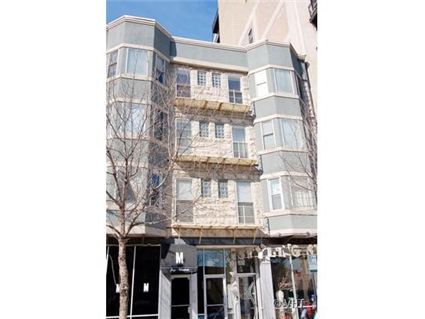

Why Isn’t This Condo Selling? 1520 S. Wabash in the South Loop

Market times are increasing for many properties.

You’ve seen them if you read Craigslist regularly. Month after month after month. The same condo unit. The same listing. Only, with “price reduced” on the Craigslist ad.

Take this cute one bedroom unit at 1520 S. Wabash, a 9-unit building in the South Loop. It is one of the few condo units in that area that isn’t in a big, brand-new high rise.

It’s been on the market since September 2007 and has had two price reductions.

Why?

Unit #4N: 1 bedroom, 1 bath, 850 square feet

- Sold in March 2004 for $156,500

- Originally listed in September 2007 for $259,900

- Reduced

- Lowered to $239,900 by March 2008

- Reduced

- Currently listed for $229,900

- Assessments of $154 a month

- No parking- but leased behind the building

- W/D in the unit

- Central air

- @Properties has the listing

Low assessments; is that driving up the selling price? At the 2004 price I like it.

because is to expensive 200k for a freaking 1 br I can use that money for something else

I have followed this unit on the MLS and really like it. It is a fantasic and different building in this neighborhood. Would definitely be interested in jumping in around 180k. So thats about two years off at the current rate.

Another greedy seller chasing the market down. What if they had priced this at [230k – (their carrying cost over the past 10 months)]. The unit would’ve probably sold and their profit would be the same. But no…their loss => the REO portfolio’s gain. Another fine property vacant for 10 months now because of an idiot.

I can see several annoyances with the building, even though that is the size of building I was looking for.

1) Assessments may be too low for maintenance, raising threat of special assessment.

2) Building backs onto the el, but is slightly far from a station (closest is Roosevelt, about 1/2 mile away).

3) About four buildings from heavy rails — presumably Metra, but maybe other things run parallel to 16th here.

4) Small building means no in-building amenities — some people like doormen, exercise rooms, and pools.

5) My standard sense that the South Loop is short on neighborhood amenities, especially restaurants. Grocery (and horrible traffic) is available at Roosevelt. Chinatown isn’t too far away. But this block has maybe one restaurant (in this building), a car wash next door, and a Firestone further south.

I don’t have a feel for what the vagrant and other safety issues here are, but it looks a bit sketchy with the handy rail viaduct. Again, some people might not like that.

I’m not a real estate expert, but I wouldn’t purchase this condo for the following reasons:

1. Unreasonable sellers. They originally wanted to make over $100,000 after owning for about three years. They still want almost a $70,000 profit after only 4 years. I would not want to deal with unreasonable people. It’s just not worth it.

2. No parking. This is huge. I would not feel safe parking my car behind a building. Plus, what guarantee do people have that the parking lot will not be removed?

3. Building is too small for my taste. If one person goes into foreclosure or stops paying the assessment, it could mean a lot of trouble for the rest of the people.

4. I saw a condo on the same block with about the same square footage for $200,000 including parking. The unit needed about $10,000 worth of work.

Overall, the unit itself is nice looking, but it seems way overpriced.

The building does indeed back up onto the EL and our realtor wouldn’t even show us anything this close. From Google Maps, it is clear that the building is up against Wabash with a parking lot between them and the tracks, but it is still very close. It is also unclear how you drive into the lot, but it looks like the only access might be under the el tracks. That would turn me off.

This is also a surface parking lot across the street and a bit north that might be a development target at some point.

The very low assessment also gives me pause.

The tracks just to the south of the building a freight tracks, but I understand that they might be history soon. I have a friend who lives just south of those tracks an Indiana, and she say’s they aren’t an issue. The metra is a long way away.

This part of the South Loop is still a bit of a dead zone interms of stuff you want all the time – drug stores, etc. but the Jewel/Osco is only 3 blocks north, with a Walgreens right across the street from that. The Target is a five minute walk further.

Basic South Loop units will be under $200/sf before long, and that won’t be the bottom.

The washer in the kitchen is a big buzzkill for me. It’s unsightly and it usually this means there’s no place for a vented dryer.

Jenny,

At this point in the cycle you will find the majority of sellers are unreasonable. If you aren’t willing to deal with unreasonable people either wait out the downturn further or don’t plan on buying any time soon.

This site (and the MLS to a lesser degree) highlights the gamut of unreasonable people. You find comps of the same unit but on a lower floor often listed for 15+% more than a lower priced unit on a higher floor and all other kinds of unreasonableness. Its quite entertaining.

The 2004 price is nice and probably reasonable. My biggest issue with a condo like this is the small association. Speaking from experience, small association condos can be serious headaches in terms of people reneging on their duties (both for their required labor and their required payments), and make it hell for the people trying to actually run the building. I’m surprised these ever became popular, and place a significant price penalty on getting a unit in such a building because you can expect a LOT more work involved to keep things running, in contrast to a stable highrise or just otherwise a large association. The smallest I’ve ever dealt with is a 9-unit, and even that was a headache. I couldn’t fathom anything smaller.

