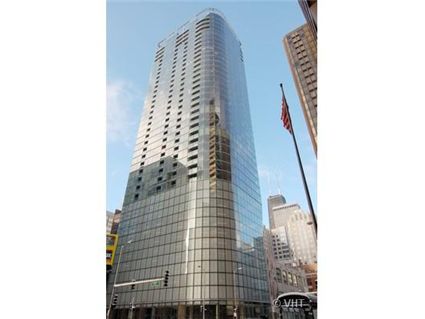

Flipper Alert: Losing Money in 600 N. Fairbanks in Streeterville

Flippers continue to close on units thinking they can make a profit flipping them. Some have been lucky- especially in “prestige” buildings such as 340 On the Park.

This seller of a 3-bedroom in 600 N. Fairbanks isn’t one of the lucky ones. We’ve seen some 1 and 2-bedroom units flip successfully in the building. But many have also simply been rented instead.

We’ve seen this 3-bedroom tier before- with #1301- which finally ended up selling after several rounds of price reductions.

Here’s the listing on Unit #3601 (which went into contract almost immediately upon the last price reduction):

Reduced Price For Immediate Sale! No Short Sale! Upper Tier In World Renown Architect Helmut Jahn Building W/Awesome Lake & City Views! Light & Bright Unit Is Completely Drywalled W/Upgraded Hardwood Floors & Fixtures.

10′-12′ Ceilings,private Balcony,granite & Marble Counters,miele,wolf & Subzero Appl. Bld. Offers Sun Deck,lap Pool & Fitness Center. Blocks To Navy Pier & Michigan Ave. Premium Parking Spot #201 -$65k!

This unit is one floor below the amenities floor, correct? It has nice views.

Also note: this seller decided to drywall over the concrete ceilings.

Rusty Clements at Baird and Warner has the listing. See more pictures here.

Unit #3601: 3 bedrooms, 2.5 baths, 1746 square feet

- Sold in April 2008 for $1.139 million

- First listed in April 2008 for $1.4 million

- Reduced several times

- Reduced to $1.2 million by August 2008

- Reduced several times again

- Reduced to $1 million on Oct 14, 2008 (parking $65k extra)

- Under contract on Oct 15.

- Assessments of $780 a month

- Taxes are “new”

No the amenities floor is 41. This is one level below the penthouse tier.

SSDD

Ah my Ellsworth Toohey building once again.

and for 1746 sq ft one would think you could get some kitchen cabinets in there.

1,786 is slightly bigger than my studio in Uptown. Does anyone have a link to a floor plan?

Thank you Jeff. I thought it was pretty high up in the building though. It seems to have nice views.

There are plenty of “01” tier units on lower floors still on the market – several listed for more than this unit. Reality will be tough to swallow for those sellers.

Love the finishes in these units, but they really skimp on the living/dining/kitchen space. Despite the “high design” look, it’s really like most other new construction units – they make living space appear larger than it is by openning up kitchen to LR/DR. You look at an $800K unit and wonder where you can put your dining room table.

“and for 1746 sq ft one would think you could get some kitchen cabinets in there.”

There’s a decent amount of cabinets to the left of the refrigerator which you cant see in the pictures.

so that’s what you get for $572 dollars a square foot.

Even with the seller taking a loss, I’m still surprised that they were able to find a buyer for this unit at $1M.

the building is nice. the apartment is pretty ugly though…run of the mill condo. The thing I find funny about these luxury places is how they have a simple 2 dial thermostat. It looks like that from the picture of the fam room. I know the Streeter has these too. Can contractors not pay an extra $50 for programable thermostats? Is there something i’m missing?

“an extra $50 for programable thermostats”

Not-basic but not-fancy programmable thermostats cost about $50 at retail. Cheap ones are $25, fancy are $100+.

Basic thermos are around $15 at retail. So, with bulk wholesale purchase, it’s probably more like an extra $25-30–or as little as a couple bucks if one uses the cheapest progammable thermo. Which makes it even more ridiculous.

Flipper got lucky, got out of this falling knife with barely a nick.

This seller was lucky and smart enough to know that the faster you take the loss in this housing market the better. I really wonder what the other flippers in this building will do now.

1301 re-sold for 805K, including parking. The exact same price original buyer paid for it from developer.

