The 21st Century Bucktown Brick Cottage: 2235 W. Homer

This 4-bedroom vintage brick cottage at 2235 W. Homer in Bucktown is in a “hot” location as buyers are suddenly discovering this area.

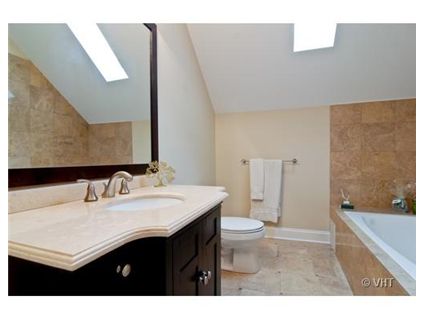

Built in 1878, it has been renovated so that it has all the modern amenities including central air.

But not all of the vintage features are gone. The cottage still sports the original stained glass in the living room, crown molding and mahogany inlay.

The house is on a smaller than normal Chicago lot at 24×100 but still has a deck and a 2-car garage.

It also has a walk-out basement that contains the 4th bedroom and the 4th full bath.

The kitchen has stainless steel appliances and granite counter tops.

Robert John Anderson at Baird & Warner has the listing. See more pictures here.

2235 W. Homer: 4 bedrooms, 4 baths, 2 car garage

- Sold in June 2001 for $250,000

- Sold in May 2005 for $648,500

- Sold in July 2008 for $831,500

- Currently listed for $850,000

- Taxes of $7930

- Central Air

- Bedroom #1: 19×16 (second floor)

- Bedroom #2: 15×14 (second floor)

- Bedroom #3: 12×7 (second floor)

- Bedroom #4: 16×11 (lower level)

Beautiful home. I really like this house. I could live here.

However:

July 2008

$624 1st mortgage

$123 2nd mortgage

10% down payment

______________________

$831,000

Behind most fancy homes are even more exotic mortgages.

Nice place but wowzers big price

I think I have to disagree with calling this areas “suddenly” hot. That area has literally been on fire for the past decade.

wow, there’s a lot of info about this transaction on the internet. blockshopper has bios on the buyers and sellers of the 08 transactions. everyone involved was drinking the RE kool-aid. That’s how a 1,260 sq ft cottage at Armitage and Damen eventually sells for $831,000 a few weeks before Lehman collapsed.

HD:

“Beautiful home. I really like this house. I could live here.

However:

July 2008

$624 1st mortgage

$123 2nd mortgage

10% down payment

______________________

$831,000”

What’s so exotic about this one?

Pretty standard to get a normal rate on the 1st mortgage and do a HELOC or 2nd mortgage for the rest. You don’t have to get a jumbo for the whole amount.

“a 1,260 sq ft cottage”

That’s no more credible than most realtor SF numbers. Why not just call it 550 SF? If you’re going to make up a number (yeah, yeah, it’s the assessor’s sf number, I know), take it all the way.

The house is ~1000 sf footprint, making it ~1700 above ground (sloping second floor roof) + ~900 basement.

Property looks hella nice.

it’s been “literally” on fire for a decade? Then it should be going a lot cheaper than this.

Very nicely done reno for the home. Price is tough though.

“it’s been “literally” on fire for a decade? Then it should be going a lot cheaper than this.”

I’d expect more tires, too. Hard to keep a fire burning that long w/o appropriate fuel.

Graduate from school, get an offer to work in the RE dept – buy an $831,000 house? what ever happened to two years W-2’s? It looks like during the summer of 2008 all they wanted was two paychecks! But hey that’s all you need to qualify for a trial HAMP loan mod.

“What’s so exotic about this one?

Pretty standard to get a normal rate on the 1st mortgage and do a HELOC or 2nd mortgage for the rest. You don’t have to get a jumbo for the whole amount.”

amazing home. price seems in the right ballpark, but if they are in a hurry to sell you could take 50k off.

Anon(tfo): the assessor thinks it’s 1,260 sq feet.

http://www.cookcountyassessor.com/Property_Search/Property_Details.aspx?Pin=14313030140000

“Anon(tfo): the assessor thinks it’s 1,260 sq feet.”

Do you even *bother* to read? To wit:

“(yeah, yeah, it’s the assessor’s sf number, I know)”

Am I missing something?

850000 > 83100, but

http://blog.redfin.com/chicago/files/2010/01/Chi-Case-Shiller-Tiers_2009-11.png

Maybe I’m forgetting that this place is different than all other real estate; its a special property that could possibly have declined in value like all that _other_ real estate has.

Seriously though, is it uber impolite to ask an RE agent what they are thinking when they ask more than the 2008 sale price?

So anon(tfo) you’re doubting the validity of the assessor’s number?

has the sq footage of the house changed since it was built in the 1800’s?

I think 1260 is a fairly reliable # there’s no reason to be all like “make up any number – 550” you’re being absurd. The 1260 doesn’t include the below grade finished bsement, i know.

maybe $725 – 750k is my guess, if the owner needs to sell.

it’s a beauty, but I don’t see any way this goes for more than the 2008 price.

“So anon(tfo) you’re doubting the validity of the assessor’s number? ”

Yes, I am doubting the assessor’s number. I *almost*always* doubt the assessor’s number. Do you think that the reno was fully permitted and, if so, the revised space properly reflected in the assessor’s records?

If you really believe that, you probably also believe that Cook County government is run efficiently. And I’d like to sell you some bridges, get you to invest in some llama farms and have you help my friend, Prince Adubike, get his inheritance.

Or are you playing deliberately obtuse for effect?

Did anyone see the NYT’s front page today? When was the renovation? Then again, I don’t care. It won’t justify the difference in the 2005 and 2010 ask prices in this dead market.

“Did anyone see the NYT’s front page today?”

No. What did it say?

what’s on the front page of the NYT? Online there’s like a million stories.

Anon(tfo) you’re being absurd for the sake of being absurd. Your creating straw man arguments about cook county efficiency.

Look, the assessor says 1260 sq feet. I don’t see any additions on the house. you’re assuming proper permits weren’t pulled. 1260 is a good starting point I think, it’s nothing like making up numbers like you accuse me of. This is a small house on an even smaller lot. The photgraphy makes it bigger.

“#anon (tfo) on July 21st, 2010 at 11:21 am

“So anon(tfo) you’re doubting the validity of the assessor’s number? ”

Yes, I am doubting the assessor’s number. I *almost*always* doubt the assessor’s number. Do you think that the reno was fully permitted and, if so, the revised space properly reflected in the assessor’s records?

If you really believe that, you probably also believe that Cook County government is run efficiently. And I’d like to sell you some bridges, get you to invest in some llama farms and have you help my friend, Prince Adubike, get his inheritance.

Or are you playing deliberately obtuse for effect?”

