The Vetro Update: Free Parking Crushes Flippers

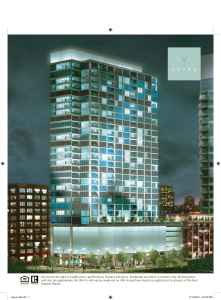

The Vetro, at 611 S. Wells, in the South Loop near Printers Row, has started closings. The 233 unit building is only 50% sold. Last week, the developer began advertising “free parking” to new buyers.

The free parking is a huge price reduction on the units. For instance, the developer currently has a $250,000 1 bedroom, 1 bath on the market. Throw in the $35,000 parking for “free” on that unit and it is essentially a 14% price reduction.

Happy Holidays flippers! You’re scr*wed.

There is no way a flipper can compete with that kind of incentive. Which is maybe why I’m not seeing that many flips for sale so far. Most of the flips are for rent. Craigslist has several, including this 720 square foot one bedroom for $1850 a month (plus $150 a month for parking).

The flippers in this building have little choice but to rent out their units and wait to see if there is appreciation in the next several years.

The people have to be kidding me. Trying to get $1850 + Parking for a 1 bedroom apartment. Don’t they know it is December and the slowest time for renting. Even in the summer when the rental market is at its best, the max you could probably get is $1400+Parking.

But I still think that in 5-7 years these will make great investments as you just across the street from Roosevelt Collection shops/theaters/restaurants and are within a 5 min walk to the 2nd largest business district (i.e. Jobs) in the US.

How much lower do you expect them to be in “5-7 years”?

Vetro is a great building, the only problem is that it came on the market at the wrong time + its prices have not been adjusted to reflect the market until now.

I think 235 Van Buren is a better investment. It is already 60% sold and it is scheduled to be completed in 2+ years, when the market will rebound. The buyer is also required to live in the unit for at least 6 months before reselling it, so it is not as attractive to the flippers as Vetro, and other buildings in the loop.

235 Van Buren is only 60% sold (which it has been for the last few months) because those units sold to corporations. If you ask at the sales center, they’ll tell you that corporations bought up whole floors of units so their employees won’t have to stay in hotels.

It’s essentially an apartment building. Who else will want to buy in there with no steady owners living in the building?

I’m also not sure that 235 is a better “investment.” It’s right next door to the Sears Tower and the CME, that is true. But otherwise, there is no “neighborhood” there (unless you call the McDonalds down the street that is the only thing open on Sundays a “neighborhood.”) At least with the Vetro, you can stroll over to Printers Row on the weekends.

Condo Investor: Isn’t the Roosevelt Collection several blocks to the south of this building? I’m pretty sure it is.

I agree that the apartment rent is high for the location and the building. You can rent dozens of other units in other brand new buildings around the downtown for the same (or cheaper.) Why this one? And it’s small as well.

But the flippers have to try and cover as much of their costs as possible, right? If they rent it for only $1400 a month they’ll be losing $750 to $10000 a month instead of $500.

“The market will rebound” in 2+ years? That would be 2+ how many years?

The credit markets may not return for decades to the easy money that financed this bubble. All that leaves to insure a “rebound” are enourmous income increases and massive down payment savings. What are the odds of those occurring?

I’ve said for awhile that if we have to go back to even 10% downpayments, bye-bye Chicago housing market (at these price levels.) How many 20-somethings do you know that have $40,000 to put down on a $400,000 condo?

Ah, the joy of 100% financing. Those days are long gone now.

and I wouldn’t want to be a seller in 701 S Wells (or anywhere nearby). good luck.

S: “But the flippers have to try and cover as much of their costs as possible, right? If they rent it for only $1400 a month they’ll be losing $750 to $10000 a month instead of $500.”

But if it goes un-rented for 2 months, that’s almost $3000 of additional loss. If you ask for rent you aren’t likely to get, you’re worse off b/c of the delay.

Roosevelt Collection will be about two blocks South of this location. So within a 3 min walk you will have access to about 40 stores, 15 screen movie theater, many restaurants… Also don’t forget the easy access to transportation. If you look at the success of real estate over the last 30-40 years you will see that easy access to jobs and transportation are a common thread. You are just next to the Blue Line Harrison stop, 5 blocks to Union Station and just next to the Congress which will get you on to any of the highways in Chicago.

If you look at how housing has performed in Chicago over the last 30 years which includes the days when interest rates were > 10% and the recession of the late 70’s and early 90’s over any 5-10 year period real estate has averaged 3-6% annually. I’m not saying it will do it over a single year but the average will come out to there. Real estate is not a race but slow and steady.

