Flipper Alert: Some Flippers Getting Realistic in 600 N. Fairbanks

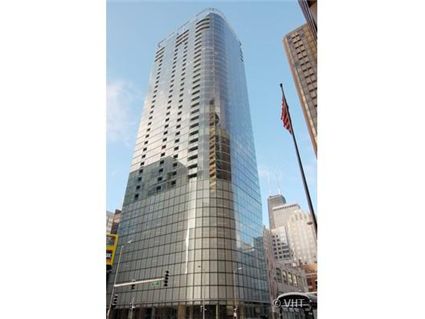

It’s time for an update on 600 N. Fairbanks the Helmut Jahn modern skyscraper in Streeterville that started closings the first week of November 2007.

Out of 227 units in the building, the current building statistics are:

- 25 units for sale

- 8 units for rent

This is the highest number so far for the building. Two units are both for sale or for rent. That comes out to about 14% of the building either for sale or for rent. Closings continue.

There appear to be some decent rental deals in the building, such as this one on a 1700 square foot 3 bedroom, 2.5 bath unit on Craigslist from the Chicago Apartment Finders. They are asking only $4200 a month. The ad claims it is “way below market.”

3bdrm, 2.5 bath, Laund in unit. Gourmet Ktchn with top of the line appliances,Hdwd floors, Surround sound wired thgroughout. 1 block off Boul Mich, this never lived in top of the line unit is priced to move. $1800 per mo less than identical lower floor units. Walk-in closets, Fitness center, Balcony, Doorman, pool, club room, Sundeck, Heat/A/C Cable included.

This is Streeterville’s finest new landmark building. Be the first to occupy at a price that is way below market. Dont ask why, ask when you can see it. Come ready to rent, this is an oppertunity which will be gone soon and will not come again. Just listed today. Will be gone tomorrow.

Some of the small one bedroom units that are being flipped have been coming down a bit in price probably because of competition.

Unit #1403: 1 bedroom, 1.5 bath, 873 square feet

- Currently listed for $395,000 (parking is $60,000 extra)

- Listing says it is a “Rare developer’s unit”- implying that the buyer never closed because the 1 bedroom units were sold out. I cannot find an original sale price.

- Schatz Realty LLC has the listing (they were NOT the developer’s agent)

Unit #1503: 1 bedroom, 1 bath, 873 square feet

- Sold in November 2007 for $423,000

- Currently listed for $448,000 plus $60,000 for parking

- Listing says it’s “Ready for Occupancy”

- Koenig & Strey has the listing

Unit #1603: 1 bedroom, 1 bath, 873 square feet

- Sold in November 2007 for $404,000

- Currently listed for $410,000 plus $60,000 for parking

- Listing says it is “Priced for Buyers- This is not a flip”

- Rubloff has the listing

As you can see, the selling will be tough for #1503 because these three units are basically identical. (I couldn’t find pictures for #1403- but trust me.) In this building, everything was pretty much already upgraded. It’s just a matter of what finishes you chose.

As far as I can tell, NO UNITS have resold since closings began in November 2007. However, the flippers trying to rent out their units have been more successful. A half a dozen or so have rented.

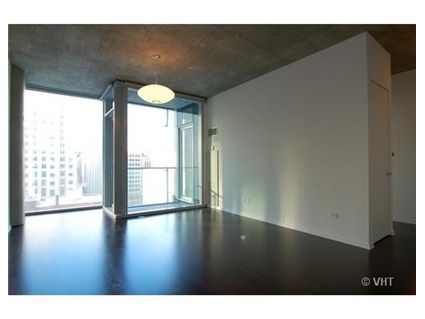

Am I crazy for liking these units? I really like the modern details in the interior of these units (even the exposed concrete ceilings) and am curious if this is attractive to most buyers, or only a handful? I am thinking of going to view a couple of these this weekend.

I bought a unit here pre-construction (haven’t closed yet). I had a chance to check out a unit last week and they are incredible and definately unique. What can’t be captured in a photo is the impact of the 10 foot ceilings, they are amazing. There are certainly some design quirks and there is very little storage, but overall there is a segment of the market that is going to love this building.

D

10 foot ceilings aren’t that high. Standard is 9 foot. You really don’t get a lofted feel until you hit about 12 feet.

This building is definitely going to deter a lot of buyers who are interested in more standard interior design, but personally I like it. That being said, I think it will be a tough sell. My guess is your buyer’s demographic will be young finance types, and they’re not faring too well right now.

in addition to the 10ft ceilings u have 10 ft tall windows which something like 340 on the park is lacking. I have seen many of the units and having many of these windows in a room gives an amazing feel.. way too exposed w.o. shades though

Yes- the floor to ceiling windows takes some getting used to. It’s like nothing in any other building, actually. You almost feel like you can fall right out of the building!

There are also floor to ceiling windows in some of the bathrooms, which makes things interesting.

I’m not sure there is another high-rise in the city with 10 foot ceilings. Also, I’ve been to cocktail parties, and “young finance types” is not even remotely close to the demographic that bought in this building. It was mostly empty-nesters and older design-minded folks. This is not a building for everyone, but for people looking for contemporary design this is a gem.

FYI, I meant to say that I’ve been to cocktail parties hosted by the developers for buyers in the building.

D

I was just in 1720 S. Michigan and they have 10 ft ceilings. Also, X/O, and the Vetro, too, all have floor to ceiling windows. But Sabrina, maybe you are making a distinction btw floor-to-ceiling unbroken by cross supports, and sheer glass floor-to-ceilings?

What’s makes the fairbanks windows unqiue are they are 10 ft tall and 7 ft wide with no cross bars. Imagine havong 2 to 5 windows like these in your rooms..

Yes, I meant that there are no cross supports. In fact, there are almost no windows that open in the units! (because it would have broken up the aesthetic.) You have the doors to your balcony and, if you’re lucky, one or maybe two small windows that open about 3 inches (the ones I’ve seen have been in the bedrooms.)

Not going to get much of a spring breeze in those units!

But they ARE unique as far as what’s on the market. They aren’t for everyone- but worth checking out. 1720 S. Michigan is a similar contemporary design (with the use of the concrete etc.)

Kenworthey- did you go on the South Loop Tour on Sunday? Do tell.

I did–it was very interesting (and very fun). I sent a detailed report to you as a “tip.” I’m happy, however, to write it wherever you think best. Perhaps a comment in a post about each building? (I believe you’ve made at least one post about each of the five on the tour. You can send me an email telling me how to proceed. (Short answer: prices are probably too high, but 1720 S. Michigan might not be, and was surprisingly nice given the price point–and even NOT given the price point.)

DeaconBlue. I will defer to your knowledge on the buyers’ demographic. Could you be more specific though? I have a hard time imagining empty-nesters, especially if they are coming from the suburbs, getting used to exposed concrete wall and ceilings.

The problem I have with the glass curtain they used for this building is that it should only really be done when you have a great view of a park or water, and should be avoided when it is located somewhere where you see rooftops and neighbors. The simple reason being you’ll have to close your shades and never get to enjoy the huge windows.

I’ve been in a few of the units here, and most of the time I walked away thinking – all that exposure to see rooftops? I’d rather actually have SMALLER windows.

Unless you’re walking around in your underpants, many people (like me) would say, Who cares if people can see me? And at night, I’d rather have a view of rooftops (or more aptly, city lights) than of the pitch black lake. (I spend most of my time at home after dark, anyway.) You are right that the building is not for everyone–but for urbandwellers and urbandweller-wannabes, the design is lovely. (The main flaw is not design, but expense, in my opinion!)

when you say rooftops you must be referring to the north facing units. I agree those views are not excitimg other than Hancock. The south facing units givegreat views of tribune sears and sheraton. I agree nightime lake is just blk nothing exciting..

I think that less people are like you than you think. I have no phobia about people seeing me, but one’s apartment is usually taken to be more of a private space.

I don’t mean to sound negative on this building, because actually as I mentioned before I like it. In fact, it’s probably one of the nicest buildings I’ve come across for new construction. I love the design for the most part, have my qualms with the wood doors but love the bathrooms particularly.

I agree though that pricing does not reflect current reality, to put it mildly.

