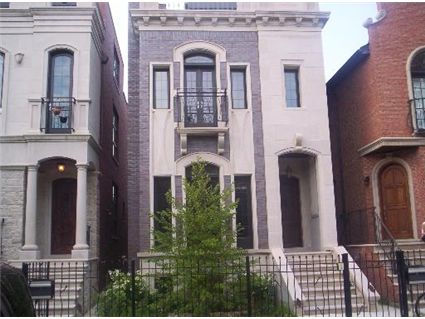

2324 W. Charleston in Bucktown Going into Foreclosure

In February 2008, we chattered about two new construction houses on West Charleston in Bucktown where the owners were clearly in distress.

One of them was 2324 W. Charleston.

That house just went to foreclosure auction. Here’s the history:

2324 W. Charleston: 4 bedrooms, 3.5 baths, 2 car garage

- Original house (teardown) sold for $346,000 in July 2004

- Public records show the house selling in February 2007 for $1.5 million

- Originally listed for $1.7 million in July 2007

- Lowered to $1 million in February 2008

- Currently listed at $1 million

- Foreclosure auction price of $1,037,495

Stay tuned to see what the bank lists it for.

The house next door that was also in distress in February, 2322 W. Charleston, is also still on the market for $1 million.

I dont know about that bathroom sink/cupboard combination. But damn, what a nice looking place. How much work was put into the house between the 2004 purchase and now?

Seeing as it was a teardown, I would imagine the work was considerable!

If it falls another 700k I’m all over it!

Any bank details G? I want to be gleeful as to who was left holding the hot potato of 700k of writedowns.

$1mm first, with lis pendens filed by HSBC on August 14, 2007.

$425k second, filed in favor of MERS (so could be almost any lender).

$75k dp from Steven R Anderson.

Deed and mortgages recorded 2/6/07–almost certainly NEVER made even the first payment.

First-payment defaults should be prosecuted as mortgage fraud, as the buyer clearly intended to defraud the bank.

Is there a way to find out what price a property sold for at an auction (besides being there in person). There was a 3 flat on Montana that went up for auction and hasn’t since been listed, I’m curious.

Thanks,

Jordan

Jordan:

If it actually sold at the auction (a big “if”) it would be in the public records. If it was more than 30 days ago you can search on the Tribune’s website by address. You can also search on various Chicago property record websites (for the county.)

I’m not seeing much selling at the auctions- but I’m sure some properties do.

It’s taking awhile for properties that are now bank-owned to come back on the market so it could be the bank simply hasn’t listed it yet.

It’s taking awhile for properties that are now bank-owned to come back on the market so it could be the bank simply hasn’t listed it yet.

—

I have been looking for a while at REO SFRs. MAJOR mold and water damage! Was just at 5321 W. Winsor. I know I know way too far west for most of you, but DANG is that joint F-ed up! It was new construction too. I’m talking knee-high toxic black mold ALL the way around the walls of the basement.

These banks are letting these homes ROT. It is such a shame. Many of these homes I looked at probably need to be re-gutted. A different house I was at was listed at $299,999 and was un-inhabitable. I’m talking water damage from the top floor’s ceiling to fuzzy mold on the underside of the joyces of the main floor. The REO agent admitted that she was never even in the house. They since dropped that one to 279 but big deal. That joint needs to have the “ET” tent put over it and nuked.

This is a big story that has not hit the light of day yet.

Stuckinthecity:

Thanks for your observations. Have you seen any that have been broken into and been vandalized? I’m surprised this isn’t happening more- if for nothing more than to strip out the copper wiring, appliances etc.

Some houses have been sitting there empty for one to two years.

Sabrina or Stuckinthecity,

Echoing Jordan’s question above, can either of you provide a little more information with regard to foreclosure auctions. Are these auctions open to the public or only to realtors or cash only buyers? Are final prices published?

Thanks!!

Sab,

I have not see any burgalry, childish vandalism, or theft. The water damages i have seen were not traceable on just a showing. I never wasted my time or money on an inspection for any of these homes. But, I surmised most of the sources were either roofing problems, or leaky bathrooms. Whether the bathrooms were leaky bec of maliciousness or faulty winterization process (if any) is unknown.