“Look, the assessor says 1260 sq feet. I don’t see any additions on the house. you’re assuming proper permits weren’t pulled. 1260 is a good starting point I think, it’s nothing like making up numbers like you accuse me of. This is a small house on an even smaller lot. The photgraphy makes it bigger. ”

You trusting the assessor’s records is absurd. The assessor doesn’t trust the assessor’s records–see http://www.chicagotribune.com/news/local/ct-met-cook-county-tax-rolls-20100720,0,1244.story

Sorry, I meant WSJ, not the NY Times. My bad!

Checked a couple neighbors’ houses with recent, permitted, improvements for assessor’s SF. Neither reflect the increased SF (one had a *major* expansion of ~40% more SF, the other added ~20%) even tho both note a home improvement exemption. The larger one is flagged for review for improvements.

Yeah – housing is primed for a double dip.

When you get ridiculous listings like this place for $850,000 of course nothing is selling.

Ridiculous.

“#ALT on July 21st, 2010 at 11:50 am

Sorry, I meant WSJ, not the NY Times. My bad!”

“Sorry, I meant WSJ, not the NY Times. My bad!”

Housing Market Stumbles:

Construction Slows, Inventories Build Amid Weak Job Growth, Tax-Credit End (??)

Link:

http://online.wsj.com/article/SB10001424052748704723604575379463676740680.html?mod=WSJ_hp_mostpop_read

Anon(tfo) – I’m not saying 1,260 is the word of god, I used it as an approximation of the size of the house. It’s a cottage on a small lot. Not counting the basement, what, maybe 1600 sq feet? It’s still a small house on a small lot. get up off my grillllllllllll! Regardless it’s a lot of money!

way overpriced. Basic home depot style renovation. I think they’ll be going way down on this one, maybe $750,000 gets it sold.

“get up off my grillllllllllll!”

I’m mostly hassling you for relying uncritically on the Assessor’s office. Trust info obtained from Cook County? Really?

“Regardless it’s a lot of money!”

Yeah, too much considering the lot and what appears to be an unusual floorplan (maybe I’m making bad assumptions, but I don’t like what I see layout wise).

850k!!!!!!!!! are you seriously kidding me? no Sabrina its gotta be a typo.

Its a beautiful 3br place and I would love to call it home, but at 850k come on.

did the seller grab a crazy from the wilson stop bribe someone to give the uptown nut a RE license and then ask the legally mentally insane new agent to list it at a price they think is fair?

no seriously come on!

Grove77:

got a throw away email address? I have a 3 bdrm to ask you about.

Chichow

Groove77cc at yahoo dot com

“did the seller grab a crazy from the wilson stop bribe someone to give the uptown nut a RE license and then ask the legally mentally insane new agent to list it at a price they think is fair?”

No, they priced it so that they don’t have to bring any $$ to closing if they get an offer reasonably close to ask. An offer at ~5% off, less transaction costs, drops them down awfully close to the not quite $750k they owe.

I don’t think this will end well for them.

Man, sucks to have purchased in July of ’08; buried by Labor Day. Alas…

That aside, like the reno, for the most part, and this stretch of Homer is one of the best blocks in BT, for my money…just not 850k of my money.

off topic question (auto related):

any advantages for a resident of Cook County to buy their car outside the county?

save anything by buying in the burbs or out of state?

“off topic question (auto related):

any advantages for a resident of Cook County to buy their car outside the county?

save anything by buying in the burbs or out of state?”

within Illinois, you’re taxed based on your home address, not where you buy, so no. Outside Illinois, you have issues with licensing the car in Illinois, unless you pay “use tax” (which, btw, you are supposed to file an annual return for for all online and out of state purchases). Even if you can license the car out of state (bc you use your parents house or whatever), there are issues with insuring and (possibly–if relying on zoned parking) parking your car in Chicago.

Nope…in Illinois you pay the sales tax where you live not where you buy.

Chicago style is to (police write) ticket now,

(vehicle owner) go through bureaucratic mess later.

Cook County and Illinois apparently will hunt you down for the sales tax revenue. Dealers send paperwork to state as part of transaction, and often obtain new plates for buyer. Previous owners of our house bought their new cars, using our address two years after sale. A series of notices came from motor vehicle and tax collections. We forwarded all those bills to them. We still get their doctor bills too.

“No, they priced it so that they don’t have to bring any $$ to closing if they get an offer reasonably close to ask. An offer at ~5% off, less transaction costs, drops them down awfully close to the not quite $750k they owe. I don’t think this will end well for them”

all it takes is one burb transplant wanting to be kewl to pay this price for the street cred card.

thanks to all…about what i’d heard but wanted a few more sources of info….was hoping it would be like shipping jewelry out of state but i guess not.

The county will sue you for the sales tax. Most of the surrounding counties just collect it on behalf of cook county anyway but some of the more outlying counties don’t. when you get sued you become responsible for the court costs and fees. I’ve seen a number these cases over the years. There’s really no defense.

anon (tfo), thanks for posting the WSJ article. The featured home is the case in point of the following, especially where Chicago is named as having a rising foreclosure rate:

“Another reason inventory is rising: “Unrealistic sellers have flooded the market” after reports of bidding wars and home-price increases earlier in the year, says Steven Thomas, president of Altera Real Estate, a brokerage in Orange County. The amount of time that homes there have sat on the market there has swelled to 3.78 months, up from 2.35 months in April.

“The sellers think the market’s coming back. They’ve tacked on an extra 5 to 10 to 15%. The buyers aren’t going for it,” says Jim Klinge, a real-estate agent in Carlsbad, Calif. Over the next six months, “it’s going to feel like a double-dip because sellers are going to have to lower their prices.”

I sure can vouch for this being the case. I can also vouch for the difficulty of obtaining financing even with excellent credit.

ALT “I sure can vouch for this being the case. I can also vouch for the difficulty of obtaining financing even with excellent credit.”

I recently bought a place, 20% down, have excellent credit and no debt and STILL had to go through a hell of a mess to close. I dont know if I would attribute it to tougher regulations today, or simply the fact that almost everyone I had to work with during the loan process seemed a couple cards short of a full deck… I’m not sure if I had a normal experience, but it literally amazed me that 1. these people have jobs, and 2. that they are able to get any deals done at all.

A couple of places I would much rather have in this area for $850K:

2131 W Dickens

2123 W Dickens

1923 N Winchester

Based upon a breif look at the other properties in the area I’d think $750K is a good list.

“I recently bought a place, 20% down, have excellent credit and no debt and STILL had to go through a hell of a mess to close. I dont know if I would attribute it to tougher regulations today, or simply the fact that almost everyone I had to work with during the loan process seemed a couple cards short of a full deck… I’m not sure if I had a normal experience, but it literally amazed me that 1. these people have jobs, and 2. that they are able to get any deals done at all.”

I’m (hopefully) closing in a week or two and have had a very similar experience. 20% down, excellent credit, no other debt except a car payment that’s done in a few months, and it’s a major pain. The people I’ve been dealing with haven’t been dumb so much as completely inflexible. The amount of paperwork that the underwriters require is enough to fill a forest.

For what it’s worth, the house we’ve been chatting about on 2243 Homer sold (via redfin) for $522,550. Well, I’ll grant you 2243 is less desirable (cramped kitchen, spiral staircase), it’s certainly not worth 325k less than this home.