The proof is in the pudding, ja, and given mls listings, you just might be right. I counted 25 resales in 600 N Fairbanks just now; I don’t know if any were relisted and then sold but at least a few I recognize as having been there since the building started closings. And that doesn’t include Craigslist, which I’ve not looked at…

The window shades are great if you want some privacy or to knock down the sun. Also, the appliances in Fairbanks blow the other condo projects out of the water. Wolf, Sub-zero, Meile and the lobby is even very cool.

I talked with someone who bought in the building and she said it took some time to “get used to” all of the concrete but that she does love the modern feel of it.

The appliances and finishes are excellent. I agree wtih Sally that this building blows most of the others out of the water (especially in that price range.) And from what that owner told me- about 90% of the buyers in the building bought those blinds that cover the windows. Sounds like that was vital for privacy (and also to make the building look uniform from the street- when you are looking at it from a block away.) Heaven forbid someone should have pink lace curtains or such!

There are, however, quite a few flips in the building. But that is apparently the norm for new construction now. I’m guessing that it will be about 25% to 30% flips by the time all the units close- which would be around what the “experts” were saying were investors in the Chicago market in 2005-2006.

Few thoughts- Virtually everyone bought the blinds and they are likely to become standard at the first board meeting. As for the demographics, the people I saw were definately urban and sophisticated, not really people from the burbs. I actually remember a bunch of alternative lifestyle folks as well (I consider that a good sign!). There is definately a subset of the market who is really into modern design and architecture that love buildings like this. It’s definately unique, but it’s the best contemporary building in the area, IMHO, and I think it will hold its value really well once the flippers are out. As for the view, I’m on a high floor and won’t be looking at any rooftops. I was in the NW corner 2 bedroom on the 25th floor the other day and the view was incredible- lake to the northeast and out the western windows a great view of Trump/the Loop. The view north to the Hancock was actually better than I thought and you can see Playboy tower. It’s not the best view in the city but it’s still awesome. I’m curious what the breakdown of the flips is- are they mostly 1 bedrooms?

D

Totally unsubstantiated, but I have a friend who’s been flipping real estate for years and he said that he did some research and that there were fewer flippers in this building then most of the other new construction towers. Think of it this way- I think there are about 220 units in the building and there are only 25 on the market right now. I know for a fact that they are closing up to the 29th (of 41) floor right now. Even if only 3/4ths of the flippers have put their units on the market already (very unlikely that anyone is waiting to list a high floor or penthouse) then you end up with 35 flips or so, which is a lot less than 25% of the building. Probably will end up closer to 10-15%, which really isnt’ bad, especially if they are mostly one-bedrooms.

D

It is more than that….sorry, I like the building (and have a client in it) but a lot of the flips are 2/2s

Which two bedrooms are being flipped? i’m just curious what they are asking because I haven’t seen many 2/2s listed. I’m really glad I got preconstruction pricing, I think that anyone who bought at full market value over the past 1.5 years is probably not getting their money back.

D

Deaconblue, do you have a list of preconstruction pricing? Sure would be interesting to compare.

Deaconblue,

At 600 N Fairnbanks, in mls, for sale right now there are:

1 3/3.1

5 3/2.1

3 2/2

9 2/2

6 1/1.1

1 1/1

There are also four units listed for rent on Craigslist. (2 3BR, 1 2B, and 1 1BR). Not known whether they are the same as ones listed for sale.

there is but I as an owner would think would be better not to publish it.

Here are the obvious 2BR flips that I found today, it looks like some ohters have already been pulled from the market.

#1402 closed 11/12/07 $503,200 asking $624,900

#1802 closed 12/7/07 $640,000 flip closing 12/11/07 $576,394

#2307 closed 12/28/07 $535,000 asking $629,000

#3402 pending contract 7/10/07 $692,000 asking $705,000

It looks like the flipper of #1802 understood that his flip was depreciating rapidly. That comp will hurt the others and probably prove to be a falling knife for the ‘lucky’ buyer.

Hi G,

Something is off with 1802 on the MLS. The original closing price from the developer was 576,394, the owner then flipped it for 640K. I can tell this by looking at the agents on each transaction. The 576 was from FRANCESCA CAWLEY ROSE who worked for Koenig/Developer

Streeterville Realtor,

Thanks for the clarification. I would correct that if I were the realtor since the MLS clearly shows the lower priced closing coming after the higher one. Considering it is the one resale I could locate, it will impact appraisers/lenders if it is left as is.

If so, then #1802 flipper made $65K on his/her investment. VERY nice work in this market!

Don’t forget about the commission and closing costs. Due to the error in the MLS, it is difficult to tell if there was carrying costs as well. Even without, the profit would be less than half of the $65K. Still pretty good considering the bloodbath to come.

The flipper definitely found themselves a knife catcher. Considering all of the uninformed buyers that created the bubble, it isn’t surprising that there are still some around. That is why prices deflate slower than they inflate the bubble.

You are correct G. The flipper probably paid 5-6% commission, so didn’t make very much….think of the closing costs for 2 closings in the same month!

I amend my statement: The realtor made about $32K. VERY nice work in this market! 😉

G,

You make everything sound so negative. It isn’t as bad as you portray it but perhaps you are pessimistic in general.

I own in the building.. its not pessimism its fact… u try to flip for 10 percent more but 5 percent commission will kill u if u sell shortterm vs. wait it out..

kenworthey,

the agent likely did list it and sell it so it would be 1/2 of the 32K that the agent made…..correct???

oops….meant to say didn’t instead of did….sorry

Sally,

I am very optimistic that housing will become much more affordable in Chicago in the near future. I happen to think that is a very good thing. I don’t think there is anything pessimistic about that outlook, wouldn’t you agree?

You see, what you think I portray as “bad” is in fact very good. Very, very good.

Kenworthey,

Your amended statement made me laugh out loud. I think used home salepeople are going to find it increasingly difficult to command such fees in the future. This will be due to the public’s coming realization that they dispensed a lot of bad advice to buyers. I am thinking along the lines of “real estate always goes up” and “buy now or be priced out forever”, etc.

It happened to stock brokers and it will happen to used home salespeople, too.

But you don’t think that 600 Fairbanks is a good place to own a condo?(it certainly is much better than the St Clair)

65k will not return you 32k post tax if they used a broker on both ends. 35k for broker’s commission, then you have closing costs (attorney, capital contribution, mortgage interest if there was a holding period, mortgage fees if they did get a mortgage, etc.). And then factor in taxes of 30-40% depending on their bracket. They’re lucky if they came out with 15k in the end.

Ja, don’t go blowing it for the agents that are depending on knife catchers. Informed buyers are not what got us into this bubble and informed buyers are not what they need to put food on the table. The flipper of this unit was indeed lucky compared to what other flippers will get “in the end.”

Sally,

It is a good place to rent a condo, if it appeals to you. There are sure to be rental deals due to the number of accidental landlords. Maybe it will be a good place to buy a condo in the future. It sure isn’t now.

Why anyone interested in the building would buy now is beyond me. Rent a unit, save the difference, and buy later at a lower price.

so what kind of price do you think is a good deal on one of these one bedroom units? I mean, if people are going to take a bath like you are suggesting, then when is a good time to jump in and buy one???? What price point would you recommend.

I’d think that $330 to $350 including a parking spot is probably “reasonable” for the one-bedrooms. I might ratchet that down, depending on the assessments.

I was thinking the same… but maybe that’s just wishful thinking!

What was the range of presale prices on the 1BRs? Anyone know? If $330 to $350 far off from what they were selling for about 2 years ago? Because if so, that’s somewhat consistent with various things I’ve heard, like that appraisers are frequently now considering 2004 or 2005 prices as the “real”.

Also, and on a related/unrelated note… $65K for parking??? I know that is the norm now for Streeterville units… but why? A parking floor is less expensive to build than a unit, I suspect, and well, look–you can fit several cars into the same footprint as an apartment! What gives? There’s an economic theory here just waiting to be offered (and just saying “because the market will bear it” doesn’t cut it for me.)

I would be curious what the new psf construction cost is now on a highrise such as this. Could one even build a tower with 900 sf one bedrooms with parking selling for $350,000?

