The Ultimate Church Unit: 1638 W. Superior in Ukranian Village

If you love unique properties then this duplex at 1638 W. Superior in the Ukranian Village is for you.

Yes, we’ve chattered about this 1880s church several times before (see our prior discussion about another unit that went into foreclosure here.)

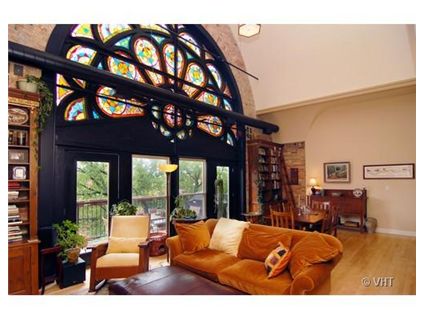

But who doesn’t love that 14×15 stained glass? There is nothing else like it on the market.

It has 20 foot ceilings, two full slate baths and the kitchen has updated granite countertops and stainless steel appliances.

The second bedroom is also fully enclosed and also has church features.

Greg Vollan at @Properties has the listing. See more pictures and a virtual tour here.

Unit #9: 2 bedrooms, 2 baths, 2 parking spaces, no square footage listed

- Sold in September 1999 for $314,000

- Sold in September 2006 for $449,000

- Originally listed in June 2009 for $499,900

- Reduced

- Currently listed for $479,900 (2 parking spaces included)

- Assessments of $404 a month

- Taxes of $5559

- Central Air

- In unit washer/dryer

- Duplex

- Bedroom #1: 17×16

- Bedroom #2: 13×12

- Living room: 30×16

- Kitchen: 12×10

Unless this was renovated, why do people still think they can ask more than peak bubble prices???????? I realize this property is unique but don’t these sellers watch the freakin news?

I really like this place and don’t think it’s WAY overpriced. I like the tile inset in the kitchen (I have wood floors and think this would be nice to do). The fact that the master bedroom isn’t closed off could be a problem, but not everyone minds that (I do).

We went and saw the bank owned property that eventually sold. It was very spacious but really a 1+den and it needed about 80k of work (in our opinion) and the neighborhood was not very desireable to us due to lack of easy public transit to the loop. This unit is in much better shape and really cool, but obviously way out of our price range. I’d imagine it sells since the bank owned property in far far worse condition sold for like 330k.

400k

Take the Chicago bus to the Blue line or the Ashland bus to the Green line. If you use bus tracker, you’ll be in the loop in 20 minutes.

No thanks jd… I’ve done the bus to train commute before and I hated it. Transfers are awful.

From here to the Blue Line is about a 15 min walk. which I would not mind at all during nicer weather.

Love bustracker. In the old days I would try hard to be by the El but with bustracker it is a little less important now. I use it all the time.

agree with sonies, transfers blow.

Cool looking place. I like it.

i used to live 3 blocks away, i could make it to green line stop in 10 min. It did suck in the snow though, because Ashland sidewalks were never plowed

I always wondered what those looked like inside. It’s about a 7 block, that’s 7/8 mile to the Chicago Blue Line. Not as bad of a walk in good weather and Chicago Ave has a lot of new restaurants and shops; much more than when I lived over there 5 years ago.

The kitchen/living/dining combo doesn’t seem all that spacious on the 360 deg virtual tour. It’s a neat place though, and it has two parking spots and a balcony.

Walking 7 blocks through the snow in a suit totally sucks. Must either take bus or live near train.

i Agree with bluesteak that kit/dinning/living looks a tad tight.

i love the uniqueness of this place, beautiful, all that stained glass, oh so nice.

i dont like the lofted bedroom. i rented with some friends a three bedroom with one of the bedrooms lofted, and thought it was cool so i took that room. Well you can hear every thing and for some reason i could hear the tv louder that some one on the couch in front of it

I personally couldnt live in a church, just gives me the willies!!!!!!

but oh that stained glass, just love it

I used to own a similar type of unit in an old catholic high school. In it, both of the bedroom’s were lofted. Instead of being simply open to the first floor though, there were windows which opened and closed. It was done properly (including adequate ventilation/HVAC) and worked very well. It would be a little work, but it could probably be done in this unit as well.

Doesn’t compare the stained glass in unit 10 (the foreclosure one), which is twice the size and doesn’t have the ductwork running in front of it.

The dark stain on the wood in this one makes the glass colors pop even more, though, and it’s cool to have the balcony there, too. truly beautiful.

