The Greystone Lincoln Square 2-Flat: 2242 W. Leland

Looking for a 2-flat where you can live in one unit and rent out the other?

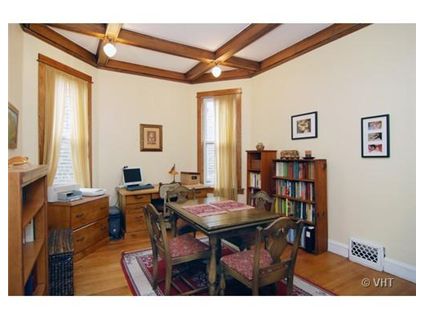

This greystone 2-flat at 2242 W. Leland in Lincoln Square has two 3-bedroom, 1 bath units and a 2.5 car garage.

It has an unfinished basement (which the listing says could be duplexed down) as well as some nice vintage features like the beams in the dining room. It’s also within walking distance of the Lincoln Square shops.

Each unit has separate utilities.

Ellen Webber at @Properties has the listing. See the virtual tour and more pictures here.

For more information on the individual units, see the listing here.

2242 W. Leland: 6 bedrooms, 2 baths, 2.5 garage, unfinished basement

- Sold in August 2001 for $417,500

- Currently listed for $649,000

- Taxes of $7120

- Two 3 bedrooms, 1 bath units

- Separate utilities

Looks nice on the outside. How hard is it to convert a place like this into a SFH?

Too much money.

Ah, this might be close, doing this in my head, but mortgage of about $3500 with 20% down.

Ouch, thinking is hurting my head, little hungover after last nights Sox game……

Looks like it has good potential… nice location, good bones, but finishes need to be upgraded

Too much money? This place will easily sell for close to asking and some one will spend a couple 100K and convert it to a single family.

Brian,

I take the other view that that won’t happen because the days of 850k SFH’s in non-prime neighborhoods (Lincoln Square) are mostly over, IMO. A friendly bet it is.

If I’m a big shot lawyer or i-banker I don’t want a heck of a commute to my downtown firm. Again there are far more 850k homes out there than there people with the wealth or income to support them.

My guess for this is 540k.

Or someone will buy it with cash and rent it out to some recent college grads from craigslist. Perfect rental building, although a tad bit pricey still, I’d imagine you could get $700 x6 people living in here no problem.

http://chicago.craigslist.org/search/apa?query=flat+%22lincoln+square%22&minAsk=min&maxAsk=max&bedrooms=3

Rents for similar properties in Lincoln Square are between $1,300 and $1,650.

I suspect this will be snapped up. Lincoln Square is pretty much a prime location, people are going to have to adjust and to realize that Lincoln Park is what has been massively over-hyped for the past 10 years.

I also agree with Bob, $850k for non-prime neighborhoods is a thing of the past; IMHO this property didn’t even cash flow at the 2001 selling price of $417k why would anyone buy it for $650k is beyond me…then again the barriers to real estate ‘investment’ are pretty low it’s not like you have to pass any boards or get a degree so everybody thinks they can do it

Lincoln Sq. is cool no doubt i’ve always liked that area but in reality its a bit west of the lake, pretty far north, not near the highway or LSD…it’s just sort of there, nothing too special about it.

Doesn’t make sense as a rental with $1500 per unit. That’s a 4.4% ROI.

Lincoln Square is really the last bastion of the German culture in Chicago, which, given that Germans dominated the north side from its inception, is nothing to sneeze at.

I have friends from all over the City I grew up with who have gravitated there, it’s definitely considered hip, if not as “high rent” as LP.

“Lincoln Square is pretty much a prime location”

Skeptic I am curious of your criterion of a “prime location” given HD’s spot on quote below. Sorry but just because a bunch of white yuppies live there demographics alone can’t make an area. The location is terribly inconvenient to getting just about anywhere.

650k? HAH go buy this two flat then. I’ll go buy a two flat in another non-prime neighborhood for 150k and we’ll see which one of us is cash flow positive.

“in reality its a bit west of the lake, pretty far north, not near the highway or LSD…it’s just sort of there, nothing too special about it.”

“it’s definitely considered hip,”

Hipness comes and goes. Remember parachute pants or big hair bands?

I don’t think it being “the last bastion of German culture” justifies ridiculously overpriced real estate.

Not to defend LP but at least with that neighborhood you also get a great location convenient to transportation and downtown for that real estate premium.

Methinks any business person making a decision to purchase a two flat for 650k considering the ‘hip’ factor won’t be in business very long.

Lincoln Square has one of the best bowling alleys in the city. Plus it seems like a pretty family friendly place. I don’t think the schools are that great though. Coonly is supposed to be improved but this isnt in that district.

”

Rents for similar properties in Lincoln Square are between $1,300 and $1,650.”

Yeah I thought it was in Lincoln Park… if it was in LP it would make sense, but Lincoln square… at that price you probably are not going to get the rents to make it a decent investment.

