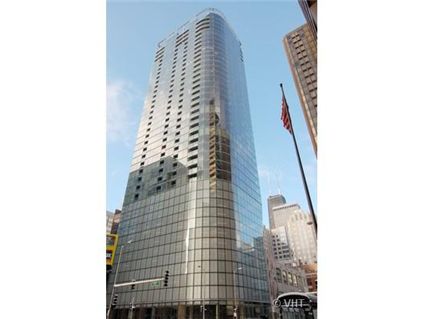

More Price Reductions in 600 N. Fairbanks

Thanks to some of you astute readers who are clearly watching 600 N. Fairbanks in Streeterville very closely. Several of you noticed that our often chattered about three bedroom, Unit #1301, has had another price reduction.

Here is the history:

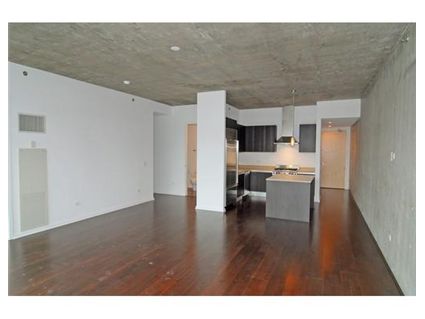

Unit #1301: 3 bedrooms, 2.5 baths, 1746 square feet

- Sold in November 2007 for $805,000

- Originally listed in January 2008 for $929,000 (plus $60k for parking)

- Reduced

- Was listed in March 2008 at $895,000 plus $60k for parking

- Reduced again

- Listed in early April 2008 for $839,000 plus $60k for the parking

- Reduced again

- Now listed at $799,000 pluse $60k for parking

- Assessments of $585 a month

- Koenig and Strey has the listing

Unit #1501 two stories above it with an identical layout and similar finishes is still listed for $1.1 million.

The cheapest two bedroom is now Unit #1502. It is on the Northeast corner.

Unit #1502: 2 bedrooms, 2 baths, 1258 square feet

- Sold in February 2008 for $575,000

- Originally listed for $634,000 plus $45k for parking in October 2007 (before closing)

- Reduced twice

- Was listed at $603,900 in March 2008

- Reduced again

- Currently listed for $559,900 plus $45k for parking

- Assessments of $435 a month

- Rubloff has the listing

Unit #1402, one floor below, is still listed at $606,900 plus $45k for parking.

Yeah Yeah Come down even more before I even bother come and see your units! I am done visiting this building for now, as I already know what I want; I am just waiting for the right time to really put my 20% down, while it’s enjoying some interest in the bank right now….

Interesting…I may be interested in 1301 when it gets down to preconstruction pricing. It is worth that at most in this declining market.

It will be interesting to see if these price reductions pressure the other flippers in the building. A few of you have reported putting in low offers on units only to be rebuffed by sellers who really wouldn’t negotiate.

What?!? 600 NF worth “only” pre-construction pricing? UNpossible! It’s a unique property that’s going to hold it’s value. Don’t be a hater, David.

I own in the building and think in this market preconstruction value is actually good.. other buildings may suffer below preconstruction value as evidenced by 550 st. clair or parkview which is only 70 percent sold and incentives being offered.

As an owner in this building as well, and a BIT of a real estate pessimist, I would be thrilled if prices stalled at pre-construction pricing in this market. It will be interesting to see what happens at 550 and Parkview with the unsold units, I agree. At least 600NF has not done any incentives on unsold units thus far.

How is 340 OTP faring? That seemed to be the building with the best claim of succeeding in this market so far.

From the handful of flips at 340 OTP, sellers have been netting about 100K or so over preconstruction pricing. 340 OTP started closing almost 1 year ago and has FABULOUS views to the South and nice views to the North. I agree that 550 St. Clair and Avenue East (160 Illinois) will have more problems.

Hey Sabrina, why don’t you ever do an update on the other Fairbanks. Fairbanks at City Front Plaza? It is done and closed.

Given how quickly 1301 is being reduced it hints that the flipper may be nearing financial distress. Although they are still trying to eke out a small profit it appears.

In any case 1301 & 1502 are going to be a comp-crushers for the other flippers in those tiers. The owners of units 1501 & 1402 either don’t need to sell or haven’t woken up to reality yet.

For those that must sell this building is going to get ugly in the near future.

$60K for parking?

That is normal for parking in new construction in Streeterville. It ranged from 45K-65K I believe.

