Steal and Deals: A Two Bedroom in the Heart of River North at 630 N. State

A lot of people are eager to get into the latest new building in River North or Streeterville. But what about the buildings that were built in the last decade?

Some of them are in great locations right near the Mag Mile, restaurants and clubs.

630 N. State is one of them. The 27-story building was built in 2000 and has 178 units.

There are currently only five units on the market.

Unit #1008 is a two bedroom that includes the parking for under $500k. According to the older sales in the building, it would be around 2005/2006 pricing.

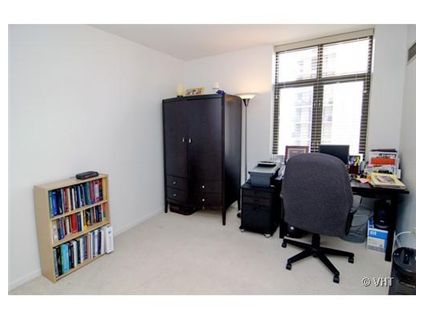

Unit #1008: 2 bedrooms, 2 baths, 1365 square feet

- Sold in July 2002 for $350,000

- Currently listed for $469,000 (parking included)

- Assessments of $787 a month

- Rubloff has the listing

Unit #1108, which is the same square footage and layout, sold for $456,500 in December 2005.

Is this a deal for the location?

Not sure if its a deal. I don’t see the draw. It just feels like you are living in some crappy, highrise apartment. Not homey at all, I wouldn’t want to live there and I don’t care if its on the Mag mile…. 😉

It’s no deal. This place should sell for the 2002 price, but not 2005 prices or higher. It’s nice, but there are thousands like it.

We’re rolling back to 2002 prices, and that’s the price this place is worth.

The “marginal” areas like Rogers Park and Edgewater and Uptown, and overbuilt areas like South Loop are caving first, and the rest will follow in due time, probably when the oncoming wave of Alt A and Pay Option arm resets hits in the next few months.

Does anybody know if 1108 also had parking included? Seems like a pretty good deal for the neighbourhood.

“at 2005 prices” reads “at peak bubble prices”.

Crash crash crash.

Was the earlier sale you quoted with, or without, parking? We need to compare apples to apples.

I’m not sure the market is rolling back to 2002 prices; my prediction is that the average Chicago home will end up where it was in 2004.

That said, some neighborhoods clearly will be hit much harder than others. As Laura pointed out, Rogers Park and the South Loop are in particular trouble. In other areas, however, I can see prices holding their value and perhaps even going up a bit. For example, there are some good things happening in Avondale right now; based on what I’ve seen, places are selling.

One of the biggest problems for this unit is that there is little to distinguish it from anything else. When you consider the assessments, you’re paying over $3,500 to live in what’s basically, as Jason put it, a crappy apartment. No thanks.

I have to doubt that other, more valuable areas will not follow the path of marginal areas, that are the “canaries in the coal mine” of a crashing housing market.

Since the first time buyers have been knocked out, thus the deceptively higher median price, “move-up” buyers will be unable to step up from beginner-level dwellings to larger, more expensive places.

Worse, the boom triggered a monster spate of luxury home and condo building in Chicago, way more than local demographics ever justified to begin with. There are way more upscale “McMansion” type places and luxe condos than there are buyers in the price ranges to support them.

In every neighborhood I view, the prices are far out of line with rentals for comparable units, no matter what the figures happen to be for this place or that.

Laura, how many times does someone have to explain to you that condo/home values are not based on rent parity? Sure, there’s a correlation, but there are so many other factors in play like the income tax benefits, security of fixed payments and permanence of occupancy, etc. EVEN IF PURCHASED AS AN INVESTMENT a condo will cost more than rent parity because (1) rent increases, while your mortgage payment won’t (or shouldn’t), and (2) if purchased with very high equity, then the condo can be vaguely thought to function more like a bond: the rent payments are your coupon, and the maturity/par value are the result of your skill at reading the market and timing your sale.

But anyway, yeah, this unit is unremarkable except for its location. Not sure what the right valuation is, probably in the 2003 range like most other Chicago properties.

