Lincoln Park Vintage Rowhouse Beauty: 410 W. Webster

Built in 1885, this 3-bedroom rowhouse at 410 W. Webster in East Lincoln Park has undergone renovations over the past few decades. But it’s vintage charm is intact.

It has central air and a basement rec-room. The third bedroom, however, is very small at only 7×9.

Will only having “covered parking” hurt the sale of this home? (It looks like it has a carport space.)

Here’s the listing:

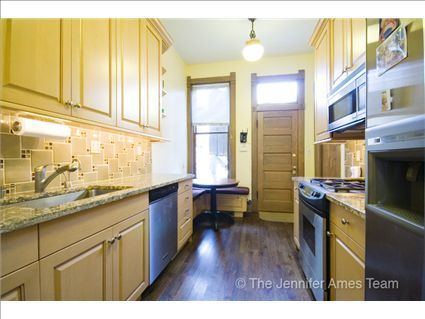

Beautifully renovated East Lincoln Park historic rowhome with covered parking. Well preserved vintage millwork, plaster medallions, stained glass and period lighting. New gourmet eat-in kitchen with custom cabinets, granite, stainless steel appliances and a banquet. 3.5 new baths including two on the second level.

Large lower level rec/playroom with built-ins. Private deck. Lincoln School District. A great townhouse alternative!

Jennifer Ames at Coldwell Banker has the listing. See more pictures here. See the property’s brochure, with floorplans, here.

410 W. Webster: 3 bedrooms, 3.5 baths, no square footage listed

- Sold in February 2004 for $751,000

- Currently listed for $899,000

- Taxes are $10,516

- Central Air

- Carport parking space

- 2 fireplaces

I think what hurts this house is the miniture lot it sits on as well as the fact it is across the street from an incredibly ugly midrise rental building.

Oh and I forgot outrageous taxes.

It is a really well-done listing; too bad there aren’t more realtors who put in the same amount of effort.

As to the neighboring 4+1, it’s actually not too bad, as 4+1s go. As to the taxes–get used to it.

wow–I think this place is great!

Back to back listings of SFHs in areas people really want! Its about time we got some lemonade mixed in with the multitude of RE lemons out there this site frequently features.

Bob, you’ve got it all wrong, the lemons are the overpriced million dollar homes in LP! Personally I like the wide variety of homes featured although I wish she’d throw in a unique suburban property once in a while.

Nice place, and well done. Don’t really have a comment on whether the asking price is reasonably or not. It’s a substantial increase over 2004, but I’m not sure how exactly much work went into it in the meantime.

The 3rd bedroom upstairs is really more study-sized…. 7×9? That’s a tight squeeze.

I don’t think this is a SFH. It’s attached to its neighbor. And I do think it’s too expensive–but not outrageously so.

Very nice – quite frankly, I was expecting the listing price to somewhere substantially well north of $1 million…..!

Too bad we’re going into a monster recession: anyone *bold* enough to plonk down the quarter-million dollar downpayment and take on monster monthly payments right as we slam face-first into an Epic recession is really whistling past the graveyard and can be called the Ultimate Optimist……

When that nest egg is suddenly the only thing keeping you and the the rest of the family from sleeping on a park bench or a shelter, once the pink-slips are delivered next month, (the BigLaw firms are *very* quietly cutting back, the investment/commercial banks, well, we all know about them….)

Perhaps it’s best to keep all that cash someplace safe, like short-term savings bonds, then to take down a big-ticket item like this and find yourself, or your significant other unemployed (or both) and re-discovering what “cash crunch” REALLY means……

The sad thing is that this looks like a wonderful place, but the key demographic this place would be perfect for (young, dual high-income-earners) would be colossally stupid to take this on right now……..

Personally, I think it’s a beautiful place, nice neighborhood, heck I’d think about buying it — but only well on the other side of this recession…!

Er, in the penultimate sentance, I meant to say:

“The sad thing is that this looks like a wonderful place, but the key demographic this place would be perfect for (young, dual high-income-earners) is too smart to do something as colossally stupid as to take this on right now……..”

I suppose I should proof-read a little more….!