Have any of you been in 550 St Clair or in Ave East? They do not even compare to 600NF (in my opinion) as far as design, quality or finishes. While I know that they’re all in the same hood, etc I am not really sure how anyone can be comparing the 3 to each other as each are so different and would surely attract different buyers.

I haven’t been in Parkview or 340 so I can’t comment on those. But I have been in City Front Plaza and my sentiments stand on this one too. Another cookie-cutter yawn building that can’t be used for a fair comparison.

me.

Bob I agree, these units will be comp killers. In fact, the worse scenario is if they actually sell now rather than going rental, for the simple reason that any potential resales in these lines going forward will not be able to appraise above where these close.

If I were an owner I’d pray that they turn them rental. Banks simply will not appriase any of the other units close to their askings.

Very bad situation here.

As long as you bought the place to live in, as opposed to flip, you are fine.

“Banks simply will not appriase any of the other units close to their askings.”

Nor should they even if the units in this post rent instead of sell. Wacky appraisals is a large part of what got us into the current financial mess.

The absence of recent sales alone in a building this size will set off a red flag. The listing activity can only lead to a checkmark in the declining market box of the appraisal. That will mean no loan in many cases, or at minimum 10% down and strict underwriting standards. Any jumbo loans (over $417K) will be at even higher down payment and asset verification levels.

The cat’s already out of the bag. Any lender who will continue to make condo loans will expect the appraiser to have reviewed the listings that haven’t sold. In the absence of current sales in the building, a potential lender will be more concerned about cancelled and expired listings than sales from even 6 months ago.

The pre-construction pricing will not hold in this building.

Unit #1301 has the potential to go way down in asking price. It was bought with pkg space #38 on 11/5/07 for $805,000. The purchaser has a $644,000 mortgage with Natl City Bk. We shall see what it will take to unload this bad investment.

While it’s true that the dearth of resales activity in this building will set off a red flag to a lender who does their due diligence (or, rather, the appraiser), one could still argue that the lack of activity is due to stubborn owners, and that value isn’t that much from asking; or, alternatively, if these rent instead of selling, then one could argue that the owners decided to rent rather than sell at a price that was too low for the market. There are ways around it, and appraisers are much more flexible than one would think, or rather than they should be. Many have the mindset, even today, that “buyers generally know what they’re doing, and we’ll only not appraise it in the face of concrete evidence to the contrary.”

That being said, a resale at a level close to or below preconstruction pricing will simply demolish appraisal value – no matter how flexible the appraiser – for all future units in these lines.

This is a very bad situation, and I’m not sure if people really even grasp how bad it is. Basically, you’ll have to bank on an all-cash buyer stepping in and buying a couple units to offset these lower prices.

I’m surprised we’re seeing the higher-end market fall this early, I had expected it to really get hit hard this fall/winter.

I agree with Investor on appraisers. Appraisers will go along with the game because thats how they earn their living and proving fraud is difficult if not impossible.

Investor this building seems to be one of the first experiencing problems, but I expect it to spread to many others by the fall. Whats interesting is that the low end (150-250k) seems to be holding up comparably well so far.

Also how long the flippers hold out will depend on how much they made on previous flips. The owner of 1301 put a 160k of equity into this unit. They may well have a cusion and stand to lose $100/mo from renting it for quite awhile. The flippers that will be wiped out will be those that can’t afford to carry a monthly loss for any extended period.

Assuming he loses $1,000/month renting it and holds it for 5 years thats only $60k out of pocket, still up 100k overall.

Investor, memories of the days when lenders relied on appraisers being flexible and finding “ways around” reality are fading fast. Regardless, there is no way to stop the prices from dropping because there are sure to be weak hands in this building whose lenders will have to sell eventually. They will set the comps if no flipper is smart enough to lead the market down. This is all a very good situation for the vast majority of potential buyers who did not participate in the recent speculative housing mania.

Bob, the owners of #1301 have not owned any other real estate under their name in Cook County for at least 20 years (if ever.) They might be investing profits from flipping elsewhere in the world. However, I would bet the odds are just as good that they borrowed equity elsewhere than they actually invested their own money. That would be more typical of a flipper. I don’t think the strategy you laid out is very likely, and it would not halt price reductions in the building for the reason you noted – the weak hands will fold first.

I thought someone on here knew the owners of this unit: they bought and lived there with two(?) small children. This scenario is plausible when you look at the pictures–and was even more obviously so in their previous set of pictures, which I’m glad to see they swapped out, for their own sakes.) In other words, I don’t think these owners are “flippers” in the sense we usually mean; I suspect instead they bought a few years ago, before they knew they’d have little kids to deal with, and are now trying to sell given that the unit is not working out for them. It’s kind of sad–on the other hand, if you even think you MIGHT not be able to live in a place for several years, it’s hard to feel too sorry for you if buy anyway.

