Flipper Alert: Does Paint Matter? 8 E. Randolph

This is a tale of two flips on the same floor in MoMo, at 8 E. Randolph (otherwise known as Joffrey Tower) in the Loop.

One has been “upgraded” with paint and kitchen tile and the other has not. As a buyer, does paint persuade you?

Here’s the listing for the one that has not been painted, Unit #3005:

Spectacular 30th floor corner Unit at JOFFREY TOWER! Floor to ceiling windows afford breathtaking views of River & City. Chef’s kitchen w/S.S. appliances, Granite counter-tops and Contemporary cabinets. 2 large BR, 2 luxury Bth, 9ft ceilings, W/D hook-up H/W floors and a private covered balcony.

This Unit will ‘WOW’ you every step of the way, downtown living at it’s best! One garage space deeded separately 60k

Karen Cobbing-Loft at Coldwell Banker has the listing. See more pictures here.

Unit #3005: 2 bedrooms, 2 baths, 1460 square feet

- Sold in September 2008 for $515,000

- Currently listed for $515,900 plus $60k for parking

- Assessments of $623 a month

- Taxes are “new”

Here’s the listing of the unit that has been painted, Unit #3008:

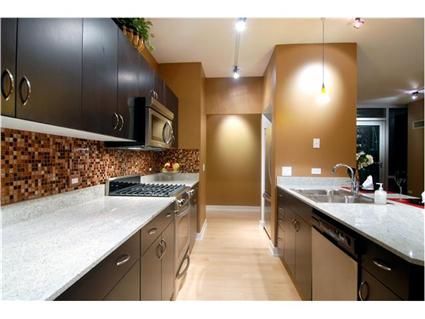

JOFFREY TOWER LOCATED AT THE CENTER-MACYS, THEATERS, BALLET THE PICASSO, MILLENNIUM PARK. SPECTACULAR VIEWS OF THE LAKE FROM THIS 2BED/2BA, WITH BAMBOO FLRS, FLR-CEILING WINDOWS, GRANITE KITCHEN, W/ITALIAN GLASS TILE BACKSPLASH, EUROPEAN CABINETS SS APPLIANCES.

MARBLE BATHS W/ITALIAN TILED ACCENTS LARGE TILED INSET PATIO. MANY AMENITIES, 24/7 DOORMAN, GREEN ROOF, EXERCISE & CLUB ROOM.

Anita Constant at Coldwell Banker has the listing. See more pictures here.

Unit #3008: 2 bedrooms, 2 baths, 1348 square feet

- Sold in June 2008 for $485,000

- Currently listed for $595,000 (parking probably available for extra)

- Assessments of $633 a month

- Taxes are “new”

These look nice. Valasko, how is it living there?

(Two things, though, I just utterly don’t get: overmounted sinks, and frosted glass at the base.)

I dont understand the frosted windows as well. Whats the point of floor to ceiling windows if you cant see out of the lower quarter of them. Plus if you’re sitting down you wont have much view out of the windows.

The unit with the paint/tile certainly shows a lot better but it doesnt warrent an $80k premium.

This building has some of the worst standard finishes that I have EVER seen. The Bathrooms are particularly gross. They need to be gutted and they are new. Truly bad finishes

On a separate note, the units have nice layouts and are spacious feeling

Ohhh uggh I am totally not feeling the interior design of the second unit. They would have to lop 80k off, not add 80k, to the plain unit to compensate me for restoring the unit back to more neutral and less offensive colors.

What a terrible color scheme that doesn’t even match the finishes. It looks like all thats missing from the second unit is some shag carpeting.

Quirky paint choices and an ugly shower curtain are easy enough to fix.

I guess I’ll also give the obligatory, “Of course, it is massively overpriced.” Maybe I should just announce that that is my default position, and I’ll only mention price it if I think it is WELL priced.

I live near this building. Its empty. I count maybe, MAYBE 8 total occupied units on the west facing side.