Streeterville Realtor,

What you neglect to mention is that that sale went into contract a couple months ago if I recall. The housing market has changed drastically in the last couple weeks.

Best of luck to all. Prices are set to crash this winter like I have predicting for quite a while now.

I never like view of the 01 tier personally, yes it is big, but the view is pretty blocked…

The swing in price of units in this building is insane.

Is the sale price of $1M on oct 14 with parking or without parking?

If the closing price at $1M is with parking, then yeah I think the seller lost. Don’t forget though what the seller paid in april 08 for $1.139M ALREADY includes parking!

So the value of the property itself is $1.139m minus $65k (or could be less than the $65k, because parking ranging from $50k to $65k on average), so do the math .. the value of 3601 could be anywhere between $1.074M to $1.089M.

Little Boi: Maybe I am missing something in the math but if it is under contract at $1 million it doesn’t matter if that includes the parking or not because they paid $1.139 million WITH the parking.

Either way- they are selling for less than what they originally paid.

We won’t know until it closes if it includes the parking or not.

And if you add in closing costs and costs to pay the realtor- this seller lost quite a bit of money (again- we won’t know until it actually closes.)

Yes- flippers are losing money now – even in popular buildings (which is what 600 NF is.) I can’t tell you how much worse it is in the non-popular buildings. The flippers can only hold on so long (losing money month after month.)

Sabrina,

I would assume the 1m includes parking but he is correct that if they sell the parking separately their Net Receivable would be above the 1 mil.. So it matters but regardless of that, with broker fees, tax, carry costs, (even w/o) they took a loss. Although I think they should feel relieved.

Yeah, I am saying if $1 nillion closing price did INDEED include parking, then the seller was not making money, because he paid $1.139 originally (with parking included).

How much money do you think DeaconBlue lost so far?

“Yeah, I am saying if $1 nillion closing price did INDEED include parking, then the seller was not making money, because he paid $1.139 originally (with parking included).”

Whether $1mm included parking or not, if the sale price was $1mm, then the seller lost money. $1.139mm in more than $1.065mm. Even if it included two parking spots at $65k each, $1.139mm is more than $1.130mm (which is $1mm + $65k times 2). There is **NO WAY** if the sale price was $1mm that the seller did anything other than lose money on that unit, and in the worst case scenario, quite a lot of money.

Flippers in this building deserve to lose their ass. The closings happened well after the real estate bust; the writing was clearly on the wall. They just chose to ignore reality, or perhaps thought they were better than all the garden variety speculators because they were flipping in a “classy” building. These people represent greed in the extreme, and I will have no sympathy when they go into foreclosure.

What kind of leech honestly thinks they deserve to make $100,000+ profit just for holding the deed to a condo for three months?

I’ve been wondering what happened to deaconblue too? Once Wall Street started having problems we stopped hearing from him. I knew he lived in Streeterville but didn’t know it was this building. Guess his ego is suffering a little.

Most figured, as they were going into closing, that the offers listed on the bldgs were showing above their purchase price. Throw in the 10% deposit and they figured they had wiggle room to get out better than their -10% walk away cost.

Now why they didn’t just take their offers down closer to original sales price and get out immediately is the fear/greed factor.

I preicted long ago that the wife would cut the DB off when she discovered his hubris due to her money.

I’m worried more about poor, poor Sally.

“What kind of leech honestly thinks they deserve to make $100,000+ profit just for holding the deed to a condo for three months?”

The same kind that failed to consider they could lose as much when the worm turned.

Enjoy!

Units are reselling in this building for a profit (small one) but a profit.

Out of all of the Streeterville new construction, it has definitely been the best received.

For example,

1402 (North/East 2/2) originally closed for $503,200.

Resold and closed on 12/3/08 for $560,000.

Any examples? I know some have sold for more than purchase, but I am not sure that resulted in profit for many.

Crossed posts there. Take out transaction and carrying costs. Was there a profit?

G,

You are correct, but at least it’s not a loss!

Here is an example of the seller making more of a profit, not just breaking even.

2505 N/W 2/2

Sold on 2/6/08 from developer for $586,500

Resold on 11/18/08 for $682,500

1402 may have been a loss. When was it purchased?

2505 might have made about $25K after $34K commission, $5K transfer tax, and $35K int/prop tax/assmts. Not to mention the opportunity cost on the deposit (1-2 years) and down payment.

“Here is an example of the seller making more of a profit, not just breaking even.”

