We Love Authentic Lofts: 2332 S. Michigan in Motor Row

In the last sevveral years, some developers have been converting old automobile showrooms on South Michigan (known as “Motor Row”) in the South Loop into outstanding authentic lofts.

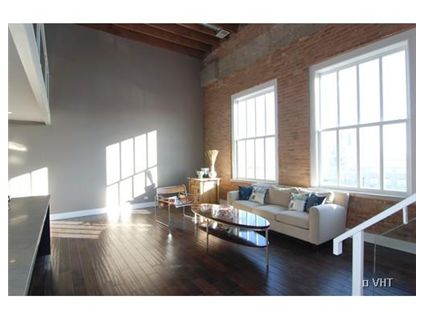

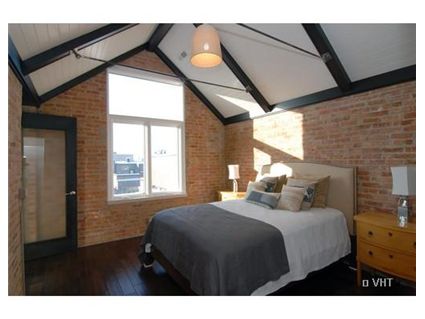

This 22-unit building at 2332 S. Michigan is a blend of the authentic loft elements of brick and high ceilings with modern kitchens and bathrooms.

This particular unit is a 2-bedroom triplex with a “recreation room” on the top floor, complete with wetbar and city views from a private deck.

Vivienne Frow at Rubloff has the listing. See more pictures, a virtual tour and a floorplan here.

See the property website here.

Unit #409: 2 bedrooms, 2.5 baths, recreation room, about 1730 square feet

- I believe it is still available from the developer – as I couldn’t find a prior sales price

- Currently listed for $569,000 plus $30,000 for parking

- Assessments are $174 a month

- Taxes are “new”

- Triplex

- Fireplace

- Open House: Thursday, January 29 from 5:00 PM to 8:00 PM

yeah and across the street you can view the 1/2 finished construction project and on the other side stateway gardens. Motor Row never made it over the hump as far as gentrification, these units may be worth 1/2 of the ask.

Gorgeous unit, but no way it is worth that much coin on that part of Michigan. I agree… $300-$350k and now we are talking. For $570k you can get a similar unit in already gentrified areas of town, so why pay that much to be a pioneer.

I like the floor plan, well thought out.

I’m an intermediate term and long term bull on the area, but agree 100% with the prior posters. No way is that worth 599k including parking, when you can get the same or more space for 150k-200k less (parking included) north of Cullerton.

I agree, you can get the same price/sq ft downtown where you have the city at your footsteps and can walk to work. 600k for 1700sq ft is a Streeterville, gold coast and east lincoln park price.Beautiful unit. I wouldn’t mind being a Pioneer if that unit was in the 300s.

For 570k you can get a nice SFH in Bridgeport with twice the square footage. Yeah I know different market, but at the 570k price range the developer forgot that the SFH market is a lot bigger than the condo market.

Paying 570k for a 1,700sf condo is like buying a turbocharged, modded, riced out Honda Civic for 40k. Yeah it might be the baddest 4-cyl Civic on the block, but its no Mustang/Corvette/etc.

Another developer who way overshot the market on this one. Plus this far south this place can’t be near any sort of amenities or el stops it appears. Well I guess you could get a ‘massage’ on the walk down Cermak to the Chinatown stop. Yeah, no thanks.

320k tops.

I totally agree with all the comments here. The finishes are great (except for the beige travertine…how did that sneak into what was otherwise a very high-end rehab?). Also, I’m kind of confused about the two kitchens. Does this unit have two complete kitchens, or is one of the kitchens a photo from another unit? That seems like a huge waste of space and money.

I really really want a space like this…something with great architectural details and a really gorgeous, modern kitchen. However, I have to remind myself that buying a place in a terrible location just for the finishes is the worst investment decision I could make. I could MAYBE talk myself into being a pioneer here if the price I paid made everyone’s jaw drop when they saw the interior. But at 600K, their jaws would drop with disbelief that I paid that much to live next to McCormick Place.