Barry and JP$ — you’re in good company. Exact same situation here — we’re looking at 60% LTV with great credit and are beyond annoyed with the lending process. I CANNOT believe how ridiculous the process has become and how incompetent all who touch our loan appear to be. Where are all of the smart people in residential lending? I know they are out there…

“Where are all of the smart people in residential lending?”

The smart people left before the bubble burst…

As a lender, I can tell you that it is hard as hell to get a loan to closing. It doesn’t matter how much money you make, how big of a down payment, etc.

The entire residential lending process is FUBAR. Most of it is driven by Fannie/Freddie because that is where the vast majority of the loans are being securitized. Underwriting mortgage loans is not about credit risk which is what people fail to understand. It is about can the loan be sold. Fannie/Freddie are making lenders buy back billions in loans so every loan is scrutinized to the nth degree to ensure the bank isn’t stuck with a worthless loan. Nothing is about common sense… it is about do the loans meet the guidelines. Common sense and underwriting guidelines don’t necessarily go together. Think painting by numbers.

The mortgage industry is the poster child for over regulation in the name of helping consumers and it is only going to get worse with that financial reform bill sitting on Obama’s desk.

If you want to know how that healthcare bill is going to work out with the public option, look and Fannie & Freddie and how they have screwed up the mortgage market which is essentially the public option for mortgages and think how much of a pain in the ass getting a mortgage is these days. Apply that to your healthcare….

Now now, the government couldn’t possibly screw it up more than the insurance companies already have, right? We’ve all seen Michael Moore’s Sicko. I mean, why in the sam hell do we live in a world where the insurance companies make us pay co-pays? Seriously, I shouldn’t have to pay $10.00 every time I see the doctor nor should I have to pay $20.00 for my prescription for Valtrex. This is my health we’re talking about here and I don’t want anyone but the government peering in to my personal life. This is non-sense. I just want to show up at the doctor, whenever I want, and as often as I want, and get whatever healthcare I want, when I want it. And Obama is going to give it to me.

“If you want to know how that healthcare bill is going to work out with the public option, look and Fannie & Freddie and how they have screwed up the mortgage market which is essentially the public option for mortgages and think how much of a pain in the ass getting a mortgage is these days. Apply that to your healthcare….”

“A couple of places I would much rather have in this area for $850K:

2131 W Dickens

2123 W Dickens

1923 N Winchester”

What are the chances they will go anywhere near $850 either? 2131 Dickens was sold for under $700 in 2003, new – and now there is work to be done.

Russ, “that financial reform bill sitting on Obama’s desk” was signed into law today, if you are talking about the Dodd-Frank Act. Welcome more layers of bureaucracy, all so that Obama could play FDR and say this is the most sweeping financial reform since the Great Depression.

“And Obama is going to give it to me. ”

Our last 8 presidents already gave it to all the old people; why should the Boomers be the last ones to get a drop of blood from the rest of America?

Because we’re out of money?

“why should the Boomers be the last ones to get a drop of blood from the rest of America?”

Anon (tfo) — Because you can’t squeeze blood from a stone? Because the last eight presidencies coincided with a trend whereby the generational standard of living has declined when higher housing, education, medical, food, and other costs are considered against salaries/employment?

HD, you read my mind.

“Because we’re out of money?”

Nope. We’re not out of money, it’s just horribly mis-allocated.

“Because the last eight presidencies coincided with a trend whereby the generational standard of living has declined when higher housing, education, medical, food, and other costs are considered against salaries/employment?”

So get the government out of my medicare! Take it away from the old people. What, they can’t get insurance otherwise b/c they’re too poor or the premia would be too high? WTF? If it’s good enough for granny, it’s good enough for everyone. Find me an elected official who would openly support a *complete* elimination of medicare and then I’ll have time for this stuff. Until then, it’s just a bunch of electioneering BS and *every* national politician is guilty.

Of course, if anyone from John Birch to Emma Goldman, Malcolm X to David Duke, were running for Illinois governor, on a platform of firing and re-hiring immediately *every*single* state employee, in order to terminate their pension accruals and get them on the defined contribution plan. Fix most of our state’s problem right there. I’m just sick of the “they’re sooooo awful” when the accuser has *nothing* to offer to fix the underlying problem.

Um, in case you haven’t noticed Medicare is the best run health system in the US with low cost. Hope it will be there when I can apply. And as for the Boomers getting the last drop of blood, they are not in good shape for retirement, with losses on houses and retirement funds and possibly not having SS.

“Um, in case you haven’t noticed Medicare is the best run health system in the US with low cost.”

I seriously hope this was a sarcastic comment. If not, then you have NO idea what the country is in for (including YOU).

And this is what is very hard to get the spendthrift plebiscites to understand: if we wait until the bond market vigilantes show up it is going to be a very rough transition to the lower standard of living in America’s future. Best to start that transition now so it will be smoother and not cause as much disruption.

America is in for either severe fiscal strain or a fiscal collapse. I am hoping for the former.

Also look at what politicians have systematically done over the past 30 years: they spend now and assume they can raise taxes later or don’t care as much about the future. I’m not voting for any politician who has ever raised taxes in the past or wants to in the future. Already 47% of Americans pay no income tax. Which party do you think they’re voting for?

“Nope. We’re not out of money, it’s just horribly mis-allocated.”

2243 W Homer is an interesting comp. . . so is 2141 which sold last summer for $560k (listed as a 4/2.5).

I was in 2141 and it looked slightly nicer than 2243 (which I did not see). But 2141 really only had one more bedroom (on the main floor) if you count 2243s basement family room as equivalent to the total non bedroom in the basement of 2141.

So, 38000 more for one extra, tiny, main floor bedroom as well as one additional bath, everything else equal.

This place is far nicer than both those comps with much higher quality finishes, plus it has 1.5 more baths. . .

figure in maybe $20k more for the deck. . .

. . . nope, sorry, can’t get to $850k.

Beautiful rehab though.

“Medicare is the best run system in the US with low cost”

If you believe that then here is the other newsflash that you might have missed. LP RN WL and Bucktown homes will all post double digit gains in 2011!

“Medicare is the best run system in the US with low cost”

No, my remark was not sarcastic, but comes from experience with helping others with Medicare and health insurance. Medicare has premiums that are indexed to the amount of money made and you can’t be denied health insurance coverage, etc. etc. But this is off topic.

Nice house with a steep price. I’d rather have a townhouse in Lincoln Park for that money.

Medicare was a godsend for my mother. Prior to that she was on private insurance that cost her $17,000 a year (including a $5,000 deductible, which, once she got sick, she always had to pay out of pocket every year.)

The care was better and cheaper under Medicare. It covered more therapies and other things than her private insurance EVER did.

The problem is how to pay for it all.

“Nice house with a steep price. I’d rather have a townhouse in Lincoln Park for that money.”

You can get a house in LP or Lakeview for the same price (but easier to find in Lakeview- but we’ve chattered about some in LP in this price range too). It all depends on which neighborhood you prefer, obviously.