I personally am a bigger fan of 235 VanBuren, if you were to choose between the two. You have lower price points and less amenities and for the value minded consumer (i.e. first time buyer) many don’t care for a swimming pool, fitness center, business center…as these amenities will later lead to increased assessments. This is the market where there truly will be a shortage in Chicago in the next 5 years. It will be in the entry level condo market. There are a lot more buyers in the 250-300K range than there are in the 400-500K but the supply of the higher end condos in the city is increasing much faster than the lower end. So in a few years there will be a huge shift in supply/demand ratios for the high and entry level market. As there are more zoning resrictions espically with parking and height restrictions, most downtown developers are shifting to building high and ulta luxery units. Their profit margin is a lot higher on selling condos in the $600-1000 sq/foot then in a $300/sq/ft. So if you look at almost any of the proposed condo buildings most are in the higher range.

In this building the one bedroom floor plans from what I remembered, you have to walk through the bedrooms to get to the bathroom. Thats not a great selling pioint.

Sabrina

I did some quick calculations. I don’t have the exact number for the assessments so it is just a guess. But if you were to buy a one bedroom at $220 (After discounts) and put 10% down and get a 30yr fixed at 6.5%. Your monthly interest payment would be $1083/month, assessments approx $300/month, taxes for the first two years $100-125/month (since it is a new construction the taxes are based on the previous assessment by the county). So you monthly cost for the unit is about $1500/month. You can buy renters insurance for $175/year and since it is new construction you don’t have much in the way of repairs. So your total cost at most would be $1600/month. You should be able to get with parking $1500-1600 / month. The new AMLI rental building at 900 S Clark is going to charge around $1600/month for a one bedroom without parking.

You are still just about breaking even mabey losing $100-$200/month. But in the past two years I have been able to raise rents by about $100/month each year as many of these renters have been priced out and now have to rent and also many of the apartment buildings have been converted. So by the time the taxes do get properly assessed your rental income has gone up to off set it.

Condo Investor: I thought 235 W. Van Buren was selling for much higher prices than $220,000 for a one bedroom? They had very small (600 square foot) one bedrooms in the promos in their ads but most of the “bigger” one bedrooms are more expensive.

It still takes a pretty high salary (not entry level) to buy at those price points.

Used to be, only five years ago, you could get a one bedroom for about $125,000.

Prices have to come way down to give people incentive to buy these one bedrooms. You’re only going to live there, on average, about two years. What will be the motivation in a declining market? There won’t be any.

Sabrina

They did have one bedrooms in the 700 sq ft range from 205k-225k but that was in the pre-sales.

AS for entry-level, I don’t mean entry level salary. I mean the first condo a person or couple buys. It may be 3-5 years after they start working out of college or grad school. I know many of you think that prices are going to go much lower but there is a base in all real estate and that is determined by the rent. If prices go so low that you can make a decent amount from buying the unit and renting it out. If you used formulas that we do for commercial real estate, at a certain point the CAP rate becomes high enough that you will get investors (not the amatuer flippers that we have seen the past 5 years). While the sellers market has been slow for the past 12-15 months, the rental market for landlords has been great. We have seen rental increases of 5-15% in some cases. When the CAP rate gets high enough you will see all types of high net investors buying.

Just wondering, which one bedrooms were you able to buy 5 years ago for $125K. It couldn’t have been new construction in the downtown area. It may have been some conversions, or older one bedrooms in some of the older high-rise condo buildings. And it was probably more like 10 years ago if that.

Sabrina,

Prices on remaining one bed rooms are $235,000 – $260,000. I have their pricing sheets from March and October, and it looks like the cheaper ones (lower floors) have sold out. Those units went for $200,000 – $230,000. Square footage is between 650 and 820. So $305 – 335/Sq. Ft. Price per square foot in 2 bedrooms runs apprx. slightly higher. But the building will be ready in early 2010, so you have 2 years of nothing to worry about. If you’ve purchased a unit for yourself, and not planning on flipping it.

Even with a free parking spot, Vetro is still more expensive, + if you noticed, they include the balcony in the overall square footage of the unit. Isn’t WRONG?

I believe there will be a huge correction in downtown Chicago condos(I’ve been on this bandwagon for awhile, so relax). Once flippers and developer start to panic there will definitely be one bedroom condos in the $100-$200k range in the less desirable areas and buildings. There will be so much inventory built up in a couple of years and the slow bleeding will kill even the most patient of condovesters.

It’s shocking to me that anyone would pay more than $500,000 for a condo. In due time, the bloodbath will cleanse the absurdity and ridiculous of these prices. Tighter lending, burnt condo investor mentality, inevitable US recession, foreclosures, rising property taxes, astronomical condo assessment fees and high inventory will eventually lead to a precipitous drop in prices back to reality. I think the argument about equivalent rent is b.s. There are so many expenses when buying and renting out bought condo that one cannot even break even without a huge down payment.

