Get an East Lakeview 1-Bedroom with a Fireplace for $225,000: 630 W. Waveland

This 1-bedroom in 630 W. Waveland in East Lakeview came on the market in May 2023.

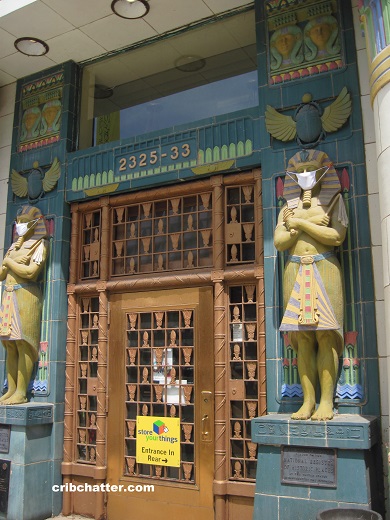

Built in 1926, this courtyard building has 50 units. It does not have parking or any amenities.

This unit has 9 foot ceilings, a foyer, hardwood floors throughout the living room and bedroom and a wood burning fireplace in the living room.

The listing says it is “freshly painted.”

It also has a built-in multi-shelved desk nook next to the fireplace in the living room for work-from-home or a beverage bar.

The 3 windows in the living room overlook the landscaped courtyard.

The kitchen has white cabinets that go to the ceiling, stainless steel appliances, a black and white checkerboard floor, and a euro-style washer/dryer combo unit. The listing says there is enough room for a breakfast table.

The listing also says the bedroom is big enough for a king sized bed. It has custom built-in white closets and vanity/desk.

The “timeless” bathroom was remodeled and has a built-in linen closet.

The unit has a walk-in-closet near the foyer and a 10×5 storage unit in the basement.

It does not have parking, although there is rental across the street, nor central air.

This unit is near the shops and restaurants of Broadway in East Lakeview as well as the lake front with its bike trail, golf course, and other park amenities.

Listed at $225,000, that’s $25,000 more than the 2020 sales price. The listing says there is no rental cap in the building.

Is this a good investment for someone who wants to be a landlord?

Mark Buckner at Compass has the listing. See the pictures and floor plan here.

Unit #1E: 1 bedroom, 1 bath, no square footage listed

- Sold in April 1997 for $86,000

- Sold in November 2002 for $155,000

- Sold in July 2012 for $115,000

- Sold in May 2019 for $189,000

- Sold in October 2020 for $200,000

- Currently listed at $225,000

- Assessments of $350 a month (includes cable, exterior maintenance, lawn care, scavenger, snow removal, Internet)

- Taxes of $2825

- No central air

- Euro-style washer/dryer combo in the unit

- No parking- rental available across the street

- Wood burning fireplace

- Bedroom: 13×10

- Living room: 17×12

- Kitchen: 10×11

- Walk-in-closet: 8×4

- Foyer: 7×4

- Balcony: 3×11