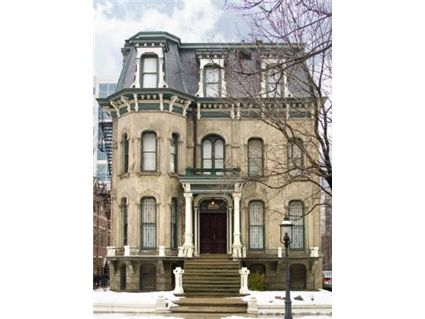

Have the Rich Always Fled Chicago? The Keith House at 1900 S. Prairie in the South Loop

This 8-bedroom mansion at 1900 S. Prairie in the Prairie Historic District of the South Loop has been on and off the market since 2008.

The house is known as The Elbridge Keith House.

Built in 1870, here’s more information from the listing:

Built in 1870 and designed by J. R. Roberts, the Keith House is a breathtaking property situated along Chicago’s historic Prairie Avenue. The original “Gold Coast” in the late 19th century, the opulent Prairie Avenue was once home to the city’s elite with legendary Chicago families from the Pullmans to the Fields calling the tree-lined avenue home. Named for banker and merchant Elbridge Keith, the Keith House is one of the few remaining original mansions in the heart of the Prairie Avenue Historic District. Today, the home sits along a secluded cul-de-sac just moments from bustling Downtown Chicago.

We actually chattered about this house back in 2008.

Back then, the listing described it as a “project.”

But it had the same uses as it has in 2020. The first floor is still being used as event space and there are two apartments on the upper floors.

The current listing has pictures of the first floor including its magnificent crown molding and inlaid floors.

In the 2008 listing, the coach house had been “renovated.” You can see what it looks like in the current listing.

See our 2008 chatter here.

This house is zoned DX-3 and the listing says it can be a single family home, a condo conversion or a boutique hotel.

It also has historic tax incentives.

Built on a 50×176 oversized lot, it has a 2-car garage in addition to the coach house.

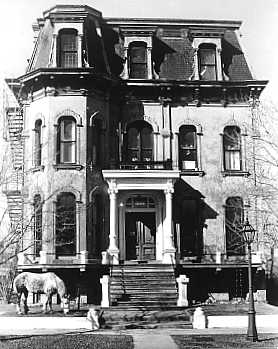

Here’s an old picture that I used in the 2008 post. I still love the horse in the front yard.

Here’s more detail from the 2008 listing:

For the first time in many years historic 1900 S. Prairie Avenue is on the market. Built in 1870 it is thought to be the oldest existing mansion on the Avenue. Elbridge Gerry Keith a wealthy banker and wholesaler hired architect Jonathan W. Roberts to design this three story structure and stable.

The main residence is about 7100 square feet. Constructed of top quality materials including Joliet limestone and red brick this home has many of its original details still intact: plaster moldings large windows fire place mantels mahogany woodwork and parquet inlayed floors.

The home has been transformed over the years. The 2100 square foot stable was recently renovated and converted into a two bedroom two bath coach house with beamed ceilings hardwood floors and a family room and an attached two car garage.

Homedelete argued this week that the coronavirus is going to change everything for Chicago.

“That’s why, my friends, I say, drive out of the city limits until you can find an acre or more. In the matter of weeks, the Big City lifestyle is suddenly toxic, and will remain so for generations. The irony of his all is that big cities, for most of history, were cramped diseased filled places of poor people. Anyone with any money at all got out of the city and into the countryside and spent time at a villa. Anyone with means LEFT the city, and out of that experience came the suburbs. The new urbanism made an assumption that turned out to be faulty: big cities would remain clean, safe and disease free, and right now, most big cities are no longer.”

This house was pending in the last week of March 2020, during the coronavirus.

It has since been re-listed.

When we chattered about it in 2008 it was listed at $3.35 million.

It’s been reduced to $2.695 million.

Is it a myth that the rich have always “fled” Chicago and other cities, as Homedelete argued?

This mansion is now 150 years old.

Hadley Rue at Dream Town has the listing. See the pictures and floor plan here.