“Too much money? This place will easily sell for close to asking and some one will spend a couple 100K and convert it to a single family.”

There are two two-flats ~8 blocks south in the Bell school attendance area on the market for $599– 1 frame, 2.5 stories and the other brick, otherwise just like this. They may not be as nice on the inside, but maybe they are. Plus they are in a desireable school area.

They seem to have picked the median listing price–using redfin, in an area b/t ~Belmont and ~Foster, River to Lake, there are 101 nulti-units listed for $650k or less and 108 for $650k or more. Looked like there were a couple of duplicates.

$540k, as Bob suggested, would probably get it sold. 7-foot ceilings in the basement is a negative, tho, if they mean 7′ from floor to joists, as many of the two-flats in NC/LS have closer to 8-foot clearance w/o any excavation (ie, usable rec room space w/o excavation–I think 7-feet is too little).

Bob, you long ago proved you don’t have much to add of substance to these debates – I really don’t know why you’re here.

My friends aren’t, by any stretch, all yuppies. Some qualify, but many more are artists, musicians, etc. Lincoln Square has an Old World feel to it that LP can’t touch –

Apparently some people need this beaten in their head repeatedly, so here goes:

Not everyone views buying a home strictly in investment terms.

Lincoln Square is quite accessible – there’s a Metra stop, a Brown Line stop, but more importantly, you can walk to almost anything. There’s night life, day life, and everything in between. We would have moved to Lincoln Square when we were looking, but it was out of our range as it had just been “discovered”.

methinks you guys don’t understand the premium greystones command, but we’ll see – the market will speak!

“The location is terribly inconvenient to getting just about anywhere.”

?? No, it isn’t. Anywhere you go, maybe. Not anywhere I go. Nor my neighbors.

Is it as conenient to the Loop as Old Town? Of course not. But terribly inconvenient to (just about! great weasel-phrase) anywhere? Be serious.

I love Lincoln Square. We rented there many years ago. There are a couple good schools (parochial and public) and lots of great restaurants and shops within walking distance. There is Sulzer Library, Old Town School of Folk Music and a great park at Lincoln and Montrose. There are concerts, festivals and a farmer’s market. Commuting was never a problem, but back then I didn’t drive. If you do, I could see that distance from an expressway is an issue.

I think the ideal owner for this property is someone who wants to live in Lincoln Square but doesn’t have the money for a SFH. So the upstairs tenant subsidizes the mortgage (don’t forget all the tax breaks you get when you live in a two-flat you own) and perhaps the owner can duplex down to the basement.

Our $45k earning but $360k condo spending paralegal lived in Lincoln Sq.

“Our $45k earning but $360k condo spending paralegal”

You were making an assumption about what she made. And not necessarily a good one. She still made a dumb purchase and paid the price, but you have no more idea of what she actually made that I do of what you make.

If I was the owner of a two flat i’d live upstairs… I wouldn’t want to hear my tenants stomping around above my head!

“Commuting was never a problem, but back then I didn’t drive. If you do, I could see that distance from an expressway is an issue.”

It’s 4-10 minutes, depending on the time of morning, from LSD on Lawrence or Wilson. It’s ~1/2 mile to Metra. If you work DT it’s easy. If you drive to DuPage for work, you’d be nuts, but East (aka “Prime”) LP or LV wouldn’t be meaningfully better.

My $45k assumption is completely reasonable within a range of +/- $8,000. Could I be wrong? Maybe, but in life we make estimates everyday, sometimes we’re wrong but then we change our estimates to conform with the evidence we have.

“Bob, you long ago proved you don’t have much to add of substance to these debates – I really don’t know why you’re here.”

I’m here to throw bricks at your glass house, skeptic. You’re not going to slip by trying to pretend this place is worth two thirds of a million dollars based on some ‘hipness’ factor or ‘old world feel’/’german heritage’.

I add nothing? Well I certainly don’t add unjustified cheerleading based on hipness. We’ll judge whose opinions on here are more valid based on whether this property gets ‘snapped up’, or rather languishes on the market for a lengthy time until it sells for 540k or less.

‘Snapped up!’ is one of my favorite bubble phrases.

“Not everyone views buying a home strictly in investment terms.”

True. But if people are buying two-flats not for investment terms I think we’re in a heap of trouble. Hey you can claim you “own” and subsidize the rent payments of your tenant! You’ll both live under the same roof in an area with a similar square footage yet you’ll definitely pay more for the pleasure of owning and being a landlord.

Pay more and get to deal with the hassle of being a landlord? Where do I sign up? lol

“My $45k assumption is completely reasonable within a range of +/- $8,000.”

Yes, and so would be an assumption of $65k. For both the paralegel and you. You’ll be insulted, or think I’m an asshat, but making assumptions about the assets and incomes of people one does not know will lead to insults, asshattery or both more often than not. And I’m just pointing out that I think you’re being an asshat with your repetition of “$45k paralegal”.

