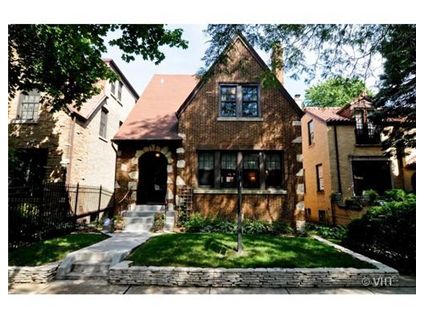

Tudor Lover? This 3-Bedroom in Peterson Woods Is For You: 5761 N. Virginia

This Tudor 3-bedroom single family home at 5761 N. Virginia in the Peterson Woods neighborhood of West Ridge just came on the market.

It has some of its original vintage features including arched doorways, woodwork, and leaded windows.

Many of the other windows have apparently been replaced.

There is also new space pac and a new deck off the back of the house.

Built on a 30×125 lot, the house has a 2-car garage.

The house last sold in 2007 and in that listing it was described as having “lots of potential.”

The kitchen now has new stainless steel appliances and there are 2 new bathrooms.

Given the updates, is this house attractively priced for this neighborhood?

Terry Silis at Baird & Warner has the listing. See more pictures here.

5761 N. Virginia: 3 bedrooms, 1.5 baths, 2100 square feet, 2 car garage

- Sold before 1988

- Sold in May 2007 for $485,000

- Currently listed for $539,900

- Taxes of $6830

- Space Pac cooling

- Wood burning fireplace

- Bedroom #1: 20×14 (second floor)

- Bedroom #2: 15×11 (second floor)

- Bedroom #3: 19×10 (second floor)

- Unfinished basement

cute house

Nice Place, Good location. I like the dining room paint job

Waiting to see the crib bashers comments unfold this afternoon on this place.

ex. do you know what you can get in Oak Brook for $500K

ex. Schools suck in Chicago proper, why would anyone want to live there.

You are exactly right Lunker…only negtive posts will be made. And I can hear it already…if you bought this place (link follows) in Oak Brook you’d be a HAPPY PERSON!!!!!!!!!!!!!!!!!!!!!

I agree Lunker. What they don’t get is, someone interested in this house is not interested in Oak Brook…. AT ALL

attractive house with interesting details, pretty hood too. Transit is tough, and it’s even a longish drive downtown. Over half a million seems steep to me but I have a beer budget so….

Don’t know Jamieson elementary but it looks acceptable. High school is “NS Prep,” wow lucky family.

Love pic 3, Bag End front hall.

Love the dining room. They need to squeeze another full bath in somewhere (even if only a shower stall).

nice house, I’m not sure how this one will fare, but I could totally live in a place like this for 350-400k i’m sure someone will complain about the schools sucking or a magnet being listed as the “local” school though

I grew up near here, so I have an affinity for this area. I would definitely pick it over the suburbs.

It seems very overpriced though, especially since it only has one bathroom. I’m surprised it sold for so much in 2007.

“a magnet being listed as the “local” school though”

That’s a complaint about a bad, bad realtor practice, tho, not about the house. The house didn’t do anything wrong.

1.5 baths at $550k is tough, especially as the 3d bath would end up in the basement, or require a substantial addition.

Nice place, but DZ’s standard question–where do you put the tv, if you dont want it in the living room?

Pix from before the ’07 sale are here:

http://tours.vht.com/realestateforsale/PhotoGallery/1044873/5/Bedroom-5_5761-N-Virginia-Chicago-Illinois_60659.aspx

Nice room sizes and interior

Putting in a bath in the basement (if unavailable any other place) should help the bath situation

Price seems high by about 100K

Is NS Prep a neighborhood school now?

The proximity to the Chicago river (branch?) would worry me.

Lots of competition in this price range.

How do you know that a buyer who is interested in this isn’t also interested in living in the suburbs? that’s ABSURD to say that the two are not comparable. When you live in peterson woods your quality of life isn’t that different than living in mt prospect. you drive everywhere, it’s a long commute downtown, you shop at the box stores, there’s not much walkable worth walking too….

These tudors are EVERYWHERE in the city. There’s nothing special about this one other than the fact that it’s been updated. This is going to sit for a long time.

I hope the 2007 buyers like it because they’re stuck there for a while!

(things that make you go hmmmmmmmmmmmmmmm…..)

http://goliath.ecnext.com/coms2/gi_0199-6152873/Battles-over-bad-habits-at.html

“Living with annoying habits of family members and friends is a fact of life. But what happens when your hard-won professional expertise gives you certain knowledge that their habits are just plain bad?”

************************************

“******************, 35, an investment manager and president of *************************** in Chicago, says his girlfriend’s shopping habits “drive me nuts.” Her penchant for buying unnecessary items just because they’re on sale makes little financial sense, he says.

“She purchases clothes on sale and, in many cases, never wears them. They pile up with tags still attached,” Mr. ************** says. “I’m an advocate of being frugal, but buying items and not using them contradicts the theory.”

His girlfriend, ********************, 36, says she has tried to change her habits since dating Mr. *************. “I am getting better about not spending money on things I won’t use,” she says, though “I don’t tell him about everything I buy, either.”

hmmmmmmmmm………….yet they bought a house together….

I’m a fan…great little area, and you’re right by that park along the river.

neighborhood HS, by the way, is Mather…

I would consider this house and wouldn’t consider a suburb. Sorry HD

like the place, like the reno (except for the kitchen), like the hood (not true you have to drive to *everything*, Tampopo is def walking distance), like the space pak, like the 2-car garage & yard, and don’t mind awkward tv placement or lack of full 2nd bath. wouldn’t pay anything close to this price, though. ’07 price is nutso, especially since it was sold “as-is”. they’re never recouping the cash they put in.

anon, what’s the flooding history here?

might be good for 2 city workers (who don’t have Mt Prospect as an option), one of whom who works at NSCP or Mather??

“Vlajos on August 31st, 2011 at 11:01 am

I would consider this house and wouldn’t consider a suburb. Sorry HD”

How do you explain the fast food exec living in graceland west putting his house on the market after buying a similarly priced home on the north shore?

I’m not that fast food exec.

Vlajos,

HD interpreted:

“someone interested in this house is not interested in Oak Brook”

as “anyone interested in this house is not interested in Oak Brook”

as opposed to “[there is] someone interested in this house [who] is not interested in Oak Brook”

HD’s gloss is how most native English speakers would read it

“How do you explain the fast food exec living in graceland west putting his house on the market after buying a similarly priced home on the north shore?”

How do you explain Carrot Top?

now homedelete is becoming as annoying as clio

“one of whom who works at NSCP or Mather??”

Or Lane or Seen or Amundsen or points west. It’s a fine location for getting around, if you aren’t going south of ~Belmont. Little bit of a long bike ride to Wrigley, tho, especially pulling a trailer.

“what’s the flooding history here?”

The Channel doesn’t really flood, does it? Altho, the (apparently completely) unfinished basement is a bad sign for sewer backup flooding. No recollection of an overland flooding issue along the channel, but it’s certainly possible.

i’ll be damned if I’m gonna stick around here and see scott thompson’s comedic credentials so impishly impugned.

good DAY, sir…

“HD’s gloss is how most native English speakers would read it”

Agreed.

However, does anyone *really* think that someone who would seriously consider buying this house *right now* is trying to decide between living in Peterson Woods and living in OB? Mt Prospect (and many other suburbs), sure, but not OB.

I like Carrot Top and the other big prop comedian Gallagher. Carrot Top is explainable in that if you look like that and want to get girls you better damn well be or learn to be funny.

So, Bob, I’m sure you can also explain the dude who moved from GL West to Winnetka. Help your pal HD out, since he seems to be having trouble.

“I like Carrot Top and the other big prop comedian Gallagher. Carrot Top is explainable in that if you look like that and want to get girls you better damn well be or learn to be funny.”

and/or work out 3 times a day.

the guy that made that movie’s name must surely be Einstein not because he’s a genius but rather I was with HD & under the impression such a thing violated Newtonian laws of physics

“Given the updates, is this house attractively priced for this neighborhood?”

I’m not very familiar with the neighborhood, but looking at recent sales I’ll say … no. I’ll guess it goes for around $460k.