“Worse, the boom triggered a monster spate of luxury home and condo building in Chicago, way more than local demographics ever justified to begin with. There are way more upscale “McMansion” type places and luxe condos than there are buyers in the price ranges to support them. ”

Completely agree but I don’t know if this is even bad if you’re a fence sitter. As the buildings are already built they’re a sunk cost. This just means the price ranges are going to have to come down.

The income tax ‘benefit’ means you’re paying a dollar to get .30 cents back.

Yeah, yeah, there is the benefit of permanence, if only you bought something you could really afford. But it’s laughable to discuss “permanence” and “having a home” when you consider that the main thing that drove these prices was rampant speculation in combo with unsustainable mortgages that were rigged to blow up in the borrower’s face. And people have not been buying what they could afford, because it is not in parity and is therefore a big step down from what they’re renting- they have been making deals where they end up paying TWICE the monthly rent for an exact comparable, in payments.

The distance from rent parity means that if you want to pay what you can afford, you are taking a big step DOWN when you buy, which pretty much takes the joy out of home ownership. And if you pay a substantial premium that figures out to a payment twice your rent, just to get something as good as what you rent, how are you an “owner”? You are just another renter-for-life, committed to paying much higher “rent” (known as the “mortgage payment”) for an “asset” that can depreciate as easily as appreciate.

Houses and exceptional condos might sell above rent parity, but there is no reason on Earth for a commonplace mid- or lower- priced condo to sell for one dime above it, especially with the oversupply of such units we have now. Shall a person living in in an attractive, reasonably priced apartment where she has no extra liabilities and can just skate right out of the place if problems develop with the building or neighborhood, take on much larger payments PLUS assessments, insurance, taxes, plus liability for future repairs and assessments, just to get an “ownership stake” in a place subtantially inferior to her rental? For that is what buying a place over rent parity amounts to- you are going to pay that much more for the same thing, only you will be on the hook in a way you never were as a tenant. Buying wrong can literally wreck your life- ask anybody buried in a glossy new condo who just got hit up for an extra $1000 a month in assessments because the building is only half occupied, the developer folded, and SOMEBODY has to pay to run all those elevators and burn all those lights in the hall.

The only people who can safely disregard rent-parity ratios and other traditional measures of value are those who are RICH, by which I don’t mean somebody who makes $200K a year but is buried in $700K worth of debt, and who would drop down to a much lower bracket if he lost his job. I mean people who have an asset base over and above their primary dwelling, of $3MM at least.

In my mother’s time, you tried to buy “cheaper than rent”. Now, many people will say, it’s not 1970 anymore. However, we are discovering from the wave of foreclosures and tens of thousands of people with newly wrecked credit, that there’s no such a thing as a “new paradigm” when it comes to money and numbers. 2+2 still equals 4 after all these years,and housing fundamentals are still the same- local incomes and rents.

In the long term–and by long term I mean the length of a lifetime, or at least a 30-year-mortgage–owning *has* to be cheaper than renting. If it weren’t, then no one would own buildings, and if no one owned buildings, no one could rent the units in them. In other words, we can’t *all* be renters. Owners are compensated for taking on the risk of ownership, but again, over the long haul, it’s a good bet, and traditionally pays about as much as if you stuffed your money in a T-bill.

But that is in no way inconsistent with the idea that in the *short* term, it might be cheaper–right now, considerably cheaper–to rent. Prices are falling. Why not wait? (Unless, of course, the “intangibles” of ownership are worth spending extra for–which is perfectly rational, in the short run–but those intangibles are worth more to some than to others.)

Laura, the tax benefits are not as simple as paying a dollar to get 30 cents. You can borrow a dollar at 6% (fixed mortgage rate), and invest it (after tax) at 8% in, say, a low cost index fund (which over the last 250 years have paid 10%, on which you pay capital gains netting you 10%- 2% = 8%). Now you’ve made 2% on your dollar. If in addition, you get a tax deduction for the 6% you pay in interest on that dollar, then your real interest rate is not 6%, it’s 4%. Meaning you’re netting 8% – 4% = 4%. That’s not a loss, that’s a real gain. (You’re being compensated for taking on risk, which if you are risk neutral, is fine.)

Ignoring rent and income parity is the first step to knife-catching in this depreciating market.

