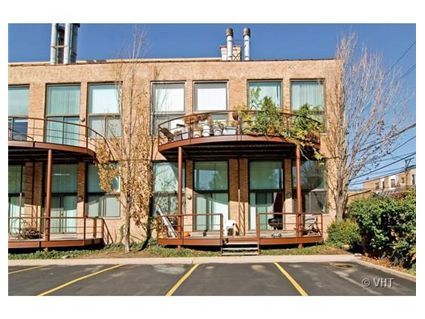

The Starter 1-Bedroom Condo in Lincoln Park: 2343 N. Greenview

This 1-bedroom unit at 2343 N. Greenview in Lincoln Park has been on and off the market since September 2009.

It has been reduced $110,900 in that time.

The unit is now listed $11,000 below the 2005 purchase price.

It has the amenities buyers look for such as central air, a washer/dryer hook-up in the unit and a deeded parking space, which is right in front of the unit.

The listing says the unit has a new kitchen with stainless steel appliances, granite counter tops and 42 inch cabinets.

It has loft-like tall ceilings with 12 foot windows.

Is this a deal for a starter 1-bedroom condo?

Emily Phair at Koenig & Strey Real Living has the listing. See more pictures here.

Unit #107: 1 bedroom, 1 bath, 850 square feet

- Sold in July 1990 for $105,500

- Sold in November 1992 for $138,000

- Sold in April 1996 for $143,000

- Sold in April 1998 for $156,000

- Sold in July 2003 for $243,000

- Sold in April 2005 for $250,000

- Originally listed in September 2009 for $349,900

- Withdrawn

- Re-listed in November 2010 for $239,000

- Currrently still listed at $239,000 (includes the parking space)

- Assessments of $152 a month (includes snow removal)

- Taxes of $1818

- Central Air

- Washer/Dryer hookup in the unit

- Bedroom: 10×13

I don’t like the 1st floor but it seems OK. Of course, you can get a 2/2 in parts of downtown, RN, Lakeview for the same price, so I guess it just depends on how much one loves this particular location/convenience of having car a few ft from front door!

The price is exactly right.

Washer/dryer, parking space, low assessments – looks like a good price

Nice parking lot; reminds me of the apartment I had at International Village in Lombard in 1973.

Maybe ok for someone who always drives, but for someone like me who has totally embraced the pedestrain lifestyle, and as Lincoln Park goes, I would not like this location at all. Really a stretch calling this Lincoln Park…

Who is the market for this? Why would you buy a one bedroom condo when you can rent one?

“Who is the market for this? Why would you buy a one bedroom condo when you can rent one?”

Several reasons:

1. It is much cheaper to buy this place than rent (total monthly costs are somewhere between 1000-1100 if you buy it).

2. Security – you know you don’t have to move after one year, your payment will stay relatively the same.

3. Individuality – you can decorate or not redecorate, redesign, remodel etc. the way you want

4. pride of ownership – something about owning makes many people a little happier (? – crazy in my opinion, but true).

5. appreciation – prices are going to start appreciating. That is just icing on the cake

6. hedge to rent inflation – in 10 years, rents are going to be higher than now but, if you buy, your cost is going to be the same. Young people and people who have been in their homes for less than 5-10 years don’t realize this – but ask anyone who has owned a place for over 15 years, that difference is HUGE.

1990 price + (cpi + 50 bip) = $195k.

What possessed *anyone* to try for $350k for this place? What did they use for a comp?

#105 (2/1) is also for sale for $324,900. ’03 sale for $272.5; ’01 sale for $125 (not a typo).

“total monthly costs are somewhere between 1000-1100 if you buy it”

Taxes are misstated, actually 170/mo + 152 for ass., leaving 778 for cost of funds. Are sub 4% fixed rate mortgages still available?

slightly off topic question but that kitchen picture brings it up: what is the idea arrangement/distance for a fridge, stove, dishwasher and sink in your kitchen? In other words, if you could build from scratch, what is the optimal configuration? Assume an average size kitchen, not a mansion sized one

I don’t know. It’s a nice unit but I think you can a better location for that price. My guess is 209k.

“Are sub 4% fixed rate mortgages still available?”

You know the answer to this is no.

“Taxes are misstated, actually 170/mo + 152 for ass., leaving 778 for cost of funds. Are sub 4% fixed rate mortgages still available?

At a purchase price of 225k (20% down) at 4% interest, your monthly costs (including assessment, taxes, principal, and interest) are $1181 at 4.5% the monthly cost is $1234.

perhaps closer to 200 per sqaure foot: pretty boring otherwise

well swap places with the microwave/stove/oven and the fridge and thats basically my setup except my dishwasher is to the right of the sink and I have an island. seems to work for us I don’t know if there’s anything i’d change about it except to make it a mansion sized one 🙂

Clio, how does “at 4% interest, your monthly costs are $1181 at 4.5% the monthly cost is $1234.”(by the way it probably needs to be closer to 5% now) equal “1000-1100”.

Just another example of you making up numbers and exaggerating to try to prove you are right. Your “don’t let the facts get in the way of your argument” philosophy is getting ridiculous.

“1. It is much cheaper to buy this place than rent (total monthly costs are somewhere between 1000-1100 if you buy it).

2. Security – you know you don’t have to move after one year, your payment will stay relatively the same.”

Thanks for the reply. But it’s really only “much cheaper” if you stay for a long time. Because when you try to sell it again in 4 years, you will lose money on the deal.

The other reasons all seem kind of trivial. I understand they are part of the motivation, but not enough to have this make sense to me.

So I guess this makes sense if you say to yourself I’m not going to move, I’m not going to get married or have anyone move in, and I’m not going to have kids for 10 years.

Which is fine, I just don’t believe that’s much of a market.

“Just another example of you making up numbers and exaggerating to try to prove you are right. Your “don’t let the facts get in the way of your argument” philosophy is getting ridiculous.”

The numbers listed by Sabrina were wrong (as anon pointed out). I based my 1000-1100 on Sabrina’s numbers (the taxes were wrong).

Furthermore, I don’t need to “make up numbers” to prove my points. Please enlighten me on my “don’t let the facts get in the way of (my) argument” philosophy. Have I misled or misinterpreted any data? If so, show some examples. 3SKing, maybe this is all projection since YOU are the ones without the facts about my comments. Maybe if you put more thought and research into your comments, you could move up from “3SKing” to “PHking”!

“At a purchase price of 225k (20% down) at 4% interest, your monthly costs (including assessment, taxes, principal, and interest) are $1181 at 4.5% the monthly cost is $1234.”

