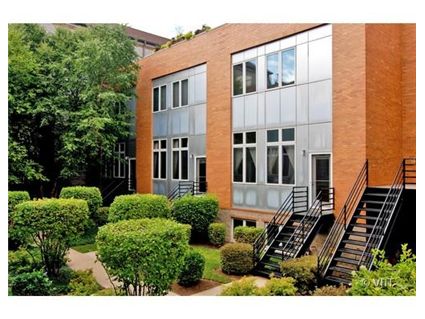

4-Bedroom Bucktown Townhouse Closed in April: 1742 N. Winnebago

I missed the closing on this 4-bedroom spacious Bucktown townhouse at 1742 N. Winnebago that we chattered about several times in the past 6 months.

See our January 2010 chatter and pictures here.

At nearly 3000 square feet it had more square footage than most single family homes in the price range in the neighborhood.

It also had a rooftop terrace and a two car garage.

The townhouse sold for $115,800 under the 2007 purchase price.

Robert John Anderson at Baird & Warner had the listing.

Unit #B: 4 bedrooms, 2.5 baths, 2 car garage, 2934 square feet

- Sold in November 1996 for $304,500

- Sold in April 2004 for $542,500

- Sold in January 2006 for $611,500

- Sold in April 2007 for $662,000

- Originally listed in August 2009 for $649,000

- Reduced

- Was listed in September 2009 for $635,000

- Reduced

- Was listed in January 2010 at $625,000

- Sold in April 2010 for $546,200

- Assessments of $55 a month

- Taxes of $7,040

- Central Air

- 3 bedrooms are on the upper floor and 1 is on the lower level

darn HD, you almost got this for your dream 2003 pricing… 2004 price! What a deeeeal

Do the limbo:

“How low can you go?”

+1 for the buyer

That is a big loss for the 2007 buyer. Like… $130K ish loss. Although if they had put all of that money into the stock market (instead of a down payment), 25% of it would be gone anyway.

Tough investment time frame.

Is $186 psf low in Bucktown? Seems like it is. Buyer probably got a deal on this one.

Fortunately this, as a non-distressed, arms length transaction, will be used as a comp going forward.

“Is $186 psf low in Bucktown? Seems like it is. Buyer probably got a deal on this one.”

I’m sure the next door neighbor with the identical layout is thrilled.

As someone new to Chicago without kids, I need to ask – what are the school options like in this hood?

>>>Fortunately this, as a non-distressed, arms length transaction, will be used as >>>a comp going forward.

This one, and the SFH at 1918 Oakley selling for $490 a year and a half after they listed around $575 should make Bucktown prices pretty interesting for the next year….

I can’t imagine sending my kids to the public schools in the Bucktown area. I have to think that people send their kids either to private schools or “selective enrollment” public schools.

Joe,

Look at the previous Chatter for this place — lots of info about local schools. 🙂

Well, the big hope in Bucktown is that the newly converted Pulaski will become a good option for elementary. Starting their new program in the fall, I believe?

The other elementaries are all mediocre, from what I’ve read.

The house on Oakley is what I would consider to be today’s ‘deal’. Yes it’s on a smaller lot but it sold for $470,000 in 2001 and even with upgrades it sold for $490,000 today. Finally, pricing is starting to return to earth. Glorious will be the day all homes in the neighborhood are listed for and sold at these 2001ish prices.

“Glorious will be the day all homes in the neighborhood are listed for and sold at these 2001ish prices.”

Someone’s faking HD again.

“CSAL on June 16th, 2010 at 2:11 pm

Is $186 psf low in Bucktown? Seems like it is. ”

The price PSF reflects two things…

1. It’s a townhouse, not a SFR.

2. The relationship between SF and price is not linear. Generally the larger you go, the less PSF

Nope anon, it was me.

“Nope anon, it was me.”

I know. Just a joke about celebrating 2001 prices after so much “we’re gonna buy property like its 1999”.

Re: public school. This property is in the attendance boundary of Pulaski, which is beginning a new International Baccalaureate program in the fall. All children in preK and K enrolled from the attendance area will be in the IB program, and any other spaces leftover will be filled via lottery. The IB program will add a year as the children age up. Pulaski’s current non-IB students will remain in the school, as will the school’s existing regional gifted program. The IB program will have its own principal, Pat Baccillieri, who headed South Loop school during its turnaround years. Bottom line for those with kids entering K or who are younger, this is definitely a viable option.

