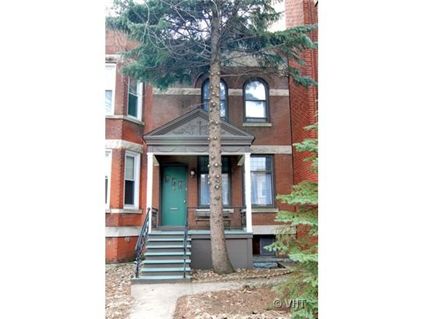

Offers Within 2 Days: Vintage Rowhouse at 1469 W. Foster in Uptown

This 4-bedroom 1892 vintage Italianate rowhouse at 1469 W. Foster in Uptown just came on the market and already had several offers within the first 48 hours.

The rowhouse has skylights, central air, a sunroom and parking for 2 cars. The listing says there’s room for a garage.

Yes- the bedrooms are small. But apparently, the price is right.

Mario Greco at Rubloff has the listing. See more pictures here.

See the property website here.

1469 W. Foster: 4 bedrooms, 2 baths, 2 car parking, no square footage listed

- Sold in January 1990 for $200,000

- Currently listed for $324,500

- This is NOT a short sale

- Several offers pending

- Taxes of $4,087

- Central Air

- Decorative fireplace

- Bedroom #1: 16×10

- Bedroom #2: 13×8

- Bedroom #3: 12×9

- Bedroom #4: 9×7

I think the price is actually very good and the property feels very much like a single family. Assuming it goes into a bidding war, I wonder where it will potentially end up. My only gripe would be finishes, (nothing about 25k-35k couldn’t fix) and the lack of a powder room, or bathroom for that matter on the main living floor. From the looks of the floor plan http://media.rubloff.com/files/property/4687066/981/Floorplan/ there appears to be only one bath on the 2nd level and then a tiny one in the basement. Not sure I would want to have guests climb up or downstairs.

Other than the unfinished family room, I like this place.

(not directed at the above poster) I never understand why people want vintage places, yet complain ablout not having master baths, granite this, more storage, etc.

The broker and seller underpriced this property. Good bones, classic row house in a decent location with 2 car parking. Should have been asking at least $425K.

The market it is back folks.

Those of you looking to buy your dream home ought to get your offers ready. The next few months are going to change the game.

Good for the seller for pricing it low and being realistic. congrats to the eventual buyer for a good buy.

Finally we are seeing a property that makes sense at an affordable price!

In looking thoroughly at the pictures, evaluating the price point and the location, all seems to be in order. This house seems like it would work on a number of levels. It is even one I would seriously get into a bidding war on as it needs very little, if anything to be move in ready.

I agree with nsarch, the only thing(s) needed would be an additional bathroom or to enlarge an existing one to meet the needs of a 3 bdrm house, (the 4th bdrm is so small, it would function well as a computer room/work area). As far as the ‘finishes’ go, the existing would work just fine. If deemed unsuitable, that minor detail could be redone at a later time.

My priorities would be, as mentioned above, to add/enlarge a bath, then considering the winters here, I would build a garage on the space provided. Other than that, this is a perfect and actually, a quite beautiful home. Where else could you get that LR size for this price in Chicago? In considering 235vb as a home for myself, even the top floor ‘penthouse; (IF you could call it that) had a 10’ wide LR that was totally unusable.

I will be very surprised if this listing elicits negative comments on this forum considering the less than acceptable properties of late!

That place is very nice. It fronts onto Foster which is a slight negative, but at $324,500 it’s a great deal.

And nsarch, I don’t really get your position. This place is priced perfectly, and the lack of all the amenities required by “contemporary” buyers (whoever they are) isn’t a problem for me. If they were trying to sell the place for $700,000, then maybe I’d agree with you, but not at the asking price.

But my first order of business would be to get rid of the pine in the front yard. Since the house faces north anyway, it’s not providing any sun block, but probably makes the house darker.

With a north/south oriented rowhouse, you want to maximum the amount of sunlight, not limit it.