Neither of which are “somewhere between 1000-1100”, unless there’s new math I’m unfamiliar with.

“The numbers listed by Sabrina were wrong (as anon pointed out). I based my 1000-1100 on Sabrina’s numbers (the taxes were wrong).”

Wrong by $20/month. You were off by over $100. Own your off-the-cuff miscalculations.

“Neither of which are “somewhere between 1000-1100?, unless there’s new math I’m unfamiliar with.”

Are you frickin’ dense? I just stated that those numbers were based on the facts that Sabrina provided (taxes of 1800/year) which, as you pointed out, were wrong.

“Neither of which are “somewhere between 1000-1100?, unless there’s new math I’m unfamiliar with.”

Are you frickin’ dense? I just stated that those numbers were based on the facts that Sabrina provided (taxes of 1800/year) which, as you pointed out, were wrong.

1234 a month is still a good deal considering you can deduct a part of that and consider the principal payments of a few hundred a month as well when doing rent equivalent comparisons. I mean I doubt you’d find a rental as nice as this place for $1300 a month, but what do I know

“Wrong by $20/month. You were off by over $100. Own your off-the-cuff miscalculations.”

OK – this is getting ridiculous – but I have to prove you wrong once again. 1000-1100/month that I stated in my initial post was not only based on the wrong info (yeah, 20/month) but we were comparing renting vs. owning so I took the principal out of the equation. My later posts included the principal. Regardless, the bottom line is that it is MUCH cheaper to buy this place than to rent a similar place.

“Are you frickin’ dense? I just stated that those numbers were based on the facts that Sabrina provided (taxes of 1800/year) which, as you pointed out, were wrong.”

Yeah, I pointed out that the taxes are $170/month instead of $150/month. 170-150=20. 1100+20 =/= 1181 nor 1234. Unless H-ah-ah-ah-ah-vard taught you some special number theory that the rest of us aren’t privy to.

You really are an unpleasant cat when challenged *at all*, aren’t you?

“You really are an unpleasant cat when challenged *at all*, aren’t you?”

Why do you always have to get the last word in?

The other times you ignore facts is when Case Shiller data comes out showing that prices and the number of sales are declining but you swear its not true “EVERY realtor i know is doing great, blah blah”. It’s not a big deal, I’m just saying you lose some credibility.

“My later posts included the principal. ”

But no op.cost for the DP. Not quite a wash, but if $20/month is material, so is allocating cash to RE equity.

Case-Shiller is a snapshot of all properties – it is irrelevant to individual home buyers/sellers. That is my point. I stand by it. Real estate is very location and property specific. CS is meant for financial types to get a grasp on the overall picture of the real estate scene. It is detrimental and misleading for individual home buyers/sellers to use this information for their personal real estate decisions. That should be obvious to everyone (but apparently not)

“But no op.cost for the DP. Not quite a wash, but if $20/month is material, so is allocating cash to RE equity”

There you go again – trying to get the last word in.

“There you go again – trying to get the last word in.”

I know you are but what am I?

“I know you are but what am I?”

A passive aggressive twit?

single tear

“A passive aggressive twit?”

is FHA ok for this unit?

“But no op.cost for the DP. Not quite a wash, but if $20/month is material, so is allocating cash to RE equity.”

When you consider that if you had a hundred million pennies you’d be a millionaire, every penny is material.

And opportunity cost of the DP should be the highest possible guaranteed rate of return you can get. So I use 3.5% for the first 30k (reward checking acct of 5% less taxes at 30%).

“is FHA ok for this unit?”

Maybe if you can’t come to the table with the required downpayment amount without using FHA you shouldn’t be playing in the big kids sandbox?

“Maybe if you can’t come to the table with the required downpayment amount without using FHA you shouldn’t be playing in the big kids sandbox?”

But it’s a rentsaver, Bob. Which makes it (kinda) okay, if one is prepared to be a landlord after it’s time to move on from the 1 br.

Of course, if that’s your plan at purchase, it’s technically fraudulent to get and retain an FHA mortgage.

where you guys basis at? i come up with a different #

i am taking the 239k at 4.75 30 fixed, 152 ass fee, 172 taxes, 30 insurance, and i get 1,598.74.

still i dont know if you could get a rental with W/D and parking a your door for 1,500 in this area? but it is a one br so you know how i feel about that 🙂

Bob

Why would I use my money when I can use yours?

ok thinking about my math, i shall change it to better reflect waht going on in my head

i am taking the 191.2k at 4.75 30 fixed, 47.8k over 30, 152 ass fee, 172 taxes, 30 insurance, and i get 1,482.17.

Am I the only one who gets tired reading Clio’s daily cheerleading? Clio, seriously!

I met a guy who in a single year bought 3 homes (and retained them all) with FHA loans. Granted he did this at the height pretty much every 5 months he was buying a new home owner occupied with FHA 3.5% down.

“Am I the only one who gets tired reading Clio’s daily cheerleading?”

No.

“At a purchase price of 225k (20% down) at 4% interest, your monthly costs (including assessment, taxes, principal, and interest) are $1181 at 4.5% the monthly cost is $1234.”

Isn’t the real problem with this scenario- with or without the extra $20 a month in taxes- is that a first time homebuyer would have to come up with $45,000?

Say they’re 25 and looking for their first place. She’s an accountant so she’s making $55k a year. This person would have to save $10k a year for 4 1/2 years just to come up with the downpayment (and $10k a year would be HUGE savings. That is 20% of their salary.) Unless they’re getting the downpayment from the parents- there is no way they are buying this unit. They will be renting for 4 or 5 years instead (even if they are disciplined) and by then be 30 and their whole life scenario probably has changed.

But this is why I DO support raising the downpayments to 20%. It will make people make very different buying decisions. In 2006, the buyer in this scenario could have just walked into this unit with no money down. So then it does make sense to compare it to renting. Otherwise, most people would not be able to buy this with a 20% downpayment requirement. (And I’m not talking about the lost opportunity costs for investing the $45k elsewhere.) I’m just talking practically speaking.

Heck, if you look at the financing history of most 2/2s in LP and Lakeview- it is a very rare unit from the last 5 years that has actually put 20% down. I would say probably no more than 2% or 3% of all buyers. So most of those sales would NOT have occurred without the easy financing. I’m not saying those buyers don’t have good incomes, but, again, to save up $100k on a $500k unit, even for two high income professionals, it will take 2 to 4 years, or longer, to save that kind of cash. And then they’re going to have to have discipline.

“Am I the only one who gets tired reading Clio’s daily cheerleading?””