Mike, there is a correction and its happening right now! A HUGE correction, I don’t think soo…

It’s called living in the ONE OF THE BEST METRO URBAN ENVIROMENTS in the WORLD. People pay these prices 10 fold in NEW YORK, LONDON, PARIS, BOSTON, L.A.??? CHICAGO IS a CITY that will continue to grow and so will its prices… PEOPLE pay more on average to live in Downtown Denver than Chicago right now… Its a joke. International Investors all realize that THE DOWNTOWN ARENA is under valued… Good Products sell and Bad Products flop. Walk past Vetro, peak inside the Lobby and you will realize why its not doing well. It looks like the Developer went to CB2 to buy all the furnishings. It was overpriced to begin with!!!

Mike

When you say there are so many expenses, could you please elaborate.

Also, lets assume we get this major correction of your. Lets say it is unlike any correction we have had before in the past 30yrs and we get a 20% correction. Look at our history in this region(http://www.ofheo.gov/hpi_city.aspx) There has been only one quarter in the last 30yrs where we are neg. If you average it out the avg annual return is around 6% with a standard deviation of 4%.

So for example you take the 240K one bedroom condo and it goes down by 40K to 200K. Now as a real investor I put in 20% as a down payment and get a mortgage of 160K. Current rates for a 30yr fixed rate are 6.125%. So my interest cost on a monthly basis is $817, the assessments will be around $250 and taxes for the first year will be low (new appraisal) at around $100. The monthly costs are about $1150, but lets just call it $1200 to cover renters insurance and other misc. expenses. The current market rent is about $1500. So on a monthly basis we get a return of $1500-$1200= $300. So on a yearly basis we get a return of $3,600/$40,000= 9%. Don’t forget if you use straight line depreciation (27.5yrs), all of that return is tax deferred. So in you can get a 9% return tax deferred plus any future appreciation which will actually get your total annual returns over 20%. If you use simple cap rate calculation this investment is around 7%. As time goes on your biggest expense stays constant while the increasing rent covers you for the increase in taxes and assessments.

At a certain point between 240k and 200k there is a point where investors will find the investment to be too good to pass up. This is how you can sort of determine the true intrinsic value of a property. Saying that the sky is falling doesn’t cut it. You have to know when to jump back in and you have to have a predetermined rate of return that is acceptable for which, you as an investor will start to reinvest.

Mike.. Your also forgetting the power of leveraging. $10,000 used for a down payment on a typically priced home in the U.S. at a typical home appreciation of 5 percent will return you $110,000 after 10 years. The same $10,000 invested in the stock market appreciating at 10% annual increases will result in $23,600.

No wonder the Data from the Federal Reserve show consistent results year-after-year of the staggering difference in net worth between homeowners and renters. A typical homeowner had $184,400 in net worth versus only $4,000 for a typical renter.

“Also, lets assume we get this major correction of your. Lets say it is unlike any correction we have had before in the past 30yrs and we get a 20% correction. ”

??? Sabrina just demonstrated a 14% mark-down IN ONE DAY in the very building we are discussing! Oh, and BTW, they are still not selling! Why does 20% seem outlandish to you?

The OFHEO data understated the rise in prices on the way up and it is already understating the price decline on the way down, my view.

If we agree that we spent 3-5 years at double (I would say triple) the long tern trend (in price appreciation) then we should be at 0% for quite a while just to get back to the mean. IMO, we will get a negative overshoot to the downside to correct the divergence within a few years, as opposed to 10+ years of 0 appreciation.

I agree with you in general, we will ultimately get to the point where rental rates in relation to purchase price will put a floor below prices. We can argue all day about the math. For example, I do not agree rents will keep going up in a market where prices are falling. MANY conversions will revert back to rentals and many new condos will turn into rentals when they can’t sell enough to pay back the construction loans (hence my running joke about the Deutche Bank apartment complex). This happened all over NY in the 90-91 market, I wasn’t in Chicago then. Maintenance will be higher than expected because these builders/converters ALWAYS cut corners in a tight market (I didn’t see any maint at all included in your numbers). You do not factor in turnover either, you will lose at least one month’s rent every two years in a market where rents are flat and supply is increasing (my assuption, like I said we can argue the math but inventory is growing much faster than population).

But the biggest factor IMO will be the general economic conditions. Most investors are fully invested, where will they get the money to invest more in a down market? I know where they get it now because I get the phone calls (and I am small time). Money grows on trees in an up market, not so in a down market. Sure there are some vulture funds and plenty of people like myself (former investor, current vulture wannabe), but we are not looking for 7% cap rates. We are looking for fire sales, which we will get on a case by case basis. The run of the mill investors are already ALL IN for the most part (or into commercial after the residential fantasy of prices-never-go-down was exploded). The credit markets will not be there for them in a sinking market, even if the rental numbers look good. Heck, the credit market is almost completely gone right now and OFHEO hasn’t even caught the turning market yet.

Like I said, you are correct in principal, it is just a matter of the math. I respect your assuptions are different, just trying to show another perspective.

John

Wow- people are STILL talking about leverage here? Ha!

