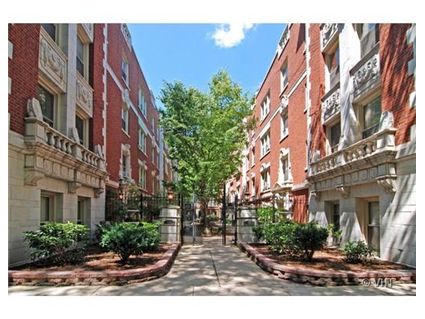

Renovated East Lakeview 1-Bedroom Sells In 4 Months: 546 W. Surf

We chattered about this 1-bedroom at 546 W. Surf in East Lakeview several times because it was originally bank owned, sold, and then came back on the market completely renovated.

We chattered about this 1-bedroom at 546 W. Surf in East Lakeview several times because it was originally bank owned, sold, and then came back on the market completely renovated.

See our August 2011 chatter about the rehab here.

On the market a little over 3 months, the unit recently sold for $145,000 (according to public records) or $24,900 under the original list price of $169,900.

The rehabber recently checked in with the following post on the old Crib Chatter thread:

“Hi- I am the developer who rehabbed this unit. We just closed last week. I found all of your comments helpful and they will guide me as I continue to look for other area opportunities.

We closed on the unit at $140k. We had offers- and believe we would have sold it in the $160ks- if not for the fact that building non-owner occupancy went above 50% after we closed above the unit. That meant more than 20% buyer equity, which dramatically cut into the pool of people who could buy our unit.

The feedback we got was that this issue was more important than any of the other issues, such as no parking, no laundry in the unit or no “built-in” air conditioning.

Ultimately, the buyer was an investor, who said that he intended to rent it.

Incidentally, we are looking for more opportunities like this one. While we have an agent checking the MLS for us, I would like to hear about any properties that are not MLS listed. Please feel free to contact me at schiller@sshomes.com“

In the prior chatter, most of you had complained about the lack of parking, in-unit washer/dryer and air conditioning. But apparently investor buyers don’t care about such things.

Also, several of you guessed the $145,000 sales price on this unit. Congrats!

Does this sale tell us anything about the market given the financing issues that were encountered with it?

How many buyers have 20% downpayment for a 1-bedroom condo?

If you have to put down 20% to move in, is renting better than buying?

Lance Kirshner at @Properties had the listing.

Lance Kirshner at @Properties had the listing.

If you want to see what it looked like before the renovation (kind of) – look here.

Unit #3N: 1 bedroom, 1 bath, 750 square feet

- Sold in March 2006 for $216,000(looks like there is an error in the data as there are 2 sales recorded in 2006)

- Lis pendens foreclosure filed in September 2009

- Bank owned in January 2011

- Originally listed on Apr 12, 2011 for $129,900

- Reduced

- Was listed in April 2011 for $72,500

- Reduced

- Was listed in May 2011 for $69,900

- Sold in July 2011 for $77,400

- Re-listed in August 2011 for $169,900

- Sold in November 2011 for $145,000

- Assessments of $202 a month

- Taxes of $3037

- No central air

- No in-unit washer/dryer (looks like its free in the building)

- No parking

- Bedroom #1: 14×10

- Living room: 16×13

- Kitchen: 7×13

25k in profit after closing costs, buildout, taxes, permits, labor, and assessments?

Investors selling to investors. Sound familiar?

yeah why should anyone improve the quality of the housing stock? lets just sell it from one deadbeat to another… 99%!

get real HD

whats the deal? cribchatter has been insanely slow for the past week!!!

I barely come on now as it is, but now when i do try its slower than [insert joke here]

Groove,

Same with me. It’s so slow it’s keeping me from wanting to look at the site. Sometimes I write a message and try to post and get an error message.

“If you have to put down 20% to move in, is renting better than buying?”

I’d phrase it differently: if it is difficult for you to scrape together $30K to put down on a $150K condo you shouldn’t be buying anything, not because of any buy vs. rent calculations but because you can’t afford it.

sabrina had better get this fixed fast – studies have shown that after one week of inaccessibility to web sites results in HUGE numbers of followers abandoning the site. Lucky for all of you, the CLIO system uses multiple computers and multiple personalities – so you won’t see this persona leave anytime soon!!!