This property is not special, and not unique to the nothwest side.

I was thinking it would be listed under $400k.

Then I saw the current occupants were asking 12% more than peak bubble purchase price.

Good luck with that.

They cannot get 500-plus for this location with just 3 BR and 1 bath. Under 400 is more realistic.

What do recent sales look like?

“Then I saw the current occupants were asking 12% more than peak bubble purchase price.”

Look upthread for the link to the “before” pix: It si currently far, far nicer than it was in ’07. No comparison, really.

They spent money to rehab it that’s why it’s listed so high. They had the ‘buy, rehab, sell 5 years later for $profit’ plan. Except that plan was old school thinking, new school thinking is “walk away”

Its going to be fun watching transplants like this lose a bunch of money. Lets be honest here, folks: the people who dropped 485k on this place unupdated then at least another 80k on rehab weren’t from this neighborhood. Probably a clueless couple who read Chicago style magazine. They were obviously well capitalized, too. Now they can flame out of the RE game and go back to where they’re from with their tail between their legs. These a-hats should’ve stuck to areas they know like old town. Now they’re stuck trying to get a huge premium on a house located in a Hood where locals know what things are worth and coastal transplants (the best marks for getting to overpay) don’t venture out here.

I see. 2 new bathrooms. De-cluttering, pull the carpet, paint. Space Pac. Looks nicer for sure.

Still aint a half million dollar + home.

“Still aint a half million dollar + home.”

Not arguing that, but there is a reason they are asking more than the ’07 price.

Anon, you asked a while back about “friends of” organizations for various CPS schools. Go to guidestar.org and you can pull the 990s which have all the information you’d want.

Thanks, JMM. Interesting stuff.

I’ll say $450 on it.

Not my preference of hoods Im more in preference of Beverly, Norwood Park, Edison Park, Oriole Park, Mt. Greenwood etc.

“Bob – Its going to be fun watching transplants like this lose a bunch of money. Lets be honest here, folks: the people who dropped 485k on this place unupdated then at least another 80k on rehab weren’t from this neighborhood. Probably a clueless couple who read Chicago style magazine. They were obviously well capitalized, too. Now they can flame out of the RE game and go back to where they’re from with their tail between their legs. These a-hats should’ve stuck to areas they know like old town. Now they’re stuck trying to get a huge premium on a house located in a Hood where locals know what things are worth and coastal transplants (the best marks for getting to overpay) don’t venture out here.”

That’s right Bob, native Chicagoans are tastless cheap asses…only transplants value updating/modernizing.

“That’s right Bob, native Chicagoans are tastless cheap asses…only transplants value updating/modernizing.”

Well, just look at that kitchen–not a scrap of linoleum on a non-floor surface. They’re clearly stuck in Northbrook, c. 1994.

I think that price is crazy high. We paid a lot less for a comparably finished, much larger bungalow in North Park, which is closer to transit. No fireplace but finished basement.

Wouldn’t want to send my kids to Mather either.

It’s a “nice house”, but I think seller overpaid in 2007, modestly renovated, and is stuck. I can’t see this house selling for more than $425,000 to a buyer who likes “newness”. Remember that much nicer unrenovated tudor bungalow that sold for much less earlier this year? At least those buyers (if not flippers) can afford to send their kids to Ignatius or Loyola for HS with the relative savings after renovation compared to this overpriced house.

The people on this site are absolutely crazy – when they “guess” prices or state what they think something is worth, I doubt many actually look at the comps – I think most of them just think “what would I pay for it” or they look at what the person paid for it (or how much money that person owes on a property) and then decide how much it is worth based on what type of profit/loss they think the seller should get/take – that is just plain ignorant and idiotic – westloop – THIS is why schooling is important – we wouldn’t have so many idiots in the world!!!

“That’s right Bob, native Chicagoans are tastless cheap asses…only transplants value updating/modernizing.”

No but the people who owned these forever are notorious for not maintaining them and now trying to cash out for crazy appreciation.

This is a nice house that we walked by this week. The neighborhood is really attractive showing lots of care. Close to the park which has been greatly improved in the last 10 years. This house should go close to the asking price.

Architect:

The house you’re remembering was on Ardmore.

http://cribchatter.com/?p=10127

It sold for $400,000- so not that much less than this one (without any renovations.)

I took the driving portion of driver’s ed. They had car simulators where you were supposed to “drive” along with a projection. My mom went to Mather for high school and the funny thing was looking in her year book and seeing the same simulators being introduced as “high tech” 30 years before.

I would do the CPS home school program before sending a kid to Mather.

brenda on August 31st, 2011 at 4:19 pm

I think that price is crazy high. We paid a lot less for a comparably finished, much larger bungalow in North Park, which is closer to transit. No fireplace but finished basement

———-

I wouldn’t say North Park is a better neighborhood than Peterson Woods. Just Sayin

clio on August 31st, 2011 at 5:59 pm

The people on this site are absolutely crazy – when they “guess” prices or state what they think something is worth, I doubt many actually look at the comps – I think most of them just think “what would I pay for it” or they look at what the person paid for it (or how much money that person owes on a property) and then decide how much it is worth based on what type of profit/loss they think the seller should get/take – that is just plain ignorant and idiotic – westloop – THIS is why schooling is important – we wouldn’t have so many idiots in the world!!!

———–

Yeah, what would be the chance some people on here are licensed realtors and brokers? How odd would that be

The big problem with this house is that’s smack dab in the middle of that big NW side “no man’s land” with very poor public trans access.

That didn’t matter so much some 60 years ago when the mantra for “urban planning” was car-centric suburbs and newer urban “outlying” nabes because in the Brave New Postwar World every family would own at least one car. Public transportation was seen as obsolescent, needed only by old people and poor people, and who in the Baby Boom years wanted to be characterized as one of those?

So in the 80s along come the grown-up Boomers and their younger siblings, who see public trans as a “plus” rather than a “minus” when looking at where to buy a home. So “downscale” Lakeview and Wicker Park become the “in” spots and “nice” locations like Peterson Woods and Portage Park are passed over.

How to change the situation?

Maybe if we could build an L track over Lincoln…

ChiTown Gal,

Your point about public transportation is correct; it is not convenient around this location.

However, this would make a good home for someone who works in the northern suburbs but wants to live in the city. You’d have pretty decent access to the Edens from here. There are a lot of jobs in the north suburbs (I should know, as I work there myself). Lots of big companies like Kraft, Baxter, Abbott…

From here, you could go west on Peterson to the Edens in 11 minutes or in 9 minutes if you take Foster, according to Google Maps.

Well I absolutely adore it.

Dan #2 – Funny that there’s no L running down the middle of the Ryan like all the other expressways…

There is an L running down the middle of the Ryan. Did you mean the middle of the Edens? Not a bad idea, that.

“the middle of the Edens? Not a bad idea, that.”

With a junction of the blue line at IPR. And then swerve over to the Yellow, as extended to Old Orchard. Good stuff.

Who wants this stupid hobbit home off the beaten path when 425k gets you an SFH in Wrigleyville these days.

MLS 07840896.

Workers cottages were designed for workers. And these idiots were paying half a mill for them during the bubble..

I can’t wait for the cribchatteratis, most of whom live in overpriced and undersized McCrapBoxes, to criticize that listing above.

Bob– we’ve discussed that dump before. Not a family home, nor a family home location. Perfect for the “brau” crowd you regularly deride.

ChiTownGal, there was a streetcar up Western, Lincoln (if I remember right) and on Devon when this house was built. There was a proposal to do an el line from the new swift station at Oakton down to the blue line, which would have been just a bit west of here.

Yes – there were streetcars on Lincoln and Western when the house was built. But I imagine getting from this area to downtown on a streetcar took quite a while (about as long as taking the Lincoln bus today). Not the kind of commute most people would desire.

Steetcars should not be confused with rapid transit. They’re basically buses on tracks with a wire overhead, stopping at every red light and picking up passengers at practically every cross street.

“Bob– we’ve discussed that dump before. Not a family home, nor a family home location. Perfect for the “brau” crowd you regularly deride.”

And given you could probably pack in 20 of em, put up some greek letters, charge them $350/mo rent each..might be an investment. Would obviously need a monstrous security deposit tho.