The stock market is a FAR better investment than real estate EVER has been. EVER! Far more millionaires are made from the stock market than housing (of course, you can point to people like Sam Zell who made billions in real estate- but he isn’t as rich as Warren Buffett. Not even close.)

Look- you can go back 30 years and say that the Chicago area has never seen 20% price declines. That is true. But this boom is similar to the boom in the 1920s when all of our beautiful co-ops and vintage condo buildings were built. What happened after the 1920s? It took decades to recover.

The Sun-Times had an article about this about 7 years ago and I wish I could find it again. It talked about a condo that was bought for $1 million in 1928 in one of the vintage Lake Shore Drive buildings near the Gold Coast.

During the Depression, prices dropped nearly 80% in some areas.

By 1972, that same condo sold for $200,000. It sold several times from 1972 to 2000. By 2001 it again sold for $1 million. It took just over 70 years to again break even.

We just experienced one of the biggest real estate booms in our nation’s history. Don’t think that we won’t experience a similar bust. Sorry to be gloomy but the glory days are gone. Question is: how long will it take to reach the bottom and how long will we stay there?

John: I agree with what you are saying. But isn’t psychology also at play? It seems easy- right now- to say you’re waiting for the bottom and then you’ll go in (as a vulture.) But historically, most people don’t invest at the bottom because it’s too scary.

As prices drop, investors run for the door. How many people will invest in units in a building that is only 50% occupied and maybe the developer has gone under or there are weeds growing in front of the building (not farfetched scenarios for the future.)

And you’re right- even with the price reductions we’ve seen- STILL no one is buying- which means prices will come down even more. Heck, I’ve written about the “deal of the century” in River City which was 49% off the 2005 price and it’s been for sale for months so clearly investors don’t think it’s yet a “deal.” I also recently saw another unit in the building that is the same size as the “deal of the century” unit and it is 55% below its 2005 price (sold for $511,700 and is now listed for $229,000).

Yes- River City has its own problems. But even still, investors don’t think these prices are cheap enough.

The Vetro is going to have to do more than just give away free parking in order to sell these units. They’re going to have to cut prices AND give away the free parking.

“It seems easy- right now- to say you’re waiting for the bottom and then you’ll go in (as a vulture.) ”

I mean fire-sale bank auctions, not some developer close-out at 20% off. I don’t care about the bottom of the market, just the individual property. I agree that many so called vultures are either dip-buyers who will get slaughtered or leveraged funds that won’t get the financing when they need it.

John

John: Okay, that makes more sense. There will likely be quite a few auctions in the next few years.

Chicago is a world-class city with a bustling and diverse economy. I agree.

It is a matter of supply and demand. A large percentage of the condos have been bought out my speculators with the intention of flipping(and not for personal use) and most of the supply is in the so-called luxury class. Now, they are stuck with properties that can not be sold for profit and eventually the market will have so much supply, they will have no choice but to lower their prices for a loss. Renting condos out is not lucrative if there is no appreciation, but instead deprecation. You cannot count on historical data to back up that your property will appreciate 5% a year. The United States had an unprecentated boom and will likely be followed by a bust. Over a span of decades, I agree, that the appreciation for a piece of property will likely be 1 to 2% above the government supplied inflation rate(real inflation is much higher).

Foreclosures will be the key. Earlier this year, I was tracking some 2 and 3-bedroom condos at 33 W. Ontario and 345 N. LaSalle that had haircuts of over $200,000 that were bank-owned properties.

The condo market is dead in Chicago. Just ask Donald Trump. Once the buildings start dumping inventory at rock bottom prices, look out. Just look at what is happening in California and Florida.

Disclosure: I own a condo and I am not a bitter renter. Discuss.

How do you “track” such properties? I am considering moving downtown to be closer to work (and because I am concerned about safety in my current neighborhood). I have a loan approved from my bank. Now it’s just a matter of finding the right property. I monumentally don’t want to buy Month 1 and have the price drop 20% by Month 6. I know no one can predict what will happen in the market–especially what will happen with any one given property–but the idea of buying at firesales sounds less risky…

Kenworthy: It’s much cheaper to rent right now. Move downtown and just rent one of these condos. Some of the owners will get quite desperate for renters to stem the bleeding so you can get a deal.

Then in one or two or three years, you can buy something.

That’s just my advice. Prices are declining right now. Why buy now?

You can track foreclosures on the Tribune’s website (they publish them for free on-line in the real estate section.) Also, if you look at some of the listings in certain buildings, like 345 N. LaSalle, you can see that some are “bank owned” and that the prices are much lower than what they sold for two or three years ago.

Kenworthy-

Do not buy. It is finanical suicide to buy now. Don’t be swayed by real estates shills who want to pad their salaries with commissions from sales. They lie. They are on the same level as car salesman.

For foreclosed property, look at bank-owned REO sites by the big lenders like Countrywide, JP Morgan Chase and the like that lend in the Chicago area. Type REO bank owned into Google. There aren’t that many now, but there are more and more properties being foreclosed on and the process takes awhile from start to completion.

