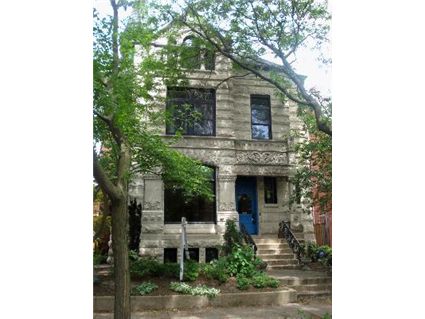

Greystone Vintage Beauty in Wicker Park: 2152 W. Caton

The basic greystone never goes out of style and Chicago is blessed to have many of them.

This greystone at 2152 W. Caton in Wicker Park was built in 1891 and, the listing says, recently rehabbed.

Here’s the listing:

EXQUISITE REHAB BY RENOWNED ARCHITECT OF 1891 NATIONAL LANDMARK HOME IN HISTORIC WICKER PK! ORIG GREYSTONE FACADE W/ALL NEW MARVIN WOOD WNDWS.

GRAND CSTM OAK FRNT & REAR STAIRS W/OAK HANDRAILS, BEAUT STAINGLSS WNDWS THRUOUT, CUSTM CABS IN KIT W/GRNTE CNTRS & CSTM BTCHR BLOCK. SUBZERO FRIDGE, WOLF SS RANGE W/CSTM MOSAIC TILE BCKSPLSH. MRBLE HTD FLR IN KIT.

GRNTE/MRBLE CNTRS IN BTHS. 1-C ATT GAR, GAR DECK & REAR PATIO.

Does the 1-car garage hurt the saleability of this house?

A lis pendens was also just filed against the property in August.

Emily Sachs Wong from Koenig & Strey has the listing. See more pictures and a virtual tour here.

2152 W. Canton: 5 bedrooms, 3.5 baths, 5400 square feet, 1 car garage

- Sold in February 1998 for $535,000

- Sold in May 2003 for $865,000

- Currently listed for $1.995 million

- Lis pendens filed in August 2008

- Taxes of $11,788

- Central air

Yet another example of why this board should be renamed MostRidiculousListingsInChicago.com

There is a one car garage because there is no alley in the back so a large part of the lot is taken up by the driveway. Appears to be little outdoor space in the back from arial view.

This listing is a joke right?

I’d pay a decent premium for a greystone over new construction. Of course, this asking price is still outrageous.

Now if I could afford the 2003 price, we’d be in business.

Is that a type-o?

Maybe Johnny Depp walked by this place on the sidewalk or drove down West Caton at some point thus justifying the >100% premium the seller is asking over five years.

depending on the existing condition of the home, that rehab could have EASILY cost $750k.

I could only guess the owner HELOC’d the hell out of the place and need to get this much to pay off the loan. No way will they get it.

First mtg of $1.605mm; second of $250k. Lis pendens filed on the first on August 26.

Furthermore, show me the number of 2M sales in Wicker Park. Talk about pricing out of the market!

per my research, over the last 6 months, 1 property in wicker park has gone under contract (the sale is pending) for a price exceeding 2mill – it is a detaached single, new construction. (so we don’t yet know the closed price). during this same 6 mo. period. 9 homes sold/closed for a price exceeding 1mill in the wicker park area.

the price needs to come way down.

plus, I would want the current owner to tear down the garage, remove the driveway, and fix up the landscaping.

It’d be so much nicer to have a full yard rather than a fugly garage.

Under contract.

i Wonder what the pending contract price is? 1.7?

active again, same ask

I read this just now. As for America the greatest country on Earth!!

There are over 42 million American adults, 20 percent of whom hold high school diplomas, who cannot read, as well as the 50 million who read at a fourth- or fifth-grade level. Nearly a third of the nation’s population is illiterate or barely literate. And their numbers are growing by an estimated 2 million a year. A third of high school graduates, along with 42 percent of college graduates, never read a book after they finish school. Eighty percent of the families in the United States last year did not buy a book.

Of course it’s the greatest country. 1/3 of Americans can’t find any others on a map!!