Agreed with the sentiments on this property. It is either priced low or correctly for the market and will sell quickly at or above ask. Though paulj I’m not sure you can extrapolate this one property to the broader market.

paulj is calling bottom again. It didn’t work last year, but, if at first you don’t succeed…

The unintended humor here the past day has been great.

“Should have been asking at least $425K.”

LMAO. But then it wouldn’t sell, like 99% of the others with fantasy pricing.

Holy shit, this is funny:

“The market it is back folks.

Those of you looking to buy your dream home ought to get your offers ready. The next few months are going to change the game.”

I am waiting to see what the final price will be. I hope someone adds it here once it sells.

underpriced

Here’s to the next comp selling for even less!

I’m curious, when there are multiple offers within a day or two of listing, are people making offers without having seen (at least the inside) it, or had they seen it before it’s officially listed?

That said, a very nice home and clearly a great deal at 325k (certainly looks as though it will close above list).

This place was priced appropriately. It sold in two days because there is demand at this price point. That’s what markets are: supply and demand. There is scant comparable supply at this price level but high demand so it sold quickly. Congrats to this seller for being realistic about pricing. There’s nothing smart about over pricing a property and chasing the market down with price reductions for six months and then selling with plenty of concessions.

“underpriced”

The fantasists should get used to it.

Better yet: Buy, buy, buy. RE only goes up, dontyaknow?

“underpriced”

That might be the idea. Low price to start and let people fight for it.

We can debate if it’s worth it or not I guess but I would not be surprised to see this sell for well over ask and I am a bit bearish on RE.

This is a 4 bdrm brick SFH, and a nice looking one at that, in Andersonville on the north side that is being offered for under 325K!? If this becomes the norm I would be very happy.

If anyone knows of similar properties at this price feel free to post some links. I would even be happy with something that needs a lot of updating for less.

Nice price for the place, how’s the yard on this one? I totally would have looked at this one if it had a nice yard, even though its kinda far from downtown & work for my tastes. Also what’s the sqft? basement?

What is baffling to me is that the nega-toids on this site treat homeownership like a share of stock on the market. ” It’s up! It’s down! The end is here! The end is near! My house is worth $5000 less this month than last month!!'”

I live in my homes and plan to be in them for a long time. I am not sure I care on a minute to minute basis what the value is on Zillow.

I need one of the nega-toids to explain their mania and obsession with real estate market fluctuations. Buy a home and plan to live there for 5 years or forever. Plant some trees, install a new kitchen, most importantly, enjoy it.

I get the sense that many regulars on this blog have never owned their own home and don’t completely understand all of the intangible benefits. If you won’t sleep at night because you are worried about losing value or paying too much, this fear won’t likely go away, no matter how low values may go.

My advice for those living in fear, continue to rent. I love what we landlords call their “roach” tenants – the ones that check-in but never check-out. (Settle down, this does not mean you are a roach, it is just a old saying..)

ME,

Let me elaborate. I wasn’t referencing amenities by any means. I agree that the price is very good, but to get it to a place where I would like it to be, I would invest approx 25k into this property. That would hopefully allow me to enlarge the bath, finish out the family room a little better, do something w/ the kitchen since there appears to be a lot of wasted space, and I personally don’t care for appliances touching one another (such as the stove/fridge do here). Even w/ 25k into it, you would be under 350k and would still be getting an amazing deal. It is obviously a property that is already move-in ready and these would be things I would do to it. The character and charm is great so thee is no argument there.

“And nsarch, I don’t really get your position. This place is priced perfectly, and the lack of all the amenities required by “contemporary” buyers (whoever they are) isn’t a problem for me. If they were trying to sell the place for $700,000, then maybe I’d agree with you, but not at the asking price.”

HD-“There is scant comparable supply at this price level but high demand so it sold quickly.”

Agree, so just price it a little bit higher. I think this will close at ask or a little higher.

G-“Better yet: Buy, buy, buy. RE only goes up, dontyaknow?”

I am. I have more places that John McCain. No fear. I don’t live scared.

And you have ignored my requests to tell what happened to your RE investments? Did you lose money and therefore have sour grapes to the RE market? You are like a bitter woman, who swears all men as assholes. Are you ashamed?