While I agree this place is about 100K over priced, show me a similar multi-level loft with this level of fit and finish in RN, Gold Coast or LP for this amount of money. Also include the amount of outdoor space. This place is fairly unique. Let me also go on record I wouldnt pay a dime for this place because of its location.

Don’t worry you should be able to buy this as a bank owned property for 300k in the near future. Or rent it for 2k a month.

Danny – I think that is a wet bar on the third level and not a kitchen.

I’m not talking about the wet bar. There is a photo of a huge kitchen with white countertops. Then there’s a photo of the “great room” with exposed brick and a big kitchen with gray countertops. They both have sinks and ranges and space for a full-sized fridge.

This poor developer needs a taxpayer bailout. Afterall, he DESERVES $600,000 for a 2/2 in a seedy part of town.

I believe these units also benefit from some sweet property tax deal with the city, such that you wouldn’t pay taxes for the first eight years. It’s a pretty big bonus.

Oh, and you HAVE to buy from teh developer to get the tax boon.

I have been considering the south loop as a place to buy when prices reach what I would consider to be a more grounded level. I think the area has good potential, and it is the most convenient part of the city for me for getting back and forth to my office (which is a big part of it’s appeal). But I don’t understand the prices that are being asked. The area may have potential, but I certainly don’t see it as comparable today to the better neighborhoods on the north side. Yet the prices I have seen seem to be nearly equivalent. I like the look of this unit, but who is going to pay that kind of money for that location? I have walked every block of the south loop and that far south you are not near much of anything besides some old commercial buildings and the public housing on State street.

I just googled that address: it’s next to a Burger King and down the street from the Expressway and a hospital…..$334/sq ft

I agree with Marco’s points about this type of loft being hard to find anywhere else. I guess the developer might have thought, “This is a very unique space and it would be a rock-star, million-dollar pad in any other ‘hood. At 600K, I’m giving someone who makes decent money but who’s not a rock star to live like one in a crappier ‘hood for half the price.”

I get the logic. Some successful accountant or doctor or dentist or computer programmer looks at this place and imagines the great parties he’ll throw or imagines bringing a girl back to his place and feeling a sense of pride when he opens the front door and turns on the lights. However, I think it’s getting harder to find anyone who is willing to pay this kind of a premium for an impressive space that none of your friends would want to visit you in because they’re afraid to leave their cars outside or walk from the train to get to your door.

You’re right Danny, sorry. I think they messed up on some of the pictures. The floor plan shows only 1 kithcen.

Danny, you’re right! There are actually 2 pictures from that kitchen with the white countertops (and the white couch), one picture from the kitchen with the great room, and one picture of the wet bar.

“There is a photo of a huge kitchen with white countertops. Then there’s a photo of the “great room” with exposed brick and a big kitchen with gray countertops. They both have sinks and ranges and space for a full-sized fridge.”

Yeah, they totally mixed up the pix from two units. The window and stairs layout, etc. is also different b/t the pix and from teh floorplan–if you look at the floorplan, some of teh pix are obviously not the same unit.

Danny,

“Some successful accountant or doctor or dentist or computer programmer”

Hate to break it to you but of the professions you mentioned the only one with an income that can come close to the ask on this place is a doctor. And a doctor will probably wind up buying it for 300-400k as its near Mercy hospital.

Accountants, dentists and computer programmers don’t live in 600k pads. Investment bankers do…err did. 😀

Anybody who needs to spend 600k on a place to impress a girl is delusional and not good at math. You could get a 300k place in that case and get ‘guaranteed’, high end girls multiple times a week.

Good. I just wanted to make sure I was seeing the same pics as everyone else. This post interests me because I can understand why people overpay for places like this. If you want a beautiful, unique, modern space in this city, you don’t have a lot of options. There are some architects building nice, really expensive units in bucktown/wicker park, I’ve seen a few buildings in the west loop with relatively unique finishes (e.g., glass tile and something other than granite countertops) and you have a few high rises like 600 N. Fairbanks. But maybe you always wanted a private rooftop deck or huge terrace, which eliminates Streeterville…and maybe your job is on the south side and Bucktown is a little too far away.