1900 S. Prairie: 8 bedrooms, 7 baths, 10,660 square feet

- There’s no original sales price but looks like it might have last sold in 1999

- Was listed in November 2008 at $3.5 million

- Reduced

- Currently listed at $2.695 million

- Taxes of $29,252

- Coach House

- Central Air

- 2-Car Garage

- 50×176 lot

- 5 fireplaces

its a nice mansion, but I don’t think its architecturally significant enough to entice someone like Fred Koch (Yeah I know he died) to undertake the rehab.

wow. this mansion is stunning. Not my cup of teat but I definitely appreciate the architecture and elegance of this place.

It’s an event space without even a catering kitchen in the basement?

Nov-08 + cpi = $4.25m, or the other way around

$2.695m – cpi = $2.215m

Maybe if they’d been asking $2.25 in ’08 they would have gotten it sold.

’99 deed was not a real sale. Other resources show it’s been in the current family since 1978.

“cup of teat”

heh.

I can’t remember why, but somehow while reading I came across the Everleigh Club, which led to this interesting South Loop history: https://en.wikipedia.org/wiki/The_Levee,_Chicago

Event space, I agree. Grand enough, but can’t imagine wanting to live in it.

Just your daily reminder that Chicago today has fewer residents than than it did in 1920:

Historical population of Chicago

Census Pop. %±

1840 4,470 —

1850 29,963 570.3%

1860 112,172 274.4%

1870 298,977 166.5%

1880 503,185 68.3%

1890 1,099,850 118.6%

1900 1,698,575 54.4%

1910 2,185,283 28.7%

1920 2,701,705 23.6%

1930 3,376,438 25.0%

1940 3,396,808 0.6%

1950 3,620,962 6.6%

1960 3,550,404 ?1.9%

1970 3,366,957 ?5.2%

1980 3,005,072 ?10.7%

1990 2,783,911 ?7.4%

2000 2,896,016 4.0%

2010 2,695,598 ?6.9%

I wonder why someone who so obviously despises the city of Chicago keeps coming back to this site. Doesn’t he have anything better to do? Maybe a real estate site for those who treasure one-acre lots in the burbs?

He’s a troll or to quote his master he “could be somebody sitting on their bed that weighs 400 pounds.”

Just about every major city that was a major city going back as far as homedelete’s data has less population than at peak. Duh. It’s called the interstate highway system and government subsidizing single family mortgages and encouraging white flight to the suburbs.

The Cat:

That’s at best an exaggeration, *if* you define “major” largely by population, and don’t cut it off at 10. Top 20 in 1920 (census), together with 2018 estimates (wiki, citing to census):

New York 5,620,048 8,398,748 UP

Chicago 2,701,705 2,705,994 FLAT

Philadelphia 1,823,779 1,584,138 DOWN

Detroit 993,078 672,662 DOWN

Cleveland 796,841 383,793 DOWN

St. Louis 772,897 302,838 DOWN

Boston 748,060 694,583 down

Baltimore 733,826 602,495 DOWN

Pittsburgh 588,343 301,048 DOWN

Los Angeles 576,673 3,990,456 UP

Buffalo 506,775 256,304 DOWN

San Francisco 506,676 883,305 UP

Milwaukee 457,147 592,025 UP (!!!)

Washington 437,571 702,455 UP

Newark 414,524 282,090 DOWN

Cincinnati 401,247 302,605 DOWN

New Orleans 387,219 391,006 FLAT

Minneapolis 380,582 425,403 UP

Kansas City 324,410 491,918 UP

Seattle 315,312 744,955 UP

Yes, 7 of the top 10 are down, but 6 of the 2d ten are up, plus one in each cohort basically flat. I find Milwaukee to be a shock–did they manage to annex territory after 1920?

In 1922, the Milwaukee Common Council passed a new ordinance making all future extensions of the city’s water system contingent upon annexation to the city.

https://emke.uwm.edu/entry/annexation/

So MKE is almost 4x as large by area. Didn’t realize that.

KC is apparently almost 5x as large as it was in 1920.

Lots of lesser annexations by several of the others after 1920.

Soooo, adjusting for sprawl and annexation, I’m right?

Aldous Huxley: “Los Angeles is 19 suburbs in search of a metropolis” LOL.

https://la.curbed.com/2014/4/3/10121264/los-angeles-sprawl-history-map-animation

“Soooo, adjusting for sprawl and annexation, I’m right?”