I purchased a unit here and am cery dissapointed with the Developer (Smithfield). They didn’t give anyone a choice to the bathrooms, kitchens…. We only had a choice of 4 granite tops for the kitchen and the carpet color for the bedrooms. When I purchased the unit pre-construction, I assumed that I would have a choice in some finishes. The bathrooms are horrible, standard beige colored marble and overmount sinks. I don’t mind paying for an upgrade but we didn’t have a choice. I wouldn’t recommend buying from this developer again especially is you are spending 400K.

Can rent that sencond unit for my 1970’s theme Halloween party? I definately get that vibe… disco and pumpkins. ugggg

Undermount sinks RULE!!!

Now as for white stone kitchen countertops… I’d be in a panic to serve wine or cook beets.

Convenient location, but the frosted windows are bizarre, and the fixtures appear to have been lifted from a Holiday Inn.

And I know I’m beating a dead horse, but what planet is the owner of the second unit living on? Bought the unit for $485K — tries to flip it 4 months later for $595K (plus parking)? Did I miss something?

My wife and I love our unit. The layout is very clean lined and spacious, goes well with our modern furniture and art. I have an 8’x10′ terrace which I installed an ipe wood deck and mexician beach pebbles, a very zen garden. The living room has glass on 3 walls and the entire unit has almost 80 lineal feet of floor to ceiling glass. And I like the frosted lower glass.

Sabrina, Joe Zekas has mentioned your website on his (yochicago)…. Everyone go over and weight in, on his comments…..

Oh ipe wood… that stuff (if real ipe) is getting crazy hard to get your hands on. Sounds nice valasko.

Btw.. anyone see the 30yr Jumbo fix. FINALLY hit 10%. Keep pumping and lowering the front end. The back end not liking it one bit.

The ipe I purchased (about 1 year ago) wasn’t that hard to find. New construction will be grinding to a halt, so I don’t believe there will be any supply issues in the future. All construction material pricing shouldn’t be going anywhere but down.

Valsko,

I am trying to politely say that unless the seller can show you FSC certification it is very likely that it is not real ipe. That stuff is not a sustainable wood and is almost completely illegal to be logged (unfortunately it still is) Stuff takes about 200+ years to grow to maturity and maybe 2-5 trees per acre since it is not farmed.

Several sellers of it could not provide me with FSC certification and by the time I found it I realized it was more “zen-like” to go with teak.

Well not sure about my wood being FSC certified. But this stuff looks like ipe, and it’s a bitch to cut, even if its not still looks great. I don’t know of any similar wood that is that dense.

Yeah sometimes they use stuff and call it ipe ironwood. As you said nothing harder and crazy dense but also likes humidity. I think it is just beautiful. tree also flowers around this time of year and if you are near an area that has them you see them poking out here and there on the mountains. bright yellow. BTW I like the frosted glass also. I tend to put sandblasted glass on my interior doors a lot.

This is why no matter how bad a market is I can not rent. I love tearing things apart. To me the rent/owner premium is a non-issue. In an emergency situation I had to rent when i first moved to Chicago and it was a joke. Owner tried holding my deposit because i let calcium build up on the shower glass.

I explained Illinois law and penalties for witholding deposits without notice (which are INSANE) and i think after confirming with a lawyer friend she wrote back the check real damn fast (it is something like treble damages and my deposit was 2 months because of having dogs)

By the way a posting on The Fordham (shithole with assholes living there) and the cracks all over the exterior would be fun to see Sabrina.

iB- I sold 80% of my real estate holding in the last 3 to 5 years. I know from a financial stand point it doesn’t make sense to buy. But I too like owning and changing things around. I look at my house as a place to live and not as an investment. Also took 600k out of the stock market last year to buy this place. So in my mind I am way ahead of the game.

Hard to be a bigger bear than me, but I know what you mean. I think this is all part of a supercycle anyway and 20 years from now this looks like a blip. Just doesn’t feel that way now. I am starting to look at different commodities (food, minerals) a bit at these levels. Exponential population growth is pretty much my support on that one. Resources can get scarce quickly. We just got a taste of that and will see it repeated eventually. Housing is screwed though for a while but I’m still getting my architect plans finalized tomorrow and moving forward with my renovation come hell or high water.