There are 227 units in this building. Don’t forget- when figuring out what percentage are being flipped in the building, you have to take into account that a decent number have already been rented. At least a half dozen or more.

I would actually think we’ll see MORE units being flipped in this building (and not less) simply because they sold a lot of 1 bedroom units in the building.

The 1 bedrooms ran from 330ish to mid 400’s for high floor. They range in size from 800 sq ft to 940 or so.

There are actually 208 units in the building because of people that combined 1 bedroom units. i.e. unit 2211 that is for sale right now.

There seems to be lots more places to live vs. places to park, thus the reason parking is high…..supply and demand.

I don’t think they will go to $350K including parking. Time will tell. Maybe $400 including parking.

I don’t have a list of preconstruction pricing, but my unit looks like it was discounted about 8% compared to the units above and below me which sold later. G, you need to go away if all you are going to do is be negative and pick fights.

D

P.S. Your comment about stockbrokers was completely wrong, by the way, more people use brokers for advice now than ever before and I doubt that realtors are going away.

Deaconblue,

In fact I think it is true that the presence of brokers will decline over the long run, although they will never totally disappear. Too many people have just had bad experiences with too many brokers and don’t trust them any more. It’s not something that will happen tomorrow, but 20 years from now I would bet that broker commissions are substantially lower and we have a more open MLS system not monopolized by realtors.

As far as 1bd’s in this building, I think you’ll see them revert back to lower 300s without parking. This year is going to be bad for housing, and right now we are in the midst of a collapse.

Just because G doesn’t say what you want to hear don’t tell him to leave. Albeit he could do it in a less snide way, nevertheless what he says I agree with generally.

PS It’s hard NOT to be negative about real estate in times such as these.

PPS Any appraiser using 2005 figures is clueless as that was the peak. Right now I’d use 2004 numbers, and 3 months from now when you see the real pain I’d use 2003 numbers. Again, you probably don’t want to hear this but it’s what will happen. And I’m an owner btw, just facing reality

“now I’d use 2004 numbers, and 3 months from now when you see the real pain I’d use 2003 numbers.”

Although ’05 wasn’t really the peak in Chicago–more like summer of ’06, that’s probably a reasonable guide–reasonable asking prices should be ’04 numbers and offers should be based on ’03 numbers. If you’re selling and want to close, you should be prepared to accept ’03 numbers.

Speaking with many investors, I am told fall of 05 was the peak, although it probably took some time for prices to start declining. Of course I will, as always, retract these claims in light of data if anyone has any. I’ve been unable to find any charting prices in chicago over the last 7 years.

anon,

To get to a reasonable price for units here, then, you’d take developer’s prices (which were ’05 numbers), and discount by whatever Streeterville appreciation was between ’03 and ’05? (What was it, anyway? 10% a year?)

That results in extraordinarily low estimates of the value of these units. According to previous poster, the cheapest 1BR was about $330K in ’05. If appreciation between 2003 and 2005 was 10% a year in Streeterville, then 2003 price estimate would then be roughly $275K. Yet these units are asking $495K. They can’t possibly be asking for $220,000 more than they are worth, can they?

I’d love to live in this building–hey, there’s a side of me that would thrill to see a $275K 1BR there, but a much bigger side that is a bit skeptical of of prices dropping to 2003 levels. Or are my underlying calculations/assumptions wrong?

whhops–cheapest 1BR is actually asking $395, not $495. Still, $120K more than they’re worth by these calcs…

ja (9:49): The investors are probably focusing on when the peak was as far as them making money–Fall of ’05 was probably the peak of a combination of minimum market time and price. From everything I have read, prices continued upward into ’06, though market times went up (i.e., sales went down). From an investors perspective, a longer holding period means making a lower return–so $450k tomorrow is much better than $460k in 180 days. Looking backwards, as we are doing, generally ’05 prices were lower than ’06 prices, and time from listing to sale isn’t important.

Kenworthey (10:21): The pre-construction prices should have been set at a level that made the developer its expected return if all of the units available sold pre-construction. I don’t know if the developer made all of the units available for pre-sale. It’s probably not reasonable to think that the units have depreciated from their construction cost (at least, not yet), but it MAY be reasonable to think that they aren’t worth more than the actual cost of construction (which is lower than the original pricing by some amount–altho probably not 20%+). You should assume there hasn’t been any genuine appreciation in real estate ‘value’ since ’03–so pre-construction prices first available since then should be the rule.

It’s also not crazy to believe that a lot of seller’s are over-pricing condos by $200k–it’s happening all over. I certainly think that asking $495k for a 1 br is pricing it at least $100k over what it is “worth”–5% appreciation (too high, but not ridiculous) over 3 years makes the $330k into $382k–and that $60k for a parking space is nuts; it should be $30-$40k (which is still nuts). The $395k “developer’s unit” isn’t out of whack, but I still think it’s high.

That said, I don’t think that there’s a good way to KNOW what the ’03 price was for a building that didn’t go into pre-sale until ’05. You need to look at roughly comparable units in nearby buildings and adjust for the relative quality of the units and building. Since there is general agreement that 600 is a lot nicer than nearby buildings, and the units are nicer, you’d have a significant upward adjustment. Would it really get you to $330k for a 1 BR? Maybe, but I’m not too interested in doing the research needed to figure that out.

anon–thanks for such an informative series of posts. Much food for thought. 🙂

http://www.nytimes.com/2007/07/12/us/12parking.html

Anon, would you pay 225k for a deeded parking spot???

For Parking Space, the Price Is Right at $225,000

“In Houston, $225,000 will buy a three-bedroom house with a game room, den, in-ground pool and hot tub.

In Manhattan, it will buy a parking space. No windows, no view. No walls.

While real estate in much of the country languishes, property in Manhattan continues to escalate in price, and that includes parking spaces. Some buyers do not even own cars, but grab the spaces as investments, renting them out to cover their costs.

Spaces are in such demand that there are waiting lists of buyers. Eight people are hoping for the chance to buy one of five private parking spaces for $225,000 in the basement of 246 West 17th Street, a 34-unit condo development scheduled for completion next January. The developer, meanwhile, is seeking city approval to add four more spots.

Parking in new developments is selling for twice what it was five years ago, said Jonathan Miller, an appraiser and president of Miller Samuel.

Kenworthey,

You said “To get to a reasonable price for units here, then, you’d take developer’s prices (which were ‘05 numbers)”

Remember, I bought my unit in October ’05 and got and 8% discount to the market price at that time (and those prices sold out in under 30 days for 2 bedrooms). The real market price at the time I bought was much higher. I find it really hard to believe that the prices could drop below the intial pre-construction prices. The only way I can imagine that is if we get some panic selling and then within 6 months the prices will jump back up again, regardless of the comps. I don’t think I’ve made more than the initial 8% discount, but I think this building will end up holding its value very well compared to other projects once the speculators clear out.

D

Kenworthey,

Regarding parking, the prices are so high because if you live in the building, you basically have no choice. There is no other convenient parking nearby so they can charge a lot and people will pay. There were 2 or 3 different price points and I chose $65k to be on the first floor. It sounds like a lot but it’s really only $150/month which is well worth it. If anything, they could have charged more because a lot of people wanted multiple spots and couldn’t get them!

D

Deaconblue, I have asked this before: What’s so negative about predicting increased affordability of housing in Chicago? It will positively impact at least as many people as it will negatively impact.

And for anyone who thinks a building cannot go below the developers cost, there is plenty of proof of that happening before – even in Manhattan after their last bubble burst.

City Agent,

Are you actually saying that NYC is not in a bubble? Do you know what happened to the last RE bubble there?

No, I won’t be going away soon. Just like the real estate crash.

Deaconblue,

Can you please explain how $65 is only $150/month? 65K at 6% for 30 years is almost $400. + tax and assmnt, which will run you about $100 together. So you are paying about $500/month, where you can rent one for $200-$300 a month

G, NO I’M SAYING THAT NYC IS NOT IN A BUBBLE… I’M SIMPLY ASKING ANON IF HE WOULD PAY 225K FOR A DEEDED PARKING SPOT IN NYC???

