Flipper Alert: More Flips and a Reduction at 600 N. Fairbanks

The Helmut Jahn modern skyscraper at 600 N. Fairbanks in Streeterville is still not fully occupied. They are probably about a third of the way through closings on the building. There are 227 units. The flippers, however, have been out in full force.

An updated count of the units for sale and rent:

- 20 for sale

- At least 3 for rent

(Some of the units may be for sale AND for rent)

Six of the units for sale are 1 bedroom units of which there were 5 on nearly every floor. There will be a lot of competition to flip the one bedrooms because more of them are going to be listed for re-sale. It’s no surprise, then, that the first price reduction in the building is on a 1 bedroom unit.

Unit #1404: 1 bedroom, 1.5 baths, 873 square feet

- Sold in November 2007 for $385,000

- Originally listed for $449,000 plus $55,000 for parking

- Reduced to $425,000 plus $55,000 for parking

A cheaper 1 bedroom was just listed. Unit #1603 which is the same square footage and baths as #1404. It is listed for $410,000 plus $60,000 for the parking. The listing insists “Priced for Buyers- This is Not a Flip.”

Rubloff has that listing.

The most expensive 1 bedroom is listed for $499,500 (and yes, it’s the same square footage as these units that are $75,000 to $100,000 cheaper.)

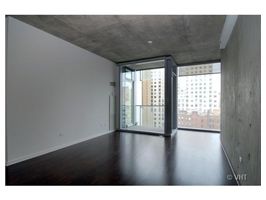

Does anyone else think those weird recessed balconies look like a phone booth or a shower stall in the middle of the living rooms? They look so tiny it is hard to imagine what you could even do on them–I don’t think they’re even big enough for two chairs. How low do you guys suppose these units will go? Even lower than developer’s prices?

Hi Kenworthey,

I have been on these balconies many times and they do fit a small table and 2 chairs comfortably. The building is hot and these 1 bedrooms will sell.

Streeterville Realtor: If it’s so “hot” why are they reducing prices on the flips?

I grant you that the building nearly sold out pre-construction (which is great in this market.) It IS a different type of product and some buyers bought just because of the modern aesthetic.

But 550 N. St. Clair will be closing shortly and it has similar finishes and the modern feel.

Won’t all of this inventory bring down prices in the end? I think so.

Sure, they’ll sell–the question is at what price. With the amount of inventory coming out in the next 4 months, I honestly can’t imagine these units holding their value. I think it will be another Erie on the Park–beautiful building, but over-priced.

Just another development where >20% of the closings are immediately coming back on the market. They better get the other 2/3rds of those units closed fast before the remaining investors figure out they’re in the hole and stop showing up for closings.

“I have been on these balconies many times and they do fit a small table and 2 chairs comfortably. The building is hot and these 1 bedrooms will sell.”

Yet there they are, sitting on the market, not selling. C’mon Streeterville Realtor, we are not talking about some FSBO that no one knows about, these listings are just sitting there, overpriced like everything else, not selling. Every day that goes by is another day where these units don’t sell, how can they be “hot”?

The market clearing price for these listings is probably back down to developer sales price. The first sellers to lower their prices will be the winners here, capturing what few dumb buyers are left out there. The rest will never sell at a profit… “Hello accidental landlord, welcome to the club”.

John

We will see what happens with the building. There is already a two bedroom unit that has resold. In addition, the developer just sold a 1.6 million dollar penthouse. I believe that the building will hold its value if not go for 5-7% more than developer prices.

FYI..I live in the building.

As of today, there are 18 units in this building listed on the MLS for sale. Of those, 7 appear to be flippers (and one ‘income investor, lol):

#1401 1746 sf 3BR 2.1 BA

purchased 11/28/2007 for $800,819 w/parking

for sale 11/22/2007 for $1,090,000 w/parking

for rent 11/22/2007 for $8,000 w/parking

#1402 1258 sf 2BR 2BA

purchased 11/12/2007 for $503,200 w/parking

for sale 12/3/2007 for $624,900 parking add’l

#1404 873 sf 1BR 1.1BA

purchased 11/28/2007 for $385,166 w/parking

for sale 12/5/2007 for $425,000 lowered from $449,000; parking $55,000

for rent 12/4/2007 for $2,200 w/parking

#1501 1746 sf 3BR 2.1BA

purchased 11/13/2007 for $806,000 w/parking

for sale 11/6/2007 for $1,100,000 parking $70,000

#1503 873 sf 1BR 1.1BA

purchased 11/20/2007 for $422,913 w/parking

for sale 11/26/2007 for $448,000 parking $60,000

#1603 873 sf 1BR 1.1BA

purchased 12/4/2007 for $403,751 w/parking

for sale 12/4/2007 for $410,000 parking $60,000

#1901 1746 sf 3BR 2.1BA

purchased 11/26/2007 for $778,000 appears to be w/parking

for sale 10/1/2007 for $1,140,000 parking $70,000

#1602 1258 sf 2BR 2BA

purchased 11/28/2007 for $563,159 w/parking

for rent 12/2/2007 for $3,400 w/parking

This should be interesting to follow.