You might of missed my post yesterday where I tried to put a positive spin on it (first time) seel the place in Chicago -10% and buy one in Sydney with the currency drop for -60%. I really liked Chicago but Sydney… ahhh!!!!

life is all a matter of perspective.. there is no reality except the one that exists in your mind and that’s not real either. Kinda why I have a bizarre respect for SHill.

My wife is an Australian citizen, she is from Adelaide. So maybe we should move back!

Just got back from Dubai…. that is the biggest realestate bubble…… man when that pops it will be nasty. The typical condo usally flips twice before it reaches its final buyer- crazy land!

I hear Dubai is empty. Crazy monstrous empty buildings. If I die without ever going there and seeing for myself I’m very content with that.

Australia is awesome, great people, great attitudes, loved the left clutch left stick thing also- i was switching gears like Felipe Massa, just too far if you have family in the states. Traveled thru there for 6 months one time and never could figure out what day of the week it was back in the States.

Btw.. wasn’t your building the one that dropped the plate of glass?

The curtain wall came from China, it’s going to be a future headache.

There’s an Ezra Gorden building in the Gold Coast (on Dearborn around from Treasure Island) which used to have the frosted lower window panels – either to give some privacy from the street or to stop people being freaked out from heights while still letting light in – and architects design conceit outside.

“Sabrina, Joe Zekas has mentioned your website on his (yochicago)…. Everyone go over and weight in, on his comments…..”

Thanks for the heads up Valasko. Believe it or not, Joe and I actually do mention each others websites every once in a while (and link to each others sites.)

If you’re looking at new construction, Yo has the best information out there on what is currently available and what is happening with pricing (in many new buildings and developments.)

I feel like Crib Chatter allows people to talk a bit more freely about what is going on in the overall market.

IB said, “I think this is all part of a supercycle anyway and 20 years from now this looks like a blip.”

I respectfully disagree. This real estate depression is one for the record books. The drop in the real estate market has shattered real estate records since real estate industry records have been gathered. Vacancy rates, new home starts, price declines, foreclosures, inventory, etc. Things aren’t looking any better either. Lower prices going forward are going to help the market but sales volume is still low. Lower prices going forward doesn’t help those who overpaid, some tremendously, during the boom. This mess, the credit mess, or real estate, or financial deregulation, whatever you want to blame, will be studied for generations. My personal opinion, which scares the living daylight out of me, is that the worst has yet to come. I haven’t stocked up on guns, gold and ammo, nor do I think our country will turn into Afghanistan, but economically, we’ve got a long way down to go. This mess is going to ride until 2012 or 2013 at the earliest. The period between ’07 and ’13 will be known as our ‘lost generation.’ The crazy thing is that I’m not really a doom and gloomer in life. I’m not a pessimist or overly negative. I just look at this storm cloud brewing above and I’m calling it like I see it. I hope I’m wrong, I really do. America, and a large part, the world, has overextended itself financially, and until we wash out all the bad debt, excess and waste, we’re going to struggle through some extraordinarily troubled times. As an analogy, on a very micro sale, think of our economy as the boomer FB who bought a luxury car, a mcmansion, played the stock market, borrowed from his 401k) and lived beyond his means. He’s still got a job earning some income but it’s decreased. he’s already worked through his savings, maxed out the credit cards and every month he’s struggling. Numerically there’s just no way he can repay all the debt he has without winning the lotto or declaring bankruptcy. He’ll stay afloat month to month for some time, but, he can’t get back to normalacy until he declares BK, discharges the credit cards, crams down the value of the car, loses the house in foreclosure, and gets his fresh start. He returns to work the next day and without all the debt and excess hanging over his head, he’s able to finally get a firm footing on the ground and move forward. There are so many people and corporations struggling like the FB above, and until these companies/entities/governments get the opportunity to start fresh, they’re just prolonging the pain.