“Hey Sabrina, why don’t you ever do an update on the other Fairbanks. Fairbanks at City Front Plaza? It is done and closed.”

…Agree, was interested in this building for a while, would like to get more people’s opinions, comments on it. Location, prices seem comparable, but haven’t heard much ‘chatter’ about it. Love the site, btw.

Not all sellers are flippers (even in new buildings.) Circumstances DO change. How long do you think most people live in condos downtown anyway? Not that long (especially 20 and 30-somethings.)

If you look at enough listings you’ll see the second bedroom as a baby room more often than not. And if you factor in job transfers- that’s another group of people who likely won’t live in the condo longer than two or three years.

The problem is, in a declining market, you can no longer sell and make any money in two or three years. Only now are people figuring that out. We’ve already seen numerous properties selling for below their 2005 prices in the last few months. More will come.

But undeniably, there will be sellers who can hold on and some who won’t. Those who won’t will set the comps in the building.

my agent told me that 2704 has gone to contract. can anyone verify if this is true and if so, how much did it sell for?

tom, here’s some info:

1/22/08 #2704 purch from developer for $445,500 w/pkg

1/22/08 #2704 $356,064 mortgage to JP Morgan Chase

3/10/08 #2704 listed for sale for $439,000 plus pkg (no price quoted)

5/1/08 #2704 contingent contract signed, no way to know price until (if) closing

There was some relationship between the flippers of #2704 & #2703. They are also offering to combine the units. Here’s the info on #2703:

1/22/08 #2703 purch from developer for $466,500 w/pkg

1/22/08 #2703 $373,113 mortgage to JP Morgan Chase

2/25/08 #2703 listed for sale for $450,000 plus pkg (no price quoted)

G, do you need MLS to find out that information? i know you can use the tribune website to find closings, but is there a way for a non-agent to find out information on contracts and/or mortgages?

a more general question, do flippers normally put 20% down?

I don’t think there is any way to see that something is under contract without mls access. Mortgage and sale info is available on the Cook County Recorder of Deeds website. You will need a buyer or seller name, or the property PIN to find something there. Keep in mind that new condos are recorded under the common PIN so it can be difficult to wade through the many recordings in order to find what you are looking for. It becomes much easier after the individual condo PINs are recorded. You can find PINs through address searches on the Cook County Assessor’s website.

Most honest flippers had to put 20% down. However, much of the “down” in these cases was borrowed elsewhere. If they lied and claimed owner-occupancy, they could have gotten away with $0 down but now would still need 10% in most cases.

Unit 1501 just dropped in price by $100,000, from $1.1 million to $999,000. It’s hard to compete with 1301, which is listed at $799,000. The view does not change that much in two floors.

Thanks for the update on Unit #1501. It isn’t surprising. What is surprising is that it took them this long to reduce it given the price of #1301.

Utter nonsense. #1501 needs to face reality. His unit will not appraise even if he manages to find a sucker. 100k/floor – don’t think so.

I like this building. I think it will become one of the prime victims of the overbuilding bubble. The lowest priced unit I think was 410k or something like that…maybe I buy in a few years if one of these lower ones goes into foreclosure and I have a decent chunk of changed saved up. But the ceilings and supporting beams would be painted white.

Lets see by the time I have 100k saved up it will at least be three and a half years from now. No hurry on the bubble bursting..lets take it slowww…ok I am dreaming that 410k one won’t go into foreclosure for 300k and I probably won’t have 100k saved up either, but I can hope.

Bob:

Why do you think it’s a “dream” that one won’t go into foreclosure? We are now seeing foreclosures in the following recent new construction buildings:

1620 S. Michigan

1160 S. Michigan (The Columbian)

And there are others.

The Columbian started closings around July 2007. It takes awhile for investors to feel the stress.

I have no doubt that many in this building will indeed go into foreclosure. However I think it is a dream of mine that one will fall to my price point at precisely the same time that I will be able to afford it with no chance of financial distress to me in the future…but at the end of the day I am a realist.

The lowest price sale was at 410k at this building. I think it doubtful that the lowest priced unit would decline > 25% in this building. Maybe other higher priced units could decline more. Real estate is based on comps, and the lower priced units will not suffer the same depreciation as the higher end is my guess.