Remember this cute 4-bedroom on Webster that sold for $740,000 – which had been featured on the Sheffield Garden Walk?

http://cribchatter.com/?p=8312

LOL some idiot got 85k and bought what is at best a 650k house.

I bet this doesn’t end well either.

Do not pass go, do not collect $200. You spent near a million dollars in crappy Bucktown and all you got was a wrecked credit score.

My viewpoint comes from the other side of the healthcare system. It is likely that Medicare will change dramatically over the next few years. Several practices that I know well are no longer accepting new Medicare patients. They will continue care for the existing patients but have drawn a line in the sandbox on any future losses. Yes losses! On many procedures they are actually losing money by treating a Medicare patient and it is slated to get substantially worse in the years ahead.

If your mom, dad, or other loved one needs a total knee or other Orthopedic procedure that they have been putting off I highly suggest that they strongly consider getting this done now. Those procedures will still be offered in the future but it will be with higher patient cost responsibility, a more limited amount of surgical time allocated to Medicare patients, and a much more limited and likely shorter rehab time due to capitated pricing for the procedure.

At this moment Medicare is indeed a good program for seniors! Enjoy it while it lasts!

Clarification

I did not mean shorter surgical time in the or to do the procedure but meant less time slots allocated to Medicare patients. This means more wait time for scheduling like in Canada and other national health care based systems.

ok, this conversation has jumped the topic shark, so I’ll just weigh in with an example of why medicare has GOT to be better than the private alternative.

1) no CEO making tens of millions a year which gets skimmed off the top

2) no shareholders skimming dividends off the top

3) the health insurance industry is the most administratively wacked system on earth – something like 35 cents of your health care dollars goes to the insurance companies. that’s just ridiculous, this is an industry that is supposed to keeping people alive and healthy.

my personal example (from this week) is I just got chased down by my old health care group because of a billing snafu involving my co-pay. Apparently I should have paid $20, but only paid $10 – this was for a routine appointment LAST MAY. $10. Looking at the amount of billing & crediting mumbo-jumbo on my invoice, and knowing how much it costs my workplace to cut a check (about $60 in admin time), I’d estimate the “health care industry” spent about $300 to collect that $10.

dumb, dumb, dumb.

as anon said, there’s plenty of resources, we just aren’t allocating them right – the top tax rate (for people making over $3million in today’s dollars) in the great depression was 90%. JFK lowered it to about 70%, then Reagan to 27% or so. Clinton got it back up to maybe 35%, and then Bush knocked it down again.

in the meantime our debt has soared and our national infrastructure has fallen apart. isn’t hard to see the problem here. concentrating wealth in a few hands is those few hands biting the larger hand that is feeding it, society.

My friend Adam had this strange idea, invisable Hand thing or other. bushie and his whole party (before and after him) never really liked Adam.

come on the soak the rich attitude is getting old. 47% of the population pays no federal income tax. That’s the problem. The producers are paying for the lazy and the congress is spending even more than that.

“My friend Adam had this strange idea, invisable Hand thing or other. bushie and his whole party (before and after him) never really liked Adam.”

Dude, no politician–no matter what s/he says–like Adam, at least once they’re elected, because that takes power away from politicians.

“Already 47% of Americans pay no income tax. Which party do you think they’re voting for?”

The party that gave them Medicare Part D?

I’d guess 99% of the people who quote the whole invisible hand thing have never read any part of the Wealth of Nations – it’s one of the most incorrectly-used quotes in human history.

take this line for context:

“People of the same trade seldom meet together, even for merriment and diversion, but the conversation ends in a conspiracy against the public, or in some contrivance to raise prices.”

Sure doesn’t sound like a defense of a “free market” to me.

HD – you’re wrong. there’s a book called “America: Who Really Pays the Taxes?” you should read – it’s a bit old, but the central themes and examples are all still relevant.

forget all the simplistic stats politicians on both sides of the aisle bandy about, the rich write the tax codes (remember, almost every single member of Congress is a multi-millionaire), and they most certainly are not favoring the poor, working poor or shiftless poor.

>>>the health insurance industry is the most administratively wacked system on earth – something like 35 cents of your health care dollars goes to the insurance companies. that’s just ridiculous, this is an industry that is supposed to keeping people alive and healthy.

35% is exagerated. You also ignore the fact that built into that admin expense are the hordes of case mgrs, nurses, therapists, etc. that work on insurance company dime to improve individuals’ health (those with employer-based coverage). I’m certainly not an apologist for the industry, I see the waste every day in my job, but I also see the inaccuracies blurted out non-chalantly by those that are ignorant to the whole system. Also, remember that skyrocketing insurance rates are largely reflective of the rising costs of hospitals and doctors…and denied claims are the result of employers asking the insurance companies not to pay for certain procedures.

Solution? free med school so docs don’t have to charge astronomical fees to pay for astronomical student loans. Prohibit hospitals from being specifically for-profit. Single-payer would remove a lot of the duplicated admin costs of the various for-profit insurance companies. Regulate 30%+ year-over-year increases in big pharma rates to their cash-cow drugs. Tax HFCS sodie pops and candy bars and chips and tobacco. We’re a country of unprecedented fatsos, of course our health care spend is unparalleled.

Oh, while this neighborhood is top-notch, I can’t justify more than $725k for this house.

One major problem with the healthcare system is the dislocation between the patient and the value of the services they want/need. People will pay $30 for an oil change but complain about a $20 copay for their diabetes medicine.

The strawman argument that was frequently used during the healthcare “debate” was that if the government can require you to buy car insurance it can require you to buy health insurance. The big difference is if your car breaks down, your insurance doesn’t cover it. Car insurance is meant to protect you from liability if you cause an accident and maim people, or get into an accident. Seems fair. Also seems fair that if you ride your clutch or need a new transmission, you’re paying for it yourself by taking it to a qualified repairman.

If you eat yourself half to death or smoke yourself to the radiation suite apparently it’s OK to expect someone else to not only keep you alive but to do it for no cost to you.

As for random illness and accidents, properly underwritten insurance and risk dispersed across a broad range of patients should provide you with reliable coverage. There’s no excuse for either the insurance industry’s “deny first” mentality, or the price dislocation in the markets driven by subsidies and greed.

I don’t know about you guys but if I got into a car accident and broke my hip, I would sure be willing to go bankrupt to get it fixed. Because you have multibillion dollar institutions standing between you and your doc, negotiation isn’t even on the table. FUBAR indeed.

“remember, almost every single member of Congress is a multi-millionaire”

Senate only. I don’t believe that even a majority of the House is multi-millionaires.

@Russ

Seriously, all of the “consumer protection” type documents involved seem to do nothing more than to make the whole process more confusing. I felt like I had to review and sign the same document 3 different times (even though they were “different” documents). The process that is designed to do one thing, seems to do the complete opposite.