homedelete – I’m with you on that post for sure. I am an optimist but not stupid and have been continuously monitoring events and have reacted ahead of the curve. I am seriously considering buying my first gun and taking lessons…due to possible social unrest and the very very very remote possibility of a martial law type of thing….very unlikely but our troops have been training for such stuff for years in Iraq. The right to bear arms is in their for a reason…both protection from others and protection from the government should it no longer be “of the people”. Again, I have never owned a gun nor am I the militia type whatsoever…just prudent. The optimistic view is there are a good chunk, the silent majority, that are savers and responsible and many are getting “mad as hell” over having to cover for the irresponsible…about time too. What will be remembered in the history books is how government programs distort the market and do more harm than good…. in this situation, what was there to promote homeownership over decades morphed into a monster program that distorted the real risk in lending money. That really is the fundamental point here – money was lent without charging an interest rate commensurate with the risk involved. Had subprime mortgages been at what should have been high subprime interest rates, those people would not have been able to even make one loan payment and wouldn’t have taken the money to buy the house. We had a massive risk distortion primarily caused by government programs that started decades earlier. Opportunists took full advantage of this distortion and took it to the extreme until the system collapsed. Now risk is being priced into the interest rate (and other requirements to reduce the risk such as large down payments, income verification, etc.) for debt financing going forward. Debt financing had been turned into essentially what equity is supposed to be. There is a fundamental difference between equity and debt that had been lost and now we have found “debt religion” again and it will be historically painful. We’ll get through it, but socialism is NOT the answer.

John,

Good luck getting a legal gun in Chicago. You aren’t one of the templars (CPD or other govt) of King Daley, so they make the regulations so onerous so as to be almost impossible if you aren’t law enforcement, former LE/mil or fire dept or gov EMT (still near impossible for private/contracted EMT is my understanding).

The Supreme Court’s decision is being ignored in practice. They don’t want responsible citizens owning guns in Chicago, but if you’re a gangbanger you only get a week or two in jail for a weapons violation, a month tops. Thats fine for gangbanger who has flexible hours with their jobs ‘slingin’. Not so fun for those of us who pay taxes and have real jobs other than pimping and pushing drugs.

As the latest high-profile murder (Hudson) demonstrates of Chicago: career criminals aren’t penalized in the least. This 26yr old crackhead was convicted of attempted murder and carjacking six years ago, already out and was caught with cocaine while on parole back in June, yet still on the streets. Car jacking and attempted murder and he is out within seven years, weapons charges will get you less than a month in county.

I don’t disagree with your preparedness just be sure to include your lawyer in your plans to ensure the Chicago government doesn’t make your life hell for wanting to be prepared.

Also as an addendum: your suggestion is only one component of a good civil unrest plan, if all hell breaks loose that won’t save you nor get you far.

Other items (even higher priority) might include: a satphone, a solar still, enough food in any form (oats, vitamins) to last 1-2 weeks, a motorized bike/moped capable of navigating in less than a lane of traffic and most importantly a plan.

I don’t have most of these items but have thought about this too if I saw this becoming a greater possibility. I don’t think its worth the expense now given the probability I estimate this happening (

Good morning…

Ok maybe a gun might help with civil unrest but this is not the 1770’s and standing behind a wall with a musket is not exactly going to hold up well against an Apache helicopter, so if the gov’t ever comes for you I suggest walking to Guatemala instead.

As for blip I am talking a much longer time frame. HD you are young, even if this goes to 2015 it will still look like a blip one day. the faster this craps out the quicker we can move forward. The gov’t not wasting money would help also (not going to happen).

It is a HUGE world which is often something Americans forget (actually they often refuse to even think about anything but America) If you are unskilled labor it will not be a blip, it is over forever, you are freaking screwed huge!!! If you are talented and smart and ambitious you will have many chances to succeed at a level never before seen. Much of the world got it’s first taste of the good life. They will produce and move forward.