Gross Profit: $94k

9 months interest: ~$22k

9 months assessments: ~$5k

Realtor fees: ~$41k

Transfer tax: ~$4400 on the buy; ~$2500 on the sell

Title insurance, loan fees, etc.: ?? at least a couple thousand more.

It evaporates quickly, unless you aren’t paying realtors. But yeah, still made a couple shekels.

It also depends if the seller was actually living there during the process or it sat empty…not sure what the deal was with this buyer. Thus far not one unit has sold for less than original closing price but that does not mean it will not happen. If a few places/buildings hold up better than others why do people seem to get so bitter?

“If a few places/buildings hold up better than others why do people seem to get so bitter?”

Why do you have to ascribe “bitter” feelings to everyone who disagrees with you about the “value” of your unit? People get upset b/c people call them “bitter”; you’re probably confusing their reaction (spewing bile, generally) to your accusation with expressions of bitterness.

I ain’t bitter at all; indeed, I’m all for people making money on whatever (except my labor), so long as they don’t come to the government looking to be saved when things turn bad.

Fairbanks,

I agree that this building will hold up better; however, 1301 resold for the exact same price as the original closing.

When you factor in the fees, it is a decent loss for the owner.

1301 is a 3 bed 2.5bath lowest floor

11/13/07 closed for $805,000

8/4/08 closed for $805,000

David:

But 1301 *was* lived in, so they just had a really, really expensive rental.

Why are so many people praying that someone lost money? You guys are pathetic! Did Deaconblue ever say that he/she was trying to flip the unit?

“You guys are pathetic!”

Woohoo. More sophisticated discourse. For someone bothered by the views of others, you have little skill in changing anyone’s mind.

Why do people cheer for the sunset in Key West?

It is no less predictable, that’s for sure.

If it’s predictable, how come no one has lost money on this building?

“you have little skill in changing anyone’s mind.”

Who is trying to change someone’s mind? I simply asked why you are hoping that someone you don’t know loses money. That’s not an argument, it’s a question.

“Why do people cheer for the sunset in Key West?”

So you get the same pleasure out of watching someone lose money as you do watching a beautiful sunset? You are a truly disturbed person then, you may want to go talk to someone about that.

It’s called Schadenfreude: the just desserts for all the greedy flippers/specuvestors/passive investors (aka homeowners) who helped destroy the American real estate market and broader economy.

btw not all homeowners are passive investors, just those who bought with the greedy expectations of massive future appreciation, heloc’s, exotic financing, howmuchamonth financing, “i’ll only live here for a few years” etc

“I can always rent it out.”

“I simply asked why you are hoping that someone you don’t know loses money.”

Anyone who doesn’t currently own is “making” money on a future purchase if prices decline. So some of it is related to that.

I’m not rooting for anyone to lose money, but I do wonder why everyone here who complains about the “people praying that someone lost money” resorts to ad hominem. As the bubble inflated, many non-owners were called stupid for not “getting in the game” by people like the nameless flippers talked about on the CC. Cheering for the misfortune of mean people is a normal human reaction.

“Cheering for the misfortune of mean people is a normal human reaction.”

But according to Fairbanks, no one in this building has lost money! I don’t feel bad for idiots who tried to flip $800k one-bedrooms in the Trump tower, but apparently this building hasn’t dropped so why are people routing for it to? Also, did the person who bought here say he/she was flipping? If they aren’t flipping, it looks to me like they have made money!

“If they aren’t flipping, it looks to me like they have made money!”

It’s worth rental equivalence until they sell or extract $$ thru a non-recourse loan. No one “makes money” on an illiquid asset while holding it. But that’s an accounting question, so look at it however you want, but be consistent.

“But according to Fairbanks, no one in this building has lost money!”

He’s an interested party; don’t rely on research from an interested party. With the transaction costs of real estate buying and selling, you need to be up at least 5% to reasonably assert you didn’t lose money. The owner of 1301 lost money. The owner of 3601 will lose money when the unit sells (and, if you insist that a rising home value = making money; then 3601 has already lost money and Fairbanks is wrong).

PS: Much better about seeking a reasonable answer.

PPS: Do we need a tutorial on the difference b/t rooting and routing? Is it something about this building, b/c it seems it’s the only one where the problem comes up repeatedly.

Unit 3601 lost money, the topic of this posting.