Bam and Barbie, people out there need hope and encouragement. In reality, 99% of people reading this site are never going to make any money in real estate and are never going to accumulate any real wealth – however it is the HOPE and POSSIBILITY that keeps people going, motivated and encouraged. All of the talk about schools on this site is an example. Do you think that even 1% of the children of people reading this will make it to an Ivy League or great school? Chances are no – but the possibility and hope that it may happen is what makes people excited, motivated and generally happy. I try to do the same with real estate.

Also, if you don’t what I post, don’t read it. As far as I can see, the extent of both of your contributions to this thread was to try to insult and embarrass me – nice try.

Skip clio’s posts. It’s that easy. I do it all the time 😉

“#bam on December 11th, 2010 at 8:26 am

“Am I the only one who gets tired reading Clio’s daily cheerleading?”

No.”

HD – putting a smiley face after saying something mean doesn’t make it nicer. If you want to say something, say it and don’t be apologetic, wishy-washy or insecure about it – but try to keep the subject to real estate on this blog.

That’s why these are really $100k or $120k units with $20-24k down payments.

Absurd, I know. But it will take three years for a 23 or 24 year old, with a $300 a month student loan payment, possibly a car note (if they work in the suburbs like so many do), gas, other bills, etc, to save $20,000. It’s not easy but it’s not hard either. Like Sabrina says, it takes discipline. Lots of it.

And then they buy when they’re 25 or 26 and stay there until 29 or 30 when life changes, and then sell it to the next 24 year old for

$100k or $120k.

OF course teh sale price during the 1990’s was in the $140’s but today’s kids are less likely to be employed upon graduation and have higher, much higher student loan debt. So the reduction in price compensates for that.

__________________________________

The $250,000 sale in 2005 was 100% financed

The $247,000 sale in 2003 was 90% financed ($25,000 DP)

The $146,000 sale in 1998 was 90% financed (~$16,000 DP)

The $143,000 sale in 1996 was 70% financed ($43,000 DP)

The $138,000 sale in 1992 was 95% financed ($6,900 DP)

The $105,000 sale in 1990 was 75% financed ($27,500 DP)

“Absurd, I know. But it will take three years for a 23 or 24 year old… to save $20,000… And then they buy when they’re 25 or 26 and stay there until 29 or 30 when life changes, and then sell it to the next 24 year old for $100k or $120k.”

Yep. Well said. Except I would sell it to the next 24 year old for 120-140k (try to make a profit for the SFH in ELP). 🙂

I forgot about the school loans and whatever else Homedelete (car payments, gym membership, cellphone bill). So that makes it even more difficult to save up $20k or, like in the example, $45k. That is a ton of money- for anyone. The tightening of the lending standards is the #1 reason we’re going to continue to see prices falling.

Next year, I will be taking a weeklong training/certification course (at a no name “institute”) that will cost more than what I paid for a semester at UIUC twenty years ago.

“Isn’t the real problem with this scenario- with or without the extra $20 a month in taxes- is that a first time homebuyer would have to come up with $45,000?”

Sabrina,

I am in tune with your calculation of how difficult it is to save $45,000, but that doesnt mean that peopel dont do that… especially young folks. Some take the opportunity to live at home for a couple of years after school and stockpile cash. OR they choose to live in a cheap joint with a couple of roommates and have an all-in monthly housing cost of $600-700. I know, because I kept my expenses in check (lived with roommates in cheap places) for the first 5 years I was out of school. Another thing to point out is that kids coming to the city for “real” jobs are getting offers in the mid fifties right out of undergrad, and probably averaging $65 to $75K per year during the first 5 years they are out of school. So while it takes discipline to save 25% of your after income for 4-5 years to build up enough money to buy a place, its not impossible.

No way there are enough of those savers to rescue this market. It was built/reno’d/priced to the demands of those with easy credit and little down.

Of course, your cohorts do make excellent bagholders, much to the delight of future taxpayers.

I agree, JP$. Also, there are a huge number of people who get loans/gifts from their parents. Each parent can give 13k to their kids each year without any tax consequences. This is how a large number of first time buyers get their downpayment.

Hey clio,

Maybe you’re right. This segment of LP does seem to be selling.

Especially when you consider the average listing price is 796k, yet the median sale price is 251k. LMAO!

http://www.trulia.com/real_estate/Lincoln_Park-Chicago/2924/

Hey clio,

Maybe you want to hold off on calling that a good investment.

This chart says it all:

http://www.trulia.com/real_estate/Lincoln_Park-Chicago/2924/market-trends/

But don’t be swayed by that annoying propaganda called data, the roses smell nice today!

“Maybe you want to hold off on calling that a good investment.

This chart says it all:

http://www.trulia.com/real_estate/Lincoln_Park-Chicago/2924/market-trends/

But don’t be swayed by that annoying propaganda called data, the roses smell nice today!”

Just tells me that the market area is down so it’s a good time to buy!

“Just tells me that the market area is down so it’s a good time to buy!”

Please do. And tell your friends, too. My children will thank you.

“Just tells me that the market area is down so it’s a good time to buy!”

If you look at a market with an average list price of 800k yet what is selling has a median price of 250k, that should tell you something of the state of the market. And if you think that tells you “it’s a good time to buy”, then I have a get rich quick scheme to sell you.

Bob – one ‘problem’ (or solution depending on how you look at it) is that Jumbo loans are more difficult to come by these day. You need excellent credit, a hefty downpayment and an income to match. This is the complete opposite of 2006, when jumbo loans were very easy to obtain – in fact I knew people who made $30,000 and obtained $900,000 mortgages….(they never made a payment of course)

A significant number homes today are priced as if there still exists a vibrant and resilient jumbo market. As Russ can probably attest to – that market has nearly dried up. Home prices are correlated with how much a buyer can borrow – and in today’s market, the $417 conforming, for most people, is the upper limit.

But eventually, these homes will be the deals – the homes that required a jumbo in 2006 that now require only a conforming and a $60 or $70k down payment. There will eventually be some pretty good deal deals in the $350k to $500k range and only the truly special homes will be more expensive than that.

Some people still want to live in LP pretty badly. Also, the $13,000 parental gifts will probably only increase as the stock market continues to recover and is now at around a 2 year high. If non-conforming loans are so difficult to come by, is anything priced over $521,250 in some kind twilight zone ($417,000 mortgage plus a 20% down payment)?

Freddie Mac just changed its rules. For even SFH’s you would need 25% down to qualify for the best financing terms. Otherwise they tack on 75bps (I think) in fees onto the loan at origination. So for the optimum financing that would be a 139k downpayment on a 556k home.