“And given you could probably pack in 20 of em, put up some greek letters, charge them $350/mo rent each..might be an investment. Would obviously need a monstrous security deposit tho.”

Bob, please don’t insult the greek system at colleges/universities. It truly was instrumental in my development and growth. Honestly, the only things I remember about college center around the social activities at the house. I made friendships that are so much stronger than important to me than any useless book knowledge I learned. People have a wrong impression – they think fraternities are all about partying and getting laid – that is incorrect. We are all about building relationships, having fun, and enjoying ourselves. Nothing – and I mean NOTHING in my life has yet compared to the fun I had with my brothers. NOTHING….

“Bob, please don’t insult the greek system at colleges/universities.”

Stop being such an effeminate overly sensitive idiot. I went greek too but I can still poke fun at the stereotypes. Stop trying to play the victim card like everyone today dude it makes you look pathetic.

hahahaha Bob – that’s why I love you – my post was exactly what all the morons in the world today want me to say/feel/think. I have had to go to anger management classes, sensitivity classes, etc for being an asshole – and this is the type of shit they teach you. Ridiculous. Thank you for restoring my faith in mankind!!!

“what all the morons in the world today want me to say/feel/think. I have had to go to anger management classes, sensitivity classes, etc for being an asshole”

They don’t make you go, actually believing it will change how you feel and think. They send you to learn to shut up, so that you don’t have to ever go back to anger and sensitivity class.

I’m confused . . . does northside prep have a neighborhood component? If you buy this house and your kid is reasonably smart, does s/he get to go to NS prep? If so, I’ll buy the house tomorrow. (Only partially kidding!)

“I’m confused”

Assuming you are serious–no, there is no neighborhood component, and no radius preference. Which is why we mercilessly mock listing that include NSCP (or payton, young, lane) as the “high school”.

Thanks, Anon (tfo). I guess I didn’t read carefully. So, NS prep doesn’t even ‘prefer’ neighborhood students? If that is true, the realtard who listed it as neighborhood school should lose his/her credentials.

endora,

honest question – are you very desperate to get into an excellent school system? you area making it hard on yourself – just move to wilmette or westmont – you can easily buy a similar house for a similar price (if not cheaper) in either the new trier or hinsdale central school districts. both of them rival northside prep (depending on what rankings you look at – ie, like comparing harvard to stanford).

Yes, good point Clio. We are not at that point yet, but if we need to when we get there, that is what we will do (not Westmont, though, or even Winnetka. Maybe Lagrange or Hinsdale). It is absurd that CPS makes it so difficult to get an excellent (or even good) high school education for your kids in the city.

“So, NS prep doesn’t even ‘prefer’ neighborhood students?”

No prefernce AT ALL. Until they change things (kidding, mostly, as NSCP and Payton, at least, has never had a locality preference).

“If that is true, the realtard who listed it as neighborhood school should lose his/her credentials.”

This just goes to show you that many of you don’t know anything about what it takes to be a realtor.

The realtor listed NS Prep as a neighborhood school because once kids get acceptance letters to the school- parents actually DO look for homes in the area so that their kids can walk there.

Imagine that! Yes- it’s true.

So she listed both NS Prep and Mather as options so that those buyers looking close to the school would know that it was close to the school.

But none of you are agents in the neighborhood- so you really have no clue about what is driving the market here (including housing prices in the neighborhood.)

“Bob, please don’t insult the greek system at colleges/universities. It truly was instrumental in my development and growth.”

Clio- I thought you went to Harvard? They don’t have the greek system there.

“The realtor listed NS Prep as a neighborhood school”

So, people have that much difficulty looking at a map, that realtors need to use terms that have one common meaning to indicate something else?

Saabrina, you’re the best, but come on–it *doesn’t* mention Mather–“high school” field in the listing is NS Prep, period.

Frankly it is a little hard to imagine people buying a house in Peterson Woods/North Park in the summer following 8th grade so that their newly admitted NS Prep student can walk to school for 4 years.

Not saying it doesn’t happen; I am saying it doesn’t happen much and is not “driving the market” in these hoods–note contrast v. Bell Elem for instance. Might as well factor in NEIU and NPU student rentals, miniscule as they are, while we’re at it.

“Clio- I thought you went to Harvard? They don’t have the greek system there.”

college at U of Chicago. Medical training at Harvard.

Harvard correspondence school of medicine based in Grenada?

HD – huh?

“college at U of Chicago. Medical training at Harvard.”

I have to call this out. On previous threads you hated on UChicago and talked about how it’s not all that, and you went on and on and on about how you trained at STANFORD and HARVARD, not Uchicago.

If this is Tier 4 then the school actually doesn’t want them, unless they are getting perfect scores. In fact parents are better off applying from a Tier 1 or 2 address then moving once the acceptance letter comes in.

Jennifer are you an expert on admission decisions with CPS schools already or are you just a chattermouth?

You claim to know a lot about the behind the scenes decision making process based on tiers which is interesting considering the tier segmentation is quite new. I’m skeptical and going to call bullshit on your claim.

Um Everything Jennifer wrote is true. It’s not that arcane Bob. We city parents have to stay up to date with cps.

I understand why people are so concerned with schools (they can be incredibly instrumental in deciding the collegiate path of your kids). What I don’t understand is the unnecessary pain and hardships that you people go through finding these schools. There is free (FREE) superior education in the suburbs (Hinsdale, Winnetka, Naperville) all of which are better than almost any CPS.

This got me to thinking – only one of two possibilities exist for people to be unable to make this easy decision:

1. They are true morons (and nothing can help them).

2. Their kids’ education really isn’t their number one priority – and that is fine – there are other important things in life – but don’t fucking fool yourself and waste your and everyone elses time debating this idiotic subject. There is an easy and clear decision, and you are NOT going to be able to have your cake and eat it too. Make some sacrifices or face the fact that your kids will go to inferior schools (oh, the tribune also did a front page story last week on how the CPS students – even at the best cPS schools – were absolutely 100% ill prepared for college).

I am posting and writing this not because I really give a shit of where you live or where your kids study, but more because I can’t stand people who fool themselves… again, the choice is VERY VERY simple.

I have a question (sorry if it is stupid but I have no clue about the K-12 education): can one live in GZ and send ones kid to say a good school in a burb? Of course there is the driving but potentially parents can carpool or hire a driver together or one has to have a residence in a specific burb to be able to send ones kids to school there? I assume it is the latter.

miumiu, what a great idea – why don’t you try it?

oh, and i think we now know which one of the two groups most people on this site fall into……. just saying (sorry miumiu).

Clio, I don’t live in Chicago : ) Also I have one brat in a house hold of over 200K income so we should be able to send him to private school assuming he is not smart enough to make it to a good program.

miumiu – wait 5 years – I bet there will be 1 or 2 more “brats”…..

I’m surprised all of you GZ art fags haven’t caught MLS 07890064. Appears GZ condo valuations are plummeting as of late.

“Um Everything Jennifer wrote is true. It’s not that arcane Bob. We city parents have to stay up to date with cps.”

Bob doesnt even seem to know anyone with school age kids, so it IS that arcane to him.

The tier thing *will* have a meaningful change some time in the next five years. The fact of no change this year can be written off to the regime change–not enough time to figure out how to make things more complicated.

“The tier thing *will* have a meaningful change some time in the next five years. The fact of no change this year can be written off to the regime change–not enough time to figure out how to make things more complicated.”

Wrong wrong wrong – mainly for two reasons:

1. You don’t know what exactly is going to happen. Unless it has already been decided you don’t know – are you willing to take a chance like that with your kids’ education. If so, you are dumber than you sound.

2. 5 (FIVE) years is a long time to wait for many people. Remember, 5 years if you have kids aged over 8 is too long a period. Also, where did you get this number?

Again, sorry if I come off like an asshole – but the point is that you are ACTING like one – DON’T give advice that is potentially going to hurt some kid’s education. People may actually believe you and act accordingly – it is one thing for someone to lose a little money – it is another thing to ruin a kid’s life because you gave bad/wrong advice. Be careful, some angry parent might come back and sue you….

Bob – funny you mention that place, I was actually VERY interested in it. Why do you reference “art fags”, though? Is that the new gay neighborhood?