“the BigLaw firms are *very* quietly cutting back”

Only quiet if you aren’t in the industry. If you are, it’s pretty apparent and will (probably) be rather ugly in January.

DancesWithVols,

I would argue that even in normal (non-bubble) economic times a dual high-income earner couple wouldn’t be very wish to take on an 800k mortgage. I suppose they could swing 640k if they had a 20% downpayment, but even 640k would mean their income would need to be 180k for the couple to mortage no more than 3x their income.

The days of people leveraging up their mortgage of 4x their income are likely over. Its going to have to return back down to 3x or at least 3.5x is my guess.

Bob–

bad math–it’s $215k to be 1/3 of $640k.

And the future of 4x income borrowing is more about rates than anything else–$500k at 5.5% is about the same payment as $400k at 7.5%. So if rates were to drop back into the mid-5s, then you’d have 4x lending.

Although I have heard of law firms cutting back recently, I wouldn’t be surprised if this reverses itself soon. I can imagine a huge surge in securities and other fraud-related lawsuits. Those Wamu shareholders want someone other than themselves to pay for all that shareholder equity that went up in smoke.

Whenever there are bankruptcies, liquidations, fraud allegations, contract disputes, etc. there are always tons of lawyers involved. All of this stuff increases in a recession.

“It is a really well-done listing; too bad there aren’t more realtors who put in the same amount of effort.”

What’s the effort here? The staging and the photos? I don’t think that’s too much to ask from a realtor, esp. at this price point.

From a quality standpoint the renovation looks pretty well done. However the designer really hamstrung this property with the upstairs layout. This house is perfect for a young high dual income couple with 2 small children (or dinks), but this is not a house that will fit them once the children start school.

If you look at the original building plan, its was a 3bdrm w/ a reading room. While I see it as a nice luxury to have a master suite with a large master bath, it isn’t a long term viable option with these row homes.

Its too bad that this will be a transient house with new owners every 4 or 5 years.

Listing maid’s rooms as third bedrooms is a tiresome practice. I’ve wasted several trips to supposed 3 bedrooms only to find the third a small box behind the kitchen and on the backstairs. There should be some more honest category.

anon, what makes you think rates are going to sink into the mid-5% range? I personally just don’t see that happening.

This is a very nice place. I like it a lot. But that price is way too much for me.

“anon, what makes you think rates are going to sink into the mid-5% range? I personally just don’t see that happening.”

Nothing at all. I agree that those days are (at best) very unlikely to return soon. I was just pointing out that the appearance of 4x mortgages wasn’t objectively crazy–although not necessarily wise–as it was driven by rough payment equivalance.

“What’s the effort here?”

It’s more than most, which *is* really pathetic. But in comparison to the average listing, this required effort that has not been common even in listing at twice this price.

“Although I have heard of law firms cutting back recently, I wouldn’t be surprised if this reverses itself soon.”

One DC firm just cut a bunch of litigators in DC and NY, saying that there just wasn’t the expected lawsuit flow. So I wouldn’t be certain.

“Those Wamu shareholders want someone other than themselves to pay for all that shareholder equity that went up in smoke.”

Good luck to them. It’s hard to get blood from a stone and JPM assumed *no* corporate-level obligations.

This is really a 2 bedroom and it is overpriced. The pictures can be staged but the floor plan doesn’t lie. I think this goes below the 2004 price. This is another case where the seller is just praying someone is stupid enough to bid 50K below the outrageous asking price thinking they are getting a deal.

Also, not to anger the many lawyers that use this site, but I think there is an overabundance of lawyers in the US so if there is a reduction coming, this would be most welcome. Disclaimer: I also think there was a bloated amount of financial jobs as well before the massive layoffs recently.

I really, really hope they get this price because I live in a nearly identical rowhome in the same nabe, but of course I paid way less many years ago. I’m not planning to sell, but it would be great to have comparables like this ready just in case.

Location is the key here. Someone will buy this location with a very average house sitting on it. Many in Chicago would rather sacrifice interior space to enjoy the surroundings of the neighborhood. The location is great!

