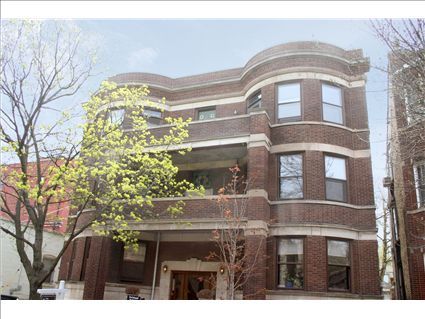

“Timeless Vintage Details” in this 2-Bedroom at 817 W. George in Lakeview

This 2-bedroom at 817 W. George in Lakeview came on the market in October 2021.

I’m not sure when this vintage building was built but it has 8 units.

There’s storage in the lower level and an exercise room.

If this unit looks familiar, that’s because we chattered about it in 2012 when it was listed as a short sale and we debated whether nor not it was a “deal.”

See our chatter here.

G chimed in on that thread. I miss his observations and data. Where’d you go G?

But if you recall, this unit has many of its vintage features still intact and has numerous built-ins.

The foyer has the original beveled glass mirror and there are large crown moldings throughout.

The living room has a brick gas fireplace with built-in glass front cabinets and a mantle.

There are also built-ins in the family room, or dining room depending on how you use the space, which also has its original coffered ceiling.

The “updated” kitchen has light gray cabinets, new stainless steel appliances, quartz counter tops and a subway tile backsplash.

There are refinished hardwood floors throughout.

The listing says the one bath has been “updated.”

The unit has 2 large storage rooms in the lower level and washer/dryer in the unit.

It doesn’t appear to have central air or space pak, but I can’t tell for sure.

And parking may be leased nearby, but I can’t tell for sure on that either. In 2012, however, we debated whether you needed to have a car in Lakeview when talking about this unit.

It has a rear private outdoor deck which is large enough for a couch and table.

In 2012, Laura said:

“Beautiful old place with plenty of space and wonderful vintage details for this price.

Change a few colors and fixtures here and there, and the place is perfect.

I’m surprised by the price drops in Lakeview, Haven’t seen prices like this for a long time there.”

It sold as a short sale in 2012 for $222,500.

The unit has come on the market in 2021 at $400,000.

Do you kick yourself for not buying this condo in 2012?

Derek Disera at @Properties has the listing. See the pictures and floor plan here.

Unit #1W: 2 bedrooms, 1 bath, 1350 square feet

- Sold in August 1987 for $128,000

- Sold in September 2000 for $255,000

- Sold in January 2003 for $289,000

- Sold in October 2004 for $317,000

- Sold in a short sale in December 2012 for $222,500

- Sold in August 2018 for $352,000

- Currently listed at $400,000

- Assessments of $395 a month (includes heat, exterior maintenance, scavenger)

- Taxes of $7453

- No central air (unclear if any cooling)

- Washer/dryer in the unit

- Leased parking? (unclear)

- Fireplace

- Bedroom #1: 11×11

- Bedroom #2: 11×9

- Living room: 16×15

- Family room/dining room: 17×11

- Kitchen: 11×9

- Foyer: 9×7

- Deck: 13×7

“It doesn’t appear to have central air or space pak”

Listing details sez central air.

I see only the minisplit in the dining/family room.

Nice place, but who is the target buyer who will stay for 5+ years? [do NOT point to prior hold periods; looking for who, now]

“Nice place, but who is the target buyer who will stay for 5+ years?”

The same people who bought last time? There was a crib in one set of the pictures in the second bedroom.

2/1s are those ages 27-34 who want to stay in Lakeview but are tired of renting. They may be married or a couple but no kids (yet). Will be starting a family in a few years, or maybe never, as Millennials aren’t having many kids.

Some nice details here however the hodge podge of stain and paint on the woodwork is too much. Some left natural/stained, others painted black, and even more painted white.

Insanely overpriced, wow

“ Nice place, but who is the target buyer who will stay for 5+ years? [do NOT point to prior hold periods; looking for who, now”

PAT for some that want to live in this hood.

Agree with Marco – pick one thing and stick with it

Love the layout (powder room would be nice).

Nooo not the grays. Foyer was so promising.

“who will stay for 5+ years?”

“The same people who bought last time? ”

“Sold in August 2018”

I didn’t know we’d skipped ahead to 2023! Amazing!!

“I didn’t know we’d skipped ahead to 2023! Amazing!!”

Huh?

The people who sold in 2018 had a crib in the pictures, right? They were there for 6 years. That’s who is going to buy it again.

Duh.

“The people who sold in 2018 had a crib in the pictures, right?”