First, find the PIN number for a specific address and unit from http://www.cookcountyassessor.com. Then, plug the PIN number into http://www.ccrd.info to get the sales information and how much the owner paid for the unit and how much of a mortgage they have. Also, http://www.cookcountytreasurer has how much the unit owner paid for his property tax for the last year. This will give you vital information needed if you are buying.

There’s a lot of information out there. Don’t be stupid and buy now. Be patient and rent.

Thanks for the info/advice from you both. Yes, my inclination is to cool my heels for now in the place I already have. I can’t bear the idea of renting downtown, though–I currently own my admittedly-tiny little co-op apartment in Hyde Park, and it’s essentially free to live there. Downtown would be more convenient is all–and so if I find a place that is truly an amazing deal, I want to be ready! 🙂 It’s just very hard, for all the reasons you guys point out, to identify what an actual “deal” is in this market…

Sabrina,

My point was not to say you can make more money in real estate than stocks. I believe you can make more money in stocks any day.

If I had a million extra dollars laying around 60% would go into stocks, 30% in a piece of real estate and the other 10% would be left in cash.

My point is that Home Owner is very important. Why do you think Rich People always have more than 1 home. I believe that more and more people believe in Urban Lifestyles and I believe that more people that have homes right outside the city are buying 2nd homes inside the city because of how much are city has changed in the last 5-15 years!!!

OWNERSHIP…sorry

Mike your an idiot. You obviously don’t understand that land is getting more expensive and so is the cost to build these places.

There is an old saying in real estate and that is that there is no new land. That being said, the only place left to go is up. After September 11, a lot of the wind was knocked out of the high-rise boom. But the confidence of both the developers and the potential buyers of Chicago condos has since moved up and with it so has the number of floors in the buildings. Even the current down trend in market conditions hasn’t leveled off the really lofty projects. In fact it may have even helped to keep the buildings moving up because spectacular, unobstructed views are obviously the main draw to these towers.

Another major factor that makes building tall attractive to developers is the astronomical INCREASE in LAND prices in Chicago. With more floors and thus more Chicago condominium units to sell, the developer can spread out his cost over more buyers. This translates into more profits. And architecturally, the taller, thinner buildings are becoming more appealing on several points than shorter, stockier buildings. They cast less of a shadow and create less of a impedance to the views of other towers. The slimmer design also, along with the technological advances in structural components, fares better in the wind and sways less. And finally, the more narrow width satisfies those with a bent towards ecology because they present less of a flight hazard for migrating birds and in some cases give off less reflective heat.

Renting is fine and I understand why some people need to rent because it just makes sense. There is nothing wrong with renting but who is collecting the money on rents genius. Me, investors, landlords. So continue to pay me $1,500 a month for a 1 bedroom so I can build up more equity and buy more stocks and live a better life!

Thats fine with me but if you can buy a condo with putting at least 5%-10% down you can also recieve tax benefits and in the end you are going to make money as long as you invest wisely. You can’t just buy into any building and expect to make money. Its the same way with stocks there are losers and winners???

There wont be another waive of building like this until 2035-2040. Just think how expensive land will go up in lets say 20 years here in Chicago.

Pat: If I’m paying my $1500 a month rent to you, who is the greater fool if your costs are $2100 or higher? You are losing $500 or more a month. Why does that make the landlord a genius?

The landlords, right now, aren’t covering their costs. Rents have historically moved in tandem with sales prices. When one of them is out of whack, the system corrects. Right now, sale prices are way out of whack with rents in Chicago. Either rents will have to substantially rise or sale prices will have to come down.

I’m betting on sale prices coming down.

I don’t know if you’ve been looking at the Rental Market but its been rising very steadily. Actually No, I make smart Investments that don’t lose $500 dollars a month. I’m not talking about Vetro I’m talking about other investment properties that do very well in Lakeview/Wrigleyville.

Sabrina, You might as well take your $1500 dollars and burn it in your fireplace at the end of each month….

Sabrina

Rents do not correlate with housing prices. During the recent housing bull market from 2002-2005 there were very few rent increases and most rental buildings were giving concessions like one or two months of free rent. This past year while the housing market was flat, rents hit an all-time high. Less people can afford to buy so they rent, thus the demand for rental units increases.

Just take a look at this article in Crains from a few months ago.

http://chicagobusiness.com/cgi-bin/news.pl?id=26071

“Mike your an idiot [note to Pat, try not to make any 4rd grade grammatical errors in the same sentence where you’re calling someone an idiot] . You obviously don’t understand that land is getting more expensive and so is the cost to build these places.

There is an old saying in real estate and that is that there is no new land.”

I remember in 1991 when Japan found all that new land in the 4th dimension. It caused prices to go down for 18 consecutive years. That was a bummer for the ‘real estate only goes up in the long term’ crowd. Now kids are inheriting their parents’ 100 year mortgages, also a bummer. Good thing there is no new land in the US, it would stink if the same thing happened here. It’s a good thing that ‘new land’ is the only thing that can make prices go down. Do we have a 4th dimension in Chicago?