It is small and a very narrow unit. The 3rd bedroom will have to used for a crib which works well for a young family wanting to attend Lincoln Park Elem. One month ago it would have sold in 30 days in the $800k range. With the market the way it is (financial market), it is very possible it will sit into 2009.

“One month ago it would have sold in 30 days in the $800k range.”

One month ago they would have had to take ~10% of ask?

“The 3rd bedroom will have to used for a crib which works well for a young family wanting to attend Lincoln Park Elem”

When did Lincoln Elem (there’s no “park” in the elem school name) start enrolling kids who count their age in months? What do they do in 3 or 4 years when the younger kid is ready for a real bed in a real room? Move?

I would get rid of that wrought iron fence in front and put another parking space there instead, if zoning allowed it. (Someone will understand my reference, I’m sure.)

The seller only borrowed $500K back in 2004 with nothing else recorded since. If the seller needs to sell, then they have room to play. These are the kinds of sellers (along with banks) that will, indeed, set new comps.

Otherwise, we are just looking at another future cancelled/expired listing.

Jan,

Why stop there? Gut the entire first floor of the building to make it a garage…drive right into your rowhouse. Or just tear the whole thing down and build an elevator parking garage you can lease to the neighbors, since secure off-street parking is obviously the determining factor of property and neighborhood desirability.

Yeah, the Mid-North Landmark district wouldn’t allow it even if the R5 zoning did (which it does only when there is no alley access), thankfully.

“When did Lincoln Elem (there’s no “park” in the elem school name) start enrolling kids who count their age in months? What do they do in 3 or 4 years when the younger kid is ready for a real bed in a real room? Move?”

Anon – I would guess they would move the kid into the 2nd bedroom. The listing say the 2nd bed is not usuable? You must be related to HD

Uh, I was assuming two kids. You are assuming a single child. Neither of us said anything about our assumption, but mine was more clearly implied. You must be related to Palin.

David the first — sorry, that was just a bad joke on my part, referring to a recent thread where someone else made the ludicrous suggestion of add parking in front of a charming historic home:

http://cribchatter.com/?p=5357

You can easily, *easily*, have three children in that unit. Two kids in the larger bedroom, one kid in the smaller. In fact, you could have even more if you turn the basement into a bedroom (or two). Those who think otherwise, unless your parents were quite rich, please recall your own childhoods. Kids used to routinely share bedrooms, and bathrooms. This idea that every child should have his/her own room–and a large one, at that–is entirely a product of easy lending and people buying too much house.

And it will end. Soon.

If things don’t turn around I will buy it and live in it with 5 of my friends and their families.

The SHill fails to disappoint once again: “One month ago it would have sold in 30 days in the $800k range. With the market the way it is (financial market), it is very possible it will sit into 2009.”

LMAO. The SHill is really going out on a limb here. I think we have found the source of his claims of having been correct about something.

There were 71 home sales in LP for the period 9/14/08-10/13/08. The median market time was 71 days and the average was 125 days. However, this has already been on the market for 21 days, so if we remove the 14 sales with market times under 21 days, the median market time jumps to 109 days and the mean to 153 days. Dare we say it? The SHill might actually predict something correctly.

By the way, there were only 4 sales in the $700K-$1M range. They had market times of 164, 74, 217 and 23 days.

There are currently 122 listings in LP between $700K-$1M. Based on the past 30 days’ sales, that means there is over 30 months of inventory.

Just as I predicted, the SHill is claiming that the “financial market” is to blame for the LP slowdown, when it was well underway regardless (including solid median price drops for Sept YOY.)

Steven obviously has the causaulity link backwards: it was the slowdown and decline in the RE market that led to the collapse of the financial markets, not the other way around.

You guys are on crack. Every data point pointed to LP holding constant pricing. This is going to change now and I am the first to admit it.

Again we will go to the data –

1048 N Mohawk C Sold for $539k in 2006 and sold again in 8/08 for $572k

1838 B Halsted unit 7 – purchase in 2002 for $435k and sold in July of 2008 for $551k

708 w Schubert unit a – purchased in 2003 for $597 and sold in August of 2008 for $685K

1630 n Mohawk unit 1630 – purchased 10/2004 for $552k and sold July 0f 2008 for $652k

You guys can claim until you are blue int he face that LP was declining in the 1st half of 2008 but you were wrong. Pricing has increased 3- 5% over the past 7 years.