NYC and SF and DC = zero annexation. Guess you could call Queens and the Sunset ‘sprawl’.

LA’s post-1920 annexations are minimal. Yes, the Valley filled up from basically being an orchard in 1920, and it is sprawlly, but it was part of LA proper before 1920.

If “major city in 1920” means the greater rust belt + Boston, sure, why not? 7 of the 9 of them are down (by less than NYC is up, which is merely an interesting aside, not meaningful)–which means that Chicago looks pretty good being flat.

But in every one of those cases, the jobs moved out, too. It’s not just that you could live further away from work, it was also that your job was likely to be further away from the old downtown (if it still existed).

“Just about every major city that was a major city going back as far as homedelete’s data has less population than at peak.”

Yep.

Cars!

Lots of cool advertisements here in Chicago for the new “suburban dreams” in places like Berwyn that were being built in the 1920s-50s.

“But in every one of those cases, the jobs moved out, too.”

Sure. That’s why there’s Schaumburg.

That’s what makes the last 10 years so striking in Chicago. The jobs are moving back downtown. The tide has shifted back to the cities. Nothing going to stop that for the next 20 to 30 years.

“That’s what makes the last 10 years so striking in Chicago. The jobs are moving back downtown. The tide has shifted back to the cities. Nothing going to stop that for the next 20 to 30 years.”

Other than property taxes, crime, cost of living, etc

“Other than property taxes, crime, cost of living, etc”

———————————-

And the young’uns deciding that if they’re going to have children, they want them in the suburbs, not a cesspool school system like Chicago’s.

That’s not 20 or 30 year out.

“And the young’uns deciding that if they’re going to have children, they want them in the suburbs, not a cesspool school system like Chicago’s.”

You really must want to read Sabrina’s foolishness about how Chicago has the highest rated HS in the state.

“You really must want to read Sabrina’s foolishness about how Chicago has the highest rated HS in the state.”

The *5* highest rated (all in the top 100 nationwide), and 7 of the top 10.

CPS also has 41 of the 46 worst high schools in the state.

“Other than property taxes, crime, cost of living, etc”

and infectious diseases, no jobs, having to take public transit everywhere, ew

“The *5* highest rated (all in the top 100 nationwide), and 7 of the top 10.

CPS also has 41 of the 46 worst high schools in the state.”

That’s nitpicking, isn’t it?

Should be

That’s just nitpicking, isn’t it?

“That’s just nitpicking, isn’t it?”

How so? (honest question; not seeing your point)

Should have added to those number (and it’s 40 out of 46, counted wrong):

That’s out of 165 HS’s (93 CPS, 68 various charter/contract most of which are pretty small). About 10% go to one of the “best” and something north of 1 in 3 go to one of the worst.

Basically, both points are correct, and it’s matter of which is more important to “people”.

The comment was more directed at Sabrina’s incessant harping that the HS in Chicago are excellent/don’t matter depending on the day.

Just for discussion comparing the options for the typical buyer of Cribchatter discussed properties (aka UMC & White)

All numbers are approx

Brooks is out

Not including the Military academy

Payton – 50% white, 600 slots

Lane – 40% White, 1600 slots

Northside 30% White, 350 slots

Young – 30% White, 600 slots

Jones – 40% White, 800 slots

4000 slots or basically = Stevenson. The odds are far from good that the typical Chatter-er w/ kids is going to get them into one of the “good” schools, especially with potential demographic trends “Eve-ryone wanting to live in the city”.

IMO its going to be an ongoing issue in keeping families in the city (along with the other points) CPS may improve/add more top flight schools but the financial picture for CPS, city and state are not optimal

“IMO its going to be an ongoing issue in keeping families in the city (along with the other points) CPS may improve/add more top flight schools but the financial picture for CPS, city and state are not optimal”

Chicago can come back – despite what some naysayers say, I want it to come back too. Chicago needs to improve schools, lower taxes, reduce crime. Things everyone wants but the people in power seem utterly incapable of doing. Until people stop voting for niche social justice issues, and start focusing on policies that improve their own lives, and empower citizens with freedom to make their own decisions, Chicago will continue to decline.

“Chicago will continue to decline.”