I think the mortgage brokers on here (Russ) might know much more about this than me but I’m just repeating an article I read a couple of weeks ago.

$139,000 is a nice chunk of change to save up, parental gifts or not. Wow. For the people who currently own, chances are they don’t have much equity in their current place to sell it and try to move up, let alone $139,000 total.

To answer your question, from what I understand, yes, many homes priced over $521,250 are in the twilight zone right now. Bob pointed out the $700k average listing price to the median $251k selling price. Now I understand that average listing to median sales is like comparing apples to oranges; but there is something glaringly disparate about the large list price and sales price that can’t easily be explained away. But it goes to show that many sellers wants to sell their home at to someone who will require a jumbo mortgage, but the jumbo buyers are far and few between – 50% of the homes in the LP allegedly sold for less than $251k in recent months. The jumbo buyer has nearly disappeared. Which sort of begs the questoin, now that lending standards are more normal, how many jumbo buyers were there to begin with?

“If non-conforming loans are so difficult to come by, is anything priced over $521,250 in some kind twilight zone ($417,000 mortgage plus a 20% down payment)?”

“But eventually, these homes will be the deals – the homes that required a jumbo in 2006 that now require only a conforming and a $60 or $70k down payment.”

You guys have no clue as to the number of people with money out there. Come on, do you really think only a few people in chicago are making more than 250k? There are thousands of people in the chicagoland area making well over 250k – there are even more people with inherited wealth/family money. The upper end housing market is NOT going to dry up and prices are NOT going to precipitously fall for high end housing.

“$139,000 is a nice chunk of change to save up, parental gifts or not. ”

What’s crazy is the amount of downpayment needed to get the optimal financing on a max conforming loan (417k here in Chicago) has only risen since this crisis began and is a moving target upwards.

Parental gifts aren’t all that common. It’s not that they’re uncommon, but they’re in no way shape or form ‘the market’. During the heyday of the boom years the number of low payment buyers was something ridiculous % of the market.

Moreover, a lot of people got their equity by flipping their current house at a profit. Buy in 1995, sell in 2000 for profit, buy again with a large down payment, sell again in 2005 for profit. Sort of like a ponzi scheme, where new entrants in to the market supported the bottom so that people could keep moving up. At the end of the day many of the ponzi scheme buyers still had the same sized mortgage but they were just transferring their equity from one property to another.

But the ponzi scheme is over. There are few new buyers. The fence sitters, the few that there were, all bought with the tax credit, and now their equity has been wiped out. There are no new entrants into the market to support the ponzi scheme and the entire price structure is resetting.

“There are no new entrants into the market to support the ponzi scheme and the entire price structure is resetting.”

only certain types of housing in certain areas. I hate to keep disagreeing with all of you constantly, but you really need to hear from people who deal with high end housing/areas. Prices have come down a bit for upper end housing in great areas – but nowhere near the decline that most other areas felt. Now, we are seeing prices start to climb and inventory start moving in Oak Brook/Hinsdale. People with money realize that now is the time to buy and, instead of buying a 1.5 million dollar house in Downers, Elmhurst, Willowbrook, they are able to buy a house in Hinsdale/Oak Brook and are doing so.

Clio, how many people making over 250 want to buy condos in the city as their primary residence? Will they make the market? If there were enough of these people, they would support these high asking prices, but the places aren’t selling. So what gives?

Still Nothing but Gloom Ahead for Housing

http://www.marketwatch.com/story/still-nothing-but-gloom-ahead-for-housing-2010-12-13

Guess all of clio’s market saviors are wintering in the Hamptons. LOL!

In the neighborhood in which I live, as of 4:09 p.m. there are 23 single family homes for sale priced over $500,000.

In the last six months, only four (4) single family homes priced over $500,000 have sold. One in June, one in July, one in August and one in November.

There is one single family home priced over $500,000 pending.

Although there are 23 homes over $500,000 I can with confidence add another 6 or 7 homes priced of $500,000 to that list that have been withdrawn from the market in the last 3 months and will likely be relisted in the spring.

The jumbo market is dying and is nearly dead. It will be tough to revive this market. It ain’t comin’ back for a long long time.

Thank goodness.

“The jumbo market is dying and is nearly dead. It will be tough to revive this market. It ain’t comin’ back for a long long time. ”

HD – your neighborhood is not representative for the entire jumbo market. Good homes in great areas are ALWAYS going to be in demand. It’s just a fact. Believe me, houses in Winnetka and Kenilworth will still sell for a premium. No large volume fire sales going on up there. I’m sorry that you made a bad real estate decision (which, actually is really surprising given your in-depth analysis of the real estate market – but also very enlightening with regard to your overall negative view of real estate).

“Believe me, houses in Winnetka and Kenilworth will still sell for a premium. No large volume fire sales going on up there”

Clio, i guess you havent been in the market ova dare? look for the smoke because there is a fire.

Yeah, Winnetka is hurting just like most of the other suburbs. Look at sales volume statistics.

The only bad decision I made was NOT buying in 2004 and HELOC’ing the crap out of it to pay off my student loans, and then I could stop making payments on the mortgage, file BK, and then walk-away student and debt free.

Alas, I did the ‘right’ thing and patiently waited and saved and paid off debt instead of doing the smart thing and pay off my student loans with funny money from a HELOC. Damn it.

“I’m sorry that you made a bad real estate decision “

“Yeah, Winnetka is hurting just like most of the other suburbs. Look at sales volume statistics.”

Of course sales are down – that’s no big news. However, prices are not decreasing at the rate/levels people here think that they are. Also, with the stock market doing so well, don’t be surprised if sales volumes start going up in these more expensive burbs.

“However, prices are not decreasing at the rate/levels people here think that they are.”

Clio i shall rinse, lather and repeat myself again;

“Clio, i guess you havent been in the market ova dare? look for the smoke because there is a fire.”

But where will the move-up buyers come from? Where will they get the equity for the down payments, which are approaching $200-300K, which in the past many people got from selling their previous house or condo for a large gain?

25% down is the new 20% down. With 25% down, both Fannie and Freddie waive some of the loan level price adjusters that get made for things like FICO scores, property types, etc.

I’ve been saying for the past couple of years that Chicago has a no man’s land with jumbos because of the tighter underwriting guidelines. Unlike other high cost markets (NYC, Boston, LA, SF, DC), we still have the $417k conforming loan limit whereas those markets can go up to $729k with 10% down. We got screwed because our metro area is bigger and it brings down the stats that are used to determine what metro areas get the higher conforming loan limits from Fannie/Freddie.