This place will sell for way more than $324k. There are two bedroom condos in the area selling at $400k+. It really is a great deal in a phenomenal neighborhood. The only downside is that it is on Foster which is busy and noisy, but the value of this place can’t be beat. It also looks well maintained.

There are some people who will be negative no matter the situation. Yeah, there was a housing bubble, but folks need to get over the idea that they are going to be buying nice 2/2 condos in LP for $99k.

For the price, I love this place. I agree with WL that the biggest need is another bath–I’d want to dump the 4th upstairs BR and use the space for a bath and some closet space (along with re-arranging some BR walls. Add a guest room space in the basement, if you actually need it.

I question the “room for a garage” if you want to maintain two car parking; the lot is 17′ wide, so a two car side-by-side garage would be lotline to lotline (so it would need to be brick/block, per code, and no eaves on the E/W sides) and still only a cozy 2-car garage.

paulj,

Good words of wisdom. Also the decision to purchase real estate, and at what price, is likely the largest financial decision people make (aside from having kids, perhaps) and thus timing the entry and exit points and prices has an enormous impact on your long-term wealth accumulation.

Someone recently posted an article here, and I’m kicking myself for not bookmarking the link, comparing two couples. One that rented when RE was overpriced and then bought when it crashed and one that over-leveraged and paid peak pricing. Granted I think the example was comparing two couples in CA which will has much more volatility than here but the premise is still the same.

“What is baffling to me is that the nega-toids on this site treat homeownership like a share of stock on the market.”

“I personally don’t care for appliances touching one another (such as the stove/fridge do here).”

That’s a practicality issue, too. If you use your oven at all, you’re making the fridge work much harder to deal with the heat. Never should put a fridge next to an appliance that generates a lot of heat.

paulj,

You’re right, people planning to buy a house should expect to live there for 5 years or more. I can’t speak for other people, but I’m bearish on the real estate market because I think prices have been overinflated due to cheap credit and people getting overemotional on those ‘intangible benefits’ you seem to value so much. And while yes, you can get enjoyment out of actually owning and living in your own place, it doesn’t change the fact that your house is also an investment.

For people that make sound decisions now, their home will be a valuable asset, and will greatly improve their financial position many years down the road. It’s all about opportunity cost. Small decisions now can have very large implications in the future. You seem to think that we have extremely short horizons, but in reality, some of us have much longer horizons than just 5-10 years out and are already making decisions based on how it will affect our retirement.

Looks like they took all factors into consideration when pricing it for a quick sale. This appears to be a pretty darn good deal.

Much experience with bitter woman?

“You are like a bitter woman, who swears all men as assholes. Are you ashamed?”

“This place will sell for way more than $324k. There are two bedroom condos in the area selling at $400k+. ”

Edumakated I don’t think our paralegals making 75k are getting 95%+ LTV loans anymore. People who paid 400k+ for a two bedroom condo are what I call maroons on here.

If you had some recent data points from this year to support your belief that two bedroom condos in this area are selling for 400k please post it and refute my assumption. But I am of the belief you are quoting peak bubble pricing and current ask prices.

Yes.

I guess this shows that if you buy RE and hold it for 10, 20 years, it turns out to be a good investment. The buyer purchased in 1990 and is now selling for near double.

Sure, Brad, if you ignore all the relavent “rent v own” factors? What, for example, if renting the equivalent saved hundreds per month for those 19 years?

Do some research with ccrd and google and learn that the previous owner, a professor, died a few months ago. The property was put into trust a few months before he died. My assumption is that the trustee or the beneficiaries of the trust wanted a quick sale, which they got.

“Sure, Brad, if you ignore all the relavent “rent v own” factors? What, for example, if renting the equivalent saved hundreds per month for those 19 years?”

if you saved $200 a month by renting the difference is $45,600 over a period of 19 years… not even close to the profit.

-You’d have to worry about your landlord selling the building, and increasing your rent.

-You wouldn’t want to put any improvements into the place so you’d be living in a dump.

