictures here.

Unit #4001: 2 bedrooms, 2 baths, 1160 square feet

- Sold in February 2004 for $574,000

- Originally listed in September 2008 for $420,000

- Reduced

- Currently listed at $339,900

- Assessments of $632 a month

- Taxes of $7,846

- Central Air

- In-unit W/D

- Parking is available to rent in the building

They sure have a funny definition of “floor to ceiling” windows.

Just one of the many issues that this seller has.

1,160 SQFT for a 2 bedroom makes it two rather small bedrooms. My 1 BR is 1000 SQFT, cant imagine where I’d sneak in another bedroom.

Also, they did an amazing job making the the Italian marble floor look like hardwood, ceramic tile and carpet depending on the room. Or is that just an artifact of the camera work?

kp- My first thought as well on the definition of floor to ceiling windows.

The “Italian Marble” floor looks like wood…. or is it just brown marble? Wall to wall marble just seems excessively tacky to me, not to mention cold underfoot.

Oh, I forgot… Who knew that the Sterling was “prestigous”?

Looks like a classic bait and switch to me…

Place is horrible.

Taxes and assessments seem high given this is a relatively small unit in a relatively new building. Any chance the taxes on these places will drop as valuations fall…or am I being hopelessly naive?

Someone told me that they had a special assessment at Invsco’s 10 E Ontario recently to pay for all the foreclosure & short sale units that weren’t paying assessments. Can anyone verify that?

And, looking at the river does not on the river make.

So, the lies in this are:

1) “FLOOR TO CEILING WINDOWS”

2) “ITALIAN MARBLE FLR THRU-OUT”

3) “INCREDIBLE LOCATION ON THE RIVER”

4) “CUSTOM ITALIAN LIGHTING”

Are there any rules about what realtors can and can’t say? At least you could sue a used-car salesman for this kind of rubbish.

Add the lie about the granite in the bathrooms.

I suspect that they just have the wrong listing with these pictures, frankly.

Yes the have an official NAR code of ethics. Enforceable by NAR.

I’m sure if you file a complaint they will get back to you by 2012.

Funny you should mention used car salesman. I expect that’s what most will be doing shortly.

Will be entertaining to see everyone now waiting for spring trying to beat all the other listings. Should look like someone screaming “fire” in a crowded room with one door.

This is an example of deceptive advertising and this unit is in an Invsco conversion. However, I still believe that this will still sell for around the current asking price (say 315K?)

On a separate note, I notice short sales/foreclosure pricing are way, way lower than the rest of the market (almost all are at or below 2003-2004 prices). This leads me to believe that the true market right now for Chicago housing still has a long, long way to go down. And it seems like every seller is too ignorant (still believes housing always goes up!), unmotivated, scared, or poor (can’t afford to bring money to closing) to drop prices to where their house would actually sell.

In other words, the lack of capitulation in prices (which would be accompanied by a significant rise in volume) indicate that the bottom is still to come (and it will be a ridiculously long bottom) and further shows that anyone buying right now will be sitting in a “loser” for at least a year. It’s no wonder that banks don’t want to lend right now. They would just lose more money!

I’m sure i’m in the minority on this one, but I feel it’s priced nicely and I would be willing to take a look. My biggest (obvious) fear is on the assessment side, but I think the price is solid. Flame away.

Mayday,

I don’t actually think the price is that bad either. ~60% of a 2004 valuation is probably fair in this market and represents around where I think the market clearing price is for most properties in Chicago. As trader notes above the biggest problem in this market (and what is leading to a 7 year low in condo sales) is that most sellers haven’t accepted that reality.

As a current renter looking to become a first time buyer (within the next year or so) I am certainly looking at foreclosures / short sales as I think the valuations on some of them are fair. However, I have yet to see anything that wasn’t a foreclosure or short that was fairly priced.

As to this property, the big thing to be worried about is assessments. This building in particular (as well as the 400 LaSalle building just north of it) have had a lot of whispers of problems with assessments, the need for specials, etc. I would want to be very aware of owner-occupier percentages in this market and get all of the financials that you can from the condo board / developer. If they won’t let you see the books that means something is wrong and you should just go look at another property.

