Steals and Deals: 550 N. St. Clair Slashing Prices on All Units

I’ve been waiting for developers to finally throw in the towel and just start cutting prices in order to move product.

It’s finally happening now at 550 N. St. Clair in Streeterville.

A tipster has informed me that the developer, Sutherland Pearsall Development, is holding a “private developer closeout” on the remaining available units.

They are not currently on the MLS but should be by the end of the week.

Here are the building stats:

- 112 units in the building

- 30 still available from the developer

- 3 for sale on the MLS

- 2 for rent

Closings began in February 2008.

Here are some of the price reductions on the developer’s units:

9th Floor studio:

- Was $298,500

- Reduced to $208,000

17th Floor 1 bedroom:

- Was $415,000

- Reduced to $312,000

9th Floor 2 bedroom/2 Bath:

- Was $588,500

- Reduced to $439,000

16th Floor 3 bedroom/2 Bath:

- Was $868,500

- Reduced to $668,000

Parking is $50k extra with all of the units.

Will these price cuts create new comps in Streeterville for other new construction buildings?

These prices are significantly lower than any of the similar nearby buildings such as 600 N. Fairbanks, Avenue East, Fairbanks at Cityfront Plaza or ParkView.

Additionally, anyone who bought earlier in 550 N. St. Clair is going to feel pain.

Take this flipper of Unit #2204. It’s a former 2 bedroom, 1.5 bath unit converted into a large one bedroom.

How will this owner ultimately make out?

Here’s the listing:

1/2 BLCK FROM THE MAG MILE!! CUSTOM-DESIGNED, UPGRADED, HUGE CORNER 1 BR, 1 1/2 BATH (ONLY ONE LIKE IT IN THE BUILDING; A 2 BED CONVERTED INTO A 1 BED W/ROOM 4 ENTERTAINING) W/ 11′ FT. CEILINGS; W/D; BAMBOO FLOORING THRU-OUT; SUBZERO, BOSCH; GRANITE, GROHE-THERMO CONTROLED SHOWER W/ BODY SPRAYS; HUGE TERRACE.

GREAT IN-TOWN, 2ND HOME OR INVESTMENT. RENTED UNITL 8/31/09 FOR $3,100/MO. PARKING FOR 2 CARS $55,000.

Weichart Realtors- First Chicago has the listing. See the listing here.

Unit #2204: 1 bedroom, 1.5 bath (was a 2 bedroom unit)

- Sold in June 2008 for $425,000

- Rented until August 2009 for $3,100 a month

- Currently listed for $474,500 (plus $55,000 for parking)

- Assessments of $336 a month

- Taxes are “new”

- Developer has one 2 bedroom/1.5 bath left- now priced at $383,000 (parking extra)

Or take Unit #1504, a 2 bedroom/2 bath, which is also on the market.

Here’s the listing:

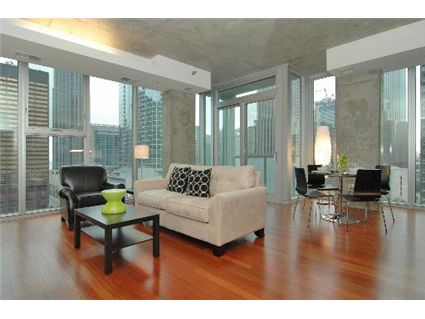

Elegant & beautifully finished 2bed/2bath SE corner unit. Steps from Michigan Ave. Impressive views of the city! Floor to ceiling windows throughout. Bosch appliances. Master suite with large walk-in closet and upgraded master bath.

His and her sinks. 24hr drman, heat, air condition, work out facility, in-door heated pool, and sun deck included in assessments! Will not last! Parking is $45k.

Sue Tao at Sudler Sotheby’s has the listing. See more pictures here.

Unit #1504: 2 bedrooms, 2 baths, 1200 square feet

- Sold in March 2008 for $620,000

- Currently listed for $585,000 (parking is $45k extra)

- Assessments of $472 a month

- Taxes are “new”

- Developer is selling the remaining 2/2s for: $439,000 to $522,000

For more information see 550 N. St. Clair [developer’s website].

Sabrina, please update us on Avenue East, 160 ILlinois, and 600 N LSD.

I’m not a huge fan of the St. Clair and the other Modern buildings.

Thanks for your good work!

Millie

I walked thru this building as part of my due diligence. Thought the layout on the 2 bedrooms and 1 bedrooms were awkward but I really liked the studios, if thats what someone is looking for. Fantastic location, IMO. Big problem on that corner with the homeless though.

Oh, by the 7-11 over there Ze? I live in the area and try to avoid that corner at night.

Millie.. If they lower anymore one of those guys might be moving in. Cop one day was telling me what the guy in front of the Starbucks pulls down a day and it is a hell of a lot more than the people working at Starbucks.

People are in such denial still. I had one guy in my tier, more than 10 floors lower than me, with fewer upgrades, offered almost 80k higher than me. I kept lowering my price and he never budged. Eventually took it off the market and rented waiting for next year. Not like I was getting lifted either. Will be an interesting spring when all the geniuses come out at the same time. That should begin the real capitulation. Now I’m headed off into the slums to construction materials. 🙂 My wife is trying to make me look less like a Gringo for it. Impossible task.

G – so glad I could bring back the memories…

Wait, so the kitchen is really just a wall unit in the living room? I dig the materials used, the colors, etc but not that layout. When I’m cooking for friends I prefer that I get my space in the kitchen – they can watch but not hover.

“Additionally, anyone who bought earlier in 550 N. St. Clair is going to feel pain.”

May I suggest dollar cost averaging?

Sounds like great prices when compared to the other new developments.

Do you guys think at these prices this will bring in buyers?

Anyone know the breakdown of one bedrooms or two bedrooms that are still remaining?

There are likely to be buyers. Some still have dollars and no sense.

See….Chicago will follow the downward path like Miami….maybe not as far but this is a good sign. But again, there is no rush, more deals are on the way. It is a waiting game and the buyers have all the power.

There will be buyers at these prices. People continue to buy at a much higher price point in 600 N. Fairbanks, for instance.

Lake Effect- will you be checking these out now? (I know you were thinking of this building now that the sellers in 600 NF refused to negotiate on their selling price on the 1 bedroom.)

Sabrina, any updates on 600 N LSD and 160 E Illinois?????

Sabrina — You say they that there will be buyers at these prices. However, you didn’t mention whether you think these are “good” prices. Do you think these newly slashed prices are still in knifecatcher territory?

Is this the start? Obviously know one will know for certain … but I’m curious to hear thoughts.

John999,

I don’t know if these prices are “good” but a 25% cut on new construction is big news and certainly brings these units into the approaching reasonable valuation category. When your develop decides to wipeout every flipper and investor in the building you are starting to see capitulation in the market.

Really when you think about it makes sense. Unlike a individual owner or small time investor a large developer is going to do the math and make the smart decision to cut prices now and move inventory when delusional individuals and small timers still aren’t willing to accept where valuations are. Carrying costs are a pain for everyone and the developer is smart to make this move now before others do.

Now prices might come down a bit more from these levels, and I certainly wouldn’t buy these as an investment. But if you are looking for new construction in this area to actually live in (and can deal with the hideously crappy kitchens in these “modern” buildings) these aren’t as bad as a lot of things out there.

$439 for a 2/2 in this area is a comp killer. I expect that buyers will come, as these are now the cheapest units in Streeterville. The kitchen is still a wall though.

Agree with everyone. There will definitely be sales at these price points. These prices are very attractive relative to other Streeterville units. 550 St. Clair is being smart (relative to other developers/flippers) and finding the buyers.

I agree with G on another point. Those that buy now are still buying too high in the long run. For example, I personally think 2/2’s in this building can eventually fall below 400K.

By the way, some flippers are idiots. They make money on a few units during boom times and feel like God and when the tides CLEARLY turn they don’t know how to react. Here’s some advice: cut prices!

Query (and sorry for not thinking of this a minute ago):

Does anybody know what the various prices on these units were over time? i.e. What the pre-construction, post-construction, etc. pricing was?