“The tier thing *will* have a meaningful change some time in the next five years. ”

Unless CPS ousts its chief or changes it’s methodology. Then you parents will have to hop to.

Remember CPS had to change it’s admissions criteria to comply with a Supreme Court ruling that race cannot be used as an admissions criteria. So what did CPS do? They used census tract level data as a proxy for race.

If they aren’t happy with the racial mix that results from this look for the methodology to change and for them to try to find another backdoor way so the kids can hold hands and sing kum bye yah.

“Bob – funny you mention that place, I was actually VERY interested in it. Why do you reference “art fags”, though? Is that the new gay neighborhood?”

Clio you can’t buy every property on the way down. You may think you’re a man of means but you’re probably already levered up to your teeth and can’t get any more credit.

Your one man bullish shop can’t save Chicago valuations. You’d actually have to be able to do something about every single property that comes onto the market you feel is underpriced and sorry most people like you just don’t have the ability to do that.

thats a great deal on a property in a nice location, why don’t you scoop it up bob. Yeah the finishes are of rental quality, but youre used to that right

“thats a great deal on a property in a nice location, why don’t you scoop it up bob. Yeah the finishes are of rental quality, but youre used to that right”

I’m thinking about it.

Taxes don’t look right on it, tho. Not sure how long those low taxes would stick around.

“Taxes don’t look right on it, tho.”

taxes are monthly. sorry, YOU can’t afford it……

“Clio you can’t buy every property on the way down. You may think you’re a man of means but you’re probably already levered up to your teeth and can’t get any more credit.”

Bob – you fail to understand the psychology of an investor. If we see something that can potentially make money, we just shift our investments. There are billions/trillions of liquid dollars not making ANY money looking to be invested in a real entity with real returns.

well the taxes will probably be around 4k a year if it sels at that price

Clio, I was just thinking how unfortunate for you, that you weren’t down here. Someone half as bullish as you would probably be up 30-40 the past 5 years…. Just makes me laugh…. You need to stop being so intelligent and learn to find the right places at the right time… Flow a bit with lady luck!

“sorry if I come off like an asshole”

No, you arent, so why not just stop pretending? Be more honest with yourself.

““The tier thing *will* have a meaningful change some time in the next five years. ”

Unless CPS ousts its chief or changes it’s methodology. Then you parents will have to hop to.”

Do you even bother reading what you are “disagreeing” with before you quote and post? It will change, unless it does change? Really?

““Taxes don’t look right on it, tho.”

taxes are monthly. sorry, YOU can’t afford it……”

There actually is a nuanced difference between willingness to pay and ability to do so. This nuance is lost on a lot of those who are leveraged to the hilt in RE, but is summed up nicely by this:

http://media.fakeposters.com/results/2009/07/27/zmx20jzqxh.jpg

Bob,

the problem is that taxes everywhere (except oak brook and schaumburg) are increasing at a ridiculous rate. You are NOT going to be able to buy anything in Chicago without paying a LOT of real estate tax. The morons on this site that say “oh, just get them lowered” don’t know wtf they are talking about. I have done this DOZENS of times, and, sure, they get lowered for about 1-2 years, followed by a HUGE increase in valuation and HUGE increase in taxes. Ask anyone who has done this over 3 years ago and they will tell you the same thing.

Bottom line is that you are NOT going to get away avoiding taxes. Sure you can pick up a 500k place for 250k – but you are going to be paying “500k-type taxes” on the place. This is the thing most people buying short sales and foreclosures fail to realize (the upfront sales cost is only part of the magic number).

Bob (and everyone else) the real estate tax issue and school system issue are the only reasons I keep bringing up oak brook – oak brook doesn’t have real estate tax and the school system is tops in the country. It is strategically located right next to 294, 88, 290 and close to all areas of chicago (compared to any other suburbs). I personally am a city person and don’t like ANY of the suburbs (esp because I am single and my children live out of state) – so I don’t have any ulterior motive to push oak brook – but I read everyday how many people are complaining about taxes and schools – there is a very easy solution – but I guess people don’t really want a solution – they just want to bitch and moan.

“The morons on this site that say “oh, just get them lowered” don’t know wtf they are talking about”

Actually what I have found is in the city of Chicago top floor penthouse type lofts such as this seem to be taxed at a much higher rate than what their current ask prices are.

I’ve seen it in 4-5 floor buildings in most instances over the city: the tax man feels entitled to tax them more just because it’s a top floor unit in one of these loft spaces.

The over taxation doesn’t seem to apply to top floor units in 3-4 floor 2-6 flats though.

My wife and I have our eye on a place that is currently has a long term homeowner exemption. The taxes are $2,000. Seems like a deal, right? Back out the exemption and the senior exemption and the taxes jump to $9,000 a year. The monthly taxes are only slightly less principal & interest. What a joke.

There’s another place we like, even more expensive, taxes are $8,800 a year. The current owner appealed them in 2004, 2007, 2010 and lost each appeal. The biggest jump appears to have come in 2004 and it looks like the taxes in 2003 were roughly $5,000 a year and now they are $8,800. $450,000 for a small house with no AC and $8,800 in taxes. Nice place but at 500 days on the market it’s no shocker why it just sits.

I had a client come in the other day. They purchased in Will County in 1997 and taxes were a whopping $3,500 back then which was more than the $2,400 they paid in cook at the time.

Fast forward to today, the taxes are roughly $7,000. The problem is that they didn’t have a tax escrow and they were a few weeks late paying their taxes. The bank paid the back taxes, and then set up a tax escrow to repay the back taxes and to pay the future taxes. Their mortgage payment jumped 125% over night. They missed two payments, got the default letter and now they’re in foreclosure. True story.

I have story after story of people who got in trouble because the taxes increased exponentially, and combined with some other situation (medical, job loss, etc) they went into default, from which taxes were a major cause.

My rent is $850 bucks a month (Which everyone tells me is ridiculously low and cannot be replicated, I have a good landlord) and the taxes on the house I really like are $750. Fucking absurd. So, homes in this particular area just sit and sit and sit. Hundreds of homes listed at $400k+ and few of them go under contract, but the smaller homes listed in the $200’s and $300’s(and those crazy $8,000 taxes) seem to sell pretty quickly if they are livable. over half of the homes appear to be FHA low money down (10% or less) up to the conforming limit. Few people in their right mind want to purchase up for a $450,000 house with $10,000 or more in taxes per year for the next 30 years. IT’s nearly DEAD out there, I don’t know how realtors and mortgage brokers are feeding their families; activity picked up a few months ago with new contracts but nothing seems to be closing. I see homes under contract for 150 days now and not closing and these are not REO’s either. How are realtors paying their bills? How are they putting gas in their car? How are the paying the car note on that ubiquitous Lexus SUV they all drive? I have serious concern for the financial health of the individual members of the real estate industry.

I think the thing people have to understand and start to accept is that taxes are here to stay. You are NOT going to get a great big house on a big lot and NOT pay high taxes (except in oak brook). Again, just because foreclosures are priced low – doesn’t mean that taxes are lower. People just have to accept the fact that they are going to pay a lot of taxes – just accept it (and remember, of all world class cities, chicago real estate taxes are relatively low – just look at new york, sf, boston).

Again, YOU ARE NOT GOING TO BE ABLE TO AVOID PAYING HIGH TAXES IN CHICAGO IF YOU WANT A NICE PLACE – YOU JUST AREN’T!!!

“How are realtors paying their bills? How are they putting gas in their car? How are the paying the car note on that ubiquitous Lexus SUV they all drive? I have serious concern for the financial health of the individual members of the real estate industry.”

The realtor I know is indeed struggling. But he doesn’t drive a Lexus SUV he drives a Chevy sedan. And he’s getting by off of deals in neighborhoods that aren’t covered here on CC: deals on $5k properties in places like Englewood. It’s a meager living but that’s how some are getting by.

impressive hd. now who pays less rent, hd or bob? what about on a per sqft basis.

impressive hd. now i’m wondering who pays less rent, hd or bob? what about on a per sqft basis.

HD on a sqft basis..easily.

“Again, YOU ARE NOT GOING TO BE ABLE TO AVOID PAYING HIGH TAXES IN CHICAGO IF YOU WANT A NICE PLACE – YOU JUST AREN’T!!!”

