Update on Some Past Properties in Lincoln Park: Now Reduced

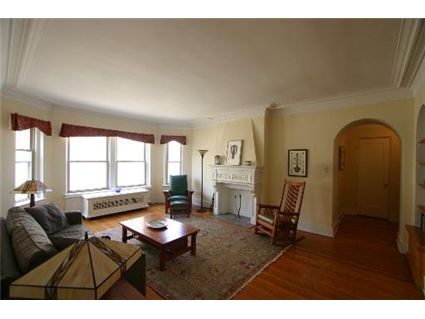

Remember the vintage with good bones but an older kitchen on lovely Pine Grove at 2724 N. Pine Grove in Lincoln Park that we chattered about in early June?

It’s still on the market and has been reduced again.

Unit #3: 2 bedrooms, 1 bath, diningroom

- Sold in August 1999 for $210,000

- Originally listed for $325,000

- Reduced

- Was listed in June 2008 for $309,000 (parking is rental nearby for $225 a month)

- Reduced

- Currently listed for $299,000

- Assessments of $382 a month

- Taxes of $3072

- Window units (no central air)

- No Washer/Dryer in the unit

- The Jelinek Group at Coldwell Banker has the listing

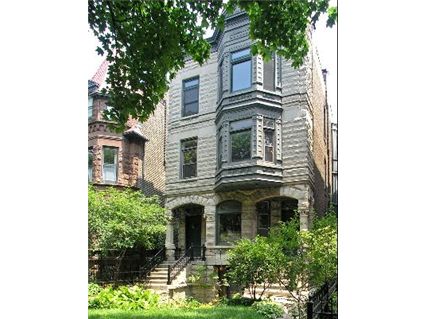

This vintage unit that we chattered about last April at 2523 N. Burling has also been reduced. But it still sits on the market.

Unit #2: 3 bedroom, 2 baths, 1625 square feet

- Sold in June 2006 for $595,000

- Was listed in April 2008 for $599,000 (parking included)

- Reduced

- Currently listed at $579,000 (parking included)

- Washer/dryer in the unit

- Back porch

- Central air

- Assessments of $100 a month

- Taxes of $5936

- Coldwell Banker has the listing

I have been watching the unit on Pine Grove, and am really astonished it hasn’t sold at this price.

I’m also surprised to hear the place on Burling is still there.

We might be in for more of a price drop than we thought. It looks like the credit markets are far worse off than anyone wanted to think about, and if Freddie and Fannie fail, we will have a very difficult time getting any kind of financing out here.

If, however, Congress tries to rescue Fannie and Freddie and assume their $5 Trillion plus in mortgages, then our currency will be worthless and the economy will be destroyed completely.

I never thought prices could roll back beyond 2002 levels – am already seeing 2002 prices in the far north nabes- but this could do it. It’s not even about the oversupply anymore, even though we have big supplies coast to coast. It’s about the trashed credit markets, and if prices end up going back to pre-200 levels, the way we’ve treated credit for the past 10 years will be the cause of it.

Fannie and Freddie won’t fail outright, but they need not fail for people to feel the affects of the credit markets.

The WSJ has an article titled “Mortgage Insurers Raise Bar” which Steve H already quoted parts of in another thread (it mentions that LP and Hyde Park are appreciating) that talks about PMI requiring at least a 10% downpayment in most markets (including Chicago).

“the insurers’ tighter standards are “wreaking havoc,” says Michelle Collins, director of mortgage lending. For a popular conventional loan package, “easily 70% of the previous set of borrowers will not be able to buy,” she adds.”

“Nowadays, insurers are frequently requiring at least a 10% down payment, compared with previous standards that might have included a 3% to 5% down payment. Prices also are rising. Next month, for example, MGIC plans to charge an annualized premium of up to 0.75% of the loan balance for fixed-rate, 30-year mortgages with a 10% down payment, up from 0.67% this month. The company doesn’t plan to change course anytime soon.”

“”It’s either an FHA loan or a conventional buyer with 20% down,” she says. “There’s no in-between.”

We might be in for more of a price drop than we thought.

Laura, there have been people on this blog that have said repeatedly that prices still had a long way to go before bottoming out. 🙂

I still like it and still think $250,000.

Both of these condos look bland as heck to me. Boring walls. solid colors. I know they need to be neutral to sell, but give me a break. There is hardly anything visually satisfying in the pics, except for the stained glass in pic 8