I’m glad other people brought up the kitchens in this buidling. I love the materials and look of them, but at least in the smaller units they are really just a single wall of cabinets/appliances. sort of half a kitchen, uncomortably open to the main living area, which is also small.

these are tiny, if beautiful, units.

Also no counter space in the kitchens. It’s a delight deciding whether to keep your toaster or coffee maker on the island.

HA, 300k for a studio shoebox. RIGHT.

What are the 3+ bedroom units like? I couldn’t find any photos on the developer site.

Anyone know the sq footage on these 1 br and 2 br units? Just curious what we’re dealing with here.

The kitchens are GREAT in this building. Not for everyone though. I prefer St. Clair to the others in the area. Nice floorplans. I think this building has a better potential to go up in value relative to the others. On another note, we are getting very close to the price floor if it hasn’t hit bottom already. There is the cost of contruction to consider and I’m sure you can’t build a condo for these prices today or in the near future. Condo supply is starting to dwindle which will stablize prices assuming the economy starts to recover within the next year. I’m a buyer at these prices but I also don’t mind if prices dip a bit more. I need a place to live after all. Also, check out the penthouses in this building.. Yummy!

this is a great time to buy since real estate always goes up.

I have seen three bedroom units in the building…many of them opened up the third bedroom into a media room…the bedrooms were fairly spacious…they were around 1600 square feet units.

It will be interesting to see what happens in my building (600 NF) as there are many 2/2’s for sale all in the mid 600’s with the parking.

Buy now or be priced out forever! Ha ha ha. I wonder if that idiot from the Rubloff blog can still say with a straight face that people better buy now or pay more later.

I went to look at units in this building six or seven months ago and the sales woman told me to make an offer and that she was sure the developer would be “flexible” on price. She even sent me a follow up email reminding me that the prices were open to negotiation. At the time, I remember thinking, “Well, when the developer is ready to come down from 589K to 400K on a 2 bed 2 bath, let me know.”

Now, however, I don’t think I’d buy another condo at any price. Things in my current condo building are a disaster. More people are not paying their assessments, no one can sell, and more special assessments are looming, so I have sworn off condo ownership for good. And no, I don’t live in some faulty new construction building with millions of dollars of repairs needed…it’s just a typical little vintage building in Oak Park with around 20 units.

I’m not interested in any more communal living where I wind up footing the bill every time someone decides they can’t afford to pay their assessments. One unit in our building was foreclosed on and left us with over 5K in assessments we’ll never see because when it finally sells, we can only get back 6 months worth of overdue assessments. Meanwhile the owner basically got to live somewhere for free for nearly a year.

But I digress…getting back to 550 St. Clair…Why in the world would someone buy a condo for 439K that you could rent for $2850 per month and never have to worry about assessments of any kind? (Here’s a 2 bed for rent at that price: http://chicago.craigslist.org/chc/apa/911774765.html )

Here are the rentals in the mls for this bldg:

Unit # Beds Baths RD RP/RNP

1508 3 2 4/26/2008 $3,495

1405 2 1.1 4/8/2008 $2,745

1404 2 2 7/2/2008 $3,000

1601 2 2 9/8/2008 $2,650

1605 2 2 4/21/2008 $2,250

902 1 1 6/19/2008 $1,800

1206 1 1 6/8/2008 $2,200

1402 1 1 7/25/2008 $2,000

1406 1 1 3/19/2008 $2,050

1606 1 1 4/28/2008 $2,100

1103 0 1 4/17/2008 $1,300

1207 0 1 2/27/2008 $1,650

1307 0 1 6/1/2008 $1,650

2102 0 1 8/11/2008 $1,450

???? 1 1 9/26/2008 $2,050

1705 1 1 asking $2,300

904 2 2 asking $3,000

Based on rentals, then, I would think these units are finally priced about right–for instance, if they throw in parking, I would guess the buyer is fine. G, do you agree?

fairbanks or G,

how many units are for sale in 600 N FB? Also, where is this homeless corner in relation to 600 N FB?

Thanks G for the update on what things are renting for at St Clair…

Wren… It’s literally one block over, I am not a fan of 600NF but in all fairness. for some reason. it doesn’t feel the same with the homeless on that corner. Maybe because Columbus Drive is so busy and the corner is so narrow. But you do need to pass it to get to Mich Ave.

Damn am I happy I puked on myself getting out this summer… Whole world of ugly coming… I agree with John.. No rush. Sellers over in size and NO CHANCE this runs up and you miss later, too much inventory around that needs to be cleaned out and still more coming.

I looked at this building. I liked the 1/1 with the large terrace overlooking Michigan Ave. The amenities floor was a joke and the pool area is tiny and cramped.

Kenworthey,

No, I don’t agree. Rents for these types of units will fall due to supply and demand. Too many accidental landlords and too many new class A rental units yet to come will result in quite the supply increase. And on the other side of the equation, the recession will be working away at demand destruction.

Condos like these will probably end up selling at a discount to renting when the bottom is in. This will be due to rent instability driving away investors and condo-as-financial-prison stories driving away homeowners.

the kitchen as a wall concept is so weird. couple that with the unfinished walls and it makes for the cheapest looking apartment i have ever seen.

there is a way to do timeless modern, but this ain’t it.

i see implosion here.

Speaking of Rents:

The Market Tightness Index, which measures changes in occupancy rates and/or rents, dropped from 40 last quarter to 24. This was the fifth straight quarter in which the index has been below 50. (For all of the survey indexes, a reading above 50 indicates that, on balance, conditions are improving; a reading below 50 indicates that conditions are worsening; and a reading of 50 indicates that conditions are unchanged.)

Thanks, G.

I hope you’ll tell us when you see something on this site you think is priced fairly! (Last one that seemed like it came close was the loft with the pool… but you were very coy, so hard to say!)

Moving to Chicago,

The only studio and 1BR sizes in the mls are ’07’ tier studios listed at 600 or 650 sf, and ’06’ tier 1BRs listed at 800 sf. I don’t see any sizes on ’02’ tier 1BRs or ’03’ tier studios.

The door is getting smaller… The room is getting more crowded… and the flames are starting to get a lot hotter…

From Best Buy CEO today…

“Since mid-September, rapid, seismic changes in consumer behavior have created the most difficult climate we’ve ever seen.”

It’s now freaking over… There is no way out…!!

K, coy? That’s a first.

There is nothing priced fairly today that cannot be found at a fairer price tomorrow.

By the way, I don’t think the loft in the Bodine Bldg is worth more than the 2005 sale, regardless of the work done since. Then again, what is? It is a very nice unit in a nice conversion in a good neighborhood (except for the schools and distance from train.)

In response to some others I wonder what the rental market will look like in the next 12 months.

Yes, there is a lot of supply in these new buildings since nobody is buying to live in them but I wonder if you have a large (and growing) group of buyers that would normally being moving into these units that are just choosing to rent instead.

I have the downpayment and cash flow to buy a 2/2 if I wanted but I just don’t know when the right time is going to be to pull the trigger, but unlike some I can definitely use the tax advantages of a mortgage since I’ve got a few other deductions already and I’ll be in AMT land soon enough.

I guess I’ll just have to keep reading and compare the rental market and valuations in the spring when my lease is up.

kp,

The new downtown condos did not replace existing units. That “group of buyers that would normally being moving into these units” was never enough to fill all of the units. The developers built to speculative demand, and it looks like it exceeded real demand from occupants by around 30%. Toss in the current apt overbuilding and the recession and rents will decline. Declining rents mean no bottom to prices and one heck of a self-perpetuating downward spiral.

Does everyone agree with G? Are rents and prices destined to keep going lower because there’s just too much supply all around? I don’t see how rent can go much lower when these accidental landlords probably can’t afford to take much more of a loss every month covering the difference between incoming rent and outgoing mortgage and assessment payments…we’re already seeing rent rates that seem like a very bad return for the unit owners who are stuck and can’t sell. But maybe I’m wrong.

Danny — It you look at it from the other side of the coin, rents certainly aren’t going up anytime soon given the sheer amount of inventory vs. demand. However, accidental landlords do have the option of just walking away, leaving the already troubled banks holding an even bigger portion of the bag. But that’s what bailouts are for right? 🙂

kp — I’m in the same exact boat as you on the sidelines waiting to re-evaluate of the market come spring. I’m thinking with all of the economic factors at work here, there’s going to be some sort of catalyst that _forces_ prices down (e.g., 550 N St. Clair is a start…). All the bailouts in the world aren’t going to prevent prices from deflating the current unrealistic valuations.