The duct in the center of the stained glass window hurts. Can that be changed?

You could bend it over the window, but that might look worse and would probably be a fairly expensive fix.

Gorgeous. But I agree with Groove – I couldn’t live in a church, it would just freak me out.

I think its absolutely hilarious the likes of jd, bluestreak and GL would seriously consider a bus/CTA connection/long walk combination to get downtown on a loft that they are asking half a million dollars on.

At the end of the day if I’m dropping a half million on something other than a spacious house, I’m not going to _do_ transfers.

For people that can realistically afford a 500k place (as in no toxic mortgages no financing games), time is money. You hipsters better learn.

Hi! My name is Phil. I’m a Realtor who knows the market very clearly and writes a blog about the state of the market (see website if you want).

I just previewed this property earlier this week for a client who is potentially interested in finding a way to buy it. And I have to agree with the first comment (CC’s) that asked the RIGHT QUESTION:

“Unless this was renovated, why do people still think they can ask more than peak bubble prices???????? I realize this property is unique but don’t these sellers watch the freakin news?”

This unit closed within months of the peak. Based on the Case-Schiller index, this property is worth as little as $383K. I’m convinced it will trade between $400-425K. And if I’m wrong, then the prospective buyer isn’t doing their due diligence, the appraiser is being influenced, or the overly-trusting buyer has an agent who isn’t doing *their* due diligence.

Greg is a good agent and someone who does business consistently. But I agree – this is a unit that is overpriced by at least 10%, and in reality, more like 15%.

““Unless this was renovated, why do people still think they can ask more than peak bubble prices???????? I realize this property is unique but don’t these sellers watch the freakin news?””

Because it was obviously renovated quite extensively, “Phil the Realtor”…

Phil wrote: “I’m convinced it will trade between $400-425K. And if I’m wrong, then the prospective buyer isn’t doing their due diligence, the appraiser is being influenced, or the overly-trusting buyer has an agent who isn’t doing *their* due diligence.”

Interesting perspective, Phil. Not only do you know and somehow have the ability to predict the market, but you also have already concocted a way to justify how your price was correct *even* if the market determines that the unit should sell for higher than you deemed it should. That’s a hell of an ability….and a hell of a statement.

“Because it was obviously renovated quite extensively, “Phil the Realtor”…”

Are you *sure* that the renos were done post-2006?

based on the counters in the kitchen, the kitchen looks original to the 1999 convertion/rehab. Now the appliances could be new, thats anout it.

“Are you *sure* that the renos were done post-2006?”

Based upon what the REO unit looked like, yes. But who knows, I could be full of shit just like the sellers realtor.

“Based upon what the REO unit looked like, yes.”

I agree that the kitchen has been updated since 1999; but assuming that the reno was post-06 is too much for me.

Do the assessments seem high to anyone? I can understand them being slightly higher since its an older building, but I would expect these should be in the $250/month range rather than $400. I suppose heat may be included, which would be a huge value b/c I have to imagine that huge window isn’t very energy efficient!

The REO unit had a far more massive window than that and it was in January during a blizzard we went to see the unit… there was no real cold seepage at all, it was kinda wierd, but it was very well maintained and not leaky at all.

I don’t think Phil’s prediction is that out of whack. Remember the Chicago FHA limit is 410k. Also nice blog Phil.

The only other condo building I’ve seen anything like this is in McKinley park and those lofts are a lot cheaper. Some have complained that not as much vintage was maintained in that development, but you still know at all times inside and out it used to be a church!

Personally I would have no reservations about living in a former church. As a not very religious person I figure it can do nothing but help me out from an ecclesial point of view.

Think of the side business: you could become an ordained minister and charge people from the burbs to come into town and get married there. Get a huge tax break out of it too 😀

lol, that is a good idea. That would make it a CF positive property. Bob here your sign to get off the fence and buy, people will come up with reason to buy like this and price for properties won’t come down as much some think.

We looked at this place in 2006, when it was sold the last time. Doesn’t look like any renovations have been done since then. We also seriously considered the REO unit way before it was REO. This unit is TINY compared to that one. The living/dining room looks cramped because it is! And the second bedroom was small with odd door placements that would have made furniture placement difficult. But the unit overall was nice and it significantly better shape than the REO unit…

Bob, 10 minutes is not a long walk (at least for me). Ashland Greenline stop is 1 stop away from Clinton and 2 from Clark/Lake, thus if you time the train right, you are at Clark/Lake in 15 min(10 walk +5 train), which is faster than getting there from Lincoln Park train station anytime, even if you live on the platform.