Yes I am watching 1620 S Michigan, I really like the building but its a little far to walk to work when I get loop gigs, the Columbian doesn’t appeal to me at all. Perhaps its all that time working and going to school in 1930s brick buildings, call me a concrete & glass modernist. I’m also closely watching Vetro & Wells St tower (locations I consider on par with 600NF). Five years ago people got some really good deals at Wells St tower..they may indeed return.. so I can wait.

The MLS is showing two more units under contract:

A high floor one bedroom in the high 400’s

A high floor two bedroom (05) tier in the mid 600’s

plus parking

Not sure what the offer prices are.

i recently saw unit 3603, 1br. the north views on the 36th floor are unbelievable. the original buyer defaulted and the developer let them walk away from their deposit. the unit was amazing but the developer wants 499k for it.

The higher floors do have great views, as a unit owner on a lower floor I was able to sneak a peak at some high floor units before they were done. They are trying to command a premium for the view, that is for sure. the 03 tier is the middle size one bedroom floor plan and that is a lot to ask for it in my opinion. I see that 1508 has just reduced their asking price, it is slightly larger and south facing.

Looking at buying a unit in Fairbanks. Parking is going for 60K. Other buidings show 35K. Why the discrepancy? Anyone know original prices?

Lake Effect: It depends on where the parking spot is located. $60k might be a lower floor. I think they originally went for $45k or $50k in that building.

Sabrina- Thanks for the reply. I’m not very familiar the Streetville condo market but prices still seem a bit high. The 1 bedroom units that I saw are about 60 higher than pre-construction prices. I’d hate to jump in (@ 429k for a 1bed w/o parking)and have the market fall off the cliff:)

The parking spots varied from $45k-$65k originally I believe. It all depends on what floor you are on. I’m sure you could sell the spot at a nice premium to someone else in the building if you didn’t want it, most units only got one spot.

I had an extra spot in my Streeterville bldg. Paid 55k… Had it offered at 55k for 3 months. 3 phone calls. Never found a buyer. Still met a woman in the bldg that kept telling me parking was worth 65k. Didn’t matter how many times i told her I was offfering 55k with no buyers.

Lake Effect: Why are you buying something that is nearly half a million dollars if you’re not familiar with the market at all?

While Chicago prices are holding up better than other parts of the country, citywide prices are down about 10% from their peak. Of course, as we’ve discussed here many times, it varies by neighborhood and block and property.

Properties are selling in 600 NF and some flippers/investors have made some money- but not all.

The question is- what will be the appreciation going forward?

Do you intend to live in the 1-bedroom for a long time? Say- 7 to 10 years?

If not- why not rent it for much cheaper instead? Especially if you’re concerned the market is going to “fall off a cliff.”

I’m just wondering why there is the urge to buy it when you can live in it for much, much less as a renter.

Sabrina -The going rental rate at 600FB is $2500/month for a 1bed. my mortgage + taxes would be about $2900 – lower if I factor in the income tax deduction.

LE.. did you include monthly assessments into that?

yes – we dont know what the taxes will be yearly…but i guessed $425 month

Rent vs owning calculators are limited in usefulness as there are two assumptions that can easily tip the scale either way: Expectation of future rent increase/decrease and future appreciation/depreciation of home value.

If you assume no change in rental rates and no change in home value over the time horizon you plan to hold, then there is no way it makes sense to purchase in this building.

Also, Lake Effect, what were your assumptions for % down? And you didn’t factor in monthly assessments (different than taxes) into your total monthly costs.

LE…

I came up with this… assuming 429k purchase – 20% down pmt, $450 a month assessments, 1.6% tax, 6.5% loan rate and 3.5% basic interest (op cost on dwn pmt)

$1,859 monthly int

$ 572 monthly tax

$ 250 monthly op cost

$ 450 monthly assessment

$3131 per month

I do not know your tax rate or marriage status for deductions but remember you are entitled to about 6k or 11 k and can not deduct the first 6k or 11k against the above figures or that would be kind of double counting.

NFL.com international streaming in HD RULES!!!!!

Lake Effect- The rent is really $2500? I saw them as low as $2000 when the building was first closing (and that was “negotiable”) so if someone is getting $2500 now- that’s much more than what the going rate is in Streeterville (even at the nice rental buildings like the Streeter- I believe.)

Investor- You’re correct that no rent to own calculator is complete but the NYT calculator is pretty thorough (see the link on Crib Chatter.)

With the calculations used here- and even allowing for a 3% increase in home appreciation and a 3% rental increase- it will take you at least a decade to have buying pay off over renting.