As to my previous comments, I just like to make fun of realtors, particularly when they do this kind of non-sense with their listings.

-kp

For those that haven’t seen the Crane’s (and other places) story:

http://www.chicagobusiness.com/cgi-bin/news.pl?id=31752

Mayday,

I don’t actually think the price is that bad either. ~60% of a 2004 valuation is probably fair in this market and represents around where I think the market clearing price is for most properties in Chicago. As trader notes above the biggest problem in this market (and what is leading to a 7 year low in condo sales) is that most sellers haven’t accepted that reality.

As a current renter looking to become a first time buyer (within the next year or so) I am certainly looking at foreclosures / short sales as I think the valuations on some of them are fair. However, I have yet to see anything that wasn’t a foreclosure or short that was fairly priced.

As to this property, the big thing to be worried about is assessments. This building in particular (as well as the 400 LaSalle building just north of it) have had a lot of whispers of problems with assessments, the need for specials, etc. I would want to be very aware of owner-occupier percentages in this market and get all of the financials that you can from the condo board / developer. If they won’t let you see the books that means something is wrong and you should just go look at another property.

As to my previous comments, I just like to make fun of realtors, particularly when they do this kind of non-sense with their listings.

-kp

(may have had a problem since I had put a url in my comment?)

“On a separate note, I notice short sales/foreclosure pricing are way, way lower than the rest of the market (almost all are at or below 2003-2004 prices). This leads me to believe that the true market right now for Chicago housing still has a long, long way to go down. And it seems like every seller is too ignorant (still believes housing always goes up!), unmotivated, scared, or poor (can’t afford to bring money to closing) to drop prices to where their house would actually sell.”

You may also notice that the bank owned properties, when priced at 2003 pricing, sell with mulitiple offers in just a few days. This would lead me to believe they are under priced.

The problem with the Sterling is the taxes and assessment are high right now. This will change when the new market values are adjusted for taxes. Also the assoc just won a huge lawsuit against the developer and the building will not have huge reserves. Assessments are set to come down substantially in ’09.

$315k for a high floor 2 bed 2 bath is a steal. Let’s look att he numbers.

With the taxes and assessments as they are –

Mortgage Interest $1,260

Tax 654

Assess 636

Total $2,550

Anticipated

Mortgage Interest $1,260

Tax 375

Assess 616

Total 2,051

Rents for between $2,400 – $2,700

You have to see what others do not to make money in the market…

Steve, after you pay income taxes on the property, where is the profit???

Sure you could depreciate the unit, but you would just recapture when you sell anyway, so lets leave that assumption out.

So after paying personal taxes and HOA (which is not a deduction for income tax purposes), you are breaking even. All it takes is one special assessment and your investment is underwater.

Mayday — I don’t think you’re going to get flamed per se. However, I would disagree that it’s ‘priced nicely’ given the mess that is this building. The purchase price _has_ to reflect the risks you open yourself to as a buyer (e.g., special assessments as a result of non-existent reserves from non-paying, bank-owned foreclosures). Look at those assessments…. yikes.

Personally, I’d never buy in an Invesco development (17 N. Loomis was on my radar until I found it was an Invesco conversation). If this unit was in a building that was was stable, I’d be somewhat interested at ~340K.

“You have to see what others do not to make money in the market…”

Or leave out the opportunity cost of the down pmt of 20% (approx $185 a month at 3.5%). Well you finally answered my question even though you didn’t answer it. I am assuming in my simpleton ways that you did an 80/20 loan at 6%, since you don’t like to tell people things.

Left out the closing costs too I see. And no I will not respond to you no matter how pathetic you try to bait me but I will protect others that don’t realize the piece of shit used car salesman shill that you are.

when the bubble growing, even if the cashflow didn’t make sense people bought because prices were going up. will we see that reversed on the way down… cashflows make sense but people hold off because prices are going down?

“…used car salesman shill that you are.”

Ouch 🙂

I don’t understand any of your responses. I included taxes and assessments and there would be NO income taxes on either scenerio until you sell. Have you guys actually ever owned anything?