I’d also be skeptical of those freakishly low assessments for a relatively old building, even if it was recently rehabbed.

I mean, it looks like a nice unit, and the location ain’t bad either. But for the reasons already listed in this thread, there’s a big reason this shouldn’t command any sort of price premium.

So what is s reaaonable assessment? How could we ballpark a decent # – % of condo value? rough ranges for 1,2 or 3 BRs?

For a building with no amenities, I’d like to see assessments on the order of 1% of value per year (maintenance) plus $50-100 per month (utilities). Normal rules of thumb for houses are 2-3% per year of maintenance — the association doesn’t have to do all of the maintenance, but they do pay for some utilities.

For this unit, that is about $2200/year ($180/mo) plus a little — call it $200. If all the units are similarly short, the association is perhaps $450/mo ($5000/yr) short of what is needed to cover major repairs.

As you get into larger condos, you need to start paying for things like elevators, pools, and doormen, which may not be fully valued for the 1% rule. 24 hour doormen probably cost $100-200K per year (with benefits and taxes) — perhaps $100/unit/month.

Parking, if it is not charged separately, should be close to market rates — perhaps another $100/month plus another $100 if valet.

“Another greedy seller chasing the market down.”

Not greedy, just insufficiently motivated to sell.

That is an absolutely adorable unit, but in an area which has an overabundance of units for sale IMO it’s overpriced for a 1-bedroom. Also, it looks like this is yet another older building that the developer decided to do horrible things to the exterior in order to “modernize” it (turning off people in the process).

In a building that small I would want to meet everyone there before signing on the dotted line; all it takes it one douche in the building to make everyone miserable. :/

Question: Why is this house/condo/coop/farm etc not selling?

Answer: because it’s overpriced!

Anything will sell for the right price. If you’ve been trying to sell a property for more than several months, have listed it on the MLS or otherwise publicized it and you’re not getting any offers, the price is too high!

“Anything will sell for the right price.”

I don’t necessarily agree with that. Look at 60620 in the MLS and there are 70+ SFH’s for less than $99,000 and none of them are selling. How about Detroit? They have trouble selling property for $1. Sometimes there literally are not enough buyers regardless of price. There aren’t enough buyers because there is not enough cash available to buy them. We are entering that phase of the economy right now. There are too many properties and not enough buyers with money. I don’t believe, like some people do, that there is a large amount of fence-sitters with good credit waiting the crisis out. Like I said a few days ago, everybody Tom, Dick and Harry with a FICO of 620 and below purchased or attempted to do so in ’05 and ’06. Most of the prime qualified buyers purchased in 02-04 when interest rates dropped to historical lows. In order to keep the party going the banks lowered lending standards to allow for NINJA, Option-Arms and subprimes. I think there probably is a steady amount of prime new households forming, just like there always has been, and many of them are the knifecatchers keeping the market alive. I have a number of prime first time buyers that I’ve helped close since late ’06. They buy because a new household is formed and they enter the market. If an existing household was going buy, it would have bought from ’01-’05; calling existing renting households ‘pent-up demand’ is just wishful thinking, IMHO.

Thx, Kevin

You priced it too aggressively in a declining market in the fall. That’s water under the bridge. In the first 6 months of 2008 values have declined for 1/1’s in your area by 9%. Your appreciation is really 19% — not at all bad in a market that’s been declining for about 2 years. Based on your original purchase price, you should expect your selling price to be $186,000. Reduce to $199K and hope for the best. Good luck. Ellen

A 9% loss in six months could mean an 18% loss in one year. G might be on to something when he says $200 a sq ft in the south loop.

“A 9% loss in six months could mean an 18% loss in one year. G might be on to something when he says $200 a sq ft in the south loop.”

Your statement is meaningless. It could also mean a 40% drop in one year or a 50% increase in one year or any number at all. Simply extrapolating the first half of the year (improperly) tells us nothing. Not only that, your math skills are laughable.

D

I don’t know or think units like this will represent the bottom in $/sf in the South Loop. This unit is different than the hundreds of cookie cutter conversions or new high-rises going up in the neighborhood. There aren’t many buildings like this in the South Loop so I think these units may not ever represent the bottom priced units in the area.

Deaconblue,

Your statement is meaningless. It could also mean a 40% drop this year but it will never again mean a 50% increase in one year. Simply making up numbers (improperly) and then saying that they don’t mean anything tells us nothing. Not only that, I hope the Chicago market returns to 1995 prices to ensure affordability for everyone. You can dream for a return to 2005 prices but that ain’t gonna happen.

HD

Homedelete,

Your are a joke. I used random and meaningless numbers to illustrate that your prediction made no sense. The rate in the first half of the year should not be automatically doubled (I won’t even get into your incorrect math). You could come up with any number you want for the second half of the year, the number from the first half has nothing to do with the second half. If you just extrapolate the first half number going forward, then homes will cost $5 in a matter of years! You continually show your financial/economic ignorance and thus you have no credibility at all. Good luck waiting for homes to go back to ’95 prices, let me know how that works out for you.

D

“Your are a joke”

“I used random and meaningless numbers to illustrate that your prediction made no sense.”

I’m not sure how to respond to your……um…argument, but I know that this thread has officially outlived its usefulness.

My argument was that your prediction made no sense and that you should stop talking about finance because you have no clue what you are talking about.

D

Unit 4E is a short sale with an ask price of 220k. It is advertised as a 2/2 with 1,650 square feet.