Wow. Sold for $885,000 last month.

Serious deal for the buyer.

Seems so.

Interesting history:

http://books.google.com/books?id=-mvoHHT5DpgC&pg=PA127&lpg=PA127&dq=2152+w+caton&source=bl&ots=fgmvzBeyix&sig=2Y8hUo6ED1U6oBNjrHyvwIzpQHQ&hl=en&ei=5xq6S6uWNI76NZa6neIL&sa=X&oi=book_result&ct=result&resnum=9&ved=0CCAQ6AEwCA#v=onepage&q=2152%20w%20caton&f=false

Who was the “renowned architect” who did the rehab?

Or the asking price was waaayyyyy too high.

I love America. It’s one of the few places you can have a large $177k down payment – and yet – still leverage it into a $708k jumbo mortgage – and nobody will even bat an eye.

Stop being stupid HD

FB much Sonies?

“Sonies on April 5th, 2010 at 11:33 am

Stop being stupid HD”

Exactly Sonies, nobody bats an eye and most definitely not even you.

Why are you so obsessed with other people’s purchases? This person will likely be fine and can probably easily afford the mortgage payment, so who cares. The bank gets paid, the buyer has a house and an investor gets paid. Welcome to an economy where people spend money on things they enjoy.

Because I’m showing that the bubble still has a ways to deflate.

People comment on other people’s purchases all the time and I just show that buyers, especially on the high end, are still leveraging themselves at a 5:1 ratio. 20% down a “super jumbo” is a large step in the right direction from 100% financing of the recent past; but ultimately a $900k house is a $900k house because some buyer can afford to borrow $700k of it with a X/1 Interest Only ARM.

Please direct your vitriol elsewhere Sonies, no need to call me stupid

20% down is the historical normal down payment. The fact that this person even qualifies for a jumbo loan means they are extremely financially capable people who have a low projected default rate.

Do you really think that people need to be paying 100% cash for homes until the bubble fully deflates? Because thats what its sounding like you are saying and that is really stupid.

The days of 100% LTV “investment” properties, reckless Helocs, and fast flipping, are over and have been for years now. There will probably only be another year or two of low home prices like this to get rid of the final excess inventory before they start building again, so don’t worry you’ll pull the trigger soon enough. You probably have soooo much money saved from your 10% After Tax Income rental in OIP you can buy a house for all cash.

For those interested in such things this was a very interesting process……..

-Bank foreclosed on property with owner owing $1.6m+

-Property was sold at Judicial sale for $580,473 back to the bank (10/28/09)

-Bank never sought order approval sale but instead allowed owner to short sell it for $885k.

So the bank chose to receive $300k more now and likely forgave the other $750k rather than chasing the former owners for the $1+m deficiency. The interesting bit is the property was never listed below $1.995m and had anyone outbid the bank at judicial sale then the bank would not have been able to agree to the short sale as the buyer could have demanded the approval order was sought.

This is extremely unusual and possibly heralds a new phase of rationalisation from lenders?

For what it’s worth I think the house is stunning and I was gutted to have missed it at auction.

neo: Thanks for the very interesting post.

Sonies, nice straw man argument. You’re good at that. I never said that people should be paying 100%. However, historical lending standards IIRC were higher than 20% down for super jumbos (in those rare cases), investment properties and 2nd homes.

Neo, IIRC there was a second mortgage for $250,000.00 and unless National City in the short sale (only 50/50 chance) it’s not going away. I don’t see National City now PNC walking away from a $250k mortgage. $30k or $20k second mortgage, maybe. But a $250k? I don’t know, I wasn’t at the closing but I wouldn’t be surprised if there was a prom note and a BK or settlement to follow.

“Do you really think that people need to be paying 100% cash for homes until the bubble fully deflates? Because thats what its sounding like you are saying and that is really stupid.”

20% down/LTV = no PMI, so the banks think 20% down is a just fine amount to be putting down on your house.

neo – thought you might be interested

not far, needs a lot more work, but price is ok?

http://www.trulia.com/property/3006490121-2140-W-Concord-Pl-Chicago-IL-60647