No shit sherlock. the answer, however, now that ‘affordability’ mortgage products have disappeared (And another recession is looming) is that the price of said property will need to drop to reflect the high taxes.

Call me crazy but the magic number for me is $1,800 – $2,000 a month PITI. Of course if you want a big place, or you have a small downpayment and finance 90% of the purchase price, you should and will pay more per month. But for someone like me, a normal middle class guy, two working parents, a kiddo or two, wants to live in a decent area, a 20% down payment, doesn’t need a big house or a new house, $1,800 is a nice round number and should buy something nice. But it doesn’t in many areas – inlarge part because of taxes. In many areas including nice suburbs the low end $200,000 to $350,000 is hot (still slow but hot compared to the above $350k market) because you can engineer a payment of $2,000 or less; but once you start getting these 1960’s ranches listed at $400,000 plus $8,800 taxes it’s just absurd, you need a doctor’s income to afford these home; whereas the doctors and law firm partners are picking up the mcmansions as short sales for $400,000 and $500,000.

It’s a long, slow, drawn out dragged out slough to the bottom. This is going to take YEARS.

“IT’s nearly DEAD out there, I don’t know how realtors and mortgage brokers are feeding their families; activity picked up a few months ago with new contracts but nothing seems to be closing.”

Several months ago, a realtor told me that the year was “over” and he was waiting until 2012 for anything major to happen (with sales or otherwise.) And that was in the middle of the summer!

Inventory is very, very low. There is little coming on the market. But little is selling either. Occasionally I’ll see a rehabbed property sell pretty quickly.

But I can feel a desperation in the air that usually I feel about November (when sellers realize they’ll have to wait until spring.) Right now- they’re already realizing they’ll have to wait 8 more months to sell.

And it looks like the stock market is about to go in the crapper again. That’s going to affect the upper bracket the most.

My rent is cheap yes but again, it’s vintage, well maintained, study, dated, 980 sq ft, near the el, nw side. I have a buddy who rented a slightly dingier place but slightly larger on the NW side for 1,200 a month and he said that you can’t get anything ‘decent’ for $900 a month these days. You need to jump up past $1,000.

With rent that is $850 a month I can save tens of thousands a year without any real trouble. I don’t live paycheck to paycheck like my bankruptcy clients do (and there are no shortage of them).

HD- there are some houses in Oak Park I’ve been looking at but when you get the taxes – it’s a whole nother mortgage payment. And yes, those are going to go up.

So who can afford the $400,000 home PLUS the $12,000 to $15,000 (or whatever it’s going to be now) in taxes?

“So who can afford the $400,000 home PLUS the $12,000 to $15,000 (or whatever it’s going to be now) in taxes?”

Few want to buy the junk listed for $400,000 that should be listed for $225,000.

“So, people have that much difficulty looking at a map, that realtors need to use terms that have one common meaning to indicate something else?”

Um…yes. If Crib Chatter is any indication.

People search the MLS for many things- including the school name.

Again- don’t talk about what you don’t know anything about. People move to that neighborhood solely to be close to NS Prep- after their child gets in.

“It’s a long, slow, drawn out dragged out slough to the bottom. This is going to take YEARS.”

WRONG WRONG WRONG – I’m sorry HD, but your posts reek of self-centeredness, self-absorption, and arrogance (for the other readers – it is subtle finding but definitely there). There is still a lot of money out there and a lot of people willing to pay the prices sellers are asking. Just because it may take YOU several years, does not mean the whole real estate market is bad. Again, the real estate market does NOT center around you. You need to stop feeling helpless and sorry for yourself, brush yourself off, pick up your purse, untwist your panties and go out there and get what you want. Your whiny wimpy attitude makes me want to puke!!

“Saabrina, you’re the best, but come on–it *doesn’t* mention Mather–”high school” field in the listing is NS Prep, period.

Frankly it is a little hard to imagine people buying a house in Peterson Woods/North Park in the summer following 8th grade so that their newly admitted NS Prep student can walk to school for 4 years.”

Wrong again! Why don’t you talk to some realtors in the neighborhood and find out if it’s “a little hard to imagine”?

Imagine this: you live in the South Loop (maybe your child goes to South Loop elementary) and, miracle!, she gets into NS Prep. Are you going to drive all the way up there every day, 5 days a week for the next 4 years?

Um…maybe not!

Not too hard to imagine to me.

Peterson Woods is lovely with leafy side streets and old housing stock that isn’t found in other parts of the city. Maybe you should go visit it and find out? Not too hard to “imagine” that someone might move up there if their child was going to school nearby.

Also- the agent DID list both schools in the listing (at least the public listing, since I don’t have access to the MLS I don’t know what was posted there. But usually they don’t differ.)

School Information

Elementary School: JAMIESON ELEMENTARY SCHOOL

Elementary School District: 299

Junior High: JAMIESON ELEMENTARY SCHOOL

Junior High District: 299

High School: NORTHSIDE COLLEGE PREPARATORY SE

2nd/Alternate High School: MATHER HIGH SCHOOL

High School District: 299

“Just because it may take YOU several years, does not mean the whole real estate market is bad. Again, the real estate market does NOT center around you.”

No- it just centers around all those short sales and foreclosures out there.

Gosh- I was busy looking at Park Ridge lately and haven’t looked at Oak Park. Chris M, you should be glad you sold and got out of there because it looks pretty awful in Oak Park right now. Those $700k houses are selling back in the $400s (which is where they should be anyway.) Yikes!

Sabrina,

who has the money to move from the south loop (and, presumably take a huge loss) and then turn around and buy a SFH or condo in another area?!! IT’S NOT HAPPENING. People with that kind of money (to lose on a condo and STILL have enough for a downpayment on a new house in chicago) are most likely sending their kids to private school. You are delusional if you think otherwise.

“Those $700k houses are selling back in the $400s (which is where they should be anyway.)”

WAit, why “should” they be around 400k?!!! Just because you THINK they should?!! Just because that’s what you think someone can afford? That’s not how it works.

I agree with you Clio… Tons of opportunities. Like I said earlier. Had you been long just 1/4 of the value of your Oak Park estate, but here in Ipanema, you would have made more in profit, in the past 6 years, than the entire value of your current portfolio. I really have no idea how a brilliant and worldly guy like you, so bulled up on real estate, could have missed this. Had you only listened to me, clio!!! Really you’d be up 50-100. One day you’ll get better, i am sure that with more experience, you will.

“So who can afford the $400,000 home PLUS the $12,000 to $15,000 (or whatever it’s going to be now) in taxes?”

The Chicago tax code is going to create a bifurcated system where people below the senior exemption age are increasingly going to rent as on a cash flow basis it is significantly cheaper and people above the senior exemption age that qualify for it are increasingly going to own because their cash flows are cheaper than renting.

It is above people’s comprehension that enact these tax codes that people act rationally and modify their behavior to maximize their economic outcomes.

Bob,

I don’t know if you know any “seniors” but they DON’T have a lot of money and they are NOT going to rent until they are 65 (or whatever age) and then all of a sudden turn around and buy a place in chicago. Most seniors are looking to SELL and liquidate their assets (they need liquid assets).

Your analysis is logical, but you fail to factor in many of the variables (just as most academic economists, etc. do).

clio… It’s kinda like if you were hyper bulled up on tech in ’93, but instead of buying Intel you bought AMD, but worse!! AMD didn’t go down. Chicago did…. Right place… Right time… So easy… You’ll learn, your smart, just stick with it, lil fella!

Bob, Clio is correct about factoring things in. Take for example Clio. Clio was correct by 1000 percent, that buying real estate was the thing to do. Now had Clio been an advanced investor. Clio would have factored in WHERE to buy real estate. A simpletons mistake really. All novices like Clio make them. I guess it’s called ‘payin for your education’

ze, why are you pretending to know me and my portfolio? What makes you think I have lost money in real estate? Thus far, I haven’t lost a penny in reality or on paper. Again, perseverance and patience are the key to building wealth.

Sure my properties lost 20-30% of value since 2006, but I bought most before then and they are ALL still worth more than what I paid for them. Also, these properties are rented and I am making 4-5% on my investment. Sure, it isn’t great, but better than putting it in a CD, or savings account. The stock market is uncertain and cannot be reliably counted on.

