Want to Be a Landlord? 33 W. Huron in River North

33 W. Huron is a 1998 mid-rise building in River North across the street from the Whole Foods. The units usually sell pretty quickly in the building due to their size.

The last sale was in November 2007 but there haven’t been many units listed for sale in the interim period.

Unit #304 is currently on the market. If you’ve been watching River North real estate for awhile, you might remember this unit as it was last on the market in 2005.

It didn’t sell, but was rented out instead. Apparently, the renter is still in the unit. From the listing:

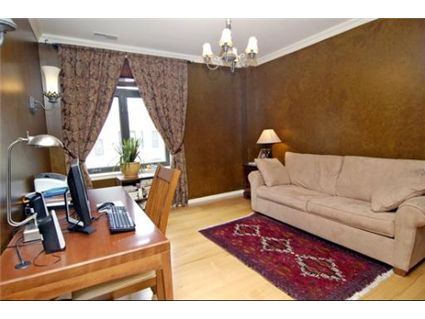

GORGEOUS 2BR/2BA 1761SF DECORATED CORNER SUITE W/CUSTOM PAINTED WALLS W/WALL FABRICS, GOURMET KIT, GRNT C-TOPS, WIDE PLANK MAPLE FLOORS, WINDOW TREATMENTS, & CUSTOM MIRRORS.

SEP SHOWER WITH WRLPOOL TUB AND DBL SINK STATIONS. HUGE LIV SPACE, SEP FOYER W/MARBLE & FRENCH DOORS. HUGE PRIVATE OPEN TERRACE HTD GAR PKG $50K. TENANTS PAYING $3100/MO TILL FEB 2009.

Does it make sense to become a landlord for the next six months?

You know how I love the New York Times rent versus own calculator. It’s not perfect, but it gives you some perspective.

Unit #304: 2 bedrooms, 2 baths, 1761 square feet

- Sold in March 2003 for $569,000

- Was listed in September 2005 for $624,900

- Reduced

- Was withdrawn from the market at $614,900 in December 2005

- Rented for $3100 a month

- Currently listed for $640,000 (plus $50k for parking)

- Assessments of $478 a month

- Taxes of $7391

- Baird & Warner has the listing

Are these actual unit photos? Is it really rented for 3100 and they use the second bedroom as an office?

I toured this property the last time around. I believe it was a 3 bedroom that they converted into a 2 bedroom. They still want the 3 bed price and probably won’t get it. Also, the terrace is nice but looks right into new building next door

So in 2005 they wanted 615k for it but now they want 690k for it. Hoping thee are still enough idiots with loans…waiting for Godot they are.

Let’s ask how much the renters could be willing to pay for this.

Being generous, assume that they make $200K (33% tax), have plenty of cash to make 20% down, and will buy down their jumbo interest to 7% (market seems more like 7.5% and zero points). Even with all this, the renters shouldn’t be willing to pay more than $600K.

Interest: $2800 first month on $480K at 7%

Principal: $393 first month

PropTaxes: $616/mo

Assoc: $478/mo

Total monthly payment: $4287

After tax deduction: $3160 (33% for interest and taxes)

(If we take into account the cost of capital for the down payment, say 2%, breakeven for the renters happens at about $550K with $440K financed. That is close to conforming, so it might make sense to use a 75% conforming and 5% second rather than an 80% jumbo.)

If the rent is close to market (which seems plausible), it looks like even the 2003 price of $569K is rather high.

The break even point is less than $550K. Calculations should also take into account that federal tax deductions are limited over $156,400 and that renters can use the standard deduction of $10,700 for a couple without itemizing on schedule A.

So we are looking at what should be about $300/sf with pkg ($528K?) That would put it at about 2001 prices if you take off 4%/year from the 2003 sale. But why be hasty in the calculation? The unit sold from the developer on 5/7/99 for $389K. The 2003 purchase price looks bubbly relative to 1999 (good catch, Kevin) even with the possibility that the 1999 purchase was from a contract signed in 1997.

Rents will feel increasing downward pressures. This will create real worry among investors and we will overshoot the bottom when they do not get back in when properties “seem” to make financial sense. But that is for another day. Knife-catchers, commence buying.

$616 a month for taxes sounds low. That is only $7200 a year, way less than 2% figuring on a purchase price of $500K, which is what this place looks to be worth.

Count on a monster tax hike for the next buyer, and figure it into the payments

Secondly – at $200,000 the owners may be subject AMT which would greatly reduce the expected tax benefit from owning.

This building was beautiful — but it is showing a little age and the new building next door appears to have really blocked the view from this unit. It was probably worth more in 2005 for this reason alone. Also, has mid-level and dated finishes (white kitchen?) for the price point.

Mr. Pesci–excellent points; and the congestion and noise (taxi horns) on Huron is omnipresent.

Wow.. using NY rent vs. own calculator… this price makes absolutely no sense relative to the 3100/month rent! Assuming a very generous 3% house appreciation, 3% rent appreciation, 25% down and a hold time of 7 years… the price would need to be around 540K (100K cheaper than the asking price) just to “break even” on the purchase… and those estimates are very, very generous.

The 3100 in rent does not even cover the owner’s assessment + tax + mortgage costs (assuming they put 10% down)! If I loved the unit, I would just ask to rent for 3200 after the current renters finished their contract…

Realistically, this should rent for 3500 and the condo should sell for around 525K-550K.