“…building non-owner occupancy went above 50% after we closed above the unit…That meant more than 20% buyer equity”

Just to make sure that I follow this, the building has a rule that a 20% downpayment is required for any non-resident buyer whenever the non-resident owner percentage is above 50%?

This site is SO yesterday. For no apprent reason, I have never had a comment posted, and not all were acidic. I still think Sabrina is that douche from Yo Chicago

I agree with JPS. If you can’t find $30K to buy a $150K place, you shouldn’t be buying.

As a buyer, I wouldn’t want to live in a building where more than 50% of the other residents were renters. This is another building that should have stayed rental.

I think a lot of the 3/2, 2/2 and 2/1 condo conversions will become rentals for the next decade or some.

I’m also confused about “…building non-owner occupancy went above 50% after we closed above the unit…That meant more than 20% buyer equity”

I thought the only way owner occupancy would impact financing availability would be if the building were to lose FHA approval. I show 519-529 Surf as FHA approved, but not 549. Am I missing something? Is this an additional requirement commonly imposed by lenders?

Agree, jenny. It should be a rental.

“I agree with JPS. If you can’t find $30K to buy a $150K place, you shouldn’t be buying.”

I’m afraid that I have to disagree with you both. 20% is an arbitrary downpayment amount (albeit one that is probably sensible, even though it would present major barriers to ownership, and depress prices). From an association standpoint, sure: insisting on more stable owners makes sense. On the other hand, an association – or a lender – should perhaps be happy with 10% down, with 10% shown in savings. So why not put $15k down, and keep $15k in savings? Russ would know better, but it seems that rates are pretty attractive for 10% down loans (with lender-paid PMI – which makes it tax deductible as it’s rolled into the interest rate).

I didn’t put 20% down on my current place and, unless I win the lottery and/or lending requirements change in a couple of years, I likely won’t put 20% down on my next place. Student loans, savings and kids’ educations seem like better places to direct financial resources.

Anonny/Russ, generally speaking how much more is the interest rate on LPMI than the going rate? I assume someones credit scores factor in but is there a general rule of thumb, i.e. if the rate is 5%, LPMI will be 5.2?

Anonny 20% down isn’t an arbitrary number it’s an arbitrary ratio. But one that substantially shields the lender from downside valuation risk. We would’ve not had a financial crisis in 2008 if all mortgage loans required 20% down.

“Just to make sure that I follow this, the building has a rule that a 20% downpayment is required for any non-resident buyer whenever the non-resident owner percentage is above 50%?”

It could make the building unwarrantable. Fannie Mae guidelines state that a condo must have an owner occupied ratio of at least 51% for investment properties. If it does not, then Fannie may not take the loan. And if Fannie won’t take the loan, the bank may not give you the loan, because they can’t dump it on Fannie.

I love this 51% rule – it knocks first time buyers out of the picture – only cash investors (the big fish) are in the game……this pushes prices for these types of units lower, decreases competition, keeps the poor poor while the rich get richer. Why don’t you idiots realize this and protest?

“Just to make sure that I follow this, the building has a rule that a 20% downpayment is required for any non-resident buyer whenever the non-resident owner percentage is above 50%?”

I’d like compare the returns of GZ investors (like this subject unit or clio-types) versus the return of EQR over the last ten years. Plus, why is that investors have no trouble leveraging RE investments to 80%, but would recoil in horror in doing the same on something on the NYSE, like EQR?

“Plus, why is that investors have no trouble leveraging RE investments to 80%, but would recoil in horror in doing the same on something on the NYSE, like EQR?”

Well, you could buy call options on EQR and get 10-1 leverage (or more).

“Lucky for all of you, the CLIO system uses multiple computers and multiple personalities – so you won’t see this persona leave anytime soon!!!”

I can’t tell if this is a tongue and cheek reference to other posters’ complaints on clio or an admission that clio is really a group of people being dicks on the internet. I’ll go with the latter.

Beautiful apartment, seems like a good deal for the money,until you consider it is mostly investor-owned. Like other posters, I’m loathe to buy into a building that is half-rental. This usually means that owner-occupants have less to say about the operation of the building and have to duel owner-investors who view the building as a cash cow and are unwilling to spend the money necessary to keep the place in top condition.