I have a decent familiarity with the medical system due to the various personal injury plaintiff/defense work i’ve seen over the years and I’ve rarely ever seen the ‘big bad insurance co’ deny a claim or have the deny first mentality. what i see are people failing to pay co-pays, bitch about their doctor or have no savings to tide them over if they’re out of work for a few weeks.

Sure, it might cost you $2,000 if you’re seriously injured, including meds and co-pays. That’s nothing, nothing at all given the state of modern medicine. These are the same people that pay $455 a month for their 2006 chevy malibu but refuse to pay $20.00 for their diabetes medicine.

There’s a mentality out there among some people that they shouldn’t have to pay anything at all whatsoever out of pocket for their medical care. I’m not saying that the ‘deny first’ mentality isn’t out there, or doesn’t happen often, but its not where near as prevalent as the single payer advocates want you to believe. your politicians went along with the ‘big bad insurance co’ meme and some of the population has bought it hook/line and sinker.

“I’m not saying that the ‘deny first’ mentality isn’t out there, or doesn’t happen often, but its not where near as prevalent as the single payer advocates want you to believe.”

But if it’s you, or your kid, who can’t get coverage at all b/c of a pre-existing condition, it’s a different story. That’s the real issue, rather than one-off denials of claims.

Mea culpa regarding the House of Representatives, anon. But- take a look, you’ll see my point is still dead on, and I would love to see an average net worth:

http://www.opensecrets.org/pfds/overview.php

as for health care – this is an old study after a quick search, and I don’t think it’s gotten better since then. I fully agree we have to help aspiring doctors, you can’t address the demand side of the health care issue without also addressing the supply side.

http://content.nejm.org/cgi/content/short/349/8/768

“Results In 1999, health administration costs totaled at least $294.3 billion in the United States, or $1,059 per capita, as compared with $307 per capita in Canada. After exclusions, administration accounted for 31.0 percent of health care expenditures in the United States and 16.7 percent of health care expenditures in Canada. Canada’s national health insurance program had overhead of 1.3 percent; the overhead among Canada’s private insurers was higher than that in the United States (13.2 percent vs. 11.7 percent). Providers’ administrative costs were far lower in Canada.”

“If you eat yourself half to death or smoke yourself to the radiation suite apparently it’s OK to expect someone else to not only keep you alive but to do it for no cost to you.”

I hate this argument. With most illnesses you can’t prove cause and effect. I’m lucky I have good private insurance because there is no way I could get private insurance. I developed asthma in my mid-20s and am in remission from Hodgkin’s for about 18 months. So, what reason are you going to give me for denying my claim? I ate sugar cereal as a kid? I smoked a few cigarettes in my teens? I smoked pot in college?

I didn’t say I would decline your claim, in fact later in my post I went on to say that the “deny first” policy is a major problem, even if HD discounts its overall contribution. In principle, in any case, it is wrong.

My point is that fat people should pay more for their healthcare out of pocket, so should people with an admitted history of smoking. They should pay for an insurance policy that classifies them as such, and in return agree to a fair reimbursement process based on their payments for that insurance, which should be higher than the average healthy weight non smoker.

I went through cancer treatment 4 years ago as a 25 year old. I’ll likely never be able to get life insurance outside of an employer policy, but even I would argue it was insane that I paid 2k out of pocket for top notch treatment at a world class facility. In my perfect idealized world, health insurance would be for catastrophic coverage, issued by diversified ans stable non profit entities, with coverage subjected to the recommendations of your doctor, and no one else. If doctors have to take the Hippocratic oath, the entities reimbursing them shouldn’t be profit motivated.

losing my marbles today, posted this in wrong thread:

And my links are preventing my messages from going through, but from opensecrets.org you get these nuggets (I was a bit off on the Reps):

“U.S. senators had a median net worth of approximately $1.7 million in 2007, the most recent year for which their financial data is available, and 62 percent of the Senate’s members could be considered millionaires. In the House of Representatives, the median net worth was about $684,000, with 39 percent of members having net worths estimated to be at least $1 million. By contrast, only about 1 percent of all American adults can be considered millionaires. ”

And just google “health care overhead” you’ll see studies coming in around 31%, that’s not 35%, but it’s obscene nevertheless and WAY worse than medicare.

What about people who eat like shit but don’t get fat? What about drinkers? What about people with a DNA profile that shows they are likely to get Parkinson’s? Genetics plays too much a part in people’s health. Going down that path doesn’t work.

Since we’re on the subject of health insurance, the state of Illinois has an incredibly cost effective plan. The state self insures and uses Cigna as an administrator. Cost is about $5,000/employee, almost half of what private insurance companies charge. Just why are we (especially employers) paying so much for so little?

I agree with russ 100% on the regulation problems. You all championing the new HC bill or even financial bill are idealistic and very naive. You have this pollyanna view that government is both capable of effectively getting involved in ever increasing aspects of the economy effectively and that they should do this.

Taxes should not have to be raised to pay for people’s entitlements nor to pay for runaway spending by politicians in prior eras. The HC bill will be largely a dead weight loss on the economy and just push the US closer to financial problems much sooner.

skeptic you are arrogant to post top marginal tax rates from prior eras as somehow a solution to these problems. You and larger society are simply not entitled to 90% of a productive person’s pay or even anywhere close.

The government cannot force me to buy a service I don’t want and they know they can’t pay for the HC bill without attempting to force healthy people to sign up for a plan to subsidize the LOSERS. And that’s what all of you sick or previously sick people are that like this HC bill: you like it for its handouts and you like that productive, more healthy members of society who aren’t health LOSERS like you are to subsidize your misfortune. I’m not subsidizing sh_t.

Its the County Health system thats bankrupting Cook County and I’d guess you can extrapolate that out to being health care that winds up bankrupting the nation.

The health insurance companies wrote the health care bill. They receive subsidizes from the government to sign up 45 million or so new insureds. The government is paying the insurance companies to insure those who were previously uninsured. The insurance companies are money from the bill and and the money to pay from them is coming from the treasury.

Demonizing the insurance companies while they wrote the insurance bill is just plain sinister. It was just a ploy for the insurance companies to pick the treasury’s pockets and it was successful to the tune of 45 million new insureds.

Bob: go to the Constitution and Bill of Rights and show me where it mentions either capitalism, or the right to hoard wealth.

You live in the wrong country – America was expressly founded so that people could NOT hoard wealth and create another feudal class of half-wit barons, dukes and earls who simply exploited the land.

The fact is that nobody works hard enough to justify making tens of millions of dollars. Nobody. Not pro athletes, health insurance CEOs, or idle investors (hardly “work,” and who are taxed at lower rates).

Get a clue and learn how allowing corporations to lobby has screwed this country beyond recognition.

You can go move to Cuba or Venezuela the socialist paradise where everyone is poor.

“#skeptic on July 23rd, 2010 at 8:40 am

Bob: go to the Constitution and Bill of Rights and show me where it mentions either capitalism, or the right to hoard wealth.

You live in the wrong country – America was expressly founded so that people could NOT hoard wealth and create another feudal class of half-wit barons, dukes and earls who simply exploited the land.