For me, I’d rather try to find a bargain on the north side along the red line and pick out all the finishes myself. But I get why some people don’t want to (or don’t feel capable of) doing that themselves. Until recently, I think some people really wanted a very particular type of space and were willing to make big compromises on location to get that space at a price they could kind of afford. That’s why people bought those townhouses on Wabash we were just talking about the other day that are just a block over from this loft. They looked at townhouses in a better area, then they saw that for the same price, they could have one with a two-car garage and a better floorplan and better finishes, so they figured they’d compromise on location. They’d just accept that they’d have to drive everywhere. What did it matter if the projects were nearby? They’d have a security system and lots of locks and an attached garage to prevent them from ever walking outside where they’d be exposed and vulnerable.

I wonder how long it’ll be before anyone is willing to sacrifice location for finishes again.

“Accountants, dentists and computer programmers don’t live in 600k pads.”

Bob, I think there are plenty of 30-somethings with white-collar jobs that pay 80 – 100K who live in places in the 500K – 600K range. They might have to save up for a while or wait until they build equity in their first or second home…or they might have a significant other who makes 75K+ as well.

I don’t know why some people on this blog love to claim that only people who make 200K per year can afford a 500K house. Yes, there are single yuppies who make 60K who were told by some banker that they could afford a 400K condo with little or nothing down. But there are also people out there who save and invest wisely so that they can eventually afford a home that costs more than 2.5 times their annual earnings.

Danny, I don’t think that many were sacrificing as you describe since most of those buyers believed “real estate always goes up.” Many also believed marginal areas had the highest upside. In most cases, the sacrifice you describe was tainted by greed.

Most the people buying these places in this price range are MARRIED COUPLES. Pretty much DINKs, Dual Incomes, No Kids. You can easily spend up to $600k with two incomes in the 80-$100k range for each spouse depending on debts and down payment. There are plenty of people in Chicago making that kind of money and they aren’t all doctors.

The problem now is that most of them have the income, but don’t have the down payments required by the lenders for jumbo financing now which is putting a lot of pressure on prices as these borrowers are looking at cheaper places that don’t require 25% plus down payments.

Edumakated,

If I were a DINK I could see spending 450k for a 2/2 in LP but not 600k for this 2/2.5 in nowhereville.

Epic fail.

I agreed edumakated. However, the DINKS that bought with low down payments and exotic financing (probably a high percentage of those in $600k units at 4.0x – 5.0x income) are in for a world of hurt: the mortgage is underwater and the payments is about the adjust upwards. They can’t sell without bringing money to the table and they don’t have the money.

One thing I try to remember when I see expensive units is that lots of people bought units in good neighborhoods pre-bubble and have a much much much lower cost basis. Next door neighbors with the same exact townhouses can have radically different mortgage payments. Obviously in this case being new construction that doesn’t apply but when I see some of the seasoned lofts it makes me cringe to think if I bought there is a good chance that my neighbor’s mortgage payment would be half the size of mine.

Bob, no disagreement from me there. My comment was more directed at people who seem to think people making $200k in household income is a rarity in Chicago.

“If I were a DINK I could see spending 450k for a 2/2 in LP but not 600k for this 2/2.5 in nowhereville.”

That’s your preference. Differences in preferences make the market.

What if DINKs were a prof at IIT and a nurse at Mercy. Yeah, I know that’s not you *and* that they’d have to expect to take a capital loss on re-sale, but not everyone looks at a condo as an investment.

**Anybody who needs to spend 600k on a place to impress a girl is delusional and not good at math. You could get a 300k place in that case and get ‘guaranteed’, high end girls multiple times a week.**

hahaha. And you would still be way ahead….

Even the head of the Treasury department, Geithner, makes only $191,000 a year.

