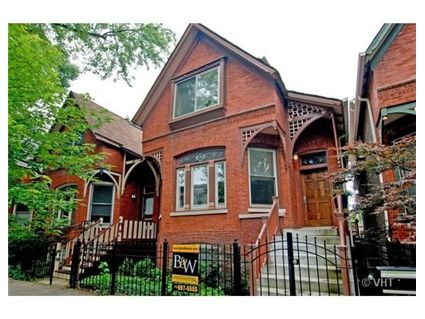

4-Bedroom Historic Bucktown Cottage With Contemporary Flair Still Available: 2235 W. Homer

If you love the look of vintage but want contemporary finishes then this 4-bedroom historic home at 2235 W. Homer in Bucktown is for you.

We have chattered about it several times, most recently in November 2010. See our prior chatter here.

Since it was originally listed in June 2010 it has been reduced $50,100.

Built in 1878, 3 of the 4 bedrooms are on the second floor which has cathedral ceilings.

The fourth bedroom and a family room are in the finished walk-out lower level.

Some of the vintage features have been preserved including original stained glass, crown moldings and mahogany inlay in the dining room.

The kitchen has stainless steel appliances and granite counter tops.

Built on a 24×100 lot, the house has a 2 car garage and central air.

Robert John Anderson at Baird & Warner still has the listing. See more pictures here.

2235 W. Homer: 4 bedrooms, 4 baths, 2 car garage, no square footage listed

- Sold in June 2001 for $250,000

- Sold in May 2005 for $648,500

- Sold in July 2008 for $831,500

- Was listed in July 2010 for $850,000

- Reduced

- Was listed in November 2010 for $829,900

- Reduced

- Currently listed for $799,900

- Taxes of $8394

- Central Air

- Bedroom #1: 19×16 (second floor)

- Bedroom #2: 15×14 (second floor)

- Bedroom #3: 12×7 (second floor)

- Bedroom #4: 16×11 (lower level)

This is an interesting place. The vintage facade is unique, I have never been by this stretch of homes. The workmanship and finishes of this place look good. unfortunately that doesn’t equate to the 800k asking in this climate. $650k gets this one sold.

I’d live here with only minor floor plan changes. I like that the backyard pours out into the play lot. I like it for the ’05 price.

I agree with the others. It’s back to the ’05 price for me. It’s got a lot of charm from the outside and the inside has some nice lines and other architectural features. It’s decorated nicely, but I wouldn’t equate these finishes with the asking price.

Maybe it’s the angle of the picture, but do you really think you can fit 2 cars in that garage?

mid to high $500’s. conforming loan plus large 20% down payment. NOTHING about this home screams JUMBO loan, except for maybe a bubble purchase, just months before the crash.

Here’s my comment from July explaining why it sold for so much in 2008.

“#homedelete on July 21st, 2010 at 10:11 am

Beautiful home. I really like this house. I could live here.

However:

July 2008

$624 1st mortgage

$123 2nd mortgage

10% down payment

______________________

$831,000

Behind most fancy homes are even more exotic mortgages.”

Speaking of mortgages I just clicked on the mortgage calculator on the B&W site. They say with 20% down after taxes and insurance the monthly nut it $4,510. They estimate your income requirement at $132k! Are they high? At $132k you’re taking home 65% of that (10% in your 401k) which leaves you $85,800 or $7,150 a month. They think you should spend 63% of your income on your house, not even considering gas/electric/water & sewer, etc.

“They think you should spend 63% of your income on your house, not even considering gas/electric/water & sewer, etc.”

I can buy 10 packs of Ramen Noodles for $1.00.

of course spending 65% of your income on this home makes perfect sense if you plan on selling your house for a million dollars or more in 3-5 years when the ARM resets. You eat ramen for three years, sell, walk away with $300,000 profit.

Oh wait, they haven’t held six or 7 years….maybe they should wait until 2015 and then they’ll be OK.

“#Chris on February 3rd, 2011 at 3:14 pm

Speaking of mortgages I just clicked on the mortgage calculator on the B&W site. They say with 20% down after taxes and insurance the monthly nut it $4,510. They estimate your income requirement at $132k! Are they high? At $132k you’re taking home 65% of that (10% in your 401k) which leaves you $85,800 or $7,150 a month. They think you should spend 63% of your income on your house, not even considering gas/electric/water & sewer, etc.”

Chris:

You always “qualify” for more than you can “afford.” Subtle difference. Standard qualifying ratios are 28/36. 28% of gross monthly income to PITI and 36% gross for PITI plus major installment and revolving debts. Typically included are car notes, student loans, and min payments on credit cards. Banks don’t look at 401k contributions, savings, how much you spend on cigs, gym memberships, etc.

Rule of thumb is 3x’s gross annual income for how much you can qualify for.

Great looking place on a nice block. I’d say $750 might get this one sold.

Russ,

I agree on 3x gross income…which means $396k worth of house using the same $132k income on the B&W calculator, not $799k. Do realtors still try and push people into houses they can’t afford? Or the real question is can people actually still qualify for more mortgage than they can afford?

hey, HD – i commented on another post a few weeks ago where you talked about those two-mortgage setups for a jumbo loan, but i dont think you saw my comment.

some banks are STILL doing that – i know two people last year that got around doing a jumbo loan, by doing a $417k mortgage and then another one for whatever the remaining amount was and with anywhere from 8-10% down total. I think the people I know did have great credit, but those ‘exotic’ mortgages still exist. Again, I don’t know how hard it is to get – but still interesting.