The fact is that nobody works hard enough to justify making tens of millions of dollars. Nobody. Not pro athletes, health insurance CEOs, or idle investors (hardly “work,” and who are taxed at lower rates).

Get a clue and learn how allowing corporations to lobby has screwed this country beyond recognition.”

“Venezuela … where everyone is poor. ”

Haha. Ha. Yeah, everyone in Venezuela is poor.

skeptic, I hate to say this but that pile of crap you just spewed in addition to your comment in another topic of “deregulation is the reason we’re in this mess” is such a bunch of crap, you are the epitome of a clueless liberal… what do you mean nobody should make millions of dollars? Did you ever think in your small mind that someone who makes millions of dollars provides more than what they make to society, and the economy in general, otherwise the companies they work for probably wouldn’t keep them on as employees?

its been a while since I’ve heard something so stupid but your last post takes the cake

Sonies – again, you need to brush up on your history.

If someone wants to make millions of dollars, fine – but the incremental tax rate you pay once you get past single-digit millions should be what it was before Ronnie Raygun bankrupted the country with his trickle-down voodoo economics (a phrase coined by George H Bush, btw) baloney.

Facts are facts. Republican presidents since Reagan giving the most-wealthy people massive tax cuts is not sustainable – we’ve gotten nothing but massive debts out of it.

You should also do some reading up on corporate personhood, and how this has allowed companies to basically rewrite all of our laws to favor their interests.

And no, I most certainly do NOT think the people making these millions are doing much for society – by definition they are extracting wealth from society.

I laugh that you call this “liberal” talk. Was Thomas Jefferson a liberal? Adam Smith, author of Wealth of Nations? Dwight Eisenhower, WWII General & hero and Republican president who didn’t see any reason to knock down the top tax bracket?

I won’t say you’re stupid since I don’t know you well, but you are stunningly ignorant.

skeptic, look at this chart, it doesn’t matter what you tax the richest people in the country, gross tax receipts are going to remain around 20% of GDP!

http://www.americanthinker.com/blog/Tax%20Rates%20and%20Revenue.jpg

I don’t know about you, but i’d like incentives to make a lot of money for those businesses and individuals in our economy instead of punishment so that our GDP can remain growing

Uh, Skeptic… the beauty of this country and why so many people are willing to get on inner tubes in shark infested waters to get here is that everyone has an OPPORTUNITY to get wealthy. Does it mean everyone will be wealthy? No, but only in America do people regularly go from bottom of the barrel to well off with hard work.

The free market doesn’t put morals on earnings. People earn what their skills can generate. PERIOD. There are only a handful of people who can hit a baseball, so they earn millions of dollars a year. Relative to the income that is generated, the salaries of the players are relatively inconsequential. Very few people have the skills to make it to the C-level suite. Shareholders decide what their CxOs are worth, not the government or social libs.

Much of the screws up related to the housing market are very much tied to too much government involvement in the name of HELPING PEOPLE. I can rattle off all kinds of legislation that lenders have to deal with a on a daily basis that do nothing but raise costs for everyone involved.

Hell, here in IL, there is anti predatory lending law that adds at least $200-$400 in costs on EVERY MORTGAGE to consumers. The law has been an abject failure and done nothing to prevent foreclosures. Look up SB1167 or HB4050. This law requires COUNSELING on mortgages. The reason no one knows about is because the mortgages that it would apply to have all but been removed from the market place. However, the end result is at least $200 in costs complying with the law and an occasional millionaire being told they need to go to credit counseling with some $40k/yr credit counselor because they want an interest-only loan.

#”Since we’re on the subject of health insurance, the state of Illinois has an incredibly cost effective plan. The state self insures and uses Cigna as an administrator. Cost is about $5,000/employee, almost half of what private insurance companies charge. Just why are we (especially employers) paying so much for so little?”

HAH! If you haven’t heard, the state is broke, can’t pay it’s vendors, and has doctor’s offices waiting > 6-9 months for payments from the state for those Cigna carrying state employees.

Doctors are actually informing patients carrying Cigna from the State that they will have to pay upfront, or they will not accept new patients w/ Cigna. It’s a great thing in theory, but in practice, at least in this State, at this time, it’s not working out so good for the doctors or the patients.

(okay, I have Cigna. I’ve had my accounts sent to collections because the State isn’t paying out in a timely fashion. While I’ll get reimbursed eventually, it’s not always easy to find an extra few hundred dollars or more to keep the collectors at bay and protect my credit rating.)

Hey you all…

The entire healthcare problem and the need for government intervention can be reduced to one problem:

pre-existing conditions

If anyone can offer a solution to solving this problem without government intervention, I would love to hear it because no one else has ever found one…

deep in my heart i am a socialist in that I would like to steal everything that the rich people got. It’s there for the taking if you know what I mean, but, in reality, there is a huge gap between the rich and the poor and that gap is widening. It’s not so much the punitive progressive tax rates or corporations but something called globalism and the global wage arbitrage. As long as there is a guy in laos who is willing to sew my garmets for 2 cents an hour and a bowl of rice a day, wages here will continue to be depressed while those at the top reap all the profits. There’s nothing you can really do about it. Blaming anything less or even blaming Reagan is just a straw man, misplaced anger, it’s what you want to believe is the source of the troubles but it’s not.

HD:

True, but the sad thing is that it really isn’t that hard to be reasonably successful in America. The formula is not that complicated…

Stay in school, work hard at whatever you do, don’t do things that can derail your life (out of wedlock babies, felonies, etc) and almost anyone can have a decent middle class lifestyle.

Rich people do things that make them rich and poor people do things that make them poor.

Globalism is just making it that much harder for people who make bad decisions in their lives to recover from those decisions.

HD: globalism has been pushed on us BY the corporations, the trans-national ones are only to glad to be able to exploit poor people for labor in the 3rd world, sell us the junk, and not pay proper taxes to the Federal Treasury.

Russ: you’re wrong. that’s an America you’ve been sold by various folks, but it’s not what we were founded on.

Read this Adam Smith quote from Wealth of Nations a few times:

“People of the same trade seldom meet together, even for merriment and diversion, but the conversation ends in a conspiracy against the public, or in some contrivance to raise prices.”

ie – regulation against oligarchies & monopolies is in society’s best interest, indeed, our survival depends on it.

Sonies, American Thinker. Really? You can do better than that.

The graph that counts is the one showing our national revenue vs expenditures. and don’t yap on about “making money” – you know how you make money? you either print it, or you become a bank, which is legally allowed to create it out of thin air with reserve-ratio lending.

“The graph that counts is the one showing our national revenue vs expenditures”

no not really, because the point i was trying to make is that taxing the rich doesn’t really do anything (like generate additional tax revenues)

what you are talking about is lack of restraint from the politicians over the last 60 years using the treasury as their own personal credit card with an unlimited limit to buy votes

Skeptic:

Nah, I speak from personal experience being reasonably successful (or “rich” according to libs) and also a minority. I live it everyday.