I, like most on this board are surprised that it’s generally held at the current level for as long as it has….

“I don’t see how rent can go much lower when these accidental landlords probably can’t afford to take much more of a loss every month covering the difference between incoming rent and outgoing mortgage and assessment payments…”

Yeah, but who cares what they can afford? There are other condo lanlords who do have the flexibility to lower the price, and the apartment building who also may be able to offer discounts. So, these accidental landlords may have to choose between holding onto the empty unit, renting at a loss or foreclosure.

Hmmm… The market DOES NOT CARE what they can afford. It is not even a variable for setting price. Best thing you can do after buying something is forgetting what you paid for it. It is irrelevent.

Zero or Something. Pretty Simple. At some point it will be death by a thousand cuts or puke it out. Very likely both!

Being in the financial services sector (I work at a local bank) I like to read these blogs. I agree with much of what has been said here. The oversupply of condominiums has never been worse, this building will create new low comps for this neighborhood, there is a problem with homeless people in front of 7-11 (but i do think it is overblown here), condos rarely make sense as rentals, and surely some of the condo inventory in the next 6-12 months will be owned by banks. On the other hand, my banking background coupled with the fact that I made loans to two buyers in this building, I do have another perspective, and that is, that to some degree this building is unique (it has higher ceilings and hardwood throughout and hi-end finishes and actually quite good amenities considering its smaller size), I will also say, a 25% haircut seems formidable, what i mean by this is that most developers aren’t even working on a 25% margin (I know this because the bulk of my business is commercial lending) and what that says to me is that this developer just wants out. It also says to me that any other developers probably won’t be willing to cut their prices this much and even if their lenders take back their unsold units, the lenders themselves won’t be willing to drop their drawers much when it comes to selling off their REO. Cheers

Serious question – Like I have claimed in the past, I track every single property that closes in LP. As I have stated in the past, I do not see the price drops accross the board. Don’t jump on me because I agree with most that the crisis we are facing is bound to collapse even the strongest neighborhoods.

Here is my question – Here are the closing from this week in LP. It will not take long because there are only 4 so far and 1 is new construction.

2770 N Wolcott B

Pur – 07/2004 for 473,000

Sold – 11/2008 for $531,000

1660 N LaSalle # 311

Pur in 7/2004 for $215,000

Sold 11/2008 for $2670,000

1651 N Dayton # 304

Pur in 11/2003 for $360,000

Sold 11/2008 for $465,000

Are there losses out there? Yes, but I still the majority of sales as gains. Sure the people who purchased new construction in 2006 & 2007 may be in trouble but I am just not seeing it yet in LP. Yes, sales have all but halted. But have they halted because properties are over priced or because financing is gone and confidence is at close to 0. If credit frees up in the next few months I will go on a limb and say that LP will remain stable and pricing will hold constant.

I will list closing on a daily basis (if there are any at all) and we can track the data together. Sound good?

Steve presents three LP condos/townhomes that sold, likely with conforming loans. How many properties have been bought there lately with jumbo mortgages? How many on the market are priced above about $530K (20% down) or $460K (10% down)?

Steve:

How can you say prices won’t fall in LP if you’re saying the following (which is what you said above):

“Yes, sales have all but halted”

How long can sales be “halted” before prices eventually have to fall to move product? Not everyone MUST sell right now but some people do for various reasons. They’re not all willing to keep their property on the market for 8 months to a year to get their elevated asking price.

Also- I’m less concerned about what will happen in LP than what will happen in Lakeview, which is much more dense and has much more product at high prices.

Prices are going to fall hard in Lakeview, in my opinion.

Are jumbo loans that hard to come by? I have been following the market on cribchatter since May, and bought a unit in one of the oft discussed buildings in August. I love the new place and intend to live in it for a number of years. Obviously I’m curious about potential resale value down the road, but admittedly I didn’t consider the conforming/jumbo threshold in my consideration. Abstracting from the present circumstances, is it generally much harder to qualify for a jumbo mortgage, or is it simply necessary to have greater income (something on the order of $10k/mo for a $500k loa)) in order to cover the higher cost?

realtor/stalker here. don’t post a lot but based on what i have seen i totally agree with G. the freewheeling credit of the not too distant past not only allowed consumers to buy too much, but for way too much new construction. the current economy will constrain or more likely reduce rents, which normally rise a bit during a housing correction, usually due to rising interest, thus exacerbating falling home values.

my feeling is the price cuts at 550 are only the beginning of the dam break for developers. homeowners unhappy with the drop in prices may choose not to sell (those in a good financial position anyway) but developers don’t have that choice.

to whose who pointed out the homeless issue near this building, i would say that one of the saddest things about the market/lending policies of the last decade is that not only has the market failed to accurately value properties, allowing prices to rise to many times the rent, it has failed on a more human level. at a time when almost 3% of homes are vacant nationwide we still have a huge problem with homelessness that will only get worse as foreclosures continue and unemployment rises. I think the problem of homelessness is far sadder and of more concern than a mere inconvenience on the way to ones luxury condo.

Steve.. kevin and bri make great points. This is high end area and nothing can trade on the high end. It’s not just a matter of freeing up credit, the only people who want credit right now are people that need it so badly they can’t qualify for it. Everyone else doesn’t want to buy a damn thing. Sentiment is now adding to the problems and this is going to be the ugliest X-mas in 30 years. Then more layoffs. A lot more layoffs!!! The system is deleveraging hard right now. Going to get worse before this gets better. Stocks have been in a 1 month holding pattern and it looks like its about to break out of that right now (guess which way). I really think everyone had their chance this summer to get out with little pain, I think all that did not will pay very dearly for their optimism (stubbornness).

CountDeMonet,

I agree completely with your comments on homelessness. In fact in many areas harder hit by the bubble people that are being forced from their houses are forming sporadic tent cities. It is very sad to see so many idle dwellings and yet so many homeless. It really shines line on how bad the markets are not clearing right now.

This is why I disagree with the bailout and government intervention at this time. The real estate correction should be quick, bloody and painful and over in as soon a time as possible and equilibrium re-established. Only then will we be able to house more people. The government intervention is only keeping prices high and delaying the inevitable. Let the banks that got involved with the derivatives that contributed to this bubble fail I say. Surviving banks will step in to fill the void.

It never got as bad here in Chicago but on doctorhousing bubble he profiles 900sf shacks that sold for 500k at the height of the boom.

Tent Cities

http://www.youtube.com/watch?v=CnnOOo6tRs8

http://www.cnn.com/2008/LIVING/wayoflife/09/19/tent.cities.ap/index.html

http://www.msnbc.msn.com/id/26776283/

“the lenders themselves won’t be willing to drop their drawers much when it comes to selling off their REO.”

Market Watcher, to paraphrase Linda and Ze above, “the market does not care what the bank is willing to sell for, their choice will be what the market offers or zero.”

Ze,

Can you show us another time when the stock market has fallen 40%+, stabilized, retested it’s lows several times, and then collapsed some more? It’s never happened. Even in 1929 after a 46% or so collapse, the market rallied 50% before it dropped again years later. Of course, anything can happen, but if you are such a financial wizard, what are you basing this claim on? I’ll offer you a gentleman’s bet that the market bottoms no lower than Dow 7700 (worst case scenario, probably won’t get below 8000) and that it closes the year over 9500.

T2

Ze – I am no optimist on the market (pertains to all markets). I do question the end of the world scenrio as it is talked about too openely in blogs like this. Ususally the general public is the last to the party and the only one that does not benefit from their late opinion. I think we are going to see a lot of pressure from the feds to get these banks lending again. I would not doubt it if we see forced lending on the part of the fed and an increase in conforming amounts well past the $417,000 level we see today. Obviously the key to turning this economy starts with stabalizing housing. The feds know this and they know jumbo’s represent a large amount of homes that simply cannot be financed today. If you think about it, it is silly that a $417,000 loan is safe but a $500,000 loan is absurdly risky. Freeing up jumbo loans will surely clear up a lot of the problems we see in LP. It is a real problem but it is a simple solution for the gov. Expect a change in conforming rates (accross the board and not just for NY and CA) by Jan 1st.