-Tax benefits over the last ten years or so

-Oh did I mention you basically lived for free for 19 years after the sale of this place?

Rent vs. Own over an extremely long period of time like 19 years is always going to lose.

MADFLY, bought everything in the 80s early 90s, mostly 2-4 flats and lots in West Town. I thought they were long-term holds, but good luck resulted in beginning selling in 2001 and sold last in early 2005. I didn’t bother exchanging since the taxes were obviously less than the downside on avilable properties at the time.

I’ve been involved in far-flung scavenging, as well. I have taken some lumps, too. Mostly associated with far south purchases associated with da mayor’s plans for the Lake Calumet Airport. They still cash-flowed and were very cheap, so the pain wasn’t too bad.

No bitterness from me, just amusement.

Timing is everything in RE, and buying in the midst of an obvious correction shows no knowledge of this fact.

Bob, 2/2’s were selling for around $400k in ’05. Those same units are listed up to $475k now. They won’t get that, but even if you discount the units dramatically, they are still substantially more than this place. Heck, when I moved to Aville in ’01, 2/2’s were at $300k or more and that was when most people in this city thought anything north of Irving Park was Wisconsin.

The price is right for this place, or perhaps a little on the low side, since it sold so fast.

But prices by and large are still sticky at 2005 peaks, which were justified only by the weirdest lending practices in history, which will NOT return anytime soon.

From here forward, prices will have to have a reasonable relationship to the incomes of likely buyers, and to rents.

Incomes are deteriorating and the job situation is dismal, so most prices have a lot of give left in them.

When prices finally do bottom, they will bounce along the bottom for a long time, only keeping pace with inflation. Given the return of normal lending standards, housing might revert to the sort of appreciation we saw between 1950 and 1975, when it only kept pace with inflation……

… unless our financial policy makers in D.C. and their Wall Street Masters manage, by means of tossing over $7 Trillion of the taxpayer’s money at relieving banks of all their bad mortgages and derivatives based on them, and putting a taxpayer-supported “floor” under the housing prices, manage to spur a wave of hyperinflation, Weimer Germany style. You can see clearly that the feds are trying like anything to do just that, to inflate our way out of this mess.

It might not work, though. You do NOT, in a healthy, rational housing market, experience “appreciation” on your house equal to a year’s income. Where was it written that people should make double-digit returns on their housing “investment” merely by living in the place?

Thanks for the personal history, above posters. I love Lake Calumet this time of year.

Super charming property, though. assessor lists it as 1,572 square feet.

The first floor rooms have okay dimensions, but the second floor bedrooms are all so narrow!

a standard two-car garage is 20′ x 20′ so obviously that can’t fit on this 17′ wide lot.

does anyone know if the city will allow you to build a garage with no setbacks? i would think they’d required at least a gangway on the side, but really don’t know.

“Timing is everything in RE, and buying in the midst of an obvious correction shows no knowledge of this fact.”

Is this true regardless of the specifics of a transaction? Would the purchase of an $8M 180-unit building in Houston be a bad deal simply because it is 2009?

bubbleboi, there are other options other than a 20×20 garage.

You can park tandem, or use a car stacker which is th same footprint as a standard garage spot. You do need around 15′ clear height in the garage.

You can build a larger 1 car garage with carport/parking pad. 2 car garage will not work. But for 325-350k in this neighborhood, 2 car parking of any kind is very rare.

Considering that this house was built in 1892 and the lot is only 17′ wide any parking consideration is merely an afterthought.

> paralegals making $75k

DANG!

“does anyone know if the city will allow you to build a garage with no setbacks? i would think they’d required at least a gangway on the side, but really don’t know.”

In general, a garage constructed of Non-combustible, protected construction (metal studs, brick, block) can be built to the lotlines. There are “special circumstances” where a 3 ft setback (one side) is required, but I can’t find what they are.

paulj: “I need one of the nega-toids to explain their mania and obsession with real estate market fluctuations. Buy a home and plan to live there for 5 years or forever…”

So poulj, your point is that one can never overpay for a RE. Just buy it and forget it. After all you will live there forever, so why do you care what its resale value is?

Right? Right?