Overbearing…strip the black paint and hopefully there is a light wood underneath. Then the glass and architecture will be the hero. Maybe the bedroom would look like something with better decorating.

Agree with above Bob, $500k in this city is nothing, and a 10 minute walk is nothing either. Great building, and great unit. There is nothing wrong with the neighborhood, you guys have to get west of the river more often.

“$500k in this city is nothing”

Whatever the foreclosure closed at probably killed the comp on this thing. I remember it being much more spacious.

500k is a lot of money. There’s a. Great story in the WSJ about homes on the North Shore. Sorry no link.

Not in Turtle’s world 500k and bus rides and transfers go hand in hand. LOL!

“Not in Turtle’s world 500k and bus rides and transfers go hand in hand. LOL!”

Oh Bob, why don’t you just move to the suburbs already if you don’t want to throw down 500k on a place in a marginal hood and take bus transfers to work! LOLOL!

2/2’s used to cost nearly $500k because FB’s believed in the power of real estate, the mythical power of real estate to continuously appreciate and bring untold riches….buy a $450k 2/2 in Wicker Park now, it will be worth $550 in two years time…

the fact that you think that East Village is a marginal hood is hilarious. The average condo in the city goes for $350k, hence why $500k is not too far fetched, but yes, it won’t go for that, probably $100k less.

One reason to live in the city is for the mass transit. Not to drive your SUV 2 miles…round trip mind you…to and from work everyday. I’ll never understand why a family would live anywhere near mass transit, and have 3 cars, makes no sense.

and the unit is 1658 Superior, no?

“the fact that you think that East Village is a marginal hood is hilarious.”

I’ve visited a different unit of this property and wouldn’t feel safe for my wife walking my two pit bulls at night in this particular block. And I know there’s far shadier blocks than this particular one. This area is also in sort of a no man’s land for public transit, hence the talking about bus to train transfers when going to work (LOL) so your SUV arguement is stupid.

All,

I am the listing agent for this property and I have been reading, with interest, the various comments regarding my listing.

It seems that some posts are connecting the pricing of this unit with #10 which sold as an REO in January of this year. To be honest, there are a myriad number of differences between the units. Here are a few:

Some differences include:

1. #10 was a foreclosure sale. The unit was in poor condition. Once the owners could not sell the unit (they listed it for $525,000) and it went through the reposession process, they trashed it. The paint was ruined, the ceiling, the appliances, etc. So, whatever photos viewers are looking at are from previous listings, before the owners had neglected and abused the unit.

2. The bathrooms needed to be redone and it was only a bath and a half and they were ceramic tile & basic. #9 has two full slate baths.

3. The kitchen needed to be redone- basic s/s appliances (which I believe were taken by the owner) with white cabinets and laminate counters. #9 has hickory cabinets, 2 inch thick honed granite counters stainless steel appliances and a butler’s pantry built out by california closets (I believe).

4. The carpets were trashed in #10 (filthy) and the oak floors needed to be redone. #9 had new carpet put in in the master suite and the maple floors were refinished in 2006.

5. It is not a ‘true’ 2 bedroom (the second space classified as a bedroom is in the tower and is small and doesn’t have heat ducts or insulation. #9 has a massive master suite upstairs and an enclosed 2nd bedroom on the main level with two arched windows, exposed brick and a curving ceiling. It also has a large organized closet.

7. Unit 10 only has one parking space- #9 includes two separate parking spaces.

8. #10 had a balcony off og the side, looking toward the city, and over a parking lot. #9 has a huge balcony nestled into the crown of a 60 foot tree- like being in a tree house.

8. The floor plans are fairly different too. #10 was very long side to side, but narrow. It does have a larger stained glass window, but it is 5 steps inside the front door, so it is a little harder to apppreciate. #9 is a more graciously proportioned rectangle possessing near perfect symmetry with the center of the stained glass window providing the center point of the living space. IMHO, a much more livable space, though perhaps a bit less dramatic. According to the association dec. #10 is only 110 sq ft larger than #9 and much of that is nearly inaccessible/ unusable turret space and the long narrow space between the two turrets.