HD, there are some who are certainly screwed. Having financed a lot of 80/20s for relatively high income young professionals, most them are in a fairly good position. In fact, quite a few of my clients refinancing now are paying down their mortgages in large chunks so they can take advantage of lower rates… paying off the “20” altogether, etc. Most upwardly mobile professionals see their incomes increase quite rapidly.

The people that are screwed are those who have to sell unexpectedly after only owning for a short period of time. For instance, I have some borrowers who lost a job and eventually found comparable employment. However, they have to relocate to another state and have to sell after only owning for 1 year. Because they are relatively young, they are screwed because they are underwater and don’t have the cash available make up the shortfall of the mortgage vs what they can sell for. For many people this is just a function of being in the wrong place at the wrong time, not necessarily a result of exotic financing or because they bought with 100% financing.

His former job at the NY Fed paid him about $400k a year.

“Even the head of the Treasury department, Geithner, makes only $191,000 a year.”

You aren’t taking into account the MILLIONS that the lobbyists are slipping into his pocket.

“Even the head of the Treasury department, Geithner, makes only $191,000 a year.”

And now he’ll actually have to pay all the taxes he owes, unlike the recent past.

“You aren’t taking into account the MILLIONS that the lobbyists are slipping into his pocket.”

Uh, where are you getting that idea? He’ll make millions after he quits, but there isn’t anything being funneled to him now that isn’t genuinely illegal.

Are we downwardly mobile now??? I thought I was upwardly mobile as well until until bonuses were reduced this year. My dept is doing well but other parts of the firm, not as well. I would expect the same for anyone directly, indirectly or tangentially involved in RE, Finance or Insurance. You as a realtor I’m sure made less money this year than last…and if you made more money you’re either the exception or you’re a liar….

“Most upwardly mobile professionals see their incomes increase

quite rapidly.”

HD. I am a mortgage broker and I actually had a record year last year, so I guess that makes me an exception although I know quite a few others who did extraordinarily well also. There is no doubt that there are some people who have seen their incomes decrease, however, there are also plenty of other people who have not. My wife’s income increased dramatically this year at her corporate job as her company is doing quite well.

I work almost exclusively with high income young professionals and the vast majority of my clients have seen their incomes increase quite a bit over time. Very few have seen any significant decreases. The ones who have are still making very good incomes though. It is one thing to go from making $175k to $150k vs $75k to $35k.

It’s amazing, anyone can be anybody on the internet. The mortgage brokers I know are now tending bar or chasing geese (literally); in fact my firm’s new office space used to be occupied by a very famous and now bankrupt mortgage wholesaler. Yet this guy here says he’s had a banner year! I hope you understand why I’m a bit skeptical. I’m not saying that everyone’s wages went down, no way, and I’m sure that many of your client’s incomes have increased b/c I know my has, but the last year has been pretty brutal for a lot of professionals and 2009 will be no exception.

HD, it remains to be seen what happens in 2009. There will certainly be blood in the streets for some folks.

You really shouldn’t be so negative. I could careless if you believe me or not. I know what my w-2 says. Like most professions, 20% of the people do 80% of the business. Our company had an excellent year. Part of the reason being is that most of us have been in the business a while and have fairly large client referral bases built up over years and we also did very little subprime lending. So while the majority of mortgage lenders are probably struggling, there is still a segment of us that are doing extraordinarily well and do so even when business as a whole may be slow.

People are still getting mortgages and the guys that survived getting washed out are doing quite well since there is dramatically less competition remaining.

Quite frankly, any mortgage broker who is tending bars probably jumped in during the boom and deserved to get washed out. There were way too many people running around originating loans and selling real estate looking for a quick buck that had no business in the industry.

“It’s amazing, anyone can be anybody on the internet. The mortgage brokers I know are now tending bar or chasing geese (literally); in fact my firm’s new office space used to be occupied by a very famous and now bankrupt mortgage wholesaler.”

HAHAHA! HD complaining about unsupported claims of people on the ‘tubez by being a person making supported claims on the ‘tubez. We have no more reason to believe that you know someone chading geese or that you work for a law firm subleasing(?) mortgage wholesaler space than we do to believe Edum re his income. We’re all pots or kettles here, whenever we complain about someone asserting facts about their experiences.