And people like you call themselves investors! Boy, we have a long way to go…

Amen, crazy frog.

Andersonville is my third favorite ‘hood after Lincoln Park and Lakeview. The idea of being able to get a historic home there with no assessments and vintage charm for under 400K is making my mouth water. I hope there are going to be a few more deals like this available over the next year or two.

Well, lets face it, whoever the buyer is, just made himself a GREAT buy. He is skipping to a different tune for the next couple of days. His neighbors on the other hand, are not going to be too happy about this. lol. It just goes to show, if its priced right, theres always a demand!

Personally, I think it’s still a little over priced at $325k – but hey, it’s a nice start. $325k is only considered a spectacular deal when compared to the bubble pricing of the past. $325k is what, about 3% a year on average since the 1990 purchase, so basically inflation? The way housing was priced prior to 1998/1999? Prices across the board are trending back to historical pricing adjusted for inflation.

Danny, there will be many more to come in Andersonville. Check out this recent sale:

5336 N Lakewood Ave Chicago IL 60640

4 beds, 1.5 baths, 1,932 sq ft

Recently Sold: $416,000

It is true that needs updating, but you could not see such prices for houses like this last fall.

This Chicago RE market is coming down!

Nay they could shoot negative.

Despite all the money the government is throwing around, despite that the equity (dumb money) market has rallied substantially this month–the economic backdrop is grim and dire. Far worse than the news would like to report these days.

High-yield bonds are still trading at very distressed levels. In fact the high yield indices aren’t even quoted in the WSJ anymore. (“n.a.”)? The syndicated loan market fell off a cliff. Any bond market that the government isn’t providing a lifeline for other than the bluest of blue chips/best investment grade has disappeared.

All this foreshadows massive corporate bankruptices on the horizon, several hundred listed companies at least if not over a thousand. And sorry, the government can’t do anything to avoid this.

“Prices across the board are trending back to historical pricing adjusted for inflation.”

“All this foreshadows massive corporate bankruptices on the horizon, several hundred listed companies at least if not over a thousand. And sorry, the government can’t do anything to avoid this.”

Can’t have (successful) Chapter 11’s without lending. Until liquidity comes back, bankruptcy will mostly = Circuit City.

Nobody wanted to lend to circuit city because it was not a going concern and had no prospects for the future. Lyondell got DIP (Debtor in possession) financing but they had to pay dearly for it. Financing is available, but only to credit worthy companies. Like it used to be.

“Can’t have (successful) Chapter 11’s without lending. ”

Lenders will take massive haircuts first, instead. Which will further scare off lending. American companies are so over-levered that I am hopeful many can bide time just doing prepack or chapter 11 and forcing a cramdown on their lenders. Should buy them ample time, a few years at least.

“Lyondell got DIP (Debtor in possession) financing but they had to pay dearly for it.”

Lyondell got a DIP from it’s pre-petition LBO lenders who were completely over a barrel, so they went with the “kick the can down the road” approach, hoping it gets better. We’ll see if, after additional time to kick the tires, they’re interested in sticking around for exit financing and further extending Lyondell’s time.

CC needed a bank line to replace it’s evaporated supplier financing (for LOCs, at least), so someone would have had to stick their neck out. And they’d have to keep it all out there as exit financing. No one bank was deep enough into CC for that to make sense as loss mitigation.

CC was totally f’d anyway. They couldn’t compete with Best Buy. ALong those same lines, I read that Japan’s exports dropped 50% YOY. That’s horrifically frightening to see a drop that large. That’s great depression style drop in world trade. It’s extremely scary. The world is a really messed up place right now; i’m just trying to survive.

Maybe it wasn’t YOY but it was still a 49% drop with a 58% drop of items into the US.

http://www.bloomberg.com/apps/news?pid=newsarchive&sid=a5ElP4y2JoH8

“Maybe it wasn’t YOY but it was still a 49% drop with a 58% drop of items into the US.”

It was YOY, driven mostly by nobody buying new cars and the Japanese automakers not being experts in channel stuffing.