Sold in April 2008 for $1.139 million

Reduced to $1 million on Oct 14, 2008 (parking $65k extra) – now under contract

Assume they got close to asking, you’re looking at almost a 10% hit without factoring in closings costs. That # escalates with broker fees, title fees, mortgage costs if any, and so forth.

Good to see you still troll the site Deacon, though under a different name. Can’t blame you. Had you listened to me a year ago about the RE and stock markets you’d be a very wealthy man.

ja, congrats on being the first one to figure that out, you are apparently the only one here who is not a moron, as I’ve done very little to hide it. How, pray tell, would I have become a wealthy man by listening to you? I recently had my unit appraised (by the bank for a refi, not my own appraiser) for about 12% above what I paid pre-construction. Not bad in this market. The unit right below me recently was re-sold by the developer for about 20% above the original pre-market pricing, so I’m not to concerned about my investment. How would you have made me wealthy again?

anon, you have got to be joking. If you buy an asset and it appreciates in value, you can’t say that you’ve “made money” until you sell? Who do you think you are kidding? Unless I am forced to sell right now, I’ve made money on my balance sheet, no matter what you say.

Where is G with his MLS data when you need him? He never seems to provide data when it doesn’t fit his argument. I know for a fact that there many been multiple closings in the past six months, it would be great to see the data….hint hint.

Turd,

Just go on Chicagotribune.com and look at recent sales. I’ve actually found that the MLS data for this building is not accurate. If the original owner did not use an agent for the sale, then it appears that the developer did not enter the closing into the MLS.

and the Tribune provides the To and From names so you can confirm that it was a resale and not original developer closing

Here is some correct info on #1402 & #3601:

#1402 sold 11/12/2007 for $545,500 w/pkg (deed 731733134)

#1402 sold 12/3/2008 for $560,000 w/pkg

Obviously no profit on this after transaction and carrying costs.

#3601 sold 4/17/2008 for $1,139,000 w/pkg

#3601 sold 11/6/2008 for $915,000 w/pkg

I’ll leave the math on this one to the DB, aka The Turd.

Here are the rest of the resales in the building (all include parking unless noted):

1301 sold 11/13/2007 for $805,000 w/pkg

1301 sold 8/4/2008 for $805,000 w/pkg

1703 sold 11/27/2007 for $398,500 w/pkg

1703 sold 11/12/2008 for $425,000 w/pkg

1802 sold 11/20/2007 for $576,394 w/pkg

1802 sold 12/4/2007 for $698,000 w/pkg

(sold unit for $640K and pkg to seperate party for $58K)

2002 sold 11/20/2007 for $619,500 w/pkg

2002 sold 9/22/2008 for $683,200 w/pkg

2107 sold 12/10/2007 for $533,000 w/pkg

2107 sold 2/5/2009 for $500,000 ?/pkg (deed not yet avail.)

2211 sold 1/3/2008 for $858,500 w/pkg

2211 sold 4/29/2008 for $920,000 w/pkg

2307 sold 12/28/2007 for $586,000 w/pkg

2307 sold 3/20/2008 for $612,500 w/pkg

2505 sold 1/30/2008 for $586,500 w/pkg

2505 sold 10/14/2008 for $682,500 w/pkg

2603 sold 1/15/2008 for $426,000 w/pkg

2603 sold 4/14/2008 for $455,000 w/pkg

2606 sold 4/15/2008 for $353,000 no pkg

2606 sold 7/28/2008 for $386,000 no pkg

2704 sold 1/22/2008 for $445,500 w/pkg

2704 sold 5/27/2008 for $471,500 w/pkg

2809 sold 2/12/2008 for $483,000 w/pkg

2809 sold 10/7/2008 for $445,000 w/pkg

3004 sold 2/12/2008 for $447,500 w/pkg

3004 sold 6/2/2008 for $486,500 w/pkg

3303 sold 2/28/2008 for $412,500 no pkg

3303 sold 8/15/2008 for $415,000 no pkg

It is still early in the correction and we already have a lot of losses in this “prime” building. Don’t forget the transaction and carrying costs. Of course, the carrying costs will vary from the high costs of the flippers with vacant units to the lower costs of owner-occupants due to loss to equivalent rents.

Here are all of the sales in the bldg since September 2008:

#2107 sold 2/5/2009 for $500,000 ?/pkg (deed not yet avail.)