“was declining in the 1st half of 2008”

Who said that? July, August & September are 3Q08. Point out a reference to the first half, Stevo. Otherwise, you’re lying again.

Also, is the market the same today as it was in August? You willing to lend me money on terms prevelant in August?

What I have said since the start is that LP has been very stable over the past 12 months and that people were not losing there money unless they made bad decisions. I am now saying that the past 30 days the data is changing and prices are set to contract.

Anon Honest question? Do you live with HomeDelete?

Last 6 months Lincoln Park – Look terrible Anon, right?

Statistics Total Properties: 475

List Price Sold Pr Approx SF Beds Baths MT LMT

Minimum $239,900 $224,566 0 2 1 1 1

Maximum $1,495,000 $1,439,000 3362 5 4 821 477

Average $547,873 $529,539 1707 2 2 107 69

Sold properties closed averaging 96.65% of their Final List Price (FLP).

This reflects a 3.35% difference between property sale prices and their FLP’s.

Can’t say how low this will go but trust me, it will go. Jennifer Ames has a great shtick producing magnificent brochures. Then, with the greatest of ease, she simply tosses them up to the universal gods of real estate. “If you print it they will come.” No typos allowed. Her 2 “team members” remain on call to show show show and sell sell sell.

They try, at all cost, to entice the seller into accepting the most ridiculously absurd lowball offers. Been on the receiving end of that group. Won’t travel that road with them again.

Stevo:

I can’t trust anything you post. You’re worse than the current administration (or Stroger or Daley–equal opportunity complaints here!) about selective data production. I have to assume you aren’t giving the whole story.

Margo:

Well, given that a realtor’s fealty is to the deal, what can you expect? They seem to do a good job of getting the deal closed, which is all you can expect for your 6%.

SHill, “prices are set to contract.” Set? Like I have posted repeatedly, they already “contracted” in September. The decline was just like many here predicted (but not the SHill) based on the preceding months’ collapse in sales volume. The SHill repeatedly ignored the collapse in sales as meaningless in LP (and LV and Near North.)

Now, how many months in a row will we see YOY median declines for LP? Care to improve your prediction record, SHill?

anon, I can only imagine the amount of backtracking double-talk that the SHill must spew now to those he led into debt hell. As time goes on, more and more will realize they were played for a commission by an “expert.”

G,

Who cares and I don’t believe he did anything wrong. Buying a home is most people’s largest purchase in life, if they had done their homework they likely would have arrived at the same conclusion as most on here (us housing bears).

Stupid is as stupid does and people underwater earned it the good old fashioned way at the end of the day: via their flawed decision making.

anon:

anon:

Would expect it for 3% NOT 6%. Check it out…for each and every “showing” I made sure the place was picture perfect ready fresh flowers and all. Now then, while I hung around outside the unit as it was being shown, on 5 different occasions I overheard the respective “team” member doling out complete and totally false information with regard to appliances and HVAC just to name two. Further, there was no actual S-e-l-l-i-n-g going on.They were simply s-h-o-w-i-n-g the place. P-e-r-i-o-d. I am for certain in the wrong biz!

Margo, they were selling. You referred to it as giving false information. I call it lying. But that’s merely semantics. Lying and selling are pretty much the same thing. You were paying them to say things that you didn’t want to say.

Anon & G – How did those buyers do that were listed above? Are they suffering or do each make a real nice prifit buying real estate from 2003 – 2006. You guys are really a joke. G – prices have not dropped as of yet. This is the 1st month the data has suggested it will and it just happens to coincide with the stock and credit markets crashing. So you now are going to say you predicted a global credit crisis of this size? You are a joke! Even the best economists in the world did not see this extent of a crisis coming. Plus we still have no idea how this will play out. I just listed all transaction in LP over the past 6 months (including yesterday) and the average market time was 100 days and average selling price 97% of the ask. If the problems in the financials clear up (at least bececome more trasparent) the LOW INVENTORY levels in LP will get eaten up. There are a lot of people just waiting on the sidelines to see what will happen.