Demand has disappeared along with easy credit access. Speculative and outright fraud-based pricing are gone for a very long time, and they infected every neighborhood. Real prices will continue to decline and then wallow for a long time.

Kenworthey,

Good points and they help explain why there will be a premium to straight rent parity.

However as any mutual fund prospectus will tell you: past results are not indicative of future results. If you leverage yourself up as much as possible you can just as easily lose. Tweaking your start time of buying the place and timing of the market even a little (say 1 year) can and will drastically alter your total holding period return.

I am hesitant to look at opportunity costs and agree with Laura. Interest expense on your mortgage is still an expense. Its not equity in your pocket, its just other peoples money that the government is subsidizing you to overconsume.

The best way to compare renting vs. buying over a total holding period return is to assume you invest the savings from whichever one is cheaper into an asset. I disagree that owning is always cheaper in the long-run. I think whichever outcome is cheaper depends on the time period. During the 70s and 80s there were times when owning was cheaper than renting, times when one couldn’t count on capital appreciation in the value of their home so it was more closely tied to rents.

I predict that housing prices in Chicago will return to pre-bubble prices within the next 36 to 48 months. By pre-bubble prices I mean 1999. And when prices drop that low, I will party like it’s the same.

When all is said and done, rent and income parity are MIGHTY good guides to whether or not “it is a good time to buy” (a particular place). No, they aren’t perfect–but Laura is right to focus on them. If they get too far out of whack, as they are now, then now is *not* a good time to buy. We’re not taking small percent margins here; the bubble knocked things off by whole multiples.

I agree with Laura and G, in that rent and income parity are an important consideration in any city/condo market. Some of the points about this unit being boring and plain are spot on. It’s not a bad place by any means, but to say something as typical as this unit can command it’s current asking price is unlikely. It has many things going for it (parking, location) that will unfortunately be canceled out by the:

1. Drop in qualified buyers / tightening of lending standards

2. Underwater/stressed flippers/owners/developers/lenders in heated competition to turn a profit (or take the smallest loss possible)

The housing market is going to take quite awhile to correct itself. The question of how far is really up in the air. I will admit that the extremes that post on this board (unrealistic sellers / hungry agents vs. overly pessimistic buyers) will be forever in a stalemate 🙂

IMHO, units that are immune to all of the current mess are the ones that are truly unique with the right mix of attributes (good layout, location, amenities vs. assessments) at a reasonable asking price. A great example, 913 W Van Buren, Unit #7B, which sold very quickly.

While it is true that buying is better than renting over the long term, that does NOT include situations where someone buys at the peak of a bubble market and rides it all the way down. Those people will take decades to come out ahead. Buying the right place at the right time for the right price is great, but overpaying for an overpriced condo at the market peak is financial suicide.

Yes, Pete. Friendly amendment. Which is why even if someone plans on staying somewhere for the next 30 years, they *can* go wrong paying many, even most current asking prices. A 20% drop in value takes a long, long time to recover from.

“A 20% drop in value takes a long, long time to recover from.”

Chicago had 10% drop this year; what will next year bring? I love how people say “oh 2004 prices are the bottom” or “some units are different because of this or that”. None of that is true. All I can do is look at the cold hard data and extrapolate a return to the mean. Look at this chart and tell me what you think the mean would look like: http://bp3.blogger.com/_i7IqN0dMk7g/Ryddqk30G0I/AAAAAAAAA5g/NUq8vebJvDg/s1600-h/case-shiller.jpg

“Look at this chart and tell me what you think the mean would look like”

If you can even find the Chicago line. You hypothesize a return to 99 pricing–that’s not a “return to mean” but an overshoot.

I guess I’ll have the last laugh.

“if purchased with very high equity, then the condo can be vaguely thought to function more like a bond: the rent payments are your coupon”

Sure, but then you’re back to a rent parity like analysis (i.e., cap rate). Yeah, it’s a rougher metric with individual residenitial units and their (potentially) regular turnover, but who wants a (less than) 3% “coupon” on a $500,000 investment that requires attention and further (potential) spending in repairs? Oh, and that is relatively illiquid.

You may have the last laugh, but extrapolating a “return to mean”–what you suggested–does not yield a return to 1999 pricing. That’s not to say it won’t happen, but that it won’t happen as a result of a return to mean. But then you don’t care if people buy into your theory, so expressing it inconsistently isn’t a problem.