As I stated:

“[do NOT point to prior hold periods; looking for who, now]”

Or are you suggesting that now that the ’18 sellers’ infant is coming up on KG, they will want to move back in?

“Or are you suggesting that now that the ’18 sellers’ infant is coming up on KG, they will want to move back in?”

What is your point anon(tfo)? You asked who would be buying it. The SAME people who have bought it the last, oh, 30 years.

Come on.

You’ve been on this site for a decade. Who do you THINK is buying a vintage 2/1 in Lakeview? The same buyers who have been buying the entire time you’ve been commenting on this site.

All the buyers here have all lived there longer than the 3-year and out period. The next ones hopefully will too.

No one should be buying a condo with only a 3 year time period in Chicago. 5 years isn’t very long, especially for those in their late 20s or early 30s who want to stay in this neighborhood.

Millennials are getting married later and later. They are putting off having children, or not having any at all. It will be interesting to see what GenZ does. The oldest is about 24 now. GenZ has no recollection of the housing bubble. Will they buy condos in their mid-20s? Condos are now cheaper than renting in the luxury buildings. They may see them as a deal.

It will be interesting if GenZ turns out to be a generation that really wants to put roots down. I see it in my kids already.

“longer than the 3-year and out period”

I asked about 5. 3-years and out is a money loser plan–mortgage has to be much cheaper than rent for that to be ‘smart’.

I count 5 owners in 20+ years. Here are their results:

28 months, nominal gain

20 months, nominal gain

8 years, 2 mos, huuuge loss (f/c filed at 6 years)

5 years, 9 mos, big gain (thanks largely to prior default)

3 years and counting–likely nominal gain.

So, we have two out of 5 make it past 3 years, one who wouldn’t have been able to sell after 3, and the other got such a *great* deal on the buy that it was cheap to stay.

This is not going to be a *great* deal, and I’m sure not expecting a repeat of ’08, so I’d expect it to revert to mean which is sub-4 years, rather than over 5.

“So, we have two out of 5 make it past 3 years, one who wouldn’t have been able to sell after 3, and the other got such a *great* deal on the buy that it was cheap to stay.”

Home buyers aren’t buying because they’re trying to make a gain (in Chicago.)

They are LIVING.

That is it.

So, yes, the SAME type of buyer who bought before, will buy again.

It’s a cute vintage apartment. Prior to the housing bubble, Americans lived on average of 7 years in their homes. The housing bust forced people to stay a bit longer. The new bull market in housing means they will probably move more quickly again.

So, the answer is “no one”. No one will stay for 5+ years, at this price, unless they get stuck by a change in the market.

You may say that the ’87 buyer did, but the ’87 buyer paid the equivalent of ~25% less than the current ask, and paid waaaaaay less in property tax, too. A cheap place to live is an asset that imposes different incentives.

“No one will stay for 5+ years, at this price, unless they get stuck by a change in the market.”

You asked “who would be the buyer of this property in 2021” and the answer is the same as all of time. The same as the last 30 years.

No Dan #2 is not buying it to live in in his retirement anon(tfo).

You KNOW this. Why are you still arguing about it?

Yes- 20 and 30 somethings buy 2/1s all over the city. Every day of the year. They may be there 3 years. Or 5. Or 7. Or 10. Who knows?

But I, personally, wouldn’t be buying ANY property in Chicago if I was only going to be in it for 3 years. There are too many costs you have to cover to make any money in that short of a time period, unless we’re back in the 2005 bubble market conditions, of course. But I don’t expect to see those conditions for a LONG time.

“You asked “who would be the buyer of this property in 2021” ”

No, that’s NOT what I asked. You can look right up above; what I asked was:

who is the target buyer who will stay for 5+ years?

And I added a requirement:

[do NOT point to prior hold periods; looking for who, now]

You didn’t like that question, so you answered a different one. You’d do well White House.

No one can answer your question anon(tfo) because it’s a stupid question.

The buyers of real estate don’t change. Never have. It’s still 20-somethings buying condos in Lakeview. It’s still 30 somethings buying their first houses in Portage Park.

Ask a stupid question, get a stupid answer.

“Ask a stupid question, get a stupid answer.”

And you are certainly the one to provide it.

The premise was: this is too expensive to be a rental substitute in this part of cycle. Buying it for 3 years will be expected to result in some capital loss, due to transaction costs.

“Buying it for 3 years will be expected to result in some capital loss, due to transaction costs.”

It’s cheaper than renting the equivalent right now.

But I’ve said, no one should be buying ANY real estate in Chicago for just 3 years. Doesn’t matter what it is.

Transaction costs are too high. You’re looking at 5-7% right there. And Chicago real estate just doesn’t appreciate fast enough to cover that.