You still want to claim that LP prices were stable through August and you predicted they would fall off the shelf in September? Just remember there is NO EVIDENCE that prices have come down at all. Obvioulsy everything is suffering right now and real estate will not be immune.

You are a clown!

“You are a clown!”

I think you mean [Anon & G]:

You are clowns! Please check your grammar before posting.

Steve actually many people predicted this. This fast… no… but this… yes. I agree very few were economists. Best economists, with rare exceptions is an oxymoron.

I’m going to have an excellent time watching LP’s 2003-2006 paper equity disappear in 2008-2011 as (I’m going to use hurricane terminology) LP experiences the storm surge of the northeast quadrant of a category 5 force storm named “Alt-A implosion.”

Homedelete – Yeah, LP has a lot of ALT-A financing.

Nice run-on sentance…

nice irony

Steve: The stat that listings are selling at 97% of their asking is meaningless if the asking price keeps getting reduced.

Sabrina – With 100 days average listing time how much do you really think prices were reduced. Are people really that impatient that they drop their price 20% after 60 days on the market? Remember, time under contract counts as total listing time so the average time is really only 60 – 70 days. Read between the lines.

The SHill is shrill again. Lying, too, with comments like this “Just remember there is NO EVIDENCE that prices have come down at all.”

Using the shills’ favorite stat (at least while prices rise,) the median sale price of a condo/TH in LP dropped 10pct YOY in September.

Remember September? That was when the SHill was claiming the DOW was a steal “at 2005 prices.”

There is absolutely no “if” that will occur and clear inventory except price drops.

Sabrina – That was an honest question. How much would you reduce your home after 1 – 2 months on the market? From my experience, you wait 45 days before even considering a price drop.

G – I never said the dow was a steal at 2005 prices. I made a point to show you that the dow was at 2005 prices. I have been short equities for the past 8 months if you are interested…

“Sabrina – That was an honest question. How much would you reduce your home after 1 – 2 months on the market? From my experience, you wait 45 days before even considering a price drop.”

I know the question wasn’t directed towards me but I have an answer. Lower your price 10% below recent comps. The next seller does the same. Lather, rinse, and repeat until home prices are in line with income.

Homedelete – That was not even the question. I just took a vote and we all agree that you are an idiot.

Sure you were short equities, SHill.

What about that other lie from above? “Just remember there is NO EVIDENCE that prices have come down at all.” LP condo/TH median dropped 10pct YOY in Sept.

LMAO. The SHill is actually claiming something meaningful from percentage of last list price? That does not take into account original list price, as Sabrina correctly noted (and which would subtract 2-3pct according to recent LP sales data.) Also, it is further distorted to the high side by the practice of excluding parking from the list price, but including it in the sold price.

The SHill is a liar.

And back to the property…

The remodel seems of decent quality, however who ever did the design for the remodel really screwed this from being a long term home for a family. If you look at the original plans this was a 3+bedroom that would have worked for the typical 2 child household. With the renovation they’ve turned this into a transient home for the high dual income set. Sorry but there is no way this house will support a 2 child family once the youngest enters school.

The present owners better hope they can get their hooks into a some DiNks or DiOK’s.

I understand the allure of a master suite, but if your plan is only to stay in a property for a short period, it doesn’t make a lot of sense to limit the buyers pool. Its too bad as a lot of people with 2 kids that want to live in this area would be in one hell of a fight to buy this Vs a LP townhome.

And we return you back to the dick swinging contest…

G,

The shill is going to make up facts and lie, of course he’s going to do that. He’s a realtor and a liar. Berating him with facts assumes he actually cares about a real debate, which he doesn’t. He only cares about the insults, personal attacks and spitting in our collective faces.