Sorry, I missed one. This brings the tally to 8 flips and out of 18 on the market.

#1808 926 sf 1BR 1.1BA

purchased 11/28/2007 for $427,518 w/parking

for sale 10/1/2007 for $459,900 parking add’l

Notice to realtors: they are offering a $10,000 bonus to you for contracts before year end. Does this include buyer’s brokers?

Fairbanks, what is the unit # for the 2BR “that has resold”? The only thing approaching a resale is a contract flip which hasn’t closed on either end yet (but might have closed yesterday or today for the first purchase):

#1802 1258 sf 2BR 2BA

contract date 10/23/07 while listed at $520,812 plus parking

contract date 12/6/07 while listed at $640,000 plus parking

It will be interesting to see how things unfold. The number of attempted flips or sales is in no way a testament to the quality or future of the building. All that represents is misjudgement of the credit markets and people hoping to put their cash in something else over the next couple of years until the markets clear. I think pretty much everyone that owns a home in the country wishes it was liquid enough to do that or go back two years and sell. I personally think anyone with excess cash would be very smart to scoop up property in this building if they could get it near developers prices. It is a beautiful building and while the interior finishes may compare to 550 St Clair, the look of the building is no contest. The tall, yet slim windows make 550 St Clair look far too busy. It already looks like it was built 20 years ago. Not only that, but the higher up you go in Fairbanks I would think that the view has a much greater opportunity to improve than it would in the shorter 550 building. Who knows. What I do know is that people that buy in high end buildings don’t like to see a lot of renters moving in and out and not treating the building as well (possibly). I wonder if there are any retrictions on renting such as a minimum of a two year lease or something like that to disuade the constant shuffle. I know some other buildings have tried such rules.

G,

How do you distinguish between flipper and non-flipper?

John

Can anyone explain to me how the parking works? Can you sell the parking independent of the condo? Can you sell your condo but keep the parking space for yourself? What is the purpose of listing the parking price seperately?

John

By selling parking separate, you can get buyers at two price points. Those who don’t need the parking don’t have to buy it, and yes, you can then sell it to one of the millionaires in the penthouse who need parking for their multiple cars. Another advantage is cognitive illusion: the units “feel” less expensive when parking isn’t included. Even if you still have to pay, say, $600,000 total, paying $550,000 for the unit and $50,000 for the parking feels more affordable. (This is why ebay sellers routinely jack up shipping and handling.)

John,

Anyone who puts a unit right back on the market after (or before) closing is a flipper. I realize some may not have intended to be, but that is where they find themselves.

Did you notice that if Fairbanks’ very rosy appreciation estimates above are true it means that every one of these flippers is already upside down?

The Chicago market has historically risen 3% to 5% a year. Last quarter, for the first time in 25 years, the Chicago market actually dropped 0.25%.

Does anyone actually think we’ll see ANY appreciation in the next few years? The best we can hope for is for things to be flat (but that doesn’t seem to be happening right now.)

I: There are already a lot of renters moving into this building. The condo board can restrict the number of renters but it has to be passed by the owners and if a lot of owners are investors, they won’t want to pass such a restriction.

I agree, that if I bought a million dollar unit, I wouldn’t necessarily want to live with a renter (or two) on my hall.

You guys are being awfully fatalistic! I agree that most of these flippers won’t get what they are asking, but the first units in this building haven’t been on the market for even a full month yet! I think most of them will move at 5-7% above the developer’s original prices, at about the same prices that they’ve been on the market for over the past 1.5 years since the initial 40% sold. As for parking, you can only own a space if you live in the building. There are many different price points too, depending on which floor you are on in the garage. This building will be fine because it’s so unique for the area, but I don’t think it’s going to be the cash cow a lot of flippers hoped it would be.

D

Some of these flips were listed over two months ago- before they closed on the units. Obviously, buyers aren’t as interested before a unit actually closes.