Their website is hard to find via Google so here it is for those wanting more info:

pulaskiib.com

This is an interesting price point right now because to get over a $417K 30-year (jumbo), my understanding is you need 20% down. If you do that on a $546K property, you front $109K. Kick in an extra $20K, and you are out of jumbo territory and pay a lower rate. Did buyer put down at least $129K and avoid the jumbo? At least this property may have gone to someone who can afford it. Met a short-sale seller the other day who had put NOTHING down on property he bought for over $600K in 2005 … then paid the minimum, then got frustrated he’d “never get his investment back” and stopped paying mortgage and any assessments. The bank approved a short sale price of $350K.

@ ALT

My understanding is that if you have good credit there are a couple options. You can get 2 loans to avoid jumbo. For example – $575K – 20% down (115k) – 80% to finance – $417 on 1st and $58k on second. And I believe for SFH and townhouses, I believe, you can do less than 20% – 10 or 15%. There are just less lenders willing to do so.

I don’t know if they are still doing piggyback seconds to get to 10-15% LTV (especially 10%). Maybe Russ can chip in?

Also I’ve read that jumbo rates have fallen quite a bit since the beginning of the financial crisis, reducing the spread to conforming to under 75bps from over 150bps at the peak of the crisis.

My bets are they: 1) used a jumbo, 2) used a piggyback, 3) had enough cash at downpayment to get a conforming. In that order of speculation.

“2. The relationship between SF and price is not linear. Generally the larger you go, the less PSF”

Yes to a much lesser degree. Sub-$180/sf in the green zone is pretty unheard of when there is no distress in the properties (ie: trashed foreclosure), regardless of size*

*excluding the $1.3MM+ segment which is infinitesimal in terms of transaction volume with regard to the market.

Chicago green zone is slowly moving back to reality with sub-$200/sf. Chicago isn’t NYC, SF, London, Tokyo or Dubai and people are relearning that with each passing month.

That’s true on the townhomes, Onlooker — thanks for the reminder. Bob, they had an option 4): an ARM for the entire loan. I was told by my lender that I couldn’t get a piggyback even with 15% down, despite a 795 credit score; however, I could put the whole thing on an ARM. That is when I came to my senses and realized that I needed to put 20 percent down on whatever I bought!

But I’m still talking condos … for a townhome maybe you can get a piggyback??

“Bottom line for those with kids entering K or who are younger, this is definitely a viable option.”

I’d give the school a decent shot in part because no other neighbhorhood elem around the Bucktown/Wicker/Logan area is passable, so the area may attract families who are moving, as well as people in the general area but not within boundary if there is space for non-neighborhood. I do know one family from Logan that moved there (they were moving from condo to SFH anyway) for the school district.

The main thing preventing me from buying there is Groove won’t come to my CC housewarming b/c it’s Bucktown and anon won’t come b/c of the short lot.

“The IB program will have its own principal, Pat Baccillieri, who headed South Loop school during its turnaround years.”

This may well be very unfair, but I wonder how much of the turnaround was what he did as opposed to changes in school boundaries. Not saying in any way that he’s a bad choice. Just not sure how much of the PR/hype to buy into.

@ ALT – My understanding was that you could do a piggyback for a SFH or Townhouse/Rowhouse. I thought this was also an option for a 2 unit building (although the you might take a quarter point hit over a SFH). Who knows….seems like the rules change all the time.

ALT:

795??? 795??? ARKM?

I’m curious. You don’t have to say…of course.

Are you in your 40 – 50s? 50- 60s?

I ask because I supposedly have a good credit score 740+ and I am in my 30’s. I’ve asked why my credit score isn’t higher and its pretty much they say an age thing. To get higher, I just need to be alive for longer…

550k was a damn good price I think. I could be completely wrong though since I don’t know the neighborhood as well

There’s a $102,000 down payment with a $417,000 first and a $27,310 second. 82% financed.