And no Ze it is not a 80/20. It is a 80% LTV at 6%. The down payment is what you consider “your investment”. When you sell you then determine the return and “Your Investment”. If you sell for $420K in 10 years you then calculate a 105K gain on a 63K investment.

Any more lessons needed today?

“…used car salesman shill that you are.”

Ouch

Coming from a bunch of guys who work in a cubicle? Someday you will learn that to make real money you will have to get out from behind the desk and actually get in front of the curve. I know you guys all get your 401K’s matched… that’s great 🙂

Many make over 1 million per year in my industry. You guys there yet?

1- Not in a cubicle. “Who is John Galt”

2- Already said I have no 401K (although I might have forgotten I have one, eventually I’ll check)

3- That 20% “investment” takes away from cash flow the following month. You refuse to learn anything. You are the worst type of ignorant.

Your industry should be outlawed.

“Many” (of indeterminate number or percentage) “make over 1 million per year” (I assume this is an average calculated over some time frame, lets say the last 5 years… do you think the market will look the same over the next 5?) “in my industry.” (also not defined).

I could have said the same thing about day trading tech stocks from 1995-2002! But how has that been the last 5 years?

Hey better.. Listen to the SHill since “people” in his industry make millions and Pay 100% up front and then you can rent it for just the taxes and assessments and still be ahead. See how well his fuzzy logic holds up to a simple stress test?

Time to finish my bordelaise sauce.

Tchau!

KP.. I promise you don’t want to waste your effort with this guy. I just had to finish what I started. Now I am done.

So, I want to take a step back from the flame war going on here…

Regardless of how you want to argue about the merits of an investment at this price point, when you factor in the income tax savings for a person that will actually live in the unit, this is not bad at all vs. renting at this valuation (although you do still have to consider the down side risks of specials, etc. in this building).

Steve,

If you are renting the condo out for 2,500 to 2,700 as you mentioned, you are claiming any “Net Income” on the Schedule E of your personal tax return. So that Rent – RE Taxes – Interest is your Taxable Net Income, which is TAXED!

So then take your Rent – RE Taxes – Interest – Principal – HOA and thats your actual Net Income. Which will either be a breakeven or slight loss.

Do you not pay income taxes on your rental property?

“3- That 20% “investment” takes away from cash flow the following month. You refuse to learn anything. You are the worst type of ignorant.”

Are you assuming I am invested in Treasuries? Not all investments pay monthly cash flows. Investing in real estate is usually deferred cash flows which would be the case here.

In the anticipated scenerio you are cash flwoing nearly $500 per month. Plus you have the 10 year appreciation that should follow inflation. If you want to argue incomes will be lower in 10 years then we have a different subject.

“Steve,

If you are renting the condo out for 2,500 to 2,700 as you mentioned, you are claiming any “Net Income” on the Schedule E of your personal tax return. So that Rent – RE Taxes – Interest is your Taxable Net Income, which is TAXED!

So then take your Rent – RE Taxes – Interest – Principal – HOA and thats your actual Net Income. Which will either be a breakeven or slight loss.

Do you not pay income taxes on your rental property?”

The answer is no! You would pay $0 on your return. Besides the tyipical deductions assicated with real estate, you always have depreciation to eat up an gain left over.

Are you saying HOA exp are not deductible?

KP.. You have to remember you are entitled to 6k or 11 k of deductions non-itemized (depending on marriage status) so unless this would be in addition to itemized deductions that you have, exceeding that, it is not really fair to account for it. If you already have above the threshold for that amount on your itemized deductions then by all means you are entitled to it.

Another cute little thing you will never hear a realtor remind you of…

Holy moly, quite a few listings in this building. One of these days the tide will change for this building. It will. However, judging from unit photos that I’ve seen, I’d still like to see further price adjustments since the kitchens and bathrooms, in my opinion, need a nip and tuck.

And just to show I can agree with you Steve. Yes depreciation will eat up any need to pay taxes. Of course it lowers your cost basis and you will pay taxes when you sell by that depreciated amount (fair to say at a lower tax rate and in NPV terms discounted (see I even make arguments for you that you might not understand)) Damn your 8 yr old taught me well.