If you have MLS, look up 5947 W Wilson (i think). I was shown this one, while it was under contract. My agent told me that the description was updated to state the basement need major work after an inspector killed the contract. The basement concrete floor had mold growing on it! I never saw that before.

Greg,

I used to subscribe to realtytrac.com and followed many foreclousres. The process takes some time. From pre- to full to getting an auction date. Most auctions just pass buy. Nothing I was looking at ever sold at auction. Once the auction passes, the status changed to “Awaiting Update”. A while would go by and it would eventually be REO’ed. However, not every REO goes to the MLS. There are LOTS and LOTS of REOs out there that are not on the MLS. All the while this process goes on the homes decay rapidly.

I always wanted to go to an auction. But i never did. I read about auctions in Fla and it seems like there are 3 people there and they just stare at each other. My understanding is that you need cash to buy at auction, then you need more cash to close out other bad loans and taxes and such. I saw no sales at auction so I figured why bother? Let the banks clean up the mess and I’ll scoop something up. But you can see how well that worked out…….

I saw one REO house that had a mold problem because the bank turned off the electricity, so the sump pump wasn’t working, and voila an indoor swimming pool.

Greg:

You can go to foreclosure auctions every day at the Cook County courthouse and at other locations (sheriff’s offices etc.) Every county has auctions (some every day, some a couple days a week.)

Look on the tribune’s website. They have the times and the address.

Pete – while buying a property and never intending to make the first payment is certainly defrauding the lender, I’m struggling to understand the motivation. If I read the numbers correctly, the buyer put down 75K and then walked away from it. If it was intentional, to what purpose?

Could be builder bailout. If the builder can find someone to collude with and come up with a sale price higher than what is owed dp goes back to the builder/developer. Split up what is left and everyone wins but the banks.

Even though I’ve been looking exclusively in Lincoln Park… this piques my interest…

Out of curiosity:

1. What is the price ratio of a Bucktown property (in this location) vs. an identical Lincoln Park property?

2. What do people think is a reasonable price for this property?

The land is still “worth” at least $250-300k; replacement cost on the house is probably $500-550k (assuming ~4000 sq ft). Something around $750k would be a pretty good deal; $850k would be decent. Also assuming that everything is in like-new condition and the builder didn’t suck and cut too many corners.

That part of bucktown is pretty nice, esp. the park, but Western through that area doesn’t have much to recommend it. Neighborhood school is a possible issue (for you or your future buyer), tho I am sure it is improving and that’s a decent location for a number of private schools.

Massive water damage on both 2324 and 2322 from burst pipes due to poor winterization.

Sabrina and Stuckinthecity,

Thanks for the info. Stuckinthecity’s (thats hard to type!) post seems to indicate these might be a pretty time intensive effort which bears little fruit. Also from the readers here it sounds as through there’s a little more risk involved than what I’m willing to shoulder. Better to wait for them to emerge again…

Has anyone here actually bought a foreclosure at auction? Worth it or not?

Anon – Lots sell for $400k – $500k. Please send me a comp of a lot you have seen indicating a value of $250k – $300k.

Thanks,

S**** H*itman,

Pretty bold of you to ask someone else for comps when your response to following through with comps that you offered to post here has become “do your own research,” don’t you think?

The difference being that anyone can look up the gains made in recent Lincoln Park transactions but noone can find a lot sold for $250k on Charleston.

There is a difference. My statement is fact and his is not.

Hey I didn’t say that a buildable lot would sell for $250k-$300k. I said it was WORTH (note the quotes) $250k-$300k. Just because some people are idiots doesn’t mean everyone has to be.

Also, on my block in north center, a nice(ish) two flat recently sold for 10% less than a teardown across the street did about 2 years ago. Gives an implied value to the raw land of about $200k less. And this block ain’t as nice as mine.

Show me a lot that has sold on Charleston (east of Western) in the last 12 months.

Oh, and do your own research, Stevo.

thanks for the estimation and inside info… with water damage and other potential problems of foreclosures i don’t see why anybody would commit 1M here.

Hey I saw townhouses like those at Epcot in 1987!

Seriously those homes are a dissaster. Chicago needs a special fund to teardown these things when the opportunity presents itself.