Look anon(tfo) she had a $310k mortgage with a $50k downpayment on her $360k condo. If she’s making anything less than $100k per year as a 24 year old paralegal …. either she’s the best damn 24 year old paralegal east of the Mississippi or I’m in the wrong damn profession. Yes, paralegals can make $100k a year at the biggest firms with lots of over time and many years of experience. But I highly highly doubt that was our 24 year old paralegal.

Bob, you nailed it on the head. People don’t go into these things with logic, they go into it with the romantic notion of being a landlord and getting extra rent money from a tenant without any real appreciation for the work and money involved. This notion is so ingrained into our collective psyche I don’t think it will ever change.

“#Bob on June 4th, 2009 at 9:20 am

“Not everyone views buying a home strictly in investment terms.”

True. But if people are buying two-flats not for investment terms I think we’re in a heap of trouble. Hey you can claim you “own” and subsidize the rent payments of your tenant! You’ll both live under the same roof in an area with a similar square footage yet you’ll definitely pay more for the pleasure of owning and being a landlord.

Pay more and get to deal with the hassle of being a landlord? Where do I sign up? lol”

Lets not forget she was a serial flipper. I seem to recall she got her downpayment for her second property from her first successful flip. Instant 50k award to a 24yr old paralegal who watched HGTV, this was the bubble.

Lincoln square is a great neighborhood. Its a quick run to the hwy, its highly walkable, there are great restraunts from divy places to fancy places, there is the old town, the library, lots of borwn line L stops, the metra and its got a good mix of families and younger folks

It also has one of the best holidays ever, the “do what we say day” started by German immigrants in 1945

Someone will by this and think they are getting subsidized rent, and probably think its a good idea since compared to what Lincoln Square prices were over the last 2 years it looks like a good deal

also as an invetment property it does not make sense, assuming 1500 per unit at ask you would loose around 3K a year once you figure in the costs of being a landlord

649K @ 25% down, 5.5%

“Not everyone views buying a home strictly in investment terms”

This is precisely the problem. Most people don’t even know how to look at a home in investment terms. So they rely on some agent to tell them that the most recent comps (which of course were from 2006) were around 650,000 and that 625,000 is a steal. Meanwhile, they’d have to buy it at 400,000 to make sense from an investment standpoint.

I’m with Skeptic- Lincoln Square is a great neighborhood. Very family friendly & convenient w/public trans.

Is it $650K good? I think so. If I had the cash/income to convert this place to a SFH, I’d be all over this place. Non-updated finishes and all.

this nails it:

“I think the ideal owner for this property is someone who wants to live in Lincoln Square but doesn’t have the money for a SFH. So the upstairs tenant subsidizes the mortgage (don’t forget all the tax breaks you get when you live in a two-flat you own) and perhaps the owner can duplex down to the basement.”

sorry Bob, you are just dead wrong. you clearly aren’t that familiar with the area, or the people who have been moving there. you mistake my assessment with cheerleading – I have no dog in this fight, just a lot of friends my age (mid 30s) who moved there in the past 10 years, as well as a lot of people my parents’ age who still live there.

“This is precisely the problem.”

No, it’s the people who have been viewing SHELTER and community in strictly economic terms like you that are the problem.

People looking for a place to live aren’t who messed up the housing market and economy – it was deadbeat speculators looking for an easy buck.

I have no doubt that’s the ideal owner; now let’s get to a point where the numbers make sense for someone to actually do this. Because at anything more than $300k or so it’s not really worth it.

“skeptic on June 4th, 2009 at 10:18 am

this nails it:

“I think the ideal owner for this property is someone who wants to live in Lincoln Square but doesn’t have the money for a SFH. So the upstairs tenant subsidizes the mortgage (don’t forget all the tax breaks you get when you live in a two-flat you own) and perhaps the owner can duplex down to the basement.””

“Meanwhile, they’d have to buy it at 400,000 to make sense from an investment standpoint.”

This has been the problem with 2-3 flat investments for along time. The last time I looked at one was 2001 and of course it didn’t cash flow. The listing broker responded to me that he didn’t even remember when these properties sold on cap rate fundamentals (i.e. positive cash flow after debt service).

Does anyone remember when the last time was that these properties (2-3 flats) sold for positive cash flow???

I think it may have been in the 1980’s when you could buy them for $199K and under. Recall also that interest rates were double what they are today. Interest rate increases could kill some leveraged landlords in the future.

The ‘passive homeinvestor’, those home owners with exotic financing hoping to sell or refinance or flip within 3 to 5 years, they are equally as responsible for messing up the housing market and economy.

“People looking for a place to live aren’t who messed up the housing market and economy – it was deadbeat speculators looking for an easy buck.”

“at anything more than $300k or so it’s not really worth it.”

Don’t be absurd.

$650k is way too much, but $1400/month in rent is “worth” over $200k at a conservative cap rate. The occupancy of the owner’s unit with exclusive use of the basement and tax bennies is worth slightly more, again conservatively.