#1402 sold 12/3/2008 for $560,000 w/pkg

#1703 sold 11/12/2008 for $425,000 w/pkg

#3601 sold 11/6/2008 for $915,000 w/pkg

#2505 sold 10/14/2008 for $682,500 w/pkg

#2809 sold 10/7/2008 for $440,000 w/pkg

#2002 sold 9/22/2008 for $683,200 w/pkg

#3603 sold 9/2/2008 for $542,500 w/pkg

2107 did not include parking.

” If you buy an asset and it appreciates in value, you can’t say that you’ve “made money” until you sell?”

Tell it to all of Madoff’s investors. That “$50B fraud” is based on about $18B in actual cash investments. They collectively “made” $32B, but b/c they didn’t pull it out, they’ll end up losing ~$15B+. Count your funny money however you want, dude. Just don’t tell me you’re rich based on holding appreciated, illiquid assets.

PS–I do have to admit, that, seeing the data, it’s obvious that Fairbanks was right. Oh, wait, I’m sorry–he wasn’t. There ARE units that sold for less than prior sales.

“Count your funny money however you want, dude. Just don’t tell me you’re rich based on holding appreciated”

So because there was ponzi scheme in NY, I can’t count the obvious appreciation for my unit on my balance sheet?

Thanks for the data, G. What has happened in this building is almost exactly what I predicted. The south facing one-bedrooms (08 and 09 tier) have struggled, as they have crappy views and are rather expensive. The nice two bedrooms (05, 02 and 07), which is what I own, are all up substantially, even the ones that sold after 09/08. 2505 looks likes it went for over $100k above pre-con pricing and 2002, which went for $683k, probably went for about $550k pre-con. So most of these flippers did OK and the actual home-owners (like me) have done GREAT considering the circumstances. Thanks G, I frankly wouldn’t have been surprised if these units had done much more poorly- you made my day!

2307 sold 3/20/2008 for $612,500 w/pkg

2107 sold 2/5/2009 for $500,000 w/o pkg (probably would be around 540k with pkg)

A 72.5k (~12%) loss when you mark to market (ok, maybe take off 10k for being 2 floors lower).

Indeed, a cause for celebration.

I agree with Deacon, nothing wrong in principle in marking to market and claiming profit, only doing such isn’t easy with an illiquid asset that drops in value every week.

The smart money pulled their RE holdings last year (if not earlier) and SHORTED the stock markets (wondering if any of your market neutral holdings blew out the wrong way Deac).

By the way… Turd is 100% absolutely correct. You mark assets to your book at mark to market. Value and risk associated to that value are once again being intertwined incorrectly.

Anon… C’mon Madoff was a FRAUD.. horrendous and unfair example. Almost as unfair as him living in his penthouse ordering up sandwiches from Carnegie Deli and bagels from H+H… America is a joke.

2307 sold 12/28/2007 for $586,000 w/pkg

2307 sold 3/20/2008 for $612,500 w/pkg

2107 sold 12/10/2007 for $533,000 w/pkg

2107 sold 2/5/2009 for $500,000 ?/pkg (deed not yet avail.)

ja, how do you get a $72k loss from this? Another poster said that the resell of 2107 did not include parking, so it sold for modestly more than it’s precon price. I don’t care how the flippers did, I only care how the actual units have held up. Is there anyone here who honestly doesn’t think this building has held up well all things considered?

As for my portfolio, I was down about 9% last year, you? Saying “the smart money” was short is meaningless, anyone can make that claim in hindsight.

One last thing- the parking spots vary $20k in price depending on the floor, plus there could have been up to $35k in upgrades, so there is a margin of error in comparing units that we don’t have enough info to take into account.

2107 did not include parking. You can contact the listing agent to confirm.

Deacon, I told you repeatedly to just short the market and drop your market neutral positions – you were a recession denier – and to sell your RE holdings. Like I said, had you listened to me rather than act like an arrogant *** you would be up 50%+ rather than down 10%+.

And if I wasn’t clear, my point was the owner of 2307 is down A LOT based on the most recent resale and direct comp, 2107. I added 40k for hypothetical parking, and that still leaves over 70k difference. Take out 20k for the 2 floor difference and he’s still down almost 10%. And I don’t think there are enough upgrades in his unit to make up that difference.

Cheers!