At least in this fine neighborhood, you mostly get good tenants. In an area like Rogers Park or Edgewater, though, a high percentage of investor-owned units means you have an unregulated rental building with many amateur landlords renting to the first thing that shows up with a Section 8 voucher in hand. I looked at many deeply substandard condos in these neighborhoods that were downright seedy compared to comparable rental buildings, and were occupied by people I wouldn’t want for neighbors and that my landlord here on Pratt wouldn’t tolerate.

Taxes are horrible. $3000 a year is over the top for a $150K older apartment. Could these taxes be elevated because the building is heavily investor-owned?

Agree with those who state that if you can’t come up with $30K down, you shouldn’t buy a $150K place. Look for a cheaper condo- they’re out there, even though they might not be in a GZ neighborhood.

“Groove,

Same with me. It’s so slow it’s keeping me from wanting to look at the site. Sometimes I write a message and try to post and get an error message.”

it feels like i am in college and dialing up to the student network at 28 bits

chuk: “Well, you could buy call options on EQR and get 10-1 leverage (or more).”

True, but you’ll have margin requirements. And your clearing firm will be damn sure that your account risk won’t exceed the amount your margins cover.

Also: a future (as opposed to a call option) is a probably better comparison as it has enough downside that it could probably wipe out your account’s margins. This would be similar to a depreciating home value with a mortgage: when the price of the asset falls far enough, you lose your collateral (downpayment in the case of the mortgage, margins in the case of a brokerage account).

In general, I think people look at mortgages as good leveraged investments because they view home prices as stable and “always going up.” As crazy as it is, I don’t think people learned their lesson after the last 4 years. Yes, home prices are less volatile than equity, commodity or energy markets. But there is still significant downside to a mortgaged investment and the fact that people are pretending it doesn’t exist is extremely exasperating.

There is no investment property financing with less than 20% down. I think you are finding that investors are snapping up 1 bedrooms because typical buyers are realizing 1 bedrooms aren’t a good long term buy for primary occupancy ownership.

Lenders evauate the health of the condo association by lookng at everything from the budget to number of investors in the building. In short, not only does the borrower have to qualify, but the condo building does as well.

Fannie & Freddie have restrictions on number of rental units but it depends on the situation if the number of rentals is an issue or not. There is a full review and a limited review. A full review is when the lender looks at everything and then there is a limited review where only a handful of questions are asked. Full review is almost always required with the LTV is greater than 90% so a borrower would have a financing issue if buying in this building. A limited review is usally all that is required when the LTV is less than 90% and on limited reviews, rental occupancy is not considered a deal breaker from an underwriting standpoint.

“As crazy as it is, I don’t think people learned their lesson after the last 4 years”

TftinChi – anyone who looks at a 4year return as a “long term investment” really isnt an investor (stock, real estate, etc.). Investors are not stupid – they KNOW real estate WILL go up over the next 10 years. These are not flippers with 100-200k to spend – these are multimillionaires who control the industries. This is exactly why the common folk on this site (ie HD, Sabrina, G) don’t understand that real estate is not going to keep going down but will actually start going up (as we have been bouncing around the bottom for about a year).

annony: “On the other hand, an association – or a lender – should perhaps be happy with 10% down, with 10% shown in savings. So why not put $15k down, and keep $15k in savings?”

I guess I’m not following the logic of that, especially from a lender’s standpoint. Sure, either way the lender gets the interest. But if you get to keep that 10%, you can spend it on whatever you like. The lender can’t assume you’ll be responsible and that money will stay in the bank for when something bad happens. And as you say yourself, you’d probably use that money for something else (education, etc.)

So, looking down the road to where the borrower loses his job or is otherwise unable to pay, that’s 10% of the purchase price that the lender can’t recoup. It’s the equivalent of a clearing firm cutting margin requirements in half. Yes, it is easier to get an account (or a mortgage) which might lead to more customers and more cash flow, but the lender is taking on much more risk.

The issue, as I see it, is that lenders are able to bundle and sell their risk. They are able to make more, riskier loans only because they can offload the risk of those loans to other entities. Clearing firms have much less ability to get away with those kind of shenanigans and consequently have stringent and much analyzed requirements for account holders.

The system is broken. Until the government stops encouraging bad investments by people who can’t really afford mortgages and stops letting lenders offload the risk of their customer base, this situation won’t be fixed.

Russ,

Do you have a way I could contact you? I’m looking at trying to get financing in an unwarrantable building.