It’s declining?

Lol.

The shutdown is really messing with you HD. You need to get outside more. Get some fresh air.

“And the young’uns deciding that if they’re going to have children”

No one has had kids in the last 12 years? Gosh. Amazing.

They are all staying in the city. Once the schools improved, no need to move. Not even an issue anymore.

“Other than property taxes, crime, cost of living, etc”

Yawn.

If you don’t make enough money to afford the downtown, then no, you’re not moving there.

As I said a few weeks ago, one of my friends just bought in the South Shore. Cute little house. Totally affordable. Doesn’t have kids and isn’t planning on any. He had no intention of moving, or even looking, in the suburbs.

Nothing is stopping the city’s renaissance. GenZ wants to be in the city. They want the creativity, the arts, the sports, the restaurants, the great architecture, the parks. And many of them were now raised IN the city which means they will want to stay.

“If you don’t make enough money to afford the downtown, then no, you’re not moving there.

As I said a few weeks ago, one of my friends just bought in the South Shore. Cute little house. Totally affordable. Doesn’t have kids and isn’t planning on any. He had no intention of moving, or even looking, in the suburbs.

Nothing is stopping the city’s renaissance. GenZ wants to be in the city. They want the creativity, the arts, the sports, the restaurants, the great architecture, the parks. And many of them were now raised IN the city which means they will want to stay.”

Another straw man – I’ll give you credit, for what you lack in actual responding to comments/questions, your a pro a trying to reframe the discussion. Congrats, I guess

Does that mean I can move to RN, LP, LV, Bucktowm, etc?

I guess you stumbled on the city’s master plan. Everyone that moves in will be childless, thereby reducing the demands on city services. Us peons quake in your awesome intelligence

In general GenZ is weak. While they say they want that stuff, they sit holed up in there apartments. As things get tough, they’ll wilt like month old kale.

If you actually believe 1/2 the crap you post, you’d be the biggest buyer of real estate out there. But that would take conviction and guts, much easier to blog about it…

“the financial picture for CPS, city and state are not optimal”

Which ain’t an argument for raising kids in Lincolnshire, either. It’s an argument for suburban Milwaukee.

“In general GenZ is weak. While they say they want that stuff, they sit holed up in there apartments.”

The eldest zoomers aren’t of legal drinking age yet. You’re thinking of the younger (and prob mid-gen) millennials.

“If you actually believe 1/2 the crap you post, you’d be the biggest buyer of real estate out there.”

Maybe she is. If she were buying dozens or hundreds of vacant lots, why would she let that out of the bag in any way?

I don’t want to be any long-er on IL taxable assets than I already am, unless there is a structural change in the situation (constitutional amendment; lots of retirees dying before actuarial expectation; 10 years of 6%+ inflation–only one of those being reasonably likely in the next 20 years), so I think that would be bananas as an individual investment beyond maybe ~15% allocation.

“Which ain’t an argument for raising kids in Lincolnshire, either. It’s an argument for suburban Milwaukee”

Agree and disagree. The economic preference ranking would be Chicago<Chicago Cook Co Suburbs< Non Cook Co Suburbs<Out of state. If one is forced to live in the Chicago metro (Own a business/taking care of elderly family members/etc) being outside of the city (from an economic risk/HS schooling perspective) would be preferable

"Maybe she is. If she were buying dozens or hundreds of vacant lots, why would she let that out of the bag in any way?

I don’t want to be any long-er on IL taxable assets than I already am, unless there is a structural change in the situation (constitutional amendment; lots of retirees dying before actuarial expectation; 10 years of 6%+ inflation–only one of those being reasonably likely in the next 20 years), so I think that would be bananas as an individual investment beyond maybe ~15% allocation."

Theres a 0.001% chance she's walking the talk. Here Biases/Preferences override anything that is contra to her beliefs. The TDS has turned her into a mini JZ

Agree with you on IL property, except if the RE Market gets hammered and there's some value (Not $800k crap shacks in LS), but Chicago wouldn't be my first choice.

Anyone following the Boomer advise of "My home is my retirement plan" is a fool

“Theres a 0.001% chance she’s walking the talk.”

Agree, but there’s a not 1 chance in the universe that she’d let on, if she were.