Just my opinion…

T2 – Agree. Today’s selloff followed by INTL’s pre-announcement is perfect for a capitulation event possibly tomorrow. I don’t think the next few qrts will be pretty but it is either the end of the world as we know it, or it is simply not.

Let’s not forget that people have stopped all spending because of the credit crisis and confidence levels and not because we don’t have jobs. Finances will clear up (hopefully) and while unemployment may peak around 8-9%, life will go on with negative GDP for the few quarters. The market is always 6 months ahead of the numbers and we may be seeing a bottoming in stocks very soon.

**This is the opinion of Steve Heitman and in no way represents the opinion of “Crib Chatter” or any of it’s advertisers**

Check out this article for a look at stock market returns once a recession has been broadly accepted. http://www.hussmanfunds.com/rsi/recessrecog.htm The main point is that the market generally falls in anticipation of a recession, not during it. Keep in mind that these guys saw all this coming, avoided the crash, and are now bullish.

The stock market crashed in 1929 but didn’t reach its bottom until 1932.

#T2 on November 12th, 2008 at 9:46 pm

Ze,

Can you show us another time when the stock market has fallen 40%+, stabilized, retested it’s lows several times, and then collapsed some more? It’s never happened. Even in 1929 after a 46% or so collapse, the market rallied 50% before it dropped again years later. Of course, anything can happen, but if you are such a financial wizard, what are you basing this claim on? I’ll offer you a gentleman’s bet that the market bottoms no lower than Dow 7700 (worst case scenario, probably won’t get below 8000) and that it closes the year over 9500.

T2″

T2.. I think you went apeshit on me about a couple thousand points ago when I said 7500ish. Then Bri agreed and you said same to her. We got close.

Well we can look at Japan… 40k to 7 k. Hong Kong 32k to 11k in a few months is even more dramatic. Crude 160 to 57 in a few weeks. Volatility is obscene and saying beware. I follow trends. The trend is down and there is nothing to suggest up. Below all moving average, all facing down, all already crossed over.. And what you said never happens looks eerily like it is starting to happen right this very moment. We consolidated for a month and are breaking below. It is what I see.

And funny how it sounds when you say it but a 50% move back up is much less than the 46% move down (math is so funny sometimes)

And directional predictions does not consitute financial wizardry. Just seen lots of crazy moves and the Rorschach test is telling me I’ve seen this movie before. It’s just a bad feel. I said before on here I liquidated last Oct because I had a bad freaking dream on a plane. Just a sense and it is tingling right now. Hey last week I wasn’t even bearish anymore. Today I AM!! SPX sub 850 and the move into it was 3000 Dow points. Theory states it should match that, I just can’t find anything underneath and the NASDAQ looks the worst of them.. nothing til 1100.

Now financial wizardry is pointing out to you that you want to make a bet 500 vs 1300 points against????????? Actually it is MUCH MUCH MUCH worse than that because you are giving me a free trigger near at the money in an extremely high vol market which if we go below 7700 it automatically disqualifies you even if we do close above 9500. Think about what the hell you are saying. (I said that MUCH more politely than I normally would).

I am wrong a hell of a lot though. But even if I am wrong it is an awful bet. Now it is very late for me here. I hope you are right.

CountDeMonet: You are a realtor/lurker, not a realtor/stalker. Unless you are stalking G because you agree with him so much.

Oh and financial wizardry would be pricing the 7700 put, 9500 call binary options and the 7700 knockout option you would also be throwing in. i have no intention of doing so but I can tell you this. At this volatility it would be VERY EXPENSIVE for me to buy the bet you are offering for free. Just a game theory lesson. Not trying to be a douche. 🙂

Ted asks “Are jumbo loans that hard to come by?”

I get the impression that a lot of lenders have stopped offering jumbos at all, more are limiting themselves to “conforming jumbos” (which don’t exist in Chicago), and others are deliberately pricing themselves out of the market (like Wells Fargo with 9-10% rates).

The few banks seriously offering jumbos are asking for premiums of 1-2% over conforming and are most likely planning on holding the mortgages themselves — there is no market for jumbo mortgage MBS now. I’d expect these lenders to be requiring substantial down payments and well-documented income sufficient to easily pay the mortgage. I’d also expect that investor jumbos are nonexistant.

For example, BankRate lists only 7 lenders for a $800K 30yr jumbo with $200K down, and warns that credit scores in 680-699 will require another 1.0 points or a higher rate. Of those 7 lenders, the only “names” I see are Chase (8.125%) and Northern Trust (8.25%). If you want anything other than a 30yr fixed, you can’t get a big bank.

T2.. I think they all want to say they were right both ways. Simple rule do not get in the way of a moving train until you see it turn around. It has not yet.

You clearly want up and it prejudices your opinion, i saw that with you already. I have no prejudice. I don’t care up or down all the same to me. Actually up would be much better for me.

Steve..

**This is the opinion of Steve Heitman and in no way represents the opinion of “Crib Chatter” or any of it’s advertisers**

I liked that.. But look at U6.. it is all that matters.

T2 – I agree with your textbook MBA analysis of the market. However, I don’t necessarily agree with the smartest guys in the room anymore. Especially after everyone said, “subprime will be contained.” The problem with this market that you’re not going to find in a textbook is that consumer spending is 70% of the economy and the consumer is completely, hopelessly and utterly TAPPED OUT. His cards are maxed out and his credit score is low 600’s. There are millions of buyers and consumers that have been sidelined due to the credit crunch. So many that it’s sending right off the side of a cliff. I don’t have the stats or time or patience to write a damn thesis on the topic but the evidence is all around. Just today Best Buy said that spending was in for a seismic contraction. I’ll tell you why, because credit limits are being cut and HSBC is denying the BB store card to all except those with 720+ credit. and those with the better credit don’t need to borrow the money in the first place. Why are car sales 45% of what they were YOY? Because they stopped giving loans to people who cannot repay the money! That’s a significant chunk of the market. The world isn’t crashing but the credit contraction is going to cause of world of hurt for those businesses reliant on credit.

Steve — “Expect a change in conforming rates (accross the board and not just for NY and CA) by Jan 1st.”

The latest official word on that is the Housing and Economic Recovery Act of 2008, passed in late July. It left the $417K limit alone in most areas and *cut* the $729K high-cost cap to $625K.

See http://www.ofheo.gov/newsroom.aspx?ID=481&q1=1&q2=None

I doubt the lame duck Congress will raise these limits, but there is a chance for it in early January. Of course, they are more likely to do something unbelievably stupid like bail out more defaulting homeowners or suspend foreclosures (both of which just put off the inevitable a few months). Just let the market and courts work so that we can start the recovery.

“Because they stopped giving loans to people who cannot repay the money! That’s a significant chunk of the market. The world isn’t crashing but the credit contraction is going to cause of world of hurt for those businesses reliant on credit.”

I was not aware that so many people were not paying back their car loans. It seems the credit crisis has stopped the sale of cars. I don’t think someone with a 680 credit score should be considered as someone that will not pay thier loan back.

Steve,

In normal conditions its not. Thats certainly a respectable credit score (near mine), however as mortgage default rates haven’t even stabilized yet the finance companies are scared sh_tless of the coming economic fallout. This means that typical rate premiums that might be an extra 1% for a person with a 680 credit score might be much higher now (2-4%) if available at all.

I think demand evaporating moreso than lack of financing is what is behind domestic automakers 40% year over year decline. They made a lot of money building SUVs in the late 90s until around 2004 and unfortunately for them they paid these profits out in dividends and executive bonuses instead of diversifying their product line to more fuel efficient, higher quality vehicles. On the car front they basically invested all their R&D into increased performance.

Now they want taxpayer dollars. Let them fail, with bankruptcy they will finally be able to get the union costs under control and disgorge of the legacy liabilities (pensions, healthcare) that add cost to their products that make them uncompetitive.

Bob – Agree, agree, and agree. Except the part about credit becoming available again. It will clear up, but under realistic terms.

oops….. thank you, homedelete. i only stalk ex-girlfriends. i lurk here.