John

“Rents do not correlate with housing prices.”

In the long term rents correlate perfectly with prices, they always have and always will. In the short term you have divergences that over the entire history of free markets have ALWAYS reverted to the mean. Non-free markets with government restrictions and interventions obviously skew the relationship.

2002-2005 prices and rents diverged, now they are reverting to the mean. My guess is they will overshoot and diverge in the other direction in the next few years only to revert once again thereafter.

My philosophy is to invest when prices are cheap in relation to rents and divest when prices are dear in relation to rents.

John

Pat: You make my point perfectly. You invest in Lakeview/Wrigleyville. Thousands of other “investors” did not. They bought units in the Vetro, Burnham Pointe, Library Towers and on and on and on and can’t cover their mortgage/taxes/assessments with their rental fees.

They are violating the #1 rule in real estate investing: always cover your costs.

It’s not you I’m worried about Pat. It’s the thousands of other investors. That is money they are bleeding every month. How many months do they hold onto an investment that is sending money out the window?

We’ll soon see.

This is why I believe many of these investors will simply stop closing on these units. But we won’t see that until next year.

Pat,

1. High land prices are directly related to the over-heated housing bubble. When investor and developer demand wanes, land prices will drop the quickest, since they are valueless without property on them. Trust me, there is tons of undeveloped or underdeveloped land in Chicago in and around the loop area. We are not running out anytime soon. And with the glut of condos to hit the Chicago market, no developer will be stupid enough to buy land to build more in the near future.

2. The tax benefits are a bit overstated. If you are married, it might not benefit you at all, since the standard deduction is about $10,700. The higher your tax bracket, the bigger the deduction. It’s not a significant as the real estate gods might tell you.

3. I want you to give a real world example using a real property and the true rental price you can fetch for the unit and provide the public with how one can be profitable buying and renting a condo in the Loop, Streeterville, GC, LP, Wrigleyville, Printer’s Row, etc. etc. The numbers do not add up with 5% to 10% down in this market. It is more economical to rent. Plus, the money you are saving renting can be invested elsewhere and not in a depreciating asset like condos.

4. I assume that you are a Realtor or one of those wannabe real estate tycoons with a big ego that has been brainwashed of all logic and reason. I was shocked when your god, Donald Trump, said “The market in Chicago is dead as a doornail right now.”

Mike: What I do like about Trump is that he does (at least sometimes) tell it like it is. He knows it’s a bad housing market in Chicago and he’s not trying to sugar coat it. But he’s no fool. He also gets a benefit from blaming the overall market. This way, he’s placing the blame for the lack of sales on something other than his own building/product.

“So continue to pay me $1,500 a month for a 1 bedroom so I can build up more equity and buy more stocks and live a better life! ”

…

“Sabrina, You might as well take your $1500 dollars and burn it in your fireplace at the end of each month….”

Pat,

We are not talking about your no doubt brilliant historical investing track record, we are talking about buying vs renting right now at today’s prices.

Paying property taxes is burning money, so is paying an assessment. So is paying interest (you are selling your future income at a discount!). I’m sure you would never lose $500 a month but we are not talking about your Hall of Fame investing career. We are talking about entering the market today. And today one can very easily spend $500 more a month buying vs renting a 1br in a nice building. And with a 90% loan on a $250k condo it will take you 5 years before you are even paying $300 a month to repay principal, ie. “build equity”. Just to continue using Sabrina’s example, if renting is burning $1500 per month, then buying (at $2000 per month) is burning $1700 per month! You are only paying $300 per month towards principal!

The only reason to buy when renting is so much cheaper is to take advantage of expected price appreciation. Arguments about burning money are silly. All that matters is the net present value of all future cash flows. I’m sure you can do the math, it will take a fairly significant amount of price appreciation to make up for a $500 a month hole in your pocket. Since we are coming off the most rapid price appreciation in the recorded history of Chicago real estate, color me skeptical that buying vs. renting is the no brainer implied by the boorish tone of your posts.

John

Sabrina, I agree that many people will not show up to closings in certain buildings. I’ve always felt that a superior product at a great price will always sell though…

Well, I was able to get a first hand tour of Vetro today. Now I know why they are 60% according to sales manager today. If you get a chance get into the Building you will see that the finishes are no that great. The colors of the hallways and lobby are way to extreme and unique for the average buyer. In a Down Market stick to be different but the architect/developer went way over his head and has done everything his way. This does not work when you have to move 233 units priced from 200-700k…

Mike, maybe if Trump decided to price his units differently he would be close to 90% or even sold out. Dead at a door nail. He must be referring to his units priced at about $1,500 square foot. He has a 526 square foot studio on the Market for $850,686.00. Its 1 Room 15X18 on the 24th floor 240 feet up. Are you kidding me. He needs to wake up and realize that its not the New York Market. Plenty of room in the Loop??? I walk the Loop every day and can count the number of empty lots using all of my fingers and toes.

