2-Bedroom Vintage Beauty in Lakeview Sells: 817 W. George

We chattered about this 2-bedroom top floor unit at 817 W. George in Lakeview several times in the past few months.

See the June 2010 chatter and pictures here.

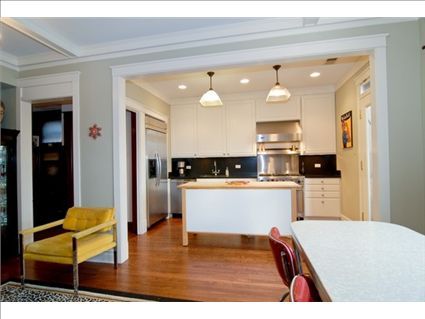

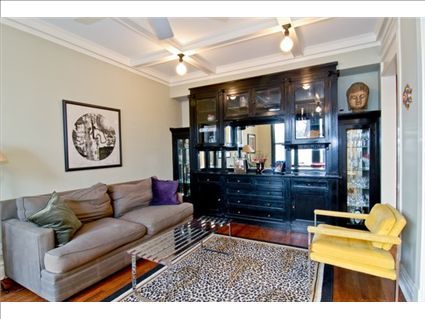

It had many of its vintage features still intact including built-in bookcases and a dining room hutch, beamed ceilings and stained glass.

But it also had many modern upgrades like central air, washer/dryer in the unit and a Viking stove in the kitchen.

The only amenity it was missing was deeded parking.

It recently sold for $41,000 under the 2005 purchase price.

Ed Jelinek at Coldwell Banker had the listing.

Unit #3W: 2 bedrooms, 1 bath, no square footage listed

- Sold in August 2001 for $315,000

- Sold in April 2005 for $366,000

- Originally listed in February 2010 for $375,000

- Reduced

- Was listed in April 2010 for $349,900

- Reduced

- Was listed in June 2010 for $335,000

- Sold in August 2010 for $325,000

- Assessments of $345 a month (includes heat)

- Taxes of $4301

- Central Air

- In-unit Washer/Dryer

- No parking

- Bedroom #1: 11×12

- Bedroom #2: 9×11

- Family/dining room: 11×17

I thought prices were increasing? Looks like not in this case. Don’t forget that the realtors took off with another 5% of the final sales price. So the seller walked away with less than the 2001 price.

This is indeed America’s lost decade.

“Don’t forget that the realtors took off with another 5% of the final sales price. So the seller walked away with less than the 2001 price.”

But that’s apples/oranges, as the 2001 seller didn’t walk away with the 2001 price, either.

This condo sale supports my notion that home-sale prices are back to 2001 price range. Many MLS listings for Oak Park and River Forest houses are also back to 2001 range – we were looking at homes at the time. There’s a nice River Forest white-frame house for sale for less than $400K. Many decent Oak Park houses are under $400K. MLS is glutted with listings.

I’ve been reading book “Aftershock; Protect Yourself and Profit in the Next Global Financial Meltdown” by economist David Wiedemer, a pessimistic (though likely accurate) assessment of world economic conditions. Book was probably written in late 2009, with a 2010 publication date. Wiedemer expects continued weakening of real estate prices, with substantial additional price reductions. Good read.

Anyone have info re: anticipated issue date of 2nd installment RE tax bills? I’ve heard Cook County tax bills may be delayed until Election Day, supposedly to delay voter outrage.

“This condo sale supports my notion that home-sale prices are back to 2001 price range”

wait a minute… let me get this straight – because this particular house sold at its 2001 price you are making the argument that “home-sale prices are back to 2001 price range”? I could show you examples of houses selling over 2005 purchase prices – does that mean that home prices are rebounding?

anon,

The situation for the seller in terms of cash in pocket is always worse than stated in the actual sales price. This is usually lost on most readers when viewing a previous sales price. Also the purchase price prior to 2001 is not listed. Perhaps the owner prior to 2001 bought the property at a price that allowed him/her to sell the unit, pay the realtors and still have a profit in the end.

The poor soul who recently sold did not have that luxury. (on the plus side the realtors got paid)

out of curiosity – if an investor bought this unit, how much rent do you think he could get?

all the critiques are true, although I wonder if there might be some less tangible benefits that came with 5 years of responsible (assuming) ownership. I tend to value just having control over my living environment/no landlord. Also, maybe better credit? how much would they have paid to rent this place, anyway?

I’m thinking the party is going to be like 1999.

“Architect on August 24th, 2010 at 7:14 am

This condo sale supports my notion that home-sale prices are back to 2001 price range.”

Party like it’s 1999:

http://noir.bloomberg.com/apps/news?pid=20601087&sid=aTa9xAXkpKaU

Sales of U.S. Existing Homes Fell in July to 3.83 Million Rate

By Courtney Schlisserman

Aug. 24 (Bloomberg) — Sales of U.S. previously owned homes slumped more than forecast in July and the number of unsold houses swelled, evidence the market is depressed by foreclosures and limited job growth.

Purchases of existing homes plunged 27.2 percent to a 3.83 million annual rate, figures from the National Association of Realtors showed today in Washington. The pace compares with the median forecast of a 4.65 million rate, according to a Bloomberg News survey.

A tax credit of up to $8,000 boosted sales earlier in the year, pulling forward demand and indicating additional advances will prove difficult. Mortgage rates at record lows have provided scant relief to the industry as unemployment hovers close to 10 percent, foreclosures hold near record-highs and the economy cools.

“To have a full recovery in the housing sector we need a full recovery in the job market,” Scott Brown, chief economist at Raymond James & Associates Inc. in St. Petersburg, Florida, said before the report. “The low mortgage rates normally would help quite a lot but we really need to see the job growth pick up for housing to improve.”

The pace of existing home sales is the slowest since comparable records began in 1999.

“Anyone have info re: anticipated issue date of 2nd installment RE tax bills? I’ve heard Cook County tax bills may be delayed until Election Day, supposedly to delay voter outrage.”

Almost certain. Expect to hear A LOT about it from Claypool, blaming the situation (accurately, imo) on the Berrios/Madigan cabal trying to get Berrios in as the assessor.

Dan:

Sure, but you were comparing the 2010 net to the 2001 gross, which isn’t a reasonable comparison. I do agree that it is *highly* likely (I’d go with “nearly certain”) that the ’01 seller did much, much better, financially, owning this unit than the ’10 seller did.

This place is gorgeous. I think the renovations we’re very nicely done and in keeping with the feel of the place while giving it an updated look. Too bad about the 1 bathroom, even the addition of a powder room would make such a difference here.

*were*

IMO it was overpriced even in 2001 and it boggles my mind a 2/1 like this with no parking goes for 325k. I doubt the new owner will be as lucky unless they have a similar timeframe for living here. I can’t predict that far out to 2019 so who knows..

If I’m not mistaken, the ’01 buyer was an architect who did (at least part of) the reno (Architect, maybe you know him?). But the ’96 ($186k) to ’01 ($315k) appreciation would seem to indicate the major reno was done by the ’96 buyer (the many loans would be another indicator). So, however well they did financially would have to include the costs of the reno they (presumably) did.

If not, they did *very* well, and both the ’01 and ’05 buyers took a bit of a hurting.