Steve.. Back to my earliest comments on here “They are insolvent, they have nothing to lend”

I am not trying to fight but merely point out. When assets are favorable to them they take the favorable mark as profit. When it is not favorable they created Level 3. Basically Reeses g’mas house goes to earnings and the shiny new condo mortgage written in ’06. Level 3. Take probably 85-90% of Level 3 assets off their books and you have the solvency of banks. And it is not just cars. It is everything that can not be financed. How many business do not use credit? Most fell to financing long term obligations with short term debt because the short end of the borrowing curve was cheaper and now they need to re-fi and can’t. And this is happening EVERYWHERE!!

Bob. They also financed the leases with the cars coming back to them way below the values they estimated and that is billions more added to the mess. Hard to believe Detroit (the city) could get worse, if it does would anyone even be able to tell?

The SHill is still making predictions?

I’ll bet the don’t on each.

T2.. Back above 850 SPX .. back to neutral for me.. And I haven’t even changed my underwear yet. 🙂

G… You wake up too early. And next time I am on Avenida Atlantica, although I rarely drink (wine does not count), I will get a nice cold chopp(beer) and toast one to you!

Go JETS!! 🙂

“The stock market crashed in 1929 but didn’t reach its bottom until 1932. ”

Homedelete, I understand that, but in between there was a 50% rally! The big crash in 1932 was the result of horrible government policies, which hopefully we won’t repeat. While your analysis of all the problems is accurate, what non-market-watchers fail to understand is that public information like this is already priced into the market. If bankruptcy lawyers know about an economic problem, believe me the traders know. That’s why the market is down 6000 points! My point is that massive rallies are a part of BEAR markets too. A rally from here back towards the 200 moving average over the next 2 months (somewhere around 10,500 at that point) would be TYPICAL for a bear market. I’m not calling for the start of a long-term bull, but bearishness is so excessive right now that many of the people who saw this rout coming are now turning short-term bullish.

“It is popularly believed that it was the Crash that inflicted the heaviest financial loss on investors during the Twenties and Thirties. But the Great Depression which followed was far more terrible. While the Crash dealt a severe blow to many a stockholder’s portfolio, the Great Depression brought obliteration and bankruptcy. Before it was over, the Dow Jones Industrial Average would lose 89% of its value before finally bottoming out in July 1932.”

Wikipedia

the true extent of the damage is actually just being realized. As the holiday season turns into a disaster, there will be retail bankruptcies and a ripple effect. Unless you are a day trader, hsbc is offering a 4%, 6 month fdic insured cd. It may not be glamorous but you will see your money back.

btw, I think it still hasn’t registered with the majority of americans that the good ol’ days were just an anomaly and they better get used to a new life style. Most folks think this is just a blip and things will be back to normal very soon. Amazing.

I’ve seen bankruptcies where a guy making $55k or $60k a year buys a new condo using 45% dti ratios. Of course he needs to furnish the place so he takes out a best buy/circuit city credit card and buys a tv, stereo equipment and an xbox. He gets a store card from Harlem or Wickes for furniture. He needs a new car to impress the valet so he takes out a car loan. He’s getting by just fine making the minimum payments for sometimne until a minor financial calamity arises (2 weeks off work, special assessment, taxes, hours cut at work, etc). So he stops paying everything. Literally just stops. Then he decides to file bankruptcy. He gets to keep all his stuff, he returns the car, he lives in the condo for free for about a year and then goes back to renting for 1/2 the price of his condo. This my friends is the ‘growth’ we’ve seen since 2003-present. Consumers buying things on credit at unsustainable levels……And now that the credit cards have been shut off, Circuit City goes bankrupt and Best Buy warns investors to prepare for a seismic contraction in sales….other retailers are warning that x-mas is DOA.. But Wal-Mart is doing ok!

Wow – There are some really good posts on this thread. I couldn’t agree more with the posts regarding the economy. I have talked to numerous people and when I explain where things are going over the next 1, 2, 3 years out they look at me like I am from Mars. I just lay it out and state it as fact. The massive consumer credit pullback is going to be very painful and felt all over the world. H.P. is just now seeing that it is a problem. As I have previously posted the ever expanding easy credit of no payments for 6 months, then 1 year, then 2 years, then 3 years….pull consumption forward until it snapped consumer credit. Now we’ve consumed for the next few years already anyway, so no a lot of real need to consume now…..hence an over correction of consumption on the downside. We see it in autos and people will just keep their cars a few years longer. Repo men aren’t being kept too busy now since finance companies are doing what they can to keep you in your car/SUV as long as you make some payments since it costs them tons more to repo the car and then have to severally discount the price to put it on a lot with others and watch it sit without a sale. We are not halfway through the pain and the clueless over spending consumer who thinks they can just juggle credit card balances is in for a wake up call. Bank credit card issuers are freaking now…

As such, this price reduction on condos is the mark of the start of the slide in Chicago. Welcome to the party!

Very interesting tread. Now comes the layoffs.

http://cbs2chicago.com/local/daley.city.layoffs.2.863161.html

Unemployment may cause a few sellers to get motivated.

T2.. I have been listening for a year to the “it’s all priced in there efficient market random walk BS (ALWAYS comes out ONLY as an against bearish argument for some odd reason)”

I always loved the Monty Python line.. “no one expects the Spanish inquisition”

Ze–

This gives some idea of what construction costs are (were)–the studios are 640 sq ft. I guarantee that the current $208k ask is still profitable at $325/ft (and also above the overall $$/ft).

Anon(tfo) Thanks.. Much appreciated. I always figure construction at 100+ a sq ft. then its calculating the land and adding in. I could be off by miles though on the 100+ per sq ft though.

Construction costs are not a floor to existing (new and used) homes in this market, period. They certainly won’t be a floor in South Florida and there is no reason for them to be a floor in Chicago, particularly with respect to urban condos….even if the land cost was zero. Things were over built and the cost to build, absent orders for new construction, is irrelevant to what people are willing and able to buy at. Hence, new construction has come crashing down as it is realized that you can’t build these things cheap enough to compete.

John.. I agree… I think I said, when i first inquired to the number several days ago, it has to go below that because it was the point even developers would stop trying to build. Now it is the banks shutting them off. At current market prices (if above new build costs – which it is) they would still be building.

“off by miles though on the 100+ per sq ft though”

On high-rise, “luxury” condos, it is meaningfully higher than that. That’s pretty fair for up to (maybe) 75′ tall. But anything like this (and, especially, taller–like Trump) is much more expensive.

The studio $$/ft is misleading tho (but I’m too lazy to calc the sq ft of one of the larger units–they aren’t just rectangles), as it has a higher allocation of fixed costs (e.g., foundation and lobby), has much less “cheap” space than the larger units and ignores the parking sq ft. (which is obviously substanitally cheaper). Overall, for a building similar to this, it likely has been in the $175-$250/ft range.

That said, John’s very correct that replacement cost isn’t a floor to sale prices. Once it’s done, the whole damn thing is a sunk cost–actually, once it’s done, it’s a liability to the owner (builder or bank) in the form of maintenance and taxes. At some point, it’s better to (basically) give it away, especially if “it” is an empty high rise.

Thank you for the credit on the big reversal call last night. Thank you! Thank you!

Here it is again if you missed it –

“T2 – Agree. Today’s selloff followed by INTL’s pre-announcement is perfect for a capitulation event possibly tomorrow. I don’t think the next few qrts will be pretty but it is either the end of the world as we know it, or it is simply not.”

Um, you think “up by 7%” is a “capitulation event”? Capitulating to what?

Well done Steve 😉

I think it might be safe to say we have put in a bottom just south of 8000.

We might need to test it another couple of times before we permanently brake out to the upside. Which I would say won’t happen until the inaugural and we get a better idea what the Messiah… I mean Obama’s, first 100 days is going to look like.

However, the stock market is leading by at least 6 months to a year so we still of course have more hurt to come in the local economy (see Daley re jobs today) and in the housing market.

We aren’t necessarily looking for a capitulation event. What we saw today was a retest of a bottom from which the market rallied back.