“if the RE Market gets hammered and there’s some value”

Of course. But “some value” to me (in the ‘practical for an individual investor’ market) would be ~10%+ (and, really, more like 15) gross current cap residential rentals. Not vacant lot speculation, and the other good bets are outside the scope of (almost all) individual investors.

“Agree, but there’s a not 1 chance in the universe that she’d let on, if she were.”

Maybe. She’s starting to sound like a shill lately with her HAWT Market Theory (TM) Or maybe she’s partnered with JoeZ

“Of course. But “some value” to me (in the ‘practical for an individual investor’ market) would be ~10%+ (and, really, more like 15) gross current cap residential rentals. Not vacant lot speculation, and the other good bets are outside the scope of (almost all) individual investors.”

With all RE, it depends

15 is a good number, for prime location and a good property. Anything not meeting this criteria would be higher to match risk/reward.

It will be interesting to see where the rental markets are at in 5 years with many of the new higher end Apt units having gone thru 2-4 renters and the downward pressure that will have on rents

“Is it a myth that the rich have always “fled” Chicago and other cities, as Homedelete argued?”

FACT CHECK: Mostly True. Harvard professor and author of book said that cities were “Cities were killing fields for centuries because of contagious disease”

NYT Article from today 4/19/2020:

https://www.msn.com/en-us/news/us/americas-biggest-cities-were-already-losing-their-allure-what-happens-next/ar-BB12RZrJ

Article: America’s Biggest Cities Were Already Losing Their Allure. What Happens Next?

* * * * * * * * * * “Ed Glaeser, an economics professor at Harvard University and the author of “Triumph of the City,” said watching the virus rip through cities was like going back in time. “It feels like it’s back to smallpox, it’s back to cholera,” he said.

“Cities were killing fields for centuries because of contagious disease,” he said, noting that the life expectancy of a baby born in a city in 1900 was seven years less than one born in a rural area. That gap disappeared by the 1920s, with the advent of modern water and sewer systems.

Over time, density became a boon, economically, socially, intellectually. Living in a city became a way to encourage health. People could walk where they needed to go and support one another in tight-knit social networks.

As the threat of the coronavirus lessens, some who fled major cities might elect to stay away while others will want to flock back to the perks of urban living.” * * * * * * * * * *

“FACT CHECK: Mostly True. Harvard professor and author of book said that cities were “Cities were killing fields for centuries because of contagious disease””

This says nothing about “the rich.”

SOLD! $2.3m:

https://www.chicagobusiness.com/residential-real-estate/prairie-avenue-mansion-sells-record-price

HAAAAAAWWWWWWTTTTT!!!

SOLD! $2.3m

———————————-

“$2.695m – cpi = $2.215m

Maybe if they’d been asking $2.25 in ’08 they would have gotten it sold.”

++++

So you called it essentially spot on, anon(tfo).

Are any adjustments needed to the HAWT market theory?

You are looking at the sale of one of the oldest houses in that neighborhood which would only have a very particular buyer and saying it’s NOT a hot market?

They rented it out for weddings and other events and were marketing it as a possible condo conversion. But apparently the buyer is going to use it as a single family home.

A real history/preservation lover, perhaps?

To me, this is actually a sign that the market IS hot because this is a really hard sale. It needs renovation and not many are willing to take that on in a historic property. But when the market gets hotter, and tighter, even the more unique properties finally find buyers.

I’m glad this finally sold.

“HAAAAAAWWWWWWTTTTT!!!”

Um…yeah. It is actually.

Yet another person who you all said would be fleeing the city and state who has decided to invest in it instead.

Beautiful house.

“ You are looking at the sale of one of the oldest houses in that neighborhood which would only have a very particular buyer and saying it’s NOT a hot market?”

So now you don’t want to take a single data point as proxy for the market and want some nuance for the sales price?

Clownshoes

“You are looking at the sale of one of the oldest houses in that neighborhood which would only have a very particular buyer and saying it’s NOT a hot market?”

I know of an obese (terrible diet) 74 year old who got COVID and was nearly 100% better in about 48 hours.

And you’re saying the virus is scary?

“another person who you all said would be fleeing the city and state”

I have *never* said this. Here or elsewhere.