Combine that with a dead second mortgage/heloc market, no PMI for jumbos, and the vast majority of the properties being condos, you have the recipe for a crappy RE market.

The buyers of these high $400-$650k places are usually high income DINKS but they lack the liquidity for the larger down payments that are now required. Given the overall malaise in the market, many of these buyers have just said screw it and are going to keep renting and just wait to buy the single family home in whatever hot suburb is once Chad makes Partner at XYZ firm and Trixie decides to download a kid or two.

The experiment of the condo as a starter home has failed miserably. Only people who should buy condos are those that can afford real high end luxury buildings at the high end and single cat ladies (or guys) at the low end imho.

“Please do. And tell your friends, too. My children will thank you.”

No Prob G!!! My friends and I have been buying up places all year. To date, I can re-call 2 places RN, 1 in GC, 1 in Schaumburg and another 2 that are looking very closely right now in RN/GC/LP.

“However, prices are not decreasing at the rate/levels people here think that they are.”

What about this one:

Sold in 2004 for $1.31mm; currently u/c with a ask price of $749k.

Is your impression that people here think that prices in K’worth are decreasing by more or less than 9.7% per annum from 2004 prices?

link is: http://www.redfin.com/IL/Kenilworth/620-Abbotsford-Rd-60043/home/13783683

sorry.

HD hit the nail on the head though regarding why the 800k places aren’t selling but the 250k ones are. If I had 160k in the bank – needed to put down 20% on that 800k place – the last thing I would do is purchase it! There are much better plays with greater ROI’s. I WOULD though, purchase a 500k place, put 100k down, and invest ~30k leaving ~30k in case *something* happened.

Bob – Your link referenced only 2001-2010 timeframe in LP? What about 1960-2001? Hasn’t the GC and LP – historically speaking – practically never lost value???

“What about this one:Sold in 2004 for $1.31mm; currently u/c with a ask price of $749k.”

Um, what arr the markings? is it oil grease? how shall we handle the fire?

thank anon i can link another if i could remember the addy, give me a few to recal

“Given the overall malaise in the market, many of these buyers have just said screw it and are going to keep renting and just wait to buy the single family home in whatever hot suburb is once Chad makes Partner at XYZ firm and Trixie decides to download a kid or two.”

Which is why prices in the better suburbs are not going to go down any further and will, in fact, start increasing. Anecdotally, there were two parcels of land that sold across the street from me in the past month. These buyers paid 915k and 1.275k for these two lots and plan to start building their houses in the spring.

““What about this one:Sold in 2004 for $1.31mm; currently u/c with a ask price of $749k.”

I’ve said this before: this particular house may be an anomaly. Most houses that are this underpriced are because of one of the following reasons:

1. Person has a lot of money and this type of loss isn’t going to seriously affect them.

2. Estate sale of people who don’t have enough money in the estate or don’t want to keep the house

3. Poser who never should have gotten a loan to buy the house in the first place.

“I’ve said this before: this particular house may be an anomaly.”

And it’s not possible that the two lots across the street from you are the anomaly? I think you are underestimating the halo of joy around the Lambo.

“thank anon i can link another if i could remember the addy, give me a few to recal”

You aren’t the lucky(?) short sale bidder on this K’worth house:

http://www.redfin.com/IL/Kenilworth/623-Melrose-Ave-60043/home/28673515

at $324k, are you? That’s over $100k less than teardowns on the block sold for in 2002(!).

clio is obnoxious at times trying to play RE mogul. It will be hilarious to see his portfolio basically get devalued and stagnate over the coming years.

Given what I know about his profession it makes sense: I remember during the dot-com boom you had doctors and lawyers daytrading on their days off. No big surprise Mr. clio played a lot in the sandbox of this bubble trying to enhance his portfolio. The opposite will almost certainly happen.

“thank anon i can link another if i could remember the addy, give me a few to recal”

Or were you thinking of this one:

http://www.redfin.com/IL/Kenilworth/619-Park-Dr-60043/home/13783132

$595k in ’02; $865k in ’05, currently asking $590k. Down from $675k in Feb.

“It will be hilarious to see his portfolio basically get devalued and stagnate over the coming years”

I don’t get it – why would that be hilarious?

“What about this one:

Sold in 2004 for $1.31mm; currently u/c with a ask price of $749k.

Is your impression that people here think that prices in K’worth are decreasing by more or less than 9.7% per annum from 2004 prices?”

O.K., can’t resist: I’ll give my semi-regular unsolicited two cents on this general topic. And by general topic, I refer to what appears to be a trend, or an impulse on the part of some folks, if you will, to “cheer the market down,” or to revel in some way at the thought of prices dropping in places like K’worth. Half of Sabrina’s posts, of course, are about the sky supposedly falling over Lincoln Park. And then there’s the fringe contingent on here who relish drops specifically in the tonier burbs, namely, the north shore.

Those two cents I promised: If things really ever get as “bad” as you think – or as bad as you hope, based on the tenor of many comments – in places such as LP or the north shore, what, WHAT I ASK, do you think is going to happen EVERY PLACE ELSE?

Either start PRAYING that things stabilize, particularly in the nicest places in this entire part of the country, or start stocking up on bullets and fresh water.

“I don’t get it – why would that be hilarious?”

Because its Monday, eleven degrees out, and the Bears got routed yesterday.

“If things really ever get as “bad” as you think – or as bad as you hope, based on the tenor of many comments – in places such as LP or the north shore, what, WHAT I ASK, do you think is going to happen EVERY PLACE ELSE? ”

For Chicago things will get worse, but not the worst in the midwest and certainly not the worst nationally. Not even comparable to NV, AZ, CA or FL. However high housing costs relative to the rest of the midwest is a bad thing for Chicago, here’s why:

Lets compare the couple that makes 80k in Cincinnati vs. a couple that makes say 100k here in Chicago. In Cincinnati a 4/3 house in a good school district costs maybe 250k. In Chicagoland lets just say 425k and thats being real conservative. A 20% decline on that Cincinnati house is 50k. On that Chicago house its 83k.

Additionally when the economy starts picking up where will the hiring be? In high cost Chicago where they have to pay workers an extra 20k/year more to equalize their standard of living vs. cheaper metro areas like Cincy or Indy?

Who knows about your particular area you talk about as you’ve basically narrowed that down to four Chicago lots so its hard to interpolate to that. However for Chicagoland I see trouble brewing for housing for the next few years.