Vivienne Frow is a babe….

I make seven figures and that John guy who claimed to be a multimillionaire on here is actually my gardener. To assuage the PC police his real name is Jose.

HD, I am a RE bear myself, but I believe what Edumakated is saying might be true. Remember his W2 is for the whole 2008. Many of my coleagues were buying investment propertis untill late September. The talk around the water cooler was all about what great foreclosure they recently bought at huge discount. The mood is strikingly different now. All of the talk is how bad is the RE market, and how much money they lose each month on their rentals. Expect Edumakated’s W2 form for 2009 to be much lower than that of 2008.

Crazy… most of my deals weren’t investment properties. Business did hit a brick wall in October though when the bottom fell out of the market. All the purchases pretty much seized up. December was great though as that was the start of the refi boom we are still in right now.

It remains to be seen what happens in ’09. I can tell you that the first two or three months will be record months for a lot of mortgage folks because of all the refinances. It remains to be seen what happens when spring comes around for the purchase market though. It will definitely be slower as a whole, but again that doesn’t mean individuals in the business still aren’t going to do well. I am still working with buyers looking for places, so we will see what happens.

Look for the refi boom to sustain him is my guess. The govvie is hell bent on trying to “restore affordability” via government intervention and lately theres talk of bringing down the yield on even the long bond.

This means more refi waves as rates drift lower and lower. The only reason rates are higher now than a couple weeks ago I heard is that the banks really had to turn off the fire hydrants as they couldn’t handle the volume. If a quarter or 3/8 point drop does this theres going to be activity all the way down.

If we’re going the way of Japan and all indications are we are, Edumakated might make out just fine riding the refi waves that are sure to come. Everyone will be so happy and brag to their neighbors about what a great rate they got but will leave out the overpriced property part!

Edumakated, you best be thankful for your lot in life.

More importantly, Vivienne Frow is a babe. 😉

“The Mortgage Bankers Association (MBA) today released its Weekly Mortgage Applications Survey for the week ending January 23, 2009. The Market Composite Index, a measure of mortgage loan application volume, was 732.1, a decrease of 38.8 percent on a seasonally adjusted basis from 1195.3 one week earlier. This week’s results included an adjustment to account for the shortened week due to the Martin Luther King Jr. holiday. On an unadjusted basis, the Index decreased 46.5 percent compared with the previous week and 40.4 percent compared with the same week one year earlier.

The Refinance Index decreased 48 percent to 3373.9 from 6491.8 the previous week and the seasonally adjusted Purchase Index decreased 2.9 percent to 294.3 from 303.1 one week earlier. The Conventional Purchase Index decreased 7.8 percent while the Government Purchase Index (largely FHA) increased 8.8 percent.”

h t t p://www.mbaa.org/NewsandMedia/PressCenter/67313.htm

HEL-LO!!!!

G you are awesome I wish I had your tenacity to follow up on other people’s posts.

HD, I am very thankful, but I work extremely hard as well.

G, those stats don’t really tell the whole story as it is the weekly stats of overall refi applications. It doesn’t tell the story at company levels or the individual LO levels nor does it reflect the changes in rates on a day to day basis that drive weekly refi volume. Most of the loans that are actually closing now were locked several weeks ago in late December and early January. It is taking up to 60 days to get a refi closed with some lenders right now. Current app volume would be lower because rates are typically higher now and most of the people jumped on refinancing in mid December.

Refi business right now comes in waves and I actually agree with Bob to some degree. Many lenders have been attempting to control volume by raising rates because they are understaffed to handle the volume. The easiest way to cut off volume is price yourself out of the market a couple of days.

It also appears that lenders are anticipating rates going lower because they are pricing the loans so that borrowers have to pay points or pay closing costs to get the best rates. This deters people from refinancing in the future when rates fall because you have to recoup your sunk costs from the refinance a couple of months ago.