A better barometer might be 340 on the Park- which started closings before 600 N. Fairbanks. From information tipsters have sent me, only two units out of about 50 have successfully been flipped in there. And yes, the flippers made decent money. But since those two sold (they were among the very first closings in the building) nothing else has moved. Only rentals.

There is tremendous competition at these price points (which are very high.) $500,000 for a 873 square foot one bedroom? Who is buying that? A doctor or a lawyer perhaps. But you can also buy a two bedroom in the area for a similar price.

I’ll be interested to see what the two bedrooms in the building sell for. Will the tightening of available credit impact sales in that price range? (above the conforming loan rate.)

“Will the tightening of available credit impact sales in that price range?”

It already has, one only has to look at the months of inventory on the market.

Along with the disappearance of the ‘prices only go up’ mentality, we have also lost the ‘I don’t have a 50-100K down payment’ and ‘I need a low teaser rate or option-ARM and by the way please don’t look at my pay-stubs’ buyers because they no longer exist. The securitization market is dead, not in a slump, it’s dead, for all but conforming loans with verifiable income and a down payment.

Most of today’s closings are taking place at price points comfortably below current asking prices (contracts 1-2 years old). The impression is that there is some safety on closing from the bank’s perspective. This will change over the coming months as comparables from flips-gone-bad roll in and the banks figure out that the buyers at more recent prices (contracts in the last year) are at prices that leave the buyers with very little if no skin in the game.

Flippers not showing up at the closing table is going to be a problem, banks not showing up at the closing table for real buyers will be a disaster. Yeah, you could say I’m fatalistic, in the short term.

John

@Sabrina

“From information tipsters have sent me, only two units out of about 50 have successfully been flipped in there. And yes, the flippers made decent money. But since those two sold (they were among the very first closings in the building) nothing else has moved.”

That is my point in saying the winners will be the first few to lower prices. There will be a few sales at Fairbanks, giving false hope to the rest who, one at a time, will accept their roll as negative cash flow accidental landlords. Occasionally one will forclose or be forced to sell due to personal reasons and the comps will start coming in lower, and lower, and lower. If you are the developer you pray this doesn’t happen before you close out the building because otherwise the banks will stop approving the loans.

@G

“Did you notice that if Fairbanks’ very rosy appreciation estimates above are true it means that every one of these flippers is already upside down?”

There isn’t too much math on the JT Foxx show, is there? Those darned real estate fees do eat into the percentages. But frankly, any realtor who can move one of these granite and stainless steel Beanie Babies at today’s asking prices is worth their weight in gold.

John

John: You are right that someone will be forced to sell quickly. I don’t think some of these flippers were prepared to hold onto their units for, say, six months (which would be on the low end given this market.)

If you conservatively estimate $2,000 a month to hold onto that unit, you’re spending $12,000 right there (and that’s “conservative”.) If they bought the one bedroom for $375,000 and list it at $425,000 and can’t sell for six months or more- good luck to them. Between real estate fees, closing costs and actually paying the mortgage- it’s a losing venture for them.

And I agree that by next year- many investors in buildings that haven’t yet closed will be hearing the stories of all the investors that are taking a bath and may decide “hey- why close?” This is happening in Florida right now.

But so far, in Chicago, I think the sellers are in a dreamworld that they WILL still sell at these higher flipper prices. Reality hasn’t set in yet that the market is going lower- not higher. When we start seeing significant price cuts, that’s when the mentality will change. Right now, there seems to be a standoff between sellers and buyers with no one blinking (which is why sales are plummeting but prices are staying pretty firm.)

Sabrina

Two thoughts on the standoff in prices regarding a buidling such as 600 Fairbanks:

1. I think that buyers in 600 are likely less stressed with the credit situation and money in general than buyers in many other buildings in Chicago (such as any of the American Invsco buildings). That may allow people in this higher end building to hold on longer… just a thought.

2. We here that any chance the spire has will be from foreign buyers buying at a discount because of the exchange rate. While I agree with most posts on this website and others that the spire project is just a bad idea at this time and that there is no way there will be enough foreign buyers to fill that whole buidling (especially at the insane prices), there is some validity to this thinking. I have many European friends who are looking to buy in Chicago right now. Is there a more attractive building than 600 for these buyers? I don’t really think so. Many of the strongest markets (in the high end) over the last decade have been supported by foreign money. New York is this way… Vail/Beaver Creek Colorado is almost all South American now. There is something to be said for the foreign money

If there is so much foreign money- why aren’t they buying in Trump? Trump hasn’t sold much in the last two years (according to a recent Crain’s article.) Perhaps they’re all just waiting for it to be completed (which would mean that the Spire is even more doomed in sales- given its completion date is years away.)