I completely disagree Bob. Again, there are thousands and thousands of millionaires in chicago. There are thousands and thousands of people making over 250k in chicago. There are thousands and thousands of people who live in 1 million plus houses and will continue to do so. Sure, many areas may suffer, but there are enough high income/high net worth individuals to keep the higher end markets stable. Also, most companies are NOT moving to cincinnati, cleveland, iowa, kentucky, west virginia – give me a break!!! Chicago is, was and will always be a world class city with a lot of appeal for many people.

“You aren’t the lucky(?) short sale bidder on this K’worth house:

at $324k, are you? That’s over $100k less than teardowns on the block sold for in 2002(!).

Or were you thinking of this one:

$595k in ‘02; $865k in ‘05, currently asking $590k. Down from $675k in Feb.”

the park drive is one of the places there is also a place we looked at, for the life of me cant remember the addy. I want to say it was on wayland, the wife is checking old emails to see if she has it.

funny thing about the AS-IS on melrose, its in way better condition than most of the foreclosures posted on CC.

but no matter how much proof we provide Clio shall not be swayed, he will always believe what he believes, even if its not reality.

“Also, most companies are NOT moving to cincinnati, cleveland, iowa, kentucky, west virginia – give me a break!!!”

If a company has to hire American workers and wants to expand, although those areas mentioned are the cultural pitts vs. Chicago, they will likely expand there. Execs tend to make these sorts of decisions on the advice of the accountants. Chicagoland is a higher cost pole vs the rest of the midwest. That can’t help our regional economy.

Companies are unlikely to relocate to WV in any case due to the mountains making transportation more difficult.

“I’ve said this before: this particular house may be an anomaly.”

clio its not an anomaly many of these on the North Shore, and many not as dramatic in Kenilworth.

who would have thought prices would drop so much that the groove family could actually consider kenilworth. and the places we viewed were darn solid homes at bargin basement prices its the TAX bill that is the kicker.

“If a company has to hire American workers and wants to expand, although those areas mentioned are the cultural pitts vs. Chicago, they will likely expand there.”

I guess you also believe that all companies are going to move out of manhattan? Wow – new yorkers had better get ready for their real estate prices to come crashing down!!

“I guess you also believe that all companies are going to move out of manhattan?”

You can compare Chicago to Manhattan all day long. At the end of the day there are totally different dynamics affecting RE pricing in both markets. So bad, but common, comparison.

“I’ve said this before: this particular house may be an anomaly.”

No- these houses are NOT an anomaly in Kenilworth. On the recent Beverly post I posted a link in the comments to a house that just sold in Kenilworth for $655,000. 2006 sale price of $944,000. That’s a 30% reduction. The listing didn’t say it was a short sale.

You can get a 3000 square foot single family in a decent part of Kenilworth for less than a comparable house in Lakeview or North Center now.

Taxes in Kenilworth are a lot more, but then again you don’t have to pay for private school if your kid isn’t some sort of strange super genius or minority. Probably has a lot to do with the howmuchamonth crowd posers that would move to kenilworth

“You can get a 3000 square foot single family in a decent part of Kenilworth for less than a comparable house in Lakeview or North Center now.”

Ok I had to laugh at this one.

First of all, “decent” part of Kenilworth cracks me up. True, some mock the Kennel of KW, but give me a break.

It cracks me up because I have been arguing this point for some time, and find it ironic that it is now being embraced when it’s convenient to an ancillary point. But let’s face facts here — East Kenilworth for less than a postage stamp in North Center? The ghost of Christmas past (circa 1982) would think you a fool to even compare the two. Yet erstwhile urban hipster yuppies now saddled with kids think 30×125 lots are practically spacious and the homeless troll in the alley is merely a charming fixture of city living. The home invasions, burglaries, that’s all just stuff that happen to others. Yeah the they have the zeitgeist alright — of 2006.

There are advantages to the city. Many people prefer it over the suburbs, especially now. But historically, the city was always, repeat, always, *significantly* cheaper than the W’s. Hipsters beware.

“Taxes in Kenilworth are a lot more”

Define a lot more. At the same assessed value tax levies are:

KW = 5.228%

Chicago = 4.627%

On a $1M AV home, this amounts to about $2k per year. Last time I checked that paid for about 1-2 months of private school for one child.

So, not really.

“East Kenilworth for less than a postage stamp in North Center? The ghost of Christmas past (circa 1982) would think you a fool to even compare the two.”

I didn’t say East Kenilworth. The house I posted was near the train and the downtown. Not that much different for commuting purposes and feel than someone also considering living near the brown line in either Lakeview or North Center. In neither one are you near the lake front.

I just used it as an example for Clio- who thinks prices are not going down in the “prime” suburbs.

I’ve said it many times- the suburbs have many deals right now. Everything (both close in and in the far outlying suburbs.) Yes- not everything is move-in ready. Some properties will need work. But there are deals to be had.

“Taxes in Kenilworth are a lot more, but then again you don’t have to pay for private school if your kid isn’t some sort of strange super genius or minority. ”

It is now ILLEGAL for school districts to use race as a consideration for admissions. So what did the CPS do? They created micro-areas and classified them according to income. Areas so small they can nit pick and try to continue to socially engineer society to their liking and dole handouts to key constituencies.

“I just used it as an example for Clio- who thinks prices are not going down in the “prime” suburbs”

I will never be convinced of this, Sabrina because it simply is still not true- of course there are going to be one or 2 houses that are cheap in these burbs for reasons I stated many times, but the vast majority (over 90-95%) are going to remain expensive. When over 50% of housing is below 2005 levels (as they are in many areas of chicago), that is a problem. That, however, is never going to happen in the better suburbs. It hasn’t and won’t. Period.

“You can get a 3000 square foot single family in a decent part of Kenilworth for less than a comparable house in Lakeview or North Center now”

Do not post things that are just not true (and can be easily disproven). Right now, in Kenilworth, there are 38 houses for sale. Only 5 of them are under 999k. NONE of these homes are anywhere close to 3000 square feet. The median price of the houses for sale is 2.15 million and the average price is higher. AS I said before, of course there will be 1 or maybe 2 deals in these areas, but these are few and far between. SERIOUSLY – I LOOK AT THE MLS EVERY SINGLE FRICKIN DAY – IF THERE WERE THESE GREAT DEALS IN HINSDALE.OAKBROOK/WINNETKA/KENILWORTH, I (and hundreds of others who are doing the same) WOULD HAVE BOUGHT THEM!!!

“of course there are going to be one or 2 houses that are cheap in these burbs for reasons I stated many times”

again, clio not to be a devil thorn in the side advocate, but i viewed more than just 1 or 2 places in Kenilworth that were “cheap”.

