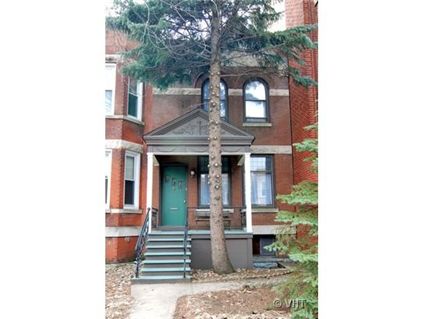

1469 W. Foster in Andersonville Sells For $25K Over List

There was much chatter in March about the 4-bedroom vintage rowhouse at 1469 W. Foster in Andersonville that went under contract within 2 days of being listed.

See our prior chatter and pictures here.

The property got multiple offers and has now closed for $25,500 over the listing price.

Was this still a deal?

Mario Greco at Rubloff had the listing.

1469 W. Foster: 4 bedrooms, 2 baths, 2 car parking, no square footage listed

- Sold in January 1990 for $200,000

- Was listed in March 2008 for $324,500

- Multiple offers

- Sold for $350,000

- Taxes of $4,087

- Central Air

- Decorative fireplace

- Bedroom #1: 16×10

- Bedroom #2: 13×8

- Bedroom #3: 12×9

- Bedroom #4: 9×7

“Was this still a deal?”

Yes.

You would think with multiple offers it could have sold for much much more. Or maybe not. This is a comp destroyer.

Very good deal assuming no structural problems. I hope the buyers got a good inspection!

March 2008 or 2009?

Survey says……deal. In fact I think this is fairly priced around $375-410k.

“March 2008 or 2009?”

2009.

what were the downsides to this place? foster is busy, school district…any others?

MADFLY on March 25th, 2009 at 7:38 am

underpriced

MADFLY on March 25th, 2009 at 8:38 am

I think this will close at ask or a little higher.

———————

quoted for truth. some of you wouldn’t know a money maker if it bit you.

Wow you predicted that it would close 7.8% higher than the list. You are a genius. Can I sign up for your real estate seminar…?

(and let’s not forget that we didn’t see the HUD so maybe the seller paid closing costs or gave a credit to fix something so the true cost to the buyer might be lower)….

I LOVED this place and the one just a few doors down that I think was listed for around 349K. Someone told me about it in the comments from the last post. Does anyone know what that place sold for? I think the buyer got a great deal…the only big downer to me was the really narrow living room. I’m sure some people would also hate the lack of garage (parking was just exposed at the back of the lot I believe), but I think for this price point, that’s fine. I’d be happy to build my own garage down the road and put a nice little studio/guest suite above it.

HD and Sonies, this must be a tough day for you. I hear that too much good news may force you both back into your caves until the next recession.

homedelete on March 25th, 2009 at 7:46 am

This place was priced appropriately. It sold in two days because there is demand at this price point. That’s what markets are: supply and demand. There is scant comparable supply at this price level but high demand so it sold quickly. Congrats to this seller for being realistic about pricing. There’s nothing smart about over pricing a property and chasing the market down with price reductions for six months and then selling with plenty of concessions.

——————-

quoted for idiocy.

paulj, you can’t help calling bottom again and again, can you?

MADFLY, I don’t see your point about HD’s quote since he basically agreed with you on the price. Since you are a bubbly condo speculator, perhaps it was the “supply and demand” reference that confused you?

“HD and Sonies, this must be a tough day for you. I hear that too much good news may force you both back into your caves until the next recession.”

I think you must have me confused with someone else on the site!

How can it be underpriced if it closed at asking price?

Is there some new math where ‘underpriced’ = ‘closed at asking price’?

“MADFLY on March 25th, 2009 at 7:38 am

underpriced

MADFLY on March 25th, 2009 at 8:38 am

I think this will close at ask or a little higher.”

You see, HD, if you consistently contradict yourself you are always right.

Always wrong, too.

“How can it be underpriced if it closed at asking price?”

Um, because–as you noted, above–it closed 7.8% above asking price. You two are going to start an argument over semantics–you probably should agree on definitions. You both seemed to me to be *mainly correct* about this one.

“underpriced” and “priced appropriately” are two different things, G.

I’m just repeating what he said.

“MADFLY on March 25th, 2009 at 7:38 am

underpriced

MADFLY on March 25th, 2009 at 8:38 am

I think this will close at ask….”

““underpriced” and “priced appropriately” are two different things, G.”

Depends on seller’s motivations–maybe, maybe not. It seems to me that HD assumed facts not in evidence and speculated (correctly, imo) regarding seller’s state of mind in choosing the price.

Based on my anecdotal observation, this listing agent has shown no hestitancy to keep places on the market for loooooong times seeking the right buyer (building near me that’s had his name on it for 18+ months). So, I think it’s fair to think that this was priced low to get a sale done quickly–thus, both underpriced AND priced appropriately for the customer. Everyone*–including the buyer– walks away reasonably happy. Nothing wrong with that.

