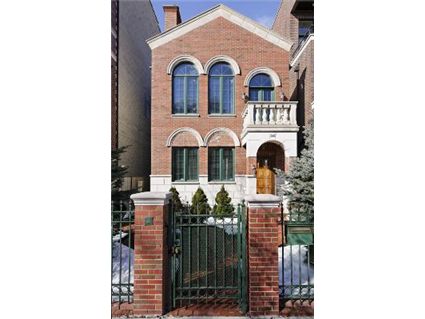

East Village 3-Bedroom House Reduced $30K: 1040 N. Wolcott

We last chattered about this 3-bedroom single family home at 1040 N. Wolcott in the East Village neighborhood of West Town in June 2010.

See our prior chatter and pictures here.

The house was built in 2000 so it’s newer construction.

In June, many of you liked it and wished you could afford to buy it.

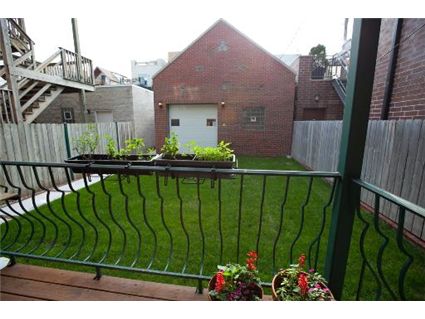

Someone commented on the snowy backyard picture (which was then updated with a nice summer green one- ah the power of Crib Chatter).

Many of you were also intrigued by the garage door that appears to open into the yard.

The house is still available 6 months later and has been reduced another $30,000.

The listing says it has hardwood floors throughout.

The family room is located on the second level and there are 2 wood burning fireplaces.

It has central air and a 2-car garage on a standard 25×125 lot.

You are also just a block to the restaurants of Division Street and the listing touts the local Lasalle II magnet school.

What will it take to sell this house?

Jason Vondrachek at Quest Realty still has the listing. See more pictures here.

Or you can see it in person at the open house this Sunday, December 5, from 11:00- 1 PM.

1040 N. Wolcott: 3 bedrooms, 2.5 baths, 2 car garage, no square footage listed

- Sold in November 2001 for $525,000

- Sold in May 2007 for $765,000

- Originally listed in April 2010 for $779,900

- Reduced

- Was listed in June 2010 for $749,900

- Reduced

- Currently listed at $719,900

- Taxes of $11,741

- Central Air

- Bedroom #1: 18×12 (second floor)

- Bedroom #2: 14×14 (third floor)

- Bedroom #3: 13×10 (third floor)

If I was going to pay this much for a house, I wouldn’t want my neighbors to be able to stare down at me while I am in my backyard.

That half tile, half hardwood kitchen floor is ridiculous. The house may be new but it screams early 90s.

The half-tile, half hardwood kitchen floor would not be a big deal if it wasn’t an open kitchen. Now it just looks like garbage.

These buyers can kiss their 10% down payment good bye! Probably more than that too. No wonder they’re taking baby steps with the price decreases.

I don’t mind the kitchen as much. I find the monstrosity three and four flats on either side of this unit to be more annoying.

http://www.redfin.com/IL/Chicago/957-N-Wolcott-Ave-60622/home/14106101

I’ll take this home a block away for an extra couple bucks a month.

Sells at 2001 price my guestimate

“These buyers can kiss their 10% down payment good bye!”

765,000 x 10% = 76,500

so a 688,500 mortgage at lets say 6.5% (from 2007)

they’re on their 43rd payment so the loan balance is $658,453.74

if they sell at the current ask of 719,900 they will receive $61,447

this of course doesn’t count your realtard fees or taxes or closing costs, but to say the entire 76500 is lost is just hyperbole

“if they sell at the current ask of 719,900”

I think HD’s hyperbole is more accurate than your fantasy. Even in your example, the loss of dp is approaching 75%. Sell for $700k and it’s all gone.

Does anyone have a methodology for the following:

An almost identical unit in my building sold for, say, $500K in June 2009 (make the math easy).

I want to list my unit now – how do I arrive at what I should get for my unit given the market in 6/09 and the market now? In other words, how much worse is the market now as compared to June 2009.

I know this won’t be the only consideration, but I thought it might help to gather this information. Thanks!