G, I MEANT TO SAY, “YES I AGREE THAT NYC IS IN A BUBBLE… “

the 3rd flr parking may only be $x/month but your spot cost $13k more than mine… Question is can you get that money back when you sell?

BTW, gotta love the heat parking garage!

Oops met 23K more… mine was 42k… granted on a higher flr.. but such a small building radius it goes up fast…

No, no I wouldn’t pay $225k for a deeded parking spot in Manhattan. But then, if I lived in Manhattan, I doubt I would own a car, and even if I did, it wouldn’t be a nice one. Besides, $1400+/month is a lot of cabfare.

Also, city agent, you shouldn’t post full articles here. It could cause Sabrina trouble, if the IP police for any of the quoted sites come looking.

Anon: Thank you for pointing that out to City Agent. Yes- you cannot just post the full articles in the comment sections.

The price of parking is a good question. What makes it valuable in one building and not in another?

American Invsco has been trying to sell parking spaces in Millennium Centre for years. They keep lowering the price.

http://chicago.craigslist.org/chc/rfs/540880706.html

Deaconblue:

Even with no interest, and amortized over 30 years, $65k is $180/month. Even if you pay cash for the parking spot, and assume no cost of funds, you’re going to be paying almost $300/month.

To get $150/month, at 6% interest, it would have to be $25k. And that still excludes tax and maintenance.

Youre right, it’s more than $150, I didn’t do the calculation and was just making a point! $65k at 6% (my rate) plus taxes is $475 or so. Plus, you can write off the interest, which is like getting back $150/month for the first few years and then you also get about $80 a month in equity by paying down the principal so at the end of the day it’s about $250 per month down the drain. Whatever the cost, it’s worth it to not have to drive up 12 stories everytime you get home. I’m sure that the people in the penthouses with only one or two spots would be more than willing to take it off my hands if I ever need to sell it.

D

G,

I didnt say that the price won’t go below the developers price, I said I don’t expect it to happen. The next 18 months are going to be brutal for the downtown condo market, but Chicago never seems to go to the extremes that the rest of the country does. I think the best buildings will simply stay flat to slightly down and the average buildings will drop 10% or so (we may already be at that platue).

As for NYC, if this environment doesn’t break the bubble, what will?! NYC is such a global city and people from all over the world are pouring money into real estate there because it’s a steal if you are paid in Euro’s. I wish they’d bring their money here instead!

D

These are very beautiful condos, and it’s strange they’re not selling at these prices.

Either $4200 is way too much rent or the asking purchase price is

way too low…. and we know it’s not too low,because if it were , these places would have sold.

Using the usual multiplier of 160X rent to come up with a purchase price, I come up with $672,000 for a fair purchase price.

Yet these units are priced in the $300k-$400K range and are not selling. At these prices you could buy as cheaply than renting, with 20% down and a 30-year-fixed at 65.

So the rent being asked is way above the market.

Excuse me, I mean a 30 year fixed at 6%

G, Just curious….have you bought and sold lots of real estate in your lifetime or do you just like to voice your opinion?

Deaconblue: Do you REALLY think that this is the bottom for the Chicago market? REALLY?

It would be nice if that were true, but sales continue to fall and until that changes I don’t know how you can call a bottom.

My concern is with all of the excess inventory. Yes, we’re not downtown Miami (thank goodness) but there are a dozen or more buildings that are coming on line just in 2008 (not to mention the smaller midrise buildings.) Most of those buildings are not sold out.

Unless a lot of buyers show up, I think the excess inventory will eventually lead to even lower prices.

Sabrina,

I generally agree. However, do you think it is possible many developers will convert unsold units to rentals rather than sell them off cheap? It’s a very common phenomena, though the reverse of what we’re used to the last few years.

I think this is a real possibility for many building whose sales have stalled out. And this should temper some supply.

That being said, this ain’t the bottom. Next winter will be I suspect.

ja: Yes, I definitely believe we will see a lot of developers simply rent out their remaining units (we are seeing that already.)

As I’ve said, there are going to be some really good rental deals out there. Renters will be able to get “luxury” condo units at pretty affordable prices.

I’m not sure if this is the bottom, it certainly may not be but it also wouldn’t shock me if, in retrospect, it is (or at least a plateau). Think about it- the mortgage market is frozen, no one can borrow as much, and we are in a seasonally slow part of the season.

I agree that there is a scary amount of inventory coming online, but the mortgage markets will improve over the rest of the year. If we go into a deep recession, which I don’t think we will, all bets are off. As I stated earlier, I think that the best buildings will fall a bit more, then plateau, and mediocre ones will probably fall another 10% (on AVERAGE, some will do worse). That doesn’t mean we will get any appreciation for several years, but I think a lot of the nicer buildings will eventually sell at the same prices they went for in 2005, it will simply take a lot longer than normal.

This kind of reminds me of the bear market in stocks in 2002 when very famous, smart people thought that the stock market would drop another 50% and instead it doubled! The wages in downtown Chicago vs. housing prices are really pretty good compared to most cities, so that will provide a floor, it’s just going to take some time to work through all the inventory over the next few years. Maybe I’ll be totally wrong, but I sense extreme pessimism in the housing market right now and that’s often the sign of a bottom.

D

In regards to the parking… Millenium Centre is not heated and also isn’t private (at least until you circle all the way up to the gated part) and also doesn’t provide direct access to your condo unit. Fairbanks does have all of the above. It may not make the parking worth double, but it makes a big difference to not have to deal with a crowded public parking garage and get into a cold car all winter.

Deaconblue.

Do you know how many units have closed in the building so far? it is my understanding that the top floors won’t be ready until march….it that still the case?

that’s true. so far they have closed to 27… 30 or 40 percent have moved in.

I rented at plaza 440 for 2.5 yrs and the cold winters sucked when taking the car out and then having to take one elevator down and walk to the lobby and then go to another elevator. I agree the fairbanks setup rocks.

fairbankslover,

are you currently renting in the building?

sorry, i just realized you bought in the building. my apologies. i’m glad you are posting positive feedback. the doom and gloomers may just be sitting on the outside wanting in. it is one thing to be pessimistic when owning one but another if only wishing to own one.

sally yeah I bought a 1 br preconstruction jan. 06. I am concerned about the prices. However at the time Fairbanks was considerably cheaper than any of the other new developments such as cityfront park view etc. w. the exception of st. clair but we know how that is going.. I think the 1 br 08 09 units are nice but some of the 2 br layouts are funky. 07 has a almost nonexistent kitchen and small living room and the 05 has awesome closet space but a huge pillar in the master br..

Since I am an owner, perhaps I am being overly optomistic, but I tend not to agree with the extremes of any argument. As for the 2br’s, I agree that there are some design flaws, but nothing that can’t be worked around. The pillar in the 05 bedrooms is odd, but I’m just going to put a flat screen on it so it won’t really matter in the end. I’ve heard the living rooms in the SW 2br’s ended up being tiny, which is too bad since they will have a jaw-dropping view of the Loop!

D

db: “The wages in downtown Chicago vs. housing prices are really pretty good compared to most cities”

That’s true, but that still doesn’t make the income to price ratio good. How many people working downtown also (a) want to live dt; (b) make at least $100k; (c) have at least 10% cash down payment; and (d) want a one or two bedroom? That, plus a v. small pool of rich people wanting a pied a terre, is your resale market.

DB–“That doesn’t mean we will get any appreciation for several years, but I think a lot of the nicer buildings will eventually sell at the same prices they went for in 2005, it will simply take a lot longer than normal.”

There is no doubt that some properties will hold their value much better than others, but the only way out of a further drop in prices in the near term is significant inflation, which would prop up nominal prices, but still cause a real loss of value. And anything selling for $350k in ’05 that also sells for $350k on (say) 2015 actually costs less in 2015–with 5% annual inflation (high, but not unreasonable) it would be “worth” 63% less.

DB–“This kind of reminds me of the bear market in stocks in 2002 when very famous, smart people thought that the stock market would drop another 50% and instead it doubled!”