“You eat ramen for three years”

Adding to the suggestion above, don’t have any money for going on trips, gym, shopping and then end up getting cancer with the poor health hoping someone will inherit the house and make a profit on it.

We saw this some time back. IMO, it’s an odd configuration by the kitchen. See the kitchen photo with the sink? That T-shaped area behind the sink is an open cut-out to a very small room. Moving towards the front of the house, the next space in front of that small room is a dining room. The busy nearby play area and the finishes were also negatives for us, but everyone’s needs and taste are different. Haven’t thought about this in ages, but the cut-out thing/way that space is configured is still mystifying!

Chris:

Depends on what is programmed into their calculator. The reality is that Fannie/Freddie with good credit allows DTI up to 45%. Sometimes we can get to 50% but they tweaked the automated approval engine so it is much harder to get.

$4510 / 45% = $10,022 a month. In theory, if you had no debt other than the house you could qualify for it on $120k.

Borrowers should figure out what they want to spend based on their own budget, not what the bank says. The reality is most people spend more than they think on misc things that aren’t considered during qualifying for a mortgage. Underwriting guideliens haven’t kept up with reality

You can still do piggyback mortgages with great credit and 10% down. Much cheaper than getting one loan with PMI which is the main advantage.

I was just about to say that the 28/36 DTI ratios are old school and the 45/45 is the entirely new paradigm but you said it first.

“#Russ on February 3rd, 2011 at 3:36 pm

Chris:

You always “qualify” for more than you can “afford.” Subtle difference. Standard qualifying ratios are 28/36. 28% of gross monthly income to PITI and 36% gross for PITI plus major installment and revolving debts. Typically included are car notes, student loans, and min payments on credit cards. Banks don’t look at 401k contributions, savings, how much you spend on cigs, gym memberships, etc.

Rule of thumb is 3x’s gross annual income for how much you can qualify for.”

whitecity – i didn’t know you could still do that. the loans I see around here are all either 20% down or FHA 3.5% financing. amazing people are still lending like that. there’s a lot of money floating around.

russ – are banks openly offering that as options to borrowers?

Whitecity. Some do and some don’t. It is much harder to get second mortgages and not every lender has access to them. Generally speaking, if you are buying a house, you can get them up to 90% CLTV with great credit. Condos are typically capped at 85%.

“the loans I see around here are all either 20% down or FHA 3.5% financing. amazing people are still lending like that. there’s a lot of money floating around”

Ahh – HD- you are beginning to see the light. Just because you deal with foreclosures/bankruptcies does not mean that the entire country is dealing with the same. Open your eyes and broaden your perspective and you will see that the world is not in as bad shape as you think. I seriously am beginning to think that your job is really starting to affect your overall outlook. Don’t go down the road of negativity – it will bring you nothing but unhappiness. Maybe you should go into managing or “advising” rich people – you will see a whole new fun world out there.

Great house. Great rehab job. Amazing comic book collection in the basement. 6 flat screen TVs. Great location. But it’s a two up with an office they’re calling a bedroom and the fourth bedroom’s in the basement. Can’t see it for this price, as it’s not really an option for people with 2 kids.

Cheap looking windows and garage for the price and of course small rooms as anticipated for a cottage. 650 max

I looked at this house. As was mentioned before, the kitchen set up is indeed odd. What is that room next to the kitchen? Why didn’t they include that space into the kitchen when remodeling? A galley kitchen when you have the space for a more traditional kitchen?

This home is one of a series of identical homes built on Homer Street. They are known as the Shepherd Cottages. The home two doors down recently sold in the low 500’s.

This home is way overpriced!

“This home is one of a series of identical homes built on Homer Street. They are known as the Shepherd Cottages. The home two doors down recently sold in the low 500’s.

This home is way overpriced!”

I agree the ask is high, but the one that sold is pretty different (2bd/1.5ba, spiral staircase). I dunno, someone would probably buy this place in the high $600K range right now.

“Maybe it’s the angle of the picture, but do you really think you can fit 2 cars in that garage?”

Yes, if you have *nothing* else in the garage. Try to put a lawn mower and a snow shovel in, too, and you’ll ding your own doors.

I looked at some 80/10/10 packages and the jumbo interest rates sucked. I had 20% to put down, but still did a few searches and found nothing worthwhile at all, and my credit and income are fine.

2233 Homer came on market recently at $675K (similar to 2235, but basement is not finished). 2235 still listed at $799K.

http://www.redfin.com/IL/Chicago/2233-W-Homer-St-60647/home/13356368

2233 w homer: it makes no sense to me to buy a house in 2008, have two cribs in the house, and then try and sell three years later. talk about short sightedness. If you’re going to have multiple children, why pay so much money for a tiny tiny house with no yard for junior and princess to play? bucktown in notorious for short lots with small homes and no yards at ridiculous asking prices. Regardles, this is a costly misktake. There are $655 in mortgages on the house at if it’s listed at $675 this is going to be a tight sell at that price. They’ll be bringing cash to the table to get out of this one.

“have two cribs in the house”

I forgot, was going to mention the multiple cribs (did you buy something fancy miumiu?).

“why pay so much money for a tiny tiny house with no yard for junior and princess to play?”

Tell them to hop the fence to Ehrler (which I never like that much for whatever reason).

Can’t let children play unsupervised at a public park because some creep might be hanging out there looking for prey. Abductions rarely happen in backyards on or the property of the victim (except ms smart in utah), they usually happen on the street within a 1/4 mile of the victim’s home ie the park across the street or walking home from school.