Personally, I prefer to bait the guy with inflammatory comments and get him all riled up. See above. He took an imaginary vote and then decided that I’m an idiot. All because I told him that in order to sell a home one needs to lower the price 10% below recent comps. Not 10% like Coldwell Banker’s trickery, but 10% below cold hard comps. Then he calls me an idiot. Yeah, we know who the real idiot is. The idiot is the guy with the Lexus payment he can’t afford and the option arm mortgage on his 3 bedroom condo downtown. And I suppose he has student loans from his unused CPA and JD. Oh that’s right, he also makes over $350,000 a year. But now he’s selling used houses. My mistake, *was* selling, because the market has dried up. There’s no more food at the troth, ole’ boy. Time to find something else to do.

G – Wait, now you are counting median prices as factual? You are such an idiot! I thought median incomes meant nothing?

What about that other lie from above? “Just remember there is NO EVIDENCE that prices have come down at all.” LP condo/TH median dropped 10pct YOY in Sept.

So if median prices mean so much I gues LP was appreciating al the way through August of 2008? Oh boy!!

BTW Homedelete – I have a BMW and a 5 bedroom single family. Good luck…

Steve.. One could have bet on the BMW. Nicely made but definitely attracts a certain clientele. My favorite was the credit card ad they once sent me saying “You already impressed the valet, now impress the waiter” Couldn’t define it better than that. Well maybe the joke I made to a friend about the lifestyle mag they send out should have a cover of someone driving a cabriolet and after just having cut someone off the driver flips the guy he just cut off the finger.

As for price drops I just did pretty much 1-2% every week until I was taken out.

Are you saying I am a bad tipper?

So IB – you dropped you price 8 – 16% every 60 days? Talk about bad strategy… After 1 year on the market you would close to $0 on asking price. Hope you did not pay 6% for that!

Steve,

1- I would assume you are actually a good tipper. I just never forgot that ad so when you mentioned it…

2- Whatever your opinion I came and got done what I had to which is more than anyone else can say in the building. Not like I was getting multiple aggressive offers or saw things trading higher so I don’t exactly believe I was very off market. I learned real early that best thing to do in a down market is not wait for bids but go looking for them.

I did not pay 6%. Truthfully I would gladly bite my nose to spite my face in order to avoid 2 brokers. One should only have to feel so dirty.

I don’t disagree with you. If you were okay with your value and did not mind doing the hsowing, 1 broker often will do the trick. dropping so quickly is a bit much. Often it takes a fairly valued property at least 90 days to get an offer. This is why understanding the direct market’s supply and demand and your overall positioning with pricing is so essential. Good job on the sale…

I was simultaneously extremely time constrained and very bearish. Honestly I think everything is toast and nothing doesn’t get hurt. I think it’s sad but hey who promised life is supposed to be easy.

I do also believe there will globally be more opportunity than ever but for average Joe six-pack he has absolutely no idea what amount of ugly is really heading his way. I actually cringe thinking about it.

Easy come and easy go.

I find the continual fights between Mr. Heitman and other members of this forum distracting and unnecessary. I suggest that someone (Sabrina?) judge his arguments once and for all, and if they are found wanting, ban him from this forum. Thanks.

Jerry – I have a nice big pillow you can use if you are really upset and want to cry for a while…

Steve spends all of his time on this site ripping on the contributors because he does not have a life. He carried this attitude around his friends, who justifiably abandoned him years ago. So lets take it easy on this pathetic guy, we are all he’s got!

He is also living proof that money has no correlation to intelligence. These people that took advantage of the system only needed a high school education. The world fastly approaching some real tough times and these retards stand to lose the most.

I am currently working in a war room with 2 Big4 partners, 2 managing directors from an IB firm, 2 CEO’s, 2 CFO’s, and several lawyers and it would be generous to call the discussions we have pessimistic. Steve, it will be extremely difficult to support that 5 br house when everybody is losing their jobs, interest rates spike, and our economy sees the deepest recession in ALL of our lifetimes. My guess is that you bought at the peak, after you made your money slangin’ real estate. I predict that we’ll stop hearing from you when your real estate inevitably becomes upside down and you cant afford the internet anymore…

$450,000

Thanks AD that is nice of you. So how is your job and home going to do in this environment? You guys in your “war room” sure must be smart. I bought my home in 1998.

Todays Wells Fargo 30yr Jumbo fix 9.875 + a point. All good!!