I don’t recall anyone believing that the market was going to drop another 50%, but I’ll even assume that’s true. Stocks are not a good proxy for residential real estate–residential real estate is illiquid, requires maintenance, won’t produce cash flow w/o intervention and is completely consumer driven. I think that the parts of Chicago discussed here are safe from 50% drops in nominal values, but I am absolutely certain that there will be no doubling of REAL values in the next 5 years or even 10 years–if you are able to sell that 1 br for $660k, it’s going to be mostly a result of inflation.

And before anyone starts, I own in the city, so this isn’t me rooting for y’all to lose your shirts so I can get in cheap. I’m just afraid that it’s reality.

so where do you own and why do you like to focus on fairbanks so much?

deacon I think you have one of the better 2 br if u bought 05. 07 theres no working around such a small kitchen or living room.. I think that’s a tough sell.. I love your living room and glass enclose br.. have u gotten used to the window in the bathroom ;)?

sally:

Why don’t you go first, if you want to know about me?

But seriously, why is this the most commented upon post I’ve seen here? Probably b/c it has a lot of comments–comments breed more comments. Most of my comments have been general market comments, rather than 600 specific.

And anyway, why do you care?

I just find it odd that you have so many opinions about 600 and don’t live there.

Sally,

I find it odd that you refer to those who see the current bubble for what it is as “doom and gloomers.” Like I asked before, what exactly is pessimistic about increased housing affordability?

I find it odd that you want personal information from those you disagree with. Why not attempt to address the points that anon, ja, Sabrina or I have made?

I also find it odd that you are surprised that people comment about real estate on a real estate blog that allows comments.

sally:

I looked back and, other than reference to price points, I don’t see what I’ve posted that couldn’t be applied to any other building in Chicago. The most specific thing was my assertion that a parking space isn’t worth $65k–DB disagreed with me (and CA asked me about NYC), and I stand by my opinion that parking in Chicago is worth that, to me, in any location, not just in 600. Maybe I missed something else specific to 600–if so, please point it out.

I guess you must be one of those people who feels if one isn’t directly involved, one’s opinion isn’t valid or, as least, one should keep one’s mouth shut. Does my fixed rate mortgage disqualify me from having an opinion on ARMs? Since I live in Chicago, should I stay silent if the topic of Highland Park–or, heaven forfend, Pakistan–comes up? And since you apparently live in 600, I will assume that you have no opinion about any other building.

G & Anon,

I happen to think 600 is a great building and I’m happy with my purchase. Neither of you own there so really, you can’t comment to the extent some of us can. As for flippers not making money, if they make $5K, that is more than you made by posting on this blog. Get in the game if you want to have more emotion.

ja,

No doubt that developers will be renting units if they aren’t taken back by their lender. This will further depress rental rates and accelerate the downward trend in sale prices. This will happen because it will cause the flippers to experience even greater negative cash flows, the weakest will begin defaulting, the foreclosure/short sales will reset the sales comps, and the downard spiral will be in full force. Bubble prices were already too high for absorption to occur at historical levels based on income and rental rates. The only new ‘paradigm’ was the incredible foolishness of bubble-era buyers. The massive over-supply yet to be delivered just about guarantees that the optimistic affordability predictions come true.

I don’t think that any amount of pessimism towards increased affordability can stop it from happening.

Sally,

“Get in the game” and lose money? Why, just to save some greater fool?

Do you even realize that the renters in your building are currently “making” a lot more money than the purchasers? And they will be able to buy at lower prices later.

Sally,

No need to get so defensive. Most of us are just discussing where we see the market headed and giving reasons, not just shouting nonsense.

You ask us to get in the game rather than post on here? You seem to forget that one can save a lot of money by waiting this downturn out. Someone who’s been in the market for a year or two has probably already saved 100k if not more.

I just see no reason for someone to purchase at this moment. I’m an owner and am realistic about the future of the market. This certainly is not the bottom.

Signs of a recovery are when supply starts to shrink. Unfortunately for the Streeterville area, that isn’t going to be any time soon. Not with all the new construction moving forward (Peshtigo, Chicago Spire, etc.). Plus you have a lot of places slated to close soon and add more inventory. For instance, Park View Condos by MCL Companies will start closings in April. They have stalled at 75% sold for some time now. Flippers will come out soon enough.

It just isn’t look good at all. There is absolutely no reason to think this is the bottom.

anon–I’m sure whether or not others appreciate your posts isn’t your motive for posting, but for what it is worth–your posts are incredibly evenhanded, informed and interesting. You win my personal popularity contest. 😉

comparisions are comparisions and while other buildings have stalled, this one did not stall or so it seemed. folks were comparing this to st clair and that really isn’t a fair comparision.

i hope your stocks are climbing up up and away these days. i’d like to see what you think about the current stock market.

Other than real estate brokers, flippers who want to give the appearance of high demand, or condo owners in the market to sell within the next 3 years, it is hard to imagine anyone with any knowledge of the downtown condo market, no matter how limited, who reasonably thinks we have hit bottom or are even within 6 months of bottom; and my opinion is not limited to this particular property. We will continue to see an oversupply in both rentals and units for sale, downward price pressure due to diminished demand, short sales, foreclosures, and auctions.

Sally,

I shorted the market a long time ago, and thankfully so. I’ve made quite a bundle.

Not sure really what the point of your comment was to be honest.

Anyone know what the absorption period is in Streeterville right now? It’s measured by total # of units on the market divided by # of sales in the current month (sometimes seasonally adjusted).

That figure should give you an idea of how bad the situation is. 6 month absorption period is considered a balanced market, anything above is a premonition of price reversion.

How long before 2/2s in this building drop to low 500s? 3 months?

ja,

Your estimate may not be far off considering that some flippers closed at those prices last month and are currently losing about $4000/month (plus what they could be making elsewhere on their downpayment) hoping to find a knife catcher.

The low $500’s will not be the bottom.

K–thanks. you’re correct that affirmation isn’t my motivation, but it does make it more engaging to post when at least one person appreciates what I (or anyone else) write–even if that person were to disagree with everything.

Sally–600 seems like a really nice building. If it suits you and you want to live there for a while, then I think that’s great. If you thought you were going to live in it for 24 months (to get favorable tax treatment) and then sell it for a big profit, I really think that you are going to be disappointed. As I own my home, I’m disappointed that values aren’t going to continue to increase forever, too, but (1) that’s the nature of the market and (2) the year-to-year increases in home prices that we had in 2002-2006 just were not sustainable with relatively stagnant wages.

Maybe gas will get so expensive that everyone who can (including a bunch of companies) moves back into the city, but that’s not a 5-year plan, more like a 20-year plan. But hey, US real estate has always been built more on enthusiasm than actual scarcity; maybe we can gin up some enthusiasm in ’09–it just ain’t gonna happen before the election, the dollar is too unstable.

G–

I’m going to hold you morally responsible if dear Sally has an aneurysm.

I’m not saying that G’s wrong, but I’m not quite as pessimistic about the genuine “high-end” buildings. I’d really hate to be holding one of those 3180 LSD condos at over $500k, tho. Those are going to regress to mean pretty hard.

i’m fine. i’m glad to have a nice place to live and right in the middle of great shopping, a heated garage etc….once upon a time, your residence wasn’t considered an investment…i think you would agree that should still be the case.

i’m glad to hear you say something nice about the building for a change.

what is going on at City Front Plaza? I looked at that one as well but 600 was the better purchase for what i wanted.

sally–

not to beat a dead horse, but where did I say anything negative about the building? I’ve been talking about the market in general. If you think that discussing the bad real estate market in the US (and Britain, and soon the rest of Europe) is knocking a particular building, even if that building was the jumping off point for the discussion, then I sugget you stay away from discussions of real estate for the next 5 years or so.

Thanks for bringing the civility back in anon. I think we know one thing for sure… this building gets people going. I don’t think it is a great building to look at in regards to what is going to happen on average to the Chicago condo market. It is pretty unique and was well sold and I don’t think that 50% of the building is going to try and be flipped. I think cityfront and parkview will tell the tale a little better. And I am not saying that to insult anyone that bought there either, I am not as pessimistic as some… but I do think that being less sold and a little less unique will show the effects of this credit crunch and housing bubble a little more acurately. I think there are a lot of people who bought in 600 to live, like Sally, and I also think that most of those people chose 600 over the 4 other buildings going up in streeterville at that time. Anyway… I am about exhausted on this one, so hope we can move on. Afterall, we all have ideas, but none of us really know at this point.

one last question you guys, since the market is so unstable right now, how is it possible that the spire could get financing? i have to think some of these projects are not going to come out of the ground.

i’m not trying to argue, just asking?

one word…. foreign invesotrs w. the currency exchange rate being favorable and santiago name…

The developer is willing to commit about 1/2 billion of his own dollars. Supposedly.