A quick search of the area around this shows me that this is WAY! underpriced and if someone picks it up for near this ask they are going to be VERY happy.

What a fantastic price on a great little unique home. I wish this had been on the market when I was looking 2 months ago!

One of my clients made an offer on this place. Apparently, the sellers took an all cash offer. Haven’t heard what the final contract price is though.

its a good place, looks a bit narrow. Somebody got a deal.

#

Sonies on March 25th, 2009 at 9:08 am

“Sure, Brad, if you ignore all the relavent “rent v own” factors? What, for example, if renting the equivalent saved hundreds per month for those 19 years?”

if you saved $200 a month by renting the difference is $45,600 over a period of 19 years… not even close to the profit.

-You’d have to worry about your landlord selling the building, and increasing your rent.

-You wouldn’t want to put any improvements into the place so you’d be living in a dump.

-Tax benefits over the last ten years or so

-Oh did I mention you basically lived for free for 19 years after the sale of this place?

Rent vs. Own over an extremely long period of time like 19 years is always going to lose.

Sonies, you like to point out that the renter would not perform maintenance and therefore live in a dump. But what about the owner of this particular house? If this 120-year old house has 19 years of deferred maintenance, I feel very sorry for the poor sap that buys it.

I would also like to point out that 1990 was the bottom of a real estate cycle in Chicago. This is a prime example of why many on this board talk about waiting until the bottom. If this home was purchased in 1988 or 1995 the situation would be far different.

You cannot claim this to be an example of ownership beating renting over a long period of time. NO! This is an example of how extremely advantageous it is to rent until the timing is perfect for buying.

Nobody has come up with what the real problem with this property is yet I see….

“Nobody has come up with what the real problem with this property is yet I see….”

Okay, fg, I’ll bit: What is the *real* problem with this property?

Bumping this one:

“Nobody has come up with what the real problem with this property is yet I see….”

Okay, fg, I’ll bite: What is the *real* problem with this property?

Bumping again, b/c I’m really curious about the “real” problem with this place. Will someone *please* tell me?

You need to get outside more. You sound desperate for entertainment.

The real problem is that there aren’t enough of these little rowhouses in Chicago.

Bob was right. Sorry, everyone.

This is a little off topic, but good news finally for Uptown!

http://yochicago.com/today/neighborhood-journal/breaking-news-see-y-wong-to-revitalize-wilson-yard-redevelopment-with-new-towers_8606/

That has to be an april fools joke.

Nothing gets by Sonies….

I did enjoy this

“”Opponents of the old Wilson Yard say it was built on a ‘failed housing model’ that focused solely on low-income homes. A luxury condo tower next door surely will bring balance to those concerns,” he says.

In a sign of gratitude toward the buildings’ namesake, he plans to offer Ald. Helen Shiller her choice of either of the buildings’ top-floor penthouses, “from which she can look down on her ward as its humble guardian.””

lulz

Yes, quite funny.

so what’s the status with this property? how much did it end up selling for?

We have to wait for it to close first!

We were one of the 8 offers on this house and were a little ticked. It was completely underpriced and had it been priced appropriately it would have been out of our price range, we never would have looked at it and wouldn’t have gotten our hopes up. I have no problem saying we were over list and still didn’t get it.

I heard that they sold this property for a lot higher than the listed price. I am sure we were one in many to see it saw it and it was a lot larger on the inside than expected, so we could not believe that they even listed it at this price—some things are too good to be true, I guess…

Vera: When the property actually closes, I’ll do an update so everyone can see what the closing price was. We should know something soon!

Crazy Frog,

just re-read this thread. 5336 N. Lakewood sold for $832,000 (a 50-foot lot with two PIN numbers). The price you were quoting is for one PIN only. So i think this sale actually shows that well located properties are holding their value quite well. Went under contract in 10 days per MLS.

“Danny, there will be many more to come in Andersonville. Check out this recent sale:

5336 N Lakewood Ave Chicago IL 60640

4 beds, 1.5 baths, 1,932 sq ft

Recently Sold: $416,000

It is true that needs updating, but you could not see such prices for houses like this last fall.

This Chicago RE market is coming down!”