“This may well be very unfair, but I wonder how much of the turnaround was what he did as opposed to changes in school boundaries. Not saying in any way that he’s a bad choice. Just not sure how much of the PR/hype to buy into”

As has been discussed before, so much of (almost) every CPS turnaround is getting the school full enough that you can limit attendance to the immediate neighborhood and, if applicable, selective enrollment admittees–in other words, making the school a genuine community school, at least as to the students. But the principal plays a significant role in teacher selection and community building–even if you make the boundaries small enough, you need buy-in from the parents, or the school will never fill up. So, for SL, I think it was necessary to both change the boundaries and have a principal who could make it work.

“I ask because I supposedly have a good credit score 740+ and I am in my 30’s. I’ve asked why my credit score isn’t higher and its pretty much they say an age thing. To get higher, I just need to be alive for longer…”

What’s you’re oldest credit account still active? Getting past 10, 15, 20, 25 years is each a + for fico. So, if you still have an account you got at 18, getting to 33 and 38 will each add to your score (and possibly in between, too, I just know that the 5 year marks definitely are pluses).

Joe,

If you move here send the kid to st iggy’s or the brit school. public schools are not worth the chance over here. IB program or not its not worth the gamble too see if it will turnaround.

also for high school if the kid/s doesnt get into a CPS “prep” your going to have to turn to private HS anyways.

DZ,

if there was free food i would visit ya, it would just take a while for me to walk there from the train with my hobbit legs and all.

There could be any # of reasons why your score is only 740. Are your credit card balances over 50% of your available credit limit? FICO calls that ‘maxed out’ and that lowers your score. Is there any unpaid parking ticket or medical bill? Did you forget to pay People’s Gas and were 30+ days late last year? All of the above will ding your score a bit. 740 is a good score, not great, but definitely good. I look at people’s scores all day in the 500’s and 600’s. Once you get into the 700’s it gets a little more technical…..last year my score was only a 770 because I didn’t use different forms of credit including home mortgage. So I paid off my car loan, I pay off my credit cards, I pay more than the minimum on my student loans, but, my score would have been higher if I had taken on a mortgage! Go figure, you know how FICO operates. It’s not set up for your benefit, it’s set up for the lender’s benefit. YOu get a higher score if you have a mortgage….what a joke.

“As has been discussed before, so much of (almost) every CPS turnaround is getting the school full enough that you can limit attendance to the immediate neighborhood and, if applicable, selective enrollment admittees–in other words, making the school a genuine community school, at least as to the students. But the principal plays a significant role in teacher selection and community building–even if you make the boundaries small enough, you need buy-in from the parents, or the school will never fill up. So, for SL, I think it was necessary to both change the boundaries and have a principal who could make it work.”

I don’t disagree much. Just musing a bit. E.g., what if you had the same boundary changes and had the median CPS elem principal in charge instead? Is SL elem a little worse off, much worse off?

The announcement (see below) seemed a little over the top, but I don’t really begrudge him that, and it’s surely good for Pulaski to have a principal who can promote the school and be promoted to parents, which helps make it a true community school, which is key as you note. And I’m VERY much for that. Just musing.

http://pulaskiib.com/?p=112

I didn’t want to get REALLY specific and still wanted to have a fudge factor.

One of my FICO scores is at 740. Other agencies are higher.

I’m in my 30’s. I have a range on the credit cards…say one credit card with a $8,000 limit and another credit card with a $50,000+ limits. I generally am never over 50% on my credit limit per card unless there is some big purchase.

I have no student loans. No car payments. Just have the mortgages.

There have been unpaid medical bills, but the amounts were

great…the site things I am injecting code.

I give up. Sorry for the multiple frag posts.

I am 32 yrs old with 807 FICO. I have no student debt and have little revolving debt on credit cards that are paid each month with only $2K in useage. I do have a car note (0.9% interest, couldn’t justify paying cash) and 3 mortgages for properties that I own. I am in the process of buying another property but have been haggling with the bank over foreclosure price after being approved for 4th mortgage. This will be my last mortgage unless my income goes up significantly as I have bascially maxed out my debt/income ratios with this upcoming purchase. I should note that I have no student loans or other consumer debt apart from what I have mentioned.

I have never been late on bills and have not had any unpaid medical (I even paid $30 dental bill that wasn’t my responsibility just to not have it appear on my record, which I was later compensated for a month later by the dentist). It is possible to have FICO over 800 if you are young, you just have to watch your credit like a hawk.

As a fellow 32 year old, I have the unfortunate duty of informing you that you’re no longer young. Sorry.

As someone in his ,late 60s let me inform you that you are young.

