Gold Coast Mansion in Foreclosure Auction: 1515 N. State Parkway

Want to buy a gold coast mansion at a foreclosure auction?

Now is your chance.

1515 N. State Parkway, an Italianate mansion built in 1906, is going to foreclosure auction this week for the mere price of $3,083,628.

That is a reduction from the current asking price of $4.975 million.

The mansion has eight bedrooms, 7.5 baths, and 8000 square feet.

Alas, it does not have parking. Here’s the listing:

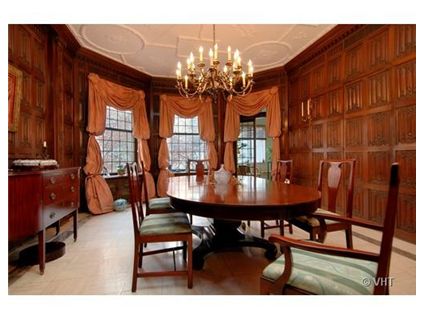

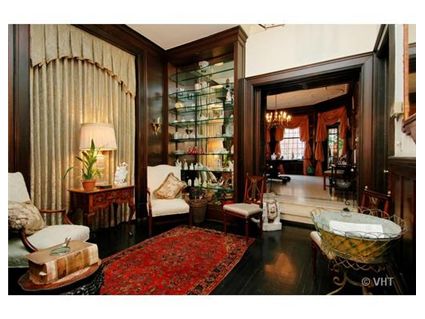

OLD COAST MANSION. ITALIANATE, LIMESTONE FACADE. 30X130 LOT 17 RMS, 8 BDRMS, 7 1/2 BTHS. 6 FRPLCS. LOVELY FORMAL RMS. INTRICATE PLASTER CEILINGS. CLASSIC MOLDINGS. HRDWD FLRS. WOOD PANELED LIVING RM W/FRENCH DOORS TO 25′ BALCONY.

HAND CARVED WOOD PANELED DRM. 2 KTCHNS. LARGE FAMILY RM ADJOINS WALLED GARDEN. LARGE BDRMS. HIS & HER DRESSING RMS. SPACE FOR ELEVATOR. UNIQUE 8000 SFT. FEE PKG NEARBY. TAX FREEZE…

They don’t make them like this anymore.

Sorry- no pictures in the listing of the kitchen OR of the 7.5 baths.

The property has a history of foreclosure issues. It has had a lis pendens filed against it since May 2006. It also had one filed in October 2004.

I can’t find a prior sales price, but public records show a $6 million mortgage taken out on the property in July 2004.

1515 N. State Parkway: 8 bedrooms, 7.5 baths, 8000 square feet

- I can’t find a prior sales price

- Currently listed for $4.975 million

- Foreclosure auction price of $3,083,628

- Taxes of $48,838

- Koenig & Strey has the listing

At the very high end parking probably isn’t a big deal as if you can afford this mansion you can also afford your own hired car and driver to pick you up and transport you.

Only $4000 per month taxes…

Sabrina, will you buy this for me for Christmas? Thanks.

The pile of mortgages here is disturbing. It looks like this property is owned by a family — at least two men with the same last name (call them LL and VL). No sale in the CCRD database (back to 1980s), but a few transfers in/out of trusts. The current mortgages (recorded since 1987 but not yet released) are these four:

0512222184 04/15/2005 $150,000 within family (PL to LL and VL)

0420146091 06/28/2004 $6,000,000 BFI GRP LLC to LL and VL

0329618107 10/21/2003 $1,300,000 North Comm Bk to LL

** Modified 10/21/2005

** Modified 01/21/2006 to $1,306,247

0316845150 05/29/2003 $2,600,000 Resource Mtg Banking to LL

** Assigned 12/10/2003 to Lehman Bros Bk

** Assigned 03/26/2004 to MERS

** Lis Pendens 05/05/2006

These could be substantially paid down by now, but the original amount of these active mortgages totals some $10M. Note also that the foreclosure is being driven by the $2.6M loan, not the $6M loan.

It also looks to me like the $1.3M loan suffered from some late payments or something, and that cost was added to the original balance.

The previous lis pendens is strange. The history of that loan is here:

0311127064 03/31/2003 $1,000,000 CIB Bk to Trust

** Released 06/20/2003

** Lis Pendens 10/26/2004

** Assigned 11/08/2005 to First Bk

I can’t fathom how there could be activity on the loan so long after the 2003 release. From the timing, it looks like this $1M loan was paid off with the $2.6M loan.