Hey just take a look at Highland Park and see whats going down over there, i think the prices are getting almost “too affordable”, but what makes HP even better is that ITS NOT CROOK COUNTY!

i really dont have time, and even if i did probably wouldnt do it for you anyway, but just look at whats listed in these suburbs 100 of examples of why you are incorrect when it comes to reality. no in Clio land it might be, but thats a especial place to be and visit

It’s a simple discussion of a market. If the market were higher, the person who bought in 2006 for $944,000 would never resort to selling it for $655,000. Becasue $944,000 is no longer the market. $655,000 now is.

Clio- your example that there are only 5 homes for sale under $1 million in Kenilworth is not even relevant. So someone who bought for $2 million and now has it listed for $1.3 million isn’t going to take a hit? Also, the market is dead right now. Nothing new coming on the market anywhere (everyone waiting for spring) and the listings that ARE on are, for the most part, old listings. This spring is going to be mighty interesting all over the Chicagoland area.

“Right now, in Kenilworth, there are 38 houses for sale. Only 5 of them are under 999k.”

JMM will Back me up if he is around, But again clio you get the bozo buzzer.

if you are looking right NOW, you are missing the many others that were listed and have been withdrawn. some may be back in spring some may not, and there may be new ones.

“again, clio not to be a devil thorn in the side advocate, but i viewed more than just 1 or 2 places in Kenilworth that were “cheap”. ”

OK – you have to define “cheap”. Fact is that only 5 houses in Kenilworth are less than 999k and ALL of these are smaller houses in “not so great” parts of the suburb. Also, HP is NOT kenilworth. If you want to debate, then do it with facts – not opinion.

Highland Park is a great deal for someone looking for a nice starter home with good schools.

“if you are looking right NOW, you are missing the many others that were listed and have been withdrawn. some may be back in spring some may not, and there may be new ones.”

Sorry, Groove, you are right. I was looking “right NOW” – maybe I should look at listing from the 70s and 80s.

I’m sure G or someone else will be chiming in shortly with many “facts” about home sales in KW and other ritzy areas. Clio- the facts are against you.

Clio- no one is looking right now. I’ve talked to agents who tell me they have a list of hundreds of properties waiting to come on the market in February/March. That is when everyone will be looking and suburbs like KW will be flooded with listings.

Sabrina, I hope so. I really would like to resolve this because it is so incredibly discordant with what I am seeing. Believe me, I would LOVE to see prices come down in these areas (as I am anxious to buy real estate right now). Unfortunately there are not that many good deals AT ALL right now. Most of the cheap places are in terrible locations or are in really bad conditions. You just can’t get a decent house in these areas for cheap. Again, I would LOVE for prices to free fall. It just ain’t happening.

Sabrina, I hope so. I really would like to resolve this because it is so incredibly discordant with what I am seeing. Believe me, I would LOVE to see prices come down in these areas (as I am anxious to buy real estate right now). Unfortunately there are not that many good deals AT ALL right now. Most of the cheap places are in terrible locations or are in really bad conditions. You just can’t get a decent house in these areas for cheap. Again, I would LOVE for prices to free fall. It just ain’t happening.

“OK – you have to define “cheap”. Fact is that only 5 houses in Kenilworth are less than 999k and ALL of these are smaller houses in “not so great” parts of the suburb. Also, HP is NOT kenilworth. If you want to debate, then do it with facts – not opinion”

IDK what you define as “facts” but the homes i viewed and one we almost put and offer on were taking hefty haircuts.

“cheap” to each of us is subjective but i will define i as if the groove family would buy it then its “cheap”

but as sabrina pointed out about the upper end of kenilworth having a home that sold in 2002 for 2 mil is now 1.5, now thats a deal to.

and really there is no “not so great parts” of kenilworth. and you should know you lived there on the west side of green bay.

and if you want to stick to your “only 5 houses” thing i will concede at this moment your theory maybe right. but lets revisit this spring, please bring extra undies.

“I’m sure G or someone else will be chiming in shortly with many “facts” about home sales in KW and other ritzy areas. Clio- the facts are against you”

Even if the average price or number of sales are down, it doesn’t mean that the price of every house is down. This is one of the dumbest but most common mistake that people make. The average prices are down because it is mostly the smaller/cheaper/short sales/foreclosures that are being sold. The number of sales are down because, as we know, people are not buying – this will change. However, this does not mean that the mansion on the lake in east kenilworth is worth much less. This is such an idiotic (but common) mistake that most morons make (expecting the sale prices of specific houses to exactly follow the average decrease of sales prices in an area).

“and really there is no “not so great parts” of kenilworth. and you should know you lived there on the west side of green bay.”

I lived east of green bay (east kenilworth)…. and kids still made fun of me for being poor.

“I lived east of green bay (east kenilworth)…. and kids still made fun of me for being poor.”

coming from what said/posted here, your track record for people skills and bedside manor really make your statement minus the “poor” part.

“I didn’t say East Kenilworth. The house I posted was near the train and the downtown. Not that much different for commuting purposes and feel than someone also considering living near the brown line in either Lakeview or North Center. In neither one are you near the lake front.”

Point of generally accepted fact, there is no downtown Kenilworth. And, the entire town was specifically platted to be in walking distance to the train, so “near the train” is not really relevant.

In any event:

http://www.redfin.com/IL/Kenilworth/620-Abbotsford-Rd-60043/home/13783683

The original home I used as an example. In fact, this home is in EKW and is on a substantially bigger lot. It may well sell around the same level, though it might need slightly more work. EKW, as Clio notes, is typically a 1M+ ring, even a decade ago. So this is a very good deal.

Given that you can actually see the lake from the train stop (at zero elevation), no house in the village in more than a 5-10 minute walk from the lake. Both in question are about 1/4 – 1/3 mile from the beach. This is nowhere near the same as living on the brown line at Southport or Irving Park, for example. Not a really good comparison / example.

“Even if the average price or number of sales are down, it doesn’t mean that the price of every house is down”

how about just look at what HAS sold. because isnt what really makes a “MARKET”

cuz if i was only list my cow away for 10 chickens, two satchels of spices and 3 jars caster oil. and everyone else is actually selling their cows for 5 chickens and a bushel of maze.

my cow price isnt the “market” its the cows that are selling that ARE the market price.

JMM, that property was under contract within hours/days of listing. Great price (of course, taxes are over 20k). I just don’t see many more houses like that coming on the market. The economy is improving, the stock market is up again and people’s portfolios are getting fatter and fatter every hour – this will translate into increased sales in better areas. Just wait….

JMM, that property was under contract within hours/days of listing. Great price (of course, taxes are over 20k). I just don’t see many more houses like that coming on the market. The economy is improving, the stock market is up again and people’s portfolios are getting fatter and fatter every hour – this will translate into increased sales in better areas. Just wait….