Its a localized bottom I expect the real bottom of this mess to be lower. But not for a year to eighteen months.

I think for much of the market it was the bottom this month on a valuation basis. Its really hard to justify low PE ratios of 5-8 in non-finance companies (and NOT GE either). For value investors they scream buy.

Yes KP. that is exactly what we saw. A failed breakdown and another crazy freaking range. Funny evil day.

But all that matters is a Jets win 🙂

I would say an 11% rally from the bottom is so what convincing. It will test it again but again I say the worst of the news is baked in. Times will be tough going forward but you will find a lot of cooperation from abroad to finance our bailout. It will start with financing housing.

“But all that matters is a Jets win”

There’s that much NFL action down there? Or you using one of the online books?

Anon(tfo) Way too emotional a Jet fan to bet on them. I think I am 0-20 lifetime on Jet games bet so I took them off the board. I’m like the poor Cubs fan who never gets to win. The fact it is past mid-season and we are playing for Division lead is enough to feel like prom night for me. How freaking pathetic and only speaking to Chicagoans can I expect empathy for my pain.

Just woke up and read Daleys comments. My god!

Steve funny thing is recessions LOOK like a series of events that will just keep spiraling but somewhere they obviously do stop. I agree with you on that. Only thing is I don’t see it coming from offshore. They are in deep poo also right now and need their money back home. Oil and China money are evaporating. I don’t think a one day bear trap rally on no volume says much about the whole economy. Just says what happens when everyone is looking at the same number and gets caught the same way. Markets like to hurt people. Thats why you always use stops and never sell options 🙂 Evil.. LOL!!!

Hey Ze – Just patting myself on the back for a call I actually made some money on. I agree that is was not very convincing and the volume was low. I do think we will get out of this w/o the worst case scenerio. Time will tell…

This is just one of many false bottoms. There’s a lot of bad news that isn’t yet baked into the prices, like the abysmal Christmas retail numbers that will be out in January. The market doesn’t fully price for events like that until they happen, and happen they will.

Steve.. well done and I hope you are right. I think the world gets out of it but next time leaves the US behind. Avg US worker that is (all he lived on was borrowed money, consumption, and is fat lazy self entitled and too busy waiting for jesus) The talented will see opportunity globally and will never have had more opportunity.

Roubini may just be too bullish for this crowd… 🙂

http://www.forbes.com/home/2008/11/12/recession-global-economy-oped-cx_nr_1113roubini.html

Ze you are spot on. It’s over for the US the land of opportunity will be moving.

Pete – You may not yet have accepted that retail sales will be brutal this christmas but something tells me the general market has. Maybe it is every local and national station talking about it all day.

This is baked into the numbers.

Ze – I take offese to that statement. We just voted out the do nothing Jesus freaks. Give us a chance.

Homedelete and Palin will be running again in 2012 but I think the whole holy leadership has crashed and burned with GW

Steve.. Oh no they have not. Today their kids in Idaho were chanting away on the bus so it seems. At least before they had a sense of being represented by the Fascists, now they have to go back to good ol’ Tim McVeigh style complaining.

I mean think how much you have to hate black people to live near New Orleans and still have voted for McCain.

I am just so glad most of these bank guys, this time around, names don’t end with burg and stein.

Ze – I think you underestimate the strength of the US worker. Sure the fat, lazy (Joe the Plumber) gets the headlines but deep down this country works hard. Worst case scenerio is we do get defeated economically, but remember we have the military strength to take whatever we want in this world.

Not only are you delusional, you’re beginning to sound like a Republican.

“#Steve Heitman on November 13th, 2008 at 7:50 pm

Ze – I think you underestimate the strength of the US worker. Sure the fat, lazy (Joe the Plumber) gets the headlines but deep down this country works hard. Worst case scenerio is we do get defeated economically, but remember we have the military strength to take whatever we want in this world.

The older I get I’m beginning to realize that ideologically the republicans and democrats are difference but in the pragmatic sense they’re one in the same. There are a handful of zealots on either side of the spectrum but most people are pretty clear in the middle.

Homedelete – Sounding like a republican would be as follows – “I think we should allow jesus to lead us with our choices in elected office. We hate gays in public but behind the scenes are all gay all the time. We vote based on who says they will stop all this abortion stuff. Most of us drive pick up trucks (with gun racks) and live trailer homes.” 🙂

So you’re one of those guys who sees the (D) next to a candidate’s name and automatically check the box. You’re just as bad as the Jesus freaks, which makes you a hypocrite and you don’t even know it.

“#steve Heitman on November 13th, 2008 at 6:15 pm

Ze – I take offese to that statement. We just voted out the do nothing Jesus freaks. Give us a chance.

Homedelete and Palin will be running again in 2012 but I think the whole holy leadership has crashed and burned with GW”

“but deep down this country works hard”

Or so you think. I have people doing work on my place and everytime I walk in there they are sweating like animals, carrying bags of bricks down by hand. Just hard cheap labor, no complaints. I had a leak in my apartment in Chicago. I almost had to sue to get them to open the wall and check. Then it took 4 people to come in and out and decide whose job it was. My wife and I still make jokes about the security guard who told us in the middle of a stairway (1 flight), as we passed her, that she had to stop in the middle and catch her breath. Joe 6 pack will have to accept global wages or why not just keep offshoring all labor.

Even many of the higher earners may be at work a lot but not necessarily working (i.e, playin on the internet). I think there are lots of smart talented people in the U.S. but definitely not the majority.

This property is only the beginning. There is a huge glut of inventory coming online in the downtown market next year. I don’t expect stabilization in the downtown condo market until 2011 at the earliest. If you own a condo in downtown and need to sell before 2015 I think you are screwed.

Not al all HD, I am a true republican, but unfortunately the people who put a (R) let to their names do not have what I believe to be republican principals.

Here, I’ll give it a try. Sounding like a democrat would be as follows – “I’m a pot smoking tree hugging PC liberal who for some unknown reason has aligned my political beliefs with inner-city Cadillac driving welfare baby mommas who voted Toddler Stroger into office because I’d rather vote for a guy who pays everyone in his family $100,000 a year to ‘work’ do nothing gubmint jobs. I can’t think for myself except that I believe that government can solve all the self-created problems I have in my life.” Of course that’s not entirely true but it’s just as ridiculous as your inane comments.

Go ahead, check the (D) box next election. They’re looking out for your best interests …. ahem.

____________________________________

#Steve Heitman on November 13th, 2008 at 8:07 pm

Homedelete – Sounding like a republican would be as follows – “I think we should allow jesus to lead us with our choices in elected office. We hate gays in public but behind the scenes are all gay all the time. We vote based on who says they will stop all this abortion stuff. Most of us drive pick up trucks (with gun racks) and live trailer homes.” 🙂

Uh….Ok. Toddler Stroger is a better vote than any of the other (R)’s out there? Checking the (D) box every election. AT least there’s something in life you can count on, right?

“#Steve Heitman on November 13th, 2008 at 8:23 pm

Not al all HD, I am a true republican, but unfortunately the people who put a (R) let to their names do not have what I believe to be republican principals.”

“I think there are lots of smart talented people in the U.S. but definitely not the majority.”

That is why we have social classes as with the majority of countries. Sure some are more eager than others but that comes with desperation. We have been spoiled over the past years. When desperation returns, there will be some competition from within for those bottom of the barrel jobs.

How can you be an attorney and a republican? Doesn’t that automatically get your license revoked?

I’m starting my own party. Pot smoking, tree hugging, abortion and death penalty loving, fiscal conservative, who wants no business tax and to offshore all jobs. And as my first act of President I promise to make the national language French.

I have to be careful not to expose my views unless among close friends or on internet chat boards. Fortunately the two partners I answer to are pretty conservative so that’s one of the reasons why they hired me. The line at the very of bottom of my resume which says “intern w/ Senator Peter Fitzgerald’s chicago office” does one of two things: get me an interview or gets my resume tossed in the garbage. It’s like a secret handshake in the underground but powerful republican community in the area.

“#Steve Heitman on November 13th, 2008 at 8:32 pm

How can you be an attorney and a republican? Doesn’t that automatically get your license revoked?”

BTW.. where are all the apartments with the great views… how come we never see those posted.