Maybe they were using this house as collateral for some other project (leading to the $6M loan). If that project has gone bad, the house of cards could be coming down.

These owners probably have so much money that this foreclosure issue is merely an oversight. They just forgot to pay the mortgage this month I’m sure and things will be straightened out after a stern talk with the accountant.

It doesn’t have parking, but it does have alley access. I don’t think there is anything keeping the owner from building a garage except a desire for maximum backyard space.

I have a feeling that these “owners” are fast-money posuers who thought a one-year bonanza on the trading floors made them the next Tommy Baldwin or somebody.

They never could afford this place.

Worse, it looks like they had it in mind to use the place and their ability to mortgage, to scam a few more million off it.

The family has owned it for decades, but a close reading of the recorded documents suggests that there are at least three generations of “LL” involved — older documents to LL, newer ones to LL Jr, and a few recent judgments against LL III.

Ahh off mark Laura. Not fast money poseurs, just future generations of increasingly less prudent people. I bet the first LL probably knew a thing or two about money having made it himself. The second LL, maybe not as much. By the time the third LL came to possession of it likely none of the original financial sense of his grandfather’s wisdom was passed on.

This happens all the time in America. Although the public is fascinated with the rags to riches story of the Horatio Algers a just as common story but overlooked is the inverse. Its just not as exciting to document a family’s wealth slowly frittered away over the decades via mismanagement and imprudence. Many people born into money naturally assume they are the best investment managers of their money for some reason. This generally isn’t the case.

Getting back to the building in question, what will this go for, assuming anybody can figure out how to get a clear title! The attorney’s bills might equal the purchase price!

LL also appears to have sold a home on Cape Cod in December 06 for $1,080,000, which was sold by the buyer (deeds recorded same day) for $1.75mm. So there’s probably been some sort of distressed situation–perhaps a problem with the business LL is in, perhaps a divorce or a death.

The $6mm mortgage would quite likely be related to the business–both based on the lenders and the fact that $6mm loans to small businesses are often (or mostly) secured by a lien on a personal residence. That isn’t odd at all.

The foreclosure auction price is $375/sqft. That seems to be quite cheap for the area. The data on my desktop focuses on large condos in this same area — median price per sqft (including assessments) for 2+BR condos (between Oak & North east of LaSalle) on the market in late May was $483/sqft. That would be about $3.9M for this 8000sqft.

I wouldn’t be surprised if would be worth about $4M ($500/sqft). They were asking over $600/sqft, which seems too high, even for a SFH.

Possible comps still on market: 919 N Dearborn ($4M, 7BR/7BA, 11731sqft, associated with Walton on the Park), 1436 Astor ($3.7M, 8BR/9BA, 6500sqft).

“price per sqft (including assessments)”

Let me clarify — that is the price plus the present value of a perpetuity of monthly assessments (5% discounting), all divided by the sqft.

Yeah, Bob, you are correct- remember the old saying “from shirtsleeves to shirtsleeves in three generations.”

It has happened many times before. I grew up around many scions of rapidly-diminishing old money. My old city was full of people who couldn’t get over who their families used to be, and continued to spend as though the family trust was still generating the income.

Many of these people ended up in really ordinary, low-to-moderate income jobs by the age of thirty, with no hope of improving their situations, as they tended to have spent their college years studying (if that is the applicable word)stuff that is delightful to be involved with but has little utility in the workaday world.

And usually, they did not manage to hang on to the family mansions that were built for 8 servants, but they at least sold them in time to avoid foreclosure.

I would imagine people that can afford that place will have other residences.

Maybe or maybe not, stuck. There used to be a time when your principal residence was your only residence, and if you were rich, you rented a cottage in Cape Cod for the summer (or what SOME folks call a cottage but what you and I would call a big country house), and wintered at Royal Hawaiian or the Breakers in FL.

Multiple residences are a royal pain in the arse even if you have ample funds. A wealthy older woman I know in this city once complained to me that her daughter owned 3 large homes, but had no servants, because of the financial drain of those houses. The result was that her houses were styes at all times. My acquaintance complained that her daughter’s kitchen floors were so dirty they were dangerous to walk on, and she was trying to persuade her to downscale to one really fine home with a full-time maid.

Nobody has an unlimited budget, and a house like this one could soak up even a really large one. It looks to me like, after figuring taxes, maintenance, housekeeping (forget cleaning it by yourself), and furniture (why buy a place like this if you can’t afford to furniture in keeping with the place), and utilities, that it would take an income of $800K a year at least to live comfortably here- a very tiny fraction of the population. And you wouldn’t have much left over for multiple dwelling.