Again, bottom line is that if you buy real estate now and have patience, you will be sitting in the catbird’s seat in 10-15 years.

“who has the money to move from the south loop (and, presumably take a huge loss) and then turn around and buy a SFH or condo in another area?!! IT’S NOT HAPPENING.”

You don’t know when they bought in the South Loop. They might have bought when it was just up and coming in 1998-2000. Their child is going to high school, don’t forget. Their child went to South Loop elementary until age 13- 14.

Also- let’s say they’re underwater. Plenty of people are renting out their condos and buying a house somewhere else (if they have the income to do so.) Gary Lucido has commented on this numerous times. I personally know a lot of people doing it- so somehow the banks are buying into it. Of course that means all these buyers are doubling down and now have quite large real estate portfolios- but that’s their problem, not mine.

“Again, bottom line is that if you buy real estate now and have patience, you will be sitting in the catbird’s seat in 10-15 years.”

Yes- if you buy now and we bottom out in, say, 2 to 3 more years. Then you will get 1% to 3% a year for the next 10 years after that. I know everyone will argue “leverage”- but you’re going to be waiting a LONG time to “make” much money from a normal real estate purchase (and not a flip etc.)

“Plenty of people are renting out their condos and buying a house somewhere else (if they have the income to do so.) Gary Lucido has commented on this numerous times. I personally know a lot of people doing it- so somehow the banks are buying into it.”

GOTCHA!!!

“I know everyone will argue “leverage””

And the fact that you dismiss it is very telling.

” I know everyone will argue “leverage”- but you’re going to be waiting a LONG time to “make” much money from a normal real estate purchase (and not a flip etc.)”

As with MOST TRUE investments, long term goals/returns and patience are the key. We have turned into a society where we want everything and we want it NOW!!! Smart investors know better. I am telling you guys – if you want to make a good long term return in a relatively safe investment AND if you have some time and are handy, then you could really do quite well in real estate investing. All the people who made the most money in the mid 2000s didn’t buy when the boom was occurring, these people bought in the 90s and earlier when everyone was telling them NOT to buy (sound familiar?). The morons who jumped on the bandwagon in the mid 2000s were too late (again, sound familiar). Don’t be a follower if you want to make money – it won’t work (just look at someone like HD)

Yes- I’m dismissing it.

LEVERAGE!!!!

That did SO MUCH for my parents and their lovely Chicagoland house that they bought in 1969. It never even came CLOSE to their stock market investments- but they had plenty of LEVERAGE!!!!

It MUST be great.

The fact is- real estate is a crappy investment in most parts of the country. It barely goes up along with inflation (if that.) The only reason some of the boomers have assets, though, is because they paid off the house and continue to live in it (those that didn’t HELOC the heck out of it.)

Just saw a house in the northern suburbs. Bought in 1998 for $295,000. Helo’d all the heck in 2006 with a $740,000 loan. NO RENOVATIONS to the house (but I hope they bought a very nice vacation condo with it.)

Back to the bank and now listed for $210,000.

Good times.

Also- the fact that we’re STILL talking about LEVERAGE more than 5 years into this housing bust is very, very telling.

There was a funny article in the Tribune this weekend about vacation homes and how you’d better buy now- because all the deals may go away.

(ha! ha!)

So I checked around. I vacation in Harbor Country every year and the same properties that were for sale 3 years ago are STILL for sale. Some of them lowered in price- some of them not. I’ll check back in again in another 3 years. I doubt it will be much different. Foreclosures are selling, but not much else.

“if you want to make a good long term return in a relatively safe investment AND if you have some time and are handy, then you could really do quite well in real estate investing.”

Why is it “safe”?

Tell that to people who bought Las Vegas homes and will never be able to sell for a profit in their lifetimes. Tell that to people selling their Southport condos for a $100,000 loss. Tell that to the person losing $250,000 on their Oak Park house they bought just 6 years ago.

Doesn’t sound “safe” to me.

“The only reason some of the boomers have assets, though, is because they paid off the house and continue to live in it (those that didn’t HELOC the heck out of it.)”

DUUUUUUUHHHHHH!!! That is the key -how the hell can you not understand this?!! Paying off your house is a HUGE deal and has HUGE financial benefits (and I am not even bringing in the social and mental benefits). Imagine living in a 400k house that is paid off – your expenses are taxes, insurance and maint (likely less than 1000/month) – where can you find a rent like that for a 400k place? Also, when and if you decide to downsize you have that 400kpayout.

AGain, the takeaway point is that real estate is a GREAT GREAT investment but you have to be in it for the long haul.

PS sabrina, for as much money that your parents made in the stock market, I can show you many many people who lost their shirt. I can also show you many many many many people who made millions and millions in real estate.

No one “lost their shirt” who bought the stock market in 1969 and is holding to this day. Heck, even if they had bought Enron as 5% of their portfolio.

I wonder how many baby boomers own their houses outright? I bet it is a small percentage. You’re always seeing those stories in the paper of the 65 year old about to lose their house in California that they’ve owned for 40 years because they can’t pay the mortgage. Or the guy who lost his job at 60 but needs it because of his huge expenses (when he should be nearing retirement.)

Maybe we only hear the worst of it.

Out of the baby boomers I know- only about half own their homes outright. All the others still have mortgages. But that is just anectdotal. And they are all in a major metropolitan area (not in small town America.)

“Tell that to people who bought Las Vegas homes and will never be able to sell for a profit in their lifetimes. Tell that to people selling their Southport condos for a $100,000 loss. Tell that to the person losing $250,000 on their Oak Park house they bought just 6 years ago.”

OK Sabrina, I said over and over and over and over again that the people that jumped on the bandwagon in the mid 2000s are the followers who lost out. They are typical of most people on this site as well. OK – but going forward, the people who made money and the people who will make money are people who bought in down times (such as now and pre 2003). Why are you basing all of your real estate advice and opinions on the limited population that bought between 2002-2008? That is just stupid stupid stupid. It is as stupid as me saying the stock market is awful because I bought etoys, lucent, fannie mae stock (which I did and lost 100%) or because I bought HD stock in 2006 (which I did and am still down 10s of thousands on that one stock). Idiotic and terrible terrible advice. Are you a product of CPS?

“Doesn’t sound “safe” to me.”

You cherry pick locations and specific times. One could easily do that with the stock market and prove your theory completely “wrong” as well.

I’m not arguing that real estate is a good or bad investment. But to dismiss the leverage involved is foolish. Just ask those who bought in 2005….

If you bought Chicagoland property in 1969- you did okay. But, again, depends on what town/location. If you bought in North Lawndale- not so good. If you bought in Olympia Fields/Homewood Floosmoor – not so good. If you bought in Hinsdale- VERY good. But who knew what would turn out “good” and what wouldn’t? Towns and communities change.

It all depends.

Most people will have paid off the house and are just living in it. That’s what they should do. Go into retirement with as little expenses as possible. That’s the name of the game.

I’m just going off of a long term holding period of 30 years- which is what Clio said we have to do now.

You could say you bought stocks in 1929 and then sold 30 years later and it would suck. But if you were re-investing your dividends during that time period you would have made 5% a year. I don’t know what real estate did during that same 30 year period. It got crushed as bad as the stock market but from the Chicago examples I saw it took anywhere from 25 to nearly 70 years to get back to breakeven (depending, again on location.)

So both asset classes during that period were equally as bad.

Of course if you had waited five years into the depression to buy either one- you would have had a better result 30 years out.

Robert Shiller has compared housing to other asset classes over the last 130 years chuk- and housing basically has sucked over that whole time period except in the 10 to 15 year time period leading up to the bust (this is national home prices.) It never really outperforms inflation.

Everyone is basing their concept of real estate on what happened over the 1995 to 2005 time period. When they need to look at what it did for decades before. If you bought a $100,000 home you sold it for $110,000 or whatever. Whoop-de-doo.

You buy real estate to live in! Unless you’re a professional investor/rehabber. There have ALWAYS been those. And there always will be those in the future.

Just buy to live there for the next 20 years. You’ll be fine. Heck – get a 15 year mortgage and pay it off and be on easy street. I know a LOT of people refinancing into the 15 year and they’re telling me their payments are the same as the 30 year.