The comments from Pat Natale just beg some questions:

Where are you steering clients to purchase condos as investments right now?

Can you give a cash flow example on a recent sale?

Have you ever worked in a deflating bubble market? (I think I know the answer to this one already, and I wish you luck.)

You seem to have the answer for Trump’s lack of sales: dropping prices. How is that answer not applicable to the declining sales and rising inventories throughout the city?

Why on earth do you call Mike an idiot? I didn’t think we had hit the fear stage yet in Chicago (at least for sellers), but do you fear he is correct?

Finally, you seem to believe in the “buy land, they aren’t making any more of it” mantra. Do you also believe that “real estate always goes up” and “buy now, or be priced out forever”?

Here’s another beating upon this already dead horse….

as mentioned above look to Japan 1980-2000 as an extreme example of the true volatility of real estate prices.

if you’re still curious, go read about Prof. Schiller’s historical examination of the housing prices of one block in Amsterdam over 300+ years.

Review you’re college notes on NPV/opportunity costs/etc.

Prepare for a big washout of part-time/semi-pro (and a few poorly positioned pro) residential real estate investors in 2008 if job growth wavers.

And remember trends in real estate don’t turn on a dime. One year of price stagnation after one decade of above average returns does not mean that real estate is a bargain.

fyi, here’s one extreme example of real estate booms/busts

http://www.fundmasteryblog.com/2007/11/15/amsterdam-real-estate-is-close-to-high-point-from-1736/

damn, real estate is so addictive.

Me: Thanks for posting the link to the article on fundmastery blog. Great chart that shows it took 271 years for real estate to “break even” in Amsterdam! Wow.

That’s almost hard to believe- but when you have a mania it can take a long time for values to return to their high.

I think a lot of buyers right now “think” they’re getting a deal just based on prices over the last two years. It sure seems cheap if that 2/2 condo that used to sell for $450,000 is now priced at $399,000, right?

Seems like a lot of people will be catching the falling knife though.

I dunno–this study is fascinating, and it also convinces me that buying in a flat market is not crazy, IF you are a very particular (and unusual) buyer: you pay cash and don’t borrow a cent.

Consider a $400,000 lump sum, that you can either put into the stock market (historical increases of about 10%/year) or use to buy a condo free and clear (which the Dutch data shows will appreciate on average with inflation, so about 4%/year).

If you choose the stock market, you make 40K a year, but have to pay, say, 18K a year in rent ($1,500) for a comparable piece of property. Thus, you net 22,000/year on the 400K investment.

If you choose the condo, you don’t have to pay the rent of 18K. But you have to pay taxes each year (assuming 2% of value or 8K), which you get to deduct from your federal income taxes (meaning net you pay about 5.5K per year). You also have to pay assessments–assume $500 month or $6000 a year. That means you are “saving” by living in your condo $6500 a year (spening 5500 + 6000 = 11500 to own, versus 18,000 to rent, 18-11.5 = 6.5). But don’t forget the 4% appreciation on your condo asset–this will net you another 16K a year. So, total “earned” per year by investing in the condo is 6,500 + 16,000 = $22,500.

In other words, even though stocks have a historically much better return, you can’t live in your stocks. Since you live in your real estate (IF you live in your real estate), you are doing about the same as you would in stocks.

Obviously, the math changes if you borrow. Also, it only works for VERY long term real estate investments. But then again, the 10% number for stocks really only applies for very long term investments, too–like 20+ years.

So there you go! I’m gonna buy a condo downtown! Just not right away. I still have the dilemma of when to buy in… 😉

also, wouldn’t it be great to see a graph like the Dutch one, for Chicago over the last 100 years? Would help us to know whether we’re in a long term peak or a trough–or like Goldilocks, “just right.”

This Pat woman is a real know-it-all!

Do we know Pat is a woman?

Given his propensity for “Realtor speak”, I assumed it was this Pat Natale: http://www.bairdwarner.com/content/agentHome.asp?agentID=177742

Kenworthy, Why would you ask the question, (Do we know Pat is a women???) Is Kenworthy a women??? Yes, that is my website at bairdwarner.com. It’s great to look at all the info the Ductch Market has provided us of over 200 years.

I believe that if I had a crystal ball I would actually not go into the Real Estate Market or Stock Market but instead pick winning numbers to the Mega Millions instead.

Anyway, I will leave you with this about any market (stocks, bonds, realestate, gold, etc.) “There’s never been anyone in history who could consistentely predict markets. What you can do is find great (companies, stocks, homes, etc.) trading at great prices and invest in them.”