***********

I read a lot of comments on this site about people buying at the peak of the market in 2006 and not being realistic if they price above that number today. I have to ask if anyone out there reasonably assumes that every buyer overpaid on every property or that every home lost value over that time? Of course not and it is irresponsible to say so. If you bought a pre-construction 2nd floor unit in a new construction three flat in 2006, you are probably in trouble today. Developers weren’t making price concessions and you can’t make a simplex on a standard lot unique. Those homes looks like 200 others so the only differentiator is price.

Similarly, quoting the Case Schiller report to define the local market is like trying to understand a river by looking at a bucket of water taken from it.The Case Schiller report gets its data by looking at ONLY SINGLE FAMILY homes and only RESALES and it pulls data from the ENTIRE country to create a generic average. I can promise you that a single family resale in Detroit or Cleveland should not be considered when pricing your duplex up condo in Chicago (or anywhere else for that matter).

Now let’s look at #9 @ 1658 W. Superior. The last time a building like this was built was 121 years ago in 1888. There is not another unit like it in the building or in the city for that matter and, if we back out $30K for two parking spaces, we are priced at $281 a square foot- hardly setting the bar for large top floor duplexes in the area. It is an opportunity for a buyer to own a piece of history that, unlike most other pieces of property cannot be duplicated. It is a beautiful, highly upgraded, well proportioned space and I anticipate it’s uniqueness will protect it from the plight being suffered by homogenous condos elsewhere.

Atypical highlights of my listing include:

*top flr duplex.

*massive original stained glass window.

*20+ ft high barrel vaulted ceiling and original church mill work following those curves.

*2 beautiful built-in book shelf units with a rolling library ladder in the living room.

*kitchen with hickory cabinets, 2 inch thick honed granite counters & s/s appliances.

*2 slate baths.

*fully enclosed guest bedroom with original church details.

*fully painted professionally a few years ago under the direction of an interior designer.

*Maple hardwood floors refinished.

*Most closets and pantry built out and organized.

*Oversized balcony nestled into the crown of a 60 foot tree.

*2 secured parking spots. One covered. Not tandem, so they can be moved independently of each other.

Well, I am going to get off my soap box. I hope this has been worth your time to read and answered (or clarified) some of the questions on this great home.

Sincerely

Greg

I appreciate when owners and agents comment on their own listings on this site, it’s usually interesting and sometimes enlightening. And I certainly agree that the stained glass makes this particular unit stunningly unique (one would obviously reply, however, that it really has no bearing on the CHANGE in value over the last few years, since these features haven’t changed), and the differences between unit 10 and 9 that Greg usefully lists are certainly relevant to their value RELATIVE TO EACH OTHER.

But among a good deal of relevant info, there is a curious comment regarding Case-Shiller. It appears that many people do not realize that there are C-S indexes for individual metropolitan areas, and not only for the entire country. While it is not neighborhood–or even city, since it includes suburbs–specific, it IS the best standard measure of the movement of home prices we currently have for broad metropolitan markets. Second, there is a SEPARATE index specifically for condos, in addition to the one covering SFH. If anyone would like to see the index that covers ONLY CHICAGOLAND CONDOS, it is here: http://www2.standardandpoors.com/portal/site/sp/en/us/page.topic/indices_csmahp/0,0,0,0,0,0,0,0,0,1,5,0,0,0,0,0.html

Finally, it uses only resales because that is the only legitimate, standardized way to measure changes in value (ie, you need two data points for each place). To be sure, there is much individual variation in change in value (by neighborhood, as Steve will point out, and by unit, as Greg suggests may be the case for this one – we shall see).

While there are many legitimate quibbles one might have with C-S, none of the reasons listed here (that it is only pulls nationwide data, that it only covers SFH, that it only covers resales) qualify.

Greg, what kinds of renovations have been done since 2006?

“Case Shiller … pulls data from the ENTIRE country to create a generic average”

I know roma already took care of this, but seriously, do you realize what happens to one’s credibility when one makes such basic factual mistakes about a point of emphasis? It’s not like you couldn’t have looked it up–you were obviously at a computer with internet access when you wrote it, and it’s easily available information.

Greg – thanks for taking the time to comment – it made alot of sense. I think much of the nuance of real estate gets lost in the constant, but uninteresting, repetition on this board of “everything’s overpriced” and “buyers/sellers are knifecatchers/greedy idiots”.

I think the case shiller is a useful but limited tool. I just sold my house for 5% below 2005 level. The buyer was trying to argue that it was worth 20% less than 2005 level based on Case Shiller – but i went through the comps in my neighborhood and my price range, which were basically at 2005 levels. There are so many submarkets within a metro area (location, property type, price range, etc etc etc) that the index can’t make sense for all of them.