$400k would be totally “worth it” and $450-480 totally plausible, assuming that the mecahnicals and brick are updated as stated and/or implied.

I’m not a mindless real estate booster, but $300K for this place is insane. If prices ever drop that low for two-flats in Lincoln Square, I’ll buy two.

Reconsidering…Of course, if prices ever drop that low, things will probably be so screwed up nationally that I’ll be digging moss out of sidewalk cracks to eat.

People always say this yet prices in CA, AZ, FL and NV have retreated farther than anyone ever imagined and I guarantee you that no one is eating moss out of sidewalks to eat.

“Reconsidering…Of course, if prices ever drop that low, things will probably be so screwed up nationally that I’ll be digging moss out of sidewalk cracks to eat.”

“The ‘passive homeinvestor’, those home owners with exotic financing hoping to sell or refinance or flip within 3 to 5 years, they are equally as responsible for messing up the housing market and economy.”

No, they followed the rules that were set for them. This is like blaming people who get food poisoning instead of the restaurant that served the food.

Don’t hate the player, hate the game – specifically, the guy who makes the rules that the game is played by.

C’mon, that’s disingenous. Skeptic has spelled out why this property would be worth $400-500K. Chicago is a bubble market but CA, AZ, FL and NV/Las Vegas were bubblier.

A $240K mortgage at current interest rates is $1200 a month. Rental rates would have to drop by 50 or more percent to say that this place can only be cash positive at $300K.

” prices in CA, AZ, FL and NV have retreated farther than anyone ever imagined”

You lack imagination. Or breadth of reading about other’s imaginations. No significant piece of the market in any of the sand states has dropped meaningfully below inflation-adjusted trend. I can certainly imagine house prices dropping *further* in CA, FL, NV and AZ.

“Farther than anyone imagined” might apply to parts of Michigan and Ohio, but $75k 1300 sqft 3/2 houses in exurban Phoenix or Vegas or BFE Riverside County are what they should be worth, given the ridiculous over-supply and local wages.

The 2001 purchaser put LESS THAN 5% DOWN using exotic financing with a 1st and a 2nd (80/15). DO YOU THINK THAT HAD ANYTHING TO DO WITH THE $417k PRICE? And now you all think it’s worth $450k or more? Oh wow this bubble mentality is a real bitch to kick. I doubt it even cash flows at $417, he might just be breaking even. $396k mortgage at 5% (very conservative given the second mortgage) is $2,125 + $600 per month taxes plus say insurance of $100 is $2,800 mortgage. Assuming both units occupied 24/7 at $1,400 a month he breaks even and then gets a slight tax break above and beyond the standard deduction. SO maybe he’s ‘saving’ or ‘making’ however you want to look at it, a couple of hundred bucks a month, tops. Hardly worth it. This seller is counting on appreciation to make him rich.

Based upon my 1999 nominal price retreat theory and the need for at least 10% or 20% down this is headed back into the $300’s. No appreciation for you, seller.

“say that this place can only be cash positive at $300K”

HD isn’t saying that, he’s saying that merely CFP is not enough for it to be “really worth it”. Although CFP + 30 years = free and clear ownership basically tax free. So CFP is a good deal, provided you can avoid focusing on the potential negatives of being a landlord (which some here cannot avoid).

HD’s just pimpin’ his RE book, which is (essentially) future vulture investing.

Nobody is going to give you 5% interest rate for an investment two-flat. Maybe 5% for an owner occupied multi-unit but then as Bob pointed out you’re paying substantially more than your renter for pretty much the same unit and you’re counting solely on appreciation to make your money.

” then as Bob pointed out you’re paying substantially more than your renter for pretty much the same unit ”

Only if you insist on a turnkey residence. Yeah, yeah, you need to put $$ into it, but if you have no interest in doing that, I **REALLY** suggest that you never buy. There’s nothing wrong with renting your whole life (no matter what you think HD, or what anyone else sez).

Taxes are an extra $600 a month…Insurance? Maintenance? I suppose if you took depreciation on the real estate you could get some tax savings but that’s about it, it’s not worth it for a couple of hundred bucks a month tops. It’s a myth that you’ll do well owning, living and renting out a two flat; at least that has been a myth for a while with the bubble prices. Lower the price enough to make it ‘worth it’ i.e. more than $300 or $400 bucks a month and then I’ll do this scenario. Ownership after 30 years? Now maybe we’re talking provided the neighborhood doesn’t go downhill. But I don’t want to be an old man with a run down two flat on the northside

“A $240K mortgage at current interest rates is $1200 a month. Rental rates would have to drop by 50 or more percent to say that this place can only be cash positive at $300K.”

homedelete,

Maybe the 2001 purchaser had the cash to cover it but rather wanted a large mortgage for the tax deduction (lol) and the german american heritage experience?

LOL! Mid-30 somethings talking about its worth 650k based on nothing other than qualitative factors like community and all their friends live there– I have a real estate get rich qwik seminar to sell you.