“how is it possible that the spire could get financing?”

If it does, it will all come from Ireland, and it will be b/c the dollar is really, really cheap. Construction costs will probably also fall a little bit (or at least not go over budget), as materials costs fall and there is more available labor.

“i have to think some of these projects are not going to come out of the ground.”

No question, several, if not all, of the buildings that have not even started foundation work will not be built. There’s the possibility of another Steppenwolf theather garage conking out around floor 3 or 4 and a reasonable likelihood of something like the black bldg in the 1200 or 1300 block of Wells happening, where litigation prevents closings from happening for 6 or 7 years.

Anon,

I agree with you about real prices, but it depends on how you look at housing wealth. If most homes in Chicago drop by 10% and mine stays flat, I have more purchasing power then I did before. Perhaps I could have rented and saved the difference, but it won’t add up to that much in the scheme of things. As for my comparison to the stock market, of course the real estate market is diffent, I simply was making the point that when EVERYONE is pessimistic, it’s often the sign of a bottom in any market.

D

P.S. Bill Gross, a famous bond investor, was who I was referring to regarding the 50% drop comment. He called for “Dow 6000” right before the market took off.

fairbanks lover,

I haven’t moved in yet, I can’t wait! I got to go into an 05 unit, though, and it was awesome! That’s too bad about the 07’s because their view is staggering!

D

Just an overly optomistic question for you all- even though suppply in Streeterville will go up later this year, won’t demand as well? We are in the slowest time of the year for sales and the mortgage market is frozen. Both of those things will turn for the better later this year. It’s not going to save the market, but it’s something to consider; things cannot get much worse, so they can only get better. That said, I think the Fairbanks is an example of a really plain vanilla building that is going nowhere. 600 NF is basically sold out except for the penthouses and its a very unique product. The Fairbanks and Parkview are both very average and the Parkview has a crappy developer who tends to do awful interiors.

D

P.S. My stock portfolio is market neutral so I’m actually up for the year!

What are prices at the Fairbanks for 2/2s?

Deaconblue: I guess we will have to know what the market is like for $500,000 one bedrooms in Streeterville. I’ve seen some sell pretty quickly- but that was before about 100 of them came on the market (between Avenue East, 240 E. Illinois, 600 N. Fairbanks, 550 N. St. Clair, 600 N. Lake Shore Drive and soon, Park View.) I’m only guessing that there will be at least 100 (if not more of them) flipped.

Also, the two bedrooms are now being priced where a professional 20-30 something couple would likely have a hard time affording them. Many of the two bedroom flips are listing in the mid to high $600,000 and even $700,000 range. This isn’t your “average” buyer.

And if the mortgage lenders are still stingy about handling non-conforming loans, those over $417,000, it will be difficult to get a loan.

We won’t know until all of these units come on the market though- sometime in the next 6 months.

Sarbina,

You are right about large mortgages begin harder to attain, but there are ways around it. I got a conforming mortgage and then a second mortgage for the difference. The average rate between the two was much less then if I had gotten one large one. Rates have plummeted in the past month which can only be a positive thing. I respectfully disagree on affordability, it’s still much better in Chicago than many other places where wages are lower. Adjustable rate mortgages were never as popular here as on the coasts for that reason, so I think it’s more of a supply/demand issue then affordability.

There was an article by Blair Kamin in the Tribune on Friday about 600 NF. Very positive response! http://www.chicagotribune.com/features/lifestyle/chi-0120_jahnjan19,0,1628247.story

Yes, the article is very positive about 600 N. Fairbanks and Helmut Jahn. It IS a nice building and a great addition to Streeterville.

Also interesting that it confirms that Schatz is the developer as there are 5 units from Schatz Realty on the market recently.

All of these were sold prior to closing. That means we know at least 5 units came out of contract. Schatz is pricing them pretty competitively (not trying to flip them for a ton of money.)

They priced the two bedroom 2007 unit at the same price as the unit that just sold in a flip. It forced 2107 to lower their price by $50,000 to stay competitive.

By the way, I thought it was interesting that they mentioned in the article how there are few windows. In some units, you have only one window that opens a few inches. All have doors to the balconies that can be propped open in the summer however.

“Yes, the minimalist aesthetic comes with certain rules and quirks: You must have an off-white window shade. Some of your concrete walls may have plug holes from the building’s form-work. The absence of operable windows on the north and south sides means that apartment dwellers there will have to nudge their balcony doors open to get fresh air. And, in a small number of units, residents will have to draw the shades to obtain privacy while in the bathroom.”

DeaconBlue,

Let’s be honest here. We’re heading into a recession, things are only going to get worse from here. We can talk about affordability of this or that, we can say Chicago didn’t appreciate as much as NYC, FL, Las Vegas, or whatever. But the fact remains we have oversupply and not enough demand. And demand is going to erode with the coming recession, while supply (in Streeterville) continues to grow.

600 N Fairbanks is a very nice building, quirky it is true but to my liking. However, to purchase at these levels now is just insanity. Why not wait a year and save 100k?

PS Who would have a market neutral strategy in this economic environment?? Just short it and rake in the money.

PS Bill Gross is notorious for making bad calls. Thank god he doesn’t micromanage the traders at PIMCO, otherwise they would have collapsed long ago.

Some buildings will hold up better than others. 600 N. Fairbanks IS a unique product in a good location (with good press and buzz) so you would think that prices would hold up better there than at, say, Park View down the street which starts closings this spring and is only 70% sold.

A lot depends, in my opinion, on how many investors are in these buildings. 600 N. Fairbanks continues to have closings. It’s about 15% flips so far- that’s under what some other buildings are at. The flipper prices are much higher than what we’ve seen in the past.

Can the market hold up with those kinds of prices? We’ll soon see.

It would be interesting to get financial information on MCL, the developers of Park View and the River East Arts Center (those lofts), both in Streeterville. I would bet they’re not faring too well. I would imagine a lot of flips in there along with people backing out of contracts.

Anyone notice more flips came on the market at 550? N St Clair. Things are going to get ugly this Spring.

ja: I’ve noticed 550 st clair. I’m chattering about it tomorrow. Yes, a bunch of flips have already come on the market in that building.

ja,

I’m not sure what your background is, but to assume that we are going to have a nasty recession just because there has been a lot of bad press lately may be foolhardy. I work for a big bank and there are a lot of smart people who think that this isn’t going to be nearly as bad as the media is making it out to be. In ’98 there was a global banking crises too and the stock market dropped 20%, but the Fed cut rates and and a year later the market was back at all time highs. If you are shorting the market right now, I’d lift your shorts because the market is EXTREMELY oversold based on every technical indicator and we are likely to see a huge rally all some point in the next week or two. I have a market neutral portfolio so I don’t have to guess where the market is going!

D

“financial information on MCL”

I know several people who have had a low opinion of MCL’s build quality since the mid/late 90s. I don’t have personal experience to directly judge, but these are folks I trust on such things.

Deaconblue,

The big banks have been right about a lot of things these days haven’t they? (note the sarcasm) If they didnt “see” the credit crunch coming, they probably won’t “see” the recession coming either. The banks only motives are to prop securities/investments up and keep the fees flowing in… they’ve trained you well. The banks cant and shouldnt make recession references as it would create hysteria in the market. Their pocket books are directly impacted by their statements, so no way would they ever release that info.

Forget the technicals, our economy is in bad shape right now.

fairbankslover:

i have a question related to our building and would rather communicate with you only. my email is skiymca@yahoo.com

thanks

For those of you interested in seeing the units in person, there is at least one open house at 600 N. Fairbanks this weekend.

Unit #2307: 2/2

Asking $629,000 plus $55k for the parking.