“cuz if i was only list my cow away for 10 chickens, two satchels of spices and 3 jars caster oil. and everyone else is actually selling their cows for 5 chickens and a bushel of maze.”

Groove, I’ll give you 6 (SIX) chickens, 1 rooster, 1 pig, 2 cows and, hell, I’ll throw in a pony for your house.

“I lived east of green bay (east kenilworth)…. and kids still made fun of me for being poor.”

Clio, that is hilarious. We all know the kids made fun of you for other reasons.

Back in the late 1970s / early 1980s, KW was a lot of lawyers, doctors and executives of Chicago area businesses. Comfortable wealth, but not pay $9M for a lakefront tear down type hedge fund master of the universe money. That came with the housing bubble and I hope it leaves with that same bubble.

“I just don’t see many more houses like that coming on the market. …….this will translate into increased sales in better areas. Just wait”

yes the theory is great until put into the wild. but honestly i pray that your hope and optimism comes true.

I know i touch on this and i have know actual proof of it. there is the magical “shadow inventory” and not just from the banks but from simple folk like me. I know once the market is better and i am not in direct competition with foreclosures i will be putting my home up for sale. there are many, many like me too and add that to banks inventory it will be a while before you stop seeing examples like the ones that ANON and JMM dropped.

““I lived east of green bay (east kenilworth)…. and kids still made fun of me for being poor.”

Clio, that is hilarious. We all know the kids made fun of you for other reasons.”

thats what i was going for when i said this:

c”oming from what you said/posted here, your track record for people skills and bedside manor, really make your statement minus the “poor” part.”

“Those two cents I promised: If things really ever get as “bad” as you think – or as bad as you hope, based on the tenor of many comments – in places such as LP or the north shore, what, WHAT I ASK, do you think is going to happen EVERY PLACE ELSE? ”

It’s funny that you use me as a jumping off point. I stopped making that point 18 months ago, bc anyone who needs that point made again is not going to be swayed.

“bc anyone who needs that point made again is not going to be swayed.”

i get that feeling that many here will stand by their typing no matter how convoluted the rhetoric they end spewing towards the finish line.

annony: “Those two cents I promised: If things really ever get as “bad” as you think – or as bad as you hope, based on the tenor of many comments – in places such as LP or the north shore, what, WHAT I ASK, do you think is going to happen EVERY PLACE ELSE? ”

anon: “I stopped making that point 18 months ago, bc anyone who needs that point made again is not going to be swayed.”

I figured anon stopped making that point because it was just a straw man. Not to mention how much worse it has gotten in the past 18 months for the NS and LP. How bad is “bad?” Clearly, it’s already pretty “bad” on the NS and in LP if “bad” means it requires significant price reductions from peak pricing in order to sell a property. Or, is this just another way to call the bottom?

The only argument that’s better than the one above is: OMG IF PRICES GO ANY LOWER WE’LL BE DETROIT!!!!!!1

“WHAT I ASK, do you think is going to happen EVERY PLACE ELSE? ”

Exactly what is happening and what was predicted here years ago. The correction will eat its way up the RE ladder, that much is certain. Does that mean the exact same collapse everywhere? Nope, and I don’t think I’ve ever seen anybody comment here to that effect.

G,

any chance you can carve out some free time for a post of stats in kenilworth?

“IF PRICES GO ANY LOWER WE’LL BE DETROIT!!!!!!1”

haven’t you heard? Oak St beach is already Detroit this past summer!!!!!!1111

Fruiti di Mare!1!1!1

@Groove77

what’s the point of carving out the stats?

The rebuttal will be one of many:

– Market is local

– Market is individual properties

– Can’t look at averages/means/medians

– Short sales / foreclosures are not part of the market

– Take a look at my one or two counter-examples

– Strawman

– Ad hominem attacks…

“what’s the point of carving out the stats?”

for the sake of, I told you so clio.

“- Take a look at my one or two counter-examples”

you forgot the most common one-OB/Hins is paved in gold all is great with the world lets go kick frogs

The streets of ob/hinsdale are NOT ALL paved in gold – just southeast hinsdale and the the hunt club estates area of oak brook.

“I figured anon stopped making that point because it was just a straw man.”

Well, I was oversimplifying the connection. Honestly, I think it will be worse if there’s a totally bifurcated market (one for the hoi polloi, one for those who can afford to overspend), which seems would be okay for annonny. I was more on the “if everything goes to hell for everyone, how are you avoiding it?” strawman.

gold bars, guns, grapes -G

on the “if everything goes to hell for everyone, how are you avoiding it?” strawman.

“gold bars, guns, grapes -G”

Well, yeah. You left off the most important G, tho: gunpowder. Makes me wonder if our “Bob” is actually short for bailout bag.

I still think it’s funny he used me as the jumping off point.

@Groove77

“what’s the point of carving out the stats?”

for the sake of, I told you so clio.

—

because it’s important to prove that x-ray vision in one’s profession doesn’t necessarily extend to other areas?

because he is really who he says he is vs. someone or a group or people adopting a persona?

because you are communicating with an an0n person on a blogroll that will say that they “sold” a place which would mean to you and me and most people that

chichow sells a place to groove77 means:

chichow gives title and keys to groove77

groove gives cash molah bling to chichow

chichow gives groove the finger

groove says FU to chichow

and we happily go our separate ways never to cross paths again.

vs. he who shall not be named

where a sale is owner-financed yeah you pay me monthly installments and maybe in 5 years we’ll conclude the transaction so in the meantime can i screw my broker and that’s my example of why the market is just doing fine.

time to head out to the gym…ltr

in the story chichow, why you gotta go and give the finger bro. and then you paint me all angry man and say FU back.

thats no how it would really go down, this is how;

well first…..oops nature calls… shall finish later.

“chichow gives groove the finger

groove says FU to chichow”

Transactions never have to be a lose-lose proposition. If you think more positively, your life will be much more pleasant. Always think of it as a win-win situation. Oh, and I don’t have xray vision at work or outside of work -you and G are mistaken about my profession. Remember, the internet is full of mistakes and misinformation – you just can’t trust it.

@Groove77:

Point being was (and I was probably too obtuse)

is that

a) how often does one stay in contact with the previous owner when the transaction is complete whether or not it is a car or boat or house…

b) and its not sticks and stones. its just words 🙂

I’ll still like ya hobbit legs

@ persona pretending to be clio

dude… you’re just radioactive. hope you are getting paid well enough or its sad that you got no other ways to get your thrills