Thats the problem with real estate “comps”. A financially unsophisticated person, for simplicity’s sake lets call them a monkey, sees a comp set by another person and deems that is the underlying value for an asset because someone else paid it. So the monkey looks around and figures its a good deal.

And given monkey’s aren’t good savers (generally people who aren’t good at ascertaining the economic value of something don’t have savings–imagine that) the government assists them with their shrewd economic decision by allowing them ownership with 3.5% down.

I’ll buy, don’t worry, just not at these prices. Let some other fool part with his money. My household makes a decent buck and I should be able to afford something halfway decent but every time I crunch the numbers with properties on this site it makes so much better sense to rent. The problem isn’t me, the problem is the market, and it has been for a long time, and I’m not the only crazy person who thinks this.

you guys are bizarre. most people look at their incomes, decide how much of that they are willing to dedicate to a housing payment, and go from there.

that’s what dictates the price of housing, not cash flow.

the problem right now is so many people are UNEMPLOYED, not that a greystone is overpriced at this amount or that amount.

man, some of you are gonna have a tough time with the next economic boom cycle.

“It’s a myth that you’ll do well owning, living and renting out a two flat”

Not necessarily. As I stated in less ‘hip’ hoods, but still safe, residential neighborhoods nonetheless, you can get two flat foreclosures now for 130-180k (need some work but def. under 50k), or non-foreclosed two-flats for 220-300k.

Its all about the price you pay. You make money in real estate when you buy, as someone stated on this board before. Let the Skeptics learn a hard lesson about economics from paying 300% more for a greystone and a ‘hip’ hood.

*Oh and I have nothing against LS I always enjoy it the few times I manage to get up there.

I personally know plenty of clients who own multiple properties and the only ones who make any money bought years and years ago so they have low costs basis. Virtually client who bought any rental in the last 8 or 9 years loses money or just breaks even. Being a landlord for the sake of a couple of extra grand a year (if you’re lucky!) just isn’t worth it, especially in this environment where you cannot count on appreciation. You don’t need cajones to be an investor, you just need a pencil, paper and some basic understanding of costs involved. But bob I’m so pessimistic there are so many uninformed people who think these things and get caught up in the fold, low and behold when you talk to them they all say “I’m losing money on the deal” of course you are numbnuts

I’ve been watching real estate and gentrification/speculation issues since I was 12, I grew up in Lakeview, and my parents did very, very well with the “live in one unit, rent out the second” model.

the only lesson that counts is don’t overextend yourself based on optimistic projections (ie, don’t assume your income is going to rise at x% for the next 10 years, etc). I could care less what my house is worth on paper right now, I don’t want to sell it, and the payments shrink every year in real terms as inflation eats into them.

and during the bubble people decided it was ok to spend 45% of their income on housing because they could just flip or sell after 5 years. All it took was one moron with 95% financing to bid a price that made no sense and it sets the comps for everyone.

“#skeptic on June 4th, 2009 at 10:56 am

you guys are bizarre. most people look at their incomes, decide how much of that they are willing to dedicate to a housing payment, and go from there.

that’s what dictates the price of housing, not cash flow.

the problem right now is so many people are UNEMPLOYED, not that a greystone is overpriced at this amount or that amount.

man, some of you are gonna have a tough time with the next economic boom cycle.”

I’m sure they did; did they buy their two-flat post-2001? I didn’t think so. Two flats used to work that’s why there are so damn many of them. But economically speaking you have to go into an off neibhrhood to get that to work, but who wants to live in Dunning?

“skeptic on June 4th, 2009 at 11:01 am

I’ve been watching real estate and gentrification/speculation issues since I was 12, I grew up in Lakeview, and my parents did very, very well with the “live in one unit, rent out the second” model.

the only lesson that counts is don’t overextend yourself based on optimistic projections (ie, don’t assume your income is going to rise at x% for the next 10 years, etc). I could care less what my house is worth on paper right now, I don’t want to sell it, and the payments shrink every year in real terms as inflation eats into them.”

Isn’t this priced high based on the fact you likely couldn’t sell the individual units as condos at 1/2 the ask ($324,500 each)?

G what do you think of the ’01 selling price? 95% financing?

if someone bought after 01, but ISN’T MOVING for a long time, this is all moot, that’s my point.

a two-flat gives a long-term way to buffer yourself against property tax increases, that has been a far more disruptive force for long-term city residents in terms of housing than any bubble.

as to how much of the market that describes, well, who the hell really knows. but there is a constant theme here that the flippers are the majority of the market, which is I think is pretty melodramatic.

“Isn’t this priced high based on the fact you likely couldn’t sell the individual units as condos at 1/2 the ask ($324,500 each)?”

And $300k is too low. Because you *could* sell the individual units for more than $150k.