This Sunday, Jan 27, from 11 to 1 pm.

There may be others as well as obviously the agents/sellers want to take advantage of the positive publicity from the Tribune article.

I’m at a fund, and I can guarantee we are better at predicting the market than whatever bank you work for. I am certainly glad I didn’t lift my short positions today, I have made a ton of money.

Also, how do you think goldman averted the disaster that other banks are facing – they shorted credit rather than trying to play it market neutral.

And a market neutral strategy is never guaranteed but statistically suposed to work. But guess what, they don’t always and that is why you see relative value funds blowing up. As these drops continue funds with big drawdowns will be forced to liquidate adding more volatility into the market. It is going to get very ugly.

You come across as a novice. And the markets and banks are certainly predicitng a recession now, don’t forget that old inverted yield curve which, while not a guarantee of a coming recession has been somewhat reliable.

Your optimism, once again, is baffling. Do you think the fed called an EMERGENCY meeting just for fun??

And technicals can be interpreted many ways depending on what indicators you use. Looks to me like many trend lines are broken and we are now in a down market. I’m curious what indicators you use. We build our models using different technologies – neural nets, genetic algorithms (classifier systems),CA, and other propeietary systems.

All of our models are showing recession to be likely. How severe I cannot go into. But we have been incredibly accurate. So technically, things don’t look too good.

Bet you’re starting to regret not lifting your short positions today, huh, ja?

I did lift many of my short positions this morning. I’m a high-frequency trader and that is what we do. Markets go up and down intraday, I am following the trend down. I certainly won’t hold a long position but short it down.

This conversation with deacon stretches back to last week, where I told him makes no sense to be market neutral at this point. I have been right so far. Had he listened to me he would probably have made his portfolio a few hundred ks by now.

Buy now and regret it this friday/monday

I told you to lift your shorts because we were due for a short term rally, which I based on Bollinger Bands, obviously and very simple technical indicator. The next day the market went up 300 points as hedge fund covered their shorts. You were wrong. I’m not interested in whatever you claim to do for a living, anyone can claim anything on an anonymous message board.

dow goes from 14200 to 12000 then back to 12300 all within 3.5 months and you’re happy because ?? you don’t think that’s a down trend ??

bollinger bands are what novice investors, such as myself use. surprised to hear someone at a bank actually uses them. you must not be a trader but in back office??

Deaconblue or Sally:

How are the windows in 600 N. Fairbanks in this cold weather? I know they put in special windows in the building but I’m just wondering how cold it is with these kinds of temperatures.

The windows are literally floor to ceiling and in the corner units in that building- the windows stretch across two walls of some of the bedrooms.

Is your heat running non-stop?

Just curious.

I have south facing. My place was 75 F w. heater turned off. Nights I keep it at 70 and its comfortable. I know summers will be brutal But I think the big windows have been good to let light in.

to clarify last weekend when it was 0 and sunny the place acted as a greenhouse and I did not need heater during the day as place was around 77 F

windows seem to be fine…and i have those great sunshades for the summer.

Hello,

Interesting discussion. I live in the “05” tier and LOVE it.

The building is not yet complete and when the amenities and lobby are finished it will be even more stunning. The location and finishes are great as we have all mentioned. I say relax and enjoy being a 600 North Fairbanks resident! 🙂

Fairbanks,

Do you know what else they are putting in the lobby? I heard that more is coming but I wasn’t sure what else they are adding.

D

lofter,

I don’t feel like arguing anymore, go back and read what I originally wrote and you will see what I was talking about.

D

Deaconblue,

I did lift some short positions – it’s pyramid-based – I told you. You don’t lift all at once you’ll have too much market impact.

AND I’m quite glad with how the week ended. Once again, this is a downtrend which you are missing out on. You’ve probably already cost yourself 1MM by not listening to my advice. Just as I would have told you not to buy in 2005 at the risk of overpaying for your condo. 🙂

PS Bollinger bands…..funny. Analyst, or as the other person said, backoffice?

Ja,

I had to laugh when you said lift all at once and you’ll have too much market impact. If you were trading that big there is no way you would spend so much time posting to a blog.

And saying Deaconblue cost himself 1MM by not listening to you… can it get any more arbitrary… why not 10MM, why not just 100k. He also missed out on 1MM by not betting 100k that Maria Sharapova would win the Aussie Open or by not putting 1MM on black last time he went to Vegas.

Let’s use this site to talk real estate and not make yourself feel better about who knows more/less about trading. The people who really make money don’t talk about it.

ja,

I actually don’t work in the back office, I am a janitor. That’s why I live on a high floor at 600 NF. Your posts are just plain silly and immature and I’m not going to argue with you anymore.

D

Spend so much time on this site?? I only found it a week ago or so. And I spend about 30mins a day on it.

I have found it to be an incredibly useful site and will continue to use it.

If you don’t believe I trade size, so be it. Don’t care.

And the 1MM wasn’t arbitrary – it was based on the minimal size of book any decent trader would get.

Have they completed the 41st floor lap pool and gym? I forgot to ask to view this on my recent tour of some units. Is the lap pool actually long enough to swim laps in? (I swim at the Lincoln Park Athletic Club 5 times a week.) I am seriously thinking this building might be the one to buy into as I have not viewed anything else quite like it. It is a about 15% more than I wanted to spend on a 2bd however, but I would just put more money down so that the payments would be “comfortable”. Despite all of the gloom and doom, some of us are looking to buy because we are looking for a HOME that fits our lifestyle and tastes. Good luck to all of the buyers in this fantastic building.

The 41st flr won’t be done until march – june. The owners can’t view the flr due to construction. I can’t wait to see how it looks.

We looked in 600 North Fairbanks, as well, but ended up buying down the street in 600 North Lake Shore.

Mostly it’s a matter of personal taste — 600 N. Fairbanks is very edgy open minimal and 600 NLSD is more traditional. Prices for the smaller two bedrooms are similar in both developments (don’t buy the hype about higher level finishes at Fairbanks — you can upgrade at LSD to the SubZero, Wolf, Bosch thing for a minimal charge)

As I said, we chose mostly on personal taste, but you should check out one significant design problem with the two bedrooms by Helmut Jahn — the corner windows with the great views are in the master bedroom instead of the living/dining room where they’d be better appreciated. More importantly, the master bedroom is set up so there is no good place for the bed — the arrangement of doors to closets, bathroom, living room and the column create a real problem.

Other than that, it’s a great looking building if you like the open exposed concrete floor to ceiling window look and feel.

As to buying too soon or too late to catch the floor, I don’t think that’s important. Buy something you love and live there for a few years and you’ll come out fine. (If you can’t commit to several years in this market, you should really think about renting!)

If I’m not mistaken- isn’t the pool going to be an outdoor pool? Or is that wrong?

The pool is indoors, but there is a sundeck that will be outdoors. I believe the gym is also on the 41st floor which will be fun in that every owner can take advantage of the views. 600LSD does not have a pool btw. There is a picture of the pool on the Fairbanks website. If it is half as great as the image, it will be really great for those of us who work out by swimming.

Sabrina, I LOVE this site. Thanks so much as it is extrememly helpful for someone like myself who is getting ready to buy property in Chicago.

I’m in a 1 bdroom at 600 NF and in the interim, 600 NF has offered us a month-to-month membership at Holmes Place located at 355 East Grand Ave, webist is http://www.holmesplaceus.com if you want to check it out. It is a great building and so close to everything and yet a quiet part of downtown.

Morgan:

If you’re interested in a great pool- check out The Heritage at 130 N. Garland in the Loop.

It has, I believe, one of the best indoor pools of any of the newer buildings.

Morgan,

Don’t know if swimming laps in Lake Michigan is appealing, but the city sets up lap lanes at the Ohio Street Beach along the sea wall next to LSD. I see people swimming laps there with life guards on duty.

It’s a short walk from most any place in Streeterville.

A one bedroom on 29th floor has closed from the developer for $440,000 PLUS parking….it is the larger 923 sq foot one bedroom.

There have thus been three closings at the higher pricepoints in the building if we include the two, two bedroom units. This is the slow time of the year….come spring we will see what really happens.

440k includes or does not include parking?