I have no doubt that some foreign buyers are looking in Chicago. It’s 50% off.

But what makes 600 N. Fairbanks any more attractive than Avenue East, 340 on the Park, 550 N. St. Clair, 600 N. Lake Shore Drive? They’re all in a similar location, similar price point. Yes, some are modern and others are not. But that’s the only real difference. There is only so much you can do with a 875 square foot one bedroom (in ALL of these buildings.)

We’ll have to wait and see when the first re-sales happen.

Closings are also still continuing in this building. We don’t know yet how much of the building will be back up for sale by next Spring.

The biggest draw 600 NF has to foreign buyers is the Helmut Jahn name, he is a big deal in Germany. Also, the building’s modern aesthetic is very different than Avenue East (ugh) and the others. 10 foot ceilings don’t hurt either. I’m not saying that the flippers are going to get what they are asking, but in markets like this people tend to be a bit more picky and this building has some real unique features that give it a better than average chance of holding its value. It’s the boring, average buildings with nothing unique to them that are in real trouble (think The Fairbanks).

D

Does “fatalistic” mean informed?

Before anyone really starts to fall for the hope of salvation from legions of “foreign buyers”, you must ask yourself how all of those Florida purchases of the last few years are sitting with the same investor group.

My mistake, it’s different here.

One other thing, those “foreign buyers” just might not have the appetite for real estate any longer. The problems with housing balloons are not ours alone:

http://www.telegraph.co.uk/money/main.jhtml?xml=/money/2007/12/10/bcnambrose11.xml

http://www.independent.ie/opinion/columnists/brendan-keenan/if-only-we-could-airbrush-the-2006-blip-from-history-1241632.html

There seems to be a lot of sarcasm attacking anyone who isn’t so fatalistic. Any good business person knows gloom and doom is when the smart money starts buying. If those who are “informed” were so informed they would have been shorting housing companies and any material supplier for the housing market 9 months ago. That is who has made money in the last year. And yes, while it may not be completely different, there are a lot of differences between Florida and Chicago. Insurance problems, way more speculative property in Florida, Second homes are hit first and harder, no financial center in Florida, barely livable conditions nearly half the year in south of Florida. I’ll take Chicago anyday… even when it is 15 degrees. Foreign buyers are not some second coming, but the sarcasm is unjustified.

I: We won’t know what the real “market” is until we see some re-sales in these buildings. This is the typical slow time of the year (in any year) and this year it is magnified because the over all market is so bad.

We really won’t know the state of the luxury market until late January, when buyers are out looking again.

Some buildings will perform better than others. I’d rather be an owner in a sold-out 600 N. Fairbanks or 340 on the Park, then in the Vetro or Library Tower. (or heck, even Trump.) At least you know someone owns all the units in your building and the developer won’t be turning it into rental heaven.

That being said- there are lots of flippers in these buildings as well. So there will be lots of rentals. We’ll have to see how it all shakes out.

I definitely agree… do you have the access code for the spire website so you can view all the floorplans? If not, email and I’ll forward some interesting info.

wondering if you could post that access code for the spire??? thanks

There seems to be a lot of sarcasm attacking anyone who illustrates that the bubble is bursting.

Gloom and doom hasn’t even hit the local market yet if anyone is suggesting that now is a good time to buy.

The number of flippers in the new buildings represent a disturbing amount of speculation. They are the bagholders, and anyone who purchases from them now will only take their place.

Click (only once) on the Spire logo at the top of the page.

A single line will appear.

Type 3425 6587 2331 1798 (no spaces)

G: All I am saying is that if you are so certain of where prices are going than there are lots of ways to make money on it… I know the supply and demand situation right now, it is obvious, but there are many many different types of buildings and many different types of real estate investors and homeowners that will support some floor… that floor may be some equation for the average building, but it will be based on more than just an equation for more unique buildings. Nonetheless… It seems you have a good idea that we are not there yet… I hope you are taking advantage of your certainty… it is a rare luxury

Sabrina–only 18 listed on MLS now. Have 2 sold? (Maybe the developer-owned penthouses?) Or are the owners just trying to rent? I note the $410,000 (or $470,000 with parkingg) 1BR is still on the market… Would be really curious, if 2 did resell, what they went for.

Kenworthy: I’ll have to check into it. I know one of the developer owned units was under contract not that long ago. That could be one of the listings.

I’ll give updates on the resales as I get the information.