I’ve learned more about the financial status and credit history/scores of people that I will never meet today than I ever thought I would. I have some follow up questions about the dental bill and the spending limits. No, really I don’t. Thanks for the incredibly uninteresting overshare!

No car note, no student loans, and unpaid medical bill (regardless of the amount a collections is a collections). You need to utilize more types of credit and in the long run that will improve your acore. Rememebr FICO isn’t your score, its how creditors view your use of credit.

i wish i was 32 again 🙁

I have no clue what my FICO score is, i can care less, Banks usually love me. maybe its a good score and thats why?

before we got the the apartment we were shopping for a Minivan (dont laugh) dealers always run your credit right away for some reason and come back with a woody ready to give me 0% (sometimes its cheaper to take the rebate) and give me the car for the weekend to test out.

in the fall i was checking into refinancing to see if it was worth it. (recoup closing costs and stuff and move to a 15 year fixed) the banks i spoke with f’ing loved me for some reason, maybe cause they wanted me to take some cash out with the refinance?

the only debit i have is my mortgage, two cars (both 0% financing), and my HELOC. I dont count the credit cards as balance is paid in full once the bill hits my desk.

i guess until the lenders get hesitant with me then i will dig into the FICO thing and be concerned.

BTW; when banks run my credit i always ask for a copy or to look at the report just to check for fraud. so far so good.

“Steve A on June 17th, 2010 at 8:46 am

As someone in his ,late 60s let me inform you that you are young.”

Not really, just not old either.

32 is plenty old enough to have an extensive credit history. A 32 year old could easily have several credit card tradelines with a 14 year history, installment loan history, and mortgage loan history. This is more than enough to get a 800+ score. In fact you could probably do it in early or mid-20s with the right credit cultivation.

“The house on Oakley is what I would consider to be today’s ‘deal’. Yes it’s on a smaller lot but it sold for $470,000 in 2001 and even with upgrades it sold for $490,000 today. Finally, pricing is starting to return to earth. Glorious will be the day all homes in the neighborhood are listed for and sold at these 2001ish prices.”

Yeah, that’s the best SFH “deal” I’ve seen in Bucktown. Looked at that house a few times, but wasn’t sure about the layout. Only a two up, and converted in such an odd way that you couldn’t really easily make it into a 3 up. The bizarre dormers created this weird crawl space/hobbit room off the front of the kid’s room that was just dead space.

But still, hope this gets all cottages in Bucktown down to 500k…

I’m 29 and am around 791, 792 and 795 for the three agencies. Only debt is a year left on my car loan @ 3.9%, a few hundred bucks on credit cards and… that’s it. I have a pretty long credit history and never pay anything late.

After I bought my house I have no idea what my credit score is, and I really don’t care. I don’t plan on using credit to buy anything anytime soon that I can’t afford on my credit cards or with cash so yeah.

“before we got the the apartment we were shopping for a Minivan (dont laugh)”

Oh, I’m laughing. You’ll fit right in in Naperville.

LOL

The grooving soccer mom in Naperville.

LOL

“we were shopping for a Minivan ”

hahahahahahahahahahahahaehahahahaheeheheheheooeooooohoooohohahahaha

oh man, that’s funny

So although I don’t agree with everything with Obama, I do believe that the lack of transparency with medical billing is screwed up beyond belief.

I had an issue with the hospital, the insurer, and 2 months of COBRA which I elected to have to pick up a gap between the start of a new insurance plan.

I went to see the doctor during that gap. The hospital charged me as un-convered and that’s when the merry-go-round started. So I choose to not pay and billing went to collections. I figured it was easier to write a check for what I REALLY owed vs. trying to get an overage back. But I guess the result is that I am in my 30’s with less than a 800 credit score. Guess I should get over it too.

Don’t get me wrong, its not my credit score limiting me when looking at properties its more of the segment that I am looking in (I don’t think the market turns over as much in the chichow DZ market)

screw you bastardz until you use the automatic sliding door you dont know what you are missing!

Chichow, dude medical billing is a nightmare even with good insurance it is a nightmare. my wife switched doctors three times and dentist 3 times also do to the f’ing up billing and charging different prices for the same thing at different times.

If it wasnt for her handling the medical stuff for the family i would be a very angry man.

Oh Oh Oh…my coworker broke down. He got a loaded Toyota Sienna?