You have been sold that line that no one can change their circumstances and the only way to get anywhere is to live off the government tit. Sorry, I don’t buy the everyone is a victim BS.

The only thing I got growing up in a blue collar family with one foot always on the wrong side of the tracks was that my parents (father was a cop) and mother was a secretary constantly told me to stay in school so I could have more opportunities than they had.

My family went from having no education (Grandparents) to my parents who finished high school and a year or two of college to me with an MBA from Kellogg. That is the beauty of America…

All my childhood friends who had kids at 18, didn’t take school seriously, caught a few cases with the law, etc are all struggling. We all had the same opportunities, but I was just fortunate enough to see long term while they couldn’t get past the weekend party or too horny to spend a buck on a condom. Now all of a sudden I am suppose to give up more of my hard earned money to take care of all these folks bad decision making through various entitlement programs because we aren’t paying our “fair share”. GTFOH.

Russ, your story actually makes my case. You got where you are thanks to the opportunities that this SOCIETY provided. Ergo, if the society had crumbled, thanks to say a national debt that destroyed from within, you wouldn’t have been able to get anywhere.

We can quibble about what it means to actually be so rich that one needs no incentives to work harder because they aren’t doing it for the money. In my mind, making 6 figures is not rich. It’s upper-middle class for sure, but not rich. 7 figures is rich. making 8 figures? you’re a menace to society. you are exactly why we have an estate tax in the first place.

While I agree everyone can change their circumstances via hard work, at the same time not everyone can be above average. If everyone went to law school and studied hard & increased the supply by 500%, how much do you think lawyers would make?

Sonies: you’re wrong. The line under Reagan was tax cuts would lead to more economic growth to tax at the lower rates. Never happened.

Shrub cut taxes on the wealthy back to Reagan-era levels, and immediately threw us into debt because he not only didn’t cut spending. You don’t work with budgets and expense reconciliation, do you? Money in, money out. Making arguments confusing correlation and cause is a typical error for folks like yourself who try to prove a philosophy (that taxes are inherently bad) the way one can prove a law of physics.

At the end of the day, what is and isn’t a “fair” tax is a matter of opinion. What’s not a matter of opinion is how deeply America is in the red. As HD mentions, the gulf between rich and poor has never been worse – so you can either watch society dissolve when the poor finally revolt as they have nothing left to lose, or the rich can determine that it might be better to reinvest in the society that provided them their opportunities and wealth in the first place.

And just in case either of you actually wander back, here’s a little more Adam Smith from the Wealth of Nations you’d do well to digest:

His employers constitute the third order, that of those who live by profit. It is the stock that is employed for the sake of profit, which puts into motion the greater part of the useful labour of every society. The plans and projects of the employers of stock regulate and direct all the most important operations of labour, and profit is the end proposed by all those plans and projects. But the rate of profit does not, like rent and wages, rise with the prosperity, and fall with the declension, of the society. On the contrary, it is naturally low in rich, and high in poor countries, and it is always highest in the countries which are going fastest to ruin. The interest of this third order, therefore, has not the same connexion with the general interest of the society as that of the other two. Merchants and master manufacturers are, in this order, the two classes of people who commonly employ the largest capitals, and who by their wealth draw to themselves the greatest share of the public consideration. As during their whole lives they are engaged in plans and projects, they have frequently more acuteness of understanding than the greater part of country gentlemen. As their thoughts, however, are commonly exercised rather about the interest of their own particular branch of business, than about that of the society, their judgment, even when given with the greatest candour (which it has not been upon every occasion), is much more to be depended upon with regard to the former of those two objects, than with regard to the latter. Their superiority over the country gentleman is, not so much in their knowledge of the public interest, as in their having a better knowledge of their own interest than he has of his. It is by this superior knowledge of their own interest that they have frequently imposed upon his generosity, and persuaded him to give up both his own interest and that of the public, from a very simple but honest conviction, that their interest, and not his, was the interest of the public. The interest of the dealers, however, in any particular branch of trade or manufacture, is always in some respects different from, and even opposite to, that of the public. To widen the market and to narrow the competition, is always the interest of the dealers. To widen the market may frequently be agreeable enough to the interest of the public; but to narrow the competition must always be against it, and can serve only to enable the dealers, by raising their profits above what they naturally would be, to levy, for their own benefit, an absurd tax upon the rest of their fellow-citizens. The proposal of any new law or regulation of commerce which comes from this order, ought always to be listened to with great precaution, and ought never to be adopted till after having been long and carefully examined, not only with the most scrupulous, but with the most suspicious attention. It comes from an order of men, whose interest is never exactly the same with that of the public, who have generally an interest to deceive and even to oppress the public, and who accordingly have, upon many occasions, both deceived and oppressed it.

thanks, skeptic… unfortunately, I think you are partaking in a discourse that is extremely lopsided in intellectual comprehension that is typically displayed in the comments section of CC…

I offered up the single issue of pre-existing conditions because it is one way I have found to stop the reactionary idealogues in their tracks…

They have to admit that in “the most advanced country on the planet”, a pre-existing condition should not prevent anyone from obtaining health insurance… then the next question is, how do we get that done?

It inevitably cascades into, yes, huge government intervention, regulation, ‘control of health care’, etc. etc….

there is no other way to make it happen…

it’s very simple to understand, actually….

taxes, regulation, the reality of capitalism, socialism, etc-ism, is all gray, not black and white like the politicians and the media like to sell it… only birth and death are black and white…

Agree that American society is becoming more polarized.. the interesting thing is that for someone who is extremely rich, more money can be meaningless, it is the power aspect that is important. I truly believe (as was the case for most of the 1900s) that higher taxes will not be that problematic for this group.

A lot of newly minted graduates I know don’t have quite the opportunities of past generations. Working hard and being focused doesn’t even get an entry level job nowadays, but it does get you a loan to pay off. These graduates are our future middle class and the economy has had a major effect on their belief in the capitalist system.

Which makes me wonder why anyone would vote for someone who denies them an extension of unemployment benefits, votes against removal of pre-existing conditions, and wants to keep taxes artificially low for the few who don’t need the money.

That’s the thing about left leaning ideas, it’s all about ‘what can you give me?’ more free money through unemployment – as if 99 weeks isn’t enough, free health insurance for the unhealthy who smoke, booze and eat micky d’s, and then also want to take whatever someone else has got and give me to me me me.

How about you live do with less income, live a little healthier and stop counting other people’s money? How about looking out for yourself for a change instead of trying to pick other people’s pockets?

“Which makes me wonder why anyone would vote for someone who denies them an extension of unemployment benefits, votes against removal of pre-existing conditions, and wants to keep taxes artificially low for the few who don’t need the money.”

ok, hd, how does a young republican who works hard, makes a decent, entrepreneurial income and happens to have a history of epilepsy get health insurance? (without it, of course, this young person will be a huge drain on society and a big contributor to our national debt

Skeptic, I love it when you get on a roll!!!

Jack – our system is not perfect. Neither is anywhere else in the world. However, your argument about a hypothetical epileptic person is a false dichotomy (either he gets health insurance or he is a drain on society). It’s difficult to address an illogical argument with two false choices.

