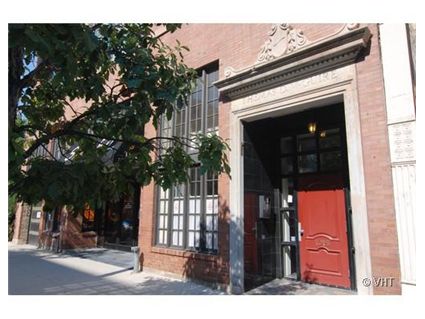

Not Everything is a Loft in the West Loop: 1016 W. Madison

This 8-unit building at 1016 W. Madison in the West Loop was converted into condominiums in 1998 but you won’t see any exposed brick here. However, you will still see 14-foot ceilings.

A 1850-square foot unit is on the market. Here’s the listing:

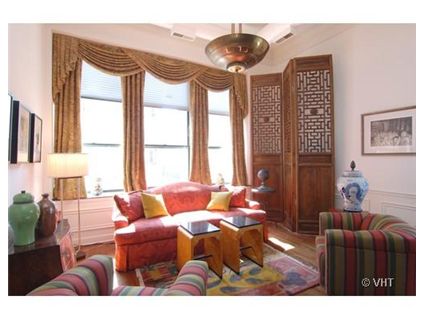

Designer Specified & Executed Home In Chic West Loop Boutique Bldg. Elegant & Intimate W/2 Units Per Floor. Unique 1850 Sqft, 2br/2ba Flrpln W/Ovrszd Rooms.

Soaring 14′ Ceilings, Current & Tasteful Finishes, Hdwd Flrs, Fp, SS Appls, Maple Cabs, Granite Cntrs, Beautiful Fixtures, Lg Laundry Rm & Great Closet Space. Gar Prkg Included. Across From Starbucks, Near Restrnts, Xway. A Very Special Home!

Robert John Anderson and Harold Blum at Baird & Warner has the listing. See more pictures here (if the B&W links don’t work properly.)

Unit #2S: 2 bedrooms, 2 baths, 1850 square feet

- Sold in August 1998 for $270,000

- Currently listed for $599,000 (includes the parking)

- Lis pendens filed in May 2008

- Assessments of $455 a month

- Taxes of $6,022

- Central Air

What a gorgeous old apartment! I didn’t know there even were places like this in the W. Loop.

But, like almost everything else languishing on the listing sheets unsold these days, it’s laughably overpriced. This is, after all, only a 2 bed apt in an older building with the maintenance issues you expect. And it’s in foreclosure.

I’d peg it at about $350K.

Definitely overpriced, but a great looking place. Hey Sabrina, how about a direct link of the address to Google maps in your listings so I can be even more lazy in the morning while I’m checking out these listings? Please and thanks.

Cool looking apartment but decor looks like my great grandmother’s flat. Too bad it’s in foreclosure. They could have gotten near the asking price a few years ago but not today.

I really like the idea of this building — small, in a neighborhood that I like — but I would never want to live in this unit. 2nd floor, facing Madison St., with the #20 bus roaring by 24-7.

Don’t fool yourselves…. This interior is not old at all. It is a recreated historically referenced interior stuck inside of an older industrial building. Kinda like trying to build a 19th century Victorian in 2008. It’s just not right…

Do you guys like anything? $189 per sq ft? Where do you think we are, in Sprinfield?

No, Steve, I don’t think we are in Springfield- I think we are in a country that is in the midst of economic collapse that will be hastened by adding trillions of $$$ to the public debt load in an effort to “rescue” Wall St from 10 years of greed, malfeasance, and a total absence of reasonable risk managment.

We are now a much poorer country than we thought we were when all the fake money was washing through the economy, and now we know it.

On an unrelated note…the Case Shiller index just came out and is relatively unchanged for Chicago in August. There hasn’t been much of a drop in the last 6 months. You can see the graph here along with the other Chicago housing data I track:

http://blog.lucidrealty.com/chicago_real_estate_statistics/

I’m as perplexed by the fact that it hasn’t dropped as everyone else here except Steve.