*Well, almost. Didn’t someone in the last thread complain about having to get in a bidding war and was unhappy about the listing price creating unrealistic expectation about what selling price would be?

HD–Sorry. Missed your point.

The hour between MADFLY’s comments was time enough for the hair of the dog.

anon- you explanation is rational, but since when do we take into account a seller’s motivation in our assessments of market price? you can make the “overpriced” versus “priced appropriately” argument for any property that languishes on the MLS for months as well.

And HD, something can be underpriced and sell at ask – whats so hard to understand about that? You’ve never bought something for under fair market value?

You’re arguing that 8 bids on a property still results in a selling price under fair market value? This was an arm’s length transaction that resulted in a fair market price.

Investopedia explains Arm’s Length Transaction

http://www.investopedia.com/terms/a/armslength.asp

The concept of an arm’s length transaction commonly comes into play in the real estate market. When determining the fair market value of a piece of property, the price for the property must be obtained through a potential buyer and seller operating through an arm’s length transaction, otherwise, the agreed-upon price will likely differ from the actual fair market value of the property.

For example, if two strangers are involved in the sale and purchase of a house, it is likely that the final agreed-upon price will be close to market value (assuming that both parties have equal bargaining power and equal information about the situation). This is because the seller would want a price that is as high as possible and the buyer would want a price that is as low as possible.

“And HD, something can be underpriced and sell at ask – whats so hard to understand about that? You’ve never bought something for under fair market value?”

madfly–

And saying that your interpretation of how HD was using “priced appropriately” gets into what he was thinking. I don’t think you said anything inconsistent, but HD’s comment implied he was thinking about timing considerations.

HD–

An arm’s length transaction can still end in a “underpriced” sale, especially with large, illiquid assets. That’s a dead-end argument.

The sellers appear to have traded $$ for time. Priced appropriately for a quick sale, while almost certainly leaving some $$ on the table. Trade offs.

homedelete on March 25th, 2009 at 12:15 pm

Personally, I think it’s still a little over priced at $325k – but hey, it’s a nice start.

————-

more idiocy

A friend of mine sold a 3-flat in Edgewater Glen ten years ago. There were no comps at the time for a 3-flat with gut-renovated 3-bedrm owner unit with new kitchen and bath and two nice 3 bedrm rental apts. One local EG realtor quoted a low asking price, that friend thought was way too low. Another local Andersonville realtor quoted a $50,000 higher asking price, but still modestly low compared to future appreciation in Edgewater Glen. Two offers came in day of listing, one at asking and one at $1000 over asking. Realtor never advised my friend “gee, you don’t need to accept either, maybe we’re priced too low”. Friend accepted offer with trepidation. 3-flat was underpriced by $100,000, at least.

Friend notes closing at title company was partylike, with yuppie entrepreneur buyer bringing a group of friends(?) and my friend’s realtor HUGGING BUYER at closing and ignoring seller altogether. Seller/friend was shocked by deportment of their realtor.

I think this may be a similar story. Realtor prices property low, owner-seller is too trusting, and realtor steers the sale to a friend already instructed to give a “over asking price” offer to lock-in the deal. I wonder if its the same realtor, or if this realtor knew that story.

“I wonder if its the same realtor, or if this realtor knew that story.”

I know this realtor sort of third hand (i.e., indirectly and I don’t recall having actually met him, and if I had, it was over 5 years ago). And we see lots of his listings here. Seems **extremely** unlikely.

But, yeah, there are a lot of sh!tty people around.

So you’re suspending the mark to market valuation of a home with 8 offers? Large illiquid assets? This is a row house not and RMBS pool.

I always think properties are overpriced….that’s no surprise. but this is a welcome correction in the right direction. Its the only good piece of news so far this month. 😉

While I am shocked that both price whiners, HD and Bob agreed this was a good price, you do have to consider that HD said in his first response “it could have sold for much much more”…no pleasing some people, huh?

I can relate to your story Architect as I have been in that position a few times before. That is the reason my family now has a few family members as our exclusive agents in the states we do business in and we deal ONLY with that agent.

Some people call rehabbers sleazy people who take advantage of buyers, we consider agents as the sleazy part of the equation.

“you’re suspending the mark to market valuation ”

Yeah, because FASB rules don’t apply to individuals.

And, if you find an uninformed garage-sale seller with an original Picasso which you buy for $10, does that mean that it’s only “worth” $10? I can bring the absurdity, too.

I’m never pleased. I’m like an audiophile – all I hear are the imperfections.

HD–

It’s like legislative interpretation–I try to read in a way that avoids internal contradiction, and refer to prior statements to establish context. Doing it that way, you and madfly were both “right” but looking at it with opposing views of the future of the market (well established).

[Comment Removed by the Editor]

Please refrain from personal comments. Thanks.

those people can buy home, man I need to move from this weird place.

john s. did you hear a black person moved into the white house.

Everyone duck and cover!