Kenworthy, In 1 post you have its Financial Suicide to buy right now???? In another post you say your going to buy??? I don’t understand???

sorry Kenworthy, mike said “financial suicide.” I appoligize. Anyway, If you want to live downtown (w/ energy prices rising & an increase for years to come) you might want to look right in the Loop. One of my favorite buildings right now is 8 W Monroe.

Walking Distance to everything and the Developer did a very nice job w/ the finishes. There is 8 on the market & 4 for rent out of 169.

PN: You can’t be seriously saying that people should buy in 8 W. Monroe, otherwise known as the Metropolis. I’ve posted on the building. At least half the building is a rental. You won’t make any money in that building for a decade (maybe longer.)

Sabrina,

I know there is a lot of rentals/investors in this building and some are looking to take a loss right now.

I want to say a 1100 square foot 2 bedroom in this building nicely appointed went for 282k.

Long term I think this building will do fine…

Sabrina,

I’ve read your post and have to disagree. I agree the one Unit you picked out of the ones for sale at the time had awful finishes..

There are 5 Units for rent right now. I love the location of this building and I think the ceiling height in this conversion is a big +. Deeded Parking, Nicely Appointed Work Out/ Business Center & a great Roof Top/ Dog Run.

The nice thing about this location is you can ditch your car.

Pat: We agree to disagree. Have you been in the building? I’ve seen half a dozen units. All of the finishes are the same. Bad. It was never meant to be “luxury” or anything.

As I said, half the building is rental. That building will never be “fine.” If you want that location, there are plenty of other better choices (including the soon to be closing Momo which has better finishes.)

Anyone interested in the location of the Metropolis should simply rent there. Renting is the way to go right now. And there are plenty to choose from.

As a woman named “Kenworthey,” I simply pointed out that one shouldn’t rush to judgment, as the poster did, that “Pat” was a female. 😉 Didn’t mean to offend you–though I’m a little unclear on the source of the offense…

Sabrina,

Check out: MLS #: 06683787. You Think those are bad finishes?? You have access to MLS right???

pn on December 14th, 2007 at 1:29 pm

Sabrina,

Check out: MLS #: 06683787. You Think those are bad finishes?? You have access to MLS right???

Okay, they put in the Brazilian cherry and granite and wannabe stainless (GE, not Viking etc). But the price is $383,000, not $282,000, and half (at least) your neighbors are renters. With $396 in assesment and who knows what taxes, buying this place would be pushing $3000 a month. What do these places rent for again???

Oh yeah, there it is right in the listing… “rental option available $2000 per month”. My guess is the rental includes the $38,000 parking space as well. Anyone dumb enough to pay near asking on this condo already owns two, which is why it hasn’t sold.

This one was so easy, I didn’t even have to turn on my calculator. That’s the problem with this market really, they finally sold a condo to the last guy that didn’t own a calculator, there just aren’t enough dummies left to keep the Ponzi scheme going.

Regards,

John

John: I can’t agree more. When you look at the difference between purchasing and renting- it’s not even close (in nearly EVERY building.) Why not just rent it for a few years? That’s all you’re likely to live in it anyway.

Average length of time in a loft is only 2 years. You’ll lose money if you buy that loft today.

That’s why the downtown condo market is going to see big price declines (more than single family housing.) The prices are too high and there are simply too many units competing for too few buyers. And those buyers will now rent instead.

I saw on Trulia that they had studio units for $150k. Not sure if this includes parking but if so count me as a new neighbor. Its not $200/sf but it is a modern building and with parking it is well worth it. I found another studio condo at 1503 S. State thats 700+sf and $140k: thats $200/sf. I don’t really see real estate prices falling below this threshold in this area unless you go south of Stevenson or west to Pilsen.

Long-term I think the area bounded by Congress, Dan Ryan and Stevenson is bound to appreciate. The reality is that this is the small area in Chicagoland with easy access to all all three interstates and the L if you live within it. Chicagoland commuters who want to live in an urban environment will always flock here.

Bob: It’s still cheaper to rent one of these. Some are listed for around $1150 a month, and that’s negotiable. Why not just rent it?

well someone’s buying… I have the Vetro as a favorite search on Rubloff. Until a few days ago 7 units were listed for sale; now it’s down to 3. But I didn’t see any studios…

Were these units from the developer? I’m assuming at only 50% sold- they are going to be very aggressive in giving away free parking and whatever else they can throw in.

There were a bunch of cancelled listings yesterday. I don’t see any new contracts this year on the MLS. However, it is difficult to comprehend exactly what the “cancelled” listings represent since several of them had contract dates. Here are all of the closings in the building from the MLS to date:

Sale Date Unit # Sale Price Size BR BA

11/27/2007 1405 $422,518 1,133 2 2

11/28/2007 1007 $527,226 1,525 2 2.1

11/29/2007 1110 $233,770 523 0 1

11/30/2007 906 $464,943 1,133 2 2

12/5/2007 1108 $311,218 712 1 1

12/12/2007 1510 $211,855 523 1 1