Chuk

chuk, can’t you just click on his name? He is here to make money.

clio: “Investors are not stupid – they KNOW real estate WILL go up over the next 10 years. These are not flippers with 100-200k to spend – these are multimillionaires who control the industries.”

You are completely missing the point. Yes, investors have the capability of weathering a 4 year shit-storm of real estate implosion. Yes, they look at the long term and hold on when it makes sense.

But what about the huge number of property buyers that *aren’t* investors? What about the wave after wave of foreclosures that have rocked the industry? What about the lenders that got caught holding the hot potato and subsequently had to take huge cash infusions to remain solvent?

You can’t use an investor as a basis of comparison. The risk of the investor owner going into foreclosure is much different than for an individual owner. IMO, the investor is a much safer bet from a lender’s standpoint. The fact that they actually have more stringent requirements than individual buyers strikes me as completely backwards.

“Until the government stops encouraging bad investments by people who can’t really afford mortgages….”

God are you stupid!!! Don’t u realize yet that over 90% of people out there really cannot afford to buy houses?!!! The government is trying desperately to avoid turning this country into countries like India where the disparity between the rich and poor is enormous and there are a very few rich ruling the enormity of the population.

“There is no investment property financing with less than 20% down. I think you are finding that investors are snapping up 1 bedrooms because typical buyers are realizing 1 bedrooms aren’t a good long term buy for primary occupancy ownership.”

Investors are snapping these up because buyers are too scared to buy <media, websites, etc), feeling that the market will continue to correct down. Yeah, right–not with rents going up. So investors buy and tenants pay more because they are scared….The transfer of wealth is happening not because buyers cannot buy–but because they cannot think for themselves. Investors can.

Why aren't 1 bedrooms a good buy? I assume because people get married/have children ? Many of us have built equity by getting into the market (not scared)by buying a 1br and then moving up. Further, there are many single, divorced or couples on a budget – all of whom find 1br’s a great alternative to paying higher rents vs ownership.

“chuk, can’t you just click on his name? He is here to make money.”

chuk obviously isn’t the sharpest tool in the shed….

I predict cooper will be richer than all of you in about 10 years….

Sorry if I got this wrong, but I just glanced through the posts.

The association has no say in what you put down. It’s the lender who requires a downpayment. During underwriting, they want to know what the percentage of owners/rentals are and the association usually fills this paperwork out for the lender.

The lender doesn’t want to lose money on lending anyone money so the higher downpayment protects them if you don’t pay them back.

clio: “God are you stupid!!!”

Fuck off you ugly troll. I’ll start listening and responding to you when you act like an adult.

Why has no one done an investment analysis of the property? How much money does this investor stand to make every month? Is it a long term thing? Cash flow vs. capital gaines vs tax write off or all of the above? Buying a onesie in a HOA building to me always seemed dumb. I have lots of stupid clients who try and do this shit all time and they never end up ahead.

cooper: “Why aren’t 1 bedrooms a good buy? I assume because people get married/have children ? Many of us have built equity by getting into the market (not scared)by buying a 1br and then moving up. Further, there are many single, divorced or couples on a budget – all of whom find 1br’s a great alternative to paying higher rents vs ownership.”

That play only works when the market is going up. Let’s say you bought a one bedroom in 2007: do you think you’ll get out with a positive return on your investment?

When the RE market is going up, up, up, liquidity isn’t a problem. When you want to get out of your house and trade up, you can. When the RE market is tanking or bouncing along the bottom, liquidity is a huge problem. If you can get out of your home, you will lose money and won’t be able to afford that 3 bedroom condo you had intended to buy.

Yes, investors can think for themselves. But they also have much more cash on hand and can weather turbelent markets much better than the average home buyer. They don’t *have* to get out of their property because they aren’t living there and basing their life around their purchase. It’s the people that had to scrape together most of their life’s savings who are screwed, not the investors.

“chuk, can’t you just click on his name?”

Doh! Never even noticed that some names were clickable…

TftinChi – WTF?!!! You are treating the market like it is only for owner-occupants. Don’t you realize investors now RULE the 1/1s? God are you stupid…..

As an investor it’s also easier to buy multiple 1BR units and treat is a single investment. There’s less risk in non-payment in two 1br units that cost the same as a 2/2.