“ok, hd, how does a young republican who works hard, makes a decent, entrepreneurial income and happens to have a history of epilepsy get health insurance? (without it, of course, this young person will be a huge drain on society and a big contributor to our national debt”

cheers skeptic! speak truth to power.

HD your wrong. Jack’s question is valid and many people face these illogical false choices. We as a society have to progress and you don’t get that by sticking your head in the sand nor spouting failed policies.

Are you suggesting that an epileptic can not get health insurance or that his would just be prohibitively expensive?

I hope that the Health Care Bill takes care of all these “illogical false choices” and progress is made towards a fair and equitable health system.

HD if you really have the opinions you expressed, then I doubt you or someone close to you has dealt with major insurance problems, otherwise you are just trolling.

I have a sister with children and she and her husband are on the state medicaid program. They smoke, booze and eat fast food six or eight times a week. I’m not trolling or exaggerating.

but you shouldn’t punish other people for the failures of some. moreover life is about learning from your mistake not punishment for how you were made(pre-existing conditions).

back to the class issue, productivity has been rising (2-4%)(benefits capital class) but real wages have been stagnant(detriment to working class) how is that fair? a progressive tax system will help rectify that inequality.

also saying 40% don’t pay income tax is poor argument b/c everybody that doesn’t is getting hosed on paying regressive taxes such as; sales & payroll tax(like 12-18% for both). Considering their savings rate is avg(or worst) than most Americans.

Whether it is the Health Care System (or rather the lack of such a system) or the Housing Crisis which we are all experiencing to some degree, this is the end result of a GOP led Government who had forced both industries to abandon their required regulations to keep the industries working in the best interests of the people of our nation.

homedelete on July 24th, 2010 at 2:14 pm

“That’s the thing about left leaning ideas, it’s all about ‘what can you give me?’ more free money through unemployment – as if 99 weeks isn’t enough, free health insurance for the unhealthy who smoke, booze and eat micky d’s, and then also want to take whatever someone else has got and give me to me me me.

How about you live do with less income, live a little healthier and stop counting other people’s money? How about looking out for yourself for a change instead of trying to pick other people’s pockets?”

Unemployment benefits, which we as a working nation contribute to, are not the jack pot many GOP members would like to have us think they are. The amounts they receive allow them to live a very frugal and sparse life while barely making ends meet to the point where so many have lost everything it took a life time to accumulate. There is nothing such as ‘free money’ when it comes to this topic. It is earned benefit and no one has the right to take this away from those in true need of it.

As far as ‘looking out for ourselves’, I think the majority of Americans do achieve this and for those who cannot do so, it is the job of the US Government both Fed and State to step up and offer assistance to those who are unable to do so on their own.

Believe me, if it were you HD who deperately needed financial help from our Government as a last resort, you would be crying for all the help you could get.

This has nothing to do with left leaning ideas at all. It is all about the GOP having selective tunnel vision which allows them to see and care only for members of their elite group. Make sure the rich keep getting richer by eliminating the tax structure for those top income earning groups while ignoring those members of our society who are in the greatest need. Why is it that the GOP is more concerned with bettering the lives of people in Iraq, Afghanistan and all of the other countries who despise our way of life?

Take all of the cash that is distributed to corrupt foreign entities and invest it in programs and businesses within our boundries. Fund a Health Care system that will benefit Americans who cannot fend for themselves. Help those who, through no fault of their own, have lost the roof over their heads thanks to the unbelivable greed of a few high level corporations.

I pay a boat load of taxes every year and I do not have a problem with that fact. But I want my tax dollars to be invested in US based companies to run programs and projects that will help to fix the multitude of problems we face.

It seems those American citizens who are in the greatest need are not allowed to realize any sort of benefit from tax dollars, while the CEOs of the most successful companies and random foreign citizens continue to rake in all the cash they can handle year after year.

Where are the voices for these people in our country who are in need? Where is the anger?

Where is the change?

revassal, the tax credits and EIC credits given to the 40% who don’t pay income taxes more than makes up for the payroll taxes they pay. I regularly see the tax returns of people who make less than the median and I can say with certainty that probably 85% of them get a tax refund more than four or five thousand dollars or more. especially those who cheat and file as ‘head of household’ and claim people on their tax returns that they shouldn’t be. by the way, which we’ve discussed here, is a huge problem.

WE just have to agree to disagree on health care. I don’t think that the government needs to get involved in giving everyone more freebies.

You see the solution to the problems private healthcare as being solved by the government. we have basic philosophical differences that we’ll never been able to resolve here.

HD: I’m also not into freebies, but getting unemployment and health insurance for two years when one can’t find a job is understandable and I would not begrudge anyone that. Bailing out banks and giving multimillion dollar bonuses for poor performance is a much worse freebie than if someone smokes, drinks, and eats fast food.

It’s worse to give the banks freebies too. however, two wrongs don’t make a right.

“the tax credits and EIC credits given to the 40% who don’t pay income taxes more than makes up for the payroll taxes they pay. ”

This is NOT something you can state this way based on anecdotal evidence. And it’s not true (not.even.close) in the aggregate.

hd… you truly show your lack of life’s experience and, indeed, your ignorance…

yes, no system is perfect, but the US system is the only one (among developed countries) where anyone with a chronic disease (whether born with it, or arguably ‘responsible’ for it) is only able to obtain health care through an employer’s group plan…

this person has absolutely no option to start their own business or join a start-up, for example, that can’t afford it’s own health care plan…

is that really the ideal capitalistic or libertarian system you think furthers the ideals of those ideologies?

and in answer to somebodies’ question earlier, anyone with a chronic disease (i.e. epilepsy, diabetes (type 1, juvenile onset), severe asthma, etc. etc.) of any age would either be refused insurance or it would be priced so prohibitively with so little benefit that it would make more financial sense for that individual to insure himself, as if that was possible…

oh, but one more thing, the current administration has fixed the pre-existing condition problem for children already, and for the rest of us soon… so, we did win and fortunately for us, we clearly won’t be going back…

good news someday soon for all those entrepreneurial folks working for a big company aching to start their own small business but unable to do so because they can’t take the risk of exposing their family to no insurance coverage because daddy was born diabetic, epileptic, etc….

“The government cannot force me to buy a service I don’t want and they know they can’t pay for the HC bill without attempting to force healthy people to sign up for a plan to subsidize the LOSERS. And that’s what all of you sick or previously sick people are that like this HC bill: you like it for its handouts and you like that productive, more healthy members of society who aren’t health LOSERS like you are to subsidize your misfortune. I’m not subsidizing sh_t.”

God damn, Bob, I hope for your sake that you never get old and/or sick.

Jack,

somehow you have difficultly getting health insurance and that makes me ignorant? Wow, resorting to the ad hominem attacks so quickly. Too bad most of the country didn’t want the health care system reformed and the party of change crammed it down our throats anyways so I guess we’re all ignorant.

hd, yes, thanks for proving my point