HD -So you guys have a lot of late private parties at the office 🙂

Alright before I get flamed, I’m talking out of my ass. I’ll shut up now and return the discussion to real estate. Only 12 more days until the Oct Case-Shiller index!

“#homedelete on November 13th, 2008 at 8:44 pm

I have to be careful not to expose my views unless among close friends or on internet chat boards. Fortunately the two partners I answer to are pretty conservative so that’s one of the reasons why they hired me. The line at the very of bottom of my resume which says “intern w/ Senator Peter Fitzgerald’s chicago office” does one of two things: get me an interview or gets my resume tossed in the garbage. It’s like a secret handshake in the underground but powerful republican community in the area.

“#Steve Heitman on November 13th, 2008 at 8:32 pm

How can you be an attorney and a republican? Doesn’t that automatically get your license revoked?””

Ze – Because this a board that has focus on the properties that have flaws and properties that people over paid for. Not always but most the time.

How come there are no stories of successful profitable sales? They are all over the place but you don;t see them here…

Nah.. most things here seem to be priced looking for profit. Fun will be when we see more posts like this one for St Clair. Now off to steal a homeless persons bottle of liquor while they sleep. Or watch the Jets somehow blow this game. One or the other. G’nite guys.

Steve asked:

“How come there are no stories of successful profitable sales? They are all over the place but you don;t see them here…”

I’ve posted on successful sales in the past and have posted on some properties that go under contract quickly after they’re listed.

The problem is- there are far fewer of those than there are of the properties that sit on the market (especially as market times are approaching six months or longer.)

Today’s Lincoln Park Closings

2712 N Racine Unit 3

Purchased in August 2002 for $410k

Sold 11/13/2008 for $532,300

2719 N Paulina unit 3S

purchased in Nov 2004 for $459,000

Sold 11/13/2008 for $444,000

**That new construction in a bad area sure will get you***

So far we have

3 gains

1 Loss

So somebody buys in 2002 and sells this year for a profit. That’s called being in the right place at the right time. It has little to do with skill or knowledge. How many 2005 buyers will sell at a profit in 2011?

Note that both of Steve’s examples were just sold by the original owner.

Further, the prices are low enough for conforming loans with reasonable down payments.

2712 Racine — bought with 20% down, refinanced to a $328K first in Apr 2003 and added a $150K second dating in Sep 2005. After closing costs, the seller may have managed to walk away with $20K of their $82K down (plus anything they managed to save from their equity withdrawl).

2719 Paulina — bought with 35% down ($290K mortgage), no refinancing or seconds. They probably left closing with $130K from their $169K down — enough to buy a $550K home with a conforming loan.

“The market doesn’t fully price for events like that until they happen, and happen they will.”

Yes, anonymous message board posters can see the future, but stupid traders can’t. Why is everyone in this board so negative? The US is still the best country. We’ve been through bad recessions before. Believe me, we’ll make it through this one and will be stronger than ever.

T2,

In my view reality is more nuanced. I’m not as bearish as most on here, but assuming our country is still “the best” besmacks of pledge of allegiance loyalty and a naievity toward the future. I don’t completely agree with others assessment here that “the talented” will flee the country either, but it seems this downturn will be particularly nasty.

The US will always have a broad talent pool to choose from (even if I might not be one of them), despite what others claim. They are operating under the broad assumption that when people see a slightly higher rate of return on their earnings/career they will leave the country. I can say from experience _this is not the case_. Not at all. That is an arrogant assumption indeed.

Bob..

You need to work on reading comprehension. Nowhere have I EVER said “FLEE the country” I said they will see opportunities abroad. As in GM making all their profits out of the US while their US manufacturing and sales blow chunks. Or almost all of our consumption was financed externally, foreign countries will diversify their lending more going forward leaving the American consumer with much less purchasing power. What I am talking about in equilibrium shifts. Kinda like that.

Think they want to deal with BS union workers anymore. Hold on call the 100k a year electrician to change the light bulb.

Please don’t put words into my mouth, if you are unsure what I am saying ask.

I mean if you have wife and kids in school of course you can’t just pick your ass up and leave, and most people hate change. Holy shit when do you think I became such a simpleton.

As for the US being the BEST country. ROFLMAO!!! That individualistic priority is probably half the reason so many are so miserable and overweight.

T2 – “Yes, anonymous message board posters can see the future, but stupid traders can’t.”

Agreed. And you could substitute “traders” with Congress, bankers, hedgies, ratings agencies, realtors, economists, and the fed.

I think we are very unlikely to see people leave the country, but more likely to see fewer come here since there are better opportunities in their home countries now. Still, I travel all over the world and every young, ambitious person wants to come to the US. We need to rid ourselves of some excesses but we will still be the dominant world power 10 and ever 50 years from now. Every time I leave the country I am reminded how far ahead of the rest of the planet we are and it seems like Europe is falling further and further behind.

“Agreed. And you could substitute “traders” with Congress, bankers, hedgies, ratings agencies, realtors, economists, and the fed.”

I am in full agreement. My point, though, is that EXPECTED bad news is already priced into the market. Unless those of us on this message board are able to foresee a future event that virtually no investors are aware of, then we can safely assume that expected bad news has already been accounted for.

I hope you don’t think I ever predicted equity future prices. I was not the one that did that. That was you. Nowhere on this board or in the past many many years have i done that. Maybe the closest is saying something like “long term trendline is xxx, looks like it wants to go there and test it” I just said where I saw stops and that they were about to be set off, and I saw nothing underneath. They were set off, no follow thru and back up thru it and then some. As I said also yesterday well before the market was open. Above 850, no reason to be short. Above I see nothing for quite a bit also. I never put numbers on where things will be on X date, nor will I ever. Thats pure Silliness. Gota go!

G.. i think he meant traders can see it better. I may be wrong.

Oh but I am firm on RE down and avg american worker will get hammered going fwd

Kevin said:

“Note that both of Steve’s examples were just sold by the original owner.

Further, the prices are low enough for conforming loans with reasonable down payments.

2712 Racine — bought with 20% down, refinanced to a $328K first in Apr 2003 and added a $150K second dating in Sep 2005. After closing costs, the seller may have managed to walk away with $20K of their $82K down (plus anything they managed to save from their equity withdrawl).

2719 Paulina — bought with 35% down ($290K mortgage), no refinancing or seconds. They probably left closing with $130K from their $169K down — enough to buy a $550K home with a conforming loan.”

It’s always interesting to see what’s really happened with the loans. Some sellers that you think should have “made” quite a bit of money, actually end up losing once they pay the realtors, closing costs etc. because they’ve pulled money out of the property.

Also- no one here is arguing that if you bought in 2001 and 2002 and never refinanced that you are currently losing money in Lincoln Park.

But what is also obvious from these sales prices is that the appreciation has slowed noticeably. If you look at sales data going out 10 years for LP or Lakeview, you’ll see properties triple or quadruple in that amount of time.

But the appreciation in the last 5 years might only be 15% to 20% (if that.) That’s a lot different from doubling every three years as we saw a decade ago.

That’s the issue going forward. Little to no appreciation (and in many areas- continued declining prices.)

Sabrina said

“It’s always interesting to see what’s really happened with the loans. Some sellers that you think should have “made” quite a bit of money, actually end up losing once they pay the realtors, closing costs etc. because they’ve pulled money out of the property.”

People’s loan amount give no indication about gaining or losing money. People could have refinanced and pulled cash out to stick in a cd for all we know. Purchase price vs selling price determine gain or loss. Also, don’t always assume a full commission is paid on buys and sells. There are often deals made when a person is selling and then buying another property. Some of us pay nothing to buy and sell out properties and actually make money doing so. If I purchase a $1,000,000 property the real price is $975,000 even thought the records indicate $1 million.

Hey Ze – Maybe our workers can become more like european workers and take 8 weeks vacation and work 6 hour work weeks. Funny how you say the US is lazy

Steve,

When the time comes for you to lay your head to rest for the final time think which one of those choices you would have preferred. Those 5-6 extra weeks every year that you spent traveling around the world, meeting different people, seeing beautiful places, learning new things about different cultures, spending more time with family and friends. Or those extra 5 weeks a year in the office?? Yeah, I would really have to think long and hard before answering that one.