Today I stopped jogging for a few minutes to watch 2 little birds dive bombing on a big bird until the big bird flew away, also my Jasmine plant that was almost dead but I nursed back to life gave it’s first flower. Played some volleyball and took a nap.

And you think making a million a year means something. ROFLMAO!!!

BTW who demeans people by saying crap like that. How about someone here that might be a teacher in an inner city school that contributes 10 times more than any SHill. You must be one insecure bastard.

You can try and reasonably allocate a portion of the HOA’s for utilities (maybe amenities, not sure) expense, but other than that, no, you cant reduce your revenues by that amount to get to taxable net income. The remainder of the HOA payments are considered capital reserve payments, which do not affect taxable net income in any setting, whether commercial or residential. If they havent already, Im guessing this is an area the IRS will soon target.

And sure, I get what you are saying with depreciation, but you will have to recapture this depreciation upon sale of your condo. Think of it as a reduction of basis. Its savings you get now, but pay for later. So you get the benefit of time.

The SHill just piles lies on top of deception. Given the 40+% drop in sales (and commissions,) there will be more and more of this from desperate used home salespeople.

For example, there were only 62 sales of condos/TH’s in Lincoln Park in October. This represents a decline of -26% YOY, -60% from 2005 peak, and -21% from the previous record October low since 1988 (78 sales in 1988, 1990 & 1991.)

For those who desire real stats for the Sterling, here are all of the rented 2/2 apts in 2008 in the mls:

4404 2/12/2008 $2,500

4803 3/4/2008 $2,600

601 4/30/2008 $2,200

401 4/30/2008 $2,200

2401 7/15/2008 $2,400

4103 8/4/2008 $2,400

4207 9/15/2008 $2,500

1806 9/27/2008 $2,200

4805 11/3/2008 $2,450

Here are the currently available 2/2 apts on the mls. It appears that rents will be dropping here.

Unit# listing date asking rent

406 9/25/2008 $1,900

3204 9/6/2008 $2,400

3301 8/29/2008 $2,600

2701 8/20/2008 $2,450

1701 8/15/2008 $2,200

3401 7/31/2008 $2,400

1206 7/21/2008 $2,200

3303 2/19/2008 $3,150

“If you sell for $420K in 10 years you then calculate a 105K gain on a 63K investment.”

Where you getting the IO loan for 6%, Stevo? Or does the pricipal portion of the monthly payment get funded by the capital expense fairy?

G, thanks for the data. Seems like rent for this place will avg between 2300-2500 and will not likely see much (if any) increase in the next couple years (a very realistic assumption). However, there is definite risk involved with special assessments and further price drops due to adverse market conditions.

As an investor, I would have to get a “deal” for under 300K on this place to consider this a good move due to the amounts of risk involved. (Yes this seems very low but assessments are very high and we can’t get too influenced by Invesco-inflated 2004 prices).

SH: a word of warning. you seem to have this faith that condo prices will cling to at least inflation-level appreciation. I can easily see a divergence from this long-term trend (where this time we may see condos appreciate less than the inflation-rate instead of the massive over-appreciation we saw earlier this decade).

On the other hand, I can still see this selling for 315K (my previous estimate) because the person buying this will probably not be thinking of profit (i.e. bought by an idiot with too much leveraged money!).

anon (tfo) Read above… he doesn’t count that. My last war with him was because he refused to clear up semantics. Today he inadvertently told the answer. Truth is he is not an idiot, he knows most of this but he spews his lies and doesn’t care who he hurts. Basically a sell you g’ma for $5 and laugh about it over a cup of cappuccino type of guy. The cognitive dissonance must be unreal.

Btw… movie recommendation, rent Elite Squad on DVD.

Trader.. IMO… I expect prices to go below new build costs, for a while, whatever the hell that is.

AD, it sounds like that might be the treatment for a co-op. An Association’s dues are deductible from rental income.

Anon – No offense but you are a f’n idiot.

Trader – Are you saying rents will also not track inflation rates going forward?

In addition – Can you clear up for the yahoo’s that you do not consider monthly principal when comparing rent vs buy? These guys can make you laugh!

Steve.. We already agreed you do not count monthly principal.