Jon, IF that is the only data point available in a vacuum, then ask yourself this: Who would pay more for RE today than what someone paid in June 2009?

Of course, the real world provides a little more data. With a tip of my hat to clio, you really need to consider many other factors – not many of which should be considered independently of the others.

“An almost identical unit in my building sold for, say, $500K in June 2009 (make the math easy).

I want to list my unit now – how do I arrive at what I should get for my unit given the market in 6/09 and the market now? In other words, how much worse is the market now as compared to June 2009.”

Why not case shiller it? Case shiller has been flat for an awfully long time. Then adjust for a discount off of list (mid to high single digits for btown based on redfin, or whatever your personal strategy dictates).

That is, $519K with some rounding and to get to a focal price point, or maybe $499K to get the under $500K crowd, you can always make parking extra…

Sonies, what if one or both of the mortgages are IO?

Secondly, this will not sell at ask. This will be a mid-$600’s.

After fees, costs, commissions, etc, they can kiss their down payment good bye. That’s what happened to people who bought in 2007 and couldn’t wait a two or three years for the deals. But then again, not everyone is as patient as I am.

Thanks DZ – makes a lot of sense.

We finally found a SFH that we like so it might be time to sell. I was just using $500 as an example, but thanks for the suggestions of making parking extra (hate when people do that, but I want to sell) or putting at a certain search number. I looked at Redfin and price per SF then and now doesn’t seem all that different.

I’ve talked to 2 realtors that are being a little doom and gloom about getting anything close to what the other unit sold for because the market has changed… which I don’t get. It doesn’t seem much worse to me. Hope that your search is going well too!

Jon, how much would it cost you to buy a similiar unit in your current neighborhood? Unless your unit comes with something the others don’t — victoria secret models for instance — than that is your answer.

“Jon, how much would it cost you to buy a similiar unit in your current neighborhood? Unless your unit comes with something the others don’t — victoria secret models for instance — than that is your answer.”

Like most buyers, there is nothing on the market like this! Ha. But maybe true-ish. top unit, 3 true bedrooms, elevator, tandem parking, huge private roofdeck, stainless, granite — IMO the layout (not contained to 25′ width but rather L shaped with 4 units on the floor) sets it apart. For that reason I was thinking it would make some sense to take almost identical unit and fast forward to 1/1/11. But I see your point (other than the models thing, of course — models are so needy they really just detract value from a place in my opinion).

I can only imagine how annoying picking all the beer bottles up from your lawn every Sunday morning would get.

“Like most buyers, there is nothing on the market like this! Ha. But maybe true-ish. top unit, 3 true bedrooms, elevator, tandem parking, huge private roofdeck, stainless, granite — IMO the layout (not contained to 25? width but rather L shaped with 4 units on the floor) sets it apart.”

Good agents should know the neighborhood- even if there are no comps in your building (and I don’t consider a sale in 2009 to be a comp. It can’t be older than 6 months to be accurate- and even that is stretching it in this market.) There must be something that has sold in the nearby area that would give you SOME idea.

If you interview a few of the top agents and they’re all saying you’re not going to get a certain price- then you’re not going to get a certain price. Honestly, I’d have Eric Rojas come over and look at it. He’ll tell it like it is (as he’s said he does). Mario Greco at Prudential Rubloff will do the same. If you truly want to know the real market for your property- call Mario. He’ll never mince words.

“It doesn’t seem much worse to me.”

According to HD, Bob and the other fear mongers, it’s down at least 20%, at least in their heads. Stick around and read a few of their posts, they will educate you.

On a serious note, use a SA CS as a proxy. That has you down 10%.

6/2009 135.7170243

9/2010 122.7539441

(9.6%)

Cut that in half I’d say as the condo index reflects a lot of new building inventory dumping. If its a stable building with a good reserve, etc. I’d say you list 25k or 5% lower and you are good to go.

“It can’t be older than 6 months to be accurate- and even that is stretching it in this market.”

I disagree. First of all, appraisers use up to a year, so if the bank will finance on it, you should consider it in your analysis. Second of all, more data is better than less data. A comp in the building is the most relevant you will get.

Its very close to Anderson / Lasalle school. So every day from 2:30-4Pm its crazy on this street.