“Don’t you realize investors now RULE the 1/1s?”

I thought that was what he was saying?

Icarus, the LPMI effect on rates vary quite a bit depending on down payment and credit score. Typically, it would probably bump the rate .25 – .75% depending on the situation and current mortgage pricing.

It is hard to say specifically because most MI companies have moved towards true risk based pricing models for each deal versus a standard rate card now.

chuk – he is making an argument of why 1/1 are going to go down in value (completely dismissing the effect of investors)……

“Yeah, right–not with rents going up.”

And we all know, rents only go up. Seriously, any proof of this statement? We know that high end new product and the slow pace of individual condo units going rental have had an affect on Class A downtown average rents, but anything else?

BTW, has anyone noticed that an awful lot of what is for sale is vacant? Combined with the shadow inventory in the foreclosure pipeline, it appears that these facts are affecting rental supply. Is it really a wonder how this will end up with all those investors “snapping up” these properties as they slowly appear, each one seemingly cheaper than the prior?

The 1/1 *should* be mostly investor owned. The fact that the government is trying to prop up the housing market is a huge part of the problem. This dream that you can buy any piece of shit property you want with 5% down and turn around in 5 years and make money is another huge part of the problem. It is untenable and unrealistic for people without significant risk tolerance.

The fact that lenders haven’t learned, the government hasn’t leaned and buyers haven’t learned scares the crap out of me.

“chuk – he is making an argument of why 1/1 are going to go down in value (completely dismissing the effect of investors)……”

You never get anything right, clio.

clio: “chuk – he is making an argument of why 1/1 are going to go down in value (completely dismissing the effect of investors)……”

Where in the world did I say that? I think that investors will keep the prices of 1/1 up for as long as the current rental bubble keeps going. But long term, they are headed down. Read what I’m saying more carefully. It has little to do with price prediction and a lot to do with how f’d up lending practices are in RE.

“Doh! Never even noticed that some names were clickable…”

if you click on mine, you get a dull blog that is at least more interesting than anything Clio has to say.

Thinking a bit more about this, it makes a bit of sense why the lending requirements on investors is more strict. I wonder if, historically, owner-occupants are less likely to default on their loans. Given the hold of the American dream, I wouldn’t doubt it.

So the savvy investors walk away from their obligations when they no longer make sense and taking a short term write down is the sensible thing to do. Owner occupants hang on for dear life, even when it makes no sense.

Still, that only explains part of it. 5% down still doesn’t make any sense to me as a lender unless I can offload some of the risk of default. I’d love to get a looksie at the books of big mortgage lenders and compare pre, during and post boom numbers…

G,

Rents are going up. High single digit increase have happened in Chicago and the suburbs over the last year. Its tough to see because a lot of the higher-end or professionally managed apartment buildings have a “market rent” for 12 month leases, which includes a free month or “rental concession”. The following year when the concession is gone, even if the market rent stays the same, results in an 8% effective rent increase. Market rents have increased, and concessions have decreased. Granted, this mainly applies to professionally managed buildings. For individual owners it is tougher to push through large increases on current tenants, but when that tenant leaves, they will end up renting for a significant premium to the previous resident. As the economy continues to improve, more renters will enter the market (people who moved in with friends and parents find jobs, and rent apartments) and this will put more pressure on the current supply, and this will affect both rental rates, and the value of lower end condos which can either be purchased by would-be renters, or investors.

Tft, you are correct. Investors are more likely to walk away as they view it as a business decision. However, during the boom, investment lending was skewed because most investors were really speculators looking to flip, not long term buy and hold based on cap rate investors. The flippers are the ones that started the whole collapse initially bringing down the regular buyers with them. Something like 50% of the foreclosures initially were actually investment properties. I call them specuvestors.

Lower down payment mortgages can and do perform well. The problems arise when the underwriting gets too lax on the other criteria such as credit, reserves, and debt ratios. VA has some of the lowest default rates and they are 100% financed with no PMI. It is probably because VA looks at true disposable income along with most VA buyers probably buying for the long term (not much of the 1 bed condo and move up in two years after having Junior crowd). Some lenders only make 100% loans to new Doctors since they have the income growth.