“the ‘01 selling price”

Yeah, that price baked in some speculation, but it was also what anything remotely like it was selling for then–if you wanted a northside 2-flat, south of Foster, you paid $400k or you are still waiting (tho there are a couple on Addison that $417k might getr you now–not as nice as this one). It would have a buyer in minutes at $417k now. At $300k right now, I’d take 4 of them, without hesitation. 10, if I has WL’s access to capital.

“there is a constant theme here that the flippers are the majority of the market, which is I think is pretty melodramatic.”

I agree with you on this. I think they are a convenient straw man to rail against. The reality is the non-owner occupants likely played a marginal role in pushing up valuations, however in real estate given the prevailing comp method of determining valuations those at the margins tend to set the prices.

A far bigger cause of the bubble I believe were these low downpayment loans. No way should that 2001 purchaser should’ve been able to buy this property with 5% down. THAT is the root problem.

95% financing at purchse, there are multiple names on the deed which normally indicates investors but it has had a homeowner’s exemption each year.

Lots of refis with two mortgages still not released:

5/10/04 $409,500 mort with MERS

7/8/05 $117,700 mort with JPMorgan Chase Bk

While two-flats are a hard-sell these days –for all the reasons everyone has mentioned above– Lincoln Square is still a great neighborhood and prices on two and three-flats there have been around the asking price of this place. I would love to buy one in that neighborhood – it is perfect for the way we want to live. I am looking to by a 2 or 3-flat with a friend of mine. We are looking for 3brms and/or the ability to duplex a unit for my little family. My friend wants the top unit, we’ll take the rest. However, we can’t find a decent building (read: needs only some work) under 400K in Lincoln Square, Lakeview, Bucktown, Wicker park, heck, even Ukrainian Village (which we love!) We like Portage Park and Irving Park alot.. but most areas are a little too removed from public transpo and city life for us (we bike and ride public transpo). We’re committed city-dwellers who like urban living. Most of our options are short-sales and foreclosures which means the price has to be low so we can afford to fix it up. Those that don’t need fixing up, are 450k and above.. mostly 500k and above.. which is more than we are willing to pay.

“a two-flat gives a long-term way to buffer yourself against property tax increases, that has been a far more disruptive force for long-term city residents in terms of housing than any bubble.”

Because those property tax increases didn’t have anything to do with the valuation increases due to the bubble?

$527,000 in refi’s on a $417k purchase….Looks like these guys already spent their appreciation.

“The reality is the non-owner occupants likely played a marginal role in pushing up valuations”

In many, many northside sub-areas, one big component was developers–they drove the price of true teardowns (and two-flats–for conversion to SFHs) up (bidding against each other and also buying out those who weren’t actually looking to sell), which drove up the price of basic cottages, driving up the price of everything better, to levels based on the lot being “worth” way more than it really was.

If the rats’ nest next door sold for $400k, how can the liveable 3/1 cottage not be “worth” $425k? (by being in the shadow of a 50′ tall condo building, of course–but that often wasn’t thought thru in advance). Especially when the 3/2 simplex condo in the middle was being marketd for $399k.

“Lots of refis with two mortgages still not released:

5/10/04 $409,500 mort with MERS

7/8/05 $117,700 mort with JPMorgan Chase Bk”

So, mid-05 appraisal probably at $558,500.

Assuming that the $117,700 is fully drawn is not a good assumption. Even Bob recognizes the wisdom of a free LOC as a cheap emergency fund.

Of 29 2-flats currently listed in Lincoln Square, only 4 are priced higher than this.

There have been 7 closings for 2-flats in 2009, only one of which sold for more than this ($575,000). 3 of the sales were foreclosures and one was a short sale.

Anything near the ask on this would be knife-catching in the extreme – entire limbs, not just fingers.

“Because those property tax increases didn’t have anything to do with the valuation increases due to the bubble?”

G–honest question–if valuations had not gone up, would mill rates have still stayed flat (or, in some cases, decreased)? Weren’t increases in P-Tax bills just a question of re-allocation? It’s not like the city, county, etc. would have decreased spending if there hadn’t been an increase in valuations.

Bob,

Investors and speculators were and still are a major cause of the bubble. The vast majority of foreclosures are investors and speculators – greater than 50%. This is why our buddy Tom Dart wanted that foreclosure moratorium because he was evicting tenants in most cases, not home owners. Not to mention outright fraud.

The problem with the speculation was exacerbated by a combination of other factors, namely occupancy fraud – a la American Invsco buyers. Stated income products and low down payments.

Banks egged on by Wall Street lost all common sense in what started out as an innocent loosening of guidelines to help QUALIFIED borrowers morphed into just giving money to anyone.

5% and zero down is fine for primary residences and when borrowers can fully document stable job histories, good credit, and decent savings. VA and FHA have been doing it for years without problems.

However, when banks started doing 5% down INVESTMENT loans and NINJA loans to people with mediocre credit and job histories all hell broke loose.

We are now paying for it dearly because banks have gone from lending to just anyone to hardly lending at all which also can have a negative effect. There is a happy medium.