Auto sliding doors on both sides. I keep imaging that scene from Mr. and Mrs. Smith:

John Smith: [hitman from the BMW opens the van’s left door. John opens the other van door and yanks the hitman through]

These doors are handy.

—

Screw you all with the minivans.

I live in the green zone. My rug rats are going to be in a VW wagon.

“my coworker broke down. He got a loaded Toyota Sienna?”

thats the one we agreed on, it has awd, power third row seats and dual screen tv, and some lexus interior finishes. next year we will get it.

gosh this is so sad i am happy to talk about mini vans 🙁

any you laughing bastards going to Randolph fest this weekend? wifey, kid and i will be there on saturday. (we wanted to go friday to see mathew santos)

“Oh, I’m laughing. You’ll fit right in in Naperville.”

Or North Center. About every third car on the street is a MV, or an MV disguised as a “crossover”.

“Is $186 psf low in Bucktown? Seems like it is. Buyer probably got a deal on this one.”

The biggest problem with this location is the “El” tracks directly across the street…a large number of buyers would not even look at a property that looks directly at an elevated track.

“If you move here send the kid to st iggy’s or the brit school.”

St. Ignatius doesn’t begin until 9th grade and the British School costs $26K per year tuition.

Jan,

brit school cost as much as parker and latin? and it doesnt have the same proven results? im i missing something there?

What about Pritzker Elementary across the street from the actual Wicker Park? I thought that was a magnet school; I have a friend who lives a block away and was a music teacher there (and other CPS locations) until retirement; I think she used to send her own kids there as well.

“brit school cost as much as parker and latin? and it doesnt have the same proven results? im i missing something there?”

1. It’s a for-profit school

2. The tuition bill is all you pay (activity fees, etc excepted). There’s no fund raising expectation.

perhaps you could hire an in-home hipster personal tutor for like half the cost

chichow, I’m in my early forties. Too old to know what “ARKM?” means but young enough to care that you may be flattering me.

was just lazy. ARKM are you kidding me.

I thought I was all good with my 700s and banks liking me, but I guess not 🙁

“Too old to know what “ARKM?” means ”

Means he used his left index finger rather that his right when trying to type AYKM.

“1. It’s a for-profit school”

bastards taking my money to pay for there summer homes and not my kids edjumkascion.

Anon,

i swear we babbled on about this school before i still dont know that much about it and havent heard good thing about it either.

26k seems like alot for profit or not, maybe its they have no alums to hit up for cash?

“26k seems like alot for profit or not, maybe its they have no alums to hit up for cash?”

Part of the charm (apparently) is that they don’t hit up parents or alums for cash other than tuition. Do you give money to your former (for-profit) employers? Where the n-ps are pretty upfront about expecting additional fund raising efforts.

“Part of the charm (apparently) is that they don’t hit up parents or alums for cash other than tuition.”

I definitely see the appeal of that. Still, is it that expensive to run a good school?

“is it that expensive to run a good school?”

When you (1) have an expensive facility, (2) have corporate overlords and (3) can’t pay your teachers *too* poorly, b/c you’re a for-profit entity, it’s pretty expensive.

On another note, DZ, I have two more, more expensive homes for you to look at. Check your email.

Yes, British is actually more expensive than Parker or Latin and is for-profit with no fundraising expectation.

As for “proven results”, I’m not sure how those are measured at any private schools since they are so hush-hush about test scores; however, I have spoken with families with kids at British, and the school sound fantastic, with small classes, dedicated teachers, an international group of families, differentiated instruction, and every “extra” that you can think of, like foreign language instruction and an extensive music program. If I had $26K extra I could burn each year for 14 years, I’d enroll my daughter in a heartbeat, but luckily, she’s getting about 90 percent of the same experience at a public for nothing more than what I pay in property taxes.

“As for “proven results”, I’m not sure how those are measured at any private schools”

i would say % of students going to college, or % of college grads, but with these upper private schools that number is skewed cause even if the kid is “slow” the parent is “connected” or an alum and can “grease” the wheel to get the kid in and donate something so the kid at least gets a BA.

Jan you are saying that with 26k a year you would choose it over UofC lab school and parker without hesitation?

I haven’t looked into each of the three programs into such detail that I could make the judgment, but I’m impressed with what I know about British.