Duplex Brick and Timber Loft in Streeterville Sells for List Price: 540 N. Lake Shore Drive

We last chattered about this unique duplex brick and timber loft at 540 N. Lake Shore Drive in Streeterville in September 2009.

See our prior chatter and pictures here.

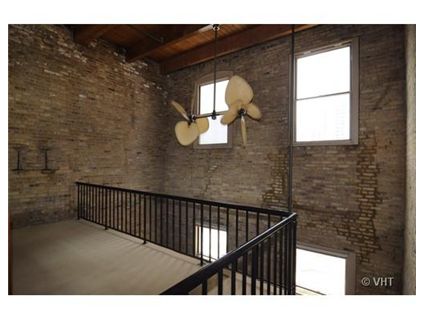

The 2-bedroom unit had new walnut hardwood floors and walls of exposed brick.

It also had a lofted area that overlooked the living room and roof-rights.

It sold for the original list from September of $399,900.

But this was already $120,000 under the 2004 purchase price.

Joe Zimmerman at @Properties had the listing at the time of the sale.

Unit #710: 2 bedrooms, 1.5 baths, no square footage listed

- Sold in March 1999 for $272,500

- Sold in February 2000 for $426,000

- Sold in October 2004 for $520,000

- Was listed in September 2009 at $399,900

- Sold in March 2010 for $399,900

- Assessments are $892 a month (includes the heat)

- Taxes are $6280

- Parking is rental in the building

- Central Air

- Washer/dryer in the unit

- Bedroom #1: 18×15

- Bedroom #2: 17×9

- Living room: 21×19

- Family room: 16×7

- Kitchen: 14×11

The buyer overpaid.

And the original thread on this property was one of my favorite digressive conversations on crib chatter! Both dog training methods and parenting skills were criticized. Awesome.

Finally a 2 BD/2 BA that deserves it’s above average price. The pre-mortgage nut is out of control but the deck and the exposed brick make up for it. Love it!!

I love exposed brick – except the kind that makes it look like you have an enormous water leak. Lovely fans too…if you live in Hawaii.

Geez! It sold for less than the 2000 price.

There is a sucker born every minute. Perhaps the realtor sensed that they had a serious looker and was able to convince that buyer that there was a bidding war from another perfect buyer. A momentary flashback to 2006 then resulted in a full price offer.

Damn it I missed all the hillarious dog banter on the last thread. For the record when we are putting on our coats to leave my dog runs to the exact spot where we hept his cage for the first two months he lived with us. He then runs in a circle and lays down like hs is in the cage. He is frequently there when we return. He is a great dog….not that smart but a great dog.

Down boy….down.

Interesting conversation on the prior chat! I still stand by my comments regarding pet damages being less serious than damage caused by SOME children.

I am glad this place found a buyer as it seems to have potential for a creative person to make it a spectacular loft.

$100k down, $300k mortgage. That’s respectable and sustainable and you’re not going to hear me say this very often. $400k for a 2/2 on LSD with a large down payment.

Nevertheless, how many of these buyers are left? Mish did an analysis of the consumer’s balance sheet the other day, and given that the bottom 80% of consumers have a mere 7% of financial wealth, there are limited numbers of large down payment buyers left sitting on the sidelines. That’s why FHA has gone from writing 3% of all mortgages to 40% of all mortgages.

http://globaleconomicanalysis.blogspot.com/2010/04/consumer-balance-sheet-and-consumer.html

“the bottom 80% of consumers”

About 40% of that 80% aren’t–and aren’t likely to be–homeowners.

That brick work is repugnant.

“About 40% of that 80% aren’t–and aren’t likely to be–homeowners.”

Probably much greater than that (since most people with a pulse and a 600 fico bought a place within the last decade) but I don’t have the time to bother looking up statistics today.

The quality of mortgage underwriting these days has gone up significantly. Very few people getting financing that aren’t reasonably qualified, especially for conforming loans. Jumbo financing requires significant reserves and those buyers are rock solid across the board now.

FHA still has some weak spots, but in general, most lenders have placed severe overlays on FHA guidelines. The actual FHA guidelines are much much more relaxed than what most lenders will actually approve. You still can do 3.5% down, but the FICO scores requirements are a lot higher. Some lenders won’t go below 660 now and hardly anyone goes below 640 even though technically FHA allows down to a 580.

What is hilarious is that HUD keeps cracking down on lenders for loan quality, yet the won’t raise the guidelines for FHA. For instance, when HUD says they cut off certain lenders in press releases for poor origination quality, it is usually the lenders that follow HUDs underwriting guidelines to the letter!

“Probably much greater than that (since most people with a pulse and a 600 fico bought a place within the last decade) but I don’t have the time to bother looking up statistics today.”

Just based on ~65% ownership rate and that some of the non-owners are top 20% wealth-wise, leaving ~32% of Americans (1) non-owners (2) in the bottom 80%.