Prices will return to 1999 prices in many areas. The value will disappear just as it was created – into thin air. Don’t forget that money was just created. One individual buys a house with real money, and as a result, every house in the neigborhood increases in paper value.

So returning to 1999 pricing isn’t that far of a stretch considering that a majority of people stayed out of the mania, including the half of the country with no mortgage at all.

Despite the negative data, some people want to believe that the party will continue but I think the party is over. The evidence and data shows that we’ve experienced quite a drop in the last year or so, and we should probably be prepared for a few more years of the same. This downward trend isn’t just going to stop or plateau or reach a bottom in the next year or so. After reviewing the data there’s no way any reasonable person could come to that conclusion.

The increase in inventory (it went up 7% overnight in my zipcode!), the foreclosures, the tightening credit standards, the short sales, etc, it all adds up to a sticky situation. Sure, in 2005, at the top of the bubble, the value of a house may have been the highest because comps in the neighborhood says it was worth that much. but it’s only worth that much if someone will pay that much. And quite frankly, the party where buyers bid as much as they could is over, and it ain’t coming back. In the process, the 2005/2006 values will be decimated. In essence, the value, or the paper dollar equiv, is disappearing into thin air, just like it was created.

homedelete,

Your scenario is not the party being over. It’s the party being endied by invasion from a violent gang who crash through the windows and proceed to machine gun half the revelers.

But perhaps you don’t really mean 1999 prices. Maybe you mean “1999 prices, adjusted upward for inflation and what would have been normal appreciation.” *That* would be regression to the mean. And it would also be more like 2002/2003 nominal prices.

homedelete,

You’re aware that since 1999, the economy has otherwise grown, and prices have otherwise increased due to inflation, right?

The “bubble” could really only be said to have started in 01/2001, when the Fed began slashing it’s overnight funds rate: from 6.5%, eventually making it all the way to what, about 1%?

So maybe I’ll grant you “2001 price plus inflation.” Let’s call inflation 2001-2008 an average of 2.25% per year (ticking upwards now), which compounds to about 17% greater than the 2001 price, or in other words…..

…roughly equivalent to the 2003 price.

K:

Exactly my point. hd might be right, but the scenario propounded of the return of 1999 prices is not “return to mean”.

“Your scenario is not the party being over. It’s the party being endied by invasion from a violent gang who crash through the windows and proceed to machine gun half the revelers.”

Your description is 100% accurate. Is it not violent? The subprime lenders have folded; the days of 100% financing are gone; foreclosures are at record numbers; banks have written off tens of billions of dollars; the securitization and auction markets have come to a grinding halt and residential real estate construction is at a standstill. This isn’t a slow down – it’s the utter decimation of the real estate industry. The figures don’t lie and they ain’t pretty. Congress with its bailouts and the Fed with its rescues are desperately trying to slow the violent subjugation of market forces, only to achieve limited successes. The credit crisis, along with oil, food prices and a slowdown in the general economy will depress prices to 1999 levels. 1999 may be an overshoot of the mean, and it may not stay there very long, but I’m expecting a joyous return to affordability. I don’t think my prediction is too bold; the pundits have been conservative in their estimates thus far. Remember how subprime was contained? It has been contained to the planet earth according to 60 minutes. Many sectors of our economy are feeling the results. I’m not predicting that we’ll have a great depression or anything, but, our real estate economy will be greatly reduced in size for many years to come.

I can’t comment on whether this is a steal or a deal, but I have lived in this building as a renter and I can weigh the pros and cons.

I will say that the management and maintenance are tremendous at this building and it is in walking distance to a ton of things including 3 grocery stores.

I have seen this particular floor plan and it is not bad, but it looks like the finishes in this unit are particularly low end and you would have to factor in for some serious kitchen upgrades. I will note that Ontario is a tremendously LOUD street and this unit might face it. (And yes I have lived in the city for 15 years and understand city noise.:-)) People tend to forget that Ontario is one of the main passages out of the city and every single Saturday night in the summer there is very loud motor cycle squealing and honking. Trust me, I had no clue until I actually lived there and when you face Ontario Street it is completely different than facing even the back of the building.

Just my 2 cents from personal experience!