Flipper Alert: Units Flipped at Village Pointe at 845 N. Kingsbury

I last chattered about Village Pointe at 845 N. Kingsbury in River North in December 2007 and profiled five units.

At the time, flippers were trying to sell several units. Three out of the five from December have now sold.

Unit #304: 1 bedroom plus “den”, 1 bath, 909 square feet

- Originally sold in July 2007 for $138,300

- Listed in December 2007 for $269,900 plus $30,000 for the parking

- Sold in February 2008 for $150,000 (not sure if this was because it was some kind of income requirement unit)

Unit #512: 1 bedroom plus “den”, 1 bath, 909 square feet

- Sold in July 2007 for $269,900

- Listed in December 2007 for $288,900 plus $30,000 for parking

- Sold in December 2007 for $308,000

Unit #611: 1 bedroom plus “den”, 1 bath, 909 square feet

- Sold in July 2007 for $291,500

- Listed in December 2007 for $287,500 plus $30,000 for parking

- Sold in December 2007 for $315,000

This larger unit is still on the market four months later:

Unit #201: 2 bedrooms, 2 baths, den, 1700 square feet

- Sold in June 2007 for $437,500

- Was listed in December 2007 for $488,900 plus $30,000 for parking

- Reduced and now listed for $475,000 (parking $30,000 extra)

- Assessments of $439 a month

- Quest Realty Group has the listing

I can’t find info on the fifth unit I chattered about. It was for sale and/or rent so it might have rented.

Not sure about this exact unit, Sabrina, but a colleague of mine attempted to purchase a low income unit in the building. I believe you must have an income below 50K to qualify through a City program. She didn’t end up getting the unit because another buyer came in with all of the paperwork completed.

What a deal!! Darn me for getting an education and trying to better myself!! Maybe I’ll quit my job….

I wonder how they define “income.”?

ouch. i recently came upon your site sabrina (i love it btw) but this post makes me cringe for 2 reasons.

1)

my friend moved into this building about 3 months ago. and she paid around $300k for a 1 bed + parking.

2)

her view is great. if by great you mean looking straight at the row houses of cabrini. you can literally look into the buildings. not really an ideal location. also considering that 2 of my friend’s cars were broken into (and mine as well), well…

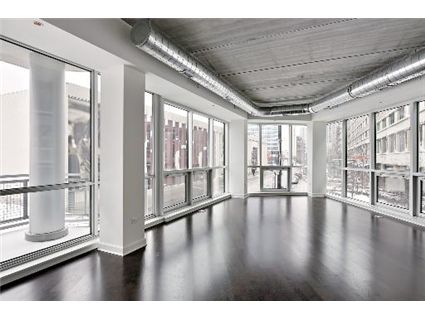

shame cause the 2/2s look nice.

I have seen the largest unit. Highly unappealing..its like you are living in an aquarium and the area around there is run down. There is a vacant lot across the street so you do get a nice view, but how long before that vacant lot houses something else.

The low priced units are part of a city program for median and low income buyers and are standard in large developments around the city. You can qualify with an income up to $60K but you need to go through several trainings, get qualified by the city, and most of the units are available only through a lottery. I don’t know if the programs have changed but you’d be hard pressed to find anything this nice at this price now (these units were mostly bought pre-construction and I believe there was a large incentive to keep some units in the neighborhood very reasonably priced to offset the loss of all the public housing to pricey townhouses–so they may have been priced lower than comparable city program units). These were about half-price and in a very desirable neighborhood, most of the program units are closer to 20% off and in less central neighborhoods.

When buying one of these units you give up the right to resell it on the open market without significant penalties for 30 years. So it’s not as strong an investment as a market unit unless you live their most of your life.

To all the armchair haters–the units are beautiful and the neighborhood is fantastic. Japonais is across the street, the mag mile right down the street.

Unit 612 is a 1/1 listed as under contract @200k.

Unit 516 is a 1/1 also with 909 square feet listed as a short sale for 200k.

Any idea on what price Unit 516 was sold for or will sell?? What would be a good price? Does this location provide upside?