IB, Japan’s blip is in its 19th year; and the GD lasted 10. My prediction is 8 at the minimum. There’s still a lot of painful deleveraging going on and there is a lot more to come.

HD.. don’t confuse a chart of market prices with the overall economy. Japan has not been in a 19 year recession. Growth just slowed considerably but people in Japan have continued to live a very high standard of living. Their equity market just got way overhyped in the 80’s.

And we need to deleverage and write down debt and take losses. The attempt to hide those losses is what can bury this thing completely. Oh and the fact that half of Americans are freaking ignorant morons that believe it is their god given right to be entitled to a standard of living that won’t continue.

HD.. let me add once again I think this gets a lot worse from here before it gets better. A LOT WORSE!!! I made the biggest bet I ever made (and I have made some monstrous sized bets in my day). I left the freaking country!!! But I do think it will get better. When I was 22 3 months felt like forever to me. I am still relatively young but now a decade to me feels like nothing.

homedelete and John, you guys should check out survivalblog.com for tips and advice on sirviving past social or economic meltdown. From the times I have glanced at it, most people acquire lots of land and stockpile weapons, fuel, seeds and animals. Sounds like a lovely life!

I’m not 22 but I’m in my 30’s. I don’t think I’ll become an ex-pat. This credit mess will be one for the history books … the panic of 1907, the south sea bubble, the GD, Japan’s lost generation. Every period of time is a blip in the sense that the earth is billions of years old. But for lot of people this blip will cause them to lose a lot of money in this bust. large storied companies and entire industries have been decimated or have disappeared (mortgage brokering, investment banking, soon the auto industry, large ins. co, major banks, etc.)

E,

ha! I don’t own a gun nor do I stockpile food. But I do recognize that we’re in a period of great financial insecurity and it may become extraordinarly difficult to earn an income for a few years. it started in RE, then moved to banking, retail is next…Plenty of people twiddling their thumbs and/or making far less money than they used to. I know that I’ll be OK but I live a rather simple lifestyle and if I needed to I could live off pennies (although that’s not preferred). I have no interest in moving to farm and growing my own food or anything like that. But if I lost clients or the banks stiffed my firm on fees or if the unions grow any weaker (all different sources of income for my firm), I don’t want to be stuck holding the bag on a $800,000 interest only ARM Jumbo mortgage or a $1,200 a month car/insurace/gasoline payment.

Part of how I first noticed the problem was when I started saying to my wife that everyone on the street appears much richer than us. I said to her then this will end badly. Everyone is not meant to be rich. This is the market correcting the excess.

Markets like to cause pain to the majority not make the majority rich. People don’t get that.

It’s pretty hard to go to Zekas’s site (yochicago) and make a comment about what you think, since he deletes most comments he disagrees with. Sometimes he just makes a rude, condescending reply to anyone who speaks negatively of real estate, but more and more the negative comments just disappear. Something tells me Joe is not a happy man these days.

I agree. But new home construction has dropped to levels not seen since WW2. I know there are a lot of criticisms of him and his site, but this is a deep, deep, new construction depression.

IB you might enjoy this too: a week ago a realtor (at a big Chicago firm) gave me a bud at the cheap bar I goto (a real high quality one too). Also this cheap bar was packed wall to wall and the first time I’ve seen this.

So yes the economy is turning and realtors are being aggressive finding clients. Unfortunately for him I’m not in a position or mindset to buy anytime soon.

Not that I will make it the center of my life but _if its free_..hey..I can smoke to that.

Bob.. it’s less harmful than the drink and MUCH less harmful than the realtor. 🙂

Hi,

I am renting here in 8. E. Randolph, and this is the second update. The floor in the living room/kitchen have started warping and its not even that humid. I am afraid of tripping sometimes 🙁 I agree that it is very spacious but all these tiny things just keep nibbling away at my hope to buy here eventually!

Ha!

I like how the listing has “Macy’s” as a selling point.

As a lifelong resident of the Chicago area, who grew up going to Marshall Fields at Christmas time, I wouldn’t be caught dead living near the dump that is Macy’s.