“Edumakated at 3:37 pm

December was great though as that was the start of the refi boom we are still in right now.”

“Edumakated at 4:20 pm

Current app volume would be lower because rates are typically higher now and most of the people jumped on refinancing in mid December.”

Whatever.

Ed, I was actually hoping to hear your answer to something I posted on the 5919 S Calumet topic:

G on January 28th, 2009 at 10:58 am

Ed said, “None of my legitimate jumbo clients are having any problems.”

Ed, they don’t have a problem with discovering that fraud contributed greatly to their inflated purchase prices/jumbo loan balances?

G:

Whatever? Do you have a clue as to how mortgage financing works?

All the loans that are CLOSING now at this very moment in January are applications that were taken DECEMBER. It takes at least 45 days to get a loan from application to closing right now. The low rates that everyone is doing back flips over were locked weeks ago. Loan applications taken last week will probably not close until the end of FEBRUARY or early MARCH.

Mortgage rates change every single day and often times multiple times per day. Rates are up one week and down the next which is what ultimately drives refinance application volume. When rates are up, loan applications will be down. When they fall, there is a mad rush for a loan applications.

Did I say loan applications from last week were higher for the industry? No I did not. I said we are in a refi boom and many Loan Officers are doing quite well right now because of it. No one knows how long it will last.

My comment about jumbo clients was in reference to them having financial troubles. The article in the WSJ implied that 7% of jumbos are in default. I questioned the stat because a lot of the non-conforming financing of jumbos also included stated/stated and other mindless loan products used by specuvestors. If you pull out all of those files, you will find that “legitimate” jumbo borrowers have dramatically lower default rates.

Obviously, anyone would be upset if their home is not worth what they think it should be particularly if the value was influenced by fraud. It is no question that many places were over priced and will ultimately come down. I have never argued against that and have commented frequently on the fraud that invaded the industry.

G,

So Ed was off by a week or reported results (two calendar weeks as rates have trended up to around 5.5%). Considering a lot of refis are closing now, I would think it is a nice boom to Ed with the commissions rolling in.

There was an uptick in 30yr rates right around the 16th. First two weeks of Jan were up significantly over PY. Of course, there was a little rush last Jan when 30 yr rates dipped to 5.5% (no cost refi) for a short time frame the third week of Jan.

Plenty of brokers have done quite well between Thanksgiving and today.

“first two weeks of Jan were up significantly over PY”

Should have clarified – applications in the first two weeks of Jan were up over first two weeks of Jan 07.

Oh man…I am done. Going to stick w/ work….Jan ’09 vs. Jan ’08.

going to have to disagree on Frow being a babe.

THis building is great. No property taxes for next 8 years since this has been designated as a historical rehab by the city. That is HUGE! Not to mention the lofts which are HUGE also. They still have the car elevator from the time when it was an auto dealership.

Couple of cool vids of the place on youtube

SXN- What will the taxes be after that 8 year freeze? I don’t trust any special deals because I’m sure some home owners forget about the honeymoon tax period and then get caught off guard by their new and improved ownership costs. It’s a cool place but I’m sure you can head south to North Kenwood, buy a run down multi-family for 150-180k, give it the same 250k facelift with the same beautiful finishes, wide elevator and have a place double that size for almost half the price. If you don’t mind being a pioneer to an up and coming location, why not take it 1 mile S/E and get real bang for your buck. I bet the day the developer is willing to unload that place for 350, it would have an offer within weeks. Is there anyway to get to the lakefront from 23rd St?

I doubt there are no taxes on this building. Historic buildings have tax freezes, if a certain amount of money is spent on rehabbing the building.

as a broker, all i have to say is there are only two kinds of agents and mortgage brokers right now – people making less money than they did before and liars.

I have watched this building for a long time.I think what people are missing here is that there may be only 1 or 2 units left from the developer.

I don’t care what area you are talking about,but when you are talking new construction,most developers have many more units unsold than sold.

Somebody likes these units and bought them,because the developer did not negotiate very much on prices and options.

They are very unique and much different than any of the new construction available thru-out the S Loop.