“Any idea on what price Unit 516 was sold for or will sell?? What would be a good price? Does this location provide upside?’

That is a 900 square foot 1/1.

It’s under contract- so until it actually closes- no one knows what it will actually sell for.

Sabrina – What would be a GREAT deal for this 1 bedroom + den? (or future units)

Thanks!

Who knows these days. I just saw a 1/1 close in 849 N. Franklin for $185k. Not sure if that included parking or not.

There are a decent number of foreclosures/short sales in the building across the street- so I don’t know if those will affect prices in nearby buildings (but probably.)

By the way- I don’t consider many 1-bedrooms to be “deals” these days. The 2-bedroom price points are coming down quickly. Why not just buy one of those?

As many people have said on this site- are you really going to live in a 1-bedroom for 7 to 10 years or more? (the amount of time you’ll have to ride out this bust.)

2 Bedrooms are more than I want to spend. I would live in it for a couple of years and then rent it out as investment property. I’m thinking a good deal would be 165-175K. With mortgage payment, taxes, and assessments that would = $1550-1600 month

Then you have to ask yourself- will you be able to rent out this unit easily in this location?

Also- you should make sure that rentals are allowed in the building. Some new buildings (but not many) have passed rental restrictions.

They currently have no rentals available. I know of people who live and have lived in building. Don’t think it would be a problem getting $1600-1800 month. I still have some reservations about the area but if I can get it for the right price, have positive cash flow, and some appreciation 3-5 years down the road

“some appreciation 3-5 years down the road”

Why are you assuming you’ll have appreciation? You need at least 8% appreciation just to break even when you go to sell. Right now- Chicago prices are still declining.

What happens when mortgage rates rise? Will the prices of 1-bedrooms be rising with the rates? That’s what you’re assuming- correct?

Also- I didn’t ask if there were currently rentals in the building. I said you should find out if there is a cap (in the condo regulations.) Because you might find when you go to rent it out- that you cannot (as other units are already rented and the cap has been reached.)

Many new buildings do NOT have the cap in place because there are too many investors in the buildings. But I have heard from some people recently that some of the downtown high rises are starting to pass the caps (because values are getting hit otherwise- as loans are hard to come by in buildings with large rental ratios.)

What’s a “deal” these days? Who knows. If interest rates rise sharply- all bets are off.

“Why are you assuming you’ll have appreciation? You need at least 8% appreciation just to break even when you go to sell. Right now- Chicago prices are still declining. ”

Matt is different. He is going to time this bottom to the tee. He is good enough, he is smart enough, and gosh darnit, people like him.

“some of the downtown high rises are starting to pass the caps (because values are getting hit otherwise- as loans are hard to come by in buildings with large rental ratios.)”

Nothing like damned if you do, damned if you don’t.

matt – We are renting my wifes one bedroom in the south loop. Althoug we break even on our costs for the most part it is a poor investment and we were hit with a large special asessment. I will make this as clear as possible.DO NOT BUT A ONE BEDROOM unit to live in for a few years and then to cash flow. YOu will not be pleased with the end result.

One of my employees had to buy a place because of that $6000 tax credit a little over a year ago. He now has negative equity in his home that he had “planned to live in for a few years and flip” when the market bounced out of this rut. He now realizes that it might have been short sited thinking.

Are you buying it to impress friends, family or others? If so then do it cause they will be really impressed. Otherwise hold off until you can swing a two bedroom or better. You will thank us all later.

.

“DO NOT BUT A ONE BEDROOM unit to live in for a few years and then to cash flow. YOu will not be pleased with the end result.”

It all depends on your cost basis. Someone will make money off of MLS 07835094, for instance. A shrewd purchaser could live there for two years then likely sell for a bit more. Even if the SLoop continues to crater I don’t see it going down to $89/sf or anywhere near that. However I have no desire to live in the south loop so it won’t be me. River City, too: someone will make money off of those 50k units.

“The 2-bedroom price points are coming down quickly.”

“7 to 10 years or more? (the amount of time you’ll have to ride out this bust.”

If the first is true, and I think it is. Second, I believe, will be more like 12-18 months. Maybe drag our ass along the bottom for another 24 after that…