Steven, I’m really impressed you drive a BMW.

Here’s how we did Steve. We purchased the unit in 2000 and sold it just under the wire this summer. Didn’t have to move as we owned the place outright. However, rumour had it that multiple “specials” were coming down yet again. After having seen our monthly assessments double+ and after having been “specialed” to the tune of 23K all within 8 year’s, it was now our time to go.

BTW the building was not vintage. It had simply not been maintained since having been built in the ’60’s.

We eked out a very small (read:next to nothing)profit all things considered (over time we had remodeled the entire unit from the windows in). My gripe is that CB’s JA Team ever so subtly continued to badger us into accepting the most inane offers. Their pitch being THE GLOOM THE DOOM THE MARKET. We were 2 days away from cancelling our listing (the broker had been made aware of this) when viola! Up pops a cash buyer, no contingencies, settle whenever. The rub is the CB JA Team had nothing to do with this buyer. Nor did her “team” ever bring in one propspective buyer.

Insofar as the my paying for the “lying” the CB JA “team” didn’t “lie” at all. Nothing they said incorrectly regarding the unit was to our advantage. For example, we put in our own HVAC system 1 1/2 yrs. prior that,at the time, was unique to the building. The broker stated to the client that it had been installed “I think 5 years ago.” The same broker also stated that W/D’s were “not allowed” in our particular tier. Completely false.

By the grace of all the powers that be, we are outta there and happily so. Not 6% but 5.75% poorer.

Sorry that was so painful Margo. Was it on Lincoln Park West?

HD: “Steven, I’m really impressed you drive a BMW”

Ha–you fell into his trap, HD–you just admitted you’re a valet!!

Hey Steve,

The condo was on N. Astor.

As an aside,I can safely tell you that 95% of the peeps residing in that building act as if they are living in the Ritz Carlton. I’m guessing the broker’s job is to react accordingly?

There are numerous contributors on this board who predicted that prices in LP/LV, etc would fall, even if they hand’t until recently, and that the housing price crash was very tied into precarious financial markets, loose lending standards, etc. How many times have we heard the term knifecatcher on here?

anyway, this is a cute little house – i’m glad to see some of them aren’t being torn down! i guess it can’t be if it’s a row house? I would live here happily, but my guess is that they would be hard pressed to exceed previous sale price unless they did the remodeling.

Bubbleboi,

I think if they did the remodeling – I am sure the brochure would point it out:)

Well done brochure…

Agree with the comments on Jennifer Ames. Looked at several places listed by her and her lazy sales team. All horribly overpriced relative to actual comp sales and her team never followed up. Been following LP sales for 2 years in SF homes around $2.0M. Nothing moving at all. Prices are only going to continue down.

I am the owner of this home. I just learned of this website and saw this posting.

We have lived here for 4.5 years and love the house and the neighborhood. We have 2 children and are relocating out-of-state. Otherwise, we would definitely be staying in this house and sending our kids to one of the wonderful elementary school options in the area (Francis Parker if our kids got in or Lincoln Elementary which may be as good and is much less expensive).

There is plenty of space inside the house for the kids to play. Of course, when the weather is nice enough we are rarely here because there is so much to do in the area from the zoo, to the gardens, to the playgrounds, to the beach, to the Notebart… and that’s without including all of the restaurants, shops, etc.

We have done a tremendous amount of work in the house since we bought it in early 2004. When we got here there was only one bathroom upstairs. We re-did that bathroom and added a second bathroom attached to the master. We gutted the kitchen 2.5 years ago and put in all new appliances, flooring, granite countertops and Wood-Mode cabinets. We also refinished the rec-room earlier this year including redoing the full bathroom on that floor. Had we stayed longer our next project would have been to replace the deck/carport with a full garage. We had architects over to the house to share ideas and the project can be completed (structurally) at a reasonable cost.

The previous owners lived in the house for 18 years with one child. We would be staying longer were we not relocating. We live in a great house in a great neighborhood surrounded by great people. I am sure whoever is lucky enough to live here next will love this house as much as we do.

Owner: Thanks for checking in and providing more information about the property. It’s a great location.