Here is what I have for rental prices from the ’01 tier

MLS # Status Rent Search Price

6323254 RNTD 2400

6363914 RNTD 2300

7008231 ACTV 2600

6471176 RNTD 2700

“Where you getting the IO loan for 6%, Stevo? Or does the pricipal portion of the monthly payment get funded by the capital expense fairy?”

Moron – If you are doing an IRR analysis then go ahead and include your monthly cahs flows. You simple have a large cash out flow at the end of the investment and less interest paid during your holding period. Seriously, do you understand finance and returns?

So, Stevo, you calculate your IRR w/o using all of the capital invested?

Where does that $41k in principal (paid monthly, in increasing amounts) go?

You don’t want to count it as a monthly expense (fair enough), but it’s going somewhere, isn’t it?

Yes, the math is a little harder, but I think your 12c should make it pretty easy, no?

Can’t say that you calculate your $105k gain on a $63k investment when you’ve actually invested $104k total over 10 years. That qualifies as a deceptive practice, Stevo.

Thanks you Just Curious. Another point I have made that I again was correct on.

Let’s see – we have the principal thing (which is 2nd grade math) and now have the HOA thing (3rd grade tax) that we have all learned today. We are moving along…

But again on a technicality you SHOULD to be completely accurate add in. (monthly principal * 6 * risk free rate) Splitting hairs, i admit, unless you are in one of your $10 mil homes where it would make a difference.

Stevo–douchebag–you said this: “If you sell for $420K in 10 years you then calculate a 105K gain on a 63K investment.”

How’s it a $63k investment when you’ve actually invested $104k if you have an amortizing mortgage? Or are you using a non-existant IO loan?

Steve you throw ten pieces of shit at a wall and 1 sticks and you pat yourself on the back. NO ONE agrees with you about the down pmt. As I said make it 100% dwn pmt and the absurdity of your logic should sink in.

HD.. I the smartest guy in the room today. Avoiding you. I had too good of a day today and yesterday for this.

SHill First 2 things that came up on Google… At least your daughter has an excuse she is only 8. Hope she’s more intellectually curious in the future than you are. Go write them and tell them they are idiots too. Funny is one is a commercial developer (but at least intellectually honest)

When a down payment is used to buy a home, the bank accepts the payment but gives nothing in return. Not a wise financial decision. Any payment made that does not generate a return, creates a cost. The cost is what that money would have been made had it been invested in a compounding vehicle. Most homeowners and investors who focus future appreciation, fail to acknowledge the costs that are compounding every year when a down payment or equity sits idle in property. Although property may be cash flowing every month, there is a hidden cost that is eating away at the eventual return.

http://www.andtego.com/Pdf/real_estate.pdf

I recently did an analysis of rent vs. own when it comes to having a large downpayment (we sold our house a year and a half ago, and are now renting). My analysis showed that the larger the down payment available, the higher the total increased cost, compared to renting. Ironically, the less money you have in the bank, the closer the numbers become (rent vs. own). In the case of a 50% down payment, the cost to own vs. rent was a multiple of 15X! The majority of this came from the loss of income from the down payment,

He also talk about not double counting the deduction benefit I mentioned earlier…

http://www.oftwominds.com/blogmay06/inflation-housing.html

“How’s it a $63k investment when you’ve actually invested $104k if you have an amortizing mortgage? Or are you using a non-existant IO loan?”

If you would like to add in the principal the principal (cash flow basis) then you simply receive more cash at the end of the transaction. Whether you pay i/o or a fully amortizing loan it is simply a cash flow issue. You don’t quite get it!

Ze Carioca

So from your analysis above, we are both in agreement that you want to put down as little money as you can. Hence the i/o loan and minimum 20% down payment. As long as you cash flow there is no reason to pay down the loan. When you sell, your initial invesntment (down payment) has created a return based on what the property sells for.

Buy a $400,000 property and assume it appreciates at a compounded 3% per year (a property that cash flows like at the Sterling) You put down 20% and take out an interest only loan to reduce cash outflows. You sell the property for $537,000 after a 10 year cash flow even hold (for simplicity). What is your IRR on the 10-year hold? Am I missing an opportunity cost or something here guys? Do you think rents may have increased to create even a larger return? How is not identifying all cash outlays?