I hope for buyer’s sake it does. If not, his net worth just declined about 100k.

JA:

Now you’re trying to hurt sally’s feelings. Why you got to be that way on a Friday, hm?

This unit has actually closed? (is not just under contract?)

It would be the first 1 bedroom to re-sell in the building.

Interestingly- if it’s from the developer- it is another unit that a “buyer” didn’t close on as all of the one bedrooms were sold out in that building before they started closings.

By the way- after perusing the listings for the building- there must have been a bunch of closings this week because suddenly a half a dozen more units have come back on the market.

There are several new listings from the developer for 2 bedroom/2 bath units.

ALL of these were sold before closings began.

This could mean:

1. The developer (or “friends” of the developer) “bought” these units initially and sales therefore looked better in the building than they otherwise were

or

2. Buyers are falling out of contract quite regularly.

Not trying to pile on here, but… I walk past 600 N. Fairbanks a couple times a week. I love the images I’ve seen of the interiors… but am I the only one who is “meh” on the outside? Especially the clear glass that has gotten so much press? I think there’s a reason high rises haven’t used clear glass much in the past–in the past few days the glass has looked streaky, distorted and generally dirty from all the bad weather. Unless they’re planning on hiring window washers once a week, I am beginning to suspect the clear glass was a bad idea.

OK, Kenwothey, don’t want to be rude, but the bu0ilding is beautiful. Just compare it to 340 OTP, Avenue East, St Clair, Parkview, 600 NlLSD, or even the older 55 E Erie, no comparison. It is a beautiful piece of architectural art. I am sorry if you don’t appreciate it….or can’t.

It is the best product built in the neighborhood in 50 years.

Kenworthey- that’s funny you say that about the glass. I’ve noticed it too.

They haven’t yet cleaned it since closings began because they are still working on the upper part of the building. I think it will have to be scheduled to be cleaned at least 4 times a year (I would think.)

But that is probably normal in a high rise like that. It’ll be interesting to see if it needs it more regularly than four times a year.

Oh, you were talking about dirty glass Kenworthey? I probably shouldn’t post after 2 glasses of wine!

I finally get it! All I need to do to appreciate 600 North Fairbanks is drink more wine.

But seriously, I don’t think it’s very fair to be critical of dirty windows during construction. On the other hand, I’d think the developer and new owners would want to keep it looking good to help sales — after all, the glass quality is a big selling point.

Yeah, I was talking in that post about dirty glass, but… sorry, Streeterville Realtor, maybe *I* should drink more wine, but I really don’t get the 600 N. Fairbanks phenom (from the outside, anyway. The interiors make me green with envy.) Does my stock lower further to say that I think 340 OTP is really cool from the outside? (If it’s the funky building I think it is, driving from the south on LSD every day. For one other taste reference point, 30 Oak St. that Sabrina posted about the other day makes me go, “wow!”)

I’m willing to be tutored here, honestly I am. What am I missing? I, 600 N. Fairbanks, I see a tall, curved building (with dirty glass, though yeah I know that won’t stay that way) with a big parking podium, and a slightly interesting (but not awe-inspiring) little ten foot jut over the building next door. The lobby is pretty, I’ll grant you that. But what else is so revolutionary about this building? I remember seeing the first proposed plan, with a truly spectacular open, spiraling garage ramp and parking on top of the building next door. That, I could get behind and say “revolutionary.” This? Not so much.

Kenworthey,

I was actually going to agree with you. From the outside I think 340 OTP looks better than 600NF.

Thanks Kenworthey. My post last night was nasty. I do like 340 OTP too and the beautiful views! I don’t like that all units are finished just about the same.

Streeterville Realtor,

Which listing is yours?

Is it me or does 600 appear much greener than blue from the renderings?

Can anyone give me an idea of what a 2br/2ba on a lower floor with a crappier view was initially sold for? Thx

Hello Matt,

I bought preconstruction (2bed/2bath)…1253 sq feet…I closed for around 587,000 including the parking. $60,000 for parking.

It went up about 4,000 per floor from the developer.

I was in a unit 20 floors higher than mine over the weekend and even though the views were nice I do not know if I would spend an additional 80,000 for it.

Hey Deac. Just checking in. How is this prediction holding up for you:

“I’m not sure what your background is, but to assume that we are going to have a nasty recession just because there has been a lot of bad press lately may be foolhardy. I work for a big bank and there are a lot of smart people who think that this isn’t going to be nearly as bad as the media is making it out to be.”

A lot of “smart people” changed their minds yesterday it seems. 😀

i’m a very interested potential buyer in 600 NF, what does everyone believe is the fair value of a one BR? it seems like people feel that buyers who have pre-construction prices are underwater? if so, how low has the market value dropped?

what are the plans for the parking lot just south of Ohio? who owns the air rights? should an 08/09 (or other south facing unit) be concerned with any future plans?

Tom: There are plans for a highrise hotel on the parking lot to the south (where the hot dog stand/parking lot is currently located.)

Eventually- those views to the south WILL be blocked.

Of course, given the current financial/construction climate, it could be awhile before anything is built there.

Anyone else remember the hotel chain that is going in? They’ve already announced it.

I agree with Sabrina. I was told the same too about the parking lot in the SOUTH side of the building by 2 very reliable sources – one is my realtor, and the other one is someone involved in marketing the Fairbanks. But again, it’s going to be a while! If you worry too much about your view being blocked, then don’t buy anything facing south. There are a lot of 1 br’s for sale facing north, but the price is not very competitive at all. It’s not that I cannot afford buying one here at the fairbanks; It’s just I don’t want to be that stupid paying their ridiculously uncompetitive price 😉

little boi – i think i’m in the same boat as you, but what do you think is a competitive price? do you think the pre-construction prices are overvalued given the current market conditions?

From upthread: “anon on January 15th, 2008 at 5:08 pm

I’d think that $330 to $350 including a parking spot is probably “reasonable” for the one-bedrooms. I might ratchet that down, depending on the assessments.”

There is still a long way to go. That is why nothing is selling. Apparently, the buyers aren’t blinking (which costs them nothing.) That is not entirely the case for the sellers. They also are not blinking. But, oh boy, it is costing them plenty.

Is it really a mystery how this will end?

This is the project proposed for 560 N Fairbanks. It is the Graves Hotel with residential above. It is to be over 700′ tall

http://www.graveshotelsresorts.com/graves-chicago.asp

G – i’m not sure i agree with anon, i think the 1br units could be worth more than that considering there is a lot of junk (poor view, small master bath, and old kitchens) 1br places currently available at the $300-350 price point. it seems like the older 1br places will have to fall before 600NF falls and that could take a lot of time. call me crazy, but i think at current prices $400 for a 1br in 600NF seems somewhat reasonable based on other places on the market, but the question is what will happen 2-3 years from now.

marco – thanks for info

what’s everyone’s opinion on hotel/apt/condo buildings? for example look at aqua, you’ve gotta be worried if youre a condo owner in that development because eventually all of the apt’s will be converted

Competitive Price for a 1BR (Tier 03, 04, 08, 09) in Fairbanks = $415-$450/sqft

Competitive Price for a 2BR (Tier 02, 05) in Fairbanks = $425 – $475/sqft

My 2 cents

being new to condos how is what flr u are on priced into sq. ft. The building has about a 90k variance top vs. bottom flr.

In new construction, the high floor premium is whatever the market will pay, just like the sale prices in general. Many delusional buyers were led to believe that higher floors = higher prices as some absolute rule. While it might be the case where views improve as one goes up (and the views are protected forever,) this was actually not the case in most buildings with this pricing structure. Mostly, it was a marketing gimmick.

Qualified buyers in the current market are no longer willing to pay exhorbitant prices that only made sense if you believed that “real estate always goes up” or “buy now or be priced out forever.”

When the correction is complete only the absolute best buildings downtown will be able to hold prices at over $400/sf. The lower end won’t even hold at $200/sf.

The mania has ended and prices will be sticky going down, but go down they will.

Tom,

I’m seeing some 1bd’s in Streeterville at 200k.

http://chicago.craigslist.org/chc/rfs/641305914.html

Sure, you may say it’s junk but at least get the price point of “junk” correct.