And I think the 2 hour lunch is a thing of beauty.

Have any of you actually been to the 550 St. Clair building? The doorman sits there like a CTA ticket collector, the dinky lobby looks like crap, and the kitchens are not only limited-space wall units which intrude into the living areas, they are made of plastic. The prices are now approaching reality.

I took a tour of the one bedrooms this weekend. I found the 3 different washer/dryer locations odd; bathroom, walk-in closet, and kitchen. You could see by the column placements that the one bedrooms were residual spaces left over from the corner units. The east-view units showed much better. From Michigan Ave, the terraces looked horrible with the variety of chairs owners had purchased for their units. Window treatments and exterior furniture needs to be an assessment item for all buildings, not a decision for the individual owner.

yes I have been to 500 St. Clair building. agree lobby is not the best looking and so the amenities floor is not the best either. once the association takes over they need to work on gardening, remove fake plans, etc. its modern looks inside. compare pricing with surrounding condos its attractive.

I was going to comment on this several days ago, but my post got eaten up by my computer so I gave up. Here is a quote from “The Mole” on Seeking Alpha today that sums up my feelings very well: “… we are still being subjected to “downside surprises” in both economic data and corporate earnings (guidance) versus what the market consensus had been for these numbers. My view is that one of the keys to finding the bottom of the market will only come when we cease to be surprised i.e. when macro economists and equity analysts adjust their perceptions to such a degree that even bad data looks a tad more rosy because it wasn’t as dire as the market expected it to be. It is with considerable disappointment and frustration then that I read that most economists seem to think that Q4 will be the nadir of this recession and that unemployment with peak at 7.5%. This is just pure bone headed lunacy driven by vanity i.e. they have to adjust their previously, crazily, over-optimistic and plain wrong views by an embarrassingly large mark to recognize reality. They look likely to be surprised again as they aren’t even playing catch-up yet.”

T2: “My point, though, is that EXPECTED bad news is already priced into the market. Unless those of us on this message board are able to foresee a future event that virtually no investors are aware of, then we can safely assume that expected bad news has already been accounted for.”

Juliana… Bravo!

How anyone who has been in a Home Depot 3 years ago vs a week ago and still says surprised is beyond me.

“unemployment with peak at 7.5%” ha ha ha ha ha ha ha ….. wow, whoever is betting on that will lose. It has just begun.

Home Depot? Hell I was in a suburban Target on Saturday afternoon and there were only three checkout lanes open. The parking lot was practically empty.

“Ze Carioca on November 18th, 2008 at 6:57 am

Juliana… Bravo!

How anyone who has been in a Home Depot 3 years ago vs a week ago and still says surprised is beyond me.”

Although when I was at the South Loop target last Saturday afternoon the place was crazy busy with most of the checkout lanes open. People were driving around in circles in the parking lot looking for spaces.

Go figure.

I’ve been to the south loop target a handful of times and it *always* seems to always be busy. And surprising the Jewel by me also seems even busier than usual.

But in the last few weeks the Whole Foods in Palatine and up on Peterson both seemed dead. I spent quite some time in retail during my youth so I have a sense when a store should be busy and when it should be slow.

They say Wal-Mart traffic is up but I haven’t set foot in one in years.

Retail is a mixed bag even though they said sales are down 2.8% the largest drop ever recorded since they started keeping records in 1982.

Sabrina- yes I’ve considered going back to this bldg. I’ve gotten several calls from the sales agent regarding the new pricing. Clearly the price is much more attractive than most new construction in this area. My concern has to with number of units sold in the bldg – i don’t think they’ve sold more than 60% – could I be exposed to much higher monthly assessments or even special assessments to make up for operating deficits.

LE-

Only 60% sold? I was looking online and the developer and other sources have claimed over 85%. Are they trying to pull a fast one on potential buyers. Also, there are only 2 resales listed on the MLS. Curious how many units are really available.

“Only 60% sold? I was looking online and the developer and other sources have claimed over 85%. Are they trying to pull a fast one on potential buyers. Also, there are only 2 resales listed on the MLS. Curious how many units are really available.”

The building was “originally” about 85% sold but clearly a number of buyers didn’t close on units as only about 65% closed.

The developer is NOT putting the available units on the MLS- so the MLS is misleading.

Hey S:

Are the numbers re available units in the post accurate? 82 sold of 112 equals 73%. 65% would be 73 sold. 60% would be 67.

I look outside my balcony and majority of the east facing units appear vacant to me..

“majority of the east facing units appear vacant”

Not incompatible with “sold”, tho it does raise the issue that sales numbers do not necessarily indicate that the assessments will be paid.

I have a list of current owners and the number of outstanding units owned by Smithfield at home. I will report back my findings tonight. I beleive Smithfield might still own 8 units and I believe there are a total of 184 units in the building.

I am just curious what will happen to the cost of real estate and to rents when hyper-inflation occurs? Granted we are in an unprecedented period of demand destruction and economic slowdown. However, the goverment is meeting this head on by printing more money than it has in its history. In addition, more and more money will be continued to be pumped into the system once President elect Obama takes office. I have been a huge real estate skeptic for along time and still feel that prices are too high, however, one has to question when an artificial floor will be created by the goverment.

shiphouse – Hyper-inflation? Not yet, and hard to tell what counter moves will occur if inflation were to pick up anyway. As it stands now, massive private credit was pushing the economy along but that is now gone … a lot of it forever … and the new money/credit by the fed govt is just an attempt to fill this void. Well, guess what, they would need $10 Trillion to fill it now and they are pushing $1T maybe $2T??? At that rate deflation is the worry as the fed govt can’t fill the private credit void….so the credit level will stay dramatically lower than it was and hence so will demand….and prices. Inflation? Not a concern for 2009…. I wouldn’t make any major investment decision based on the erroneous notion that the inflation boggy man is stalking us. The massive fed govt printing of money and extending credit would only cause inflation if private market credit supply stayed the same, it hasn’t, it tanked instead. Again, the fed govt acts are not in a static system and you have to look at the broad picture… even the Fed is out bullets to spur inflation by lowering interest rates….the effective funds rates is 0.3% and we’re still seeing substantial deflation……. Playing defensive against inflation now is not the answer….holding nominal dollar priced debt is killing people…and the lenders that secured those debts with deflating real dollar priced assets.

John – Valid points. However, the amount of base money increased by 25% alone in October. This was before any more money was pumped into the system. This is a problem, while perhaps not immediate it should be a concern. What happens when money starts rotating back out of the dollar and into commodities and other currencies baskets during the second quarter of 2009? I am willing to bet your Butterball turkey next year will cost allot more than $1.99/lb.

shiphouse – Not gonna happen in 2009. Yes, it is a concern, but by the time inflation becomes a real concern (say 5%) the fed govt will have already started to take back the money. It isn’t like the fed govt will just sit back and let hyper-inflation happen….they will never run out of bullets with that since they can raise interests forever….they can only drop them to zero which has effectively already been done (yes there is a way to go negative but not forever and is not easy). Turkey prices will be cheaper next year….that much I know. I have other dollar concerns but hyper-inflation is not one of them for 2009 or even 2010. I just did a through analysis of inflation through 2009 and concluded, quite decisively, that it is a non-issue, period. 2015, inflation may be a concern, hyper inflation, I doubt it but no really knows that far out. React to what you know and which includes what you don’t know. That is what I am doing…I can only know so much and one of those things I know is inflation is not a concern in 2009. Anyway, don’t get too scared of hyper-inflation haunting us….buy if you have any new info, please share since I constantly reevaluate what is going on and would be interested to know if I erred in anyway. Thanks.

By the way, the US dollar should strengthen based on the terrorist attacks in India. The U.S. has proven itself as a safe haven since 9/11 (credit to Bush for all you bashers out there). Investments in India will decline as people realize that India, while robust, is comparatively vulnerable since they are a country surround by crazy people. The U.S. has water, Canada, and Mexico and big arse military that will obliterate people or countries if they attack…what does India have? Brazil should benefit as a comparative emerging market since they are surrounded by jungles not crazy people with nuclear ambitions. Tough world, the U.S. has a lot to be thankful for….