“There are so many submarkets within a metro area (location, property type, price range, etc etc etc) that the index can’t make sense for all of them.”

It’s an index, based on a average weighted for a variety of factors. It’s entirely possible for it not to make sense for *ANY* submarket–every single one could be doing better or worse than the average by a statistically significant margin.

The problem is that most Americans are borderline innumerate. That fact doesn’t change the usefulness of the index, it just means that people are misunderstanding what the index actually represents. And then there are those who intentionally misuse it for their benefit. Hard to tell which your buyer was, but he did get you to take 5% less than ’05, so whichever, it worked to his benefit.

I also want to add a shout out to the listing agent for coming on to tell truth about this listing and to clear up a few misconceptions that have been aired. It does take some guts to go in front of the CC firing squad, but usually if the agent is truthful and speaks up (not always the case in the past) about the shortcomings of his place, it does seem to silence the haters on this board who just love to go on and on about a property they have no means or intention of purchasing.

It really is a very beautiful and unique place. I remember touring the other unit that was purchased by an architect. It was one of the first properties I was considering to buy for renovation. Just wondering how that project is coming along…I remember the windows needed to be rebuilt and a few other things needed to be addressed, but overall it would have made a nice home.

Just considering the original use, age of the building and change of ownership of course there are things that need to be updated. What is important in this case is that all facts are being disclosed. The buyer will be a lucky one to have the opportunity to deal with someone who appears to be upfront and honest about their listing. I know one agent/broker who shall remain nameless who should follow this example and be more honest and forthcoming about his listings.

One of the first places that I renovated and lived in for some time was a schoolhouse from the late 1800’s. Even though the individual interior spaces were renovated to rather cutting edge units making them true showcases, the age of the place and the problems it presented was evident and nothing could really be done to correct the problems without losing the original character and detailing.

My unit was one half of a large auditorium on the upper level. No matter how many times the roof was repaired, during rainy season I always had to place buckets throughout the living room. And despite many water pumps being updated, the water pressure was very low to the point of not being able to shower. I stayed on for two years and had no problem whatsoever selling for a drastically inflated price. Looking back I wish I had held onto that schoolhouse apartment…

“they have no means or intention of purchasing.”

Man you can’t stop beating this dead horse. Just sound like a bigger and bigger dickhead yourself everytime you beat this one. So i guess by your own logic you have no right ever commenting on a Renoir or a Monet.

“Sorry I can’t afford it, I will have to keep my opinions about Picasso’s blue period to myself.”

Greg.. I would say BY FAR the majority who bought in ’06 are underwater and almost everyone in Cali, Fla, Zona, and Nevada would be almost certainly underwater.

I can’t believe an agent would identify themselves and then go on to illustrate such little understanding of the CS Index.

It sure isn’t the first time that an agent came on here to lecture us about something they obviously know little about. It just isn’t common anymore for them to identify themselves with such foolishness.

BTW, I don’t see how the CS Index would ever apply to a specific property sale. However, there are innumerate sellers as well as buyers (as if that wasn’t obvious, lol,) so who can blame the buyers for trying?

what are you bitching about ze? with $25k roches scattered about your brazilian palace, you can afford to buy 10 of these churches.

“you can afford to buy 10 of these churches.”

Yeah but chances are knowing Ze he’s smart. Any of the ten churches he purchased wouldn’t require TWO bus rides or a bus AND train ride to get downtown..lol.

The bus has to be the worst form of public transit in Chicago. Know what I think when I’m on the bus to console myself that it could be worse: well I’m on a bus but at least I don’t have to transfer.

Bob, you need to ride the 11 Lincoln bus sometime, its great… typically clean (never goes south of Jackson St.) and loaded with hotties.

“The bus has to be the worst form of public transit in Chicago.”

I find the public rickshaws worse; the dudes pulling them give off an awful stench in the summer and complain so much in the winter.

“Bob, you need to ride the 11 Lincoln bus sometime, its great… typically clean (never goes south of Jackson St.) and loaded with hotties.”

How many times have I heard, “we met on the bus.” Oh yea, zero. Gross!

“How many times have I heard, “we met on the bus.” Oh yea, zero. Gross!”

