Walton on the Park’s First Tower is only 43% sold

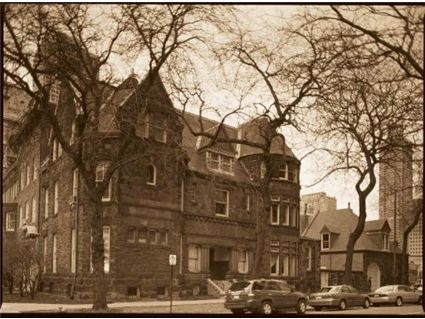

Crain’s is reporting that Walton on the Park, the two tower high rise project near the Scottish Cathedral in the Gold Coast (is that really the gold coast there or River North?) just received its first construction loans so building will commence on the project’s South Tower.

Enterprise Cos. and Mesirow Financial Real Estate, both of Chicago, plan to break ground Jan. 21 on the Walton on the Park development, says Enterprise Chairman Ron Shipka Sr. Chicago-based Corus Bank N.A. has agreed to provide the construction loan, and investors, including Enterprise and Mesirow, are kicking in about $50 million in equity, he says.

Buyers have signed contracts for 85, or about 43%, of the 198 units in the 39-story south tower, at State Street and Delaware Place. Mr. Shipka expects the groundbreaking to provide a marketing boost, showing potential buyers that the project is real.

“On the 21st, as soon as we start digging, we’re going to have a blip in sales,” he says.

Whatever happened to a developer having to have at least 50% sales in order to get a loan?

Walton on the Park has had a sales center since early summer 2007. If their sales are like everyone else’s- they had a big surge at the open (probably from investors) and very few sales since the mortgage crisis hit this fall.

The building is the typical “luxury” units. The one bedrooms start at $450,000 for around 950 square feet.

They are not even marketing the north tower (which looks directly into the south tower, by the way). And interestingly, on the model of the development they have in their sales center, they don’t even show the north tower. All that is there is the base of it. I had to actually ask the sales agent if that’s where the other building was going. According to Crain’s:

Enterprise and Mesirow will start marketing condos in the north tower when about 75% of the units in the south tower are spoken for, probably next fall, he says. The developers will need to raise more equity and secure another construction loan to finance the second high-rise.

Prices run from $450,000 to $1.25 million. They are also selling the historic vintage homes that line the front of the property on Dearborn. They are great vintage houses directly across from Washington Square Park but they need to be totally gutted.

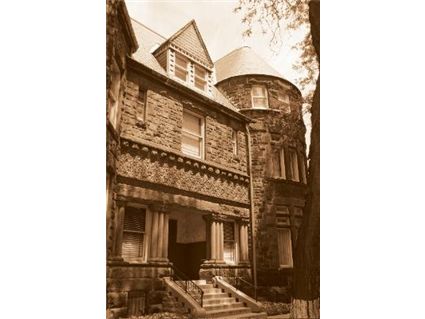

And no, these aren’t “old” pictures. Interesting use of the black and white photography.

The last I saw, they hadn’t sold any of the vintage homes. Anyone else know?

The Thompson Home at 915 N. Dearborn: 7 bedrooms, 6.5 baths, 10,041 square feet, 3 car garage

- Currently listed at $3.47 million

- The Habitat Company has the listing

The Mansions on the Park [website]

Walton on the Park [website]

What happened to 50%? Corus Bank happened, that’s what. They are knee deep in troubled loans in Florida.

http://www.creditbubblestocks.com/2007/06/initiating-coverage-on-corus-cors-part.html

If it weren’t for FDIC insurance these guys wouldn’t be able to make any loans at all. Check out their rates on bankrate for CDs.

What interest rate is the construction loan?

John

Just a comment in re: the percentage of sold units. As far as a bank is concerned, the most important measures would be loan-to-value ratio and the percentage of private equity. The sales contracts, while not money in hand, still represent at least some level of equity, and the developer is kicking in an additional $50 million in private equity for this particular project in order to get it moving. The same principal is in play with the Chicago Spire, which has sold 0 units but has a developer kicking in 30% of his own money as private equity.

^ I had some poor wording, obviously there would be some other ratios and figures the bank would care about, such as the creditworthiness of the borrower and the soundness of the business plan in terms of being able to service debt and pay off the loan. My point is just that the percentage of sold units required to obtain construction financing depends on a variety of factors, both relating to the specific project/developer and the broader market. In times of easy credit (say a couple years ago), a developer could come get financing for a project with barely any private equity if he reached a certain pre-sales level, usually in the 50+% range.

Thanks you David. I forgot about the developer funding some of it through other sources. You’re right about the Spire. They are constructing without having sold a single unit. Very risky- but we’ll see if it pays off.

Apparently Walton on the Park’s developers also believe they need to start construction in order to jump start sales. We’ll soon see if their strategy will work as well.