I went to the open house tonight to look at this building. There were three units open for viewing. All had high end finishes and were beautiful. The layouts of all three were really strange. The bedroom of one unit had windows that are on the deck of the unit across the hall. Very strange…as if there were no forethought in the designs at all. In my opinion, the neighborhood is really bad. Boarded up buildings, people hanging out on street corners. I just find it hard to believe that this neighborhood can bring in the same price psf as the gold coast or the loop. Very unique units but I don’t think they will not appeal to the average $600,000 condo buyer. I have been looking for a condo for almost two years and the units actually seem to be getting worse.

Tricia: Thanks for the update on the Open House.

Two years? Haven’t you seen just about every building? LOL!

What is causing the delay? Just haven’t seen anything you like or is it price?

Just curious.

Sabrina

The scariest part of searching for a condo in this city is that you can search for two years and still find out that you have not seen it all. I think the reason that we continue to search is that there is so much to choose from. Also, I am seeing condos still on the market that I looked at last year and the price is $100,000 down from then (15% – 20%). Makes you just want to sit back and wait to see what might happen in another year. We are purchasing a home that we will probably live in until we retire. I guess I’ll just know it when I see it. I have also found that the realtors in this city, most times, do not know as much about the current inventory or neighborhoods as I do. I guess in a city this large, just about everyone thought that they could be a successful real estate agent and never bothered to educate themselves or keep up on the market. So I am doing the research myself, usually, from the ground up. Your blog has been helpful. Thanks

1- How are the numbers worked to say someone making 200k can’t afford 600k?? Should leave him with plenty for discretionary.

2- It is not necessarily to get pants to drop. Does no one here realize there is a certain feeling you get when you come home to your own place, when it is designed how you like it, that simply gives immense joy.

I live in this building. The tax freeze is worth $70k in savings over 8 years, then taxes go up gradually in years 9 through 12. The units are quite unique and beautifully restored and finished. While there are many Chicago lofts, there are very few that reach such a high level of finish and elegance while still being a restoration as opposed to new ‘loft-like’ construction. I agree that for $600k there are much better locations to choose from, but the trade-off here is that this place would cost over a million if it were in a nicer neighborhood. 20 owners in this building here have chose a ‘large, beautiful, and unique’ space vs. an ‘ok space in a nice neighborhood for the same money.’ You will be hard-pressed to find similar level of luxury and finish for $325/sqft anywhere in the city. That kind of pricing typically gets you something “nice,” but not “nice enough for an architectural magazine,” which is what these units are. Motor Row Lofts, which is the Cadillac building across the street, does not even come close to the same level of finish but still manages to impress people who check it out. In my opinion the rare product in this building, even compared to the rareness of that product, is why this building is 90% sold whereas that one is around 55% sold.

Yes, the neighborhood is dead and boarded up but with the 8 – 10 year horizon required to receive the full tax savings benefit, those who buy here believe the area will improve in that time-frame.

I’d like to add:

I’ve noticed that commenters love to rip apart any place up to about $1m as being ridiculously over-priced, but once it goes over that dollar amount, people seem to lose their grip on relative pricing and start to say “wow, if I could afford that place, I’d buy it, it’s beautiful, etc.” Some of the mansions up in the Astor area come to mind. The reason people behave this way is that we base real estate pricing on comps, but once you get into truly unique high-end spaces it becomes difficult to use comps or we just don’t have any other comparisons against which to base our opinions accurately. It’s easy to value a 2006 Mercedes S500 but it is hard to value a specialty collector’s car. The comments that people bring, like “I can buy a faster, bigger, or newer car for the money” just go to show that it’s not always based on comps because people value certain aspects of a car or a home differently. There is a group of people, small, yes, that place a premium on architectural design. Chicago has great properties but not that many with modern yet tasteful, blending old and new, architectural design. If you want that package in a loft the selection pool is even smaller. I’m not saying its for everyone, but for those that are set on finding a high-end, masterfully crafted and rehabilitated loft, there just isn’t that much to choose from in this City.