Gary,

Its been my theory that places like Chicago that did experience a bubble but perhaps not a crazy one will adjust downward only in winter months. Sellers haven’t been budging on ask prices this year, leading to a steep drop in transaction volume. I expect the Chicago index to continue its decline in the winter months. It is pretty remarkable and quite a buck to the overall trend that Chicago managed to be stable for half of this year on the lower transaction volume.

Laura, do you watch the news? If you haven’t noticed, the WHOLE WORLD is poorer now… Taking that into consideration, everything is relative. The last time I checked the ticker, the US dollar was gaining ground on other economies.

Re Case Schiller, as has been discussed before, there would appear to be a seasonality effect for Chicago. Same thing last year–there was a decline early in calendar 2007 that was stopped during the summer and early fall months (even blipping up in one month), and then dropped significantly in the winter and then really started dropping in the late fall and winter.

Also keep in mind that these are all nominal prices, so that flat means prices are falling in real terms. Also none of this factors in any of the recent events.

Hey, SHill, I don’t think you’ll find any condos in Springfield for $189/sf. A few might hit $100-$125/sf, but most are in the $50-$75/sf range.

But $189/sf does sound about right for many ‘highly desirable’ Chicago locations.

I’d peg it at about $350K.

Laura, you’re crazy. The listing says it’s across the street from a Starbucks. That is RARE, highly desirable, and worth at least $25,000.

DZ,

Good point. I hadn’t really looked at it that way before but you are right. And the prices didn’t recover after the winter. We’ll find out soon enough.

By the way, I don’t think this is a foreclosure. The Lis Pendons was filed by the City of Chicago against all units in the building.

The only outstanding mortgage on this unit that I can find also lists another unit in the building for which the owner of this unit doesn’t appear to be the owner of.

If you buy this unit, you better make sure to use an excellent title company for the title insurance policy!

“I’m as perplexed by the fact that it hasn’t dropped as everyone else here”

Understandable since the regulars here seem to have Chicago confused with Vegas, Stockton CA, Detroit, Phoenix, Riverside CA, etc…

Ooooooooh, a STARBUCKS, how could I fail to be impressed with that?

Anybody want to calculate what a Trader Joe’s or Whole Foods within 8 blocks adds to a place?

Tipster, yes–it would be truly shocking if a home purchased in 1998 went into foreclosure 20 years later. People did treat their homes as ATMs in many cases… but this would be an order of magnitude worse than the behavior we’ve seen so far. I simply cannot imagine that this seller is underwater, which means he/she isn’t likely to lower the price radically. Better to stay put, for most people. You’re trapped in your home, true–but this is a pretty nice home to be trapped in!

I think John Cusack went to the starbucks….. that should add another 5k to the asking price.

[case-shiller]

One thing about CS that no one appears to pay attention to:

“The S&P/Case-Shiller Home Price Indices are calculated monthly using a three-month moving average”. So of course there’s stickiness in the summer into the fall in Chicago–it’s pretty accepted that sale prices are (generally) lower in the winter here (right, Stevo?).

Also, it’s not seasonally adjusted.

“I simply cannot imagine that this seller is underwater, which means he/she isn’t likely to lower the price radically”

K–I don’t know how that makes sense.

anon (tfo)–yes, now that I have reread it, and thought about it, it doesn’t make sense at all. 🙂

I was thinking something along the lines of, the seller won’t be desperate, so will stay put and not lower the price. But of course, if the seller was underwater, he/she wouldn’t be ABLE to lower the price. And of course not being underwater means the seller CAN lower the price radically. I guess I just think, given stubbornness, and based on nothing other than the stubbornness of other sellers, that the seller won’t. 🙂 Sorry for my nonsense!

K–It does look like they’ve put a bunch of money/time into the place, so they probably feel they “deserve” that sort of return on their investment. But they seem to be sitting pretty–having the ability to substantially reduce their price and still walk away with enought cash to make another house obtainable.

Short sellers can lower the price as much as they want because they’re giving away the bank’s money, not their own. It’s the people who are above water who won’t lower the price because they’re holding out for an extra few thousand dollars of capital gains.