I’d put the odds of the $117k 2nd HELOC being fully drawn are better than 50/50. The typical situation in ’05 was tax-free 100% cash out refi, then buy a nice new SUV.

Oh yeah, that $575,000 sale (4907 N Talman) was on a 35-foot lot and included a garden apartment, brick garage and renovations. Further research indicates it was also a short sale.

So, without researching further, 5 of the last 7 2-flat sales in LS were foreclosures/short sales.

“Because those property tax increases didn’t have anything to do with the valuation increases due to the bubble?”

they absolutely, unequivocally did not, at least in the macro sense.

the City & County’s tax levy is fixed by those bodies, then distributed. They are getting their pound of flesh regardless of the housing market.

Now what the valuation increases DID do was probably shift the tax burden around in some odd, more development-driven patterns. But I haven’t seen any real studies on this one way or the other.

If assessments stayed flat, taxes would only increase with the levy. It would be safe to assume that the best case in that scenario would be taxes increasing with inflation on the cost of services (as long as no new services added.)

However, the bubble allowed spending to run amok due to the old canard that “sure your taxes went up x%, but your value went up x+y% so whaddayacomplaininfor?”

In other words, if taxpayers weren’t so blinded by their unearned “wealth” due to appreciation, they would have been much more alert to actual spending (levy) increases. Now that the spending increases are in, all we will hear from the PTB is how the levy can’t be cut without “life ending as we know it.”

“So, without researching further, 5 of the last 7 2-flat sales in LS were foreclosures/short sales.”

Not surprising, really. Who other than the distressed and overextended are going to choose to sell in this market?

and what anon said!

“A far bigger cause of the bubble I believe were these low downpayment loans. No way should that 2001 purchaser should’ve been able to buy this property with 5% down. THAT is the root problem.”

I think that is clearly part of the root, but the bigger picture is still housing cost relative to income.

The problem is how all of this is interrelated – loads of people were supporting jobs by either refinancing to get a new kitchen (or turkeys buying consumer goods), or construction workers for new homes, etc.

At the end of the day, Greenspan may end up being viewed as the dumbest guy ever in charge of the Fed, not the Einstein everyone thought he was. He is the one constant (and massive) element that goes across different presidential administrations, you know?

“Now what the valuation increases DID do was probably shift the tax burden around in some odd, more development-driven patterns. But I haven’t seen any real studies on this one way or the other.’

Do a sales ratio study of assessments and you will see that the tax burden was shifted, but away from rapidly appreciating areas to less appreciating areas. In other words, areas that saw more appreciation ended up with lower assessed MV to sales price ratios than areas that were not appreciating as rapidly (or barely at all.)

G, don’t forget what was driving the levy increases – TIFs.

G, you have this study? Lord knows I’m not going to do one, it’s ancient history at this point.

“not the Einstein everyone thought he was”

Nope, not me. The correction should have started in the 2nd quarter of 2001. It was obvious, even then, that Greenspan’s priming of the credit pump was not going to end well.

“No, it’s the people who have been viewing SHELTER and community in strictly economic terms like you that are the problem.”

I find this funny…It was my “viewing SHELTER and community in strict economic terms” that prevented me from buying in the bubble. This is why unlike 95% of the people out there, I have a strong balance sheet and am now well-positioned to buy. Why haven’t I bought yet? Because it still doesn’t make economic sense. Prices have a ways to go on the downside…especially properties priced at over 500K.

“if taxpayers weren’t so blinded by their unearned “wealth” due to appreciation, they would have been much more alert to actual spending (levy) increases.”

You give the taxpayers of Cook County ******FAR****** too much credit. These are the jokers who elected Todd Stroger; no chance they would have exerted any collective political will to keep levies down.

hold on Bettieshoe, a year ago prices for 2 flats were around 700k in LS, by year end they will be aorund 500K, by next spring probably around 400K

There are a reason why the cost of these buildings increased with the inflation rate for what, a 100 years or so

“The correction should have started in the 2nd quarter of 2001.”

That may be a little early, given that capital needed to chase something post-internet-bubble. Unless you mean “should” for longterm economic health, rather than “should” as in “would have, in the absence of G’span’s rate cutting frenzy”.

“In other words, if taxpayers weren’t so blinded by their unearned “wealth” due to appreciation, they would have been much more alert to actual spending (levy) increases. Now that the spending increases are in, all we will hear from the PTB is how the levy can’t be cut without “life ending as we know it.””

Exactly. The taxpayers are doubly fawked. Because once government spending and taxes go up, they very rarely go back down. Theres absolutely no incentive from anyone in government to do so. In places where there is competition among the political parties for elected office it is rare enough. In Cook County it is a near impossibility.

At the end of the day I can’t hate it _too much_: the tax doesn’t affect me and those paying it deserve it for being so content with their phantom appreciation.