If you can rent one of these for $2300 (which I know you can)- then it will take even longer.

Why buy?

And that’s assuming a 3% appreciation rate (which we may not see again for years.)

The other question is- how long does someone live in a 1-bedroom condo? In my experience in running this site and looking at real estate every day- it’s not very long.

Bri – throw in exit costs and for that matter entrance costs.

ANd we are leaving out what John would argue that Obama will raise your taxes 500% and have his Aunt move in with you.

ROFLMAO!!!!!!

The $2500 monthly rent seems like someone’s wishing price. I’d be very surprised if they actually got a renter at that price, unless it was a New York transplant or someone for who money is no object.

Given the location don’t count out a corporate renter either. $2500/month is chump change for most companies and companies that lease generally aren’t as price sensitive and don’t often haggle.

Does anyone on this board think that 400k is a good value for a 1 bed in this bldg?

See LE this is how realtors get people. You have been given a slew of numbers and info and opinions and yet you are still waiting for someone to tell you what you WANT to hear.

If you think the market will appreciate and cover the 7k a year burn over renting plus the cost of getting in and the 6+% out. Go for it!! And yes that dress makes you look thin and is such a great color for you.

I don’t think $400k is a good value for ANY one bedroom anywhere in the city. Chicago isn’t New York; we will never “run out of land” here.

Real estate only goes up.

Except when it doesn’t.

Pete,

Chicago isn’t New York, so you need to up the 1br price to 1Million.

Based on the fallout on WallStreet the prices should fall soon.

It appears that most of the new one bedroom units in Chicago are going for way over 400K. Look at St Clair, Avenue East, Cityfront Plaza. Why are these prices still so high in such financial times? Are there really enough people buying out there and getting mortgages?

CG- I’m looking at a one bed in 600FB for 429k – sellers don’t want to negotiate because they believe this bldg is untouchable. I believe they can’t rent then either because the have reached the rental cap for the bldg.

This is the intrinsic problem with 1 bedrooms over $300k or 800 sqft. The typical buyer is a single person or in-town user. You need to take into account the worst case scenario, which is that you will not be able to sell when you move.

I lived in a 1bd/1bh unit with 685 sqft at 222 N Columbus. I was able to rent it and cover my operating costs because I do not have excessive square footage. If you want to buy it, it is for sale for $282,000. The unit has views of the lake, river and John Hancock building. Email unit3605@gmail.com for pictures.

Sabrina,

I wasn’t talking about the lack of completeness of calculators, just that you have to make certain assumptions which can tip the scale either way very dramatically for even the smallest changes. Especially the expected appreciation/depreciation.

However, that NY Times calculator is actually very incomplete. There are much better ones out there. It seems it doesn’t factor in the tax deductions, nor does it have you enter in closing costs and commission fees on the sale.

Lake Effect,

If they want to sell they will negotiate. Obviously today they don’t want to sell that badly. Be patient if you aren’t under a dictated timeframe for ownership.

The seller there obviously isn’t aware that our economy basically melted down in October. Condo markets collapse in most RE downturns (2001 excluded).

OK -so the seller was not willing to negotiate on the 1 bedroom unit…the phrase “we can rent it” came up several times….so I walked away.

In the below statement, can someone explain what the monthly op cost is (3.5% basic interest)?

IB wrote::

I came up with this… assuming 429k purchase – 20% down pmt, $450 a month assessments, 1.6% tax, 6.5% loan rate and 3.5% basic interest (op cost on dwn pmt)

$1,859 monthly int

$ 572 monthly tax

$ 250 monthly op cost

$ 450 monthly assessment

$3131 per month

Opportunity cost — how much money the down payment would have earned if invested in something other than housing. In this case, 3.5%*20%*429K per year, or 1/12 of that per month.

3.5% is a plausible rate for money market accounts (FDIC-insured variety) or 1-year CDs, although I haven’t checked that in a few months…

I would still need to subtract taxes from this OP cost interest income.

LE.. Yes.. fair is fair.

And remember you already get the tax benefit of about 6k unmarried and 11 k married so unless you have lots of itemizing to do it would not be fair to take the benefit of the first 6 or 11 k of itemized deductions owning gives you. If it is on top of the deductions you already itemize then it is ok to take all.

What i like to do is also give a risk/reward weighting as in probability assessments to likely outcomes which tells you a lot. as in market has chance of being up 7-10% but downside risk of 25-30%. That should be a huge driver to any decision. I see zero upside the next 2 years. Even when i got super bearish equities I assessed it at 14%/-30%. The current overhang is big! I am probably +3/-25 (that’s ugly) Of course just my assessment.