WM,

I agree, the lofts are unique and have great finishes. However, your neighborhood is scary and you probably overpaid. Sorry. On this unit, 350-400K MAX.

Units 407/408/409 appear to remain unsold by the developer. There are 22 units and 22 parking spaces according to PIN records. It appears that #402 purchased 2 spaces. I wonder how that will work out for the remaining units in this location?

Here are the unit sales from public records with LTV at time of purchase (and at time of refi, if applicable.)

Unit # Clsd Date Sold Pr LTV Refi Date New LTV

201 7/20/2007 $263,000 96.7% 3/27/2008 98.5%

202 7/20/2007 $401,000 cash purchase

203 7/17/2007 $327,710 76.3%

204 7/17/2007 $370,000 90.0%

205 11/5/2007 $322,000 100.0% 8/11/2008 99.4%

206 10/9/2007 $429,500 94.9% 12/20/2007 95.3%

207 7/31/2007 $474,000 165.1% same owner as 305

301 11/30/2007 ???????

302 7/19/2007 $407,000 77.6%

303 7/20/2007 $330,000 90.0%

304 7/9/2007 $374,000 92.0%

305 7/31/2007 $360,000 162.7% same owner as 207

306 10/4/2007 $401,000 90.0%

401 7/26/2007 $495,000 82.1%

402 8/13/2008 $630,000 80.0%

403 8/23/2007 $554,000 79.4%

404 11/16/2007$630,500 95.0%

405 8/6/2007 $581,000 94.8% 1/14/2008 94.8%

406 8/20/2007 $567,500 70.5%

I wonder if the “teaser” tax rate was required for some of the high LTV borrowers to qualify for their mortgages? It remains to be seen if distress will appear in the building before the tax break runs out.

Some people see nothing but addresses and comps. *sigh* It’s not quite that easy.

A crappy cookie cutter floorplan at the right price appeals to some while an awesome floorplan and nice finishes like this at a higher price appeals to another.

To the guy who suggested a SFR in Bridgeport…really? BRIDGEPORT? LOL, no wonder you like Mustangs too. Probably a Sox fan…

Check out the crime stats near this 600K place. WTF! You’re a stone’s throw from one of the biggest heroine mills in the metro area. Enough arrests to give CSI a lifetime of material going on here. Demolish the projects and clean up the filth and this might be worth a second look. When there are many diamonds to choose from…why pick the one that is floating in a toilet of diarrhea.

“Demolish the projects and clean up the filth and this might be worth a second look. ”

Looks like they are:

http://chicagojournal.com/main.asp?SectionID=1&SubSectionID=60&ArticleID=7287&TM=54392.38

The comment that got me banned from Joe Zekass’ site was along the lines of: and another bastion of intergenerational poverty is relegated to the history books. Today is a day for the good guys.

Then Joe proceeded to call me a racist and ban me. Too bad for Joe in this market he’s gonna wish he remained a social worker in a few years time when his advertisers start dropping like ebola patients.

Joe has gotta be hurting in this market. Serves him right.

Now 408 is up on Craigslist for $550,000

http://chicago.craigslist.org/chc/reo/1120092254.html

The Harold Ickes public housing project are the reason for the high crime rate centered a few blocks away from this location. The demolition plan is now official and all funds needed to carry out the demolition have been earmarked via a Federal grant. While this alone will not miraculously turn the neighborhood around, I remain bullish on Motor Row long-term for several reasons, not the least of which is the general urban planning trends in Chicago for this part of town. I think given the new market realities ‘long-term’ is the only way to look at things anyway. With time, this southern cap of Michigan Ave will absolutely become worthy of showing to all those countless McCormick Place visitors who decide to step out of the West wing for a stroll to “see what Chicago is like.”

While not this development there is an auction going on at Motor Row Lofts (2303 S Michigan). I could paraphase much of what is on Yochicago but read it from the source here:

http://yochicago.com/sheldon-good-to-auction-20-units-at-the-motor-row-lofts-in-the-south-loop/11622/

Any more news on this place? The area is still iffy right?