“Unless you mean “should” for longterm economic health, rather than “should” as in “would have, in the absence of G’span’s rate cutting frenzy”.”

anon, Not mutually exclusive choices, in my eyes. I mean, aren’t we seeing now that the “capital” you refer to was actually borrowed?

“This is why unlike 95% of the people out there, I have a strong balance sheet and am now well-positioned to buy”

that’s the melodrama I’m a-talkin’ about!

hey, I’m as glad to see housing returning to the realms of normalcy as anyone, but I’m also not too keen on abandoned homes, foreclosures, etc.

the fact is that real estate prices in Chicago have always been speculative – that’s how the City started, one large lot got subdivided, etc.

so I have hard time assessing what a house is really worth, when divorced from the actual physical value of the building – obviously land has intrinsic value, but how do you value a 100 year old building like this? How much would it cost you to build this house, today?

I’d argue you can’t even do it, at least not to the level of craftsmenship and materials that these old greystones usually have. back when these buildings were built, it was customary to spend some 15%+ extra just for decorative work, like the stone facing.

Where would you even get that stone for a similar facade, for new construction? The aggregate crap they use on new construction is a joke compared to that, it’s limestone quarried from Joliet (or thereabouts), right?

“aren’t we seeing now that the “capital” you refer to was actually borrowed?”

Answer not clear; ask again later, sez my 8-Ball.

But seriously, there’s some divergence b/t the two and there is no doubt that–whatever else was going on–rate cuts were going to happen after 9/11.

I look at three things that happened later–(1) continuation of low rates for ’04 electoral purposes; (2) “relief” for I-Banks from cap ratio requirements to compete with Hedge Fund comp; (3) OCC ruling that National Banks were exmept from Georgia mortgage lending law–that pushed a larger-than-normal-cycle RE bubble into the stratosphere.

Another exacerbating issue was the unquestioning acceptance of mezz financing for developers and consumers at rates completely detached from risk, but this crept in more gradually. If all mezz lending had been at the prices I’ve seen on some (LIBOR + 900 or more), then there would have been a lot less of it and fewer absurdities.

No argument from me, anon. I think we are kind of saying the same thing anyway. The initial push to artificially low rates is what got artificially high prices rolling. Everything that was allowed to happen after was just a way to keep ’em rolling.

Friends have a 3-flat in Edgewater, occupying one unit and renting remaining two at $1200/unit for large “two-bedrm/one bath plus den” apartments. RE taxes have increased significantly, heating gas costs are very high, and building repairs frequently needed, so despite what appears to be a substantial rent income it all goes into building operation budget. (Old buildings, with no insulation whatsoever are true energy hogs.) In return, they live at a subsidized cost, but at the penalty of frequent tenant-related issues, relative lack of privacy, no backyard, and a three-story climb home every night.

Many of these older apartment buildings need a gut renovation, to replace building systems long past their effective useful life. Some still have live gas-lighting piping in walls, knob electrical conduit w/fraying insulation, rusting plumbing pipes, asbestos, drafty windows and exterior doors, carpeting from the fifties in the hallways, hot-water boilers requiring constant monitoring, etc. Having renovated one rundown Edgewater three-flat in my life to an “owner-occupied unit with two rental units” myself, don’t want to face that task ever again.

Being an on-premises landlord is somewhat like being a kindergarden teacher, you need to be a friendly but firm monitor of all building activity and you find your tenants acting up far more frequently than their relative adult age would suggest.

This two flat is in a very nice location, but it is not worth 650k. I think an owner occupant will buy it for @ 480-520k range. This two flat does not make sense as a pure ‘investment’, few two flats do make sense as an investment these days.

It also doesn’t make sense as a conversion to SFH. You want the most derelict two flat on the best block to convert to a SFH. You need to replace all of the systems and reconfigure the floor plan anyway, so why pay the premium for a building that is already in move-in condition?

Two flats in nice hoods in Chicago are somewhere in between investment and the emotional SFH purchase for buyers.

good points above, but I’d just add that as someone who knows friends converting a brownstone 2 flat to a SFH right now, there are a few other things to consider –

1, you can take the rent as long as you need it, then, as your incomes rise, you can at some point make the decision you want the space more than you need the rent.

2, at that point, you can take your time and do the work on your terms.

this isn’t for everyone, but we’ll be the doing same thing in the next few years, it’s more common than people might think.

“1, you can take the rent as long as you need it, then, as your incomes rise, you can at some point make the decision you want the space more than you need the rent.

2, at that point, you can take your time and do the work on your terms.

this isn’t for everyone, but we’ll be the doing same thing in the next few years, it’s more common than people might think.”

Agree totally. And still, you’d agree that this particular 2-flat, in its location, is somewhat overpriced at $650k, no?

skeptic,

Just curious, what neighborhoods and price ranges are you and your friends buying two-flats in?

Sold for 580k in Oct 2009

The ownrs are now gut rehabbing the home and converting to a single family.

http://chicagorealestatelocal.blogspot.com/2010/11/construction-alert-greystone-gut-rehab.html