So don’t come on Crib Chatter complaining about the 1-bedroom condo you bought and now can’t sell- 3 to 5 years from now. I don’t want to hear it.

Hey Chuk:

Did you buy stocks 2 weeks ago when the VIX went over 40? That was your “signal” to buy- right?

Went under that again for awhile- but will probably test it again this week.

Will you be buying again then? Or do you sell when it goes back below 40 and then buy again when it is above it (if it goes above it) again. Just wondering how your strategy works.

“Gosh- I was busy looking at Park Ridge lately and haven’t looked at Oak Park. Chris M, you should be glad you sold and got out of there because it looks pretty awful in Oak Park right now. Those $700k houses are selling back in the $400s (which is where they should be anyway.) Yikes!”

The taxes were one of the major reasons I chose to sell. I received a pamphlet in the mail from the township assessor showing the trend in taxes over the years and it showed that they roughly doubled in about 5 years. Like the property HD has been watching, our taxes were artificially low due to a senior exemption and senior freeze (taxes were about $3k/year). However, once those get removed the taxes are nearly 3X higher. And I tried to get the assessed value reduced to the purchase price (county had property over assessed by about $120k), but the process is as difficult as I was warned…I got the value reduced but only about halfway. Even the township assessor admitted that they board of review wasn’t reducing assessed values properly and that they hadn’t seen this as an issue before. Anyway, if the taxes on our ~$300k Oak Park house were going to be $9k/year in 2011, if the trend continues I was anticipating taxes of at least $15k within the next 5 years. That type of trend with taxes would have been a huge burden and I am convinced that it’s going to have an impact on values (if it continues, which I think it will). It’s clear to me that homes prices in Oak Park are much lower than the city primarily because of the applicable tax rate being roughly 2X as high as Chicago.

It will be interesting to see what happens as taxes continue to rise and if mortgage rates start to rise (as they inevitably will).

leverage is a net neutral when entering an investment because it does not change the linearity of the payout of bet. Calculate as return on equity- fair enough. Leverage is a sword that swings both ways… A fun sword… End of story.

This will drive those already on the edge even closer to the strategic default. foreclosure trend to continue for an indeterminate period of time.

“Anyway, if the taxes on our ~$300k Oak Park house were going to be $9k/year in 2011, if the trend continues I was anticipating taxes of at least $15k within the next 5 years. “

chris M: what was your PITI?

PITI with the artificially low taxes was between $1,300-1,400 per month. But, when the senior exemptions get taken off, it probably would be been another $500 per month. However, we paid some points to get the rate lower (which ended up being a waste since we sold) and we rented unused garage spots for extra income. House also had only 1 bathroom, no A/C, somewhat dated kitchen/bathroom, and unfinished basement. The plumbing/electric was old and needed updates. Various other old house repairs were needed. So we were taxed like all the other houses on the block even though the house needed quite a bit of work to bring it in line with the others being taxed generally between $7,500 and $12,500 per year.

clio.. I didn’t mean to say you lost money on any of your purchases. I couldn’t know this. All I am saying is that for a RE bull, had you been a hardcore sharp investor, there are quite a few places that have rocketed. I mean Paris- think I said 2 years ago on here.. No brainer.. Last year… Up 22 percent in luxury areas. You wanna bet me 30yr forward on Paris vs Chicago for flat…. I’ll take anything you want…. So loss – technically no. Left crazy money on the table watching your beloved asset class take off elsewhere… Yep!!

So your PITI was $1,800 or $1,900 a month.

IIRC you went down to one income and moved back to your 2-flat in the city; so the $1,800 PITI was too much, right? maybe i’m just assuming or projecting too much.

The artificially low taxes are the problem on a suburban 1950’s ranch we found and *really* liked. Not quite midcentury modern but still really cool. The dining room in the house had the same layout at this room & board picture, window placement, lighting, everything, it had such potential, I could have made teh inside look nearly identical to this without spending any money but the cost of the furniture.

http://s7d4.scene7.com/is/image/roomandboard/ventura_567250_10e2?$truvu0$&wid=285

But the taxes at $2,000 were set to increase to $9,000. and to keep the PITI under 2,000 a month the price would need a 20% haircut which is not realistic at this point in the game. so, we play the game, and just wait..and wait….and wait…

“leverage is a net neutral when entering an investment because it does not change the linearity of the payout of bet.”

more mumbo-jumbo – sounds like academic bullshit.

HD – wtf do you NOT understand about “you can’t have your cake and eat it”? You are a cheapskate and want to get a good house for under 2000/month so you can hoard/save money. Sorry, you spoiled brat – it ain’t going to happen. You will be looking until you die – again, it’s NOT GONNA HAPPEN.

You have six choices:

1. continue to rent and stfu

2. bite the bullet and buy something suitable and pay the 2500-3000/month it is going to take to make it happen (your best bet – your wife and children will be happy and, in 10-15 years, you will be better off than you thought).

3. buy a shitbox with low taxes (not a good choice).

4. get a higher paying job/moonlight, etc.

5. have Mrs. HD get a job

6. a combination of the above

THERE ARE NO OTHER CHOICES AND THERE WILL NOT BE ANY OTHER CHOICES

“You will be looking until you die – again, it’s NOT GONNA HAPPEN. ”

LOL! I love you clio. You rock. It’s amazing how the places I want to live are languishing on the market. So it’s more like this:

as I save more money, prices will continue to fall, and they will meet an equilibrium where the nice place I buy (that can handle the dining room in the room and board link above) will be $1,600 to $1,800 per month PITI with a 20% to 33% down payment.

It will happen, rest assured.

“IIRC you went down to one income and moved back to your 2-flat in the city; so the $1,800 PITI was too much, right? maybe i’m just assuming or projecting too much.”

That’s what we did (although, ironically enough, wife just got a job full-time teaching position at Lane Tech). We still had a good chunk of savings and I could still reasonably afford the PITI on just my income, but it took me to the edge of what I felt comfortable with, given the repairs necessary and where I saw taxes going. Plus, we still had to maintain the 2-flat in the city, which we were renting. I discovered it’s one thing to be an owner occupant in a 2-flat but it’s MUCH more of a burden when you don’t live in the building and need to get over there to address issues, maintain the property, etc. That’s why–after this experience–I tell anyone thinking of renting their condo to seriously rethink becoming a landlord.

In fact, someone was recently asking me about refinancing or selling their 100% financed basement 2BD condo in Logan Square that they purchased at the peak so they could move to a bigger place…I told them to seriously consider walking away, because they have nothing but their credit scores on the line and even if they could refinance (which might work for them) they’re still going to be renting at a loss of several hundred dollars per month. They thought they would rent until the market turns, but it was clear they weren’t considering that it could take a very long time for that to happen.

“It will happen, rest assured.”

I agree. All the properties on my watch list are reducing prices albeit most too slowly to actually find a buyer : )

The stock market is in trouble. We have a ponzi scheme for an economy. Our government is helping Wall St. rob the weak. Government of the people and for the people? Does anyone believe that anymore?

There are not many jobs out there. Not for college grads now. Not for the college grads of a couple years ago that had to get an MBA or JD. The job market is bad, bad, bad. I hope the Made in the USA movement takes course, because globalization is bullshit. If we aren’t going to manufacture anything WTF are we going to do with ourselves. I’ll tell you what we’ll do, we will battle for the scraps that the elite in this country throw us.

I shorted the market last week but I’m not sure how long I will hold it. Commodities are showing resilient strength, but I don’t trust that either. Why haven’t oil prices come down much? The theory that China is using their saved dollars to buy up commodities makes sense, but how much longer will they go on?

If China really wanted to mess with us they would use their saved trillions in dollars and buy up commodities like food and oil and choke the hell out of the average American. They could destroy the dollar as the world reserve currency and then be the economic superpower of the 21st century.

There is only so much the incompetent Bernanke can do at this point to prop up the market. He already bought 800 billion in crap mortgages from banks at full price. Banks still aren’t lending because prices are too high and there is too much uncertainty. Like how the over-educated fools behind LTCM were exposed in 1998, Bernanke is finally understanding exactly how stupid he has been. He really thought helicoptering money would save us? He thought sub-prime would be contained? He thought that without job growth we could have a sustained economic recovery? At best he is nothing more than a fool.