You might want to run that by the SHill’s 8 year old.

Ze,

In all honesty I don’t think you can tout your probability estimates here with any authority. While I agree that the trendline is definitely down I admit I can’t accurately predict the future nor would I be willing to bet on probability curves.

If you are very confident in them you can go work for a hedge fund or bet your own money.

Bob.. “If you are very confident in them you can go work for a hedge fund or bet your own money.”

Been there (not doing it again) on the first, and I still do that on the second.

Sorry that you missed that I also gave the caveat twice, first saying “I see” and again at the end of the post “Of course just my assessment”.

Thanks though…

by the way a +14/-30 is one hell of a wide prediction and I was wrong. That prediction was Oct of 07 and we blew thru the down 30.

Just trying to say market feels capped.. use NAR Yuns up 2.9% and Roubini or CME for down about 20. So then the “authorities” would be +3/-20.

WOW that was actually close to mine. 🙂

Actually that’s wrong. What I am trying to say is there is a risk/reward component that needs to be added on top of straight accounting.

WOW!!!

So when is this one going on the market and going to be on Cribchatter

http://www.huffingtonpost.com/2008/11/09/90-year-old-chicago-woman_n_142433.html

ZC: Wow indeed. Wonder how the agent will spin this (when the house DOES go on the market.) Looks like it’s in Evanston. Poor lady. What a sad story.

A family that decays together, stays together…

“A family that decays together, stays together…”

ha! ha! Oh boy…

Roubini sounds like a cheerleader compared to Karl Denninger. If you want to feel really depressed, check out his Market Ticker. Todays comment says to watch Ireland.

http://market-ticker.denninger.net/

Ze Carioca:

Just trying to say market feels capped.. use NAR Yuns up 2.9% and Roubini or CME for down about 20. So then the “authorities” would be +3/-20.

Juliana.. funny you would mention him. I tell him all the time he is wasting his time. Man is dead on target though, 100% right! Funny thing i learned once upon a time… Being right is of little use when everyone else’s best interest are polar opposite of what you are preaching.

Who, Denninger or Roubini? The latter isn’t wasting his time at least; he has been increasingly influential, esp. in the last year.

Denninger… I like him… he is just abrasive and won’t be listened to, but he is dead on target.

Much more important though is my Jets kicked ass today!!!

$3131 per month – one thing for sure the place will never rent for anywhere near that month. I’d say you’d be looking at $-1000 cash flow minimum each month if you tried to rent the 1-bedroom unit. Even more if the rental market takes a dive due to increasing inventory put together with a worsening economy.

Roubini & Denninger are pundits IMO. Surely bear pundits who had their day in the sun, but I’d much rather trust someone who put their money where their mouth is in this market.

A hedgefund guy who made a boatload like the 37yr old who retired and said FU or Paulson who was the top earner in America in 2007 (no relation to our corrupt treasury secretary).

Well bob that’s why I only said I like Denninger.. he trades. If you don’t put your nuts on the table in my book you’re shit. Roubini to me is just an economist. Brilliant one but nonetheless an economist. Few comment that he called this when the market was about where it is now so if he made the bet then he would be broke when it went up 4,000 points before coming down. Also don’t be so impressed by one hit wonders. When thousands play some will be successful just as a matter of standard deviation. It’s year in year out month in month out. Honestly my favorite was Lahde regardless of no long term. He figured out what really mattered. Get the hell out before it kills you! No real need for the public letter but I could think of a reason or two that made sense to him.

BTW.. you are a bit unlike your normal self today.

but hey.. I shouldnt comment on anyone. My risk/reward profile on equities right now I’m currently stuck at ??/?? So WTF do I know 🙂

I had a bunch of beers today watching football at one of the great local bars in the LP/LV area. Won’t say which one as I don’t want Dorothy and friends to look at the man behind the curtain.

Yeah Lahde’s farewell letter was awesome, even if I disagree with his anti-cannabis prohibitionist comments (not his points, just that they were very much out of place). I’d imagine it can’t be often investors get a letter like his farewell letter.

But back to RE: price reductions are hitting North Lakeview as Gary L predicted. A 2/1 was recently listed for 160k, can we say COMPKILLA? 😀

That was one of my favorite of many parts 🙂 He kinda sounded very familiar 🙂

How long before you think this building will be selling below pre-con?

Does anyone know what 1502 ended up selling for?