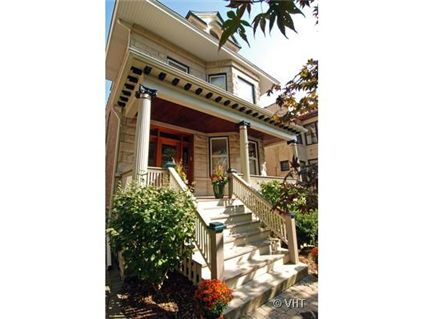

11 Months Later, Greystone 2-Flat Sold: 5207 N. Magnolia in Edgewater

We last chattered about this vintage 2-flat at 5207 N. Magnolia in Edgewater in April 2009.

See our prior chatter and pictures here.

It had a 2 bedroom/1 bath first floor unit and a 3 bedroom/1 bath owners unit with a rooftop deck.

There was also a 2-car garage. Each unit had its own central air.

The greystone had many vintage features, including leaded glass.

Pamela J. Ball at Baird and Warner had the listing.

5207 N. Magnolia: 5 bedrooms, 2 baths, 2 car garage

- Sold in December 2000 for $537,500

- Sold in June 2006 for $820,000

- Listed in October 2008 for $830,000

- Was still listed in April 2009 at $830,000

- Sold in September 2009 for $779,000

- Taxes of $6784

- Central Air

Keep these price drops coming. At $799,000, it is still unlikely to sell.

ME, did you even read this post?

Uh, it did sell….

That’s $400K a unit in a soft rental market. How much rent does it take to pay the bills on this? I figure about $2000K a unit minimum, figuring roughly. The taxes sound pretty low, so figure they will be adjusted steeply upward on the next tax bill.

How did it get financed, I wonder. But I’m reading that the FHA is underwriting some pretty preposterous loans these days, and 95% of the home loans out there now are one way or the other backed by a government agency.

Stay tuned for the FHA bailout in 2011.

My guess here is SFH conversion… which selling for 800k is still a complete ripoff in edgewater

The buyer is “5207 MAGNOLIA LLC” and they don’t have a mortgage recorded (which I would expect to see by now.)

HAHAHAHAHAHAHAHAHAHAHAHAHAHA

um ok so a base price for your SFH conversion is $800K? and your ability to cover the mortgage with rents is nill?

can someone explain this to me?

Sounds like a gut-rehab developer project, then.

“The buyer is “5207 MAGNOLIA LLC” ”

So, what do they need to do to this property to turn it into $1.55mm+ in aggregate re-sale value?

“The bottom is in.” “Buy now or be priced out forever.”

An LLC with the property address. Hmmm. Why? Whats the angle here?

A quick search online leads me to suspect that the LLC is a means to getting at the 8K tax credit perhaps?

I think that the sellers essentually sold it to a LLC of which they are the holders. They have rented out both units and the LLC is to protect themselves from potential lawsuits.

http://www.mcshanecorp.com

The main guy from these companies is the same guy who formed the LLC to buy this home.

“I think that the sellers essentually sold it to a LLC of which they are the holders. ”

If so, they shouldn’t have recorded a warranty deed–they paid a bunch of transfer tax for what should be a freebie.

“So, what do they need to do to this property to turn it into $1.55mm+ in aggregate re-sale value?”

Move the house to lincoln park?

Duh….’sold’….sorry, I’m dumb today.

They’re not going to get 2k a month when 1.5k comps are going begging… My guess is SF conversion.

Nicole : so they sold it to themselves, paid all those fee’s took a loss?

That 2 unit is on one of the best streets in Lakewood/Balmoral (andersonville). It is surrounded by very beautiful and large Victorian single family homes. The price isn’t out of line for the area. My guess is they are going to turn it into single family home which are in the upper bracket in that area…

“the upper bracket”

So, you think this turns into a $2mm+ home?

What can I say, I was taking a stab at a theory. The former owner and the holder of the LLC have the same last name and I am pretty sure both units are currently rented. The former owners had bought it to convert it to a single family, they had plans drawn up and they never went through with it. It is a beautiful property in a great neighborhood but this awfully close to foster and shares an alley with broadway. Also, in this market I find it hard to believe paid this amount. In this market no two flat has sold for this price in this ‘hood.

Didn’t define upper bracket… There are $1m-1.5m single families in that neighborhood. The properties rarely come on the market and when they do, they usually sell relatively quickly. Highly desirable area.

If I were to move back into the city, I would try to score a 2 unit to convert to a single family on Magnolia, Glenwood, or Balmoral.

“Didn’t define upper bracket… There are $1m-1.5m single families in that neighborhood. ”

Yeah, well, I don’t think that “upper bracket” in Chicago includes barely $1mm homes. Maybe it will (again) in the future, but not right now. Maybe there’s someone who agrees with you, but for that limited purpose, consider me a Missuor’an.

I think it’s foolish to invest that much $$ in a SFH that shares an alley with a bunch of vacant or nearly vacant commercial space and thus is a genuine wildcard AND is only one lot in from a busy street.

ps: Balmoral? Really? It’s only a lot-front street west of Glenwood (had to check that); do you mean Wayne or Lakewood?

So the seller-owner incorporated an LLC, and then “sold” it to the LLC? To pull cash out of deal perhaps? Don’t know how to look up ownership partnership of LLC, but wonder what connection is to McShane. “Senior guy” McShane is too suburban of an older guy to move to Edgewater, or Lakewood-Balmoral more accurately.