During the boom, Wall Street started buying increasingly low quality loans as the risk was off loaded. It wasn’t just that 5% down or 100% was bad. It was 100% down combined with stated income and stated assets was bad. Or 5% down as an investment property. Or 5% down NINJA loans. Or 100% Neg Am. Or 100% to 580 FICO scores WITH stated income. The risk layering was completely out of wack based on Wall Streets appetite to buy the loans.

JP$: I’ve observed a noticeable bump in rents in LP/LV. That said, when the economy improves I’d also expect some of those renters to become buyers, especially if the government keeps intervening in the housing market. I’m not sure I’d expect consistent upward pressure on rental prices through a recovery.

“if you click on mine, you get a dull blog that is at least more interesting than anything Clio has to say.”

Had a couple questions/comments:

1. Why not carry on one bag and check the other? (I’m also unclear on whether the $4 price differential was why you didn’t check the bag. You give conflicting accounts.)

2. I was hoping there’d be more of a payoff to the bug spray/sun screen storyline (given the buildup) and then I realized that was all there would be. Also, why not just spring for the sunscreen at the gift shop? I like a bargain as much as the next guy (unless it’s bobdelete) but you’re on your honeymoon!!

Oh, and congrats, of course.

This board always has and always will live under the assumption that everyone in the housing markey needs 4 bdrms and 3 baths, will have kids, needs great schools, etc.

This place looks like a pretty good long term buy (you know, like you’re supposed to buy housing) for an investor or owner occupier.

TftInChi: I agree that there is a limit to the increase in rental prices, and that the increase will be limited by 2 factors. The first being the increase in supply of rental housing that is going to start hitting the market next year (14 buildings currently under construction) and the second being the parity between renting and buying. At some point the people that can afford to buy are going to start buying again… right now they are afraid that they’ll be purchasing an asset that will continue to decline in value, but I’m pretty sure we’ve been bouncing along the bottom now for about a year. As soon as there are signs of a sustained improvement in the economy people will be buying again.

@DZ, can you be my editor/proofreader?

“remember the not checking our bags because we feared losing them?” I was trying to demonstrate how a normally rational and clear minded Mrs Icarus can become so paranoid as to bring the crazy stew to full boil.

the bug spray/sun screen payoff will come in later posts. though like real estate these days, only a modest ROE 😉

Aup, there is always a market for 1/1s and small condos. However, I think that segment of the market was over developed and sold during the boom, particularly at the price points being asked. There are only so many crazy cat ladies and perpetually single folks looking to be in the same place for ten years.

On refinances, it is the garden units and 1/1s that seem to be hit the hardest value drop wise from my antecdoctal observation. A lot of these places should have stayed rental imho.

Rent vs buy often just plays against each other. If rents go up too much, they make buying make more sense. As people buy more, that drives selling prices up, and then renting makes more sense. It is a bit of a see-saw. However, there are obviously other factors. It could be that buying is now preferable to renting, but some (many?) people may have no choice but to rent because they have killed their credit in a short sale/foreclosure. That will be an additional factor in rental demand that would not “normally” be there. I would expect rental demand to be abnormally high in Chicago until those people have repaired their credit in 3-7 years.

Best CC line on this thread:

“There are only so many crazy cat ladies and perpetually single folks looking to be in the same place for ten years.”

Russ http://cribchatter.com/?p=12196

JP$ could you please post a link on the rents going up statement. And I don’t mean a forward looking projection from gail lissner from thr ARC.

I’m tired of the unsubstantiated chatter and claims that rents are going up. Show us the proof.

http://www.trulia.com/blog/michael_hobbs/2011/07/going_going_going_up_chicago_rents_trending_higher

“HotPads.com recently announced that the average rate for apartment and home rentals is up 6.7% from June 2010. Prices for studio apartments are up 14.3%, and five-bedroom homes are up 12.1%, One- and two-bedrooms are seeing average increases of 2.3% and 2%, respectively.”

Of course keep in mind that all stats are lies…

Hotpads.com? Never heard of them but ill try to do some research on them later. On the face they do not appear to be credible.

Well, there are a whole bunch more. I could only paste one link at a time. But it doesn’t really matter. All stats really are lies.

http://yochicago.com/suburban-chicago-rents-up-but-incentives-remain/20285/

“The median net rent per square foot at suburban Chicago apartment complexes rose 7.4% year-over-year in the fourth quarter of 2010, according to a recent Appraisal Research Counselors (“ARC”) report.”