Go to town Ze… what did I miss?

See Steve.. on this it gets interesting. I am watching Monday Night Football which requires 2 of my monitors (so No chance Excel opens now) WHat is interesting is the adult convo of what I have been trying to explain. The difference of the rate of an I/O loan (little known) to a conventional loan most people attribute to risk which is silly since over a 5 yr period the conventional loan position for a bank maintains 90% of the I/O loan risk. It’s what I tired to point out when I asked 2 nights ago (and you ignored) “Is it better for a bank to receive pmt_int or just int) If you do the whole math down you can reverse engineer the banks benefit of getting principal to about 5/100ths of a percent. When you consider that a bank only needs $1 reserve on $10 outstanding the value of that dollar back to the bank becomes about .45%. Therin lies the difference since Finance which we agree I know the same amount as an 8 yr old dictates that equivalent risk profiles MUST have equivalent returns.

Interesting huh. So in the example you just threw at me it is built into the rate diff.

I guess we are best friends after all. Such a nice world!

Forgive and forget. Random acts of Kindness.. Always down with all of that…Great way to be!

What the heck is this supposed to mean? I didn’t even post n this thread! I thought we were in agreement most of the time!

“Ze Carioca on November 10th, 2008 at 5:37 pm

HD.. I the smartest guy in the room today. Avoiding you. I had too good of a day today and yesterday for this.”

I meant you keeping AWAY FROM the flaming thread made you the most intelligent. LOL.. re reading it does sound wrong. One day I will learn to use commas. Actually no i won’t.

Do people really think that Chicago property taxes are going to fall in proportion to the current declines in market values? City and county government aren’t going to get by with 20-30% less revenue (whether or not they SHOULD, I find it hard to believe that they WILL) — won’t our clever politicians figure out some way to increase tax rates so the lower assesments generate more or less the same revenue?

JPS,

That’s not how property tax works. The property tax rate has actually been plummeting in recent years. It’ll go back up as necessary if the assessed valuations decline.

Generally speaking, each year the taxing body backs into the tax rate, after having decided the total tax levy (revenue needed) and knowing the total assessed value of all properties subject to the tax.

Property taxes do not necessarily decrease if the value of the property decreases. If all properties decrease uniformly, then you will still have the same proportion of taxes to pay. Each property that decreases in value, increases the proportion you will pay if you did not get a decrease in value. This effect is especially noticeable if businesses get a property tax decrease, as Cook County has a higher rate for businesses. Multipliers can also increase.

I live in the building so would like to shed some light on what is going on:

1. Reserve – there is ~$1.3 million in reserves from assessments

2. This particular property has already been sold ($330K I believe)

3. The building sued AmInvesco and settled for $350K (following the special assessment that it had prior) which it should receive shortly (hopefully)

So when Steve Heitman mentions monthly taxes on this unit going down from $636 to $375 per month based on the drop in market value, this is not guaranteed to happen? Because if market rents for the units are falling but the taxes don’t do the same, these units aren’t guaranteed to cashflow even at the reduced prices.

“taxes on this unit going down …, this is not guaranteed to happen”

It’s likely to, but guaranteed? Only if you’re related to someone on the board of review.

From reading a lot of the posts on The Sterling:

Mozart

Gerry

Jolie

Valasko

Dan

Frank

Michael

Or anyone who I have missed who owns in the building,

What advice would you give for someone looking at homes in The Sterling. What is the most up to date amount in the association reserves? How is the association doing in general? Is there any news on if assessments will be lowered or raised in 2009? Have a lot of the home owners contested your property taxes with the city or do you all see them being lowered very soon on their own? What are some important things to know about the building that would be very helpful before someone would move in? What are the things that you LOVE about the building? Please don’t skimp on details!

Thanks everyone

Hi, all I am looking for a condo in Chicago because I am relocating there. I was wondering if anyone had any idea where I could look. I see that the sterling building has lots of foreclosures which is good because that’s what I want but I dont want a crappy building. Please reply to spatrickhoran@yahoo.com thanks

patrick

look at 10 e ontario lotd of unit there!!

ben