I don’t think operation twist is going to do much for asset prices or the economy. Lower longer term interest rates aren’t the problem, it’s not going to make people build new homes or otherwise help employment. I can see traders taking the market up on this theory but the reality is unless the Fed is going to purchase hundreds and hundreds of billions in bonds (and risk painful inflation in gas and food prices) we are going to have to tough this out.

Maybe Ron Paul will get elected President and he can help get Wall Street under control and start getting things straightened out. Obama is almost as bad as George W. Bush.

clio… Me.. Academic..roflmao… Nope.. You are just too unsophisticated to understand. Leverage gives no advantage because the disadvantage is equivalent.

Put numbers to that, that shows otherwise…. You really look silly to a real investor. Afraid of the stock market.. Roflmao!!! It have sharp lil teeth?? Run back to mommy a lot?

“There are not many jobs out there. Not for college grads now. Not for the college grads of a couple years ago that had to get an MBA or JD.”

I think this depends on your skill set and what you’re looking for. Can you graduate from Big Ten U and get a pretty good administrative assistant job in an office paying $25k or $30k a year right now? Sure.

If you’re in journalism and looking for something in that field- then forget it.

I’ve actually known quite a few (non medical or engineering grads)- actually all liberal arts grads- from Big Ten schools who just graduated who are getting jobs. I also know quite a few people jumping around at the professional firms. It’s nothing like it was in 2008/2009.

They’re living 3 to 4 in north side apartments and paying $600 a month in rent.

“Anyway, if the taxes on our ~$300k Oak Park house were going to be $9k/year in 2011, if the trend continues I was anticipating taxes of at least $15k within the next 5 years. That type of trend with taxes would have been a huge burden and I am convinced that it’s going to have an impact on values (if it continues, which I think it will). It’s clear to me that homes prices in Oak Park are much lower than the city primarily because of the applicable tax rate being roughly 2X as high as Chicago.”

Wow. I don’t even know what to say to taxes of $15k on a $300k house in Oak Park.

Heck- even $9,000 is crazy insane to me. That is $750 a month on top of a mortgage. Wow.

yep.. Taxes are going to go up, up, up… If you produce….be prepared to pay.

i made myself laugh, clio. I was just thinking about you shooting for 4 to 5 percent. How many hours a year do you put in for that? Anyone can get that doing nothing, and then just play around on their kite, and smoking pot all day.

4-5 percent… Not worth even settin the alarm clock.

“Wow. I don’t even know what to say to taxes of $15k on a $300k house in Oak Park.”

Here’s a recent listing in Oak Park for $240k with taxes of $13k/year.

http://www.redfin.com/IL/Oak-Park/423-N-Ridgeland-Ave-60302/home/13270590

There are quite a number of listings that have annual tax rates of >5% of market value.

I am telling you guys, you are not going to find that perfect place in the perfect location at the price you want. If you do, there will be something that bites you in the ass (ie taxes).

To all the non-posting readers out there, be very careful who you listen to on this site – the most vociferous and “knowledgable” are the people who don’t even own any real estate (yet they feel they have the superiority, experience and knowledge) to advise – what a frickin joke. Just to remind you guys:

1. HD – renter with a wife and kid. never owned. wants to buy a nice 3-4 bedroom HOUSE with lawn 2 car garage in a safe neighborhood with excellent schools for LESS THAN 2000/month. It can be done….but HD’s idea of a good area is ridiculous and not compatible with his budget. So instead of accepting it, he bashes real estate and sellers/buyers, etc.

2. miumiu – has been looking for a million dollar in-town but doesn’t want to pay more than 500k. In addition, she wants all the amenities of a full-service building but doesn’t want to pay high assessments

3. Bob – probably the most analytical of the group – but doesn’t take into consideration that he may (or may not) get married in the next few years – and that will change everything. In addition, the crapshack listings he references are ridiculous and places that most normal people would never live.

4. Sabrina, – lifelong renter and housing bear.

The thing that all of these people have in common is that THEY ARE ALL RENTERS (ok maybe not miumiu) and THEY HAVE ALL BEEN SCOURING THE MLS/REAL ESTATE MARKET FOR YEARS – yet they still haven’t found ANYTHING that is suitable. Is that reflective of the market – or the individual. Come on everyone, ask yourself that question and you will realize – it isn’t the market which is bad, it is the delusion of the people I mentioned above.

I meant to say annual tax bills of >5% of market value.

Amazingly clio, roughly half if the homes in the area I want to live have PITI less than $2,000. It’s just that so few listings meet this criteria, and consequently, so few listings ever sell….

“1. HD – renter with a wife and kid. never owned. wants to buy a nice 3-4 bedroom HOUSE with lawn 2 car garage in a safe neighborhood with excellent schools for LESS THAN 2000/month. It can be done….but HD’s idea of a good area is ridiculous and not compatible with his budget. So instead of accepting it, he bashes real estate and sellers/buyers, etc.”

“Amazingly clio, roughly half if the homes in the area I want to live have PITI less than $2,000. It’s just that so few listings meet this criteria, and consequently, so few listings ever sell….”

Then why the fuck aren’t you buying?

Because, silly, i’m a lifelong renter!

“clio on September 5th, 2011 at 5:45 pm

“Amazingly clio, roughly half if the homes in the area I want to live have PITI less than $2,000. It’s just that so few listings meet this criteria, and consequently, so few listings ever sell….”

Then why the fuck aren’t you buying?”

ha! Who is going to marry Bob? The crack whore, that he just finished cutting up?

4. Sabrina, – lifelong renter and housing bear.

Ha! I’ve owned real estate. But what do I know? Apparently nothing.

Meanwhile- like Homedelete, I’m sitting pretty in my very nice (and affordable) rental waiting for prices to continue to decline and saving money for my downpayment in the meantime.

The renters continue to be in the driver’s seat. It’s the best time to be a non-owner.

http://www.nydailynews.com/news/2011/09/05/2011-09-05_body_found_in_suitcase.html

Was Bob in NY this weekend?

“. miumiu – has been looking for a million dollar in-town but doesn’t want to pay more than 500k. In addition, she wants all the amenities of a full-service building but doesn’t want to pay high assessments”

miu wants a place that is priced in mid 600s for 550K and she is happy with assessments and the amenities. she thinks she’ll have it in a year max. the ideal place started in 700s and is selling as low as 600K exact so she is not too insane just a bit : )

FYI: http://www.redfin.com/IL/Chicago/1211-S-Prairie-Ave-60605/unit-3405/home/17560927

That 1211 S. prairie looks to me like an all cash purchase…

“It’s the best time to be a non-owner.”

Now? You sure about that?

Now is the best time to be an owner. We have been playing musical chairs and the music is about to stop……. renters beware.

“The renters continue to be in the driver’s seat. It’s the best time to be a non-owner.”

Sabrina, you are really delusional. This is the same thing people were saying to owners in 2005 (“owners are in the driver’s seat….” , “you would be an idiot not to own”,…..etc.). The fact that you are saying this now should be a KEY HINT to most people that NOW is actually the time to buy. You need to be one step ahead of the game, people. Sabrina is just the collective voice of the poor masses (people who are too scared and too stupid to do anything but follow – that is OK – but you will never get rich, stand out or get ahead listening to people like sabrina or HD- never).

“It’s the best time to be a non-owner.”

Sure, if you’re (i) not terribly picky about WHERE you live, (ii) not terribly picky about HOW you live (e.g., quality, ammeneties, etc.), or (iii) even if you’re picky as to (i) and/or (ii), you’re extraordinarily lucky (i.e., you’re renting a beautiful place with all the usual items expected by GZ owners (e.g., garage space, in unit w/d, central air), in a superior location, for far less than what it would cost to “own” such a place).

It was a sale involving a relocation company so it was a good deal, but it was not too far off the other sale:

http://www.redfin.com/IL/Chicago/1211-S-Prairie-Ave-60605/unit-3205/home/14739404

So Clio, I am 50-90K off not half a mil. You need to work on your math skills : )

the third pic of the 3205 listing is my favorite.

ze:“leverage is a net neutral when entering an investment because it does not change the linearity of the payout of bet.”

clio:”more mumbo-jumbo – sounds like academic bullshit.

UofC, Harvard, Stanford…hahahahaha

lol…I know. We laughed about that too.