“On the face they do not appear to be credible.”

Oh, you want credible. I’m afraid I can’t help you with that.

QOTD: Who caused the boom? Was it Specuvestors, Non-comforming loans, or crazy cat ladies. Cast your vote for:

Author: Russ

Comment:

The flippers are the ones that started the whole collapse initially bringing down the regular buyers with them. Something like 50% of the foreclosures initially were actually investment properties. I call them specuvestors.

Author: Bob

Comment:

Anonny 20% down isn’t an arbitrary number it’s an arbitrary ratio. But one that substantially shields the lender from downside valuation risk. We would’ve not had a financial crisis in 2008 if all mortgage loans required 20% down.

Author: Russ

Comment:

Aup, there is always a market for 1/1s and small condos. However, I think that segment of the market was over developed and sold during the boom, particularly at the price points being asked. There are only so many crazy cat ladies and perpetually single folks looking to be in the same place for ten years.

Bob,

I underwrite apartment investments in Chicago (and the suburbs). I cant post rent rolls from offering memorandums due to confidentiality agreements, or information from RCA (Real Capital Analytics) but I can tell you that on the aggregate the average increase to average effective rent per occupied unit in rent rolls has been high single digits year over year and it will be the same next year (just based upon in-place rents and lease expirations). These numbers are not pie in the sky projections (which I dont beleive either… right now we are disposing of assets, not buying) they are actual increases in collected (effective) rental income per unit.

Within our current portfolio we have seen double-digit increases at 2 properties (of 12) that we own in the area. The sharp increase in rents is what has pushed investment into the Chicago apartment market over the last 6 months. One West Superior place sold for $396K per unit, with 900 sf units. 161 W Kinzie is under contract for $520K per unit, these units are around 900 sf as well. 215 W Washington is currently for sale and will probably trade at $400K per unit. Now I dont think these buyers will have a large yield on their investment, and I know that they are projecting increases based upon current rents, HOWEVER, the fact that current rents have had such large increases over the last 2 years is what has driven prices up to these levels. BTW, none of these buildings are nicer than your average condo deal.

like 9?

“high single digits”

“can you be my editor/proofreader?”

I think you need someone creative to help you develop storylines and content (not my strength), more than editing. Maybe the newlywedness will provide some good fodder.

“I was trying to demonstrate how a normally rational and clear minded Mrs Icarus can become so paranoid as to bring the crazy stew to full boil.”

I don’t think her concerns were that unreasonable, especially if you had a connection. Certainly no crazier than your intransigence on not spending an extra $20 bucks on sunscreen on your honeymoon.

“Within our current portfolio we have seen double-digit increases at 2 properties (of 12) that we own in the area.”

Is this across a range of neighborhoods or more of a river north-ish concentration? Always seemed to me that rents in “luxury” apts in river north were in their own little world, with big movements up and down sometimes.

DZ,

Our Chicago properties are in the Green zone, and professionally managed. But we also own standard “garden-style” assets in Schaumburg, Aurora etc. Those have seen big increases as well. For context, it is important to keep in mind that that increases of 2010 and 2011 followe a truly lack-luster performance of apartments from 2007-2009, which saw effective rents AND occupancies decrease.

So glad I got out of this building when I did. I rented here from 2004 to 2006, when it got converted, and owned until 2010. I bought because at the time, thought it was a good investment, and well, honestly I didn’t want to move since I liked the area.

At the time, I had no idea the 50% rental limit for loans was going to be such an issue when trying to sell. When I sold in early 2010 (just before the second government tax credit), the building was 1 unit under the 50%, so I was able to cater to first time home buyers looking to use FHA loan.

I had to bring money to the table to close, but I was able to eat it. I was fortunate enough to be doing pretty well during the recession as I worked as a bankruptcy consultant. Just one piece of bad luck here and there and I’m sure I’d still own the place and be renting it out, instead of just not having to worry about it anymore.

The biggest problem that needs to be addressed is putting in a 50% limit on renters. Otherwise, prices will continue to suffer.

@Dingo

So did you move on to renting? or do the I am taking a hit on my property, but picking up a new property that I like at a price that I am good with?

I have moved on to renting since, an apartment in roscoe village. Not going to look to buy in the near term, until I know for sure i’ll be around the area for a while and have more savings.