Maybe I’ll play the “I do have a car at home” (I do) and “I’m just doing this for the environment” angle..haha. I bet every guy on the bus tries that line though, whether they actually own a car or not.

the Trib called the #66 Chicago “the love bus.” look it up: “Catching the No. 66 bus could be a fare to remember,” 13 Apr 2006.

and yes, I do actually do this for the environment! good line to play at the Green Music Festival this weekend, at Eckhart Park across the street.

Oh Westie.. silly boy.. the Roche were not 25k.. Those were the Molinaris, but I never mentioned those. Pretty but uncomfortable as hell also. 🙂

Oh and I prefer to walk… Never like being out of walking distance.

Anyone watching the dollar lately. Think Peter Schiff, although not my favorite, said something perfect. It will be too unpopular to raise taxes to pay Chinese. Starting to lead me towards the inflation by devaluation camp. My bet is if prices stabilize that way no one even gets what really happened. As anon(tfo) said “The problem is that most Americans are borderline innumerate”

Well dinner time… all the best!

Oh and I vote for farting on crowded subways. Oh I still can laugh thinking of a few i let go after a rough Thursday night drinking. Keeping the straight face while everyone else is choking was always the hard part.

“Starting to lead me towards the inflation by devaluation camp.”

So, you’ve come around. Welcome, ze.

All,

Thanks for the replies and the follow up after my comments on this listing (my listing). I certainly don’t profess to have all of the answers, but I also don’t think it is unwise to identify myself on this site as someone suggested. If someone wants to give their good faith opinions and answers on a topic, they should be willing to put their name (and implicitly, their reputation) out their too, right?

To answer the few questions that were posted recently:

The renovation since purchasing were:

* an intensive repainting of the entire unit which was bright yellow and several shades or purple when my clients bought it. This involved a lot of hand work, scaffolding, etc. and the job was passed on by several painting companies because of the work involved.

* the hard wood floors were sanded and refinished.

* the carpeting was replaced on the stairs, in the large master suite and the guest bedroom.

*new bathroom and kitchen plumbing fixtures.

I may be missing some others, but those are the ones that come to mind.

Several of you have pointed out that the Case-Schiller report produces metropolitan and national figures for both condos and single family homes. This is absolutely correct. My response was to one person citing the CS national average report to infer a predicted closed price for 1658 W. Superior. This national aggregate is also the number that almost every news agency latches on to and it paints a misleading picture of the local market(s) more often than not. In rereading my post I see that my comments weren’t clear. The local CS report for condos is derived from resale units in the metropolitan Chicago area as defined by the US Census Bureau. This is still a huge area covering 7 counties and is still not an effective tool if the intention of the user is to define value for a specific unit in a specific neighborhood in Chicago.

For a somewhat confusing definition of what the Chicago Metro Area is defined as:

http://en.wikipedia.org/wiki/Chicago_metropolitan_area

Also some talk about public transportation. The owners are walking distance (1/2 block to 6 blocks) to the 50 Damen, 9 Ashland, 56 Milwaukee, 65 Grand and 70 Division buses as well as the Blue Line El. My clients use public transportation a majority of the time- it just depends on where you are going and whether there is a logical route for you. When you are driving it is very close to 90/94 as well as I290.

BYW, the unit is being very well received and buyers are taking up to 40 minutes for first showings- no one wants to leave!

Thank you

Greg

“The local CS report for condos is derived from resale units in the metropolitan Chicago area as defined by the US Census Bureau. This is still a huge area covering 7 counties[.]”

Still wrong Greg. The CS Chicago-metro excludes Lake County, IL. And it consists of 8 counties: Cook IL, DeKalb IL, Du Page IL,

Grundy IL, Kane IL, Kendal IL, McHenry IL, Will IL. BUT that’s an easy mistake to make, b/c it doesn’t make any sense to exclude Lake.

Also, “This national aggregate is also the number that almost every news agency latches on to and it paints a misleading picture of the local market(s) more often than not.”

No one here EVER cites the national number as having anything to do with the Chicago market.

That said, it’s great having the detail about the unit.

LOL. You saved me from typing once again, anon.

Thanks.

I’ve seen both #10 and #9. #10 is a bigger unit with amazing downtown skyline views. The #10 stained glass window is crazy cool and can be seen from all over the unit. The turett is three levels with 360 degree views. #10 has a loft bedroom and plenty of space for another bedroom, if you wanted to build a wall. But it’s a loft – leave it open. Bathrooms did need some work and also the Kitchen. All cosmetic though. A foreclosure is just that. Discounted price so the bank can unload. Can’t compare the sales.